Global Turboexpander Market Size, Share, And Business Benefits By Product Type (Axial Flow, Radial Flow), By Power Capacity (Less than 20 MW, 20 MW to 40 MW, Above 40 MW), By Application (Hydrocarbon Turboexpanders, Air Separation Turboexpanders, Others), By End-User (Oil and Gas, Power Generation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153766

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

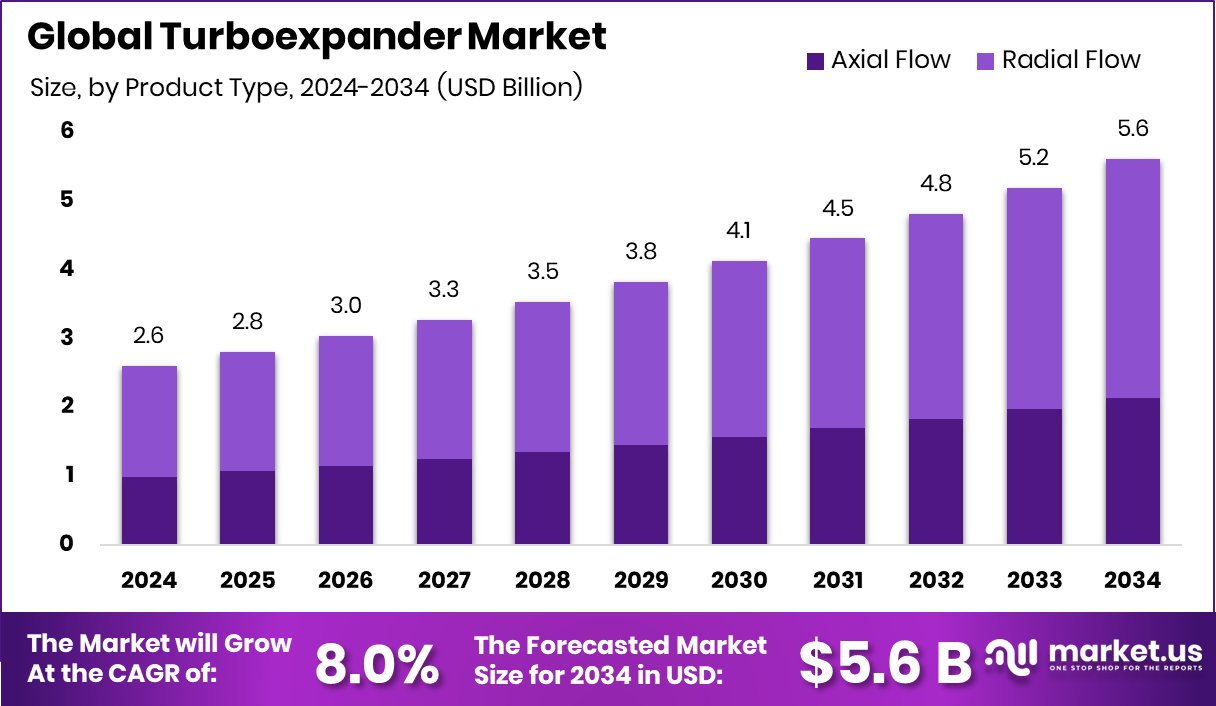

The Global Turboexpander Market is expected to be worth around USD 5.6 billion by 2034, up from USD 2.6 billion in 2024, and is projected to grow at a CAGR of 8.0% from 2025 to 2034. In 2024, the Asia-Pacific turboexpander market reached USD 1.1 Bn, leading globally.

A turboexpander is a high-speed, rotating mechanical device used to rapidly expand pressurized gas, converting thermal energy into mechanical energy. During the expansion process, the gas experiences a significant drop in temperature and pressure, which is often utilized in cryogenic applications such as natural gas liquefaction, air separation, and helium recovery.

The turboexpander market refers to the global industry focused on the manufacturing, installation, and servicing of these devices across various sectors, including energy, petrochemicals, industrial gases, and renewable applications. Growing demand for energy-efficient gas processing technologies, rising investments in LNG infrastructure, and expanding industrial gas applications are driving market expansion.

One of the major growth factors is the increasing deployment of natural gas processing and liquefaction units. Turboexpanders play a vital role in LNG plants by achieving the required low temperatures. Their ability to enhance energy recovery while minimizing carbon emissions supports wider adoption in modern gas facilities. According to an industry report, Cleantech startup Sapphire Technologies has secured $10 million in funding, with the raised capital intended to speed up the commercialization of its energy recovery systems focused on hydrogen and natural gas applications.

Demand for turboexpanders is also fueled by the growing need for industrial gas separation, especially in the production of oxygen, nitrogen, and argon. Sectors such as metallurgy, healthcare, and electronics rely on purified gases, and turboexpanders enable efficient cooling and expansion processes in air separation units.

Key Takeaways

- The Global Turboexpander Market is expected to be worth around USD 5.6 billion by 2034, up from USD 2.6 billion in 2024, and is projected to grow at a CAGR of 8.0% from 2025 to 2034.

- Radial flow turboexpanders dominate the Turboexpander Market, holding a strong 62.8% share in 2024.

- Turboexpanders with less than 20 MW capacity captured 50.2% and were favored for compact and industrial uses.

- Hydrocarbon turboexpanders lead the application segment with 59.7%, mainly used in natural gas processing plants.

- The oil and gas sector remains the top end-user in the Turboexpander Market, accounting for 67.1% share.

- Rapid industrial growth in Asia-Pacific drives turboexpander demand, capturing 43.90% market share.

By Product Type Analysis

Radial Flow dominates the Turboexpander Market with 62.8% market share.

In 2024, Radial Flow held a dominant market position in the By Product Type segment of the Turboexpander Market, with a 62.8% share. This strong positioning can be attributed to its high efficiency in handling moderate-to-high flow rates and its adaptability across a wide range of industrial applications.

Radial flow turboexpanders are particularly well-suited for cryogenic processes, where stable performance, compact design, and reliable energy recovery are critical. Their structural simplicity also enables easier maintenance, which further supports their widespread adoption in operationally demanding sectors such as gas processing and air separation.

The preference for radial flow configurations has been further supported by growing industrial demand for flexible and energy-efficient systems. As industries focus on reducing operational costs and enhancing process reliability, radial flow expanders continue to be the favored choice due to their favorable thermodynamic efficiency and durability under varying pressure conditions.

Additionally, their proven track record in long-term industrial operations adds to buyer confidence. With the ongoing expansion of gas-based infrastructure and the adoption of cleaner energy processes, the radial flow type is expected to maintain its leading share within the product type segment over the near term.

By Power Capacity Analysis

Less than 20 MW holds 50.2% of the Turboexpander capacity.

In 2024, Less than 20 MW held a dominant market position in the By Power Capacity segment of the Turboexpander Market, with a 50.2% share. This leadership reflects the growing demand for compact and flexible turboexpander systems suitable for small- to mid-scale industrial applications.

Turboexpanders in this capacity range are widely used in decentralized gas processing units, air separation plants, and energy recovery systems, where lower power requirements align with space and operational constraints.

The 50.2% share held by the Less than 20 MW segment indicates strong adoption in industries prioritizing energy efficiency and cost-effectiveness. These systems are valued for their ease of integration, quicker commissioning, and suitability for both new installations and retrofit projects. Their performance in enabling efficient gas expansion with minimal energy loss supports their continued preference across varied sectors.

Additionally, the segment’s prominence is reinforced by increasing demand for modular systems that offer scalability and operational flexibility. With industrial operators focusing on reducing carbon emissions and improving process efficiency, turboexpanders in this capacity range are viewed as a practical and strategic investment.

By Application Analysis

Hydrocarbon Turboexpanders lead applications with 59.7% market contribution.

In 2024, Hydrocarbon Turboexpanders held a dominant market position in the By Application segment of the Turboexpander Market, with a 59.7% share. This significant share is driven by their critical role in natural gas processing and hydrocarbon recovery systems, where efficient pressure reduction and energy recovery are essential. These turboexpanders are specifically engineered to handle hydrocarbons such as methane, ethane, and propane, making them highly suitable for gas plants, refineries, and petrochemical facilities.

The 59.7% market share reflects the widespread reliance on turboexpanders to enhance the performance of hydrocarbon-based operations. Their ability to deliver cryogenic cooling, reduce process energy costs, and increase throughput supports their adoption in both new and existing installations. Moreover, as global energy industries continue to prioritize the optimization of gas processing infrastructure, the demand for hydrocarbon turboexpanders remains strong.

Their proven operational reliability and efficiency in harsh environments further reinforce their dominance in this segment. With industry operators focusing on sustainable and cost-effective solutions, hydrocarbon turboexpanders remain essential assets for ensuring process efficiency and maximizing gas recovery.

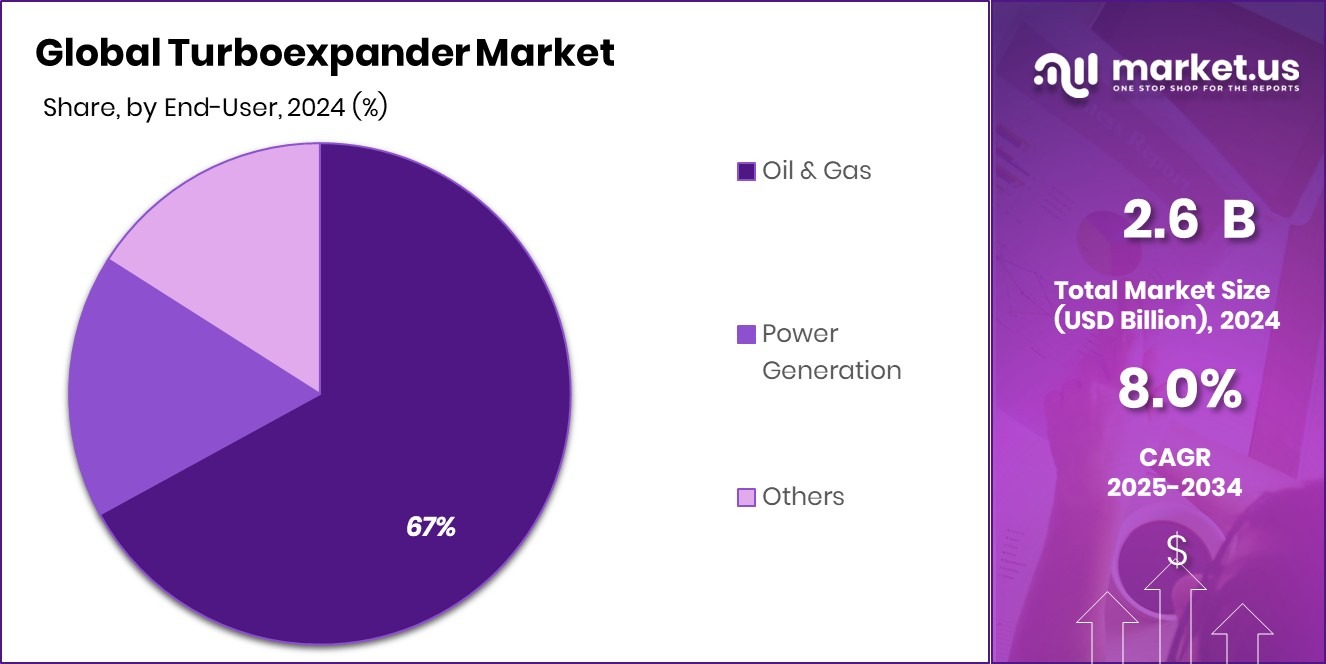

By End-User Analysis

Oil and Gas sector drives 67.1% of Turboexpander demand.

In 2024, Oil and Gas held a dominant market position in the By End-User segment of the Turboexpander Market, with a 67.1% share. This leading position reflects the extensive use of turboexpanders in upstream, midstream, and downstream operations across the oil and gas value chain. These systems are essential for natural gas processing, pressure let-down stations, and liquefied natural gas (LNG) facilities, where they enable efficient gas expansion, energy recovery, and cooling.

The 67.1% market share signifies the strong reliance of oil and gas operators on turboexpanders to optimize process performance and reduce operational costs. In particular, their role in cryogenic gas separation, where precise temperature control is required, underscores their importance in processing units.

The adoption of turboexpanders is also driven by the industry’s increasing focus on reducing carbon footprint while improving energy efficiency in refining and gas transport operations. Their durability, high thermal efficiency, and ability to handle aggressive gas compositions make them a suitable choice for demanding oil and gas environments.

Key Market Segments

By Product Type

- Axial Flow

- Radial Flow

By Power Capacity

- Less than 20 MW

- 20 MW to 40 MW

- Above 40 MW

By Application

- Hydrocarbon Turboexpanders

- Air Separation Turboexpanders

- Others

By End-User

- Oil and Gas

- Power Generation

- Others

Driving Factors

Rising Natural Gas Demand Boosts Turboexpander Installations

One of the main driving factors for the turboexpander market is the growing global demand for natural gas. As countries shift toward cleaner energy sources, natural gas is being widely adopted due to its lower carbon emissions compared to coal and oil. Turboexpanders are essential in gas processing plants, especially in liquefied natural gas (LNG) facilities, where they help cool and expand gas efficiently.

The increased construction of LNG terminals and pipeline infrastructure has led to higher adoption of turboexpanders. Their ability to recover energy while reducing pressure in gas systems makes them a critical component in improving operational efficiency. This ongoing energy transition continues to support market growth across both developed and developing regions.

Restraining Factors

High Installation Cost Limits Turboexpander Market Growth

A key restraining factor in the turboexpander market is the high installation and upfront cost. Turboexpanders are complex machines that require precise engineering, specialized materials, and advanced manufacturing. The total cost includes not only the equipment but also integration with existing systems, safety features, and skilled labor for installation.

For small and mid-sized operators, especially in developing regions, these expenses can be difficult to justify despite the long-term energy savings. Additionally, maintenance and operational costs over time can add to the financial burden. As a result, cost-sensitive industries may delay or avoid adopting turboexpanders, slowing down overall market expansion.

Growth Opportunity

Hydrogen Economy Expansion Creates New Turboexpander Demand

A major growth opportunity for the turboexpander market lies in the global expansion of the hydrogen economy. As industries and governments invest in clean energy solutions, hydrogen is gaining attention as a low-emission fuel for power generation, transportation, and industrial processes. Turboexpanders are used in hydrogen liquefaction and compression systems to cool and manage high-pressure gases efficiently.

With plans for large-scale green hydrogen plants and related infrastructure, the demand for advanced turboexpanders is expected to rise steadily. Their ability to support energy recovery and maintain process stability makes them ideal for hydrogen applications.

Latest Trends

Integration of Turboexpanders in Renewable Energy Systems

One of the latest trends in the turboexpander market is its growing use in renewable energy systems. As the world moves toward cleaner energy sources, turboexpanders are being adopted in applications such as geothermal power plants, waste heat recovery systems, and energy storage setups. These systems benefit from turboexpanders because they help convert excess pressure or heat into usable mechanical or electrical energy.

This trend reflects a shift from traditional oil and gas uses to more sustainable solutions. It also aligns with global efforts to improve energy efficiency and reduce carbon emissions. The ability of turboexpanders to support greener operations is driving innovation, making them a valuable part of future energy infrastructure across various industries.

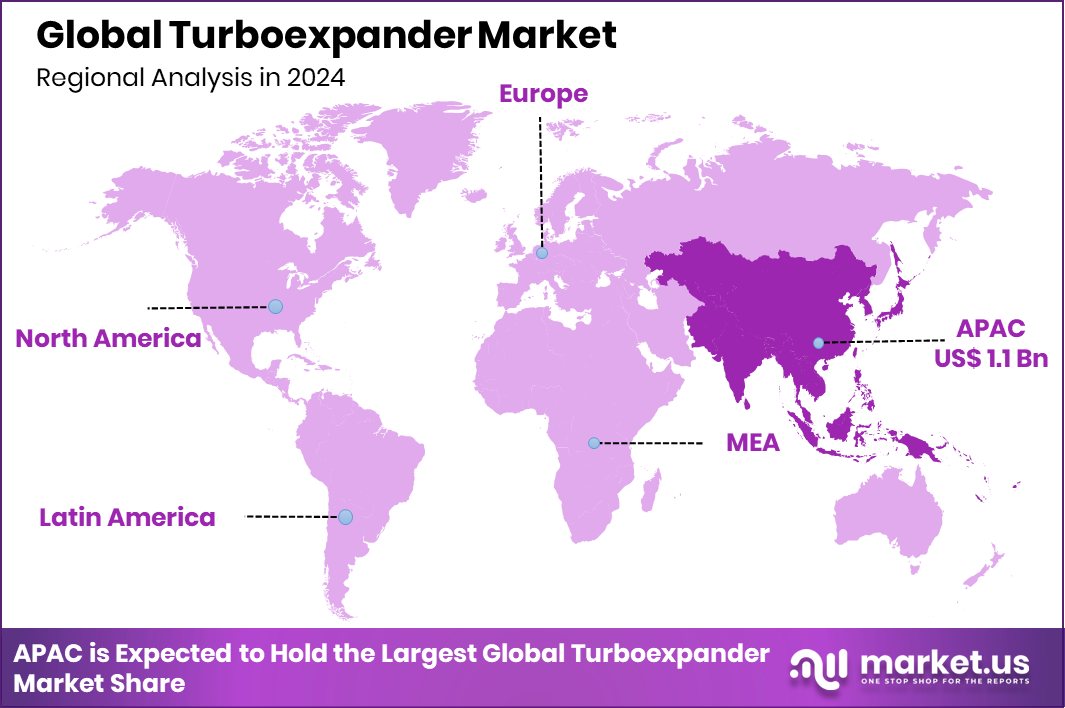

Regional Analysis

Asia-Pacific held the largest share in 2024 with 43.90%, worth USD 1.1 Bn.

In 2024, Asia-Pacific held a dominant position in the global turboexpander market, accounting for 43.90% of the total market share, valued at approximately USD 1.1 billion. The region’s leadership is primarily supported by rapid industrialization, expanding natural gas infrastructure, and increased investments in energy-efficient technologies.

Countries across Asia-Pacific have been witnessing robust growth in sectors such as petrochemicals, LNG processing, and industrial gas production, all of which rely heavily on turboexpanders for pressure management and energy recovery. The demand is further strengthened by government initiatives promoting cleaner energy and infrastructure modernization.

North America and Europe also represent significant regional markets, driven by well-established oil and gas sectors and ongoing upgrades in industrial facilities. However, they remain behind the Asia-Pacific in terms of market size.

Meanwhile, regions such as the Middle East & Africa and Latin America are showing steady progress, supported by increasing adoption of turboexpanders in gas processing and refining applications. Despite these developments, Asia-Pacific continues to lead the global market due to the sheer scale of ongoing energy projects and industrial expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Air Products and Chemicals Inc. has been acknowledged for its innovative approach to integration, offering systems designed for high energy recovery and optimized cryogenic performance. Its solutions are routinely specified in large-scale liquefied natural gas (LNG) projects, where efficiency and reliability are paramount.

Atlas Copco AB has demonstrated strength in modular turboexpander designs, focusing on ease of maintenance and reduced installation complexity. These attributes have made its turboexpander units a preferred choice in decentralized gas processing facilities and retrofit projects where operational flexibility and quick deployment are critical.

Baker Hughes Company has delivered robust turboexpander offerings tailored for industrial environments with stringent performance requirements. Their systems are engineered to operate under varying pressure and temperature conditions and to support enhanced energy efficiency in oil, gas, and chemical processing operations.

Top Key Players in the Market

- Air Products and Chemicals Inc.

- Atlas Copco AB

- Baker Hughes Company

- Cryostar SAS

- Chart Industries

- Man Energy

- Nikkiso ACD

- PBS Group, a. s.

- R&D Dynamics Corporation

- Siemens Energy (Siemens AG)

- Turbogaz

Recent Developments

- In June 2025, Atlas Copco Comptec LLC broke ground on a 63,000 sq ft expansion of its manufacturing facility in Voorheesville, New York, aimed at increasing production capacity for large integrally geared centrifugal compressors and turboexpanders. The expansion supports sectors such as oil & gas, hydrogen mobility, carbon capture, and energy storage, and is expected to be completed before the end of 2026.

- In July 2024, Air Products agreed to sell its liquefied natural gas (LNG) process technology and equipment business, including coil-wound heat exchanger (CWHE) technology integral to turboexpander systems, to Honeywell for $1.81 billion.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Billion Forecast Revenue (2034) USD 5.6 Billion CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Axial Flow, Radial Flow), By Power Capacity (Less than 20 MW, 20 MW to 40 MW, Above 40 MW), By Application (Hydrocarbon Turboexpanders, Air Separation Turboexpanders, Others), By End-User (Oil and Gas, Power Generation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Air Products and Chemicals Inc., Atlas Copco AB, Baker Hughes Company, Cryostar SAS, Chart Industries, Man Energy, Nikkiso ACD, PBS Group, a. s., R&D Dynamics Corporation, Siemens Energy (Siemens AG), Turbogaz Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Air Products and Chemicals Inc.

- Atlas Copco AB

- Baker Hughes Company

- Cryostar SAS

- Chart Industries

- Man Energy

- Nikkiso ACD

- PBS Group, a. s.

- R&D Dynamics Corporation

- Siemens Energy (Siemens AG)

- Turbogaz