Global Used Semi-Truck Market Size, Share, Growth Analysis By Class (Class 6, Class 7, Class 8), By Fuel (Diesel, Gasoline, Electric), By Sales Channel (Independent dealer, Franchised dealer, Peer-to-peer), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176548

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

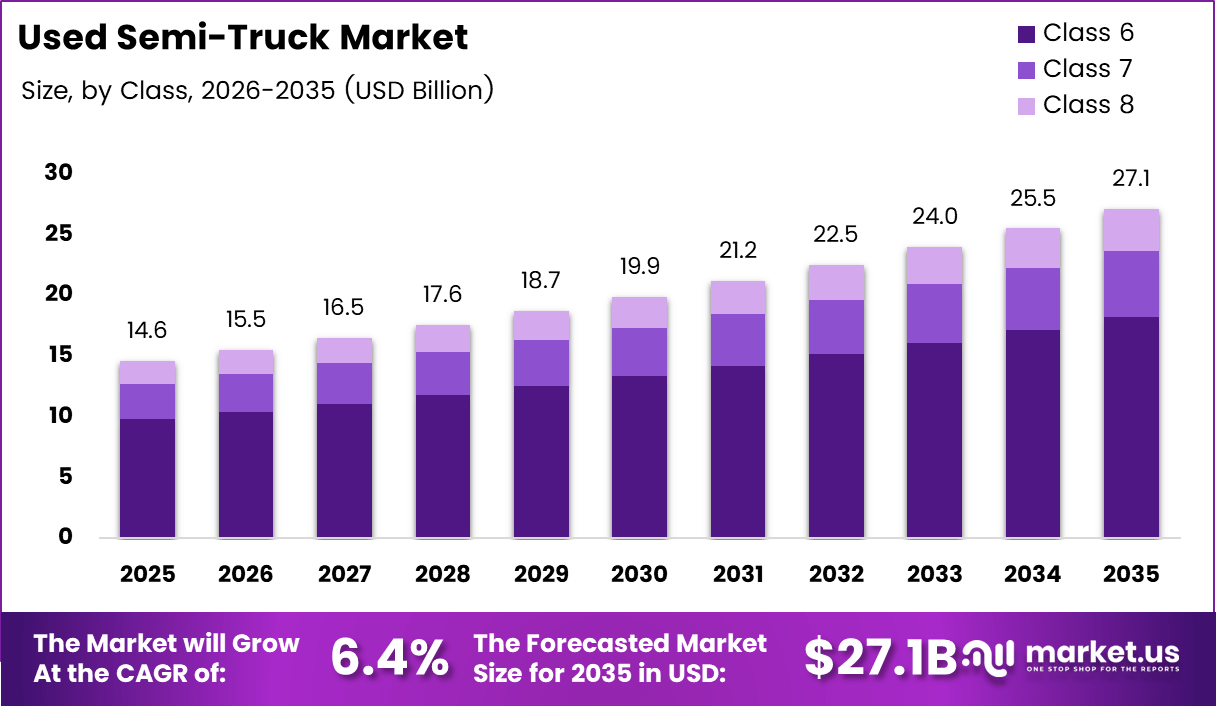

Global Used Semi-Truck Market size is expected to be worth around USD 27.1 Billion by 2035 from USD 14.6 Billion in 2025, growing at a CAGR of 6.4% during the forecast period 2026 to 2035.

The used semi-truck market encompasses the sale and purchase of pre-owned commercial heavy-duty trucks designed for freight transportation and logistics operations. These vehicles include various classes of semi-trucks that have been previously owned and are resold through dealerships, auctions, and direct sales channels. The market serves fleet operators, independent truckers, and logistics companies seeking cost-effective transportation solutions.

Market growth is driven by escalating prices of new commercial vehicles, which are pushing fleet operators toward affordable alternatives. Moreover, the expansion of e-commerce and regional distribution networks continues to generate strong demand for freight transportation capacity. Consequently, businesses are increasingly turning to used semi-trucks to maintain operational efficiency while managing capital expenditure constraints.

The market presents significant opportunities through digital transformation and online marketplaces that enhance price transparency. Additionally, dealer refurbishment programs and certified pre-owned initiatives are attracting buyers seeking reliable used vehicles with warranty coverage. Furthermore, emerging markets demonstrate growing appetite for affordable commercial transportation solutions, creating new revenue streams for dealers and distributors.

Government regulations regarding emissions standards and safety compliance are reshaping the used truck landscape. Therefore, buyers increasingly prioritize fuel-efficient and emission-compliant models that meet current regulatory requirements. However, fleet electrification initiatives are simultaneously creating a robust secondary market for diesel-powered trucks as operators transition to cleaner technologies.

According to Schneider, the company operates approximately 1,800 trucks and 7,500 trailers across more than forty locations throughout the Eastern and Mid-Atlantic regions. Additionally, including Cowan Systems, Schneider will operate over 8,400 Dedicated tractors, representing approximately 70% of Schneider’s Truckload fleet, demonstrating the scale of commercial fleet operations driving market dynamics.

The industry is witnessing consolidation as dealers expand geographic footprints through strategic acquisitions. Moreover, digital auction platforms and telematics-enabled vehicle history tracking are revolutionizing how used semi-trucks are marketed and sold. Consequently, buyers benefit from improved transparency while sellers access broader customer bases, creating a more efficient marketplace ecosystem.

Key Takeaways

- Global Used Semi-Truck Market projected to reach USD 27.1 Billion by 2035 from USD 14.6 Billion in 2025 at 6.4% CAGR

- Class 6 segment dominates the market with 67.2% share in 2025

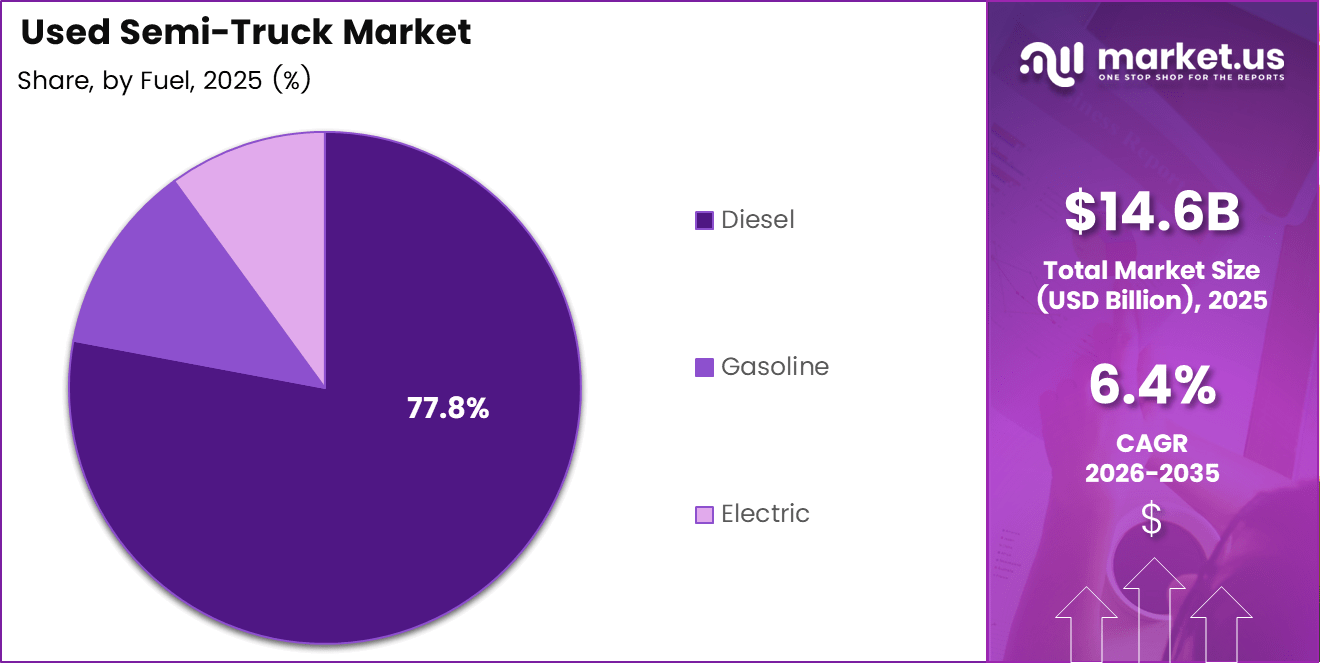

- Diesel fuel type leads with 77.8% market share

- Independent dealer channel accounts for 59.4% of sales

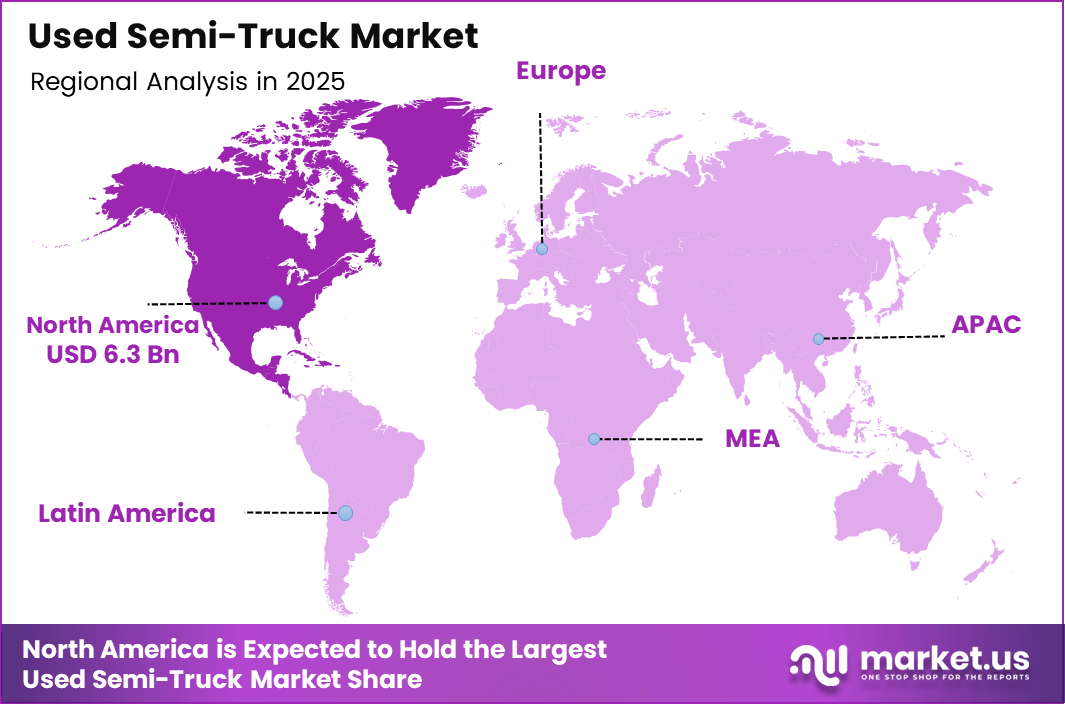

- North America dominates with 43.8% market share valued at USD 6.3 Billion

- Rising new truck prices driving demand for cost-effective used alternatives

- E-commerce growth fueling freight transportation requirements

- Digital marketplaces improving transparency in used truck transactions

By Class Analysis

Class 6 dominates with 67.2% due to versatile medium-duty applications and lower operating costs.

In 2025, Class 6 held a dominant market position in the By Class segment of Used Semi-Truck Market, with a 67.2% share. These medium-duty trucks offer optimal balance between payload capacity and maneuverability for regional distribution and delivery operations. Moreover, Class 6 vehicles present lower acquisition costs and reduced fuel consumption compared to heavier classes. Consequently, small and mid-sized logistics companies prefer this segment for urban and suburban freight operations.

Class 7 trucks serve specialized applications requiring greater payload capacity than Class 6 while maintaining reasonable fuel efficiency. These vehicles are popular among construction companies, waste management services, and regional freight carriers. Additionally, the used Class 7 market benefits from steady fleet turnover as operators upgrade to newer emission-compliant models. Therefore, availability remains strong across both dealer and auction channels.

Class 8 heavy-duty trucks dominate long-haul transportation and interstate freight operations. However, higher purchase prices and maintenance costs limit adoption among smaller operators seeking used vehicles. Nevertheless, established fleet operators frequently acquire used Class 8 trucks to expand capacity during peak shipping seasons. Furthermore, the secondary market for Class 8 vehicles remains robust due to consistent demand from independent owner-operators.

By Fuel Analysis

Diesel dominates with 77.8% due to established infrastructure and superior fuel economy for heavy-duty applications.

In 2025, Diesel held a dominant market position in the By Fuel segment of Used Semi-Truck Market, with a 77.8% share. Diesel-powered semi-trucks deliver exceptional torque and fuel efficiency essential for long-distance hauling and heavy payload transportation. Moreover, extensive refueling infrastructure and widespread mechanical expertise support diesel vehicle maintenance and operations. Consequently, fleet operators continue prioritizing diesel trucks in secondary markets despite emerging alternative fuel technologies.

Gasoline-powered used semi-trucks occupy a niche segment focused primarily on lighter-duty applications and regional distribution operations. These vehicles offer lower initial acquisition costs and simpler maintenance requirements compared to diesel alternatives. Additionally, gasoline trucks appeal to operators in urban areas with stricter noise regulations. However, higher fuel consumption and reduced torque limit their adoption for heavy-duty freight transportation applications.

Electric used semi-trucks represent an emerging segment as early fleet adopters begin cycling vehicles into secondary markets. Battery-electric trucks appeal to environmentally conscious buyers and operators in emissions-restricted zones. Furthermore, decreasing battery replacement costs and expanding charging infrastructure improve electric vehicle value proposition. Nevertheless, limited range and higher depreciation rates currently constrain widespread adoption in used truck markets.

By Sales Channel Analysis

Independent dealer dominates with 59.4% due to competitive pricing and extensive inventory selection.

In 2025, Independent dealer held a dominant market position in the By Sales Channel segment of Used Semi-Truck Market, with a 59.4% share. Independent dealers offer flexible pricing structures and diverse inventory spanning multiple truck brands and configurations. Moreover, these dealers provide personalized service and localized market expertise that attract regional fleet operators. Consequently, small and mid-sized logistics companies prefer independent dealers for used truck acquisitions and trade-in transactions.

Franchised dealers provide manufacturer-backed certification programs and warranty coverage that enhance buyer confidence in used vehicle quality. These authorized dealers maintain higher quality standards through comprehensive vehicle inspections and refurbishment processes. Additionally, franchised dealerships offer integrated financing options and ongoing service support. Therefore, larger fleet operators frequently source certified pre-owned trucks through franchised channels despite premium pricing compared to independent alternatives.

Peer-to-peer sales channels enable direct transactions between individual sellers and buyers through online platforms and digital marketplaces. This channel eliminates dealer margins, creating potential cost savings for both parties in used truck transactions. Furthermore, digital platforms provide transparent pricing data and vehicle history information that streamline purchasing decisions. However, absence of warranty coverage and inspection services limit peer-to-peer adoption among risk-averse commercial buyers.

Key Market Segments

By Class

- Class 6

- Class 7

- Class 8

By Fuel

- Diesel

- Gasoline

- Electric

By Sales Channel

- Independent dealer

- Franchised dealer

- Peer-to-peer

Drivers

Rising New Truck Prices and E-Commerce Expansion Drive Market Growth

Rising prices for new commercial trucks are compelling fleet operators to seek cost-effective alternatives in the used semi-truck market. Budget-conscious logistics companies recognize that pre-owned vehicles deliver comparable operational capabilities at significantly lower capital investment. Moreover, total cost of ownership analysis increasingly favors used trucks when depreciation and financing costs are considered. Consequently, purchasing managers are extending vehicle replacement cycles and actively sourcing quality used equipment.

Strong demand from small and mid-sized logistics companies continues expanding as these operators scale their freight transportation operations. E-commerce growth generates consistent demand for regional distribution capacity, creating opportunities for smaller carriers to capture market share. Additionally, these companies lack capital resources for new truck acquisitions, making used vehicles the practical choice. Therefore, independent operators and growing fleets represent core customer segments driving sustained market expansion.

Shorter replacement cycles among large fleet operators increase the supply of well-maintained used semi-trucks entering secondary markets. Major carriers typically cycle trucks out of primary service after predetermined mileage or time periods to maintain fleet reliability and fuel efficiency. Furthermore, growing freight movement driven by e-commerce and regional distribution networks sustains demand across market segments. However, operators must balance acquisition costs against maintenance requirements when evaluating used vehicle investments.

Restraints

Higher Maintenance Costs and Limited Warranty Coverage Constrain Market Growth

Higher maintenance and repair costs associated with aging vehicle fleets represent a significant concern for used semi-truck buyers. Older trucks require more frequent service intervals and component replacements as engine hours and mileage accumulate. Moreover, unexpected breakdowns can disrupt delivery schedules and damage customer relationships, creating operational risks. Consequently, fleet managers must carefully evaluate total cost of ownership rather than focusing solely on lower acquisition prices.

Parts availability challenges and increased labor costs for aging truck models further compound maintenance expense concerns. Older vehicle platforms may require specialized components that are difficult to source or command premium pricing. Additionally, technicians familiar with legacy truck systems become scarcer as manufacturers discontinue older model lines. Therefore, operators must factor in higher service costs when calculating the economic viability of used truck purchases.

Limited availability of certified pre-owned units with manufacturer warranty coverage constrains buyer confidence in used semi-truck investments. Many used trucks sell without any warranty protection, exposing buyers to potential repair costs immediately after purchase. Furthermore, independent dealers rarely offer comprehensive warranty programs comparable to franchised dealer certified pre-owned initiatives. However, third-party extended warranty providers are emerging to address this gap, though coverage often excludes high-wear components that most commonly require replacement.

Growth Factors

Digital Marketplaces and Refurbishment Programs Accelerate Market Expansion

Expansion of online marketplaces is significantly improving transparency in used truck sales by providing detailed vehicle specifications and pricing data. Digital platforms enable buyers to compare multiple trucks across different sellers, creating competitive pricing pressure and market efficiency. Moreover, virtual inspection technologies and comprehensive vehicle history reports reduce information asymmetry between buyers and sellers. Consequently, online channels are attracting new buyers who previously avoided used truck markets due to transparency concerns.

Increasing adoption of refurbishment and reconditioning programs by dealers enhances used truck quality and buyer confidence. Professional reconditioning addresses mechanical issues, improves cosmetic appearance, and ensures regulatory compliance before vehicles reach market. Additionally, dealers investing in refurbishment capabilities can command premium pricing while reducing buyer risk through warranty offerings. Therefore, certified reconditioning programs are differentiating dealers in competitive markets and expanding the addressable customer base.

Rising demand in emerging economies for affordable commercial vehicles creates substantial growth opportunities as developing markets expand logistics infrastructure. Fleet operators in these regions prioritize cost-effective transportation solutions that balance initial investment against operational requirements. Furthermore, fleet electrification transition is creating a robust secondary market for diesel trucks as established operators upgrade to alternative fuel vehicles. However, regulatory considerations and infrastructure limitations influence the pace of adoption across different geographic markets.

Emerging Trends

Digital Transformation and Sustainable Practices Reshape Market Landscape

Growing preference for certified used semi-trucks with telematics history is transforming buyer expectations and dealer service offerings. Modern fleet management systems generate comprehensive vehicle data including maintenance records, fuel consumption, and driver behavior patterns. Moreover, buyers recognize that telematics-equipped trucks provide transparency regarding actual vehicle condition and remaining useful life. Consequently, dealers are investing in data analysis capabilities to present verifiable vehicle performance histories that justify premium pricing for well-maintained units.

Increased use of digital auctions for fleet liquidation is streamlining the disposal process for large operators while expanding buyer access. Online auction platforms eliminate geographic constraints, allowing buyers nationwide to compete for specific vehicle configurations. Additionally, digital bidding creates price discovery mechanisms that benefit both sellers seeking maximum value and buyers pursuing competitive acquisitions. Therefore, traditional physical auction venues are declining as digital channels capture growing market share through convenience and transparency advantages.

Demand shift toward fuel-efficient and emission-compliant models reflects regulatory pressures and operational cost management priorities. Buyers increasingly screen used truck inventory based on EPA certification levels and documented fuel economy performance. Furthermore, higher interest in lease-to-own and flexible financing options is expanding market accessibility for undercapitalized operators seeking to acquire quality used equipment. However, financing approval requirements and interest rates influence actual transaction volumes across different buyer segments and economic conditions.

Regional Analysis

North America Dominates the Used Semi-Truck Market with a Market Share of 43.8%, Valued at USD 6.3 Billion

North America leads the global used semi-truck market due to extensive freight transportation networks and high truck ownership rates. The region benefits from mature logistics infrastructure, established dealer networks, and robust demand from e-commerce distribution operations. Moreover, North America’s 43.8% market share, valued at USD 6.3 Billion, reflects strong replacement demand as fleets upgrade to newer emission standards. Consequently, abundant supply and diverse buyer segments sustain market liquidity across multiple sales channels and vehicle classes.

Europe Used Semi-Truck Market Trends

Europe demonstrates steady used semi-truck demand driven by stringent emissions regulations that accelerate fleet turnover cycles. Cross-border freight transportation requirements support consistent market activity across major economies including Germany, France, and the United Kingdom. Additionally, European buyers prioritize fuel efficiency and regulatory compliance when selecting used commercial vehicles. Therefore, certified pre-owned programs and dealer refurbishment services command premium positioning in European markets.

Asia Pacific Used Semi-Truck Market Trends

Asia Pacific exhibits rapid growth potential as developing economies expand logistics infrastructure to support manufacturing and e-commerce expansion. China, India, and Southeast Asian nations demonstrate increasing demand for affordable commercial transportation solutions. Moreover, rising import activity and domestic freight movement create opportunities for both established and emerging fleet operators. Consequently, used semi-trucks provide cost-effective capacity expansion options for regional logistics providers.

Latin America Used Semi-Truck Market Trends

Latin America shows growing used semi-truck adoption as economic development stimulates freight transportation demand across Brazil, Mexico, and regional markets. Infrastructure investment initiatives and expanding manufacturing sectors require increased logistics capacity at competitive cost structures. Additionally, currency fluctuations and import restrictions make used trucks attractive alternatives to new vehicle purchases. However, parts availability and service network limitations present operational challenges in certain markets.

Middle East & Africa Used Semi-Truck Market Trends

Middle East and Africa demonstrate emerging demand for used semi-trucks driven by infrastructure development projects and regional trade expansion. The GCC nations and South Africa lead regional market activity supported by established logistics sectors and import operations. Furthermore, harsh operating environments and limited budgets make durable used trucks practical choices for commercial operators. Nevertheless, regulatory variations and service infrastructure constraints influence adoption patterns across diverse national markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

AB Volvo maintains strong positioning in the used semi-truck market through its extensive dealer network and certified pre-owned programs. The company leverages advanced telematics systems to provide transparent vehicle history and maintenance records for used trucks. Moreover, Volvo’s reputation for durability and fuel efficiency sustains strong resale values across multiple vehicle classes. Consequently, the manufacturer’s used truck offerings attract fleet operators seeking reliable pre-owned equipment with ongoing service support.

Daimler Trucks operates comprehensive remarketing programs that channel fleet trade-ins and lease returns into certified pre-owned sales channels. The company’s Freightliner and Western Star brands dominate North American heavy-duty truck markets with extensive parts availability and service networks. Additionally, Daimler’s refurbishment standards ensure used trucks meet quality benchmarks before reaching dealers and buyers. Therefore, the manufacturer maintains premium positioning in certified used truck segments through brand reputation and service infrastructure.

PACCAR Inc. commands significant used truck market presence through its Kenworth and Peterbilt dealer networks offering certified pre-owned vehicles. The company’s trucks retain strong residual values due to reputation for quality construction and operational longevity. Furthermore, PACCAR Financial Services provides competitive financing options that facilitate used truck transactions for qualified buyers. However, premium pricing for used PACCAR trucks reflects brand positioning and expected lower lifetime maintenance costs compared to competitive alternatives.

Enterprise Truck Rental influences the used semi-truck market as a major supplier of well-maintained vehicles cycling out of rental fleets. The company’s trucks benefit from documented maintenance histories and consistent service intervals performed by trained technicians. Moreover, Enterprise’s fleet disposal creates steady inventory supply for dealers and buyers seeking recent-model used trucks. Consequently, former rental trucks represent attractive options for operators prioritizing maintenance transparency and predictable vehicle condition over absolute lowest pricing.

Key players

- AB Volvo

- Arrow Truck Sales

- Daimler Trucks

- East Coast International Trucks

- Enterprise Truck Rental

- Fyda Freightliner

- IronPlanet Inc.

- IVECO S.P.A

- MAN Truck & Bus SE

- PACCAR Inc.

Recent Developments

- January 2025 – Allegiance Trucks announced acquisition of HFI Truck Center, an Isuzu dealership in Mountainside, New Jersey. This strategic expansion significantly strengthens the company’s presence in the Greater New York City metro area, enhancing service capabilities in one of the nation’s busiest transportation hubs while solidifying its position with Isuzu’s globally recognized commercial vehicle brand.

- November 2024 – Schneider entered definitive agreement to acquire Cowan Systems, LLC for approximately USD 390 million cash, plus USD 31 million for related real estate assets. Including Cowan Systems, Schneider will operate over 8,400 Dedicated tractors representing approximately 70% of the company’s Truckload fleet, demonstrating continued momentum in dedicated transportation services expansion across Eastern and Mid-Atlantic regions.

- January 2024 – Vanguard Truck Centers acquired Nacarato Truck Centers, becoming one of Volvo Trucks’ largest dealer groups in North America. The acquisition expanded Vanguard’s presence to 28 Volvo locations across 11 states including Arizona, Florida, Georgia, Kentucky, Maryland, Missouri, North Carolina, South Carolina, Tennessee, Texas, and Virginia, with full ownership of existing inventory and parts operations.

Report Scope

Report Features Description Market Value (2025) USD 14.6 Billion Forecast Revenue (2035) USD 27.1 Billion CAGR (2026-2035) 6.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Class (Class 6, Class 7, Class 8), By Fuel (Diesel, Gasoline, Electric), By Sales Channel (Independent dealer, Franchised dealer, Peer-to-peer) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape AB Volvo, Arrow Truck Sales, Daimler Trucks, East Coast International Trucks, Enterprise Truck Rental, Fyda Freightliner, IronPlanet Inc., IVECO S.P.A, MAN Truck & Bus SE, PACCAR Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AB Volvo

- Arrow Truck Sales

- Daimler Trucks

- East Coast International Trucks

- Enterprise Truck Rental

- Fyda Freightliner

- IronPlanet Inc.

- IVECO S.P.A

- MAN Truck & Bus SE

- PACCAR Inc.