Global Two Wheeler Suspension System Market Size, Share, Growth Analysis By Product Type (Telescopic Front Suspension, Rear Suspension, Mono Shocks, Dual Shocks), By Propulsion Type (ICE, Upto 150cc, 151 cc to 300cc, 300cc - 500cc, Above 500cc, Electric), By Vehicle Type (Motorcycles, Scooters, Mopeds), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159485

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

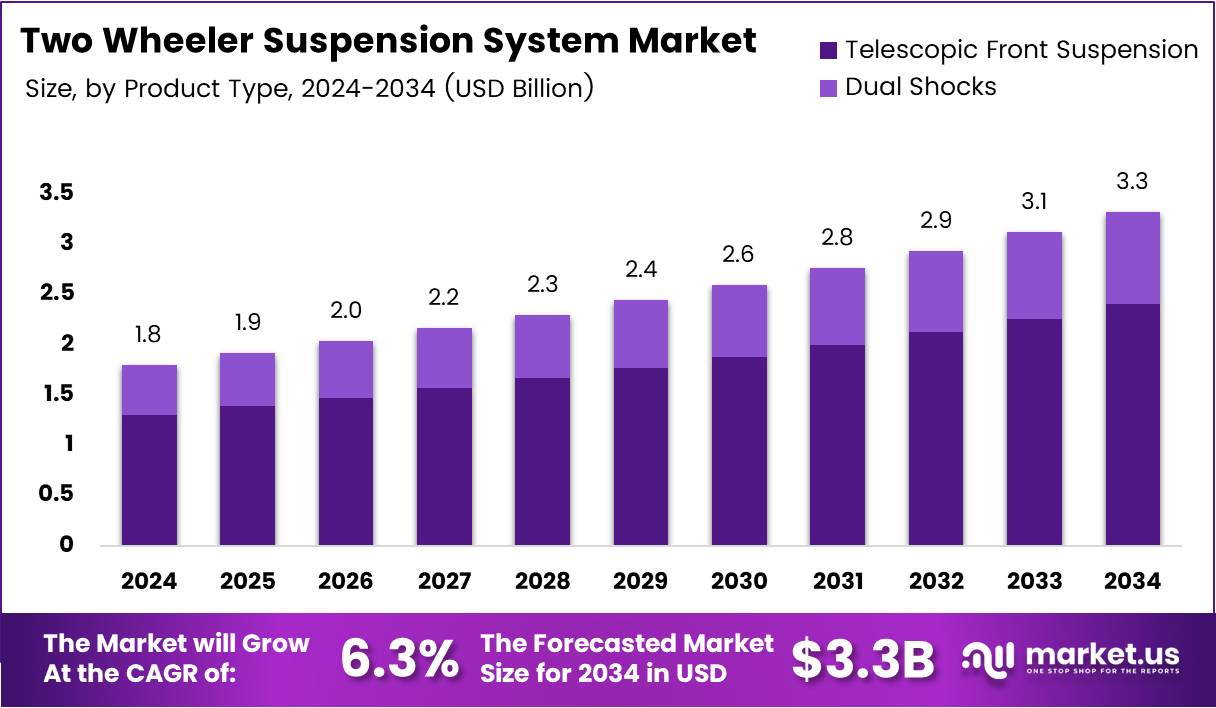

The Global Two Wheeler Suspension System Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 1.8 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

The Two Wheeler Suspension System market refers to the components of motorcycles and scooters that absorb shocks and ensure smoother rides. This market includes suspension systems designed for comfort, stability, and control, which are essential for vehicle safety and performance. Over the years, these systems have evolved with improved technology, providing a more comfortable experience for riders.

The market is anticipated to grow due to increasing demand for motorcycles in emerging economies. As urbanization rises, more people are opting for two-wheelers as cost-effective and efficient transportation.

Additionally, governments are investing in infrastructure to support these vehicles, which boosts market growth. The rise in demand for high-performance motorcycles also plays a role in driving the need for advanced suspension systems.

Key opportunities exist in the development of lightweight suspension systems, which improve fuel efficiency and performance. These systems are particularly sought after by the motorcycle manufacturing sector to cater to consumer preferences for faster, lighter, and more efficient vehicles. With sustainability becoming a focal point, the introduction of eco-friendly materials also presents significant growth potential in the market.

Government regulations surrounding safety standards and emissions are also influencing the growth of the Two Wheeler Suspension System market. Strict safety regulations encourage the integration of advanced suspension technology that ensures better shock absorption and stability. Moreover, regulatory efforts to reduce carbon footprints could push manufacturers to innovate and adopt more energy-efficient solutions in their suspension systems.

Key Takeaways

- The Global Two Wheeler Suspension System Market is expected to reach USD 3.3 Billion by 2034, growing at a CAGR of 6.3% from 2025 to 2034.

- Telescopic Front Suspension held a dominant market position in the By Product Type segment with a 72.4% share in 2024.

- ICE powered vehicles dominated the By Propulsion Type segment with an 87.7% share in 2024.

- Motorcycles held a dominant market position in the By Vehicle Type segment with a 58.9% share in 2024.

- The OEM channel held a dominant market position in the By Sales Channel segment with a 78.3% share in 2024.

- Asia-Pacific led the Two Wheeler Suspension System Market with 47.7% of the global market share in 2024.

By Product Type

Telescopic Front Suspension dominates with 72.4% due to its widespread use and cost-effectiveness.

In 2024, Telescopic Front Suspension held a dominant market position in the By Product Type segment of the Two Wheeler Suspension System Market, with a 72.4% share. The dominance of telescopic front suspension systems can be attributed to their extensive application in both motorcycles and scooters due to their simplicity, durability, and relatively low manufacturing cost. This suspension type remains the most widely adopted in the industry.

Rear Suspension, while essential, holds a smaller share in comparison. It provides support for the rear axle and enhances ride comfort, especially in off-road and high-performance vehicles. The adoption of rear suspension systems is expected to rise, but its share remains below that of telescopic front suspension systems.

Mono Shocks, which are commonly used in higher-end motorcycles, have gained popularity for their performance benefits, such as improved handling and reduced weight. These suspension systems are favored for their sleek design and superior control but have a smaller market share compared to telescopic systems.

Dual Shocks, often seen in classic motorcycles, continue to have a niche following. Though they offer good performance, the market has shifted toward more advanced and cost-effective suspension solutions like telescopic front and mono-shock systems.

By Propulsion Type

ICE dominates with 87.7% share due to the prevalence of internal combustion engine vehicles in the market.

In 2024, Internal Combustion Engine (ICE) powered vehicles held a dominant market position in the By Propulsion Type segment of the Two Wheeler Suspension System Market, with a 87.7% share. ICE vehicles continue to dominate due to their established infrastructure, reliability, and lower cost relative to electric vehicles. Despite the growing trend toward electrification, ICE remains the most widely used propulsion type in the two-wheeler market.

The sub-segment Upto 150cc under ICE includes a variety of entry-level motorcycles, commonly used in emerging markets. These vehicles are popular for their affordability and fuel efficiency. As a result, this sub-segment holds a significant portion of the overall ICE-powered market.

The 151cc to 300cc category represents mid-range motorcycles, often chosen by commuters and performance enthusiasts. These bikes combine reasonable power and fuel efficiency, making them a popular choice. However, they still represent a smaller portion of the ICE market compared to lower and higher-capacity vehicles.

300cc to 500cc motorcycles are typically favored by performance-oriented riders and enthusiasts. While this sub-segment is growing, its market share remains small due to the dominance of smaller and larger displacement motorcycles.

Electric two-wheelers are gradually gaining ground due to environmental concerns and the growing availability of charging infrastructure. However, their market share remains limited compared to ICE-powered vehicles, as electric motorcycles are still relatively new and expensive.

By Vehicle Type

Motorcycles hold a dominant position with 58.9% due to their popularity as a versatile and efficient form of transportation.

In 2024, Motorcycles held a dominant market position in the By Vehicle Type segment of the Two Wheeler Suspension System Market, with a 58.9% share. The widespread use of motorcycles across various market segments, including commuting, leisure, and sport, drives their dominance. Motorcycles offer superior efficiency, longer range, and greater versatility compared to other vehicle types.

Scooters, while popular in certain regions, represent a smaller market share. Scooters are often preferred for urban commuting due to their ease of use and fuel efficiency. Although they are growing in popularity, they have yet to surpass motorcycles in overall market share.

Mopeds have a more niche role in the two-wheeler market, typically catering to lower-speed urban commuters. Their share remains small compared to motorcycles and scooters, driven by their limited functionality and lower demand in higher-capacity markets.

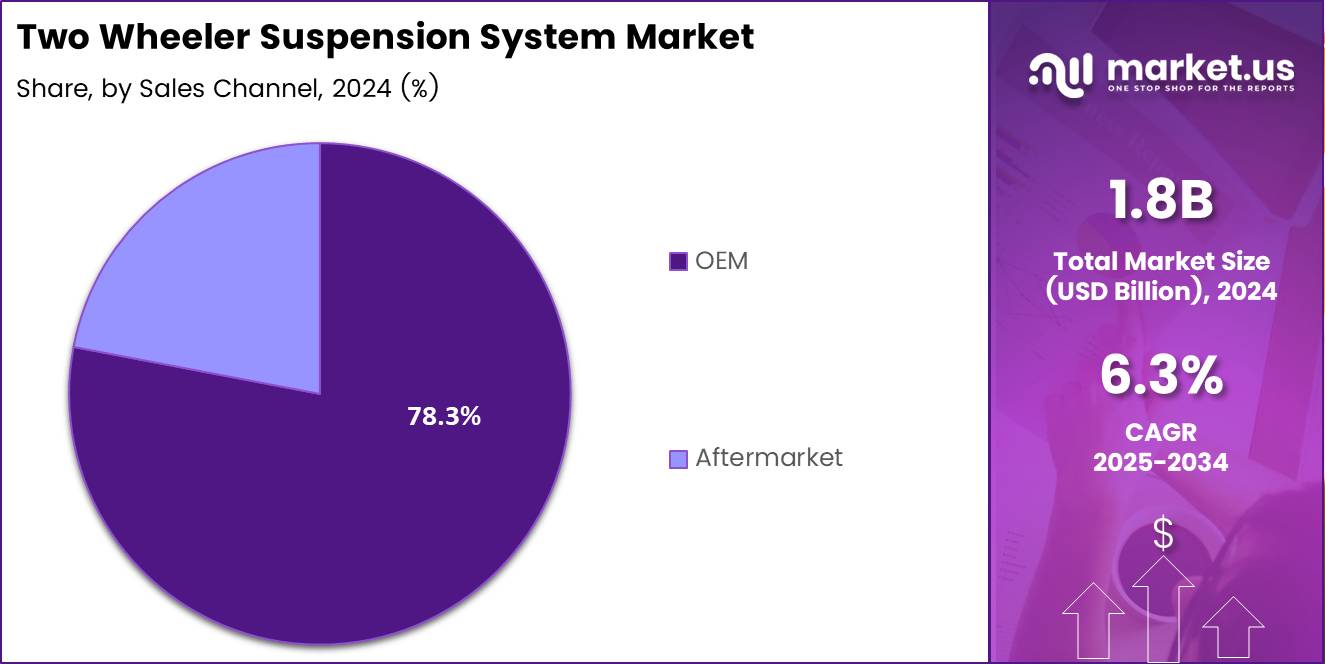

By Sales Channel

OEM dominates with 78.3% share due to the dominance of new vehicle sales.

In 2024, the Original Equipment Manufacturer (OEM) channel held a dominant market position in the By Sales Channel segment of the Two Wheeler Suspension System Market, with a 78.3% share. OEM sales dominate due to the higher volume of new vehicles sold compared to aftermarket parts. The direct integration of suspension systems into new vehicles gives OEM a clear advantage in terms of market penetration.

The Aftermarket sub-segment, while important for vehicle repairs and upgrades, holds a smaller market share. This segment’s growth is driven by consumers looking to replace or upgrade suspension components for better performance, particularly in the performance-oriented and off-road segments. However, its market share is limited compared to OEM products.

Key Market Segments

By Product Type

- Telescopic Front Suspension

- Rear Suspension

- Mono Shocks

- Dual Shocks

By Propulsion Type

- ICE

- Upto 150cc

- 151 cc to 300cc

- 300cc – 500cc

- Above 500cc

- Electric

By Vehicle Type

- Motorcycles

- Scooters

- Mopeds

By Sales Channel

- OEM

- Aftermarket

Drivers

Increasing Demand for Enhanced Comfort and Safety Drives Market Growth

The two-wheeler suspension system market is experiencing strong growth driven by rising consumer expectations for better riding experiences. Modern riders are increasingly seeking motorcycles and scooters that offer superior comfort during daily commutes and long-distance travel. This demand has pushed manufacturers to invest heavily in advanced suspension technologies.

The growing focus on safety features has become a major factor influencing purchasing decisions. Riders now understand that quality suspension systems directly impact vehicle stability, braking performance, and overall road handling. This awareness has created a strong market pull for premium suspension components.

Electric two-wheelers are gaining significant traction in urban markets, creating new opportunities for suspension manufacturers. These vehicles require specialized suspension systems to handle different weight distributions and power delivery characteristics compared to traditional combustion engines.

Technological improvements in suspension components have made advanced systems more accessible to mainstream consumers. Innovations in materials, manufacturing processes, and design have reduced costs while improving performance, making premium suspension features available across various price segments.

The emphasis on ride quality has become a key differentiator for motorcycle manufacturers. Companies are now using superior suspension systems as marketing points to attract customers who prioritize comfort and performance over basic transportation needs.

Restraints

Lack of Standardization in Suspension Technologies Creates Market Challenges

The two-wheeler suspension market faces significant challenges due to the absence of universal standards across different manufacturers and regions. This lack of standardization creates confusion among consumers and increases manufacturing complexity for component suppliers.

Different motorcycle brands use varying suspension specifications, making it difficult for aftermarket suppliers to develop universal solutions. This fragmentation leads to higher inventory costs and limits the availability of replacement parts in many markets, particularly in developing regions.

Environmental regulations are increasingly impacting material choices for suspension components. New restrictions on certain metals and manufacturing processes are forcing companies to redesign existing products, leading to increased development costs and potential supply chain disruptions.

The limited availability of quality aftermarket suspension parts restricts consumer options for upgrades and replacements. Many riders struggle to find compatible components for older motorcycle models, creating frustration and limiting market growth potential.

Regional variations in quality standards and testing requirements add complexity for global manufacturers. Companies must invest in multiple certification processes and adapt products for different markets, increasing overall costs and time-to-market for new suspension technologies.

Growth Factors

Expansion in Emerging Markets Creates Significant Growth Opportunities

Emerging markets present substantial growth opportunities for the two-wheeler suspension system industry. Rising disposable incomes in countries across Asia, Africa, and Latin America are driving demand for higher-quality motorcycles with advanced suspension features.

The integration of smart suspension systems represents a major technological opportunity. These systems can automatically adjust to road conditions, rider preferences, and load variations, offering superior performance and comfort. Early adopters are showing strong interest in these intelligent solutions.

The motorcycle racing and sports segment continues to expand globally, creating demand for high-performance suspension components. Professional racing requirements often drive technological innovations that eventually filter down to consumer products, benefiting the entire market.

Adventure travel and motorcycle tourism are growing rapidly, particularly among younger demographics. This trend is creating demand for specialized suspension systems designed for varied terrain and long-distance comfort, opening new market segments for manufacturers.

The increasing popularity of premium motorcycles in developing countries is creating opportunities for advanced suspension technologies. As consumers become more sophisticated, they are willing to pay for better performance and comfort features that were previously considered luxury items.

Emerging Trends

Development of Adaptive and Semi-Active Suspension Systems Shapes Market Trends

The development of adaptive and semi-active suspension systems is revolutionizing the two-wheeler market. These advanced systems use electronic controls to automatically adjust damping characteristics based on real-time riding conditions, offering unprecedented levels of performance and comfort.

Lightweight materials are becoming increasingly important in suspension design. Manufacturers are adopting carbon fiber, aluminum alloys, and advanced composites to reduce weight while maintaining strength and durability. This trend is driven by fuel efficiency requirements and performance considerations.

The concept of Suspension as a Service (SaaS) is gaining momentum in the aftermarket segment. This model allows riders to access premium suspension technologies through subscription services, making advanced features more affordable and accessible to a broader customer base.

Sustainability concerns are driving manufacturers toward eco-friendly manufacturing practices. Companies are investing in cleaner production processes, recyclable materials, and reduced packaging to meet environmental standards and consumer expectations for responsible manufacturing.

The integration of IoT technology in suspension systems is creating new possibilities for predictive maintenance and performance optimization. Smart sensors can monitor component wear, riding patterns, and system performance, providing valuable data for both manufacturers and riders.

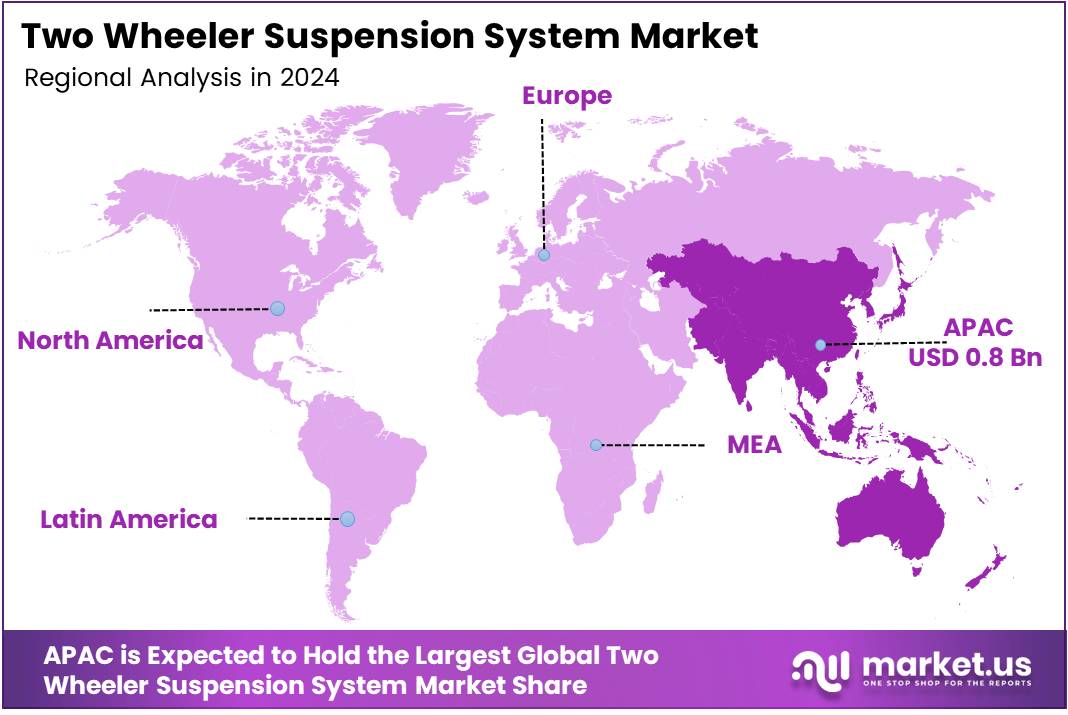

Regional Analysis

Asia-Pacific Dominates the Two Wheeler Suspension System Market with a Market Share of 47.7%, Valued at USD 0.8 Billion

In 2024, Asia-Pacific led the Two Wheeler Suspension System Market, accounting for 47.7% of the global market share. The region’s dominance is driven by the high production and sales of two-wheelers, especially in countries like China and Japan. The demand for advanced suspension systems is fueled by the increasing adoption of motorcycles and scooters in urban mobility solutions.

North America Two Wheeler Suspension System Market Trends

North America holds a significant position in the Two Wheeler Suspension System Market. The growing trend of recreational and sports biking, coupled with the rising preference for premium motorcycles, has spurred demand for high-performance suspension systems. The region is expected to see steady growth as technological advancements in suspension systems are increasingly integrated into newer models.

Europe Two Wheeler Suspension System Market Trends

Europe is a key market for Two Wheeler Suspension Systems, with an increasing shift towards electric motorcycles and scooters. The demand for efficient, lightweight suspension systems is growing due to the rise in eco-friendly transportation. Europe is projected to witness moderate growth due to stringent safety regulations and the growing trend of two-wheeler sports.

Latin America Two Wheeler Suspension System Market Trends

In Latin America, the Two Wheeler Suspension System Market is projected to grow steadily, driven by the growing popularity of motorcycles in countries like Brazil and Mexico. The demand is further enhanced by the region’s economic recovery, increased urbanization, and the affordability of two-wheelers as a preferred mode of transport.

Middle East and Africa Two Wheeler Suspension System Market Trends

The Middle East and Africa region has a developing market for two-wheeler suspension systems, driven by increasing adoption in urban transportation. The market is expected to grow modestly, with a focus on durable and cost-effective suspension systems suitable for diverse road conditions. The growing interest in motorcycling events also supports the market’s expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Two Wheeler Suspension System Company Insights

The global two-wheeler suspension system market in 2024 is characterized by the presence of several key players contributing to its growth and innovation.

Showa Corporation continues to be a significant player in the market, known for its advanced suspension technologies and strong partnerships with leading motorcycle manufacturers. Their commitment to research and development ensures the delivery of high-performance suspension systems.

Gabriel India Limited has established itself as a prominent supplier in the Indian market. With a focus on electric two-wheelers, the company has secured substantial orders from major OEMs and is expanding its presence in Europe. The emphasis on innovation and customer satisfaction positions it well for future growth.

KYB Corporation remains a global leader in suspension technology, offering a wide range of products for various vehicle types. Their dedication to quality and technological advancement has solidified their position in the market, catering to both OEMs and the aftermarket segment.

Duro Shox Pvt Ltd has made significant strides in the Indian market, focusing on providing reliable and cost-effective suspension solutions. Their strategic manufacturing facilities and commitment to quality have enabled them to cater to the growing demand for two-wheeler suspension systems in the region.

These companies, through their technological advancements and strategic initiatives, are shaping the landscape of the two-wheeler suspension system market in 2024.

Top Key Players in the Market

- Showa Corporation

- Gabriel India Limited

- KYB Corporation

- Duro Shox Pvt Ltd

- BMW Group

- WP AG

- Nitron Racing Shocks

- Marzocchi Moto

- Öhlins Racing

- K-Tech Suspension Limited

- ZF Friedrichshafen AG

Recent Developments

- In July 2025, SRAM acquired an Italian component manufacturer, expanding its portfolio and strengthening its position in the global cycling components market.

- In October 2024, Brembo acquired Öhlins, a leading manufacturer of premium suspension technology, enhancing Brembo’s capabilities in high-performance suspension systems for automotive and motorsport applications.

- In July 2024, Simple Energy, an Indian electric vehicle manufacturer, successfully raised $20 million in a Series A funding round to accelerate its electric vehicle production and expansion plans.

- In February 2024, Lit Motors, a U.S.-based electric vehicle startup, launched an equity crowdfunding campaign on Wefunder with a funding goal of $5 million to develop and scale its innovative electric vehicles.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Billion Forecast Revenue (2034) USD 3.3 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Telescopic Front Suspension, Rear Suspension, Mono Shocks, Dual Shocks), By Propulsion Type (ICE, Upto 150cc, 151 cc to 300cc, 300cc – 500cc, Above 500cc, Electric), By Vehicle Type (Motorcycles, Scooters, Mopeds), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Showa Corporation, Gabriel India Limited, KYB Corporation, Duro Shox Pvt Ltd, BMW Group, WP AG, Nitron Racing Shocks, Marzocchi Moto, Öhlins Racing, K-Tech Suspension Limited, ZF Friedrichshafen AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Two Wheeler Suspension System MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Two Wheeler Suspension System MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Showa Corporation

- Gabriel India Limited

- KYB Corporation

- Duro Shox Pvt Ltd

- BMW Group

- WP AG

- Nitron Racing Shocks

- Marzocchi Moto

- Öhlins Racing

- K-Tech Suspension Limited

- ZF Friedrichshafen AG