U.S. Carpet and Rug Market Size, Share, Growth Analysis By Type (Tufted, Needle Punched, Knotted, Woven, Others), By Material (Polyester, Silk, Cotton, Wool, Others), By End Use (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174803

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

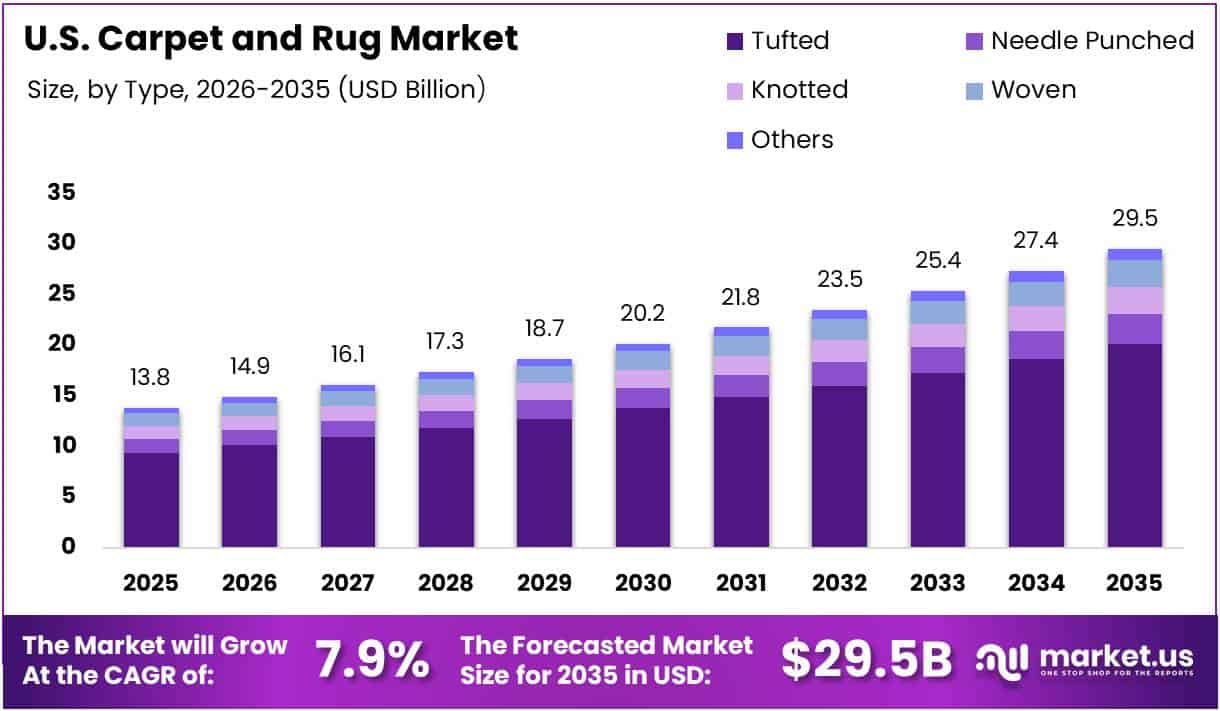

The U.S. Carpet and Rug Market size is expected to be worth around USD 29.5 Billion by 2035, from USD 13.8 Billion in 2025, growing at a CAGR of 7.9% during the forecast period from 2026 to 2035.

The U.S. carpet and rug market represents a significant segment within the broader flooring industry, encompassing residential and commercial applications. This market continues evolving through innovative designs, sustainable materials, and enhanced durability features that address consumer preferences and functional requirements across diverse settings.

Growth prospects remain promising as residential construction activities accelerate alongside home renovation trends. Homeowners increasingly prioritize interior aesthetics, driving demand for customized carpet solutions. Additionally, commercial establishments recognize carpeting’s acoustic benefits and aesthetic versatility, further expanding market opportunities across office spaces and hospitality sectors.

Government initiatives significantly influence market dynamics through housing development programs and infrastructure investments. Federal agencies allocate substantial resources toward affordable housing projects, consequently boosting flooring material consumption. Furthermore, regulatory frameworks emphasizing energy efficiency and sustainable building practices encourage manufacturers to develop eco-friendly carpet products that meet stringent environmental standards.

The market demonstrates robust penetration across American households, reflecting carpeting’s enduring popularity. Research indicates that 92% of homes featured carpet or rugs in sampled rooms, highlighting widespread adoption. Moreover, carpet constitutes 48% of the total flooring market, underscoring its dominant position within the industry landscape.

Property management sectors particularly favor carpeting solutions for noise reduction capabilities. Industry practices reveal that property managers mandate carpeting coverage on approximately 80% of floor areas to minimize sound transmission between units. This requirement creates consistent demand within multi-family residential complexes and commercial buildings, sustaining market growth momentum.

Transitioning toward future outlook, technological advancements in manufacturing processes enable producers to offer superior stain-resistant and maintenance-friendly products. These innovations, combined with competitive pricing strategies and expanding distribution channels, position the market favorably for continued expansion throughout the forecast period.

Key Takeaways

- The U.S. Carpet and Rug Market is projected to reach USD 29.5 Billion by 2035, up from USD 13.8 Billion in 2025, at a 7.9% CAGR during 2026–2035.

- By type, the Tufted segment led the market with a 68.2% share in 2025 in the U.S. Carpet and Rug Market.

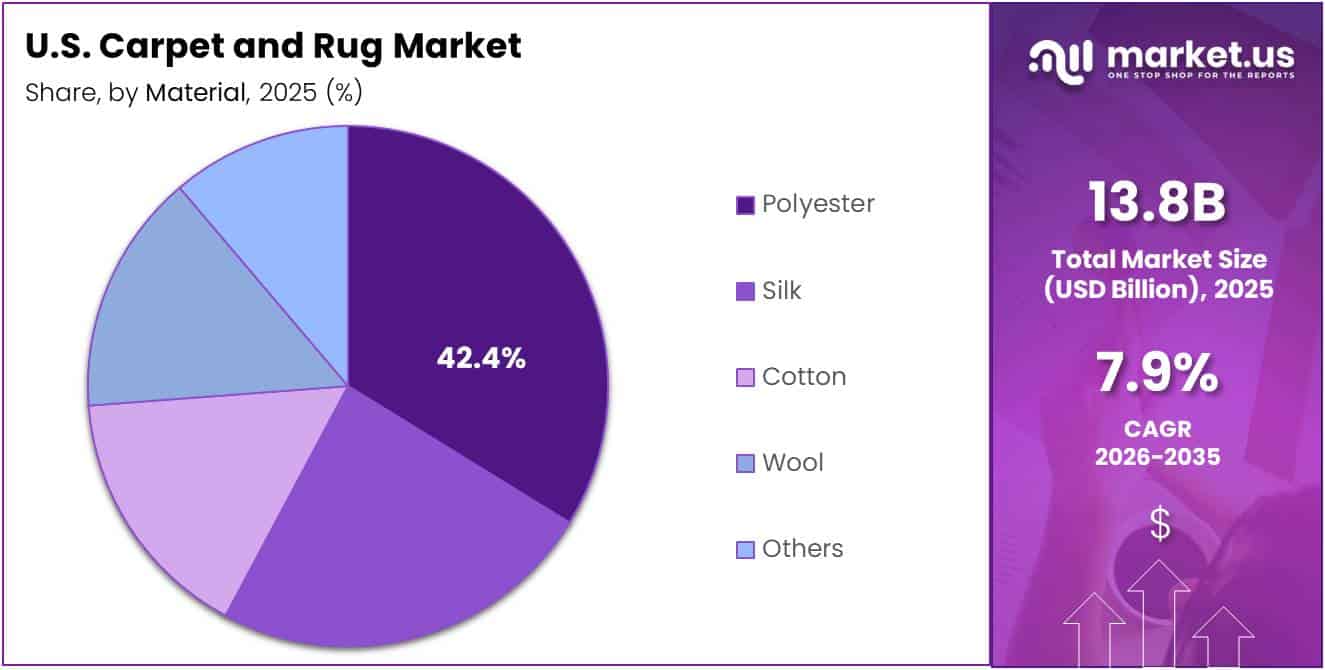

- By material, Polyester dominated with a 33.8% market share in 2025 across the U.S. market.

- By end use, the Residential segment accounted for 63.9% of the U.S. Carpet and Rug Market in 2025.

By Type Analysis

In 2025, Tufted held a dominant market position in the By Type Analysis segment of U.S. Carpet and Rug Market, with a 68.2% share.

Tufted carpets command the largest market share at 68.2% due to their cost-effective manufacturing process and versatile design capabilities. This production method enables manufacturers to create diverse patterns and textures efficiently, meeting varied consumer preferences. Additionally, tufted carpets offer excellent durability and are available across multiple price points, making them accessible to both residential and commercial buyers seeking quality flooring solutions.

Needle Punched carpets represent a significant segment valued for their robust construction and exceptional resistance to wear. These products utilize a mechanical process that interlocks fibers without weaving or tufting, resulting in dense, durable surfaces. Consequently, they are particularly favored in high-traffic commercial environments, automotive applications, and outdoor settings where superior performance and longevity are essential requirements.

Knotted carpets maintain their position as premium offerings characterized by traditional craftsmanship and intricate designs. Each piece requires skilled artisans to hand-tie individual knots, creating unique patterns and textures. Therefore, these carpets appeal to discerning consumers who value authenticity, heritage, and investment-quality flooring that appreciates over time while adding distinctive elegance to interior spaces.

Woven carpets showcase advanced textile engineering through their structured manufacturing process that interlaces fibers systematically. This technique produces refined, sophisticated products with superior dimensional stability and consistent quality. Furthermore, woven options attract commercial clients and upscale residential projects demanding professional-grade aesthetics combined with reliable performance characteristics.

Others encompass specialized carpet types including braided, hooked, and flatweave varieties that serve niche applications. These alternative constructions provide unique aesthetic qualities and functional benefits tailored to specific design requirements. Moreover, they enable consumers to explore unconventional flooring solutions that complement contemporary interior design trends and individual stylistic preferences.

By Material Analysis

In 2025, Polyester held a dominant market position in the By Material Analysis segment of U.S. Carpet and Rug Market, with a 33.8% share.

Polyester materials lead the market with 33.8% share, driven by their exceptional stain resistance and vibrant color retention properties. This synthetic fiber offers outstanding value through its affordability combined with impressive durability in residential settings. Additionally, polyester carpets provide soft textures underfoot while resisting fading from sunlight exposure, making them increasingly popular among budget-conscious homeowners seeking low-maintenance flooring options.

Silk carpets represent the luxury segment, prized for their lustrous appearance and extraordinarily soft texture that creates unmatched elegance. These natural fibers reflect light beautifully, producing stunning visual depth and sophistication in high-end residential interiors. However, silk requires careful maintenance and professional cleaning, positioning it as an exclusive choice for consumers prioritizing aesthetic refinement over practical considerations.

Cotton materials deliver natural comfort with hypoallergenic properties that appeal to environmentally conscious consumers and families with sensitivities. This breathable fiber offers moderate durability and absorbs dyes effectively, enabling rich color palettes. Furthermore, cotton carpets provide sustainable flooring alternatives that align with growing demand for eco-friendly home furnishing solutions while maintaining reasonable price points.

Wool remains a premium natural fiber celebrated for its inherent resilience, natural soil resistance, and excellent insulation properties. This material regulates indoor temperatures effectively while offering luxurious comfort and timeless appeal. Moreover, wool carpets demonstrate remarkable longevity when properly maintained, justifying higher initial investments through superior performance and enduring quality that supports sustainable consumption patterns.

Other materials include innovative blends, bamboo, jute, and specialty synthetic fibers that address evolving consumer needs. These alternatives provide unique characteristics such as enhanced eco-friendliness, improved performance attributes, or distinctive textures. Consequently, they enable manufacturers to differentiate products and cater to specialized market segments seeking unconventional material properties.

By End Use Analysis

In 2025, Residential held a dominant market position in the By End Use Analysis segment of U.S. Carpet and Rug Market, with a 63.9% share.

Residential applications dominate with 63.9% share, reflecting widespread demand for comfortable, aesthetically pleasing home flooring. Homeowners prioritize warmth, noise reduction, and design versatility across bedrooms and living spaces. Additionally, residential buyers seek products balancing durability with style, driving innovation in materials and sustainable practices.

Commercial end use encompasses offices, hospitality venues, retail spaces, and institutional facilities requiring high-performance flooring. These environments demand superior durability, maintenance efficiency, and professional aesthetics withstanding heavy traffic. Furthermore, commercial buyers prioritize lifecycle cost-effectiveness, fire resistance compliance, and brand-coherent design.

Key Market Segments

By Type

- Tufted

- Needle Punched

- Knotted

- Woven

- Others

By Material

- Polyester

- Silk

- Cotton

- Wool

- Others

By End Use

- Residential

- Commercial

Drivers

Strong Residential Remodeling Activity Drives U.S. Carpet and Rug Market Growth

The U.S. carpet and rug market continues to benefit from robust residential remodeling and home improvement spending. Homeowners are investing more in upgrading their living spaces, and flooring remains a top priority in renovation projects. This trend creates steady demand for carpet and rug products across the country.

Consumer preference for soft flooring solutions plays a significant role in market expansion. Carpets and rugs offer superior comfort underfoot compared to hard surfaces, making them attractive for bedrooms, living rooms, and family spaces. These products also provide excellent thermal insulation, helping homeowners reduce energy costs while maintaining comfortable indoor temperatures throughout the year.

The market’s strength is further supported by wide product availability across different price points. Manufacturers offer carpets and rugs in budget-friendly, mid-range, and premium segments, ensuring accessibility for diverse consumer groups. This variety allows customers to find suitable options regardless of their financial constraints, supporting consistent market demand and facilitating broader market penetration across various demographic segments.

Restraints

Growing Preference for Hard Flooring Alternatives Restrains Market Expansion

The U.S. carpet and rug market faces significant headwinds from the increasing shift toward hard flooring alternatives. Consumers are increasingly choosing hardwood, laminate, vinyl, and tile flooring options for their homes and commercial spaces. These hard surface materials are perceived as easier to clean, more hygienic, and better suited for modern interior design aesthetics.

Another key restraint affecting market growth is the extended replacement cycles resulting from improved carpet durability. Manufacturers have successfully developed carpets with enhanced wear resistance and longer lifespans through advanced fiber technology and construction methods. While this represents a quality improvement, it means customers replace their carpets less frequently than before.

Growth Factors

Rising Demand for Sustainable Materials Creates Growth Opportunities in Carpet Market

Significant growth opportunities exist in the U.S. carpet and rug market through rising demand for sustainable and recycled carpet materials. Environmentally conscious consumers increasingly prefer products made from recycled plastics, natural fibers, and bio-based materials. Manufacturers investing in green production processes and sustainable sourcing can capture this growing eco-aware customer segment and differentiate themselves in a competitive marketplace.

The expansion of commercial spaces presents another substantial opportunity for market players. Office buildings, hotels, restaurants, and hospitality venues require regular flooring updates to maintain professional appearances and meet safety standards. As commercial construction activity increases and businesses refresh their interiors post-pandemic, demand for commercial-grade carpets continues rising steadily.

Custom and modular carpet solutions represent a rapidly emerging opportunity segment. Businesses and homeowners want personalized flooring designs that reflect their unique style preferences and functional requirements. Modular carpet tiles offer flexibility in installation, easy replacement of damaged sections, and creative design possibilities.

Emerging Trends

Rapid Adoption of Modular Carpet Tiles Shapes Market Trends

The U.S. carpet and rug market is experiencing rapid adoption of modular carpet tiles across residential and commercial applications. These tiles offer exceptional installation flexibility, allowing consumers to create custom patterns and easily replace damaged sections without redoing entire floors. The convenience factor appeals to both property managers seeking cost-effective maintenance solutions and design-conscious homeowners wanting creative flooring options.

Environmental consciousness drives the growing preference for low-VOC and eco-certified carpets among American consumers. Buyers increasingly prioritize indoor air quality and seek products with minimal volatile organic compound emissions. Certifications from recognized environmental organizations influence purchasing decisions, pushing manufacturers to reformulate products and adopt cleaner production processes to meet evolving consumer expectations.

Digital and custom design technologies are transforming how consumers select and purchase carpets. Advanced visualization software allows customers to preview carpet designs in their actual spaces before buying. Digital printing technologies enable manufacturers to produce custom patterns and colors economically, even for smaller orders.

Key U.S. Carpet and Rug Company Insights

The U.S. carpet and rug market in 2025 continues to be dominated by established manufacturers who have adapted to evolving consumer preferences and sustainability demands.

Shaw Industries Group, Inc. maintains its position as a market leader through extensive product innovation and a robust distribution network that serves both residential and commercial segments effectively. The company’s focus on eco-friendly manufacturing processes and recycled materials has strengthened its competitive advantage in an increasingly environmentally conscious market.

Mohawk Industries, Inc. leverages its diversified product portfolio and global manufacturing capabilities to capture significant market share across multiple price points and design aesthetics. The company’s strategic investments in advanced manufacturing technologies and digital marketing initiatives have enabled it to respond quickly to changing consumer trends and maintain strong relationships with major retailers and contractors.

Interface, Inc. has carved out a distinctive niche in the commercial flooring sector, particularly in modular carpet tiles, by pioneering sustainability initiatives that resonate with corporate clients seeking to reduce their environmental footprint. Their commitment to carbon-neutral manufacturing and circular economy principles has established them as the preferred choice for environmentally conscious businesses and institutions.

Engineered Floors, LLC has disrupted traditional market dynamics through competitive pricing strategies and rapid product development cycles that appeal to value-conscious consumers without compromising on quality or design variety. The company’s vertically integrated operations and direct-to-retailer distribution model have enabled aggressive market penetration, particularly in the residential segment where price sensitivity remains a critical purchasing factor for homeowners and property developers.

Top Key Players in the Market

- Shaw Industries Group, Inc.

- Mohawk Industries, Inc.

- Interface, Inc.

- Engineered Floors, LLC

- Milliken & Company

- Tarkett North America

- J+J Flooring Group

- The Dixie Group, Inc.

- Nourison

- Stanton Carpet Corporation

Recent Developments

- In November 2025, STARK, a leader in luxury carpet and rug design, acquired NYC-based Fort Street Studio to strengthen its high-end, artistic rug portfolio. The deal enhances STARK’s presence in bespoke, hand-knotted silk rugs that merge fine art with interior design.

- In October 2025, U.S. flooring major Mohawk announced the acquisition of New Zealand carpet manufacturer Bremworth to expand its premium wool carpet offerings. This move supports Mohawk’s international growth strategy and diversification in sustainable flooring solutions.

- In November 2025, Beaulieu International Group acquired Congoleum Flooring to expand its U.S. manufacturing and product footprint. The acquisition reinforces BIG’s position across resilient and specialty flooring segments in the U.S. market.

Report Scope

Report Features Description Market Value (2025) USD 13.8 Billion Forecast Revenue (2035) USD 29.5 Billion CAGR (2026-2035) 7.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Tufted, Needle Punched, Knotted, Woven, Others), By Material (Polyester, Silk, Cotton, Wool, Others), By End Use (Residential, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Shaw Industries Group, Inc., Mohawk Industries, Inc., Interface, Inc., Engineered Floors, LLC, Milliken & Company, Tarkett North America, J+J Flooring Group, The Dixie Group, Inc., Nourison, Stanton Carpet Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Shaw Industries Group, Inc.

- Mohawk Industries, Inc.

- Interface, Inc.

- Engineered Floors, LLC

- Milliken & Company

- Tarkett North America

- J+J Flooring Group

- The Dixie Group, Inc.

- Nourison

- Stanton Carpet Corporation