U.S. Wireless Router Market Size, Share, Growth Analysis By Product Type (Standalone Routers, Mesh Wi-Fi Systems, Mobile Hotspot Routers, Industrial/Rugged Routers), By Wi-Fi Standard (802.11n (Wi-Fi 4), 802.11ac (Wi-Fi 5), 802.11ax (Wi-Fi 6), 802.11be (Wi-Fi 7)), By Frequency Band (Single-Band, Dual-Band, Tri-/Quad-Band), By End-user Industry (Residential, Enterprise, BFSI, Education, Healthcare, Media and Entertainment, Retail, Government and Public Sector, Others), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172905

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Wi-Fi Standard Analysis

- By Frequency Band Analysis

- By End-user Industry Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Key U.S. Wireless Router Market Company Insights

- Recent Developments

- Report Scope

Report Overview

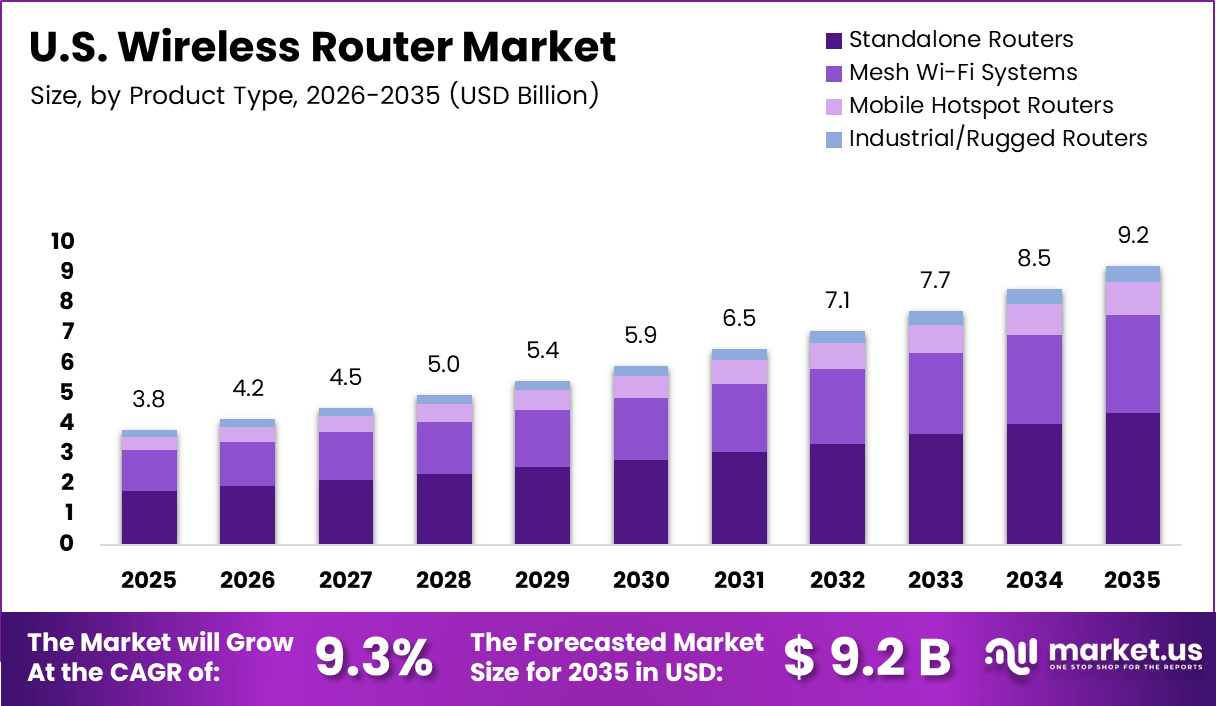

The U.S. Wireless Router Market size is expected to be worth around USD 9.2 billion by 2035, from USD 3.8 billion in 2025, growing at a CAGR of 9.3% during the forecast period from 2026 to 2035.

The U.S. Wireless Router Market refers to the ecosystem of networking devices enabling wireless internet connectivity across residential, commercial, and institutional environments. Wireless routers and access points transmit data using radio frequencies such as 900 MHz, 2.4 GHz, 3.6 GHz, 5 GHz, and 60 GHz. According to IEEE standards, typical indoor coverage reaches 150 feet, while outdoor connectivity extends up to 300 feet.

From an analyst viewpoint, the U.S. Wireless Router Market shows consistent expansion as digital reliance increases across households and enterprises. Rising remote work adoption, cloud-based applications, and connected home ecosystems accelerate demand for dependable wireless infrastructure. Consequently, replacement cycles shorten as users prioritize higher speeds, improved latency control, and stable network performance.

Growth momentum strengthens through expanding broadband penetration and nationwide fiber rollout initiatives. Government investments targeting rural connectivity and digital inclusion stimulate incremental router demand across underserved regions. Moreover, regulatory oversight by federal spectrum authorities promotes efficient frequency allocation, supporting long-term infrastructure planning and confidence in standardized wireless deployments.

Opportunities continue emerging from rising device density and evolving connectivity needs. Small and mid-sized businesses increasingly depend on wireless networking to support digital workflows and cloud operations. Therefore, demand grows for routers offering enhanced traffic management, secure connectivity, and scalable performance aligned with ongoing digital transformation initiatives.

In later stages of market evolution, technology standards define purchasing behavior. According to the IEEE, modern wireless routers increasingly adopt the IEEE 802.11ac Wave 2 standard, enabling higher throughput and improved multi-user efficiency. The IEEE 802.11 framework establishes protocols ensuring interoperability across wireless routers and access points nationwide.

Market indicators further reinforce long-term momentum. The U.S. Wireless Router Market is projected to expand from USD 3.8 billion in 2025 to USD 9.2 billion by 2035, reflecting a sustained 9.3% CAGR. This growth highlights steady upgrade demand driven by technology refresh cycles rather than one-time adoption surges.

Overall, the U.S. Wireless Router Market represents a mature yet opportunity-rich environment shaped by connectivity expectations, regulatory stability, and advancing wireless standards. As data consumption intensifies, wireless routers remain foundational digital infrastructure, supporting long-term investment appeal, recurring replacement demand, and consistent transactional activity across diverse end-user segments.

Key Takeaways

- The U.S. Wireless Router Market is projected to reach USD 9.2 billion by 2035 from USD 3.8 billion in 2025, expanding at a 9.3% CAGR.

- Standalone Routers lead the product type segment with a 47.2% share, reflecting strong household adoption across the U.S. market.

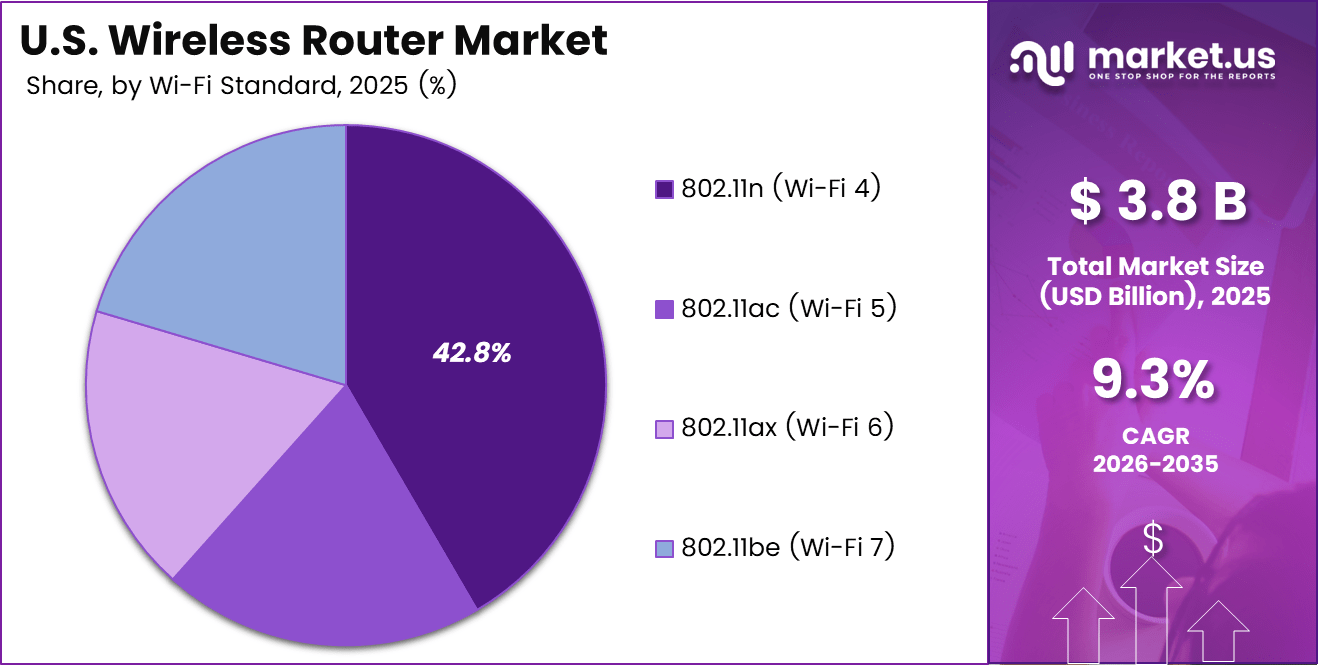

- 802.11n (Wi-Fi 4) remains the dominant Wi-Fi standard with a 49.7% share due to widespread legacy usage in the U.S.

- Dual-Band routers dominate the frequency band segment with a 51.3% share, balancing coverage and performance needs.

- Residential users account for the largest end-user share at 38.4%, driven by rising home connectivity demand in the U.S.

- Online distribution channels hold a leading 56.9% share, highlighting digital purchasing preference across the U.S. market.

By Product Type Analysis

Standalone Routers dominate with 47.2% due to their widespread household adoption and ease of deployment.

In 2025, Standalone Routers held a dominant market position in the By Product Type segment of U.S. Wireless Router Market, with a 47.2% share. These routers remain preferred for small homes and apartments due to straightforward installation, lower upfront costs, and compatibility with most broadband connections.

Mesh Wi-Fi Systems continue gaining relevance as larger homes demand seamless coverage. Moreover, mesh architectures reduce dead zones and enhance user experience. Consequently, adoption rises among consumers prioritizing uninterrupted connectivity for streaming, gaming, and remote work across multiple rooms.

Mobile Hotspot Routers support mobility focused connectivity needs. Therefore, they remain relevant for travel, temporary workplaces, and emergency usage. These devices enable quick network access without fixed infrastructure, supporting flexible internet consumption patterns across the US.

Industrial and Rugged Routers address connectivity in harsh environments. As a result, these routers support manufacturing, utilities, and outdoor deployments. Their durability, temperature tolerance, and reliability sustain demand within specialized industrial networking applications.

By Wi-Fi Standard Analysis

802.11n (Wi-Fi 4) leads with a 49.7% share due to legacy installations and broad device compatibility.

In 2025, 802.11n (Wi-Fi 4) held a dominant market position in the By Wi-Fi Standard segment of U.S. Wireless Router Market, with a 49.7% share. Many households and small offices continue relying on this standard due to adequate speeds for basic browsing and streaming.

802.11ac (Wi-Fi 5) remains a strong transitional standard. Moreover, it offers higher throughput and improved stability. Consequently, it supports HD streaming and moderate multi-device usage, sustaining steady replacement driven demand.

802.11ax (Wi-Fi 6) adoption accelerates as device density increases. Therefore, this standard enhances efficiency, latency control, and power management. It aligns with smart home growth and enterprise networking modernization trends.

802.11be (Wi-Fi 7) represents the next performance frontier. Although adoption remains early stage, it supports ultra-low latency and multi-gigabit speeds. Thus, it targets advanced applications including immersive media and future-ready networks.

By Frequency Band Analysis

Dual-Band dominates with 51.3% due to balanced performance across speed and coverage needs.

In 2025, Dual-Band held a dominant market position in the By Frequency Band segment of U.S. Wireless Router Market, with a 51.3% share. Dual-band routers balance range and speed by operating across multiple frequencies, supporting diverse household connectivity requirements.

Single-Band routers maintain relevance in cost sensitive applications. Consequently, they support basic internet usage such as browsing and email. These devices remain common in entry level deployments and smaller living spaces.

Tri and Quad Band routers address high traffic environments. Moreover, they enable simultaneous device connections with reduced congestion. As a result, these routers attract users demanding premium performance for gaming, streaming, and work-from-home setups.

By End-user Industry Analysis

Residential users lead with a 38.4% share driven by rising digital consumption and smart home adoption.

In 2025, Residential held a dominant market position in the By End-user Industry segment of U.S. Wireless Router Market, with a 38.4% share. Households increasingly depend on reliable Wi-Fi for streaming, learning, and remote work, sustaining strong replacement demand.

Enterprise adoption focuses on secure and scalable networking. Therefore, businesses invest in advanced routers to support cloud operations and workforce mobility. This segment values performance stability and cybersecurity integration.

BFSI institutions prioritize secure data transmission. Similarly, education and healthcare sectors depend on uninterrupted connectivity for digital platforms. Media, retail, and government users adopt routers to support operational efficiency and public service delivery.

Other end users include transportation and hospitality sectors. Consequently, these industries deploy routers to enhance customer connectivity and digital engagement. Overall, diversified end-user demand strengthens market resilience.

By Distribution Channel Analysis

Online channels dominate with a 56.9% share due to convenience and broader product availability.

In 2025, Online held a dominant market position in the By Distribution Channel segment of U.S. Wireless Router Market, with a 56.9% share. E-commerce platforms simplify comparison, pricing transparency, and home delivery, accelerating consumer purchasing decisions.

Offline channels remain relevant for hands-on evaluation and technical guidance. Therefore, physical stores support enterprise buyers and less tech-savvy consumers. Together, both channels ensure comprehensive market reach and sustained sales momentum.

Key Market Segments

By Product Type

- Standalone Routers

- Mesh Wi-Fi Systems

- Mobile Hotspot Routers

- Industrial/Rugged Routers

By Wi-Fi Standard

- 802.11n (Wi-Fi 4)

- 802.11ac (Wi-Fi 5)

- 802.11ax (Wi-Fi 6)

- 802.11be (Wi-Fi 7)

By Frequency Band

- Single-Band

- Dual-Band

- Tri-/Quad-Band

By End-user Industry

- Residential

- Enterprise

- BFSI

- Education

- Healthcare

- Media and Entertainment

- Retail

- Government and Public Sector

- Others

By Distribution Channel

- Online

- Offline

Drivers

Rapid Expansion of Fiber and High Speed Broadband Infrastructure Drives Market Growth

The rapid expansion of fiber and high speed broadband infrastructure across the US strongly supports wireless router demand. As broadband access improves, households require routers capable of handling higher speeds. Consequently, users increasingly replace older devices to fully utilize upgraded internet connections.

Rising multi device households further accelerate market growth. Homes now operate smartphones, laptops, smart TVs, and connected appliances simultaneously. Therefore, demand increases for high capacity home networking solutions that deliver stable performance across multiple devices without congestion or signal loss.

Enterprise adoption of cloud based platforms and remote work models also acts as a major driver. Businesses require reliable wireless connectivity to support collaboration tools and digital workflows. As a result, enterprises invest in advanced routers that ensure consistent performance and network reliability.

Growth in connected consumer electronics and smart home ecosystems strengthens this momentum. Smart speakers, security systems, and automation devices depend on stable Wi Fi connections. Thus, wireless routers become essential infrastructure supporting modern digital lifestyles across residential and commercial environments.

Restraints

Market Saturation in Urban Areas Limits Expansion Momentum

Market saturation in urban residential and commercial environments restrains growth. Many households already own routers, reducing first time purchase opportunities. Therefore, sales increasingly depend on replacement cycles rather than new user adoption.

High price sensitivity further limits adoption of premium Wi Fi 6E and Wi Fi 7 routers. Consumers often delay upgrades due to higher costs. As a result, demand concentrates around mid range products rather than advanced models.

Short product replacement cycles create inventory and margin pressure for suppliers. Frequent model updates increase operational complexity. Consequently, managing stock levels and pricing becomes challenging in a competitive environment.

Network security concerns and complex configuration processes also act as restraints. Some users hesitate to upgrade due to setup difficulties. Therefore, ease of use and security assurance remain critical challenges for market expansion.

Growth Factors

Accelerated Upgrade Cycle Creates New Growth Opportunities

The accelerated upgrade cycle from legacy routers to Wi Fi 6 and Wi Fi 7 standards presents strong growth opportunities. As data usage rises, users seek better speed and efficiency. Consequently, replacement demand continues strengthening across the US market.

Expanding demand from small and medium businesses also creates opportunities. These businesses increasingly require managed networking solutions to support digital operations. Therefore, routers offering centralized control and simplified management gain traction.

Growth of private networks supporting IoT and edge computing further enhances opportunity. Industrial and commercial environments need localized connectivity. As a result, specialized routers supporting secure private networks attract growing interest across multiple sectors.

Emerging Trends

Integration of AI Driven Traffic Optimization Shapes Market Trends

Integration of AI driven traffic optimization and network self healing features defines a key trend. Routers now adjust performance automatically. Therefore, users experience improved reliability and reduced downtime.

Growing preference for mesh Wi Fi systems reflects changing home layouts. Large US homes require seamless coverage. Consequently, mesh solutions gain popularity for eliminating dead zones.

Increasing focus on cybersecurity embedded at the router level also shapes demand. Built in protection improves user trust. Additionally, the shift toward sustainable and energy efficient hardware aligns with environmental awareness, influencing future product development.

Key U.S. Wireless Router Market Company Insights

Cisco Systems, Inc. plays a foundational role in the U.S. wireless router market through its enterprise focused portfolio and strong presence in institutional networks. In 2025, Cisco continues emphasizing secure, scalable wireless infrastructure. Consequently, its routers align closely with cloud adoption, hybrid work models, and mission critical network reliability requirements.

Tenda positions itself as a value driven participant within the U.S. wireless router market. In 2025, the company focuses on affordability and ease of use for households and small offices. As a result, Tenda appeals to cost sensitive consumers seeking dependable Wi Fi performance without complex configuration or premium pricing barriers.

From a competitive perspective, TP-LINK CORPORATION PTE. LTD. maintains strong momentum in the U.S. market by balancing performance and accessibility. In 2025, TP-LINK emphasizes wide portfolio coverage across entry and mid range routers. Therefore, it effectively addresses growing multi device households and small business connectivity needs.

Belkin continues strengthening its relevance through consumer centric wireless networking solutions. In 2025, Belkin benefits from strong brand recognition and retail penetration across the US. Consequently, its wireless routers align with smart home adoption, user friendly design, and reliable everyday connectivity expectations.

Overall, these players shape the U.S. wireless router market through differentiated strategies addressing enterprise scale, affordability, balanced performance, and consumer experience. Their varied positioning supports sustained competition, steady replacement demand, and continued innovation across residential and commercial networking environments in 2025.

Top Key Players in the Market

- Cisco Systems, Inc.

- Tenda

- TP-LINK CORPORATION PTE. LTD.

- Belkin

- D-Link (India) Limited.

- EDIMAX Technology Co., Ltd.

- Huawei Device Co., Ltd.

- NETGEAR

- Xiaomi

- ASUSTeK Computer Inc.

Recent Developments

- In January 2024, HPE announced plans to acquire Juniper Networks for approximately $14B, significantly reshaping the competitive landscape of the WLAN market. The move is expected to intensify portfolio overlap in enterprise wireless, switching, and security, driving consolidation and prompting vendors to reassess differentiation strategies.

- In December 2024, Cisco confirmed the acquisition of SnapAttack for an undisclosed value, strengthening its security driven networking roadmap. The deal enhances Cisco’s threat detection capabilities by integrating advanced threat intelligence, attack emulation, and behavioral analytics into its broader network security ecosystem.

Report Scope

Report Features Description Market Value (2025) USD 3.8 billion Forecast Revenue (2035) USD 9.2 billion CAGR (2026-2035) 9.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Standalone Routers, Mesh Wi-Fi Systems, Mobile Hotspot Routers, Industrial/Rugged Routers), By Wi-Fi Standard (802.11n (Wi-Fi 4), 802.11ac (Wi-Fi 5), 802.11ax (Wi-Fi 6), 802.11be (Wi-Fi 7)), By Frequency Band (Single-Band, Dual-Band, Tri-/Quad-Band), By End-user Industry (Residential, Enterprise, BFSI, Education, Healthcare, Media and Entertainment, Retail, Government and Public Sector, Others), By Distribution Channel (Online, Offline) Competitive Landscape Cisco Systems, Inc., Tenda, TP-LINK CORPORATION PTE. LTD., Belkin, D-Link (India) Limited., EDIMAX Technology Co., Ltd., Huawei Device Co., Ltd., NETGEAR, Xiaomi, ASUSTeK Computer Inc. Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  U.S. Wireless Router MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

U.S. Wireless Router MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems, Inc.

- Tenda

- TP-LINK CORPORATION PTE. LTD.

- Belkin

- D-Link (India) Limited.

- EDIMAX Technology Co., Ltd.

- Huawei Device Co., Ltd.

- NETGEAR

- Xiaomi

- ASUSTeK Computer Inc.