U.S. Sustainable Packaging Market Size, Share, Growth Analysis By Material (Paper & Paperboard, Glass, Plastic, Metal, Others), By Product Type (Boxes & Cartons, Bags & Pouches, Bottles & Cans, Films & Wraps, Trays, Mailers, Others), By Process (Degradable Packaging, Recycled Packaging, Reusable Packaging), By Application (Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Consumer Goods, E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158130

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

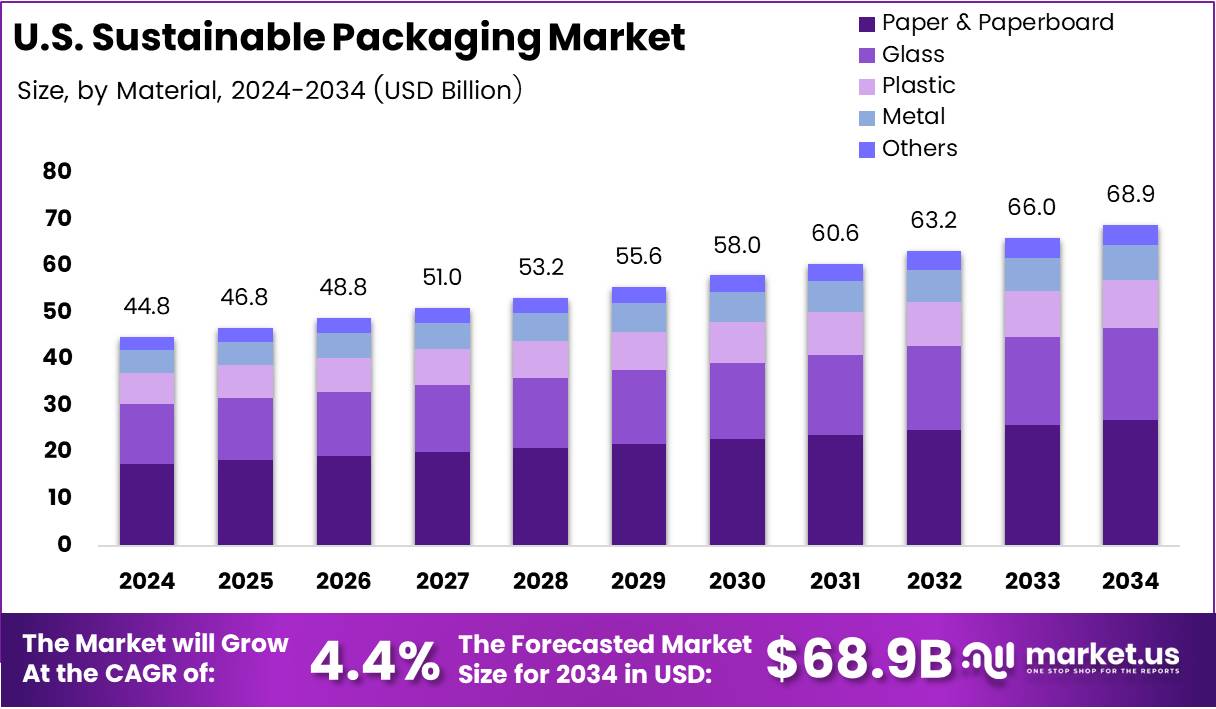

The U.S. Sustainable Packaging Market size is expected to be worth around USD 68.9 Billion by 2034, from USD 44.8 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

The U.S. Sustainable Packaging Market reflects the country’s shift toward environmentally responsible materials, production processes, and end-of-life solutions. Businesses are responding to growing consumer expectations, retailer commitments, and regulatory standards. As brands compete for eco-conscious loyalty, sustainable packaging serves as both a compliance requirement and a competitive advantage in the marketplace.

Driven by climate concerns and waste reduction mandates, sustainable packaging is gaining momentum. Companies across food, beverage, cosmetics, and retail are adopting recyclable, reusable, and compostable solutions. This transformation is not only reducing landfill waste but also strengthening brand positioning as consumers increasingly prioritize eco-friendly purchasing decisions in their daily consumption.

Government policies are significantly shaping this market. Federal and state-level regulations encourage recyclable packaging adoption and penalize excessive plastic usage. Incentives and grants support research into biodegradable alternatives, while extended producer responsibility laws ensure that companies remain accountable for packaging recovery, recycling, and proper waste management throughout the product lifecycle.

Opportunities continue to emerge with technological innovation. Advancements in plant-based plastics, water-based coatings, and smart labeling are reducing environmental impact while enhancing product safety. Businesses investing in these solutions are benefiting from both regulatory alignment and operational efficiency. Moreover, rising corporate ESG reporting standards further accelerate the integration of sustainable packaging strategies across industries.

According to the Environmental Protection Agency (EPA), U.S. cardboard recycling totaled more than 33 million tons in 2024, reflecting a cardboard recycling rate of 69–74%. Additionally, consumer perception is shaping growth—recent research shows 73% of U.S. consumers view compostable products as sustainable, while 71% see plant-based packaging positively. These insights demonstrate the intersection of consumer demand and regulatory action.

Key Takeaways

- The U.S. Sustainable Packaging Market is projected to reach USD 68.9 Billion by 2034, up from USD 44.8 Billion in 2024, at a CAGR of 4.4%.

- In 2024, Paper & Paperboard dominated the material segment with a 39.3% share, driven by recyclability and broad adoption across industries.

- Boxes & Cartons led the product type segment with a 28.6% share, supported by high use in e-commerce and retail.

- Recycled Packaging accounted for a 48.2% share in the process segment, reflecting rising investments in recycling and EPR initiatives.

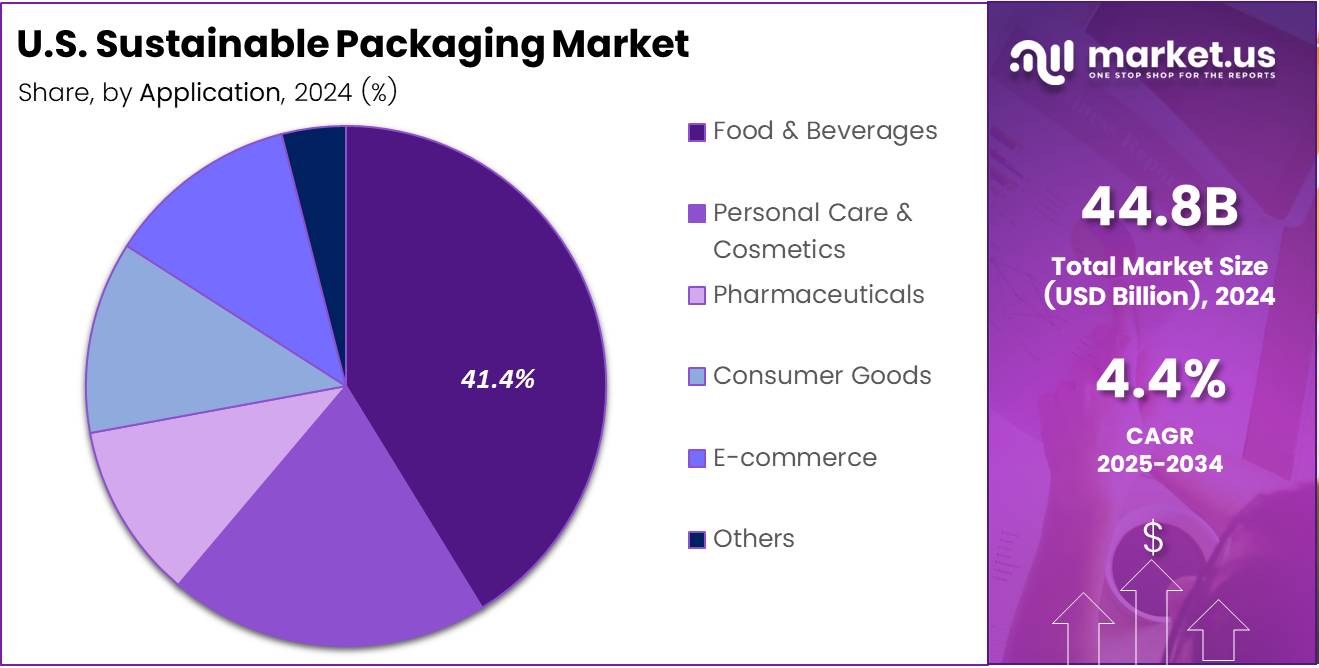

- Food & Beverages emerged as the leading application segment with a 41.4% share, owing to strong eco-friendly packaging demand.

Material Analysis

Paper & Paperboard dominates with 39.3% due to its recyclability and rising consumer preference for eco-friendly packaging.

In 2024, Paper & Paperboard held a dominant market position in By Material Analysis segment of U.S. Sustainable Packaging Market, with a 39.3% share. Its extensive recyclability and wide adoption across food service, retail, and e-commerce industries strongly reinforced its leadership in sustainable solutions.

Glass followed with steady usage as a sustainable packaging option, valued for its reusability and inert nature. Consumers increasingly associated glass with premium and safe packaging, especially in food, beverages, and cosmetics. However, high transportation costs limited its broader adoption compared to paper.

Plastic continued to maintain relevance in sustainable packaging despite challenges, as bioplastics and recyclable polymers gained attention. The material’s versatility and durability made it indispensable for lightweight packaging, while innovation in eco-friendly plastics aimed at reducing environmental impact.

Metal registered moderate adoption, particularly in the form of aluminum cans. Its infinite recyclability and strength supported its demand in food and beverage sectors. Rising emphasis on circular economy models kept metal a strong sustainable contender.

Others, including biopolymers and novel materials, showed growing potential. Emerging startups and R&D investments aimed at replacing conventional single-use materials, reflecting long-term opportunities for innovation in sustainable packaging.

Product Type Analysis

Boxes & Cartons dominate with 28.6% due to strong consumer demand and alignment with recycling infrastructure.

In 2024, Boxes & Cartons held a dominant market position in By Product Type Analysis segment of U.S. Sustainable Packaging Market, with a 28.6% share. Their wide application across e-commerce and retail, coupled with recyclability, made them the most preferred product type.

Bags & Pouches represented another significant segment, gaining traction for their lightweight nature and convenience. Brands emphasized compostable and recyclable pouches to align with regulatory compliance and shifting consumer expectations.

Bottles & Cans continued to be integral for beverages and personal care products. Glass and aluminum-based sustainable formats further strengthened their presence, driven by consumer perception of safety and quality.

Films & Wraps saw increased utilization across food service and grocery applications. Their role in preserving freshness and reducing food waste kept them in demand, while recyclable films gained focus.

Trays retained their importance in food packaging due to convenience, particularly in ready-to-eat meals. Mailers witnessed sharp adoption growth from e-commerce platforms that sought recyclable and eco-conscious delivery solutions. Others comprised innovative product types, where ongoing R&D pushed for alternative solutions in sustainable packaging.

Process Analysis

Recycled Packaging dominates with 48.2% as recycling infrastructure strengthens and consumer awareness rises.

In 2024, Recycled Packaging held a dominant market position in By Process Analysis segment of U.S. Sustainable Packaging Market, with a 48.2% share. Growing investments in recycling systems and extended producer responsibility initiatives reinforced the dominance of this segment.

Degradable Packaging emerged as an important contributor, backed by rising use of biodegradable polymers and plant-based alternatives. Brands emphasized this option to comply with strict sustainability regulations and consumer demand for plastic alternatives.

Reusable Packaging gained momentum as part of circular economy models. Initiatives promoting refillable packaging in cosmetics, beverages, and household products created new opportunities. This process also aligned with government and corporate goals to reduce single-use waste.

Application Analysis

Food & Beverages dominates with 41.4% due to high consumption and strict sustainability regulations in packaging.

In 2024, Food & Beverages held a dominant market position in By Application Analysis segment of U.S. Sustainable Packaging Market, with a 41.4% share. The sector’s high packaging demand and strong push for eco-friendly solutions sustained its leadership.

Personal Care & Cosmetics relied heavily on sustainable packaging to enhance brand perception and meet consumer expectations. Refillable and recyclable packaging gained popularity as part of premium and eco-conscious product strategies.

Pharmaceuticals incorporated sustainable solutions cautiously, with regulatory compliance being a key driver. Sustainable blister packs and recyclable cartons became increasingly common in this category.

Consumer Goods, ranging from electronics to household items, steadily transitioned to sustainable formats. Companies actively redesigned packaging for recyclability while ensuring durability in shipping and handling.

E-commerce expanded its role as a major user of sustainable packaging, driven by rising online orders. Mailers, cartons, and eco-friendly wrapping materials became critical. Others included specialty sectors exploring innovative materials to further strengthen the sustainable packaging ecosystem.

Key Market Segments

By Material

- Paper & Paperboard

- Glass

- Plastic

- Metal

- Others

By Product Type

- Boxes & Cartons

- Bags & Pouches

- Bottles & Cans

- Films & Wraps

- Trays

- Mailers

- Others

By Process

- Degradable Packaging

- Recycled Packaging

- Reusable Packaging

By Application

- Food & Beverages

- Personal Care & Cosmetics

- Pharmaceuticals

- Consumer Goods

- E-commerce

- Others

Drivers

Surge in Consumer Preference for Recyclable and Compostable Packaging Materials

The U.S. sustainable packaging market is gaining strong momentum as consumer demand for recyclable and compostable materials grows. Shoppers are actively choosing products with eco-friendly packaging, putting pressure on brands to adapt their strategies and strengthen their sustainability commitments. This trend is significantly pushing the market forward.

Extended Producer Responsibility (EPR) policies are also driving adoption in the U.S. These policies place responsibility on manufacturers to manage packaging waste, encouraging the use of recyclable and biodegradable materials. As states roll out stricter EPR frameworks, companies are expected to invest more in sustainable solutions to remain compliant and competitive.

Bans and restrictions on single-use plastics across multiple states have further accelerated the transition. With plastic bags, straws, and other disposables facing phase-outs, businesses are seeking alternatives like paper-based, plant-derived, and compostable packaging. This regulatory push is reinforcing the long-term demand for sustainable packaging across industries.

The rapid growth of e-commerce is another major driver. With more products shipped directly to customers, demand for sustainable shipping materials is increasing. Companies are exploring recyclable mailers, compostable pouches, and packaging designed for minimal waste. This shift reflects both environmental responsibility and customer preference for greener delivery practices.

Restraints

Limited Recycling Infrastructure for Advanced Bioplastics and Composites

One of the biggest restraints for the U.S. sustainable packaging market is the lack of infrastructure to recycle advanced bioplastics and composites. While these materials are marketed as sustainable, recycling facilities are often unable to process them effectively, creating a gap between innovation and real-world waste management.

Another challenge lies in inconsistent federal regulations. Unlike a unified national policy, state-level differences create compliance burdens for packaging manufacturers operating across regions. Companies often face confusion regarding standards, labeling, and certification, which slows down adoption and increases operational costs.

Supply chain disruptions have also posed hurdles, particularly in sourcing sustainable raw materials like recycled paper, bio-based resins, and plant-derived fibers. Volatility in raw material availability, coupled with higher costs, makes it difficult for packaging producers to scale operations. These disruptions limit affordability and accessibility of eco-friendly packaging.

These combined restraints highlight the need for better recycling systems, harmonized regulations, and more stable raw material supply chains. Without addressing these issues, the growth of sustainable packaging may face constraints despite rising consumer and regulatory support.

Growth Factors

Expansion of Bio-Based Polymers and Biodegradable Films in Food Packaging

Growth opportunities in the U.S. sustainable packaging market are emerging through the adoption of bio-based polymers and biodegradable films, particularly in food packaging. As consumers demand alternatives to plastics, innovative materials that balance performance and sustainability are gaining traction, opening new investment possibilities.

The development of closed-loop recycling systems in retail and consumer goods sectors offers another key opportunity. Retailers and brands are increasingly focusing on packaging take-back initiatives and circular economy models. These systems not only reduce waste but also build brand loyalty among eco-conscious shoppers.

Smart packaging with sustainability features is gaining adoption as well. Companies are experimenting with technologies that extend shelf life, monitor freshness, and reduce waste. Combining functionality with eco-friendly materials enhances value for both businesses and consumers, signaling a new phase of packaging innovation.

Collaborations between packaging producers and waste management companies are also creating growth pathways. Joint efforts help improve recycling rates, establish efficient collection systems, and ensure new sustainable materials are compatible with existing infrastructure. These partnerships accelerate adoption and provide long-term benefits for the industry.

Emerging Trends

Growth in Reusable Packaging Models Supported by Subscription Services

A major trend in the U.S. sustainable packaging market is the rise of reusable packaging supported by subscription models. Companies are offering durable containers for repeated use, with collection and refill options that reduce single-use waste. This model is gaining popularity, particularly in food delivery and personal care sectors.

The shift toward lightweight packaging is also shaping market dynamics. By reducing material use, businesses can lower carbon emissions associated with transportation and logistics. This approach not only supports sustainability but also helps companies cut shipping costs while appealing to eco-conscious consumers.

Investments in algae-based and mycelium packaging are growing rapidly. These natural materials are renewable, biodegradable, and often provide strong protective properties. As research and commercialization expand, they are expected to replace conventional plastic in niche and mainstream packaging applications.

Another trending factor is the adoption of digital watermarks for better recycling efficiency. These invisible codes allow packaging to be accurately identified and sorted during waste processing. By improving recycling rates, digital watermarking supports circular economy goals and positions companies at the forefront of sustainable packaging innovation.

Key U.S. Sustainable Packaging Company Insights

In 2024, Amcor Plc reinforced its position as a leader in the U.S. sustainable packaging market by emphasizing recyclable and lightweight solutions tailored to food and beverage applications. Its strong investment in eco-friendly polymers and partnerships with consumer brands positioned it at the forefront of sustainability-focused packaging innovation.

Ardagh Group S.A. maintained a significant presence, with a strong focus on glass and metal packaging. The company’s emphasis on closed-loop recycling systems and energy-efficient production methods supported the growing U.S. demand for packaging formats with high recyclability rates and lower carbon emissions.

Ball Corporation continued to dominate in aluminum packaging, leveraging the rising popularity of infinitely recyclable beverage cans. The company’s advancements in lightweighting technologies and its alignment with U.S. state-level recycling initiatives strengthened its role in reducing packaging waste and meeting corporate sustainability goals.

DS Smith demonstrated growth through its fiber-based packaging portfolio, particularly in corrugated solutions for e-commerce and retail. By focusing on circular design principles and investing in local recycling infrastructure, the company aligned closely with shifting U.S. regulations and consumer demand for compostable and paper-based alternatives.

Collectively, these key players shaped the competitive landscape by driving innovation, investing in recycling infrastructure, and aligning with regulatory frameworks. Their strategies reflected a clear focus on sustainability, efficiency, and circular economy principles, allowing them to address evolving consumer preferences and government-driven sustainability targets in the U.S. packaging sector.

Top Key Players in the Market

- Amcor Plc

- Ardagh Group S.A.

- Ball Corporation

- DS Smith

- Sealed Air Corporation

- Mondi Group

- Sonoco Products Company

- Tetra Pak International S.A.

- WestRock Company

- Smurfit Kappa

Recent Developments

- In June 2025, a total of $1.9 billion in sustainable packaging investments was highlighted as having missed the mark, raising concerns about efficiency and strategic alignment in the sector.

- In April 2025, Pack2Zero secured $5.7 million in funding aimed at scaling its sustainable packaging innovation, focusing on eco-friendly alternatives for mainstream adoption.

- In July 2025, Bambrew raised USD 10.3 million to expand its sustainable packaging innovation globally, reinforcing its growth strategy and international market presence.

- In November 2024, Ukhi landed $1.2 million in pre-seed funding to accelerate its bio-packaging solutions, emphasizing early-stage innovation in eco-conscious product development.

Report Scope

Report Features Description Market Value (2024) USD 44.8 Billion Forecast Revenue (2034) USD 68.9 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Paper & Paperboard, Glass, Plastic, Metal, Others), By Product Type (Boxes & Cartons, Bags & Pouches, Bottles & Cans, Films & Wraps, Trays, Mailers, Others), By Process (Degradable Packaging, Recycled Packaging, Reusable Packaging), By Application (Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Consumer Goods, E-commerce, Others) Competitive Landscape Amcor Plc, Ardagh Group S.A., Ball Corporation, DS Smith, Sealed Air Corporation, Mondi Group, Sonoco Products Company, Tetra Pak International S.A., WestRock Company, Smurfit Kappa Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  U.S. Sustainable Packaging MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

U.S. Sustainable Packaging MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor Plc

- Ardagh Group S.A.

- Ball Corporation

- DS Smith

- Sealed Air Corporation

- Mondi Group

- Sonoco Products Company

- Tetra Pak International S.A.

- WestRock Company

- Smurfit Kappa