US Natural Insect Repellent Market Size, Share, Growth Analysis By Product (Sprays/Aerosols, Creams/Lotions, Essential Oils, Candle, Liquid Vaporizers and Diffusers, Others), By Distribution Channel (E-commerce, Hypermarket & Supermarket, Independent Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145421

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

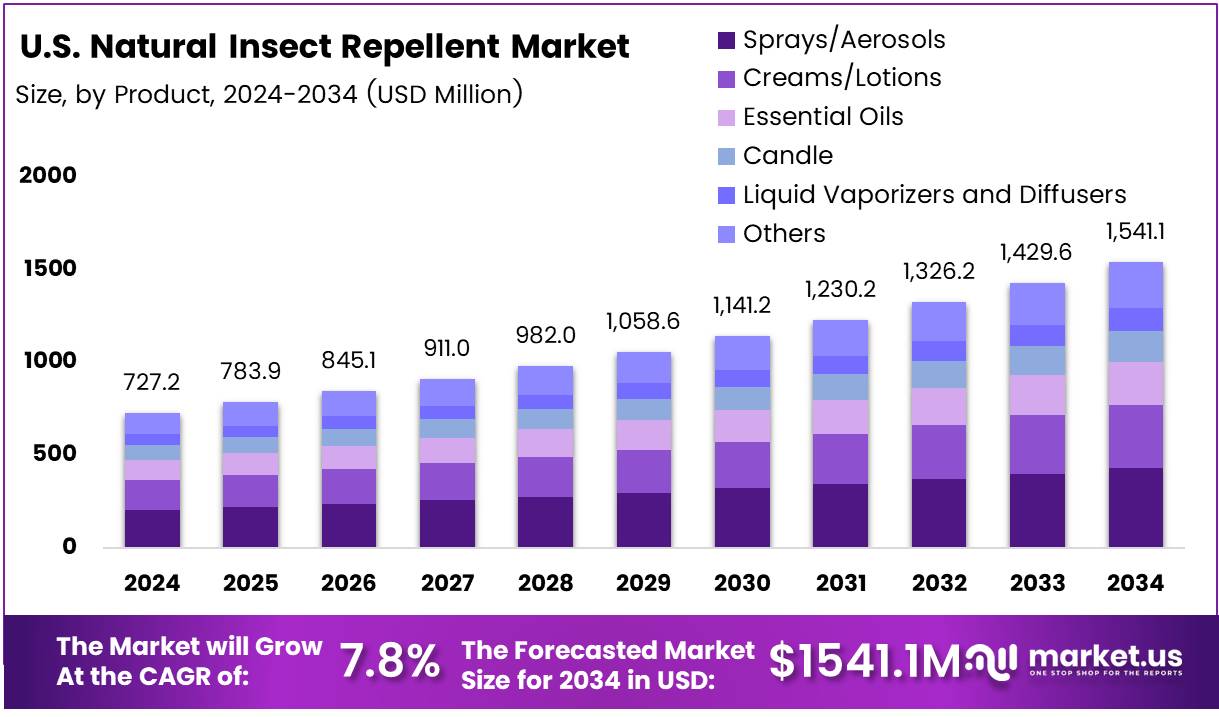

The US Natural Insect Repellent Market size is expected to be worth around USD 1541.1 Million by 2034, from USD 727.2 Million in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034.

The US natural insect repellent market has gained considerable traction in recent years due to growing consumer demand for safer, chemical-free alternatives to conventional insect repellents. The increasing awareness around the harmful effects of synthetic chemicals, such as DEET, has led consumers to shift toward natural options, which are perceived as healthier and environmentally friendly.

Essential oils, derived from plants like citronella, eucalyptus, and neem, have emerged as key ingredients in natural insect repellent formulations. The market is experiencing steady growth, driven by heightened health-consciousness and rising concerns over insect-borne diseases like Zika virus and malaria.

In fact, studies conducted by the National Center for Biotechnology Information (NCBI) have shown that essential oils like clove, cinnamon, citronella, and lemon eucalyptus offer effective mosquito repellency for over 60 minutes when used at the correct concentrations. As consumers seek natural, plant-based alternatives, the US market for natural insect repellents is expected to continue expanding.

The growth of the US natural insect repellent market is propelled by multiple factors, including increasing consumer preference for eco-friendly products and rising awareness of the health risks associated with synthetic insect repellents. According to Health, mosquito repellents containing up to 30% DEET are considered effective, but consumers are increasingly seeking natural products that are safer for children and pets.

Government regulations and investments in natural insect repellent research have played a crucial role in driving market growth. Regulatory bodies like the Environmental Protection Agency (EPA) have set guidelines for the safe use of natural repellents, ensuring consumer confidence in their efficacy and safety. Additionally, studies on the effectiveness of natural ingredients, such as neem plant products, have bolstered their popularity.

The Science Publishing Group reports that neem-based repellents had the highest frequency of usage against mosquito bites, with 88.3% effectiveness, which has encouraged further interest in natural solutions.

As the market expands, companies are investing in innovation to develop more effective and long-lasting formulations, creating numerous growth opportunities for new entrants in this space. With the regulatory environment becoming more conducive to natural product innovations, the market for US natural insect repellents is poised for continued growth.

Key Takeaways

- US Natural Insect Repellent Market size projected to reach USD 1541.1 Million by 2034, growing from USD 727.2 Million in 2024.

- Market expected to grow at a CAGR of 7.8% from 2025 to 2034.

- Sprays/Aerosols dominated the By Product Analysis segment with 42.7% market share in 2024.

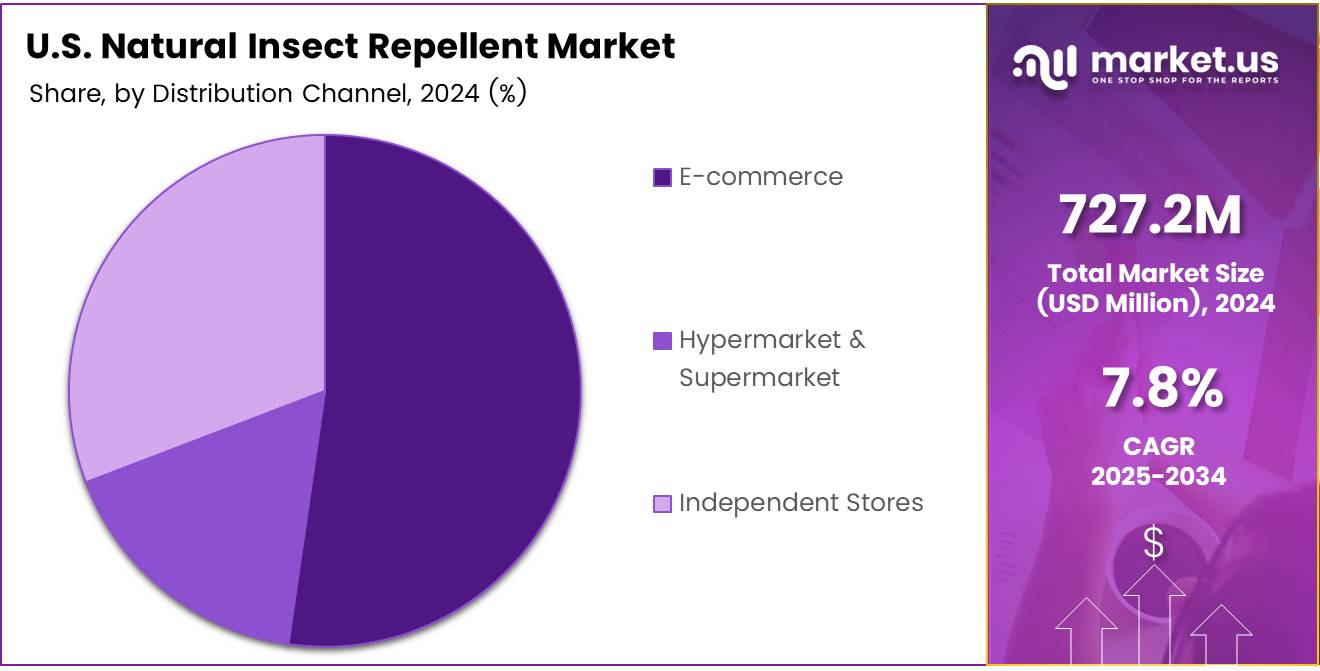

- E-commerce captured the largest share in the Distribution Channel segment in 2024 due to increasing consumer preference for online shopping.

Product Analysis

Sprays/Aerosols Lead US Natural Insect Repellent Market with 42.7% Share in 2024

In 2024, Sprays/Aerosols dominated the By Product Analysis segment of the US Natural Insect Repellent Market, holding a substantial 42.7% market share. This widespread preference can be attributed to their ease of application, effectiveness, and immediate results. Consumers favor sprays and aerosols for their convenience and fast action, making them a go-to solution for outdoor activities and daily use.

Creams/Lotions followed with a significant share, driven by their longer-lasting protection and skin-friendly attributes. These products cater to individuals who prefer a more thorough, non-aerosol application, particularly for sensitive skin areas.

Essential Oils, with their natural appeal, claimed a notable share as well, capitalizing on the rising consumer interest in organic and eco-friendly alternatives. These oils are often marketed as an appealing, chemical-free option for those who prioritize natural solutions.

Candles, Liquid Vaporizers, and Diffusers, while gaining traction for indoor use, had a smaller market share. However, they continue to grow as consumers increasingly seek ambient and chemical-free solutions.

Other products, including natural insect repellent wipes and patches, accounted for a modest portion, contributing to the diversification of offerings in the market.

Distribution Channel Analysis

E-commerce dominates US Natural Insect Repellent Market by Distribution Channel due to convenience and online shopping growth.

In 2024, E-commerce captured the largest share of the US Natural Insect Repellent Market by Distribution Channel. This dominance is driven by the increasing preference for online shopping, offering consumers convenience, a wide variety of products, and the ability to compare prices easily.

The rise of online retail platforms and direct-to-consumer brands has significantly contributed to the growth of the E-commerce segment. The ease of purchasing natural insect repellent products from the comfort of home, coupled with home delivery services, has attracted a broad consumer base.

Following E-commerce, Hypermarkets and Supermarkets are also significant players in this segment. These retail outlets provide consumers with the ability to browse natural insect repellent options in person, while also offering the benefit of in-store promotions and immediate product availability. Independent Stores represent a smaller portion, catering to a more niche market segment that values specialized products and personalized shopping experiences.

Overall, the distribution channels in the US Natural Insect Repellent Market are evolving, with E-commerce taking the lead due to changing consumer behaviors and digital transformation in retail.

Key Market Segments

By Product

- Sprays/Aerosols

- Creams/Lotions

- Essential Oils

- Candle

- Liquid Vaporizers and Diffusers

- Others

By Distribution Channel

- E-commerce

- Hypermarket & Supermarket

- Independent Stores

Drivers

Increasing Awareness of Health Risks Drives Demand for Natural Insect Repellents

The US natural insect repellent market is experiencing significant growth due to rising concerns over the health risks associated with conventional chemical repellents.

Many consumers are becoming more aware of the potential side effects of synthetic insect repellents, such as skin irritation, allergic reactions, and toxicity. As a result, there is an increasing shift toward safer alternatives made from natural ingredients like citronella, eucalyptus, and lemon balm.

People are more cautious about what they apply to their skin, particularly when it comes to products used by children or individuals with sensitive skin. This growing awareness of the health risks linked to chemical-based repellents is fueling the demand for natural options that offer a more gentle and safer approach to insect protection.

Furthermore, natural repellents are often perceived as being more in line with a holistic and health-conscious lifestyle, which is further driving the trend toward these eco-friendly alternatives. As consumers continue to seek products that prioritize both personal well-being and environmental sustainability, the market for natural insect repellents is expected to expand even further.

Restraints

Higher Cost of Natural Insect Repellents May Hinder Widespread Adoption

One significant restraint in the US natural insect repellent market is the higher cost of these products when compared to their chemical counterparts. Consumers who are more price-sensitive may hesitate to choose natural repellents, as these alternatives typically come with a premium price tag. As a result, individuals on a budget or those not fully convinced of the benefits of natural options may prefer to stick with cheaper, chemical-based repellents.

Additionally, while the appeal of natural ingredients is growing, some consumers might not fully appreciate the long-term value of investing in these products, especially if they perceive chemical repellents as more convenient and affordable. Furthermore, there are concerns regarding the limited effectiveness of certain natural insect repellents.

Some natural options may not provide the same level of protection or last as long as synthetic chemical products, which could lead to consumer dissatisfaction. This limitation in efficacy might discourage potential customers from switching to natural alternatives, as they might not offer the same reliability, especially in areas where insect activity is particularly high.

Growth Factors

Expanding Availability in Retail and Online Channels Fuels Market Growth

The US natural insect repellent market is seeing significant growth driven by the increased availability of these products in both retail stores and online platforms. As consumers become more health-conscious and seek eco-friendly alternatives, the convenience of accessing natural repellents through major retail chains and e-commerce platforms offers an exciting opportunity for manufacturers to expand their reach.

Additionally, there is rising demand for pet-safe and family-friendly products. These specialized repellents cater to families with young children and pet owners, tapping into a niche segment that is expected to grow rapidly. Manufacturers can capitalize on this trend by creating products that are both effective and safe for all members of the household. Furthermore, product innovation is playing a crucial role in market expansion.

Companies can explore new formulations incorporating a variety of essential oils and botanicals to improve the repelling effect, offering consumers more options that align with their values of using natural ingredients. This focus on innovation, alongside expanding distribution channels, positions the market to benefit from the growing demand for eco-friendly and non-toxic solutions. These factors combined offer considerable growth opportunities for businesses within the US natural insect repellent market.

Emerging Trends

Growing Popularity of Essential Oils in Natural Insect Repellents

The US natural insect repellent market is witnessing a rise in the use of essential oils such as citronella, eucalyptus, and tea tree oil. These oils are gaining traction for their effectiveness in repelling insects, especially among consumers who prefer plant-based alternatives to chemical solutions.

As more individuals become conscious of the ingredients in their personal care products, natural insect repellents made with essential oils are seen as a safer and more eco-friendly option. Furthermore, the demand for these products is being bolstered by the increasing shift toward environmentally sustainable practices, both in terms of the ingredients used and the packaging. Eco-friendly packaging, such as biodegradable or recyclable materials, is becoming a key trend, aligning with the growing consumer preference for sustainability.

Alongside this, the rise of natural personal care brands has contributed to the proliferation of natural insect repellents, making them more widely accessible. Consumers are increasingly gravitating towards holistic personal care brands, driving the market for insect repellents that align with their values of health, sustainability, and eco-consciousness.

Key Players Analysis

In 2024, the US Natural Insect Repellent Market continues to expand, driven by increasing consumer demand for eco-friendly and non-toxic alternatives to chemical-based repellents. Key players in this market include Earthley, Primally Pure, and W.S. Badger Company, each offering unique products and approaches to natural insect repellent solutions.

Earthley is a prominent player known for its commitment to clean, natural ingredients. The company’s offerings are formulated without synthetic chemicals, using organic essential oils, plant extracts, and other natural components. Earthley’s focus on sustainable practices and transparency in ingredient sourcing has allowed it to build a loyal customer base, particularly among health-conscious consumers who seek holistic wellness solutions.

Primally Pure, another significant brand, leverages the growing trend of luxury natural skincare. Specializing in high-quality, non-toxic products, Primally Pure offers insect repellents that are not only effective but also enhance the skin’s health. The company’s focus on using organic, plant-based ingredients like lavender and cedarwood oil resonates with consumers looking for products that blend functionality with self-care.

W. S. Badger Company, renowned for its natural skincare and personal care products, has successfully incorporated natural insect repellents into its product line. The company’s dedication to sustainability, including using recyclable packaging and sourcing organic ingredients, aligns with consumer values in the natural products space. W. S. Badger Company’s reputation for quality and its wide distribution network make it a strong competitor, appealing to families and individuals looking for reliable, safe alternatives to conventional insect repellents.

These companies represent the growing demand for clean, effective, and environmentally responsible insect repellent options, positioning them as key leaders in the US Natural Insect Repellent Market for 2024.

Top Key Players in the Market

- Earthley

- Primally Pure

- W. S. Badger Company

- Thistle Farms

- Murphy’s Naturals

- Repel

- SallyeAnde

- 3 Moms Organics

- Wondercide LLC.

- California Baby

Recent Developments

- In March 2025, beauty and personal care brand Pilgrim secured ₹200 crore in funding, boosting its pre-money valuation to ₹3,000 crore. This significant investment underscores the growing demand for its diverse product range in the global market.

- In January 2025, Sammmm raised ₹10 crore in funding, led by Fireside Ventures, to revolutionize teen self-care. The brand aims to cater to the unique skincare needs of young adults with innovative and accessible products.

- In August 2024, Safex Chemicals’ subsidiary successfully developed and patented a new mosquito repellent molecule, Renofluthrin. This breakthrough is set to provide a safer, more effective solution to combat mosquito-borne diseases.

Report Scope

Report Features Description Market Value (2024) USD 727.2 Million Forecast Revenue (2034) USD 1541.1 Million CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sprays/Aerosols, Creams/Lotions, Essential Oils, Candle, Liquid Vaporizers and Diffusers, Others), By Distribution Channel (E-commerce, Hypermarket & Supermarket, Independent Stores) Competitive Landscape Earthley, Primally Pure, W. S. Badger Company, Thistle Farms, Murphy’s Naturals, Repel, SallyeAnde, 3 Moms Organics, Wondercide LLC., California Baby Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  US Natural Insect Repellent MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

US Natural Insect Repellent MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Earthley

- Primally Pure

- W. S. Badger Company

- Thistle Farms

- Murphy's Naturals

- Repel

- SallyeAnde

- 3 Moms Organics

- Wondercide LLC.

- California Baby