U.S. Mechanical Watch Market Size, Share, Growth Analysis By Price (Under USD 500, USD 500-USD 3,000, USD 3,000-USD 20,000, Over USD 20,000), By Movement Type (Automatic, Manual), By Strap Material (Leather, Stainless Steel, Nylon, Others), By Case Size (Up to 35 mm, 35 mm-40 mm, 40 mm-45 mm, Above 45 mm), By Shape (Round, Rectangular, Square), By Consumer Group (Men, Women, Unisex), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168302

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Price Analysis

- By Movement Type Analysis

- By Strap Material Analysis

- By Case Size Analysis

- By Shape Analysis

- By Consumer Group Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Key U.S. Mechanical Watch Company Insights

- Recent Developments

- Report Scope

Report Overview

The U.S. Mechanical Watch Market size is expected to be worth around USD 21.4 Billion by 2034, from USD 13.0 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

The U.S. Mechanical Watch Market represents a niche yet resilient segment within the broader luxury timepiece landscape. It focuses on precision-engineered watches powered by manual or automatic movements. The market continues to attract consumers who value craftsmanship, heritage, and long-term durability over disposable digital alternatives, reinforcing strong emotional and functional appeal.

Moreover, demand in the U.S. is supported by growing appreciation for artisanal engineering and collectible timepieces. Consumers increasingly view mechanical watches as investment assets, driving steady market enthusiasm. This shift encourages brands to emphasize storytelling, heritage design, and limited-run models that enhance desirability and long-term market confidence.

Additionally, rising economic stability and higher discretionary spending enable consumers to explore premium mechanical collections. The U.S. market benefits from expanding retail footprints, online luxury platforms, and curated boutique experiences. These multichannel strategies improve accessibility and strengthen engagement with enthusiasts seeking authentic craftsmanship in the mechanical watch category.

Furthermore, evolving government policies supporting luxury retail operations and import-export transparency positively influence market flow. Regulatory focus on product authenticity and anti-counterfeiting measures enhances consumer trust. These efforts help maintain a healthy trading environment for premium mechanical watches across U.S. retail channels and certified resellers.

Looking ahead, growth opportunities stem from rising interest in heritage reissues, sustainability-driven repair culture, and limited-edition craftsmanship. Younger affluent buyers increasingly consider mechanical watches symbols of status and mechanical artistry. This shift broadens the consumer base and supports long-term category momentum within the U.S. Mechanical Watch Market.

According to research, the world produces 1 billion watches annually, including 80 million mechanical watches, highlighting significant global supply potential. Additionally, the typical U.S. luxury mechanical watch buyer is aged 35–55, representing a mature, high-income segment that consistently drives purchases within this premium market.

Key Takeaways

- The U.S. Mechanical Watch Market is projected to grow from USD 13.0 Billion in 2024 to USD 21.4 Billion by 2034, at a CAGR of 5.1%.

- Under USD 500 segment dominates the market with a 44.8% share in 2024.

- Automatic movement watches lead the segment with a 76.4% market share.

- Leather straps hold the largest share at 44.2% in 2024.

- 40 mm–45 mm case size is the most preferred, capturing 48.7% of the market.

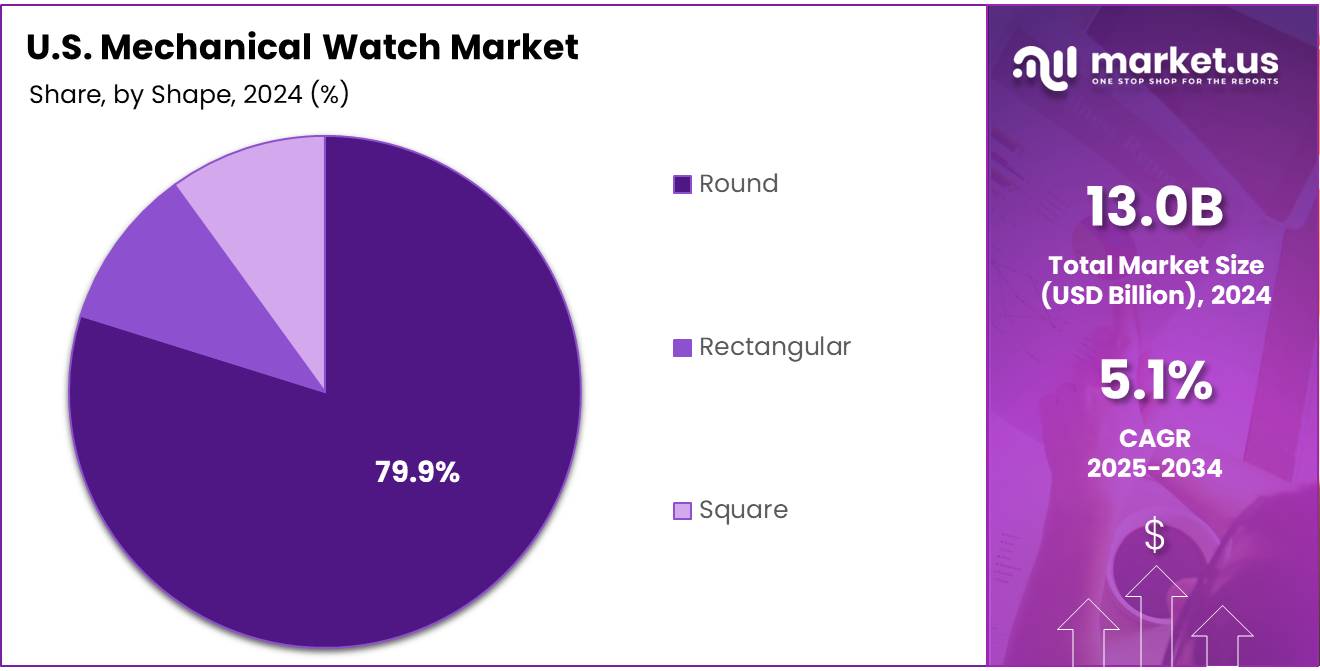

- Round-shaped watches dominate with a 79.9% share.

By Price Analysis

Under USD 500 dominates with 44.8% due to strong accessibility and mass-market appeal.

In 2024, Under USD 500 held a dominant market position in the By Price segment of the U.S. Mechanical Watch Market, with a 44.8% share. This category grows as budget buyers seek reliable mechanical options. Furthermore, strong retail presence and promotional activity continue enhancing its reach among first-time mechanical watch buyers.

USD 500–USD 3,000 gained momentum as mid-range consumers preferred refined craftsmanship without premium pricing. Additionally, the segment benefits from rising interest in durable materials and improved movement accuracy, encouraging enthusiasts to explore higher-value options within accessible pricing brackets.

USD 3,000–USD 20,000 continued expanding as experienced collectors favored enhanced engineering and finishing. Moreover, growing desire for long-lasting luxury pieces pushes demand upward, strengthening this segment’s positioning among professionals and watch enthusiasts seeking higher authenticity.

Over USD 20,000 advanced steadily as affluent buyers prioritized exclusivity and craftsmanship excellence. Additionally, limited-edition offerings and heritage-driven models increased interest, offering collectors long-term value. This segment benefits from strong brand heritage appeal and rising preference for ultra-luxury mechanical watch investments.

By Movement Type Analysis

Automatic dominates with 76.4% due to convenience and consistent user preference.

In 2024, Automatic held a dominant market position in the By Movement Type segment of the U.S. Mechanical Watch Market, with a 76.4% share. This segment thrives as users prefer self-winding convenience. Additionally, increased availability of automatic calibers attracts both new buyers and seasoned collectors seeking accuracy and comfort.

Manual watches maintained demand driven by traditionalists who enjoy hands-on winding. Moreover, the segment appeals to enthusiasts valuing vintage aesthetics and craftsmanship purity. Its niche yet loyal buyer base continues supporting stable market interest across heritage-focused collections.

By Strap Material Analysis

Leather dominates with 44.2% due to comfort and timeless styling.

In 2024, Leather held a dominant market position in the By Strap Material segment of the U.S. Mechanical Watch Market, with a 44.2% share. Its appeal strengthens as buyers prefer classic, comfortable, and versatile straps. Additionally, premium leather finishes continue elevating brand aesthetics, attracting style-conscious consumers.

In 2024, Stainless Steel straps expanded steadily due to durability and long-term value. Consumers appreciate scratch-resistant construction and professional appearance. Furthermore, the rising adoption of everyday luxury designs boosts interest in steel bracelets across multiple price ranges.

Nylon straps gained traction among younger buyers seeking lightweight and casual options. Additionally, seasonal color variations and affordability strengthen their market relevance. The category continues appealing to active consumers who prioritize comfort and flexibility.

Others such as rubber and hybrid straps advanced as performance-driven use cases increased. Moreover, outdoor enthusiasts prefer these materials for durability. Their role widens as brands introduce modern reinterpretations combining resilience with contemporary styling.

By Case Size Analysis

40 mm–45 mm dominates with 48.7% due to balanced design and strong male consumer preference.

In 2024, 40 mm–45 mm held a dominant market position in the By Case Size segment of the U.S. Mechanical Watch Market, with a 48.7% share. Its popularity grows as buyers favor proportionate, versatile sizing. Additionally, strong demand from male consumers reinforces its leadership.

Up to 35 mm remained stable as minimalists and vintage-style enthusiasts appreciated compact dimensions. Moreover, women buyers continue choosing smaller cases for comfort and elegance, sustaining segment relevance.

35 mm–40 mm increased adoption due to unisex appeal. Consumers appreciate balanced aesthetics and everyday wear comfort. Additionally, modern reinterpretations of mid-size watches further support segment growth among diverse age groups.

Above 45 mm catered to bold-style buyers seeking assertive wrist presence. Furthermore, sport-inspired designs strengthened interest. Its niche appeal persists among enthusiasts who prefer oversized aesthetics.

By Shape Analysis

Round dominates with 79.9% due to classic appeal and widespread acceptance.

In 2024, Round held a dominant market position in the By Shape segment of the U.S. Mechanical Watch Market, with a 79.9% share. Traditional styling and universal appeal drive this category. Additionally, the shape’s compatibility with most watch complications helps maintain strong demand.

Rectangular watches grew as consumers embraced vintage-inspired geometries. Moreover, formal wear trends enhanced interest in slim rectangular silhouettes, elevating its role across premium collections.

Square shapes attracted modern buyers seeking unconventional aesthetics. Additionally, the segment benefits from rising appreciation for contemporary design interpretations, making it a preferred alternative for trend-driven consumers.

By Consumer Group Analysis

In 2024, Men held a dominant position as male consumers continued driving the majority of mechanical watch purchases. Moreover, interest in craftsmanship, larger case sizes, and investment-value models strengthened demand, sustaining this segment’s market leadership.

Women expanded interest in refined and smaller mechanical watches, encouraging brands to introduce more tailored designs. Additionally, rising participation of women in luxury purchasing strengthened this category’s presence across various price ranges.

Unisex watches gained traction as buyers leaned toward versatile, shared designs. Moreover, mid-size models and minimal aesthetics increased adoption. This segment grows steadily as gender-neutral styling becomes more mainstream.

By Distribution Channel Analysis

In 2024, Online channels advanced as digital browsing and direct-to-consumer models improved convenience. Additionally, buyers increasingly prefer detailed product information and transparent pricing, boosting online mechanical watch sales across all price categories.

Offline retail remained essential for buyers who prefer in-person trials and authenticity checks. Furthermore, luxury boutiques and specialty stores continue offering personalized guidance, reinforcing offline relevance in premium segments.

Key Market Segments

By Price

- Under USD 500

- USD 500-USD 3,000

- USD 3,000-USD 20,000

- Over USD 20,000

By Movement Type

- Automatic

- Manual

By Strap Material

- Leather

- Stainless Steel

- Nylon

- Others

By Case Size

- Up to 35 mm

- 35 mm-40 mm

- 40 mm-45 mm

- Above 45 mm

By Shape

- Round

- Rectangular

- Square

By Consumer Group

- Men

- Women

- Unisex

By Distribution Channel

- Online

- Offline

Drivers

Strong Consumer Shift Toward Luxury Lifestyle and Status-Symbol Accessories Drives Market Growth

The U.S. mechanical watch market is expanding as consumers increasingly view luxury watches as a symbol of status and personal achievement. This shift toward premium lifestyle choices encourages buyers to invest in high-quality timepieces rather than digital alternatives. As a result, traditional mechanical watches are gaining renewed relevance in the luxury accessories space.

Moreover, high-income millennials and young collectors are becoming a vital growth driver. This group values exclusivity, design authenticity, and long-term asset potential, making them more willing to purchase premium mechanical watches. Their rising disposable incomes and interest in luxury self-expression continue to support steady market demand.

In addition, cultural appreciation for craftsmanship is significantly influencing preferences. Many U.S. consumers now admire the precision engineering, hand-assembly, and heritage associated with mechanical watches. This deep respect for artistry encourages buyers to favor mechanical movements over mass-produced quartz or smartwatches, strengthening the market’s long-term outlook.

Together, these drivers reflect a strong shift toward emotional and experiential buying behavior. As consumers seek timeless craftsmanship and distinctive luxury pieces, mechanical watch brands benefit from stronger brand loyalty and sustained demand across both traditional and emerging customer groups.

Restraints

Rising Competition From Smartwatches Reducing Mechanical Watch Appeal

The U.S. mechanical watch market faces steady pressure as smartwatches continue to gain popularity. Consumers, especially younger buyers, prefer devices that offer health tracking, notifications, and daily convenience. This shift lowers the overall appeal of traditional mechanical watches, making it harder for brands to capture mainstream attention. As a result, the category remains limited to collectors and luxury-focused customers rather than everyday users.

In addition, smartwatch brands move faster in product development, offering frequent updates and improved features each year. This speed creates a competitive disadvantage for mechanical watchmakers, who operate on slower innovation cycles. Craftsmanship-driven production takes longer, and models often remain unchanged for years, which can make them appear less exciting in comparison.

Mechanical watch companies also struggle to match the marketing strength and digital ecosystem of tech brands. Smartwatch makers build strong user habits through integrated apps and services, creating higher retention among consumers. This dynamic further restricts the growth potential of mechanical watches in the U.S. market.

Together, rising smartwatch adoption and slow innovation cycles limit the expansion of the mechanical watch segment. While craftsmanship remains valued, the broader market increasingly favors technology-enabled timepieces, creating a structural restraint for traditional watchmakers.

Growth Factors

Expanding Demand for Custom and Bespoke Mechanical Watch Designs Drives Market Growth

The U.S. mechanical watch market is seeing strong growth opportunities as more consumers look for custom and bespoke designs. Buyers increasingly want watches that reflect personal style, unique craftsmanship, and limited-edition appeal. This shift is helping brands introduce personalized features and tailor-made models that enhance exclusivity.

At the same time, the expanding retail presence of luxury boutiques and flagship stores is strengthening market visibility. These experience-driven spaces allow consumers to explore high-end collections in person, understand mechanical movements, and engage with brand stories. This retail expansion is creating better customer connections and boosting premium sales.

Growing interest in heritage reissues and vintage-inspired collections is further supporting market opportunities. Consumers appreciate designs that blend classic aesthetics with modern engineering, making heritage models highly attractive. Brands are using this trend to revive iconic pieces and build emotional value among collectors.

Emerging Trends

Surge in Collectible and Limited-Edition Mechanical Watch Releases Fuels Market Trends

The U.S. mechanical watch market is witnessing strong momentum as collectible and limited-edition models attract growing attention. Consumers increasingly view these watches as long-term assets, encouraging brands to release exclusive pieces that highlight craftsmanship. This trend is strengthening demand across both new buyers and seasoned collectors, supporting steady market engagement.

At the same time, the popularity of micro-brands is rising as consumers look for hand-assembled watches with unique designs. These smaller brands offer personalized craftsmanship and niche appeal, creating fresh excitement in the market. Their accessible price positioning and strong storytelling continue to influence buying decisions among younger enthusiasts.

Additionally, watch enthusiast communities are playing a key role in shaping awareness and organic demand. Online forums, social media groups, and collector meet-ups are helping buyers share knowledge and discover new models. These communities amplify brand visibility and build trust, making mechanical watches more appealing to a broader audience.

Key U.S. Mechanical Watch Company Insights

Rolex continues to set the benchmark for mechanical watch leadership in 2024, supported by strong brand equity and exceptional demand for its classic models. The company benefits from a loyal collector base and a controlled production strategy that sustains exclusivity and long-term value.

Omega strengthens its market relevance by combining precision innovation with a heritage-driven product lineup. Its well-positioned models appeal to both seasoned collectors and younger luxury buyers seeking reliability, design consistency, and strong brand storytelling around craftsmanship.

Patek Philippe maintains its position as one of the most desirable high-end mechanical watchmakers, driven by limited production volumes and strong demand for handcrafted complications. The brand’s emphasis on legacy, artisanship, and long-term value creation continues to reinforce its appeal across global luxury segments.

Audemars Piguet leverages its bold design language and high craftsmanship standards to sustain momentum in the premium mechanical watch market. Its iconic collections remain central to its strategy, helping the brand deepen engagement with collectors who value contemporary luxury paired with mechanical innovation.

Top Key Players in the Market

- Rolex

- Omega

- Patek Philippe

- Audemars Piguet

- TAG Heuer

- Tissot

- Seiko

- Grand Seiko

- Citizen

- Breitling

Recent Developments

- In July 2025, Casio launched its first mechanical Edifice watch series, the EFK-100. This marked the brand’s entry into premium mechanical timepieces, aiming to attract enthusiasts in the U.S. market.

- In October 2024, luxury watch retailer Watches of Switzerland Group PLC acquired the watch media platform Hodinkee. The move strengthened its digital presence and content-driven engagement with collectors and young buyers.

- In June 2025, Rolex unveiled its 2025 new collections, including updates to iconic mechanical models such as the Land-Dweller, GMT-Master II, and Oyster Perpetual. These releases reinforced the brand’s dominance in the U.S. luxury watch segment.

Report Scope

Report Features Description Market Value (2024) USD 13.0 Billion Forecast Revenue (2034) USD 21.4 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Price (Under USD 500, USD 500-USD 3,000, USD 3,000-USD 20,000, Over USD 20,000), By Movement Type (Automatic, Manual), By Strap Material (Leather, Stainless Steel, Nylon, Others), By Case Size (Up to 35 mm, 35 mm-40 mm, 40 mm-45 mm, Above 45 mm), By Shape (Round, Rectangular, Square), By Consumer Group (Men, Women, Unisex), By Distribution Channel (Online, Offline) Competitive Landscape Rolex, Omega, Patek Philippe, Audemars Piguet, TAG Heuer, Tissot, Seiko, Grand Seiko, Citizen, Breitling Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  U.S. Mechanical Watch MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

U.S. Mechanical Watch MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Rolex

- Omega

- Patek Philippe

- Audemars Piguet

- TAG Heuer

- Tissot

- Seiko

- Grand Seiko

- Citizen

- Breitling