U.S. Electric Vehicle Market Size, Share, Growth Analysis By Vehicle Type (Passenger Car, Commercial Vehicle), By Propulsion Type (Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV)), By Drive Type (Front Wheel Drive, All Wheel Drive, Rear Wheel Drive), By Range (Up to 150 Miles, 151-300 Miles, Above 300 Miles), By Component (Battery Pack & High Voltage Component, Motor, Brake, Wheel & Suspension, Body & Chassis, Low Voltage Electric Component, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173436

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

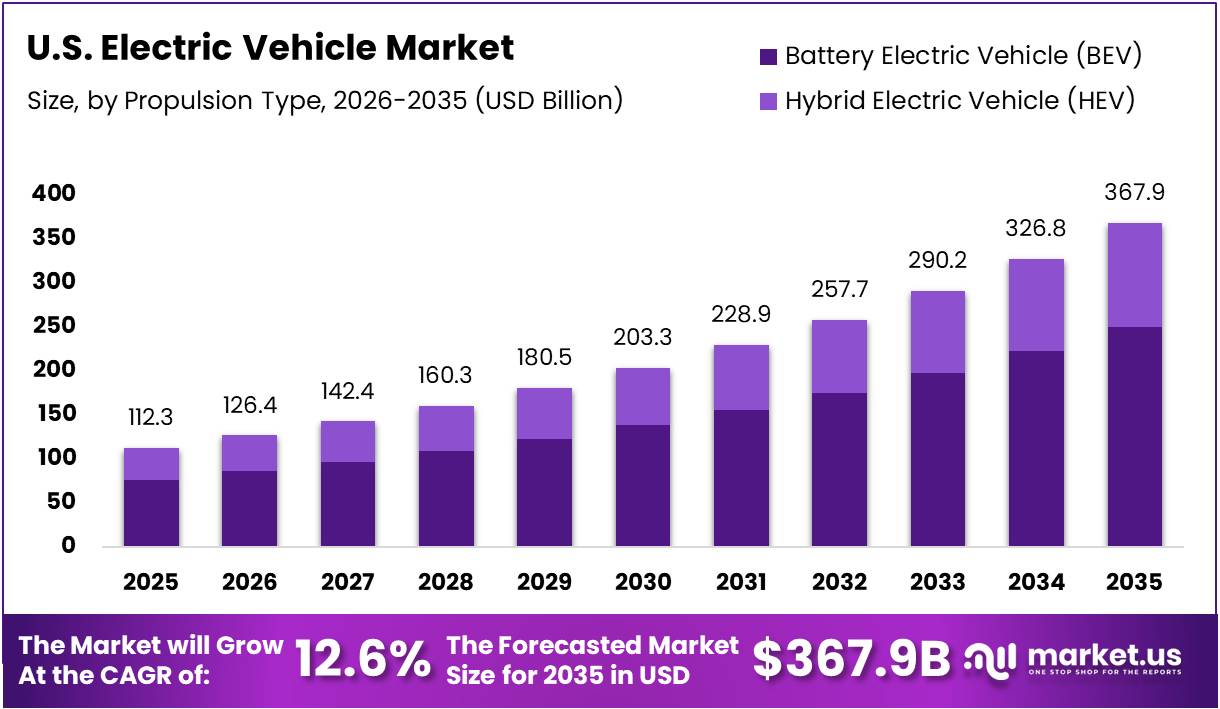

The U.S. Electric Vehicle Market size is expected to be worth around USD 367.9 Billion by 2035, from USD 112.3 Billion in 2025, growing at a CAGR of 12.6% during the forecast period from 2026 to 2035.

The U.S. Electric Vehicle Market encompasses battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and related charging infrastructure. This rapidly evolving sector represents America’s automotive industry transition toward sustainable transportation solutions. Growing environmental consciousness, coupled with technological advancements, continues driving widespread consumer adoption across diverse demographic segments nationwide.

Electric vehicle adoption accelerates dramatically as manufacturers expand model availability and improve battery technology. The market demonstrates robust growth potential, particularly within urban and suburban communities seeking cleaner transportation alternatives. Automakers increasingly prioritize EV production, recognizing shifting consumer preferences and long-term profitability prospects in electrified mobility solutions.

Federal and state governments substantially invest in EV infrastructure development and consumer incentive programs. These strategic investments include tax credits, rebates, and charging station deployment initiatives. Consequently, regulatory support creates favorable market conditions, encouraging both manufacturers and consumers to embrace electric mobility as a viable alternative to traditional combustion engines.

Stringent emissions standards and zero-emission vehicle mandates significantly influence automotive manufacturing strategies. Several states implement progressive regulations requiring increased EV sales percentages annually. Therefore, regulatory pressures compel traditional automakers to accelerate their electrification timelines, fundamentally reshaping the competitive landscape and driving innovation across the entire automotive sector.

Market penetration expands across various consumer segments, with notable concentration among younger professionals. According to research, 42% of EV owners are aged 30-44, indicating strong millennial adoption rates. Furthermore, approximately 80% of EV charging in the US occurs at home, highlighting the importance of residential charging infrastructure. Additionally, 65% of American new vehicle buyers now have a BEV available, demonstrating remarkable improvements in model accessibility and consumer choice within the expanding marketplace.

Key Takeaways

- The U.S. Electric Vehicle Market size is expected to reach USD 367.9 Billion by 2035, up from USD 112.3 Billion in 2025, growing at a CAGR of 12.6% during the forecast period from 2026 to 2035.

- Passenger Car segment dominates the vehicle type category with 79.3% market share in 2025 due to widespread consumer adoption and extensive model availability.

- Battery Electric Vehicle (BEV) holds the dominant position in propulsion type segment with 79.9% share in 2025 due to zero-emission capability and superior energy efficiency.

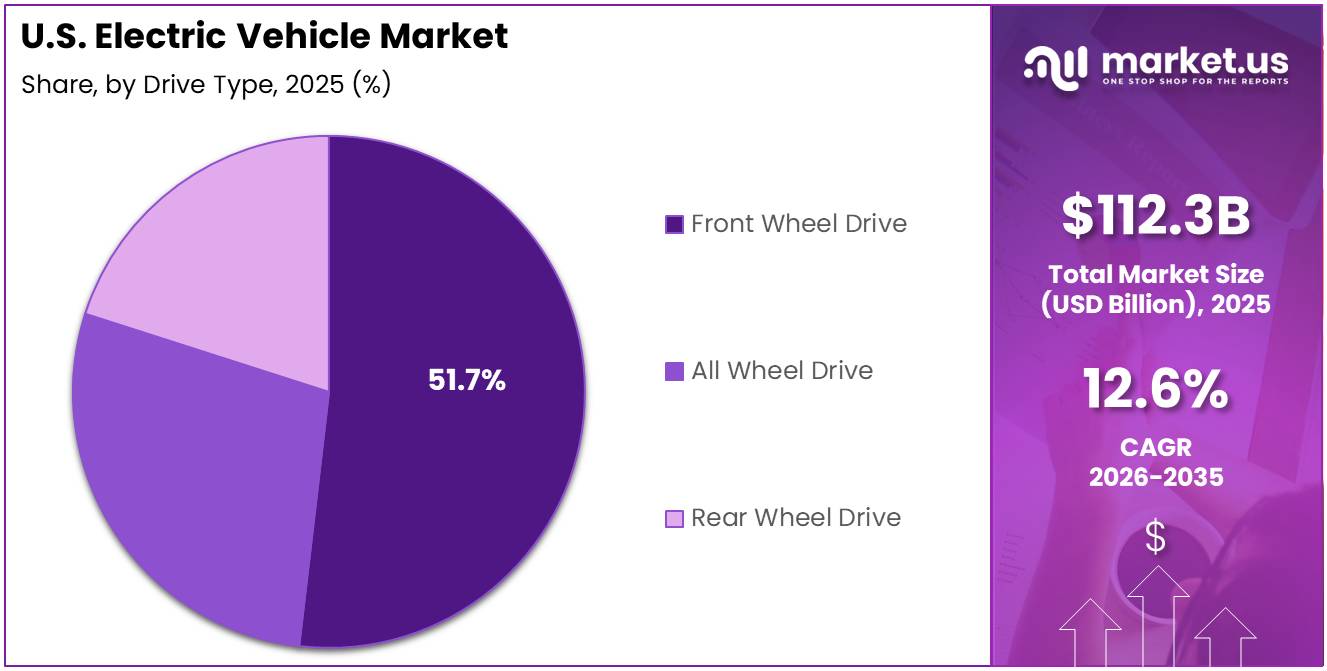

- Front Wheel Drive leads the drive type segment with 51.7% market share in 2025 due to cost-effectiveness and manufacturing simplicity.

- The 151-300 Miles range category dominates with 49.5% market share in 2025, offering optimal balance between affordability and practical usability for most American commuters.

- Battery Pack & High Voltage Component segment accounts for 45.8% of the component analysis in 2025, representing the largest cost element and technological differentiator in electric vehicles.

Vehicle Type Analysis

Passenger Car dominates with 79.3% due to its widespread consumer adoption and extensive model availability.

In 2025, Passenger Car held a dominant market position in the By Vehicle Type Analysis segment of U.S. Electric Vehicle Market, with a 79.3% share. This segment leads primarily because of increasing consumer preference for personal mobility solutions and environmental consciousness. Major automakers have significantly expanded their electric passenger car portfolios, offering diverse options across various price points.

Commercial Vehicle represents the secondary segment within vehicle type classification, demonstrating steady growth potential despite lower current market penetration. This category encompasses delivery vans, trucks, and fleet vehicles utilized by businesses for logistics operations. Growing environmental regulations and corporate sustainability commitments drive gradual electrification of commercial fleets.

Propulsion Type Analysis

Battery Electric Vehicle (BEV) dominates with 79.9% due to its zero-emission capability and superior energy efficiency.

In 2025, Battery Electric Vehicle (BEV) held a dominant market position in the By Propulsion Type Analysis segment of U.S. Electric Vehicle Market, with a 79.9% share. BEVs lead the market through complete elimination of tailpipe emissions and dependence solely on electric power. Technological breakthroughs in battery chemistry have substantially increased energy density while reducing costs. Consumers appreciate lower maintenance requirements compared to vehicles with internal combustion components.

Hybrid Electric Vehicle (HEV) serves as a transitional technology within the propulsion type segment, offering consumers a bridge between conventional and fully electric mobility. These vehicles combine internal combustion engines with electric motors, providing extended range without charging infrastructure dependence. HEVs appeal to consumers hesitant about full electrification due to range concerns.

Drive Type Analysis

Front Wheel Drive dominates with 51.7% due to its cost-effectiveness and manufacturing simplicity.

In 2025, Front Wheel Drive held a dominant market position in the By Drive Type Analysis segment of U.S. Electric Vehicle Market, with a 51.7% share. This configuration remains prevalent because of reduced manufacturing complexity and lower production costs. Front-wheel drive systems require fewer components, translating into more affordable vehicle pricing for consumers. Electric motors integrated with front axles provide adequate performance for most daily driving scenarios.

All Wheel Drive represents a growing segment within drive type classifications, appealing to consumers seeking enhanced traction and performance capabilities. This configuration distributes power to both front and rear axles, providing superior handling in adverse weather conditions. Premium electric vehicle models increasingly incorporate all-wheel drive systems to differentiate performance characteristics. However, additional motors and components increase vehicle costs and slightly reduce overall efficiency compared to single-motor configurations.

Rear Wheel Drive constitutes the smallest segment within drive type analysis, typically reserved for performance-oriented and luxury electric vehicle models. This configuration delivers superior weight distribution and dynamic handling characteristics preferred by driving enthusiasts. However, limited adoption stems from higher manufacturing costs and reduced traction in poor weather conditions. The segment primarily serves niche market preferences rather than mainstream consumer requirements.

Range Analysis

151-300 Miles dominates with 49.5% due to its optimal balance between affordability and practical usability.

In 2025, 151-300 Miles held a dominant market position in the By Range Analysis segment of U.S. Electric Vehicle Market, with a 49.5% share. This range category addresses most consumers’ daily driving requirements while maintaining reasonable vehicle pricing. The segment represents a sweet spot where battery costs remain manageable without sacrificing practical utility. Most American commuters travel significantly less than this range daily, making these vehicles highly functional.

Up to 150 Miles represents the entry-level range segment, primarily targeting urban commuters and budget-conscious consumers seeking affordable electric mobility solutions. These vehicles typically feature smaller battery packs, reducing manufacturing costs and final purchase prices significantly. However, range anxiety concerns and reduced versatility for longer trips constrain broader market appeal.

Above 300 Miles caters to consumers prioritizing maximum range capabilities and minimal charging frequency requirements. These premium vehicles incorporate larger battery packs, enabling extended travel without recharging interruptions. Advanced battery technology and aerodynamic designs optimize energy efficiency in these models. However, significantly higher costs associated with larger battery packs limit mass-market penetration.

Component Analysis

Battery Pack & High Voltage Component dominates with 45.8% due to being the most expensive and critical system.

In 2025, Battery Pack & High Voltage Component held a dominant market position in the By Component Analysis segment of U.S. Electric Vehicle Market, with a 45.8% share. This component category represents the largest cost element and technological differentiator in electric vehicles. Battery technology directly determines vehicle range, performance characteristics, and overall pricing. High voltage components encompass power electronics, inverters, and charging systems essential for efficient energy management. Substantial research investments focus on reducing battery costs while increasing energy density.

Motor components constitute critical powertrain elements responsible for converting electrical energy into mechanical motion. Electric motors deliver instant torque and smooth acceleration characteristics that define the electric vehicle driving experience. Advancements in motor design focus on improving efficiency, reducing weight, and minimizing rare earth material dependencies.

Brake, Wheel & Suspension components require specialized designs to accommodate electric vehicle characteristics, including regenerative braking systems and increased vehicle weight from batteries. Regenerative braking extends range by converting kinetic energy back into stored electrical energy. Suspension systems must balance ride comfort with handling precision while supporting heavier battery packs. Wheel designs increasingly emphasize aerodynamic efficiency to maximize vehicle range.

Body & Chassis components form the structural foundation of electric vehicles, engineered to accommodate battery pack integration while maintaining crash safety standards. Modern designs utilize lightweight materials like aluminum and high-strength steel to offset battery weight. Aerodynamic optimization reduces energy consumption, directly extending vehicle range. Chassis designs incorporate battery pack protection systems to ensure occupant safety during collisions.

Low Voltage Electric Component encompasses auxiliary systems including lighting, infotainment, climate control, and various sensors supporting vehicle operation and driver convenience features. Advanced driver assistance systems increasingly rely on sophisticated low voltage electrical architectures. Integration and efficiency improvements in these systems contribute marginally to overall vehicle range optimization.

Others category includes miscellaneous components such as thermal management systems, interior trim, and various ancillary parts not classified in primary categories. Thermal management systems regulate battery and motor temperatures, ensuring optimal performance and longevity. This diverse category encompasses various smaller components collectively contributing to complete vehicle assembly.

Key Market Segments

By Vehicle Type

- Passenger Car

- Commercial Vehicle

By Propulsion Type

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

By Drive Type

- Front Wheel Drive

- All Wheel Drive

- Rear Wheel Drive

By Range

- Up to 150 Miles

- 151-300 Miles

- Above 300 Miles

By Component

- Battery Pack & High Voltage Component

- Motor

- Brake, Wheel & Suspension

- Body & Chassis

- Low Voltage Electric Component

- Others

Drivers

Expansion of Nationwide Public and Workplace EV Charging Infrastructure Drives Market Growth

The U.S. electric vehicle market is experiencing significant momentum as charging infrastructure expands across the country. Public charging stations are now appearing in shopping centers, office buildings, and residential areas, making EV ownership more practical for everyday Americans. Workplace charging programs are particularly important, allowing employees to charge their vehicles during work hours and eliminating range anxiety concerns.

Federal and state governments are implementing stricter emission regulations to combat climate change and improve air quality. These regulations push automakers to accelerate their EV production timelines and invest heavily in electric technology. California and other states have announced plans to phase out gas-powered vehicle sales, creating a clear roadmap for the industry’s electric future.

Consumer attitudes are shifting dramatically toward environmental responsibility. More Americans are prioritizing sustainability in their purchasing decisions and recognizing EVs as a practical way to reduce their carbon footprint. Lower operating costs, combined with environmental benefits, make electric vehicles increasingly attractive to mainstream buyers.

Restraints

Limited Charging Availability in Rural and Long-Distance Travel Corridors Restrains Market Expansion

Despite progress in urban areas, rural regions across America continue to face significant charging infrastructure gaps. Small towns and countryside locations often lack public charging stations, making EV ownership impractical for residents in these communities. This creates a major barrier for potential buyers who live outside metropolitan areas or frequently travel through less populated regions.

Long-distance highway travel remains challenging for EV drivers due to inconsistent charging station placement. Many interstate corridors still have limited fast-charging options, forcing travelers to plan routes carefully and experience anxiety about reaching their destinations. The uneven distribution of charging infrastructure discourages road trips and limits the appeal of electric vehicles for families who value travel flexibility.

Grid capacity constraints present another serious challenge, particularly in regions experiencing rapid EV adoption. Local power grids were not designed to handle the increased electricity demand from widespread EV charging, especially during peak hours. Some high-adoption areas face reliability issues and potential brownouts when multiple vehicles charge simultaneously.

Growth Factors

Large-Scale Electrification of Commercial and Government Vehicle Fleets Creates Growth Opportunities

The U.S. electric vehicle market is poised for substantial growth through fleet electrification initiatives. Government agencies at federal, state, and local levels are committing to replace their gas-powered vehicles with electric alternatives. Delivery companies, utility services, and corporate fleets are also transitioning to EVs to reduce operating costs and meet sustainability goals.

Vehicle-to-grid technology represents a transformative opportunity for the EV ecosystem. This innovation allows electric vehicles to store excess renewable energy and return it to the power grid during peak demand periods. Smart charging systems optimize when vehicles charge based on electricity prices and grid conditions, reducing costs for owners while stabilizing the power network.

Fast-charging network expansion along major highways and in urban centers addresses critical infrastructure gaps. Private companies and government partnerships are investing heavily in ultra-fast charging stations that can replenish batteries in minutes rather than hours. Strategic placement in convenient locations like rest stops and city centers makes EV ownership practical for more Americans and supports longer-distance travel with confidence.

Emerging Trends

Industry-Wide Shift Toward North American Charging Standard (NACS) Shapes Market Trends

The electric vehicle industry is undergoing a major standardization shift with widespread adoption of the North American Charging Standard. Tesla’s charging connector design is becoming the universal standard as major automakers including Ford, GM, and Rivian announce NACS adoption. This standardization simplifies the charging experience for consumers and increases access to Tesla’s extensive Supercharger network.

Consumer preferences are expanding beyond traditional sedans toward electric pickup trucks, SUVs, and utility vehicles. American buyers have strong preferences for larger vehicles, and automakers are responding with electric versions of popular truck and SUV models. The Ford F-150 Lightning and Chevrolet Silverado EV demonstrate that electric powertrains can deliver the capability and performance truck owners demand while offering lower operating costs.

Modern electric vehicles are becoming sophisticated software platforms with advanced connectivity features. Over-the-air updates allow manufacturers to improve vehicle performance, add new features, and fix issues remotely without dealership visits. Integration of smartphone connectivity, autonomous driving capabilities, and intelligent user interfaces makes EVs feel more like smart devices than traditional automobiles, appealing to tech-savvy consumers seeking cutting-edge transportation solutions.

Key U.S. Electric Vehicle Company Insights

The U.S. electric vehicle market in 2025 continues to be shaped by a diverse group of established automakers and innovative pioneers, each bringing distinct strengths to an increasingly competitive landscape.

Tesla maintains its position as the market leader, leveraging its extensive Supercharger network, advanced battery technology, and strong brand loyalty among EV enthusiasts. The company’s continued focus on software integration and autonomous driving capabilities sets it apart, though it faces mounting pressure from traditional automakers who are rapidly expanding their electric portfolios.

Ford has emerged as a formidable competitor in the electric truck and SUV segments, with models like the F-150 Lightning and Mustang Mach-E resonating strongly with American consumers who value the brand’s heritage combined with electric innovation. The company’s strategic investment in domestic battery production and charging infrastructure demonstrates its commitment to long-term competitiveness in the EV space.

Chevrolet brings General Motors’ manufacturing scale and dealer network to the electric market, offering vehicles across multiple price points that appeal to mainstream consumers seeking practical, affordable electric transportation. The brand’s established presence in American households provides a trust factor that helps ease the transition to electric mobility for traditional car buyers.

BMW targets the premium segment with its sophisticated electric vehicles that emphasize driving dynamics and luxury, appealing to consumers who prioritize performance alongside sustainability. The German automaker’s expertise in engineering and design translates effectively into its electric lineup, positioning it well among affluent buyers.

Top Key Players in the Market

- Audi

- BMW

- Chevrolet

- Ford

- Harley-Davidson

- Hyundai

- Mercedes-Benz

- Nissan

- Tesla

- Volkswagen

Recent Developments

- In November 2025, JOLT acquired Volta Media Network to expand its presence in the U.S. electric vehicle market, gaining access to thousands of EV charging sites across the country and strengthening its infrastructure capabilities.

- In November 2024, Volkswagen announced plans to invest up to $5.8 billion in a joint venture with Rivian to co-develop next-generation EV platforms and advanced electric vehicle technology, aiming to enhance competitiveness in the U.S. EV market.

Report Scope

Report Features Description Market Value (2025) USD 112.3 Billion Forecast Revenue (2035) USD 367.9 Billion CAGR (2026-2035) 12.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Passenger Car, Commercial Vehicle), By Propulsion Type (Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV)), By Drive Type (Front Wheel Drive, All Wheel Drive, Rear Wheel Drive), By Range (Up to 150 Miles, 151-300 Miles, Above 300 Miles), By Component (Battery Pack & High Voltage Component, Motor, Brake, Wheel & Suspension, Body & Chassis, Low Voltage Electric Component, Others) Competitive Landscape Audi, BMW, Chevrolet, Ford, Harley-Davidson, Hyundai, Mercedes-Benz, Nissan, Tesla, Volkswagen Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Audi

- BMW

- Chevrolet

- Ford

- Harley-Davidson

- Hyundai

- Mercedes-Benz

- Nissan

- Tesla

- Volkswagen