Global Utility Trucks Market Size, Share, Growth Analysis By Type (Garbage Truck, Front Loader, Rear Loader, Side Loader, Fire Truck, Dump Truck, Sweeper Truck, Street Sweeper, Parking Lot Sweeper), By Engine (Electric, Gasoline Engines, Diesel Engines, Electric Motors), By Vehicle Type (Pickup Trucks, Vans, Box Trucks, Flatbed Trucks, Dump Trucks), By Capacity (Light Payload, Medium Payload, Heavy Payload), By Drive Configuration (Rear-Wheel Drive, All-Wheel Drive, Four-Wheel Drive), By Application (Utilities & Municipal Services, Construction, Transportation and Logistics, Government, Services), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174653

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

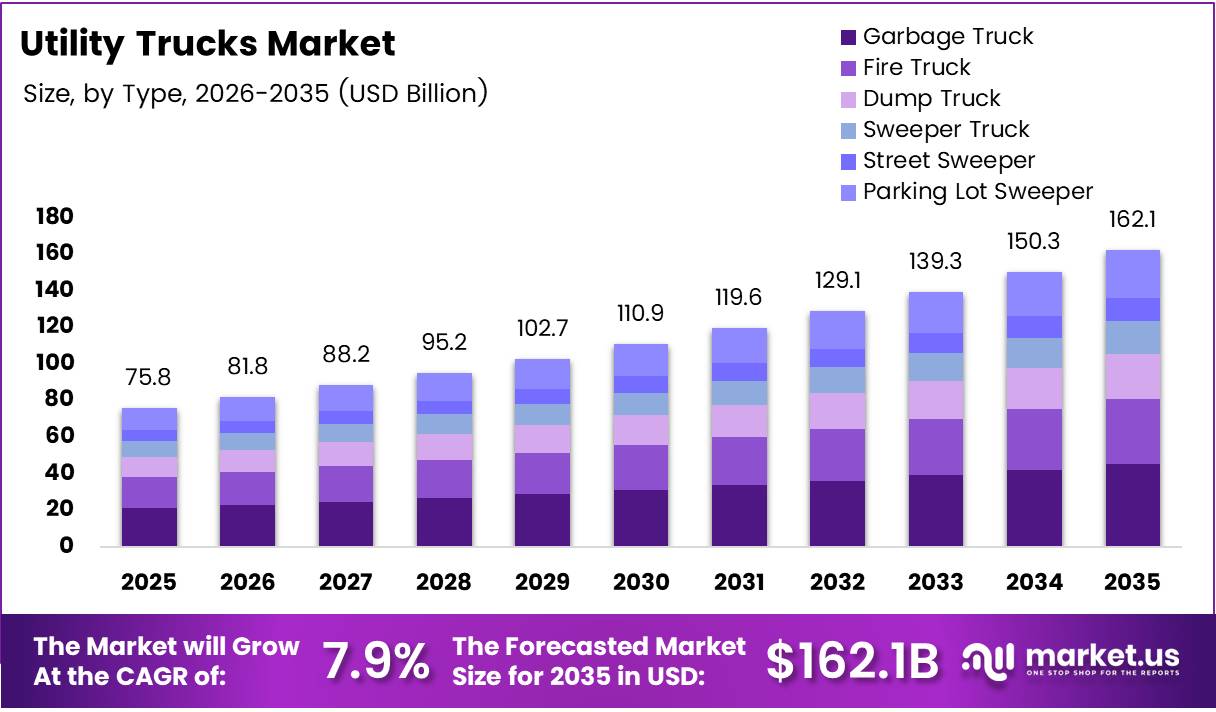

Global Utility Trucks Market size is expected to be worth around USD 162.1 Billion by 2035 from USD 75.8 Billion in 2025, growing at a CAGR of 7.9% during the forecast period 2026 to 2035.

Utility trucks represent specialized commercial vehicles designed for specific operational tasks across municipal services, construction, logistics, and government applications. These vehicles include garbage trucks, fire trucks, dump trucks, and sweeper trucks. Moreover, they serve critical infrastructure and service delivery functions in urban and industrial environments.

The utility trucks market demonstrates robust expansion driven by urbanization and infrastructure modernization initiatives globally. Additionally, the sector benefits from increasing municipal fleet upgrades and specialized service vehicle requirements. Therefore, market participants are witnessing substantial growth opportunities across diverse commercial segments and regional markets.

E-commerce growth significantly accelerates last-mile delivery vehicle demand, consequently driving utility truck adoption. Furthermore, construction sector expansion and smart city initiatives create sustained market momentum. However, manufacturers are innovating with electric powertrains and telematics integration to address evolving regulatory standards and operational efficiency requirements.

Government infrastructure investments remain pivotal in shaping market dynamics and fleet modernization programs. According to ACEA, diesel trucks accounted for 93.6% of new EU registrations in H1 2025. Additionally, according to TruckInfo, there are 13.5 million trucks registered in the US, with 2.97 million tractor-trailers and 10.5 million single-unit trucks.

Regional variations in adoption rates reflect differing infrastructure maturity levels and regulatory frameworks. Moreover, technological advancements in connectivity and alternative fuel systems are reshaping competitive landscapes. Consequently, the utility trucks market presents compelling growth prospects through 2035 across multiple applications and geographic territories.

Key Takeaways

- Global Utility Trucks Market valued at USD 75.8 Billion in 2025, projected to reach USD 162.1 Billion by 2035

- Market growing at CAGR of 7.9% during forecast period 2026-2035

- Garbage Truck segment dominates by type with 29.6% market share

- Diesel Engines segment leads with 56.2% share in engine category

- Pickup Trucks segment holds 33.1% share by vehicle type

- Medium Payload capacity segment commands 49.8% market share

- Rear-Wheel Drive configuration dominates with 49.3% share

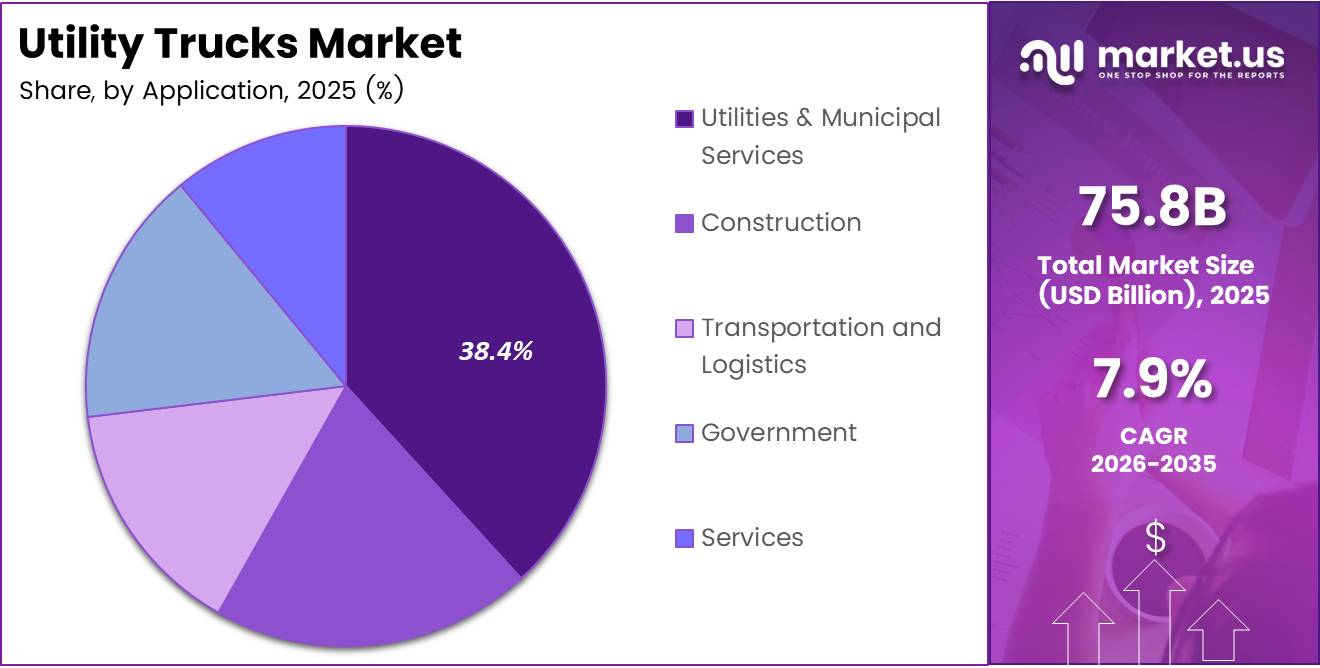

- Utilities & Municipal Services application leads with 38.4% market share

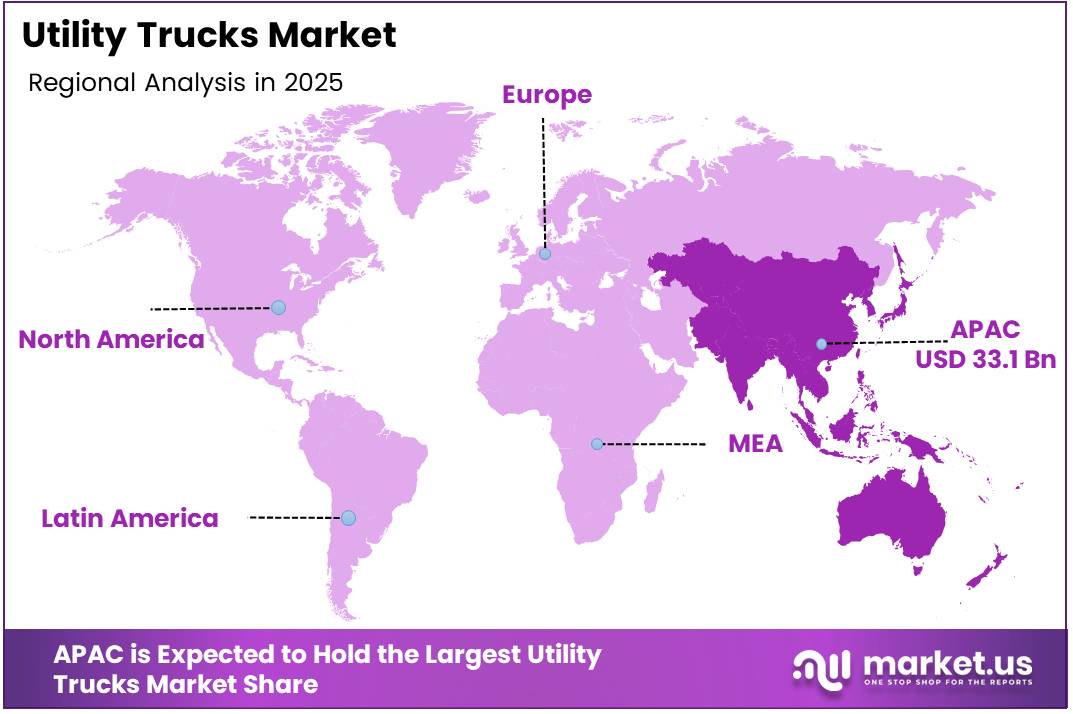

- Asia Pacific dominates market with 43.7% share, valued at USD 33.1 Billion

Type Analysis

Garbage Truck dominates with 29.6% due to increasing urban waste management requirements and municipal fleet modernization.

In 2025, Garbage Truck held a dominant market position in the By Type segment of Utility Trucks Market, with a 29.6% share. Front loaders provide efficient commercial waste collection with automated lifting mechanisms. Rear loaders remain popular for residential routes due to operational flexibility. Side loaders optimize driver safety and collection efficiency in narrow urban streets.

Fire Truck segment serves critical emergency response functions across municipal and industrial facilities. These specialized vehicles incorporate advanced firefighting equipment and rescue systems. Moreover, regulatory mandates drive continuous fleet upgrades and technology integration. Consequently, fire departments prioritize modern apparatus with enhanced capabilities.

Dump Truck segment supports construction and material transportation applications extensively. These vehicles facilitate efficient earth moving and debris removal operations. Additionally, infrastructure projects generate sustained demand across residential and commercial development sectors. Therefore, dump trucks remain essential for construction logistics.

Sweeper Truck segment addresses urban cleanliness and maintenance requirements comprehensively. Street sweepers maintain roadway cleanliness in cities and municipalities. Parking lot sweepers serve commercial and retail facility maintenance needs effectively. Furthermore, environmental regulations encourage adoption of efficient cleaning equipment.

Engine Analysis

Diesel Engines dominate with 56.2% due to proven reliability, power output, and established infrastructure support.

In 2025, Diesel Engines held a dominant market position in the By Engine segment of Utility Trucks Market, with a 56.2% share. Diesel powertrains deliver superior torque and fuel efficiency for heavy-duty applications. Moreover, extensive refueling infrastructure supports widespread commercial adoption. Consequently, diesel engines remain the preferred choice for utility operations.

Electric segment demonstrates rapid growth through emissions regulations and sustainability initiatives. Electric motors provide zero-emission operation for urban municipal services. Additionally, lower operating costs and reduced maintenance requirements drive fleet electrification. Therefore, municipalities increasingly adopt electric utility vehicles.

Gasoline Engines serve lighter payload applications with adequate performance characteristics. These engines offer lower initial costs compared to diesel alternatives. Furthermore, gasoline powertrains provide suitable solutions for specific regional markets. However, fuel efficiency considerations limit adoption in heavy-duty segments.

Electric Motors continue gaining traction through technological advancements and battery improvements. Government incentives accelerate electric utility truck deployment across various applications. Moreover, charging infrastructure expansion supports broader market penetration. Consequently, electric powertrain adoption increases steadily.

Vehicle Type Analysis

Pickup Trucks dominate with 33.1% due to versatility, payload capacity, and widespread commercial utility applications.

In 2025, Pickup Trucks held a dominant market position in the By Vehicle Type segment of Utility Trucks Market, with a 33.1% share. Pickup trucks deliver exceptional flexibility for trades, services, and light construction work. Additionally, these vehicles combine passenger comfort with cargo capability effectively. Therefore, pickup trucks remain highly popular across commercial sectors.

Vans segment serves delivery, service, and passenger transportation requirements comprehensively. These enclosed vehicles protect cargo from weather and theft concerns. Moreover, vans accommodate equipment storage and mobile workspace configurations. Consequently, service industries extensively utilize van platforms.

Box Trucks provide larger enclosed cargo spaces for distribution and moving services. These vehicles facilitate efficient last-mile delivery operations in urban environments. Additionally, box trucks accommodate temperature-controlled and specialized cargo requirements. Therefore, logistics operators favor these versatile platforms.

Flatbed Trucks enable flexible loading and oversized cargo transportation capabilities. These open platforms simplify loading operations for construction materials and equipment. Furthermore, flatbed configurations accommodate diverse cargo shapes and dimensions. Dump Trucks serve specialized material hauling and earth-moving applications consistently.

Capacity Analysis

Medium Payload dominates with 49.8% due to optimal balance between capability and operational efficiency.

In 2025, Medium Payload held a dominant market position in the By Capacity segment of Utility Trucks Market, with a 49.8% share. Medium payload trucks accommodate majority of commercial and municipal applications effectively. Moreover, these vehicles provide adequate capacity without excessive operating costs. Consequently, medium-duty segments attract broad market demand.

Light Payload segment serves urban delivery and service applications requiring maneuverability. These vehicles navigate congested city streets and residential areas efficiently. Additionally, lower operating costs benefit small businesses and service providers. Therefore, light-duty trucks maintain steady market presence.

Heavy Payload segment addresses demanding construction and industrial transportation requirements. These trucks deliver maximum cargo capacity for intensive hauling operations. Furthermore, mining and infrastructure projects require heavy-duty vehicle capabilities. Consequently, heavy payload trucks serve specialized market segments.

Drive Configuration Analysis

Rear-Wheel Drive dominates with 49.3% due to cost-effectiveness and adequate performance for standard applications.

In 2025, Rear-Wheel Drive held a dominant market position in the By Drive Configuration segment of Utility Trucks Market, with a 49.3% share. Rear-wheel drive configurations provide reliable performance for conventional utility operations. Moreover, these systems offer lower maintenance costs and simpler mechanical design. Consequently, standard applications favor rear-wheel drive platforms.

All-Wheel Drive segment delivers enhanced traction for challenging terrain and weather conditions. These systems distribute power across multiple wheels for improved stability. Additionally, all-wheel drive benefits municipal operations in diverse environmental conditions. Therefore, northern regions increasingly adopt all-wheel drive configurations.

Four-Wheel Drive segment serves off-road and severe-duty applications requiring maximum traction. These systems enable operation in construction sites and remote locations. Furthermore, four-wheel drive provides essential capability for emergency response vehicles. Consequently, specialized applications justify additional system complexity.

Application Analysis

Utilities & Municipal Services dominate with 38.4% due to essential public service requirements and fleet renewal cycles.

In 2025, Utilities & Municipal Services held a dominant market position in the By Application segment of Utility Trucks Market, with a 38.4% share. Municipal operations require diverse specialized vehicles for waste management and street maintenance. Moreover, government budgets allocate substantial resources for public service fleet maintenance. Consequently, utilities sector drives significant market demand.

Construction segment utilizes utility trucks for material transport and site operations extensively. These applications require durable vehicles capable of demanding work conditions. Additionally, infrastructure development projects generate sustained equipment demand. Therefore, construction industry represents major market opportunity.

Transportation and Logistics segment relies on utility trucks for efficient goods movement. These operations prioritize payload capacity and fuel efficiency for profitability. Furthermore, e-commerce growth accelerates last-mile delivery vehicle requirements. Consequently, logistics providers continuously expand utility truck fleets.

Government segment employs utility trucks across various administrative and service functions. These vehicles support parks maintenance, facilities management, and emergency services. Services segment encompasses diverse commercial applications from telecommunications to utilities maintenance.

Key Market Segments

By Type

- Garbage Truck

- Front Loader

- Rear Loader

- Side Loader

- Fire Truck

- Dump Truck

- Sweeper Truck

- Street Sweeper

- Parking Lot Sweeper

By Engine

- Electric

- Gasoline Engines

- Diesel Engines

- Electric Motors

By Vehicle Type

- Pickup Trucks

- Vans

- Box Trucks

- Flatbed Trucks

- Dump Trucks

By Capacity

- Light Payload

- Medium Payload

- Heavy Payload

By Drive Configuration

- Rear-Wheel Drive

- All-Wheel Drive

- Four-Wheel Drive

By Application

- Utilities & Municipal Services

- Construction

- Transportation and Logistics

- Government

- Services

Drivers

Expansion of Last-Mile Logistics and E-Commerce Delivery Networks Drives Market Growth

E-commerce expansion fundamentally transforms commercial vehicle requirements and fleet compositions nationwide. Online retail growth necessitates efficient last-mile delivery solutions across urban and suburban markets. Moreover, consumer expectations for rapid delivery timeframes intensify utility truck demand significantly. Consequently, logistics providers continuously expand delivery vehicle fleets.

Urban density challenges require compact yet capable utility vehicles for congested environments. Additionally, delivery route optimization depends on appropriate vehicle selection and configuration. Therefore, specialized utility trucks serve growing e-commerce logistics requirements effectively. Furthermore, seasonal peaks demand flexible fleet capacity adjustments.

Rising infrastructure development and urban construction projects generate sustained utility truck demand. Cities worldwide invest heavily in transportation networks and building construction activities. Moreover, government infrastructure programs allocate substantial budgets for modernization initiatives. Consequently, construction equipment markets experience robust growth trajectories.

Municipal fleet modernization programs drive replacement demand for aging utility vehicles. Additionally, specialized service vehicles support diverse industrial and commercial applications continuously. Therefore, market growth reflects expanding operational requirements across multiple sectors.

Restraints

High Initial Acquisition and Maintenance Costs Restrain Market Adoption

Significant capital requirements for utility truck acquisition limit fleet expansion capabilities. Small businesses and municipal budgets face constraints when purchasing specialized vehicles. Moreover, financing challenges affect operators in emerging markets and rural regions. Consequently, high initial costs slow market penetration rates.

Maintenance expenses accumulate substantially over vehicle operational lifespans and usage cycles. Additionally, specialized components and service requirements increase total ownership costs. Therefore, budget-conscious operators delay replacement decisions and extend vehicle service lives. Furthermore, economic uncertainties amplify financial concerns.

Fuel price volatility creates unpredictable operating expense scenarios for fleet managers. Diesel and gasoline price fluctuations directly impact transportation profitability and budget planning. Moreover, energy cost uncertainty complicates long-term fleet investment decisions. Consequently, operators hesitate expanding fleets during volatile periods.

Operating expense management remains critical for commercial viability in competitive markets. Additionally, fuel efficiency improvements become essential for cost control strategies. Therefore, volatile fuel prices restrain market growth and fleet modernization initiatives.

Growth Factors

Integration of Electric and Hybrid Powertrains Creates Market Opportunities

Electric powertrain technology advances enable viable utility truck applications across municipal operations. Battery improvements and charging infrastructure expansion support broader electrification adoption. Moreover, emissions regulations and sustainability mandates accelerate electric vehicle deployment. Consequently, manufacturers develop comprehensive electric utility truck portfolios.

Operating cost advantages and maintenance reductions justify electric vehicle investments increasingly. Additionally, government incentives offset higher initial acquisition costs for electric platforms. Therefore, municipalities prioritize electric utility trucks for environmental and economic benefits. Furthermore, total cost of ownership favors electric alternatives.

Smart telematics and fleet management solutions optimize operational efficiency and asset utilization. Connected vehicle technologies provide real-time monitoring and predictive maintenance capabilities. Moreover, data analytics improve route planning and driver behavior management. Consequently, fleet operators achieve substantial cost savings and productivity gains.

Compact utility trucks address urban application requirements with enhanced maneuverability and efficiency. Additionally, customization capabilities enable niche commercial applications across specialized industries. Therefore, manufacturers develop tailored solutions for specific market segments.

Emerging Trends

Shift Toward Lightweight Materials Improves Fuel Efficiency and Payload Capacity

Advanced materials reduce vehicle weight while maintaining structural strength and safety standards. Aluminum and composite materials replace traditional steel in cab and body construction. Moreover, weight reduction directly improves fuel economy and reduces emissions significantly. Consequently, manufacturers increasingly adopt lightweight engineering solutions.

Connected vehicle technologies enable advanced fleet management and operational optimization capabilities. Telematics systems provide comprehensive vehicle health monitoring and performance analytics. Additionally, connectivity facilitates remote diagnostics and predictive maintenance scheduling. Therefore, operators minimize downtime and maximize asset productivity.

Rental and leasing models provide flexible fleet capacity without large capital commitments. Additionally, leasing arrangements transfer maintenance responsibilities to service providers. Moreover, rental options accommodate seasonal demand fluctuations and project-based requirements effectively. Consequently, alternative ownership models gain traction.

Advanced driver assistance systems enhance safety through collision avoidance and monitoring technologies. Additionally, camera systems and sensors improve visibility in challenging operational environments. Therefore, safety technology adoption accelerates across utility truck segments.

Regional Analysis

Asia Pacific Dominates the Utility Trucks Market with 43.7% Share, Valued at USD 33.1 Billion

Asia Pacific commands the utility trucks market with a dominant 43.7% share, valued at USD 33.1 Billion, driven by rapid urbanization and infrastructure development. China and India lead regional demand through massive construction projects and municipal fleet expansions. Moreover, manufacturing capabilities and cost advantages support strong market growth. Additionally, government smart city initiatives accelerate utility vehicle adoption across the region.

North America Utility Trucks Market Trends

North America maintains substantial market presence through established commercial vehicle industries and fleet modernization programs. The United States represents the largest regional market with extensive logistics and municipal operations. Moreover, regulatory emissions standards drive technology adoption and fleet upgrades. Additionally, e-commerce growth sustains strong demand for delivery and service vehicles.

Europe Utility Trucks Market Trends

Europe demonstrates steady market growth through stringent environmental regulations and electrification initiatives. Germany, France, and the UK lead regional adoption of advanced utility truck technologies. Moreover, circular economy principles drive waste management vehicle innovations. Additionally, urban congestion challenges encourage compact and efficient vehicle solutions.

Latin America Utility Trucks Market Trends

Latin America shows emerging market potential through infrastructure development and urban expansion projects. Brazil and Mexico represent primary regional markets with growing commercial vehicle demand. Moreover, mining and agricultural sectors require specialized utility truck applications. Additionally, economic development supports gradual fleet modernization efforts.

Middle East & Africa Utility Trucks Market Trends

Middle East & Africa exhibits growth opportunities through construction booms and resource sector activities. GCC countries invest heavily in infrastructure and smart city development projects. Moreover, mining operations across Africa require durable utility vehicles. Additionally, municipal service improvements drive gradual market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Utility Trucks Company Insights

Daimler Truck AG maintains leadership position through comprehensive commercial vehicle portfolio and global manufacturing presence. The company delivers innovative utility truck solutions across multiple weight classes and applications. Moreover, Daimler advances electrification strategies with battery-electric and hydrogen fuel cell technologies. Additionally, the manufacturer emphasizes connectivity and autonomous driving capabilities for future mobility solutions.

Ford Motor Company dominates the pickup truck segment with the industry-leading F-Series platform and commercial variants. Ford’s extensive dealer network and service infrastructure support widespread commercial adoption. Moreover, the company invests significantly in electric utility vehicles including the F-150 Lightning. Additionally, Ford Pro services provide comprehensive fleet management solutions for commercial customers.

General Motors competes aggressively through Chevrolet and GMC commercial truck brands across utility segments. The manufacturer emphasizes technology integration and connectivity features in utility truck offerings. Moreover, General Motors pursues electric vehicle leadership with upcoming commercial electric platforms. Additionally, the company leverages manufacturing scale and distribution capabilities effectively.

TOYOTA MOTOR CORPORATION excels in reliability and durability reputation across global utility truck markets. Toyota’s pickup trucks and commercial vehicles serve diverse applications with proven performance. Moreover, the company advances hybrid and hydrogen fuel cell technologies strategically. Additionally, Toyota emphasizes quality engineering and total cost of ownership advantages consistently.

Key Companies

- Daimler Truck AG

- Ford Motor Company

- General Motors

- TOYOTA MOTOR CORPORATION

- ISUZU MOTORS LIMITED

- NISSAN USA

- Volkswagen Group

- Mack Trucks

- NAVISTAR, INC.

Recent Developments

- In January 2026, Ryder Acquires Truck Service Depot, expanding its service network and maintenance capabilities across key commercial vehicle markets. This acquisition strengthens Ryder’s position in utility truck fleet services and aftermarket support operations significantly.

- In December 2025, Stellar Industries Expands into Utility Sector with Elliott Equipment Company Acquisition, enhancing its product portfolio for utility and service truck applications. This strategic move enables comprehensive solutions for telecommunications and municipal service vehicle markets.

- In December 2025, JDC Acquires Atlas Truck Sales and Rentals to Expand Presence in Texas, strengthening regional market coverage and customer service capabilities. This acquisition supports growing demand for utility trucks in the expanding Texas commercial vehicle market.

Report Scope

Report Features Description Market Value (2025) USD 75.8 Billion Forecast Revenue (2035) USD 162.1 Billion CAGR (2026-2035) 7.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Garbage Truck, Front Loader, Rear Loader, Side Loader, Fire Truck, Dump Truck, Sweeper Truck, Street Sweeper, Parking Lot Sweeper), By Engine (Electric, Gasoline Engines, Diesel Engines, Electric Motors), By Vehicle Type (Pickup Trucks, Vans, Box Trucks, Flatbed Trucks, Dump Trucks), By Capacity (Light Payload, Medium Payload, Heavy Payload), By Drive Configuration (Rear-Wheel Drive, All-Wheel Drive, Four-Wheel Drive), By Application (Utilities & Municipal Services, Construction, Transportation and Logistics, Government, Services) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Daimler Truck AG, Ford Motor Company, General Motors, TOYOTA MOTOR CORPORATION, ISUZU MOTORS LIMITED, NISSAN USA, Volkswagen Group, Mack Trucks, NAVISTAR, INC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Daimler Truck AG

- Ford Motor Company

- General Motors

- TOYOTA MOTOR CORPORATION

- ISUZU MOTORS LIMITED

- NISSAN USA

- Volkswagen Group

- Mack Trucks

- NAVISTAR, INC.