Global Vaccine Adjuvants Market By Product Type (Particulate, Pathogen, Adjuvant Emulsion, Combination, and Others), By Application (Infectious Diseases, Cancer, and Others), By Administration (Intramuscular, Oral, Intradermal, Intranasal, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 21362

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

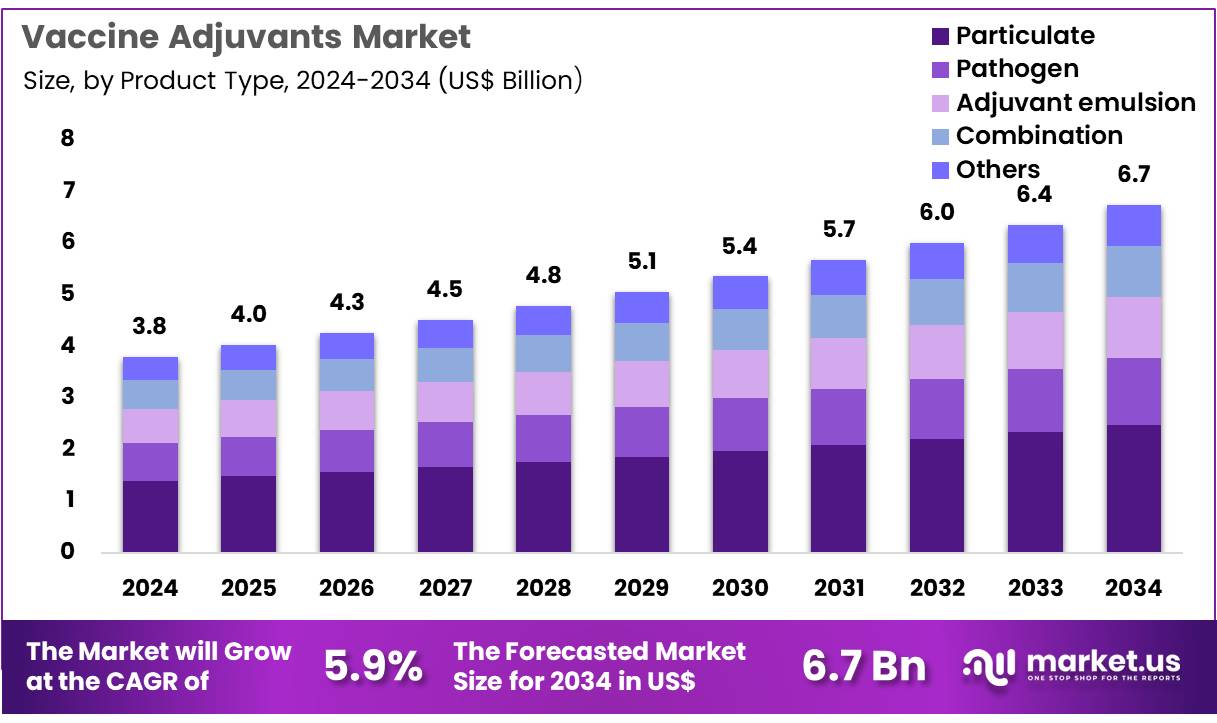

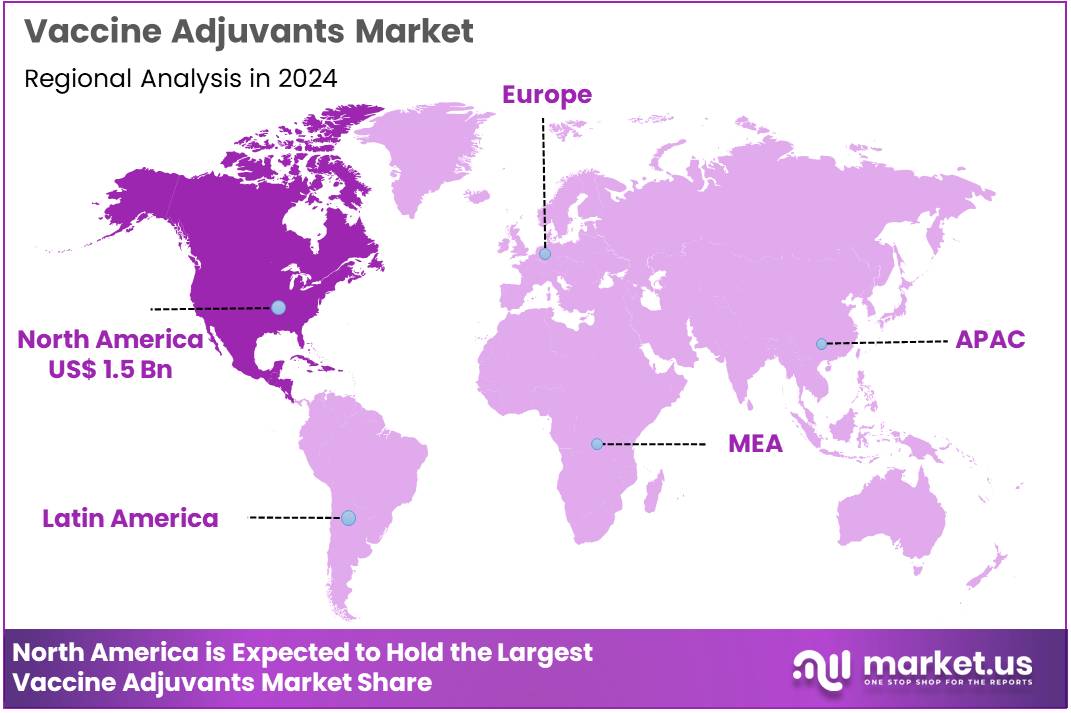

The Global Vaccine Adjuvants Market size is expected to be worth around US$ 6.7 Billion by 2034 from US$ 3.8 Billion in 2024, growing at a CAGR of 5.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.7% share with a revenue of US$ 1.5 Billion.

Increasing need for enhanced vaccine efficacy drives the Vaccine Adjuvants Market, as developers incorporate immune boosters to optimize antigen responses. Pharmaceutical companies apply aluminum salts in pediatric combination vaccines to elicit robust antibody production against diphtheria and tetanus. These adjuvants support subunit vaccines by stabilizing proteins, ensuring durable protection in elderly populations.

.Research teams utilize oil-in-water emulsions for pandemic preparedness, accelerating seroconversion rates in influenza formulations. In September 2023, CSL Seqirus partnered with Dynavax Technologies Corporation to integrate CpG 1018 adjuvant into flu vaccines, improving potency and production efficiency. This collaboration fuels market growth by advancing adjuvant applications in seasonal and emergency immunization programs.

Growing focus on mRNA vaccine platforms creates opportunities in the Vaccine Adjuvants Market, as lipid systems enhance delivery and immunogenicity. Biotech firms employ lipid nanoparticles to encapsulate nucleic acids in COVID-19 vaccines, facilitating cellular uptake and innate immune activation. These adjuvants aid oncology vaccines by promoting tumor antigen presentation, supporting therapeutic cancer immunotherapy.

Veterinary applications integrate saponin-based adjuvants in livestock vaccines, controlling viral outbreaks in poultry and swine. In May 2023, Croda International Plc acquired Avanti Polar Lipids, bolstering expertise in lipid-based systems for mRNA and oncology vaccines. This strategic move drives market expansion through innovative adjuvant designs for diverse therapeutic areas.

Rising emphasis on manufacturing purity propels the Vaccine Adjuvants Market, as technologies ensure contaminant-free production for safe integration. Manufacturers adopt advanced purification methods in virus-like particle vaccines to maintain adjuvant compatibility and consistency. These processes support recombinant vaccines by removing host cell impurities, preserving immune-modulating effects.

Trends toward scalable platforms enable adjuvant incorporation in next-generation VLP formulations for infectious diseases. In June 2025, Wageningen University introduced BacFreets technology, eliminating 99.97% of baculovirus contamination in VLP production. This innovation positions the market for sustained growth by enhancing efficiency and reliability in adjuvant-based vaccine development.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.8 billion, with a CAGR of 5.9%, and is expected to reach US$ 6.7 Billion by the year 2034.

- The product type segment is divided into particulate, pathogen, adjuvant emulsion, combination, and others, with particulate taking the lead in 2023 with a market share of 36.8%.

- Considering application, the market is divided into infectious diseases, cancer, and others. Among these, infectious diseases held a significant share of 48.6%.

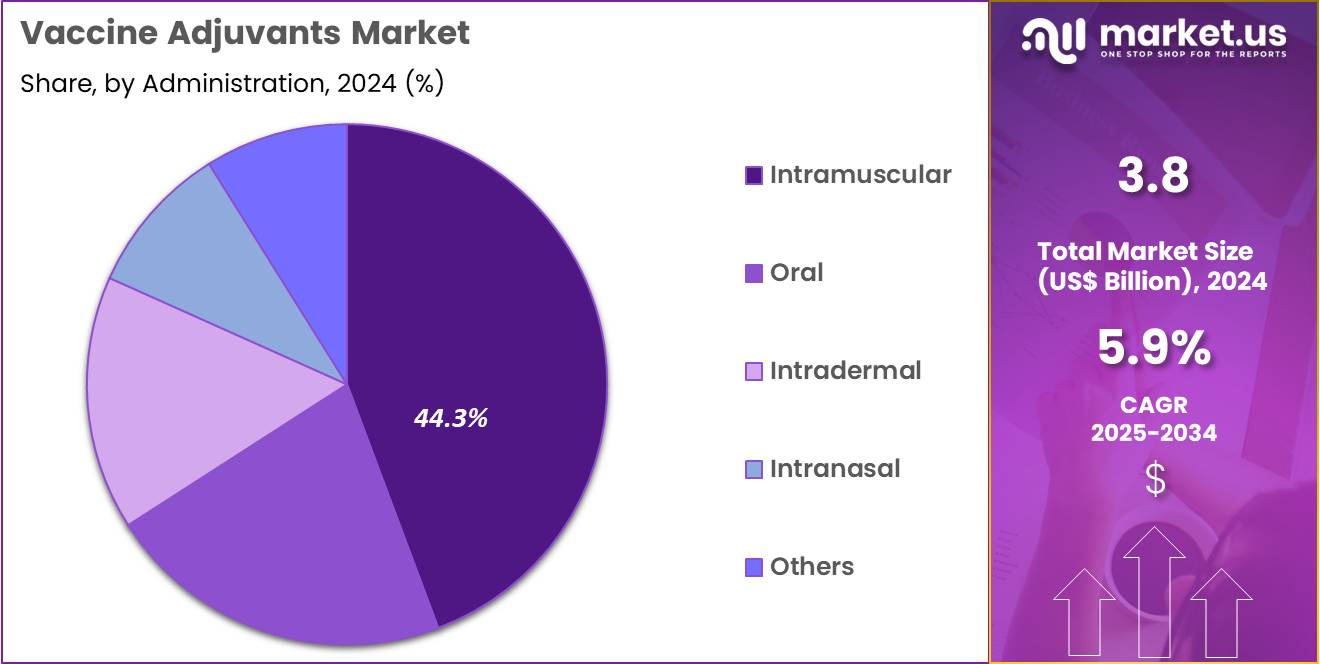

- Furthermore, concerning the administration segment, the market is segregated into intramuscular, oral, intradermal, intranasal, and others. The intramuscular sector stands out as the dominant player, holding the largest revenue share of 44.3% in the market.

- North America led the market by securing a market share of 39.7% in 2023.

Product Type Analysis

Particulate adjuvants account for 36.8% of the Vaccine Adjuvants market and are expected to dominate due to their superior ability to enhance antigen presentation and immune activation. These adjuvants, including aluminum salts, liposomes, and virus-like particles (VLPs), play a vital role in improving vaccine efficacy against a broad spectrum of diseases. The widespread use of aluminum hydroxide and aluminum phosphate in established vaccines such as DTP, HPV, and hepatitis drives their continued demand.

Nanoparticle-based adjuvants are gaining traction for their ability to deliver sustained immune responses and enable controlled antigen release. Pharmaceutical companies are increasingly investing in lipid nanoparticle formulations that enhance mRNA vaccine stability and delivery. The surge in R&D on particulate formulations for next-generation vaccines, including influenza, malaria, and RSV, supports segment expansion.

Regulatory agencies’ approval of particulate adjuvants in COVID-19 and recombinant vaccines further validates their safety and effectiveness. Continuous innovation in biodegradable and synthetic particulate systems is anticipated to enhance immunogenicity and reduce reactogenicity, strengthening their adoption across global immunization programs.

Application Analysis

Infectious diseases account for 48.6% of the Vaccine Adjuvants market and are anticipated to maintain dominance owing to growing global immunization programs and recurring outbreaks of viral and bacterial infections. The ongoing development of vaccines against influenza, tuberculosis, malaria, and COVID-19 continues to rely on potent adjuvants that amplify immune responses.

Rising awareness of pandemic preparedness and government-backed vaccination campaigns in developing nations are key contributors to segment growth. Organizations such as WHO, GAVI, and UNICEF are supporting large-scale vaccination efforts, promoting adjuvant use in both prophylactic and therapeutic formulations. Advanced adjuvant systems, including saponin-based and emulsion-based types, are being explored to boost cross-protection and durability of immunity.

Infectious disease vaccines incorporating adjuvants such as AS03, MF59, and CpG 1018 have shown improved immune memory, driving regulatory approvals and global adoption. The growing prevalence of antimicrobial resistance has also renewed focus on preventive vaccination strategies, expanding the market scope. Continuous R&D on thermostable adjuvanted vaccines for low-resource settings further enhances accessibility, making infectious disease applications central to long-term market expansion.

Administration Analysis

Intramuscular administration represents 44.3% of the Vaccine Adjuvants market and is projected to remain dominant due to its established efficacy, safety, and consistent immunogenic response. The intramuscular route allows efficient antigen delivery to muscle tissue, facilitating uptake by antigen-presenting cells and robust systemic immunity. It is the preferred route for most vaccines, including those for influenza, hepatitis, and COVID-19, reinforcing its widespread adoption.

Clinical research consistently supports intramuscular injection as the optimal method for adjuvanted vaccine formulations due to predictable pharmacokinetics and reduced local reactogenicity. Healthcare professionals favor this route for its ease of administration and minimal patient discomfort compared to intradermal or subcutaneous delivery.

The growing demand for combination and booster vaccines further supports intramuscular delivery systems. Advancements in injection technologies, such as prefilled syringes and auto-injectors, enhance compliance and precision. Pharmaceutical companies are also optimizing adjuvant compatibility for intramuscular vaccines, improving stability and immune performance.

With ongoing vaccination campaigns targeting both adult and pediatric populations, intramuscular administration is expected to sustain its leading position as the standard delivery mode in global vaccination protocols.

Key Market Segments

By Product Type

- Particulate

- Pathogen

- Adjuvant emulsion

- Combination

- Others

By Application

- Infectious diseases

- Cancer

- Others

By Administration

- Intramuscular

- Oral

- Intradermal

- Intranasal

- Others

Drivers

Growing Demand for Effective Vaccines Against Emerging Infectious Diseases is Driving the Market

The expanding threat of emerging infectious diseases has substantially propelled the vaccine adjuvants market, as adjuvants enhance immune responses to weak antigens, enabling robust protection against novel pathogens. These compounds, including aluminum salts and saponins, amplify antibody production and cellular immunity, crucial for vaccines targeting viruses like SARS-CoV-2 variants. This driver is evident in the accelerated development of adjuvanted formulations during pandemics, where they reduce antigen doses while maintaining efficacy.

Pharmaceutical companies are investing heavily in adjuvant R&D to address waning immunity in booster campaigns. The need for single-dose vaccines in low-resource settings further underscores their role, minimizing logistics and storage challenges. Global health organizations promote their use to achieve herd immunity thresholds more efficiently.

The World Health Organization reported that COVID-19 vaccination campaigns administered over 13.5 billion doses globally by the end of 2023, with adjuvanted vaccines playing a key role in enhancing response durability. This massive rollout highlights the adjuvant’s contribution to scalable immunization strategies. Advances in nanoparticle-based adjuvants improve targeted delivery, reducing side effects.

Economically, their incorporation lowers production costs per dose, supporting equitable distribution. Collaborative frameworks between agencies and manufacturers standardize adjuvant formulations for rapid deployment. This disease emergence not only escalates adjuvant utilization but also establishes their essentiality in pandemic preparedness infrastructures. In summary, it encourages innovations in combination systems, harmonizing adjuvants with next-generation vaccine platforms.

Restraints

Safety Concerns and Regulatory Scrutiny is Restraining the Market

Persistent concerns over adjuvant safety profiles and intensified regulatory oversight continue to limit the vaccine adjuvants market, as potential reactogenicity issues prompt cautious approval processes. Aluminum-based adjuvants, while effective, have faced scrutiny for associations with local inflammation, delaying their use in pediatric formulations. This restraint manifests in prolonged preclinical toxicity studies, inflating development timelines for novel candidates. Payers demand extensive post-marketing data, complicating reimbursement for adjuvanted products in national programs.

Manufacturers grapple with harmonization across agencies, where differing thresholds for acceptable risk impede global scaling. The focus on rare adverse events further erodes public confidence, hindering uptake in voluntary campaigns. The European Medicines Agency’s pharmacovigilance risk assessment committee evaluated 15 cases of suspected adverse reactions to adjuvanted influenza vaccines in 2022, leading to enhanced monitoring requirements that extended review periods.

Such evaluations reveal procedural rigors, as safety signals necessitate iterative label revisions. Clinician preferences lean toward non-adjuvanted options in low-risk populations, fragmenting market segments. Initiatives for transparent reporting evolve slowly, constrained by data privacy mandates. These safety barriers not only suppress innovation velocity but also perpetuate hesitancy in adjuvant adoption. Ultimately, they require robust evidence generation to reconcile efficacy gains with risk perceptions.

Opportunities

Expansion of mRNA Vaccine Platforms is Creating Growth Opportunities

The proliferation of mRNA vaccine technologies has unveiled significant prospects for the vaccine adjuvants market, as these platforms often require adjuvants to boost suboptimal immune activation in nucleic acid delivery. mRNA vaccines, while innovative, elicit transient responses, making lipid or saponin adjuvants vital for prolonging antigen presentation and T-cell priming.

Opportunities arise in hybrid formulations, where adjuvants enhance stability and reduce dosing frequencies for annual boosters. Biopharma partnerships subsidize co-development, addressing formulation challenges in thermostable variants. This synergy counters mRNA limitations in elderly cohorts, positioning adjuvants as enhancers for durable protection.

Funding for platform expansions accelerates procurement, extending to veterinary and therapeutic applications. The U.S. National Institutes of Health allocated USD 1.15 billion in 2023 for mRNA research initiatives, including adjuvant integrations to optimize vaccine immunogenicity. This commitment exemplifies expandable models, with trials forecasting increased adjuvant synergies.

Breakthroughs in ionizable lipid adjuvants improve encapsulation efficiency, easing manufacturing scalability. As delivery systems advance, adjuvant-mRNA combinations unlock cross-protective revenue streams. These platform evolutions not only diversify adjuvant applications but also integrate the market into nucleic acid-based health solutions. Consequently, they cultivate alliances with biotech innovators, bolstering resilience in outbreak responses.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic headwinds, including sustained inflation rates hovering around 3.0% and tighter monetary policies in 2025, squeeze R&D funding for vaccine developers, forcing adjuvant suppliers to absorb escalating raw material costs and delay novel formulation rollouts.

Geopolitical frictions, from ongoing U.S.-China trade escalations to regional instability in Europe, fragment global supply chains for critical chemical precursors, slowing adjuvant production timelines and elevating logistics expenses for cross-border shipments. Current U.S. tariffs, featuring a 100% levy on branded pharmaceutical imports effective October 1 unless domestic plants break ground, dramatically hike costs for adjuvants sourced from Europe and Asia, compelling U.S. firms to renegotiate supplier contracts and brace for potential shortages in vaccine pipelines.

These measures also trigger reciprocal duties from key allies, curtailing export avenues for American adjuvant innovators and intensifying pricing pressures in competitive international tenders. Yet, such disruptions catalyze accelerated investments in U.S.-based adjuvant synthesis, spurring breakthroughs in synthetic emulsions and toll-like receptor agonists that enhance vaccine potency.

Furthermore, amplified focus on domestic resilience bolsters public-private collaborations, streamlining regulatory pathways for next-generation adjuvants. In the end, these forces empower forward-thinking enterprises to seize leadership in tailored immunization solutions, driving sustainable expansion and fortified market positioning.

Latest Trends

FDA Approval of CpG 7909 in Anthrax Vaccine is a Recent Trend

The integration of Toll-like receptor agonists in licensed vaccines has denoted a pivotal evolution in the vaccine adjuvants market during 2023, emphasizing enhanced cellular immunity for biothreat countermeasures. Emergent BioSolutions’ Cyfendus, incorporating CpG 7909, stimulates innate responses via TLR9 activation, yielding superior antibody titers against Bacillus anthracis toxins. This authorization signifies a progression toward oligonucleotide adjuvants, supporting simplified regimens with fewer doses for rapid deployment.

Authority confirmations validate its tolerability, hastening endorsements for stockpiling programs amid geopolitical tensions. This formulation aligns with preparedness mandates, interfacing outputs with surveillance networks for efficacy tracking. The approval tackles immunogenicity shortfalls, favoring adjuvants robust to demographic variabilities.

The U.S. Food and Drug Administration approved Cyfendus, the first new anthrax vaccine in over 20 years containing the CpG 7909 adjuvant, on July 20, 2023, for post-exposure prophylaxis in adults. These endorsements accelerate development pipelines, as analogs advance for viral threats. Analysts project protocol adoptions, elevating its role in emergency stockpiles.

Sequential evaluations demonstrate response amplifications, refining strategic appraisals. The horizon anticipates broad-spectrum adaptations, forecasting multi-pathogen utilities. This agonist-focused advancement not only heightens adjuvant potency but also coordinates with biodefense priorities.

Regional Analysis

North America is leading the Vaccine Adjuvants Market

In 2024, North America accounted for 39.7% of the global vaccine adjuvants market, experiencing sustained momentum from FDA approvals of adjuvanted vaccines targeting respiratory pathogens, which enhanced immunogenicity in older adults and reduced antigen doses in formulations for influenza and RSV, aligning with seasonal immunization drives.

Biopharmaceutical firms expanded production of squalene-based emulsions to support updated COVID-19 boosters, enabling broader strain coverage and improving antibody titers by 2-3 fold in clinical evaluations, amid ongoing variant surveillance by the CDC. The National Institutes of Health’s BARDA program allocated additional funding for adjuvant platforms in pandemic preparedness, fostering collaborations that accelerated Phase III trials for universal flu candidates with novel Toll-like receptor agonists.

Regulatory efficiencies under the FDA’s accelerated approval pathway expedited market entry for AS01B-containing shingles vaccines, addressing gaps in geriatric protection where efficacy wanes post-60 years. Demographic factors, including a 10% rise in RSV hospitalizations among seniors, amplified demand for adjuvant-enhanced shots in community pharmacies.

These developments reinforced the region’s pivotal role in adjuvant innovation for public health resilience. The FDA granted full approval to GSK’s Arexvy RSV vaccine in June 2024, the first adjuvanted RSV shot for adults aged 60 and older, following its May 2023 EUA.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

National agencies across Asia Pacific project the vaccine adjuvants sector to advance during the forecast period, as public health priorities emphasize adjuvant integration to bolster efficacy against endemic viral threats in densely populated zones. Governments in China and India channel investments into mineral salt formulations, outfitting national immunization campaigns to heighten responses to hepatitis B in neonatal cohorts.

Adjuvant developers collaborate with regional institutes to refine emulsion systems, anticipating stronger protection for dengue vaccines in tropical outbreaks. Oversight bodies in Japan and South Korea subsidize liposome-based platforms, positioning manufacturing hubs to produce adjuvanted HPV shots for adolescent programs without supply constraints.

Administrative networks estimate merging adjuvant trial data with digital registries, expediting approvals for tuberculosis boosters in high-burden migrant groups. Regional immunologists pioneer saponin-derived enhancers, coordinating with WHO networks to evaluate cross-protection in avian influenza scenarios. These efforts build a versatile arsenal for immunization equity.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Vaccine Adjuvants Market drive growth by developing nanoparticle formulations to boost immune responses for new pathogens. They partner with biopharma firms to co-engineer saponin boosters, speeding validations. Companies invest in scalable manufacturing for cost efficiency in global vaccination efforts. Leaders acquire innovators to add TLR agonists for oncology and allergy uses. They expand in Asia-Pacific and Africa, aligning with immunization programs for contracts.

Additionally, they use milestone licensing with governments, leveraging evidence for reimbursement. Novavax, Inc., founded in 1987 in Gaithersburg, Maryland, builds protein vaccines with Matrix-M adjuvant for strong immunity against COVID-19, influenza, and RSV. CEO John C. Jacobs leads global operations, partnering for access in low-resource areas. The firm advances candidates through innovative delivery and alliances to enhance preventive health.

Top Key Players

- SPI Pharma

- Novavax, Inc.

- InvivoGen

- GlaxoSmithKline plc.

- CSL Limited

- Croda International Plc

- Brenntag Biosector

- Agenus, Inc.

- Adjuvance Technologies, Inc.

Recent Developments

- In February 2024, GSK plc partnered with the Coalition for Epidemic Preparedness Innovations (CEPI) to accelerate the development of new vaccine adjuvants aimed at pandemic preparedness. This collaboration enhances global vaccine readiness by fostering rapid-response adjuvant platforms capable of boosting immune protection against emerging pathogens—strengthening innovation and scalability within the vaccine adjuvants market.

- In January 2024, Vaxine completed Phase II trials for its Advax adjuvant-based respiratory syncytial virus (RSV) vaccine, marking a milestone in next-generation adjuvant research. The successful trial outcomes validate Advax’s strong immunogenic potential, positioning it as a competitive alternative to conventional adjuvants and driving further adoption of novel formulations in respiratory vaccine development.

Report Scope

Report Features Description Market Value (2024) US$ 3.8 Billion Forecast Revenue (2034) US$ 6.7 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Particulate, Pathogen, Adjuvant Emulsion, Combination, and Others), By Application (Infectious Diseases, Cancer, and Others), By Administration (Intramuscular, Oral, Intradermal, Intranasal, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SPI Pharma, Novavax, Inc., InvivoGen, GlaxoSmithKline plc., CSL Limited, Croda International Plc, Brenntag Biosector, Agenus, Inc., Adjuvance Technologies, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SPI Pharma

- Novavax, Inc.

- InvivoGen

- GlaxoSmithKline plc.

- CSL Limited

- Croda International Plc

- Brenntag Biosector

- Agenus, Inc.

- Adjuvance Technologies, Inc.