Global Undersea Warfare Systems Market By Platform (Surface Ships, Submarines, Unmanned Systems), By System Type (Combat Systems, Sensors & Sonars, Weapons, Communication Systems), By End-User (Navy, Defense Agencies, Homeland Security), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167526

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

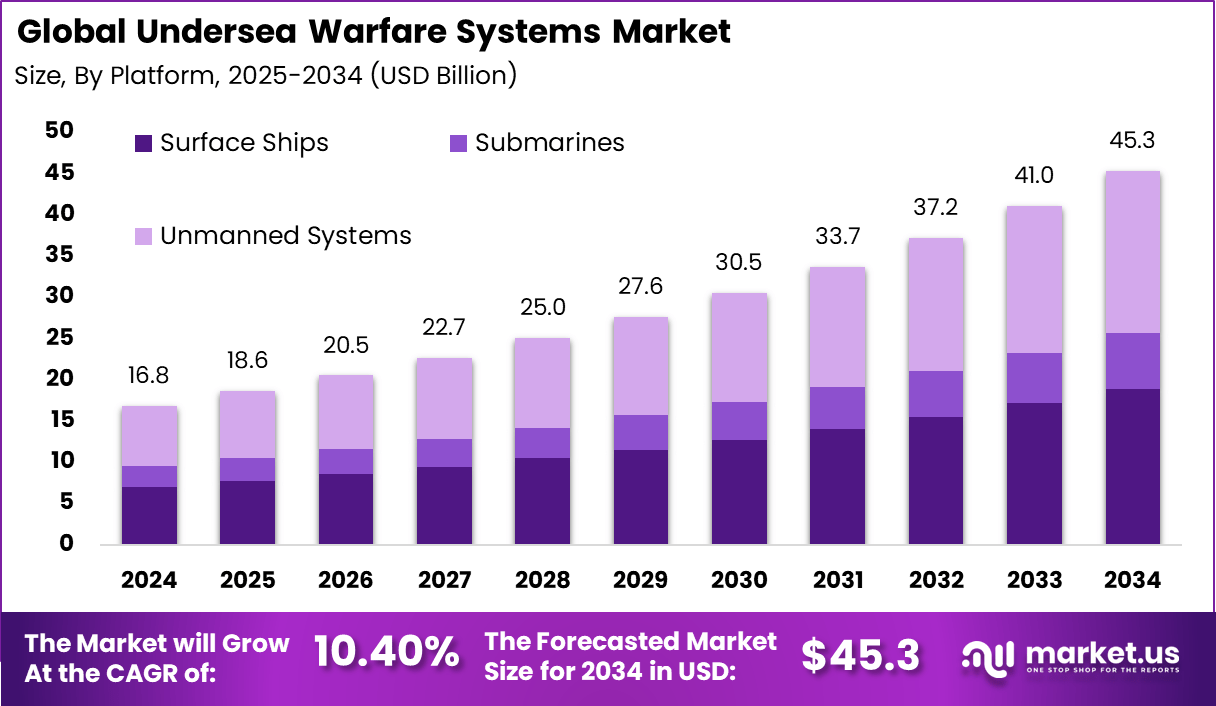

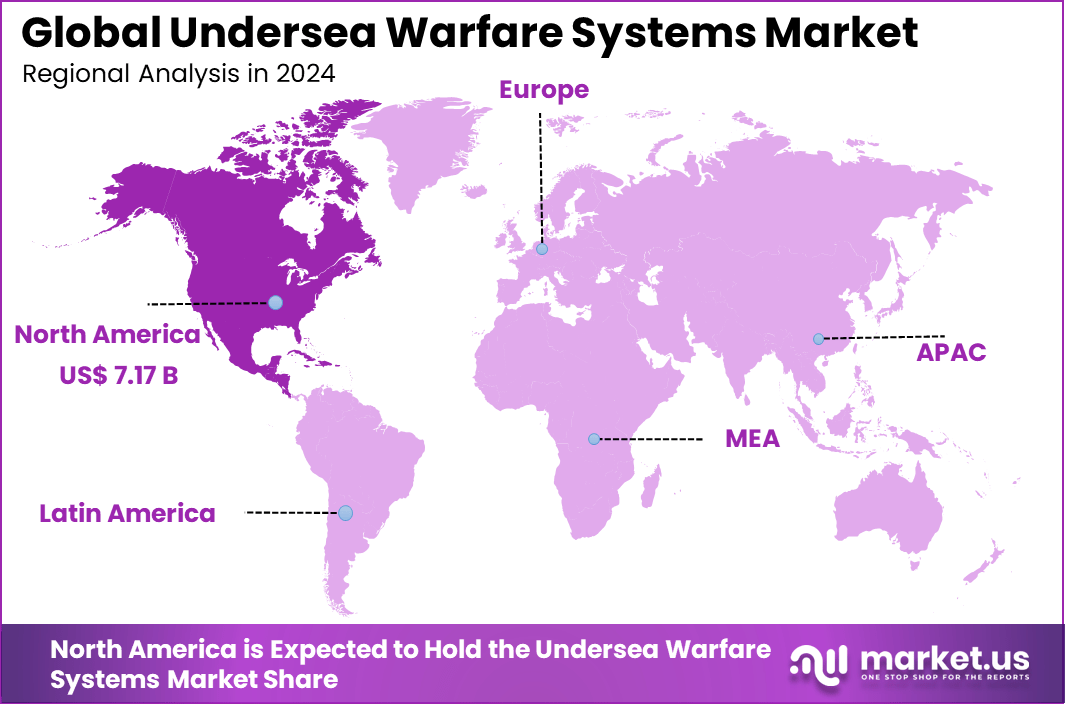

The Global Undersea Warfare Systems Market generated USD 16.8 billion in 2024 and is predicted to register growth from USD 18.6 billion in 2025 to about USD 45.3 billion by 2034, recording a CAGR of 10.40% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 42.6% share, holding USD 7.17 Billion revenue.

The undersea warfare systems market has expanded as naval forces increase investment in technologies that secure maritime borders, improve surveillance and strengthen underwater threat detection. Growth reflects rising geopolitical tensions, increased submarine activity and the need for advanced systems that operate in complex underwater environments.

The market includes sonar suites, autonomous platforms, underwater sensors, defensive countermeasures and command systems designed for modern naval operations. The growth of the market can be attributed to rising concerns over territorial security, increasing deployment of submarines and greater emphasis on maritime dominance. Nations are modernising naval fleets and enhancing underwater situational awareness.

Opportunity lies in developing cost-effective, versatile unmanned underwater vehicles and lightweight weapon systems that extend operational reach without increasing risks or expenses. Regions investing in indigenous technology development also find chances to build local expertise while reducing reliance on foreign suppliers.

Enhanced sensor fusion and network-centric warfare capabilities promise better situational awareness and faster response times in underwater combat operations. Continuous research in material science, energy storage, and autonomous navigation fuels these emerging advancements, broadening market potential for next-generation undersea warfare solutions.

Top Market Takeaways

- By platform, surface ships lead with a 41.8% share. Surface ships such as corvettes and frigates play crucial roles in underwater warfare through anti-submarine warfare (ASW), employing sonar systems, helicopters equipped with dipping sonar, and torpedoes for submarine tracking and neutralization.

- By system type, weapons dominate with 36.9% share, including torpedoes, rockets, depth charges, and other munitions integrated with fire-control systems. Weapons systems are essential for offensive and defensive undersea combat capability.

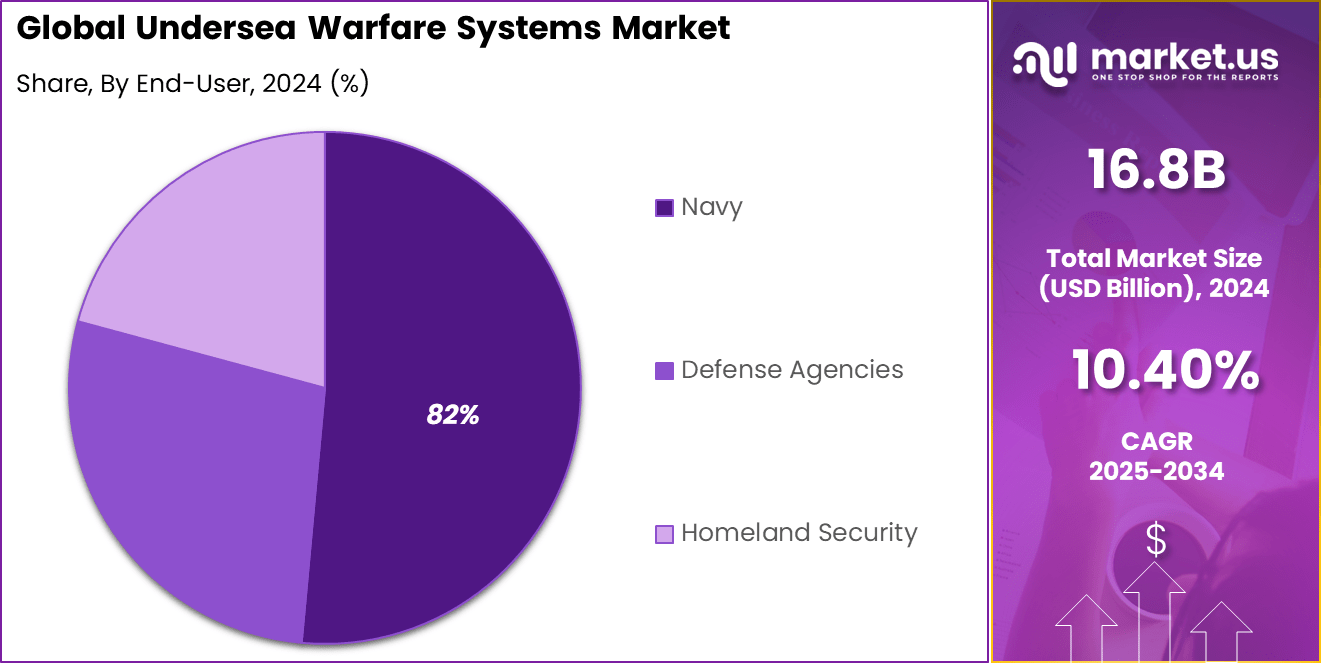

- By end-user, the navy represents about 81.6% of the market, reflecting the key role of naval forces in undersea warfare operations, including fleet protection, strategic deterrence, and maritime security.

- North America holds approximately 42.6% of the market with the U.S. leading, supported by significant investments in naval fleet modernization, submarine programs, unmanned underwater vehicles (UUVs), and advanced sonar and weaponry systems.

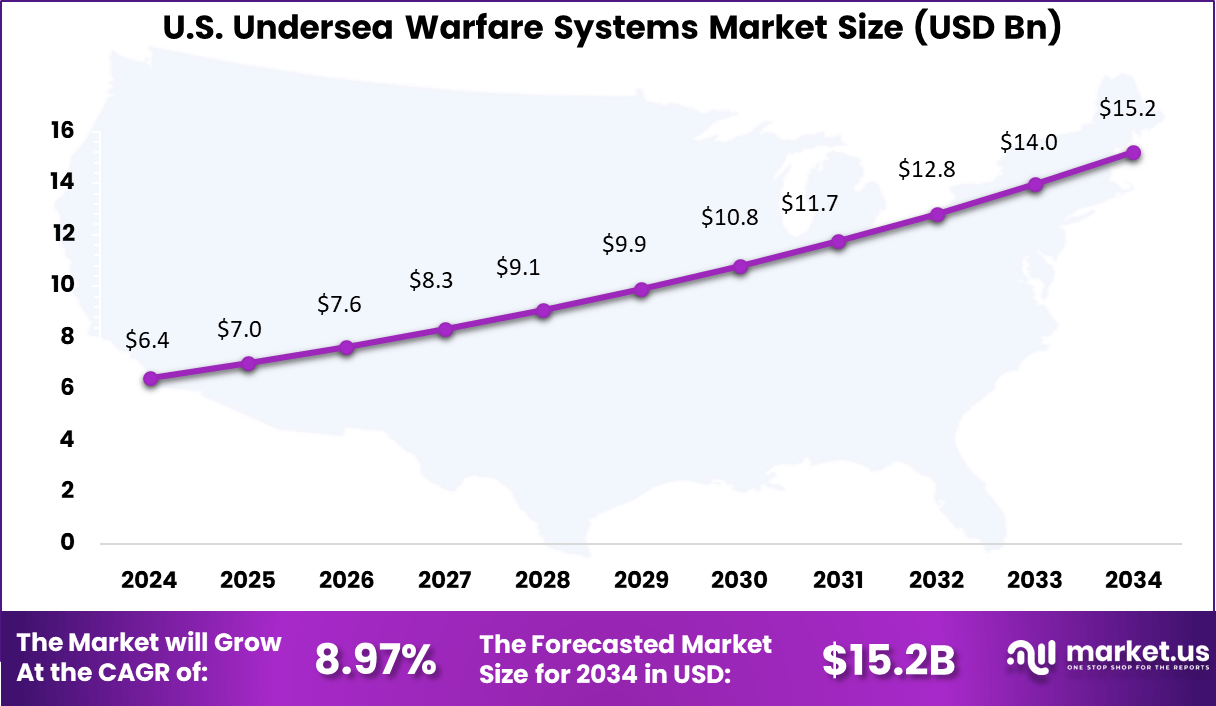

- The U.S. market size is estimated at around USD 6.44 billion in 2025, growing at a CAGR of about 8.97%, driven by rising geopolitical tensions, technological advancements in unmanned underwater vehicles, and increased defense budgets focused on underwater dominance and maritime security.

- Key industry players include Lockheed Martin, Raytheon Technologies, Northrop Grumman, General Dynamics, BAE Systems, and Thales Group, investing in next-generation sonar, weapons systems, and autonomous underwater platforms.

By Platform

Surface ships dominate the undersea warfare systems market with a significant 41.8% share. These platforms, including corvettes, frigates, and destroyers, play a crucial role in maritime security by deploying advanced sonar systems, anti-submarine warfare (ASW) technologies, towing arrays, and helicopter assets equipped with dipping sonar.

Surface ships are instrumental in detecting, tracking, and engaging enemy submarines, mine hunting, and mine sweeping operations. Their versatility and mobility allow them to conduct layered defense strategies essential for modern naval operations.

The importance of surface ships is heightened by ongoing modernization efforts in naval fleets to maintain control over maritime domains. Investment in enhanced electronic warfare capabilities and integration of unmanned systems on these platforms further consolidates their role as front-line assets in underwater warfare, ensuring maritime dominance and security against evolving threats.

By System Type

Weapons systems command a notable 36.9% share within the undersea warfare systems market, reflecting their pivotal role in underwater combat. This category includes torpedoes, rockets, and depth charges designed to neutralize enemy submarines and underwater threats.

Integration with sophisticated fire control systems and sonar arrays enables precise targeting and engagement, raising the efficacy of ASW operations. Advancements in autonomous and guided weaponry are enhancing range, accuracy, and lethality.

The defense sector’s emphasis on modernizing underwater arsenal drives continuous innovation in weapons technologies. Collaborative defense programs and increasing procurement provide momentum to the weapons segment, supporting strategic deterrence and operational readiness. The evolution of lightweight torpedoes and modular payloads also expands flexibility across naval platforms.

By End-User

The navy is the predominant end-user in the undersea warfare systems market, with a commanding 82% share. Navies worldwide prioritize investment in a range of underwater combat and surveillance technologies to maintain strategic advantages in increasingly contested maritime spaces. This includes submarines, surface combatants, unmanned underwater vehicles (UUVs), and integrated sonar and communication systems.

Modern naval doctrines emphasize networked undersea warfare capabilities combining manned and unmanned assets for comprehensive maritime situational awareness. Evolving geopolitical tensions and technological arms races fuel naval demands for advanced undersea systems.

The constant drive for stealth, endurance, and AI-enhanced operations supports large budgets and sustained development, positioning navies as the backbone of the undersea warfare market. Innovation focus areas include autonomous platforms, dynamic sensor integration, and secure communications to counter emerging threats efficiently.

Main Factors Driving Adoption

- Maritime security and sovereignty: Growing geopolitical tensions and the need to protect critical maritime routes and economic zones drive demand for undersea dominance.

- Advanced threat detection: Systems offer improved sonar, stealth, and surveillance capabilities that allow detection of enemy submarines, mines, and unmanned underwater vehicles.

- Autonomous and unmanned tech integration: The rise of autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) enhances mission scope in reconnaissance, mine countermeasures, and surveillance.

- Modernization of naval fleets: Upgrading submarines, torpedo systems, and sonar technologies to maintain technological superiority is a key driver of adoption.

- Protection of critical underwater infrastructure: Safeguarding underwater communication cables, pipelines, and resources against threats necessitates robust underwater defense systems.

- AI and machine learning: Incorporating AI/ML accelerates data processing, threat identification, and decision-making effectiveness.

- Operational efficiency: Enhancements in stealth and detection capabilities reduce the risk to manned platforms while increasing mission endurance.

- Growing investments by key naval powers: Government focus on expanding and upgrading undersea warfare capabilities fuels market adoption.

Benefits

- Strategic dominance: Provides critical military advantage by enabling control over underwater battle spaces and influencing maritime security outcomes.

- Risk reduction: Autonomous systems reduce the exposure of personnel to hostile environments, cutting down casualties and operational hazards.

- Cost efficiency over time: While initial investment is high, unmanned and upgraded systems can lower lifecycle costs through reduced maintenance and longer deployment durations.

- Enhanced surveillance and reconnaissance: Improves real-time intelligence gathering and situational awareness crucial for effective naval operations.

- Future-proofing naval capabilities: Investment in cutting-edge technology ensures navies remain competitive amid evolving underwater threats and technological shifts.

- Support for multi-domain operations: Integration with surface, air, and cyber defense systems enhances overall military capability and inter-operability.

- Economic security: Protecting underwater assets vital to global trade and communication networks prevents costly disruptions and economic damage.

Emerging Trends

Key Trends Description Unmanned Underwater Vehicles (UUVs) Increasing use of autonomous and remotely operated underwater vehicles for surveillance, reconnaissance, and combat missions. Advanced Sonar and Sensor Technologies Development of more sensitive, accurate, and long-range sonar and sensor systems for enhanced underwater detection. AI and Machine Learning Integration Employing AI for improved target detection, threat analysis, and decision-making in undersea warfare scenarios. Multinational and Multi-domain Operations Growing coordinated operations among affiliated navies enhancing strategic capabilities and interoperability. Stealth and Countermeasure Innovations Advancements in stealth technology and countermeasures to evade detection and improve underwater survivability. Growth Factors

Key Factors Description Rising Military Expenditure Increased defense budgets and modernization programs driving demand for sophisticated undersea warfare systems. Geopolitical Tensions Heightened regional conflicts and naval power projections fueling investment in undersea capabilities. Technological Breakthroughs Innovations in materials, propulsion, and electronics enhancing system performance and reducing operational costs. Expansion of Naval Fleet Capabilities Global navies expanding submarine fleets and underwater warfare platforms boosting market growth. Strategic Collaborations and Partnerships Defense contractors and governments collaborating on R&D and deployment of advanced undersea warfare technologies. Key Market Segments

By Platform

- Surface Ships

- Submarines

- Unmanned Systems

By System Type

- Combat Systems

- Sensors & Sonars

- Weapons

- Communication Systems

By End-User

- Navy

- Defense Agencies

- Homeland Security

Regional Analysis

North America dominated the undersea warfare systems market, capturing a significant 42.6% share of the global market. Valued at approximately USD 6.44 billion, the growth is primarily driven by substantial defense budgets and strategic investments in naval modernization programs.

The region prioritizes the development and deployment of advanced undersea technologies including next-generation submarines, unmanned underwater vehicles (UUVs), and sophisticated sonar systems. Strong collaboration between defense contractors, technology firms, and government agencies fosters continuous innovation aimed at enhancing anti-submarine warfare, surveillance capabilities, and secure underwater communications.

The U.S., which represents the core of the North American undersea warfare systems market, the valuation stands at USD 6.44 billion in 2024, with a CAGR of 8.97%. The U.S. Navy’s modernization initiatives, coupled with increased spending on stealth and autonomous underwater platforms, underpin its market leadership. Cutting-edge research in AI-enabled remote operation, sensor fusion, and real-time data exploitation enhances operational efficiency and mission success.

Additionally, the U.S. emphasis on maintaining technological superiority against emerging threats drives demand for advanced undersea warfare systems. This robust ecosystem of defense suppliers and continuous innovation places the U.S. at the forefront of the global undersea warfare systems market.

Key Regions and Countries

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Geopolitical Tensions and Naval Modernization

The undersea warfare systems market is driven by increasing geopolitical tensions and the urgent need for naval modernization globally. Nations are investing heavily to strengthen maritime defense capabilities, especially in critical sea lanes and contested waters. This drives demand for advanced undersea platforms like submarines, unmanned underwater vehicles (UUVs), sonar systems, and torpedoes to ensure strategic dominance and secure national interests.

Moreover, growing naval budgets, particularly in regions like North America and Asia Pacific, support the development and deployment of sophisticated undersea warfare technologies. Continuous innovations in stealth, detection, and communication systems further propel market growth by enhancing operational effectiveness.

Restraint

High Costs and Technical Complexity

Despite growth opportunities, the sector faces restraints due to the high costs and technical complexity associated with undersea warfare systems. The research, development, and production of advanced submarine platforms and underwater weaponry require significant capital investments and skilled labor. This complexity limits accessibility for smaller or developing nations.

Operational challenges such as maintaining equipment in harsh underwater environments demand specialized support infrastructure and ongoing funding. These financial and technical barriers slow broader adoption and modernization efforts, constraining market expansion.

Opportunity

Expansion of Unmanned Underwater Vehicle (UUV) Applications

Unmanned Underwater Vehicles (UUVs) present a major opportunity within the undersea warfare systems market. UUVs offer persistent surveillance, mine countermeasure capabilities, and covert reconnaissance with reduced risk to personnel. Their increasing deployment enhances naval operational reach and efficiency, making them attractive to global navies.

Integration of artificial intelligence and autonomous navigation in UUVs opens new missions including undersea communication relay and anti-submarine warfare. As these technologies mature and costs decline, UUV adoption is expected to expand across various military and dual-use applications, driving future market growth.

Challenge

Supply Chain Disruptions and Cybersecurity Threats

The market faces challenges from global supply chain disruptions affecting critical component availability for undersea systems. Geopolitical conflicts and export restrictions create procurement delays and escalate costs, impacting defense readiness and procurement timelines.

Additionally, cybersecurity threats pose significant risks, as connected undersea platforms generate sensitive operational data. Protecting these systems from cyber intrusion, data breaches, and operational interference requires robust security frameworks, continuous monitoring, and advanced encryption, posing ongoing challenges for manufacturers and operators.

Competitive Analysis

Lockheed Martin, Raytheon, Northrop Grumman, and BAE Systems lead the undersea warfare systems market with advanced sonar suites, underwater sensors, and integrated combat systems. Their technologies support anti-submarine warfare, underwater surveillance, and autonomous asset deployment. These companies focus on improved detection accuracy, secure communication, and advanced acoustic processing.

Thales, General Dynamics, Huntington Ingalls, L3Harris, Saab, and Leonardo strengthen the market with diversified undersea platforms, including unmanned underwater vehicles, towed arrays, and electronic warfare systems. Their solutions enhance situational awareness, submarine tracking, and mission endurance. These providers serve multiple naval forces through modular systems that integrate easily with existing fleets.

Kongsberg, Atlas Elektronik, Ultra Electronics, Rohde & Schwarz, Navantia, and other participants expand the landscape with specialized command-and-control systems, underwater communication tools, and acoustic detection technologies. Their offerings support coastal defense, fleet protection, and deep-sea operations. These companies focus on reliability, interoperability, and real-time threat analysis.

Top Key Players in the Market

- Lockheed Martin

- Raytheon

- Northrop Grumman

- BAE Systems

- Thales

- General Dynamics

- Huntington Ingalls

- L3Harris

- Saab

- Leonardo

- Kongsberg

- Atlas Elektronik

- Ultra Electronics

- Rohde & Schwarz

- Navantia

- Others

Future Scope

The future scope of the undersea warfare systems market looks robust, driven by rising geopolitical tensions and ongoing naval modernization efforts worldwide. Technological advancements, including the integration of unmanned underwater vehicles, AI-enabled sensors, and improved stealth and detection systems, will enhance operational capabilities and flexibility.

The market is forecasted to grow steadily as navies seek to strengthen underwater defense by adopting advanced submarines, autonomous platforms, and network-centric warfare solutions to maintain strategic dominance in underwater battlespaces.

Expansion is also fueled by growing defense budgets and demand for multi-domain operational integration.This evolving landscape points to a future where undersea warfare technology will be increasingly autonomous, intelligent, and interconnected to meet complex security challenges.

Recent Developments

- October, 2025, Kongsberg Gruppen ASA, proposed listing its maritime business independently on the Oslo Stock Exchange by mid-2026, intending to sharpen focus on defense operations while enabling maritime technology growth.

- Septembr, 2025, Inmarsat partnered with Pulsar International to expand NexusWave maritime connectivity across 300+ vessels, enabling advanced digital onboard ecosystems

Report Scope

Report Features Description Market Value (2024) USD 16.8 Bn Forecast Revenue (2034) USD 45.30 Bn CAGR(2025-2034) 10.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform (Surface Ships, Submarines, Unmanned Systems), By System Type (Combat Systems, Sensors & Sonars, Weapons, Communication Systems), By End-User (Navy, Defense Agencies, Homeland Security) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lockheed Martin, Raytheon Technologies, Northrop Grumman, BAE Systems, Thales, General Dynamics, Huntington Ingalls, L3Harris, Saab, Leonardo, Kongsberg, Atlas Elektronik, Ultra Electronics, Rohde & Schwarz, Navantia, and other. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Undersea Warfare Systems MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Undersea Warfare Systems MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lockheed Martin

- Raytheon

- Northrop Grumman

- BAE Systems

- Thales

- General Dynamics

- Huntington Ingalls

- L3Harris

- Saab

- Leonardo

- Kongsberg

- Atlas Elektronik

- Ultra Electronics

- Rohde & Schwarz

- Navantia

- Others