Global Unit Linked Insurance Market Size, Share, Industry Analysis Report By Fund Type (Equity Funds, Debt Funds, Balanced Funds, Others), By Distribution Channel (Individual Agents, Bancassurance, Brokers & Corporate Agents, Direct Channel (Online), Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163316

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

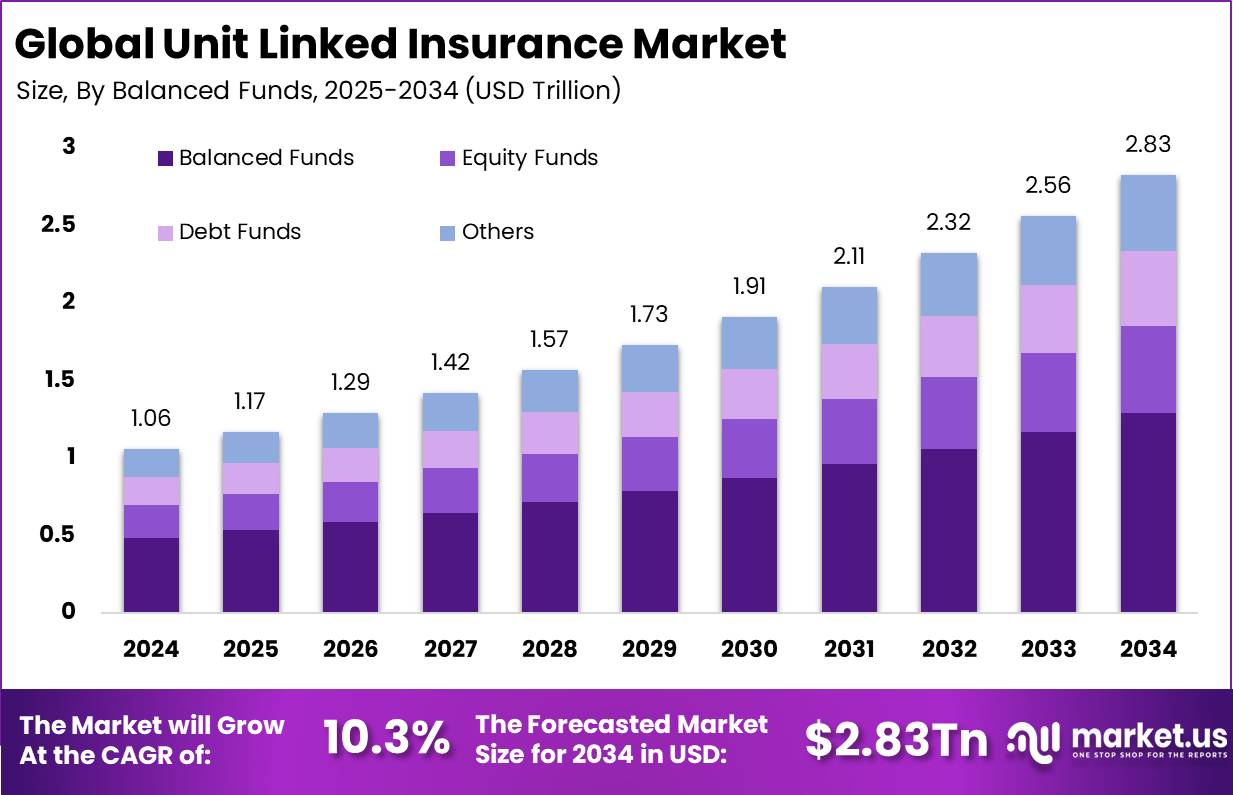

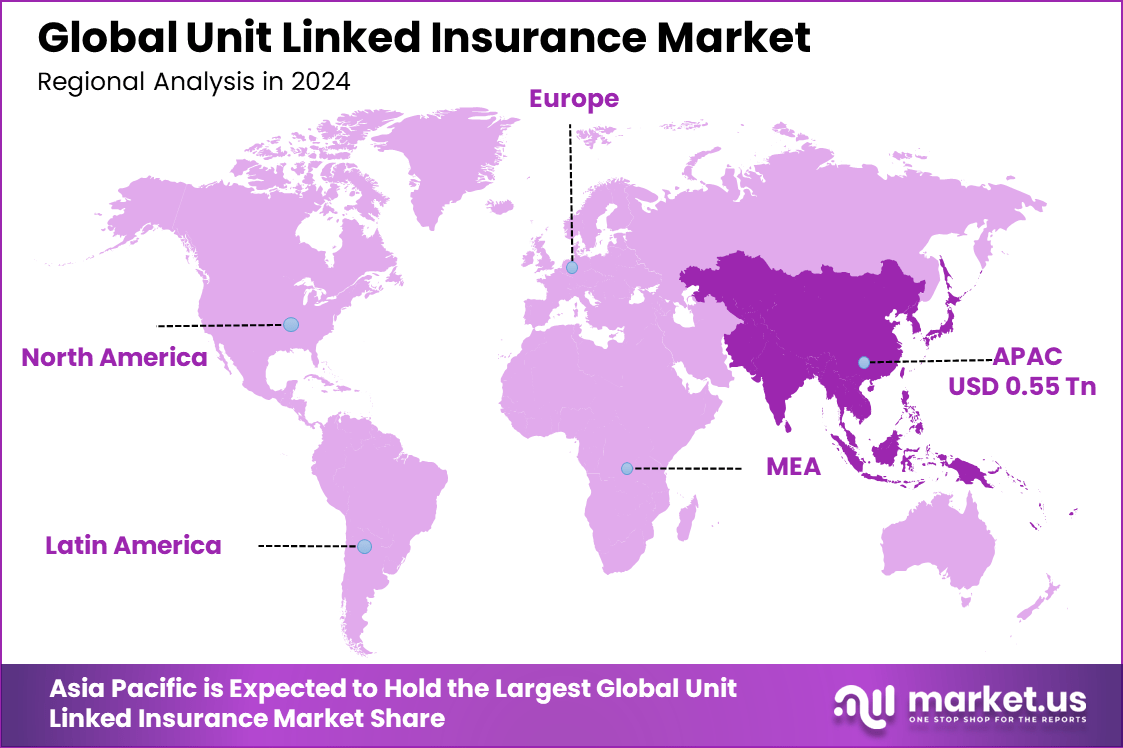

The Global Unit Linked Insurance Market size is expected to be worth around USD 2.83 trillion by 2034, from USD 1.06 trillion in 2024, growing at a CAGR of 10.3% during the forecast period from 2025 to 2034. Asia Pacific held a dominant market position, capturing more than a 52.3% share, holding USD 0.55 trillion in revenue.

The Unit Linked Insurance Market represents a unique financial product blending life insurance with investment opportunities. In these policies, part of the premium enhances life coverage, while the rest is invested in funds such as equities or debt based on the policyholder’s preference. This setup provides policyholders flexibility to switch funds throughout the policy term, allowing alignment with changing financial goals.

Top driving factors for the Unit Linked Insurance Market include the increasing demand for products that merge protection with investment potential, growing awareness of life insurance benefits, and the rise of digital distribution channels that simplify purchase and management. Additionally, evolving customer preferences for customization and goal-based financial planning boost adoption.

The market for Unit Linked Insurance is driven by increasing consumer awareness about the dual benefits of protection and investment. Growing digital adoption simplifies policy management, making ULIPs more accessible and attractive. Insurers use technology to personalize offerings, meeting diverse financial goals. Rising disposable incomes and a focus on long-term wealth creation further fuel demand. These factors collectively encourage more people to choose unit-linked policies, supporting steady growth in the market.

For instance, in May 2025, Bandhan Life Insurance launched its new unit-linked insurance plan named ULIP Plus, offering high life cover of up to 50 times the annual premium along with market-linked investment returns. This plan combines strong financial protection with long-term wealth creation, featuring flexible investment options across equity and debt funds.

Key Takeaway

- The Balanced Funds (Hybrid Funds) segment dominated with 45.6%, reflecting investor preference for diversified portfolios that combine equity growth potential with stable fixed-income returns.

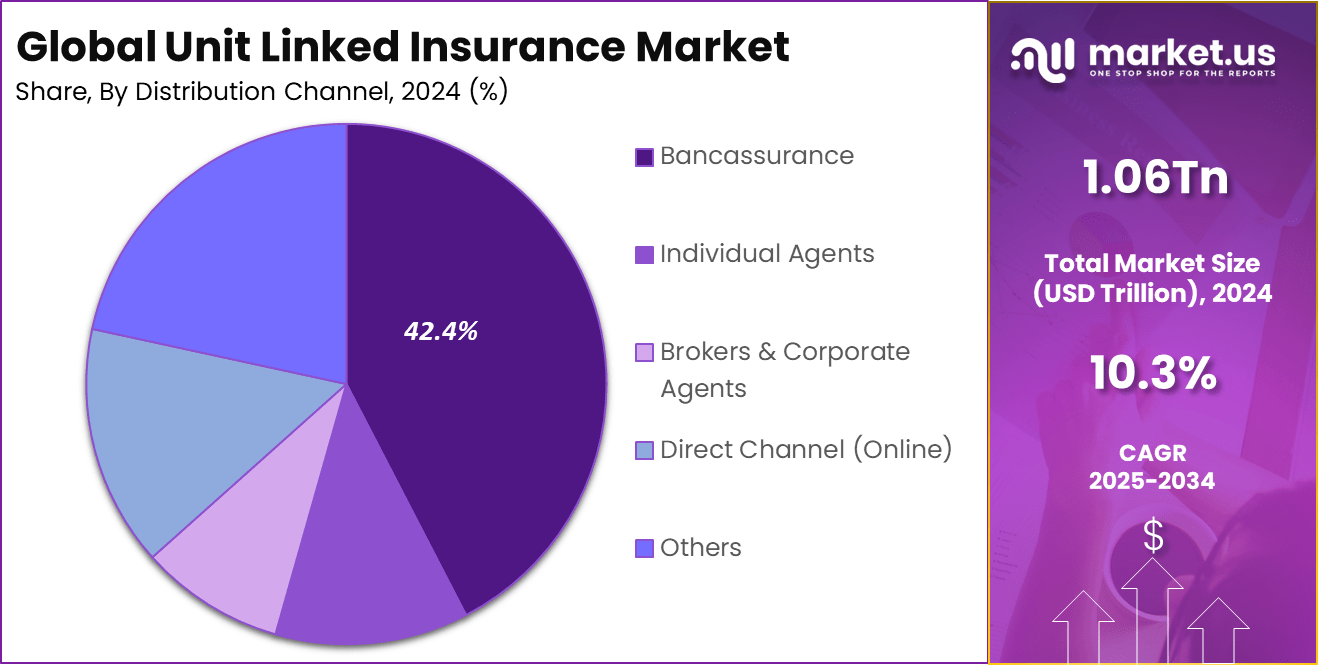

- The Bancassurance channel held a strong 42.4% share, supported by extensive distribution networks and cross-selling of investment-linked insurance products through banking institutions.

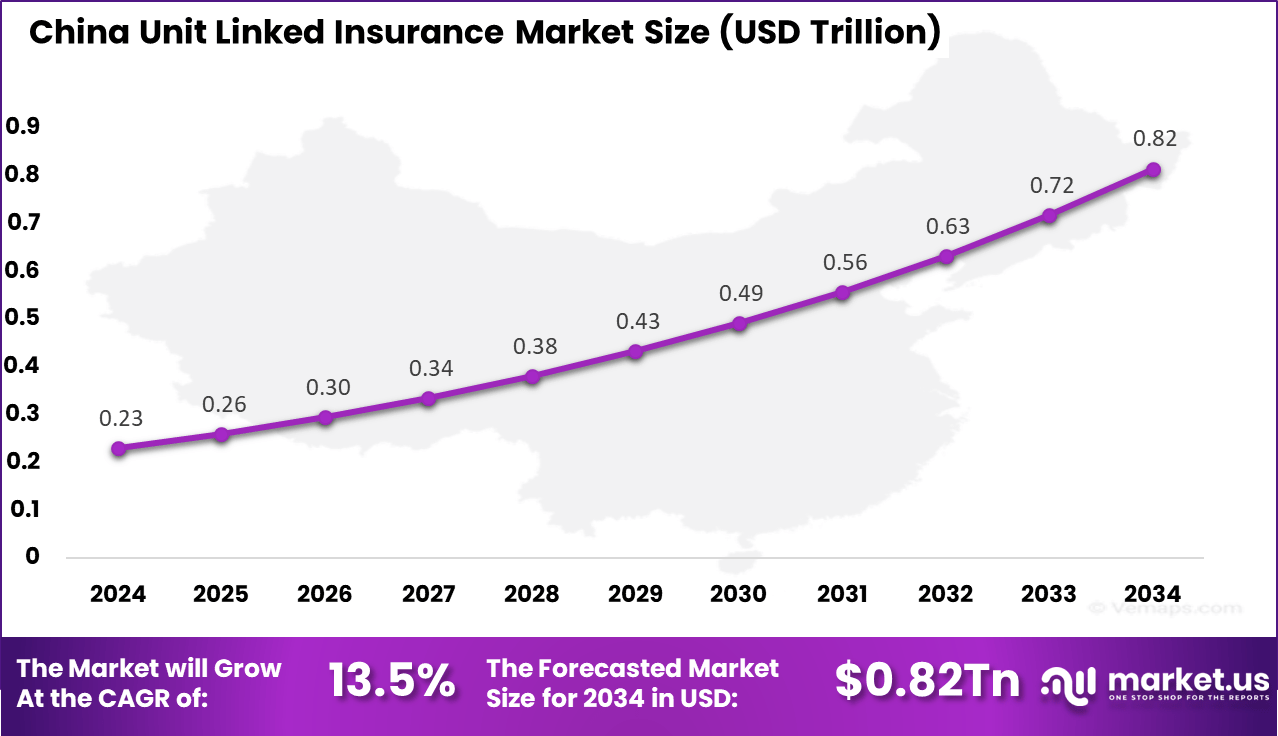

- The China market reached USD 0.23 Trillion in 2024, expanding at a robust 13.5% CAGR, driven by rising household wealth, digital insurance platforms, and increasing financial literacy.

- The Asia Pacific region led the global market with 52.3% share, supported by rapid economic growth, expanding middle-class populations, and growing demand for investment-backed insurance solutions.

Role of Generative AI

Generative AI is transforming unit-linked insurance by making processes faster and more accurate. It helps insurers analyze large amounts of customer data to create personalized insurance products that fit individual needs.

Around 61% of insurers have seen improvements in staff efficiency, and 48% have noticed better customer service to AI. This technology creates policy documents quickly and helps detect fraud early, resulting in smoother operations and happier customers. Moreover, AI provides insurers with detailed insights to improve pricing and manage risks better.

This leads to products that closely match what customers want and need, boosting satisfaction and loyalty. Insurers using generative AI have reported 14% higher customer retention and better customer approval ratings. AI is also helping insurance companies streamline processes, which is important as customers expect quick and reliable service.

Investment and Business Benefits

Investment opportunities in the Unit Linked Insurance Market lie in developing innovative, customer-centric products that combine insurance with various market-linked investment options. Insurers can expand by offering flexible premium structures, adding value through riders like critical illness cover, and promoting retirement-focused products.

Technological investments to upgrade legacy policy administration systems and implement AI/ML-driven analytics will also create competitive advantages. Furthermore, untapped demographics in emerging economies present strong growth prospects as financial inclusion improves and awareness rises. Business benefits of unit-linked insurance products extend beyond customer empowerment to insurers’ operational and financial performance.

These products provide insurers with steady cash flows through regular premiums while enabling cross-selling of other financial products. The integration of investment components attracts higher-value clients seeking wealth management, increasing policy retention. Enhanced digital tools improve efficiency, reduce errors, and enable better risk management. Collectively, these factors lead to improved profitability, stronger customer relationships, and sustainable market positioning.

China Market Size

The market for Unit Linked Insurance within China is growing tremendously and is currently valued at USD 0.23 trillion, the market has a projected CAGR of 13.5%. The market is growing rapidly due to several key factors. Rising disposable incomes and an expanding middle class are driving demand for insurance products that combine protection with investment opportunities.

Increased financial awareness and urbanization are encouraging consumers to seek long-term savings solutions like ULIPs. Additionally, digital innovation and government initiatives promoting financial inclusion are making insurance products more accessible to a broader audience. The entry of new players and the launch of innovative policies further fuel market expansion, making China one of the fastest-growing markets globally.

For instance, in May 2024, HSBC agreed to acquire the remaining 50% stake in its China life insurance joint venture, HSBC Life Insurance Company Limited, from The National Trust Limited. This move comes as China removes foreign ownership restrictions in the life insurance sector, allowing HSBC to fully own the JV, which offers a portfolio including annuity, whole life, critical illness, and unit-linked insurance products.

In 2024, Asia Pacific held a dominant market position in the Global Unit Linked Insurance Market, capturing more than a 52.3% share, holding USD 0.55 trillion in revenue. This dominance stems from rising financial awareness and increasing disposable incomes across the region. Consumers are seeking insurance products that blend life protection with investment opportunities, catering to long-term financial goals like retirement and education savings.

Strong government initiatives promoting financial inclusion and savings, along with early adoption of market-linked insurance solutions, have also played a pivotal role. Additionally, partnerships between insurers, banks, and fintech firms are making these products more accessible and flexible, fueling demand and helping maintain Asia-Pacific’s market leadership.

For instance, In June 2025, Tata AIA Life Insurance introduced two new funds focused on wealth creation and retirement planning. The initiative addresses the rising demand in the Asia Pacific region for flexible investment options within Unit Linked Insurance Plans (ULIPs). These funds combine insurance coverage with long-term wealth accumulation, aligning with the company’s strategy to strengthen its regional presence and deliver customized financial solutions.

Fund Type Analysis

In 2024, The Balanced Funds (Hybrid Funds) segment held a dominant market position, capturing a 45.6% share of the Global Unit Linked Insurance Market. These funds invest in both equity and debt instruments to offer moderate risk and returns. The combination helps reduce the volatility found in pure equity funds by balancing exposure to stocks with the comparatively stable returns from bonds.

These hybrid funds also serve as a hedge against inflation by including bonds that provide steady income. This income acts as a cushion against rising living costs and helps maintain purchasing power. Because of this balance, balanced funds appeal to those with medium- to long-term financial goals who want a disciplined approach to growing wealth with moderated risk exposure.

For Instance, in May 2025, Bajaj Allianz Life launched a New Fund Offer (NFO) within its Unit Linked Insurance Plans (ULIPs), introducing a Balanced Fund focused on up to 25 strong-performing large-cap companies. This fund offers a hybrid investment approach, blending equity and debt to manage risk while targeting steady growth.

Distribution Channel Analysis

In 2024, the Bancassurance segment held a dominant market position, capturing a 42.4% share of the Global Unit Linked Insurance Market. Banks have the advantage of extensive customer bases and trusted relationships, which they leverage to offer unit-linked insurance products seamlessly alongside other financial services. This convenience makes it easier for customers to manage both their banking and insurance needs in one place.

Consumers often prefer bancassurance because it combines professional financial advice and quick access to products. Banks also provide flexible options for premium payments and fund management, encouraging more people to invest in ULIPs through this channel. As digital integration improves, bancassurance is expected to continue driving growth by enhancing customer experience and product accessibility.

For instance, in October 2025, Life Insurance Corporation of India (LIC) partnered with RBL Bank Ltd. to expand its bancassurance reach. This collaboration allows RBL Bank’s customers to access LIC’s wide range of life insurance products, including term plans, endowment policies, pension plans, and unit-linked insurance plans, through the bank’s extensive branch network and digital platforms.

Emerging Trends

One of the major trends in unit-linked insurance is the move toward more personalized plans. Customers increasingly want flexible policies that let them adjust investment choices during the policy term. Digital advisory platforms that offer automated and custom financial advice are gaining popularity, especially among younger, tech-savvy buyers. This digital shift is making it easier for customers to research, buy, and manage their insurance plans online, enhancing overall convenience.

Another important trend is the focus on retirement planning within unit-linked insurance products. Insurers are creating bundled options that combine life coverage with long-term investment strategies aimed at retirement savings. This trend is supported by growing financial awareness, with over half of policyholders now emphasizing wealth building alongside protection.

Growth Factors

Growing financial awareness is a key driver behind the increasing demand for unit-linked insurance. More people understand the benefits of combining life insurance coverage with investment opportunities, making these products more attractive. The rise of digital platforms has helped simplify how customers research and purchase policies, especially appealing to younger and tech-literate audiences.

Economic factors also support growth in this market. With changing interest rates and market conditions, unit-linked insurance offers a flexible option for individuals looking to balance protection with investment returns. Customers appreciate being able to choose from equity, debt, or mixed funds according to their risk tolerance. This flexibility, along with rising disposable incomes in many regions, continues to support steady adoption of unit-linked plans.

Key Market Segments

By Fund Type

- Equity Funds

- Debt Funds

- Balanced Funds

- Others

By Distribution Channel

- Individual Agents

- Bancassurance

- Brokers & Corporate Agents

- Direct Channel (Online)

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Consumer Awareness and Digital Adoption

Increasing consumer awareness regarding the benefits of financial planning is driving the growth of the Unit Linked Insurance Market. More individuals now recognize that these policies offer not only life insurance coverage but also an investment component.

The rising adaptability to digital platforms has made it easier for policyholders to purchase, manage, and monitor their investments, facilitating a smooth and convenient experience. This ease of access is expanding the customer base, including young adults and professionals eager to invest in their future while securing protection.

At the same time, insurers leverage technology to offer personalized products tailored to individual financial goals. This digital integration attracts new customers and drives demand for flexible insurance policies that combine investment potential with security. The overall convenience and educational efforts around ULIPs are important factors propelling the market’s ongoing growth.

For instance, in August 2025, Aviva Investors reported outstanding growth backed by digital progress and strong operational momentum. They completed the acquisition of Direct Line, which expanded their customer base and enhanced digital integration, allowing easier access to diversified insurance and investment products.

Restraint

Market Sensitivity to Economic Fluctuations

The investment component of ULIPs exposes policyholders to market risks, which can restrain growth. Economic downturns or market volatility can negatively affect fund values and returns. Many potential buyers hesitate due to a lack of understanding of how market shifts impact their investments, reducing their willingness to commit to this product type.

Additionally, the complexity of these policies adds to consumer apprehension. Insurance providers must address these knowledge gaps to maintain trust and encourage uptake, as uncertainty around market performance is a major barrier.

For instance, in May 2025, Aegon Asset Management faced challenges as market turmoil negatively impacted investment performance. Such disturbances highlight ULIPs’ sensitivity to economic fluctuations, as policy values tied to markets declined, causing cautious investor sentiment. These factors restrain uninformed consumer enthusiasm and adoption.

Opportunities

Technological Advancements in Product Offerings

One strong opportunity lies in innovations driven by technology that enable insurers to offer more customized and flexible product choices. Digital advisory tools and AI-based analytics help tailor fund options to match customers’ evolving needs and risk tolerances. This boosts engagement and satisfaction by simplifying decision-making processes and enhancing transparency around investment performance.

The rising interest in responsible investing also opens new avenues for growth. Insurers are integrating ESG principles into their ULIP fund choices, appealing to investors seeking both financial returns and positive social impact. Adopting such features allows providers to differentiate themselves and capture emerging market segments focused on sustainable finance.

For instance, in September 2025, Standard Life announced plans to launch a new private markets pension default fund with a significant allocation to private assets. This innovative product leverages technology to provide diversified investment options and sustainability principles, enhancing appeal.

Challenges

Regulatory Changes and Market Competition

Regulatory changes present ongoing challenges for the Unit Linked Insurance Market. New rules increase compliance complexity and compliance costs, forcing insurers to continuously adapt their products and operations. This environment can slow innovation and add pressure on profit margins.

Competition within the sector is intense, with companies striving to offer better pricing and innovative features. Smaller players face particular difficulties keeping pace, especially in investing in digital infrastructure and cybersecurity, both vital for competing effectively. Navigating this competitive and regulatory landscape is crucial for sustained growth.

For instance, in September 2025, IndiaFirst Life highlighted the impact of new tax rules on Unit Linked Insurance Plans (ULIPs). The regulatory changes categorize certain ULIPs under capital gains tax regulations, altering the tax benefits previously available. This shift demands that insurers revisit product structures and communication strategies to ensure compliance and maintain customer trust.

Key Players Analysis

The Unit Linked Insurance Market is led by global financial and insurance giants such as Allianz Global Investors, AXA Investment Managers, Aviva Investors, and Zurich Insurance Group. These firms manage diverse portfolios that integrate life insurance with investment products, offering policyholders both protection and wealth accumulation opportunities. Their expertise in asset allocation, long-term fund performance, and client advisory services underpins their leadership in the global ULIP segment.

Prominent investment and wealth management entities including Prudential Portfolio Management Group, Standard Life Investments, Legal & General Investment Management, M&G Investments, and Old Mutual Wealth emphasize sustainable investment strategies and dynamic risk management frameworks. Their portfolios are designed to balance insurance protection with equity and bond exposure, providing policyholders flexible investment options tailored to financial goals and market volatility.

Additional contributors such as Manulife Investment Management, Sun Life Global Investments, Swiss Life Asset Managers, NN Investment Partners, Voya Investment Management, Principal Global Investors, TIAA Investments, and CNP Assurances, along with Generali Investments and other market participants, strengthen the sector with region-specific fund management expertise.

Top Key Players in the Market

- Allianz Global Investors

- Aviva Investors

- Aegon Asset Management

- Legal & General Investment Management

- M& G Investments

- Old Mutual Wealth

- Prudential Portfolio Management Group

- Standard Life Investments

- Zurich Insurance Group

- Generali Investments

- AXA Investment Managers

- Met Life Investment Management

- Manulife Investment Management

- Sun Life Global Investments

- Swiss Life Asset Managers

- NN Investment Partners

- Voya Investment Management

- Principal Global Investors

- TIAA Investments

- CNP Assurances

- Others

Recent Developments

- In February 2025, Bajaj Life Insurance announced a notable update on ULIP investment tax rules. The company highlighted the impact of recent circulars by the Central Board of Direct Taxes, which introduced new caps on capital gains assessment for ULIPs with premiums exceeding Rs 2.5 lakh annually. This change is aimed at curbing the misuse of tax benefits by high-net-worth individuals.

- In July 2025, Policybazaar reported that ULIP plans are gaining popularity among serious investors due to reforms that enhanced transparency, reduced costs, and increased fund options. The insurance platform emphasized the recent trend of ULIPs offering zero premium allocation charges and broader asset coverage, including ESG and foreign funds, making them more attractive for long-term wealth creation.

Report Scope

Report Features Description Market Value (2024) USD 1.06 Bn Forecast Revenue (2034) USD 2.83 Bn CAGR(2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Fund Type (Equity Funds, Debt Funds, Balanced Funds, Others), By Distribution Channel (Individual Agents, Bancassurance, Brokers & Corporate Agents, Direct Channel (Online), Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz Global Investors, Aviva Investors, Aegon Asset Management, Legal & General Investment Management, M& G Investments, Old Mutual Wealth, Prudential Portfolio Management Group, Standard Life Investments, Zurich Insurance Group, Generali Investments, AXA Investment Managers, Met Life Investment Management, Manulife Investment Management, Sun Life Global Investments, Swiss Life Asset Managers, NN Investment Partners, Voya Investment Management, Principal Global Investors, TIAA Investments, CNP Assurances, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Unit Linked Insurance MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Unit Linked Insurance MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz Global Investors

- Aviva Investors

- Aegon Asset Management

- Legal & General Investment Management

- M& G Investments

- Old Mutual Wealth

- Prudential Portfolio Management Group

- Standard Life Investments

- Zurich Insurance Group

- Generali Investments

- AXA Investment Managers

- Met Life Investment Management

- Manulife Investment Management

- Sun Life Global Investments

- Swiss Life Asset Managers

- NN Investment Partners

- Voya Investment Management

- Principal Global Investors

- TIAA Investments

- CNP Assurances

- Others