Global Ursodeoxycholic Acid Drug Product Market Analysis By Type (Tablet, Capsule), By Indication (Gallstones, Hepatopathy, Biliary Disease, Primary Biliary Cholangitis (PBC), Other Indications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 14703

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

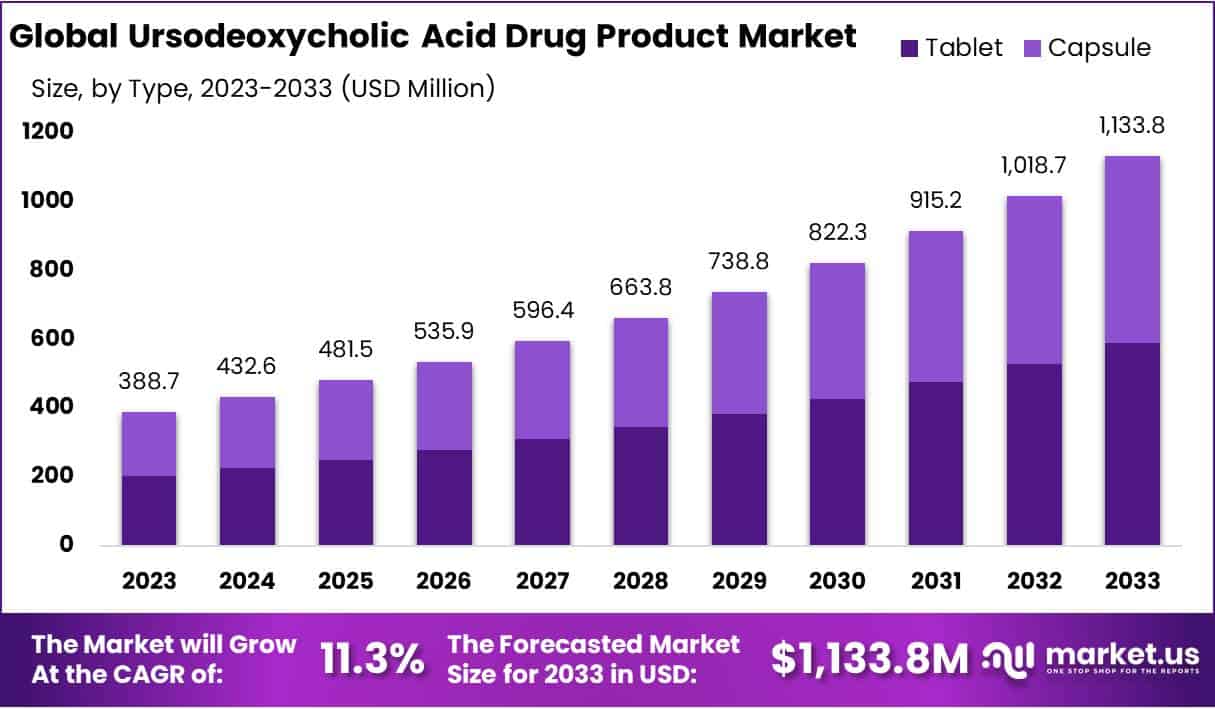

The Global Ursodeoxycholic Acid Drug Product Market size is expected to be worth around USD 1133.8 Million by 2033, from USD 388.7 Million in 2023, growing at a CAGR of 11.3% during the forecast period from 2024 to 2033.

Ursodeoxycholic Acid (UDCA), commonly known as ursodiol, is a bile acid naturally produced by the body, extensively utilized in the pharmaceutical industry for its therapeutic benefits. Specifically, UDCA is imperative in the treatment of primary biliary cholangitis (PBC), a chronic liver disease. With a global prevalence rate of 60-100 cases per million, as reported by the National Institute of Diabetes and Digestive and Kidney Diseases, PBC represents a significant target demographic for UDCA treatments, accounting for over 80% of its global prescriptions. Moreover, UDCA’s application extends to the dissolution of cholesterol gallstones in patients possessing a functional gallbladder and improving liver function in children suffering from cystic fibrosis-associated liver disease.

Regulatory bodies, including the FDA in the United States and the EMA in the European Union, categorize UDCA as a prescription medication, underscoring the stringent regulatory environment surrounding its distribution and manufacturing. The production of UDCA spans across key global regions such as Europe, North America, and Asia, although the specific dynamics of its import-export activities are complex and not widely disclosed.

The UDCA market landscape is characterized by a mature product lifecycle, with recent strategic movements like acquisitions and partnerships aimed at expanding market access and reach. For instance, the acquisition of Actavis Inc. by Alvogen in 2021, including their UDCA product line, highlights the strategic efforts within the pharmaceutical industry to consolidate market presence and enhance therapeutic accessibility.

Investment in UDCA research, both from governmental and private sectors, continues to explore its potential in treating a broader spectrum of liver diseases, although precise investment figures remain elusive. These endeavors reflect the ongoing commitment within the healthcare sector to deepen the understanding of UDCA’s long-term effects and therapeutic breadth.

The UDCA drug product market is a crucial component of the pharmaceutical industry, supported by rigorous regulatory oversight, strategic market activities, and continued investment in research to explore its full therapeutic potential, thereby ensuring its availability and efficacy for a wide range of patients globally.

Key Takeaways

- Market growth: UDCA market to reach USD 1133.8 million by 2033, with CAGR of 11.3% (2024-2033), driven by liver disease prevalence.

- Dominant type: Tablets hold >52% market share (2023) due to ease of administration, cost-effectiveness, and precise dosage accuracy.

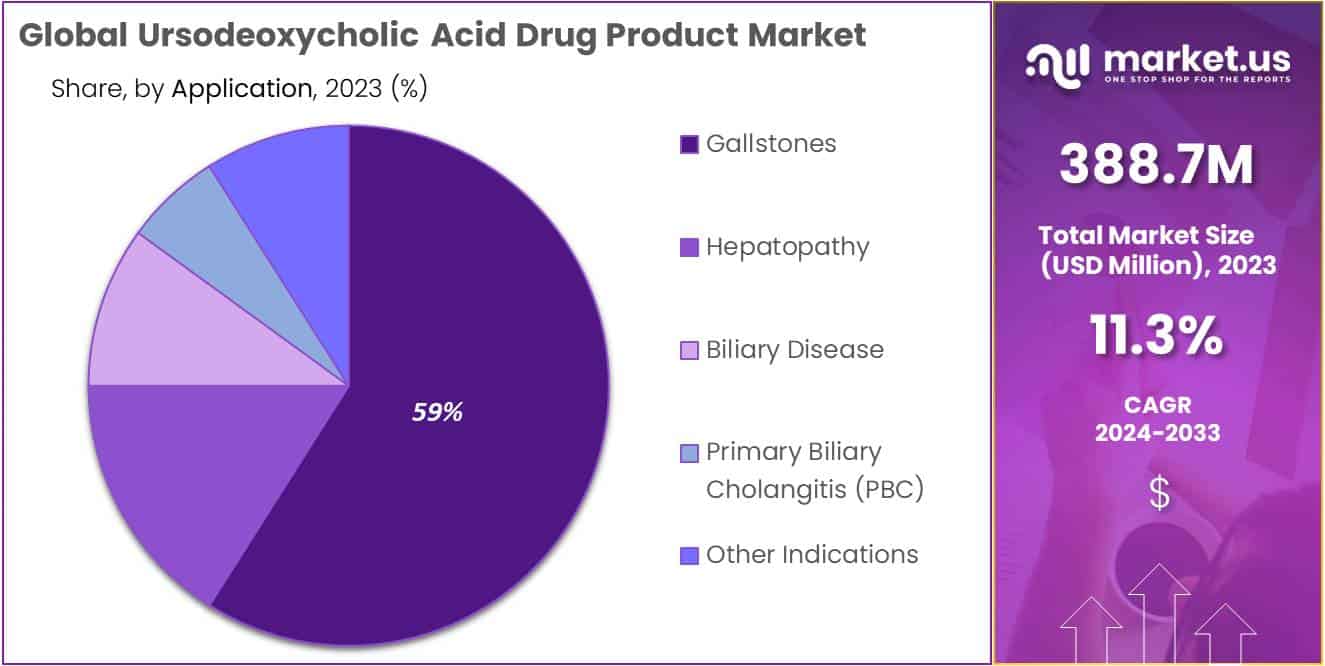

- Primary indication: PBC segment captures >59% market share (2023) driven by increasing prevalence and UDCA efficacy awareness.

- Driver: Rising liver disease prevalence, including NAFLD affecting 80-100 million Americans, fuels UDCA demand.

- Restraint: Adverse effects and limited efficacy in late-stage liver diseases challenge UDCA market growth.

- Opportunity: Research intensification offers potential to enhance UDCA formulations and explore new therapeutic applications.

- Trend: Growing adoption of generics, with up to 85% price reduction, broadens UDCA therapy accessibility.

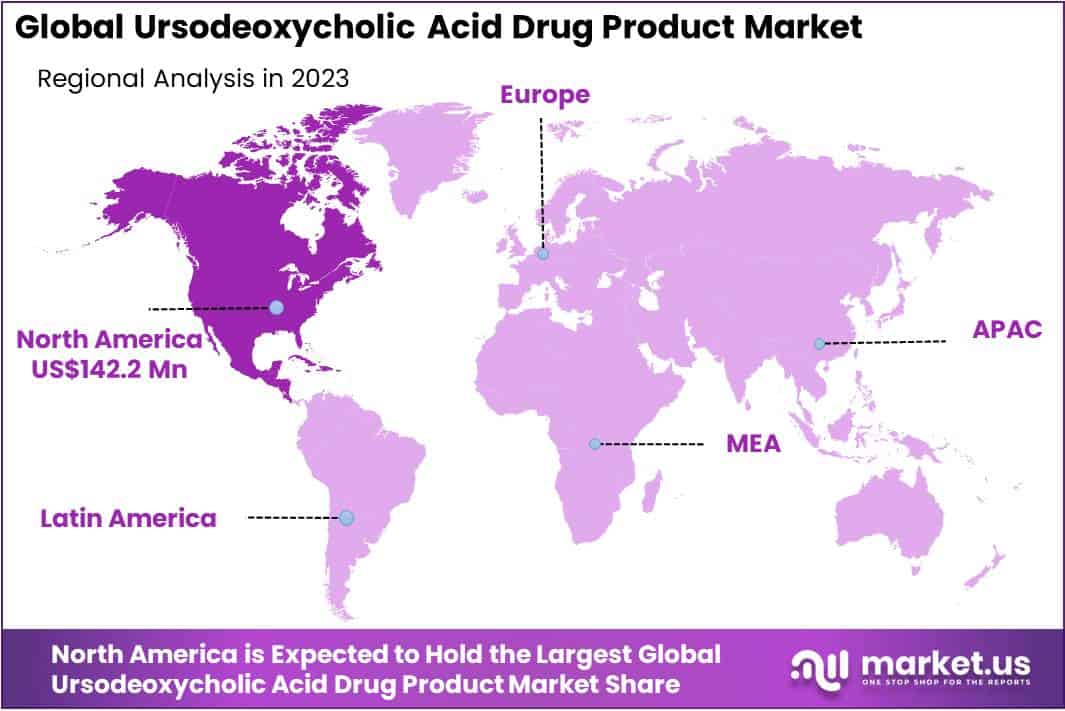

- Regional dominance: In 2023, North America led the UDCA market with over 36.6% share and USD 142.2 million value, driven by robust healthcare infrastructure.

- Market potential: Ongoing R&D and collaborations in North America suggest sustained growth, though regulatory changes may impact dynamics.

- Future outlook: Continued focus on innovation, regulatory compliance, and therapeutic advancements essential for UDCA market sustainability.

Type Analysis

In 2023, the Tablet segment held a dominant market position in the Type Segment of the Ursodeoxycholic Acid Drug Product Market, capturing more than a 52% share. This prominence can be attributed to the tablet form’s widespread acceptance due to its ease of administration, precise dosage accuracy, and extended shelf life, which collectively enhance patient compliance and convenience. Additionally, the manufacturing process for tablets allows for cost-effective mass production, making it a preferred option for pharmaceutical companies aiming to optimize production efficiency and reduce costs.

Conversely, the Capsule segment also exhibited significant market presence, driven by its advantages in terms of faster dissolution and absorption rates compared to tablets, which can be crucial for achieving therapeutic efficacy in certain patient demographics. Capsules offer a viable alternative for patients experiencing difficulties with swallowing tablets, thereby addressing a key compliance issue in medication administration.

The market dynamics of the Ursodeoxycholic Acid Drug Product Market are influenced by ongoing research and development activities aimed at improving drug formulations and delivery mechanisms. Technological advancements in drug encapsulation and release technologies have the potential to shift market preferences between tablets and capsules, based on therapeutic efficacy, patient convenience, and cost-effectiveness.

Furthermore, regulatory policies and healthcare reimbursement scenarios play pivotal roles in shaping the competitive landscape of the Ursodeoxycholic Acid Drug Product Market by type. The approval of novel formulations and drug delivery systems by regulatory authorities can significantly impact market shares by introducing more effective or convenient alternatives to existing products.

Indication Analysis

In 2023, the Primary Biliary Cholangitis (PBC) segment held a dominant market position in the Indication Segment of the Ursodeoxycholic Acid Drug Product Market, capturing more than a 59% share. This significant market share can be attributed to the increasing prevalence of PBC globally and the growing awareness among patients and healthcare providers about the efficacy of ursodeoxycholic acid in managing this chronic liver disease. Ursodeoxycholic acid, by promoting bile flow and reducing bile acid synthesis, has proven to be a cornerstone in the treatment of PBC, leading to its widespread adoption in this indication.

The market for ursodeoxycholic acid in the treatment of gallstones also witnessed substantial growth, driven by the rising incidence of gallstone diseases and the preference for non-surgical treatment options among patients. Ursodeoxycholic acid’s ability to dissolve small and medium-sized gallstones made it a preferred choice, contributing to its significant market share in this segment.

In the hepatopathy segment, ursodeoxycholic acid is utilized for its hepatoprotective properties, particularly in conditions such as non-alcoholic fatty liver disease (NAFLD) and non-alcoholic steatohepatitis (NASH). The increasing incidence of these conditions, coupled with the lack of alternative therapeutic options, has led to a steady demand for ursodeoxycholic acid in this segment.

The application of ursodeoxycholic acid in biliary diseases beyond PBC, including primary sclerosing cholangitis (PSC) and cholestasis, further expands its market. Although these indications represent a smaller share of the market compared to PBC, ongoing research and potential therapeutic benefits of ursodeoxycholic acid in these conditions could stimulate market growth.

Other indications for ursodeoxycholic acid, encompassing a range of gastrointestinal and hepatic conditions, also contribute to the market’s dynamics. The versatility of ursodeoxycholic acid in managing various bile-related disorders underpins its steady demand across these diverse indications.

Key Market Segments

Type

- Tablet

- Capsule

Indication

- Gallstones

- Hepatopathy

- Biliary Disease

- Primary Biliary Cholangitis (PBC)

- Other Indications

Drivers

Rising Prevalence of Liver Diseases

The burgeoning prevalence of liver diseases, notably primary biliary cirrhosis (PBC), primary sclerosing cholangitis (PSC), and non-alcoholic fatty liver disease (NAFLD), acts as a pivotal catalyst for the Ursodeoxycholic Acid (UDCA) drug product market. Notably, the World Health Organization (WHO) reports an alarming increase in liver disease cases worldwide, with NAFLD prevalence reaching up to 25% of the global population. This condition is especially prevalent, affecting an estimated 80 to 100 million individuals in the United States alone, according to the American Liver Foundation. UDCA, with its hepatoprotective properties, is extensively employed in the therapeutic regimen of these diseases, significantly driving the demand for UDCA formulations.

The escalation in liver disease incidence directly correlates with the expanding market for UDCA products, as these medications are integral to managing the increasing number of patients. Consequently, the surge in liver disease cases not only highlights the growing need for effective treatments but also emphasizes the market potential for UDCA-based pharmaceuticals, positioning them as essential in liver disease treatment paradigms.

Restraints

Side Effects and Limited Efficacy in Advanced Disease Stages

The restraint imposed on the Ursodeoxycholic Acid (UDCA) drug product market is significantly influenced by the adverse side effects and its limited efficacy in advanced stages of liver diseases. Notably, patients undergoing UDCA treatment may experience side effects such as diarrhea, nausea, and weight gain, which can severely impact patient compliance and overall treatment success rates.

This concern is underlined by data from leading healthcare organizations, which suggest that adverse reactions can affect a significant portion of patients, with up to 10-20% experiencing gastrointestinal-related side effects. Moreover, the utility of UDCA in managing advanced liver conditions remains a subject of debate within the medical community.

Studies indicate that UDCA’s effectiveness is markedly reduced in late-stage liver diseases, limiting its applicability as a comprehensive therapeutic solution. This dichotomy between early-stage efficacy and reduced late-stage utility underscores the challenges faced by the UDCA market in achieving universal adoption across all disease stages, thus acting as a substantial market restraint.

Opportunities

Research and Development Activities

The intensification of research and development (R&D) activities in the realm of Ursodeoxycholic Acid (UDCA) formulations is poised to unlock substantial opportunities within the drug product market. This surge in R&D efforts is primarily directed towards amplifying the efficacy of UDCA in treating liver-related ailments beyond its conventional applications, such as primary biliary cholangitis (PBC). Moreover, the advent of innovative drug delivery systems and the exploration of combination therapies incorporating UDCA herald a new era of therapeutic possibilities.

These advancements aim to address the unmet medical needs of patients and enhance overall patient outcomes. According to the American Liver Foundation, liver diseases affect approximately 100 million Americans, indicating a vast patient pool that could benefit from these innovations. Furthermore, the development of targeted therapies could significantly reduce the economic burden associated with liver diseases, which is estimated to exceed billions annually in healthcare costs and lost productivity. Thus, the ongoing R&D activities not only signify a promising avenue for market expansion but also underscore a pivotal shift towards more effective and patient-centric liver disease management strategies.

Trends

Increasing Adoption of Generic Drugs

The trend towards the increasing adoption of generic versions of ursodeoxycholic acid (UDCA) drug products marks a significant shift in the pharmaceutical landscape, particularly impacting the market dynamics of hepatobiliary treatments. This transition is largely driven by the expiration of several patents for UDCA, paving the way for the entry of cost-effective generic alternatives.

According to data from leading healthcare organizations, generic drugs can offer a price reduction of up to 80-85% compared to their branded counterparts, substantially lowering treatment costs. The advent of generics is poised to enhance the accessibility of UDCA therapies, especially in developing regions where financial constraints significantly impede access to healthcare. Consequently, the market for UDCA drug products is anticipated to experience robust expansion, facilitated by the broadening reach of treatment options to underserved populations. This trend underscores the critical role of generics in fostering equitable healthcare access and underscores the market’s adaptive response to patent landscapes.

Regional Analysis

In 2023, North America held a dominant market position in the Ursodeoxycholic Acid (UDCA) drug product market, capturing more than a 36.6% share and holding a market value of USD 142.2 million for the year. This robust presence can be attributed to several key factors.

Firstly, North America benefits from a well-established healthcare infrastructure coupled with high healthcare expenditure, facilitating widespread adoption of pharmaceutical products such as UDCA. Moreover, the region boasts a large patient pool afflicted with liver-related disorders, including cholestatic liver diseases, primary biliary cholangitis (PBC), and gallstones, which are among the primary indications for UDCA therapy.

Additionally, the presence of leading pharmaceutical companies and research institutions in North America fosters continuous innovation and development of new drug formulations, contributing to market growth. Furthermore, favorable regulatory policies and reimbursement frameworks enhance accessibility to UDCA drugs, thereby augmenting market penetration.

Furthermore, increasing awareness about the therapeutic benefits of UDCA in managing liver diseases, coupled with rising incidences of hepatobiliary disorders, propels market expansion in North America. Medical advancements and technological innovations in diagnostics and treatment modalities further drive demand for UDCA drugs in the region.

Looking ahead, North America is anticipated to maintain its leading position in the UDCA drug product market, supported by ongoing research and development activities, strategic collaborations among pharmaceutical companies, and growing investments in healthcare infrastructure. However, it is essential to remain vigilant of regulatory changes, competitive dynamics, and emerging therapeutic alternatives, which may influence market dynamics in the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Ursodeoxycholic Acid (UDCA) drug product market, several notable companies play significant roles, fostering competition and advancement. One such key player is Dr. Falk Pharma, renowned for its expertise in gastrointestinal disorders. Their ongoing research efforts result in the introduction of innovative UDCA formulations, driving market expansion.

Additionally, Daewoong Pharmaceutical stands out with its robust manufacturing capabilities and extensive distribution network, ensuring widespread availability of UDCA treatments. Teva Pharmaceuticals, a global leader in generic medicines, contributes to market accessibility by offering a diverse portfolio of UDCA products at affordable prices.

Epic Pharma, known for its specialized pharmaceutical offerings, adds unique formulations to the UDCA market, addressing specific patient needs. Together with other industry participants, these companies engage in research, partnerships, and marketing strategies to maintain competitiveness and enhance treatment options for individuals with hepatobiliary disorders, thereby driving growth in the pharmaceutical sector.

Market Key Players

- Dr. Falk Pharma

- Daewoong Pharmaceutical

- Teva Pharmaceuticals

- Epic Pharma

- Mitsubishi Tanabe Pharma

- Sun Pharmaceutical Industries Ltd.

- ICE s.p.a.

- Merck Kga

- Dipharma Francis Srl

- Axplora

Recent Developments

- In October 2023, Sun Pharmaceutical Industries Ltd. demonstrated its commitment to innovation and research by boosting its investment in the development of new treatments for liver diseases. This includes exploring advancements in formulations or delivery methods for ursodeoxycholic acid, suggesting potential future breakthroughs and product developments within the market.

- In August 2023, Teva Pharmaceuticals made significant strides by venturing into the Chinese market through the introduction of its generic ursodeoxycholic acid product. This strategic expansion into Asia Pacific markets positions Teva to potentially enhance its market presence and capture a larger share of the market.

- In April 2023, Dr. Falk Pharma revealed a notable collaboration with a yet-to-be-disclosed company aimed at developing and bringing to market a new formulation of ursodeoxycholic acid, specifically targeted for the treatment of an undisclosed medical condition. This partnership holds promise for a future product launch, which could significantly impact the industry landscape.

Report Scope

Report Features Description Market Value (2023) USD 388.7 Million Forecast Revenue (2033) USD 1133.8 Million CAGR (2024-2033) 11.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Tablet, Capsule), By Indication (Gallstones, Hepatopathy, Biliary Disease, Primary Biliary Cholangitis (PBC), Other Indications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Dr. Falk Pharma, Daewoong Pharmaceutical, Teva Pharmaceuticals, Epic Pharma, Mitsubishi Tanabe Pharma, Sun Pharmaceutical Industries Ltd., ICE s.p.a., Merck Kga, Dipharma Francis Srl, Axplora Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Ursodeoxycholic Acid Drug Product market in 2023?The Ursodeoxycholic Acid Drug Product market size is USD 388.7 Million in 2023.

What is the projected CAGR at which the Ursodeoxycholic Acid Drug Product market is expected to grow at?The Ursodeoxycholic Acid Drug Product market is expected to grow at a CAGR of 11.3% (2024-2033).

List the segments encompassed in this report on the Ursodeoxycholic Acid Drug Product market?Market.US has segmented the Ursodeoxycholic Acid Drug Product market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Tablet, Capsule. By Indication the market has been segmented into Gallstones, Hepatopathy, Biliary Disease, Primary Biliary Cholangitis (PBC), Other Indications.

List the key industry players of the Ursodeoxycholic Acid Drug Product market?Dr. Falk Pharma, Daewoong Pharmaceutical, Teva Pharmaceuticals, Epic Pharma, Mitsubishi Tanabe Pharma, Sun Pharmaceutical Industries Ltd., ICE s.p.a., Merck Kga, Dipharma Francis Srl, Axplora

Which region is more appealing for vendors employed in the Ursodeoxycholic Acid Drug Product market?North America is expected to account for the highest revenue share of 36.6% and boasting an impressive market value of USD 142.2 million. Therefore, the Ursodeoxycholic Acid Drug Product industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Ursodeoxycholic Acid Drug Product?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Ursodeoxycholic Acid Drug Product Market.

Ursodeoxycholic Acid Drug Product MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Ursodeoxycholic Acid Drug Product MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Dr. Falk Pharma

- Daewoong Pharmaceutical

- Teva Pharmaceuticals

- Epic Pharma

- Mitsubishi Tanabe Pharma

- Sun Pharmaceutical Industries Ltd.

- ICE s.p.a.

- Merck Kga

- Dipharma Francis Srl

- Axplora