US Perfume Market Size, Share, Growth Analysis By Type (Synthetic, Natural), By End-user (Women, Men), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166599

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

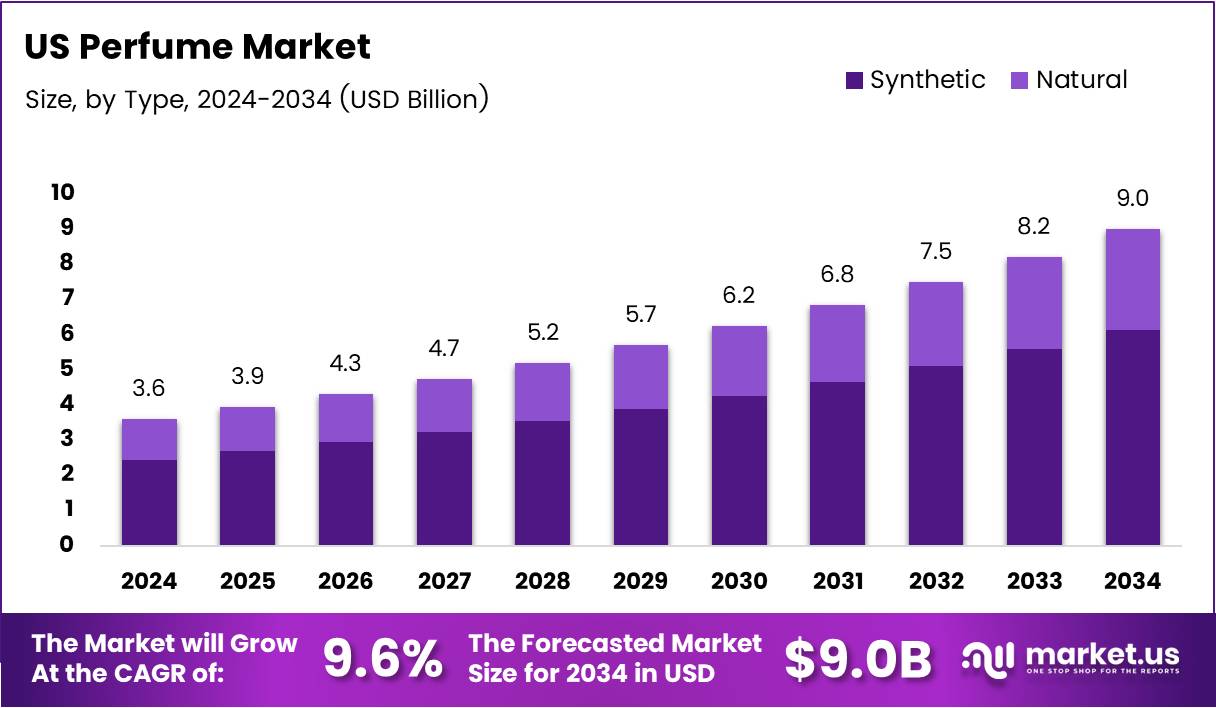

The US Perfume Market size is expected to be worth around USD 9.0 Billion by 2034, from USD 3.6 Billion in 2024, growing at a CAGR of 9.6% during the forecast period from 2025 to 2034.

The US perfume market represents a dynamic segment of the wider beauty landscape, driven by rising consumer interest in personal expression, wellness, and premium scent experiences. Moreover, shifting lifestyle preferences and higher adoption of daily-use fragrances continue to strengthen the category’s relevance while supporting steady demand across retail and digital fragrance channels.

Furthermore, the market is expanding as consumers seek niche, long-lasting, and clean-label perfumes aligned with evolving sustainability expectations. This transition encourages brands to invest in ingredient transparency and ethical sourcing. Simultaneously, heightened awareness of fragrance layering trends increases product experimentation, boosting absorption across multiple price tiers within the US perfume ecosystem.

Additionally, strong opportunities emerge from growing demand for gender-inclusive scents, wellness-inspired formulations, and personalized perfume discovery tools. Retailers and manufacturers benefit from expanding omnichannel strategies, enabling consumers to explore fragrances through AI-driven quizzes, virtual testing, and curated subscription models, thereby improving engagement and repeat purchasing behavior.

At the same time, government regulations related to ingredient disclosures, product safety, and environmental standards shape manufacturing priorities. Compliance with updated labeling rules and safe–use guidelines drives investment in R&D and sustainable packaging. These measures also motivate companies to adopt greener alcohol bases, recyclable bottles, and reduced-waste production methods.

Consequently, sustained category momentum supports long-term market growth, aided by expanding consumer education around scent compositions, longevity, and skin-friendly formulations. Rising disposable incomes and higher frequency of gifting occasions further accelerate the market trajectory, making perfumes a resilient beauty segment with broad national appeal.

According to Research, fragrances were the fastest-growing beauty category in the US in 2024, with prestige scent sales rising 12% year-over-year and reaching 28% of total prestige beauty sales—approximately $34 billion. Additionally, Gen Z Americans now spend $204.15 annually on fragrance, reinforcing future demand and broader market penetration.

Key Takeaways

- US perfume market projected to reach USD 9.0 Billion by 2034 from USD 3.6 Billion in 2024, growing at a 9.6% CAGR.

- Synthetic fragrances dominate the type segment with 67.9% share in 2024.

- Women lead the end-user segment with a 62.3% market share.

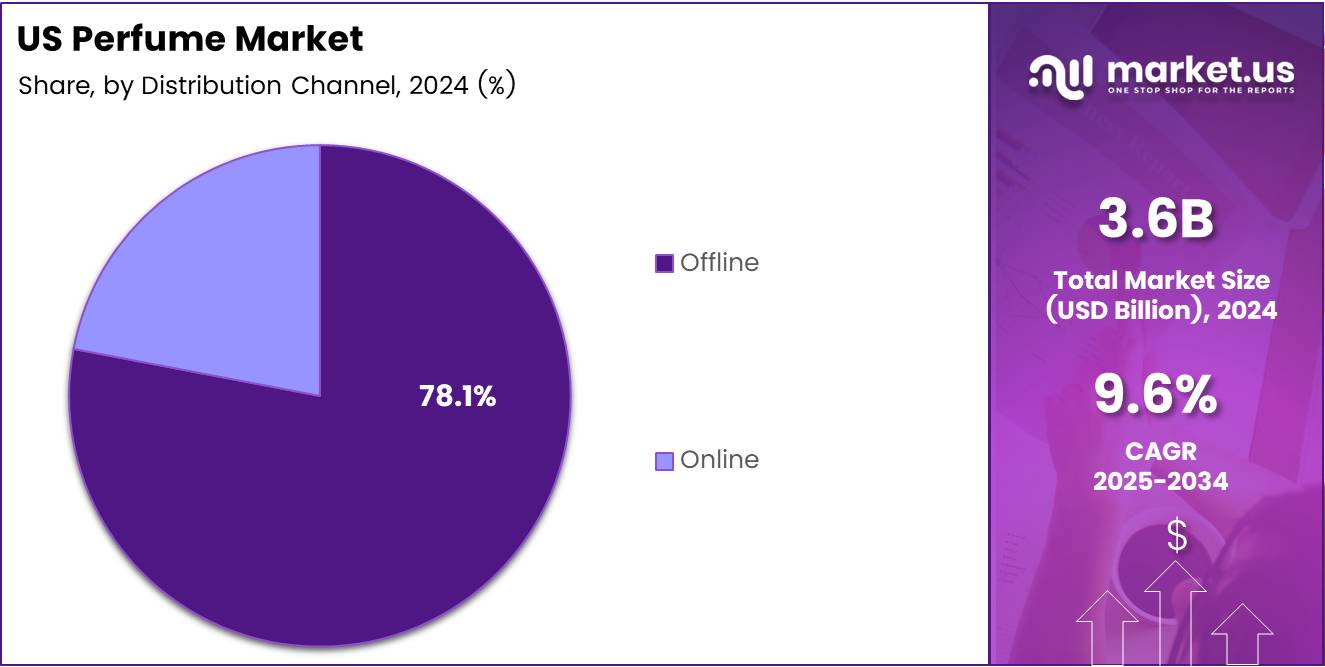

- Offline distribution channels hold a strong 78.1% share in 2024.

- North America, led by the US, remains the primary regional market within the global landscape.

By Type Analysis

Synthetic dominates with 67.9% due to its consistent quality and affordability.

In 2024, Synthetic held a dominant market position in the By Type segment of the US Perfume Market, with a 67.9% share. This segment continued to expand as brands leveraged lab-created aroma compounds to maintain uniformity, reduce production costs, and introduce diverse fragrance profiles that appeal to mass-market consumers.

In 2024, Natural fragrances grew steadily as consumers increasingly valued botanical ingredients and sustainability. Although smaller in scale, this segment advanced through niche brands emphasizing purity, transparency, and ethically sourced materials. Its appeal strengthened as eco-conscious buyers sought products aligned with health-oriented and environmentally mindful lifestyles.

By End-user Analysis

Women dominate with 62.3% owing to higher usage frequency and wider product availability.

In 2024, Women held a dominant market position in the By End-user segment of the US Perfume Market, with a 62.3% share. This dominance persisted as women’s fragrances benefited from broader product ranges, targeted marketing, and premium brand engagement that encouraged repeat purchases and ongoing category loyalty.

In 2024, Men continued to expand their presence as grooming awareness increased and brands introduced more versatile scents. This segment advanced through modern fragrance trends, including woody, aquatic, and fresh profiles, which appealed to younger consumers seeking signature scents that complement evolving lifestyle preferences.

By Distribution Channel Analysis

Offline dominates with 78.1% supported by experiential shopping and established retail networks.

In 2024, Offline channels held a dominant market position in the By Distribution Channel segment of the US Perfume Market, with a 78.1% share. This lead strengthened as consumers preferred in-store testing, premium retail experiences, and trusted guidance from beauty advisors when selecting high-value fragrances.

In 2024, Online channels advanced rapidly with digital convenience, competitive pricing, and influencer-led discovery. E-commerce growth accelerated as virtual try-on tools, subscription sampling, and personalized recommendations enhanced confidence in purchasing fragrances without physical testing, attracting tech-savvy and value-driven buyers.

Key Market Segments

By Type

- Synthetic

- Natural

By End-user

- Women

- Men

By Distribution Channel

- Offline

- Online

Drivers

Premiumization Fueled by Celebrity & Influencer-Led Brands Drives Market Growth

The US perfume market is increasingly shaped by premiumization trends, mainly driven by celebrity and influencer-backed brands. Consumers view these fragrances as status symbols, which boosts demand for high-end scents. This shift encourages brands to invest heavily in unique packaging and exclusive scent profiles.

Another key driver is the rising demand for long-lasting Eau de Parfum concentrations. Shoppers are willing to pay more for formulas that stay on the skin longer, leading manufacturers to focus on stronger and more sophisticated blends. This trend supports higher price points and premium product development.

Niche and artisanal houses are also expanding rapidly across retail channels. Their limited-edition collections and unique craftsmanship appeal to consumers seeking individuality. As specialty boutiques and luxury retailers increase distribution, these brands continue to attract a growing audience.

Restraints

High Product Saturation Creating Intense Competitive Pressure Limits Market Expansion

The US perfume market faces significant restraints due to high product saturation. With countless global, celebrity, and niche brands in the mix, competition is intense. This makes it difficult for new entrants to gain visibility and for existing brands to maintain loyalty.

Another challenge comes from increasing regulatory scrutiny on allergens and chemical components. As agencies tighten guidelines, brands face higher compliance costs and potential reformulation requirements. These pressures can slow innovation and create barriers to faster product launches.

Overall, the combination of strict regulations and overcrowded shelves limits growth, especially for smaller players with limited resources.

Growth Factors

Untapped Potential in Refillable & Sustainable Packaging Systems Creates Future Opportunities

One of the strongest growth opportunities lies in refillable and eco-friendly packaging systems. As consumers become more environmentally aware, brands offering sustainable solutions can gain a competitive edge. This shift also helps reduce long-term packaging costs for manufacturers.

Subscription-based scent discovery services are another emerging opportunity. These platforms allow consumers to test multiple scents before committing to full-size bottles. This model appeals to younger shoppers and supports recurring revenue for brands.

AI-driven custom fragrance formulation is also transforming the market. By analyzing personal preferences and lifestyle data, AI tools help create highly personalized scents. This technological advancement encourages deeper consumer engagement and opens new product development pathways.

Emerging Trends

Strong Consumer Shift Toward Clean, Non-Toxic Fragrance Labels Trends Upward

A major trend shaping the market is the shift toward clean and non-toxic fragrance labels. Consumers are paying closer attention to ingredient lists, pushing brands to highlight transparency and safety. This trend is particularly strong among younger demographics.

Retro and vintage scent profiles are also making a comeback. Many shoppers are drawn to nostalgic notes inspired by classic perfumes, driving renewed interest in heritage brands and reimagined formulations.

Additionally, micro-influencers are creating viral fragrance trends on social platforms. Their authentic reviews often lead to sudden spikes in demand, especially for niche scents. This digital influence is reshaping how brands market products and engage with audiences.

Key US Perfume Company Insights

The US perfume market in 2024 continues to evolve through premiumization, personalization, and strong consumer engagement, with key players shaping competitive dynamics.

Abercrombie and Fitch Co. has been reinforcing its fragrance segment by leveraging brand heritage and youth-driven appeal. Its perfumes complement its lifestyle portfolio, benefiting from improved retail traffic and expanding digital channels. This positions the company to capture demand from younger consumers seeking accessible, fashion-aligned scents.

Alpha Aromatics Inc. stands out as a specialized fragrance developer with strong technical capabilities. Its focus on custom formulations and industry innovation supports growing partnerships across personal-care and niche-fragrance brands. As demand rises for clean, unique scent profiles, Alpha Aromatics’ R&D-driven approach strengthens its foothold among US manufacturers and emerging brands.

ALT. Fragrances LLC continues to disrupt the traditional market by offering affordable alternatives to luxury perfumes. With its direct-to-consumer model and emphasis on high-quality, inspiration-based scents, the company appeals to value-conscious yet brand-aware consumers. Its agile product cycle and strong social-media presence enable quick adaptation to shifting fragrance trends.

BELLEVUE PARFUM USA plays an integral role in the supply and production landscape by supporting various perfume labels with end-to-end manufacturing solutions. Its capabilities in design, formulation, and packaging allow it to serve both established and emerging brands. As niche and artisanal fragrances gain traction in the US, providers like BELLEVUE benefit from increasing outsourcing needs across the sector.

Top Key Players in the Market

- Abercrombie and Fitch Co.

- Alpha Aromatics Inc.

- ALT. Fragrances LLC

- BELLEVUE PARFUM USA

- Botanic Beauty Labs.

- Capri Holdings Ltd.

- Coty Inc.

- Firmenich SA

- Kapoor Luxury Fragrances

- Ralph Lauren Corp.

Recent Developments

- In April 2024, Snif expanded its partnership with Ulta Beauty to all 1,385 U.S. stores, marking a major milestone in its retail distribution. This move brought Snif’s try-before-you-buy fragrance model into mass retail, strengthening its presence among mainstream beauty consumers.

- In September 2024, gender-neutral fragrance brand Noyz, founded in June 2024, launched The Solid Fragrance Pair, a refillable solid perfume duo. The launch capitalized on the brand’s rapid TikTok-driven popularity, positioning Noyz as an innovator within the Gen Z fragrance segment.

- In December 2024, Khloé Kardashian debuted her first solo fragrance, XO Khloé, at Ulta on December 1. The launch continued with an international rollout at Harrods in the UK starting December 8, expanding the scent’s global reach.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Billion Forecast Revenue (2034) USD 9.0 Billion CAGR (2025-2034) 9.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Synthetic, Natural), By End-user (Women, Men), By Distribution Channel (Offline, Online) Competitive Landscape Abercrombie and Fitch Co., Alpha Aromatics Inc., ALT. Fragrances LLC, BELLEVUE PARFUM USA, Botanic Beauty Labs., Capri Holdings Ltd., Coty Inc., Firmenich SA, Kapoor Luxury Fragrances, Ralph Lauren Corp. Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abercrombie and Fitch Co.

- Alpha Aromatics Inc.

- ALT. Fragrances LLC

- BELLEVUE PARFUM USA

- Botanic Beauty Labs.

- Capri Holdings Ltd.

- Coty Inc.

- Firmenich SA

- Kapoor Luxury Fragrances

- Ralph Lauren Corp.