US Soil Stabilization Market By Additive Type (Polymers, Mineral & Stabilizing Agents, and Other Additives), By Stabilization Method (Mechanical Stabilization, Chemical Stabilization, and Biological Stabilization), By Application (Industrial, Agricultural, Residential, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 111092

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

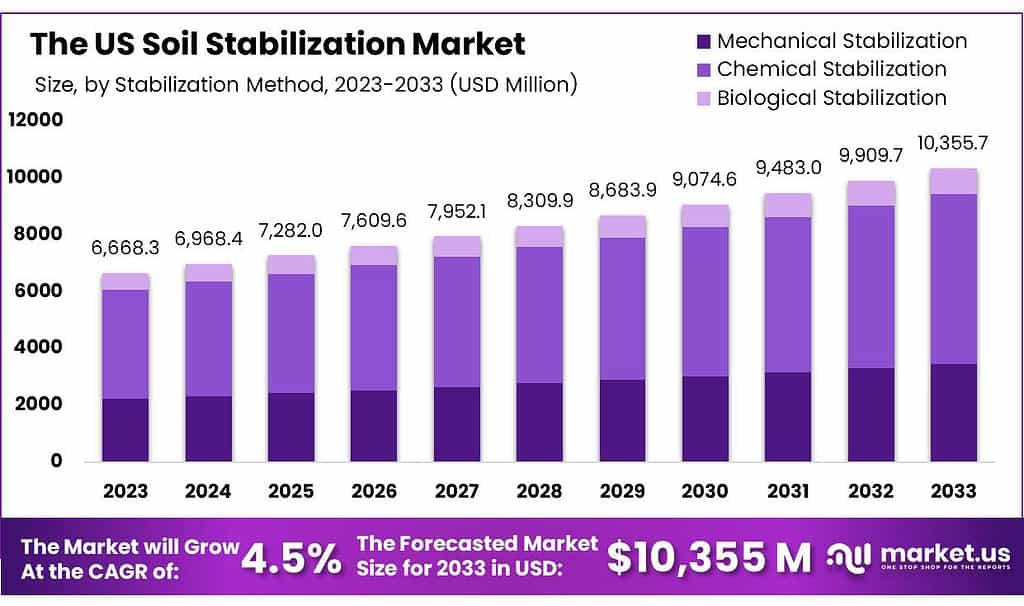

The US Soil Stabilization Market size is expected to be worth around USD 10,355 Million by 2033, from USD 6,668.3 Million in 2023, growing at a CAGR of 4.5% during the forecast period from 2023 to 2033.

Soil stabilization is a fundamental technique in the field of civil engineering and construction aimed at improving the properties of natural soil to make it suitable for various applications. It involves altering soil’s physical and chemical characteristics to enhance its strength, durability, and load-bearing capacity.

This is typically achieved by adding materials such as cement, lime, or specialized chemicals to the soil. The United States has experienced significant urbanization trends, with a growing population moving into cities and suburban areas. This urban sprawl necessitates the construction of new infrastructure, roads, buildings, and housing developments.

Given the diverse soil conditions across the country, soil stabilization becomes essential to ensure the stability and durability of these projects. Stable foundations are crucial in urban environments, where the structural integrity of buildings, roads, and bridges is paramount. The market is expected to grow robustly with continuous technological advancements, increased environmental awareness, and growing global infrastructure and agricultural needs.

Actual Numbers Might Vary in the Final Report

Key Takeaways

- The US soil stabilization market is valued at USD 6,668.3 Million in 2023 and is estimated to register a CAGR of 4.5%.

- The US soil stabilization market is projected to reach USD 10,355 Million by 2033.

- Mineral and stabilizing agents accounted for the market share of 57.2%.

- The country’s robust research and development capabilities foster innovations in soil stabilization techniques and materials tailored to its diverse geographic and geological conditions. These advancements include the development of region-specific stabilizers and additives that cater to the wide range of soil types found across the U.S., enhancing the effectiveness of soil stabilization solutions.

- The mechanical soil stabilization method accounted for the majority of the market share, with 49.7%.

- Texas State held the largest market share among other states, with 13.01% in the US soil stabilization market in 2023.

Additive Type Analysis

Mineral and Stabilizing Agents Accounted for The Largest Market Share Owing to Their Effectiveness in Enhancing Soil Properties.

The soil stabilization market is segmented based on additive type into polymers, mineral & stabilizing agents, and other additives. Among these, mineral & stabilizing agents held the majority of revenue share in 2023 of 57.9% among other additives.

Minerals and stabilizing agents, such as cement, lime, and fly ash, have proven to be very effective in enhancing soil compaction, improving soil qualities, and increasing load-bearing capacity. These properties make them favorable options in building projects due to their sturdiness and long-lasting effects on soil stabilization.

Minerals and stabilizing agents dominate the market during the forecast period primarily due to their cost-effectiveness and widespread availability. These factors make them a choice for several construction and soil stabilization projects. These factors combine to make minerals and stabilizing agents the most dominant category in the soil stabilization market, reflecting the industry’s move towards more sustainable, efficient, and cost-effective solutions.

Stabilization Method Analysis

Owing to Their Environmental Considerations, Mechanical Soil Stabilization is Preferred over Chemical and Biological Stabilization Methods.

Based on a stabilization method, the market is segmented into mechanical stabilization, chemical stabilization, and biological stabilization. Among these stabilization methods, mechanical soil stabilization accounted for the majority of the market share, with 49.7%. Mechanical stabilization is versatile and can be applied to various soil types and conditions.

This method effectively improves the load-bearing capacity of soils and controls erosion, making it suitable for diverse projects such as road construction, landscaping, and large-scale earthworks. Mechanical methods, such as compaction and the use of geosynthetics, provide immediate stabilization. This is particularly advantageous in projects with tight deadlines or in situations where immediate use of the stabilized soil is necessary.

Mechanical stabilization is often perceived as more environmentally friendly than chemical methods, which can involve using binders or other additives that may raise environmental concerns. This aspect is increasingly important, given the growing emphasis on sustainable construction practices.

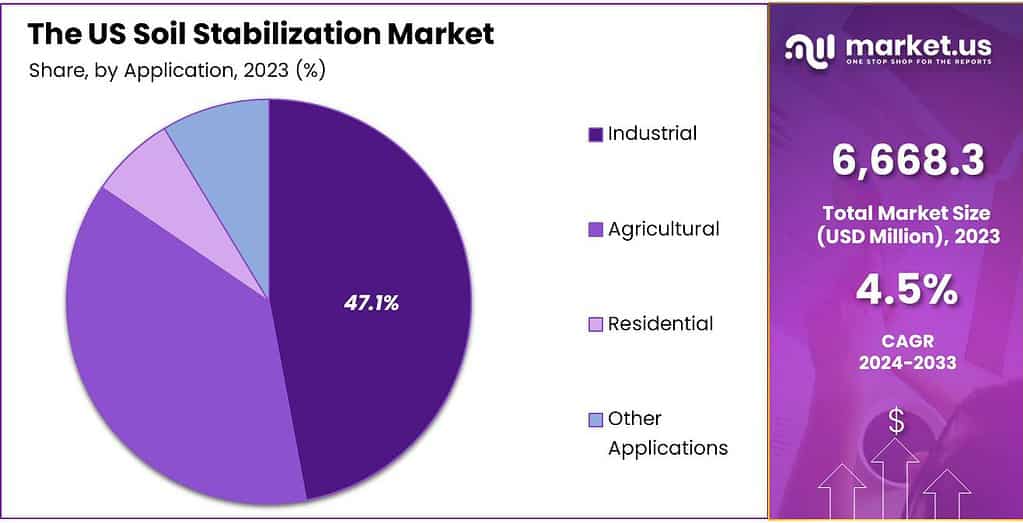

Application Analysis

The Increasing Number of Road Construction Projects in the United States, Industrial Sector Dominates the Market

Based on applications, the market is further divided into industrial, agricultural, residential, and other applications. Among these applications, industrial accounted for the largest market share in 2023, with 47.1%. The industrial sector holds the largest share in the U.S. soil stabilization market primarily due to its extensive use in road construction and other heavy infrastructure projects.

The soil stabilization process enhances the load-bearing capacity, tensile strength, and overall performance of the soil, making it highly suitable for industrial applications. These applications include the construction of dams, railroads, roads, and other infrastructure projects.

The growth in this sector is driven by increasing investments in infrastructure, coupled with rising urbanization and industrialization, which leads to soil contamination and degradation. This scenario necessitates soil protection and remediation, achieved through soil stabilization.

Key Market Segments

By Additive Type

- Polymers

- Synthetic Polymers

- Bio-Polymers

- Mineral & Stabilizing Agents

- Portland Cement

- Lime

- Fly Ash

- Others

- Other Additives

- Agricultural Waste

- Sludge

- Chelates & Salts

By Stabilization Method

- Mechanical Stabilization

- Chemical Stabilization

- Biological Stabilization

By Application

- Industrial

- Agricultural

- Residential

- Other Applications

Drivers

Increasing Infrastructure Investment Activities Is the Major Driving Factor for the Market

Infrastructure investment is a significant driver in the U.S. soil stabilization market. It encompasses a wide spectrum of construction and development projects critical to the nation’s economic growth and societal well-being.

One facet of this driver is the pressing need to address aging infrastructure. The United States boasts an extensive network of roads, bridges, and public facilities that require repair, rehabilitation, and replacement. Soil stabilization is indispensable in these endeavors as it ensures these essential assets’ longevity and structural integrity.

- The IIJA includes $550 billion in new spending to upgrade physical infrastructure such as roads and bridges, railways, airports, and water systems. The White House reported in August 2023 that the IIJA has provided over $280 billion in financing for nearly seven thousand projects, with at least $120 billion allocated to highways.

The United States experiences a growing frequency and intensity of extreme weather events such as hurricanes, heavy rainfall, and severe storms. These events can lead to soil erosion, landslides, and structural damage in vulnerable areas. Soil stabilization is essential in disaster resilience, as it can mitigate these effects by preventing soil erosion and providing stable foundations for structures.

Climate change contributes to the unpredictability of weather patterns, making extreme events more common. As a result, infrastructure projects must account for the increased risk of weather-related challenges. Soil stabilization techniques and materials are crucial in ensuring that roads, bridges, and other critical infrastructure can withstand the impacts of extreme weather, reducing repair costs and ensuring public safety.

- For instance, in 2022, there were 18 billion dollars worth of weather and climate disasters across the US that included 1 wildfire incident, one heat wave, drought, one flooding event, 2 tornado outbreaks three tropical cyclones, and 9 severe weather incidents.

Soil stabilization also plays a role in adapting to the long-term effects of climate change, such as sea-level rise and increased precipitation. Stabilized soil can help manage stormwater runoff and prevent flooding in vulnerable areas, mitigating the damage caused by prolonged extreme weather events.

Restraints

Cost and Budget Constraints of Soil Stabilization May Hinder the Market’s Growth

The United States is characterized by its diverse construction landscape, ranging from large-scale infrastructure projects in major cities to smaller developments in rural areas. Budget limitations can vary significantly based on project size and location.

While larger projects in urban centers have substantial budgets for soil stabilization, smaller projects in rural regions struggle to allocate funds for these techniques, particularly in economically disadvantaged areas.

Public infrastructure projects funded by taxpayer dollars often contend with budget constraints. Political and fiscal pressures can limit the ability to allocate funds for comprehensive soil stabilization measures. This constraint can affect the durability and longevity of public infrastructure, potentially leading to increased maintenance costs over time.

The U.S. construction industry faces fluctuations driven by economic cycles. During economic downturns, such as recessions or financial crises, construction activity can slow down, leading to reduced budgets and an increased focus on cost-saving measures.

- o According to a report published in governing, in 2017, maintenance of highways costs for the U.S. was $51.4 billion. More than twice that was used to construct new roads.

Opportunity

Rising Focus on Infrastructure Rehabilitation Is Anticipated to Create Lucrative Opportunities

The country’s aging infrastructure requires repair and rehabilitation, including roads, bridges, and dams. Soil stabilization plays a crucial role in extending the lifespan and improving the durability of these structures. Stabilizing the underlying soil helps prevent settling, erosion, and structural failures, reducing maintenance costs and ensuring the safety and longevity of critical infrastructure assets.

Infrastructure rehabilitation aligns with broader economic stimulus efforts. Government initiatives and funding programs, such as the American Jobs Plan, prioritize infrastructure development to stimulate economic growth and create jobs. Soil stabilization techniques offer cost-effective solutions for rehabilitating infrastructure, making them attractive options for public and private sector projects.

- For instance, the federal government put aside $36.6 billion for infrastructure projects in 2022. It also transferred $94.5 billion in infrastructure funds to state governments. Congress approved as well President Biden approved the Infrastructure Investment and Jobs Act in November 2021. The bill provided $550 billion in new funding to repair bridges, roads, railways, and airports, connect high-speed internet, and address climate-related issues.

Trends

Adoption of Digital Technologies

Digitalization entails adopting advanced digital technologies and processes and transforming how soil stabilization projects are planned, executed, and managed in the United States. One of the key aspects of this trend is the adoption of (building information modeling) BIM.

This technology-driven approach creates detailed 3D models encompassing all soil stabilization components within the broader construction context. In the U.S., BIM is gaining prominence as it enables better visualization and coordination among project stakeholders, enhancing project efficiency and reducing errors.

- According to the Global BIM Survey, more than 98% of the largest architectural companies across the U.S. have adopted BIM, and more than 30% of small businesses utilize it for some modeling and documentation.

Geopolitical Impact Analysis

The Current Geopolitical Impact On the Global Soil Stabilization Market Is Multifaceted, Influenced by Various International and Regional Factors.

The geopolitical landscape, particularly the ongoing Russia-Ukraine conflict, has significantly impacted various global markets, including the soil stabilization market in the United States. This conflict has disrupted the chances of global economic recovery from the COVID-19 pandemic, at least in the short term.

The war has led to economic sanctions on multiple countries, a surge in commodity prices, and supply chain disruptions. These factors have contributed to inflation across goods and services, affecting many markets, including soil stabilization.

These developments suggest that U.S. companies in the soil stabilization market actively respond to geopolitical changes by diversifying their market presence and enhancing their product portfolios.

This includes adopting technological advancements, such as sophisticated polymers and environmentally friendly additives, which comply with strict environmental regulations and meet the changing needs of the agriculture and construction industries.

State Wise Analysis

Texas State is Estimated to be the Most Lucrative Market in the US Soil Stabilization Market

Texas State held the largest market share, with 13.01% in the US soil stabilization in 2023. Texas, being one of the largest and most populous states in the US, has a high demand for infrastructure development. The state frequently undertakes large-scale construction projects, including roads, highways, and commercial buildings, all requiring significant soil stabilization. Texas is experiencing rapid population growth and urbanization.

This increases construction and infrastructure development to accommodate the growing population, thereby driving demand for soil stabilization products and services. The geographical diversity of Texas, ranging from deserts to coastal areas, presents unique challenges for construction and infrastructure. Soil stabilization is crucial in managing these diverse terrain conditions, especially in areas prone to erosion or with weak soil compositions.

The geographical diversity of Texas, ranging from deserts to coastal areas, presents unique challenges for construction and infrastructure. Soil stabilization is crucial in managing these diverse terrain conditions, especially in areas prone to erosion or with weak soil compositions.

- Soil stabilization facilities are permitted by rule in Texas if they meet the conditions stated in 30 TAC Sections 106.4 and 106.14.

Key States Covered in this Report

- Texas

- Montana

- Kansas

- Nebraska

- South Dakota

- New Mexico

- North Dakota

- Oklahoma

- Colorado

- Iowa

- Wyoming

- Missouri

- Illinois

- Arizona

- Minnesota

- California

- Oregon

- Indiana

- Washington

- Wisconsin

- Arkansas

- Ohio

- Kentucky

- Idaho

- Tennessee

- Utah

- Mississippi

- Georgia

- Florida

- Michigan

- North Carolina

- Alabama

- Louisiana

- Virginia

- Pennsylvania

- New York

- Nevada

- South Carolina

- West Virginia

- Maryland

- Maine

- Vermount

- Hawaii

- Alaska

- New Jersey

- Delaware

- Massachusetts

- New Hampshire

- Connecticut

- Rhode Island

Key Players Analysis

Companies are Strongly Focusing On Product Portfolio Expansion Through Various Strategies To Maintain their Dominance as Industry Leaders

The soil stabilization market in the United States is a significant construction industry segment. This market focuses on methods and technologies for enhancing soil strength and weight-bearing capacity, which is crucial for infrastructure projects such as roadways, airports, and site improvement programs. The techniques used in soil stabilization are broadly divided into mechanical and chemical methods.

Mechanical stabilization combines soils of different grades to create a compacted mass, while chemical stabilization modifies soil properties through chemically active materials. Companies are orienting their investments towards acquiring new technologies and securing raw materials.

They are also focusing on efficient procurement and inventory management. This strategy includes strengthening their product portfolios and leveraging capabilities to maintain growth, especially during challenging economic times.

The market players are also tailoring their strategies to specific country contexts, given the varying economic and social challenges across different markets. Major firms invest in research and development to create cutting-edge construction methods and soil stabilization materials. These efforts are focused on developing economical and ecologically friendly solutions that meet the needs of various industries such as agriculture, transportation, and construction.

Market Key Players

Key U.S. soil stabilization market players include Caterpillar, Tensar Corporation, Mintek Resources Inc., Wirtgen Group, and BOMAG. These companies are known for their significant contributions to the market through various strategies such as product development, mergers, and acquisitions.

These strategic moves by key players indicate a dynamic and evolving market driven by technological advancements, strategic partnerships, and an increasing focus on sustainable and efficient construction practices.

- Caterpillar Inc.

- Tensar Corporation

- Mintek Resources Inc.

- BOMAG

- Wirtgen Group

- The Lhoist Group

- Carmeuse

- BASF SE

- Graymont Limited

- Greer Industries, Inc.

- Other Key Players

Recent Development

- In May 2023, Caterpillar has introduced the new RM600 and RM800 reclaimer/stabilizers, which offer more power, performance, and productivity for full-depth reclamation and soil stabilization projects. The machines feature two high-tensile, six-rib belts with automatic tensioning, providing consistent rotor power.

- In May 2023, Graymont Limited completed the acquisition of a limestone quarry in Ipoh, Perak, Malaysia. The acquisition will support Graymont’s lime plant in Kampar, which has been operating since 2004. The limestone from the quarry will be transported to the Kampar plant, which produces high-quality lime products for various industries.

- In September 2023, Graymont Limited has continued its expansion in Southeast Asia by acquiring Compact Energy, a significant lime processing facility in Malaysia. The acquisition will enable Graymont to expand its regional presence and increase its production capacity.

Report Scope

Report Features Description Market Value (2023) USD 6,668.3 Mn Forecast Revenue (2033) USD 10,355 Mn CAGR (2024-2032) 4.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Base Metal Smelters, Elemental Sulfur, Pyrite Ores, and Other Raw Materials), By Concentration (Below 50%, 50-70%, 70-93%, and 93-99%), By Application (Fertilizers, Metal Processing, Petroleum Refining, Textile, and Other Applications) State Wise Analysis Texas, Montana, Kansas, Nebraska, South Dakota, New Mexico, North Dakota, Oklahoma, Colorado, Iowa, Wyoming, Missouri, Illinois Arizona, Minnesota, California, Oregon, Indiana, Washington, Wisconsin, Arkansas, Ohio, Kentucky, Idaho, Tennessee, Utah, Mississippi, Georgia, Florida, Michigan, North Carolina, Alabama, Louisiana, Virginia, Pennsylvania, New York, Nevada, South Carolina, West Virginia, Maryland, Maine, Vermount, Hawaii, Alaska, New Jersey, Delaware, Massachusetts, New Hampshire, Connecticut, Rhode Island

Competitive Landscape Caterpillar Inc., Tensar Corporation, Mintek Resources Inc., BOMAG, Wirtgen Group, The Lhoist Group, Carmeuse, BASF SE, Graymont Limited, Greer Industries, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is soil stabilization?Soil stabilization involves various techniques and materials used to improve the engineering properties of soil. It aims to enhance soil strength, durability, and resistance to weathering, erosion, and other detrimental factors.

What are the key factors driving the US soil stabilization market?Factors driving this market include increasing infrastructure development, road construction, and the need for erosion control in various construction projects. Also, the emphasis on sustainable construction practices and environmental protection contributes to market growth.

What types of projects benefit from soil stabilization techniques?Soil stabilization techniques find applications in various projects including road construction, railways, airports, residential and commercial construction, mining, landfills, and environmental restoration projects.

US Soil Stabilization MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

US Soil Stabilization MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Caterpillar Inc.

- Tensar Corporation

- Mintek Resources Inc.

- BOMAG

- Wirtgen Group

- The Lhoist Group

- Carmeuse

- BASF SE

- Graymont Limited

- Greer Industries, Inc.

- Other Key Players