US Recreational Vehicle Market Size, Share, Growth Analysis By Vehicle Type (Towable RVs [Fifth Wheel, Travel Trailer, Camping Trailer], Motorhomes [Class A, Class B, Class C]), By Application (Commercial, Personal), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152628

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

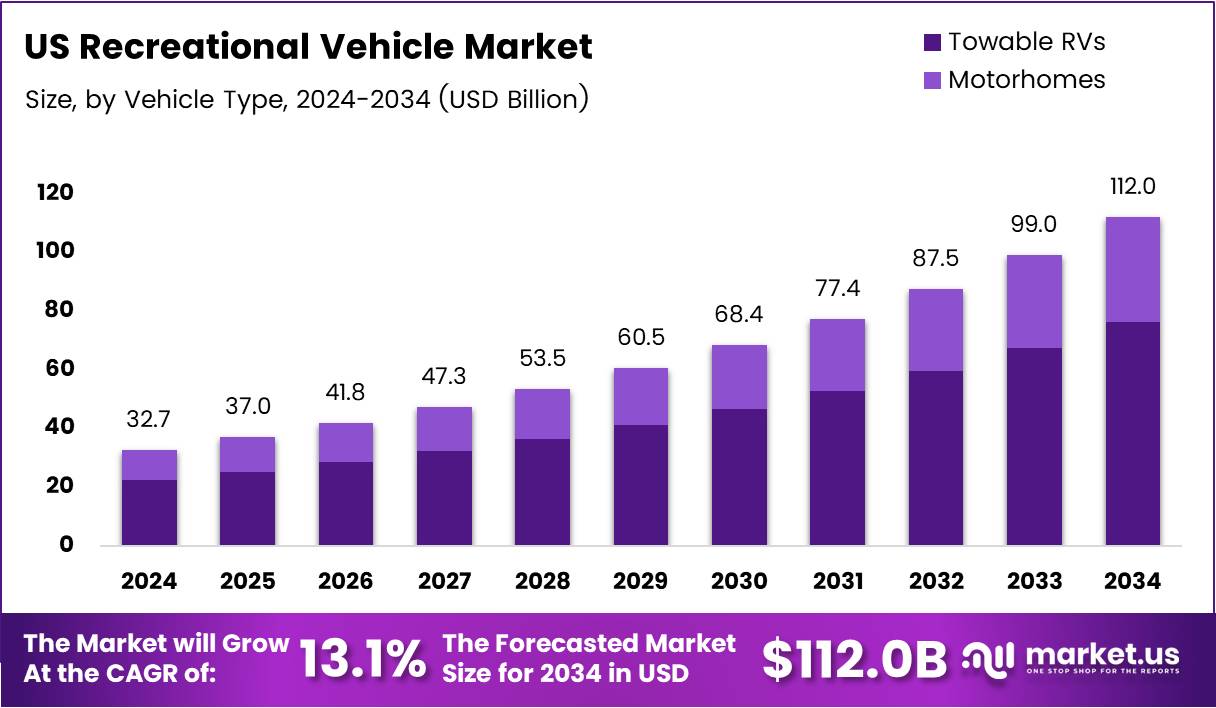

The US Recreational Vehicle Market size is expected to be worth around USD 112.0 Billion by 2034, from USD 32.7 Billion in 2024, growing at a CAGR of 13.1% during the forecast period from 2025 to 2034.

The US Recreational Vehicle (RV) market has shown impressive growth in recent years, driven by a shift in consumer behavior. As people increasingly seek outdoor activities and travel experiences, RVing has emerged as a popular choice. This market offers a variety of vehicles, including towable trailers, motorhomes, and campers.

According to Bookcleango, over 40 million Americans regularly go RVing, with 25 million of them engaging in RV travel annually. This trend reflects a growing interest in recreational vehicles, supported by factors such as convenience, cost-efficiency, and the desire for outdoor experiences. RVs provide flexibility for road trips and vacations.

Millennials have been a major demographic driving this growth. As per Bookcleango, 38% of the 40 million RV owners in the US are Millennials. This indicates a shift in the age group traditionally associated with RV ownership, showcasing a younger audience seeking adventure and long-term cost savings on travel and accommodation.

The price range for RVs varies, with towable trailers typically costing between $20,000 and $100,000. According to Homeguide, this wide price range caters to various consumer preferences and budgets, making RV ownership accessible to a broad market. The diversity in RV models ensures options for both entry-level buyers and luxury enthusiasts.

The RV market presents significant growth opportunities. Factors like increasing interest in outdoor recreation, road trips, and the desire for self-sufficiency fuel the demand for RVs. Furthermore, the ongoing trend of remote work has allowed more people to embrace RV lifestyles, enabling them to work from the road.

Government investments and regulations also influence the market’s development. Local and federal government initiatives that support infrastructure for RV parks and campsites enhance the experience of RV travelers. Regulations ensuring safety standards and roadworthiness of RVs further contribute to the market’s steady growth.

Key Takeaways

- The US Recreational Vehicle market size is expected to reach USD 112.0 billion by 2034, growing at a CAGR of 13.1% from 2025 to 2034.

- Towable RVs lead the US market in 2024, valued for their versatility, affordability, and ease of towing.

- Commercial applications dominate in 2024, with RVs used for mobile offices, group transport, and mobile service units.

- The US RV market is benefiting from a rise in outdoor recreational activities and adventure tourism.

- The growing demand for eco-friendly and electric RVs presents significant growth opportunities in the market.

Vehicle Type Analysis

Towable RVs held a dominant market position in the US Recreational Vehicle Market in 2024.

In 2024, Towable RVs led the US Recreational Vehicle market, showing strong preference among RV owners due to their versatility and affordability. They are commonly used for family trips and are known for their ease of towing, making them popular for both seasoned and first-time RV buyers.

These vehicles offer various configurations, from lightweight models to larger, more luxurious designs. Towable RVs have established their dominance by catering to a broad range of customer needs, including accessibility, space, and price.

On the other hand, Motorhomes, while still popular, accounted for a smaller share of the market in comparison. Their self-contained nature appeals to those who prioritize comfort and convenience, providing all amenities within the vehicle itself.

However, due to their higher initial cost and maintenance, Motorhomes tend to attract a more specific consumer base, limiting their market share. Despite these challenges, Motorhomes are expected to maintain a steady demand from consumers seeking a premium experience.

Application Analysis

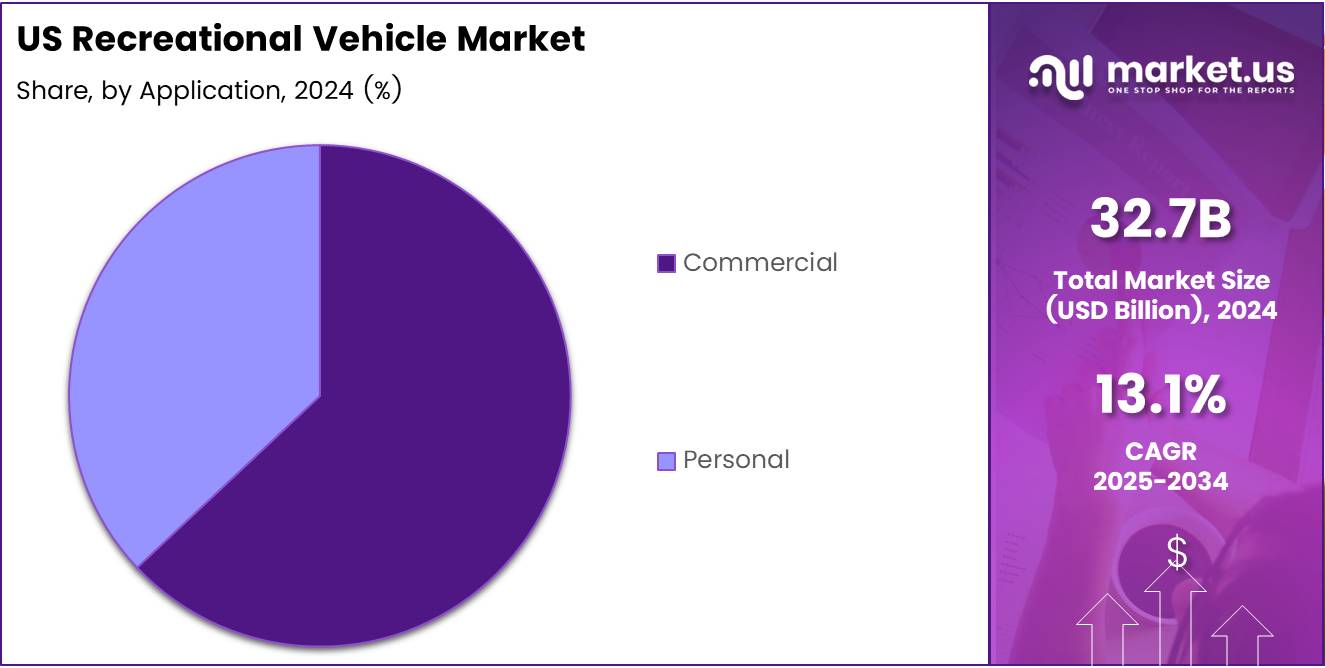

Commercial applications dominated the US Recreational Vehicle Market in 2024.

In 2024, Commercial applications took the lead in the US Recreational Vehicle market, driven by their widespread use in the business sector. Companies utilize RVs for various purposes, including mobile offices, transport for large groups, and mobile service units.

Commercial RVs offer businesses a flexible solution for travel, whether for staff transportation, promotional activities, or serving as mobile workstations. Their utility and versatility have made them a preferred choice in sectors such as tourism, hospitality, and construction.

Personal applications, while still a key market segment, held a secondary position in 2024. These RVs are primarily used by individuals and families for leisure travel and vacations. The growing trend of outdoor adventures and road trips has significantly contributed to the personal RV market.

However, the overall market share of personal RVs is slightly lower compared to commercial ones, as many individuals still prefer traditional forms of travel, such as cars or rental vehicles, when not utilizing RVs for extended trips. Despite this, personal RV usage is expected to grow as more people embrace the RV lifestyle.

Key Market Segments

By Vehicle Type

- Towable RVs

- Fifth Wheel

- Travel Trailer

- Camping Trailer

- Motorhomes

- Class A

- Class B

- Class C

By Application

- Commercial

- Personal

Drivers

Surge in Outdoor Recreational Activities and Adventure Tourism Drives Market Growth

The US Recreational Vehicle (RV) market is experiencing significant growth, driven by a surge in outdoor recreational activities and adventure tourism. With more people looking to explore nature, RVs offer a convenient and comfortable way to travel to remote destinations.

The rise in outdoor activities like camping, hiking, and fishing has made RVs an appealing choice for adventure seekers. As these activities gain popularity, the demand for RVs continues to grow, providing consumers with the flexibility to travel and enjoy the outdoors.

Consumers are also increasingly preferring RVs as an affordable alternative to expensive hotels and flights. The ability to travel while having access to all the comforts of home is a major factor fueling this trend. RVs provide a cost-effective solution, allowing people to explore the country without the financial burden of traditional travel expenses.

Another key driver is the expansion of the RV rental market, particularly among millennials. The younger generation is attracted to RV rentals as they offer flexibility, cost savings, and the chance to experience new destinations without the need for a long-term commitment. This trend is further supported by technological advancements in RV features, including fuel efficiency and enhanced safety measures, making them even more appealing to consumers.

Restraints

High Initial Investment and Maintenance Costs Restrain Market Growth

Despite the growing interest in RVs, high initial investment costs remain a significant restraint in the US market. The upfront price of purchasing an RV can be prohibitive for many potential buyers, especially when considering the various models and customization options available. This high cost may discourage some consumers from entering the market, limiting overall market growth.

Additionally, RV owners face increased maintenance and operating costs. Regular upkeep of RVs, including repairs, tire replacements, and servicing, can be expensive. Furthermore, fuel consumption is another ongoing cost that RV owners must consider, especially given the fluctuating prices of fuel. These costs can make RV ownership less attractive, especially when compared to other forms of travel.

Growth Factors

Growth Opportunities in the US Recreational Vehicle Market

The US RV market holds several growth opportunities, particularly with the rising adoption of eco-friendly and electric RV models. As environmental concerns increase, consumers are showing a preference for vehicles that reduce their carbon footprint. Electric RVs, in particular, are gaining traction, offering an eco-friendly alternative to traditional fuel-powered models.

Another growth opportunity lies in the increasing demand for customized RV designs and features. Consumers are seeking personalized options that cater to their specific needs, whether for luxury or practical purposes. Manufacturers are responding to this demand by offering a wide range of customizable features, from high-end interiors to state-of-the-art entertainment systems.

Urban areas also present a growth opportunity, as more people are looking at RVs as alternative housing solutions. The appeal of RVs as affordable, mobile homes is growing, especially in cities with high living costs. Finally, the expansion of RV-focused campgrounds and resorts is another growth opportunity, as these destinations provide specialized facilities and services for RV owners, further boosting market demand.

Emerging Trends

Trending Factors in the US Recreational Vehicle Market

Several trending factors are shaping the future of the US RV market. One key trend is the integration of smart technologies and the Internet of Things (IoT) into RVs. Consumers are increasingly interested in RVs equipped with Wi-Fi, GPS, and other connected technologies, allowing them to enjoy the same level of convenience and connectivity while on the road.

Luxury RVs and high-end customization are also gaining popularity. Consumers are seeking more luxurious experiences, with features like premium interiors, state-of-the-art entertainment systems, and advanced comfort features. This trend is driving the demand for high-end RV models that cater to affluent consumers looking for top-tier quality.

There is also a growing focus on sustainable and green RV manufacturing. Consumers are becoming more environmentally conscious, and RV manufacturers are responding by developing eco-friendly models with energy-efficient systems, solar panels, and environmentally friendly materials.

Lastly, the development of connected and autonomous RV features is an emerging trend. These innovations promise to make RVs safer, more efficient, and easier to operate, with features like automated driving, collision avoidance systems, and real-time vehicle diagnostics, further enhancing the appeal of RVs in the US market.

Regional Analysis

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key US Recreational Vehicle Company Insights

In 2024, the U.S. recreational vehicle (RV) market remains robust, with key players continuing to shape the landscape through innovation, product diversity, and strategic market positioning.

Forest River maintains its dominant presence by offering a wide range of RV models that appeal to both first-time buyers and seasoned travelers. Its extensive dealer network and reliable after-sales support contribute to sustained consumer loyalty.

Hymer AG, although European-based, continues to expand its footprint in the U.S. through smart design and compact luxury RV solutions that resonate with younger, urban-based adventurers. Its focus on energy-efficient and space-optimized vehicles supports growing eco-conscious trends.

Dethleffs leverages its long-standing reputation for craftsmanship and safety, targeting niche markets within the premium RV segment. Their emphasis on innovative interiors and family-friendly layouts ensures a stable foothold in an otherwise competitive environment.

Northwood Manufacturing has carved a strong niche by focusing on rugged, four-season RVs that cater to off-grid and adventure-focused consumers. Their commitment to durability and American-built quality aligns with rising demand for remote travel experiences in 2024.

Collectively, these companies are responding to evolving consumer preferences shaped by a blend of post-pandemic travel habits, digital nomad lifestyles, and a growing appetite for sustainable outdoor recreation. As technology integration, customization, and fuel efficiency become even more critical, the competitive dynamics among these leaders are expected to intensify, with innovation and adaptability serving as key differentiators.

Top Key Players in the Market

- Forest River

- Hymer AG

- Dethleffs

- Northwood Manufacturing

- Gulf Stream Coach, Inc

- Winnebago Industries Inc

- Trigano SA

- Thor Industries Inc

Recent Developments

- In May 2025, Monroe Capital announced a $250 million forward flow purchase agreement with Source One Financial Services, LLC, acquiring consumer recreational vehicle and marine loans. This strategic move enhances Monroe’s footprint in the specialty finance sector by capitalizing on growing demand for alternative lending solutions.

- In June 2025, amid softening demand for RVs and motor homes, Thor Industries revealed plans to repurchase up to $400 million of its shares. The buyback signals confidence in the company’s long-term value despite short-term market pressures.

Report Scope

Report Features Description Market Value (2024) USD 32.7 Billion Forecast Revenue (2034) USD 112.0 Billion CAGR (2025-2034) 13.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Towable RVs [Fifth Wheel, Travel Trailer, Camping Trailer], Motorhomes [Class A, Class B, Class C]), By Application (Commercial, Personal) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Forest River, Hymer AG, Dethleffs, Northwood Manufacturing, Gulf Stream Coach, Inc, Winnebago Industries Inc, Trigano SA, Thor Industries Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  US Recreational Vehicle MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample

US Recreational Vehicle MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Forest River

- Hymer AG

- Dethleffs

- Northwood Manufacturing

- Gulf Stream Coach, Inc

- Winnebago Industries Inc

- Trigano SA

- Thor Industries Inc