USA Maternity Apparel Market Size, Share, Growth Analysis By Product (Outerwear, Innerwear, Nightwear), By Material Type (Cotton, Rayon, Spandex & Lycra, Silk & Satin, Others), By Distribution Channel (Online, Offline) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169027

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

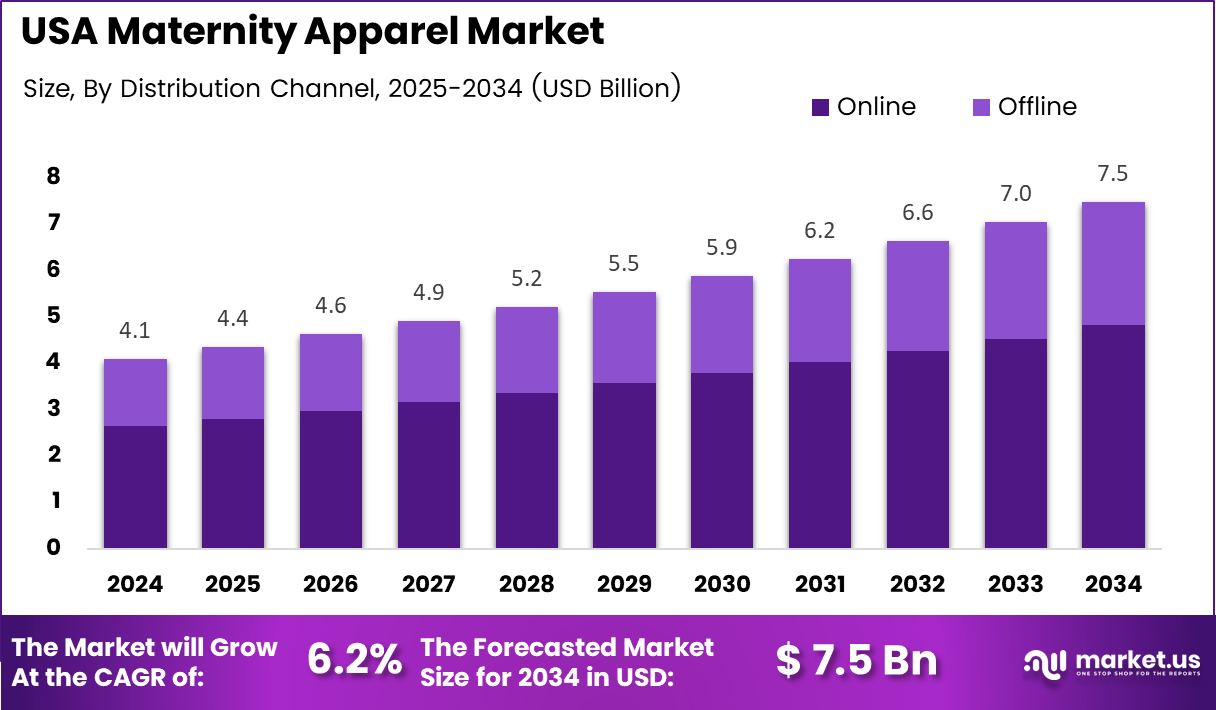

The USA Maternity Apparel Market size is expected to be worth around USD 7.5 billion by 2034, from USD 4.1 billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

The USA Maternity Apparel Market is growing steadily as more expectant mothers seek comfortable, fashionable, and versatile clothing. As the demand for functional yet stylish maternity wear rises, the market has become a key focus within the apparel industry. This growth is driven by evolving societal norms and a shift toward more inclusive, body-positive clothing options.

The increasing acceptance of maternity fashion in professional settings has opened doors for brands to create garments that blend fashion with practicality. Additionally, the growing preference for sustainable and eco-friendly materials is influencing maternity apparel designs. Brands are now more focused on incorporating organic cotton and other eco-friendly fabrics into their collections.

Expectant mothers today prefer clothing that adapts to their changing body shapes. This flexibility is crucial for the growth of the market. Maternity wear is typically bought during the second and third trimesters of pregnancy, with many consumers looking for garments that will accommodate their changing sizes. Adaptable clothing options are, therefore, a key selling point in the market.

Moreover, the expansion of e-commerce platforms has made it easier for expectant mothers to access a wide variety of maternity clothing. Online shopping for maternity wear is becoming increasingly popular due to the convenience it offers. This trend is expected to accelerate as more women choose to shop from the comfort of their homes.

Statistical data further highlights the growing demand for maternity apparel. According to industry sources, 89% of tops purchased are made of cotton, with 60% to 100% of the material being cotton. Similarly, 75% of bottoms sold contain 60% to 100% cotton, with 59% made from 100% cotton. On average, expectant mothers spend between USD 200 to USD 300 on maternity wear, demonstrating the willingness to invest in high-quality garments.

Furthermore, around 68% of women prefer brands offering both petite and plus-size options. This trend reflects the market’s shift toward inclusivity, with women seeking maternity wear that caters to all body types. Government initiatives supporting maternal health and wellness are expected to continue fueling the market’s expansion, contributing to the overall growth of the maternity apparel segment.

Key Takeaways

- Market Size: Expected to reach USD 7.5 billion by 2034, from USD 4.1 billion in 2024, growing at a CAGR of 6.2% from 2025 to 2034.

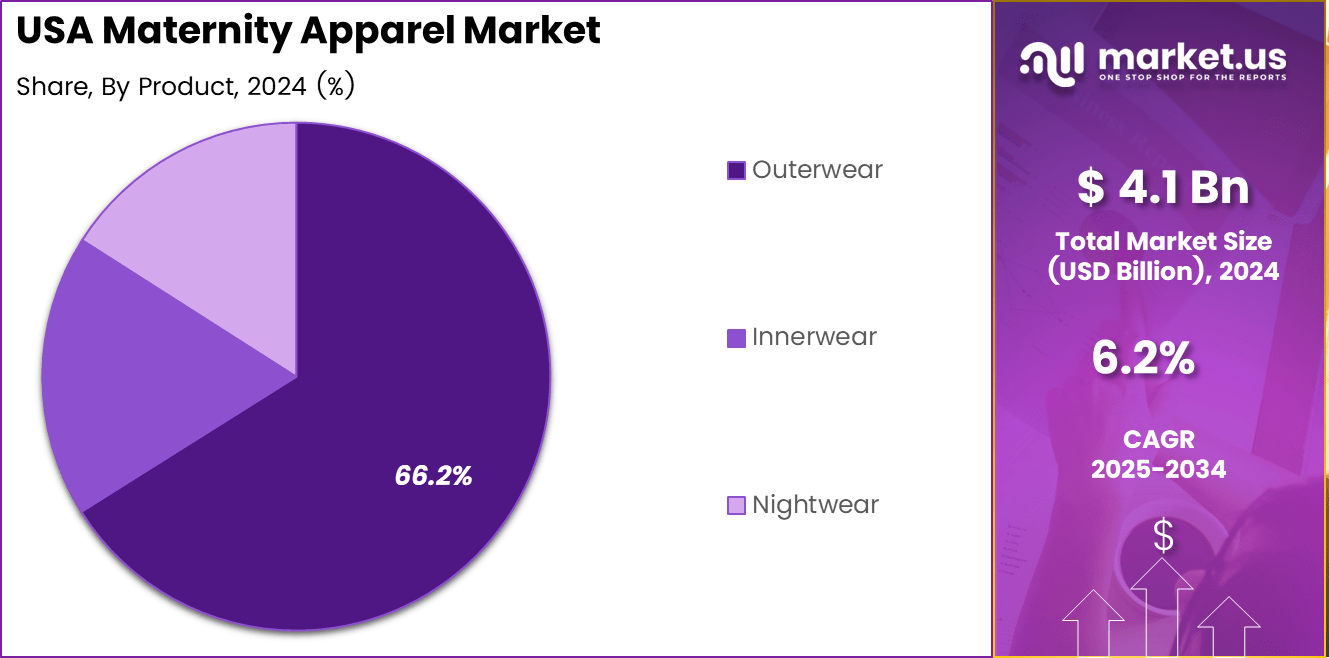

- Dominant Product Segment: Outerwear holds a dominant share of 66.2% due to its versatility and comfort for expectant mothers.

- Leading Material Type: Cotton dominates with a 43.6% share due to its breathability and hypoallergenic properties.

- Key Distribution Channel: Offline retail channels lead with a 64.4% share, driven by the preference for trying on maternity wear in-store.

- Growth Opportunity: Smart maternity wear incorporating wearable tech is expected to open new growth opportunities in the market.

- Emerging Trend: Gender-neutral maternity wear is gaining traction, fueling inclusivity and broader demographic reach.

By Product Analysis

Outerwear dominates with 66.2% due to its widespread demand for maternity wear that adapts to various weather conditions.

In 2024, Outerwear held a dominant market position in the By Product Analysis segment of the USA Maternity Apparel Market, with a 66.2% share. Outerwear is essential for expectant mothers, offering warmth and comfort throughout pregnancy. Its versatility in styling and functionality, including coats, jackets, and cardigans, makes it a preferred choice among consumers. The variety of designs available ensures it remains a dominant segment, especially during colder months.

Innerwear, although important, captures a smaller portion of the market. This segment focuses on undergarments such as bras, maternity panties, and body shapewear, specifically designed for comfort during pregnancy. Maternity innerwear is highly sought after for its role in providing support and accommodating body changes. However, the demand remains more niche compared to outerwear.

Nightwear in the maternity apparel market caters to the need for comfortable and breathable sleepwear during pregnancy. Though crucial, this segment holds a relatively smaller share, as nightwear is typically purchased less frequently. Comfort and softness are prioritized, with maternity pajamas, nightgowns, and sleep bras providing much-needed relief during rest periods.

By Material Type Analysis

Cotton dominates with 43.6% due to its breathable, comfortable, and hypoallergenic properties, making it ideal for maternity wear.

In 2024, Cotton held a dominant market position in the By Material Type Analysis segment of the USA Maternity Apparel Market, with a 43.6% share. Cotton is widely recognized for its breathability and softness, which is particularly important during pregnancy when comfort is essential. The material’s natural hypoallergenic properties make it a preferred choice for expectant mothers. Cotton’s versatility across different maternity apparel categories, including tops, bottoms, and dresses, contributes to its widespread use.

Rayon follows as another popular material in maternity wear. Rayon is lightweight, soft, and drapes well, making it suitable for dresses and tops. Its moisture-wicking properties are also beneficial, especially during warmer months. However, rayon’s market share is lower than cotton’s due to cotton’s broader acceptance.

Spandex & Lycra are commonly used in maternity wear for their elasticity and ability to stretch with the body’s changing shape. These materials are particularly popular for activewear and clothing that needs to accommodate a growing belly. However, they represent a smaller portion of the market compared to cotton.

Silk & Satin materials offer a luxurious feel and are used primarily for special occasions or sleepwear. Despite their appeal, their higher price points limit their widespread use, contributing to their smaller share in the overall maternity apparel market.

By Distribution Channel Analysis

Offline dominates with 64.4% due to consumers’ preference for trying on maternity wear in-store for fit and comfort.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the USA Maternity Apparel Market, with a 64.4% share. Offline retail stores, including department stores and specialty boutiques, remain the preferred shopping channels for many expectant mothers. Consumers often prefer to try on maternity wear in person to ensure the fit and comfort, especially with the changing body shape during pregnancy.

Online shopping for maternity apparel has seen rapid growth, driven by convenience and a wide selection of options. However, the market share for online channels is still smaller compared to offline, as many consumers prefer to touch and feel the fabric or seek in-store assistance when purchasing maternity wear. Despite the growth, online shopping remains a complementary channel rather than a dominant one in this segment.

Key Market Segments

By Product

- Outerwear

- Innerwear

- Nightwear

By Material Type

- Cotton

- Rayon

- Spandex & Lycra

- Silk & Satin

- Others

By Distribution Channel

- Online

- Offline

Drivers

Increasing Demand for Comfortable and Functional Maternity Apparel Drives Market Growth

The demand for comfortable and functional maternity apparel has surged in the USA as more women seek clothing that supports both style and practicality. Expectant mothers increasingly prioritize comfort and flexibility, and maternity brands are responding by offering designs that accommodate body changes during pregnancy. This shift has led to higher demand for garments made from soft, stretchable fabrics that provide comfort throughout the day.

The rise in online shopping and e-commerce has significantly fueled the growth of maternity apparel. Consumers are now able to browse through extensive collections, compare prices, and make purchases with ease, all from the comfort of their homes. The convenience and accessibility of online platforms have made maternity clothing more accessible to a wider audience.

Furthermore, there is a growing trend towards eco-friendly and sustainable maternity apparel options. As environmental concerns become more prevalent, brands are increasingly offering clothing made from organic or recycled materials, which appeals to environmentally conscious consumers.

Finally, postpartum fashion and wellness are becoming key areas of focus. Many women are now seeking apparel that not only supports them during pregnancy but also assists in the transition to postpartum life, boosting demand for versatile and wellness-focused maternity wear.

This shift has led to the design of maternity wear that not only prioritizes comfort but also offers better support and versatility. Functional features such as adjustable waistbands, stretchy fabrics, and clothing that can be worn during and after pregnancy are becoming essential in the maternity apparel industry.

Restraints

Challenges Constraining Growth in the USA Maternity Apparel Market

The USA maternity apparel market faces several challenges. One of the main restraints is the high price points of premium maternity clothing. While there is an increasing demand for fashionable and high-quality garments, the cost of such apparel can be prohibitive for some consumers, limiting market growth.

The limited availability of maternity clothing in smaller retail outlets is another constraint. While large department stores and online retailers offer a wide variety of maternity wear, smaller shops often lack the space and inventory to cater to the full spectrum of consumer preferences, limiting access to a broader customer base.

A stigma around wearing maternity clothes post-pregnancy also poses a challenge. Many women feel that wearing traditional maternity clothing after childbirth is stigmatized, leading them to seek alternatives, which may not always align with mainstream maternity apparel offerings.

Additionally, the seasonal demand fluctuations for maternity wear impact the market. With maternity apparel being highly seasonal, sales can be inconsistent, with peaks during certain months and lulls during others, leading to challenges in inventory management and product distribution.

Growth Factors

Growth Opportunities in the USA Maternity Apparel Market

The introduction of smart maternity apparel with health monitoring features presents a significant growth opportunity in the USA maternity apparel market. As wearable technologies gain traction, incorporating health-monitoring features into maternity clothing, such as heart rate and body temperature tracking, could revolutionize the industry and attract tech-savvy consumers.

Collaborations with fashion influencers and celebrities also offer a strong growth opportunity. By partnering with well-known figures in the fashion and lifestyle sectors, maternity apparel brands can significantly boost their visibility and appeal, driving sales and attracting a wider audience.

Expanding maternity apparel lines into international markets represents another growth avenue. As more women globally experience pregnancy, there is an opportunity to tap into emerging markets, where maternity clothing demand is also rising, thereby increasing the brand’s reach and revenue potential.

Emerging Trends

Trending Factors in the USA Maternity Apparel Market

Technological advancements in maternity clothing design are transforming the market. Incorporating features such as smart textiles and adaptive fabrics is helping brands create maternity wear that is not only stylish but also more functional and comfortable. These innovations are contributing to the rising popularity of high-tech maternity clothing.

The growing popularity of gender-neutral maternity clothing lines is another trend shaping the market. With increasing emphasis on inclusivity, brands are designing maternity apparel that transcends traditional gender norms, offering options for all parents-to-be, regardless of gender.

Integration of advanced fabrics with enhanced comfort and stretchability is gaining momentum. Maternity apparel that adapts to a woman’s changing body throughout pregnancy is becoming a key trend. These fabrics offer better stretch, support, and breathability, making them highly desirable to consumers.

Key USA Maternity Apparel Company Insights

In 2024, the USA maternity apparel market benefits from strategic plays by major fashion retailers, each bringing distinct strengths.

Adidas AG leverages its athletic‑wear heritage to introduce maternity lines that combine performance fabrics and ergonomic fits, appealing to expectant mothers seeking comfort and active‑lifestyle flexibility. This positioning helps it capture working, health‑conscious consumers who value quality and mobility.

Gap Inc. exploits its broad retail footprint and established family‑wear reputation to offer maternity clothing that is both affordable and versatile, thereby attracting budget‑sensitive parents-to-be who still want trustworthy everyday wear. Its supply‑chain efficiency allows regular refreshes of maternity basics at accessible price points.

H&M uses its fast‑fashion infrastructure to rapidly introduce trend‑forward maternity styles, attracting younger mothers and first‑time parents interested in fashion-forward but affordable clothing. Its quick turnaround from design to rack enables it to respond fast to shifting consumer tastes in maternity trends.

Hatch Collection LLC focuses on premium maternity wear that combines elegance and comfort, targeting a niche of style-conscious customers willing to spend more for refined fits and premium materials. Its curated designs appeal to urban professionals who seek maternity wear that transitions smoothly from workplace to social settings.

Together, these players reflect a market that balances affordability, functionality, fashion, and niche premium segments. Their diversified strategies—ranging from athletic comfort and budget basics to trend-driven looks and upscale maternity couture—enable the market to cater to a wide spectrum of consumer needs. Such segmentation helps drive overall growth by ensuring maternity apparel remains relevant across income levels, lifestyle preferences, and life stages.

Top Key Players in the Market

- Adidas AG

- Gap Inc

- H&M

- Hatch Collection LLC

- Inditex-group

- Ingrid & Isabel, LLC

- Isabella Oliver Limited

Recent Developments

- In Jul 2025, British retail giant NEXT acquired the brand and intellectual property of maternity specialist Seraphine for approximately £600,000 following the company’s entry into administration.The acquisition allows NEXT to integrate Seraphine’s maternity offering into its portfolio while preserving brand value through a capital light recovery strategy.

- In Oct 2024, Go Global Retail, owner of Janie and Jack, completed the acquisition of HATCH Collection, a leading US premium maternity brand.The deal strengthens Go Global Retail’s position in the maternity apparel segment and expands its footprint in high end, fashion forward pregnancy wear.

Report Scope

Report Features Description Market Value (2024) USD 4.1 Billion Forecast Revenue (2034) USD 7.5 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Outerwear, Innerwear, Nightwear), By Material Type (Cotton, Rayon, Spandex & Lycra, Silk & Satin, Others), By Distribution Channel (Online, Offline) Competitive Landscape Adidas AG, Gap Inc, H&M, Hatch Collection LLC, Inditex-group, Ingrid & Isabel, LLC, Isabella Oliver Limited Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  USA Maternity Apparel MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

USA Maternity Apparel MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Adidas AG

- Gap Inc

- H&M

- Hatch Collection LLC

- Inditex-group

- Ingrid & Isabel, LLC

- Isabella Oliver Limited