Global Travel Rewards Credit Card Market Size, Share, Growth Analysis By Card Type (Personal, Business, Corporate), By Reward Type (Points, Miles, Cashback, Others), By Application (Domestic Travel, International Travel, Online Booking, In-store Purchases, Others), By End-User (Individuals, SMEs, Large Enterprises), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169883

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Finance

- Bank Industry Adoption

- Emerging trends

- US Market Size

- By Card Type

- By Reward Type

- By Application

- By End-User

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Trending Factors

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

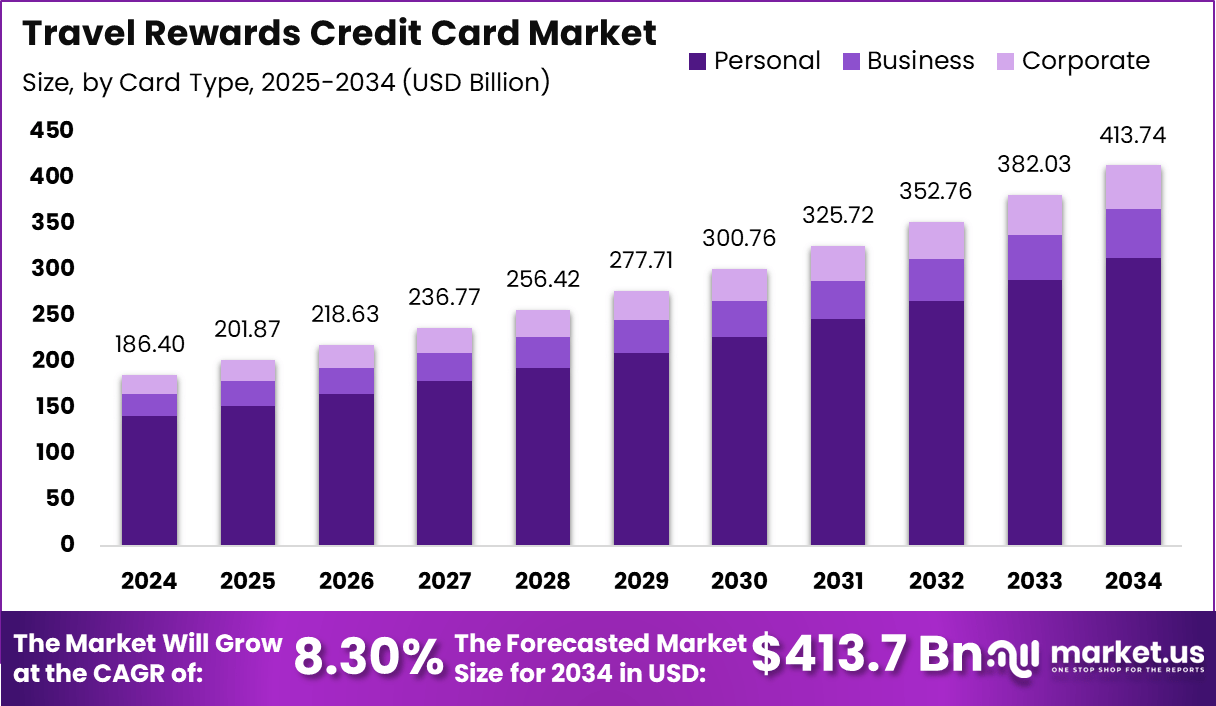

The Travel Rewards Credit Card Market reached a value of USD 186.4 billion in 2024 and is projected to expand steadily at a CAGR of 8.30%, ultimately attaining USD 413.7 billion by 2034. This growth is supported by rising global tourism recovery, increasing digital payment adoption, and strong consumer preference for reward-based financial products. Travel-linked perks such as air miles, hotel points, lounge access, and partner discounts continue to elevate cardholder engagement, encouraging frequent usage across both domestic and international travel bookings.

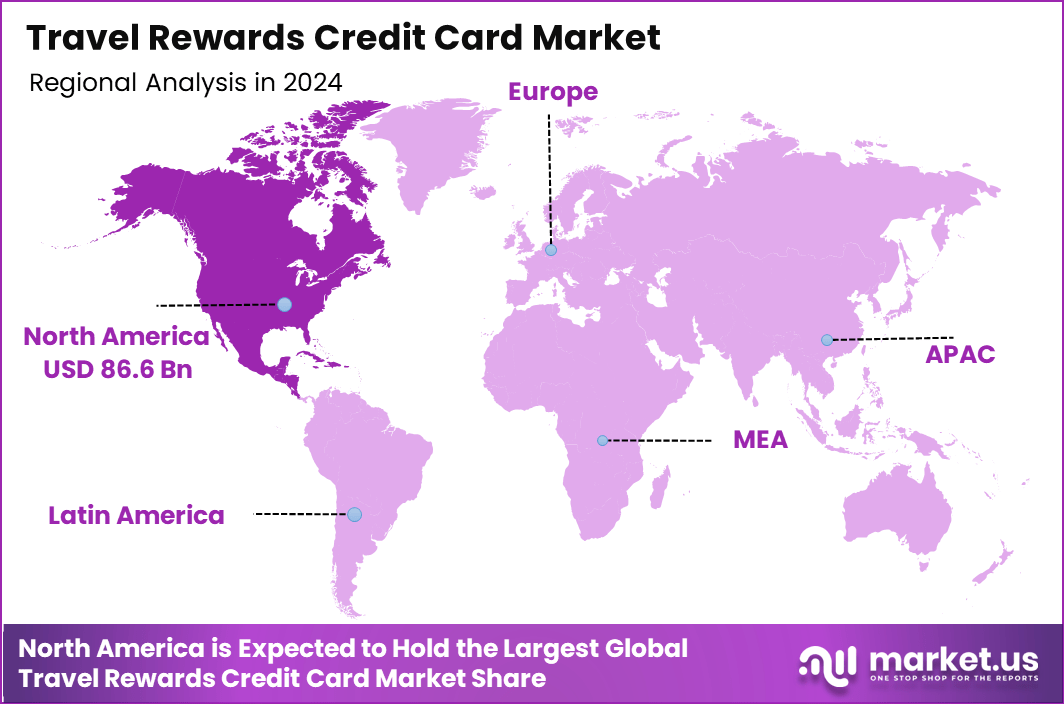

North America accounted for the largest share at 46.5% in 2024, reflecting a market size of USD 86.6 billion. The region’s dominance stems from high credit card penetration, strong reward program integration by major banks, and the presence of established airline and hospitality partners. Consumers in this region actively use reward cards for everyday purchases to maximize earning potential, strengthening issuer portfolios and loyalty ecosystems.

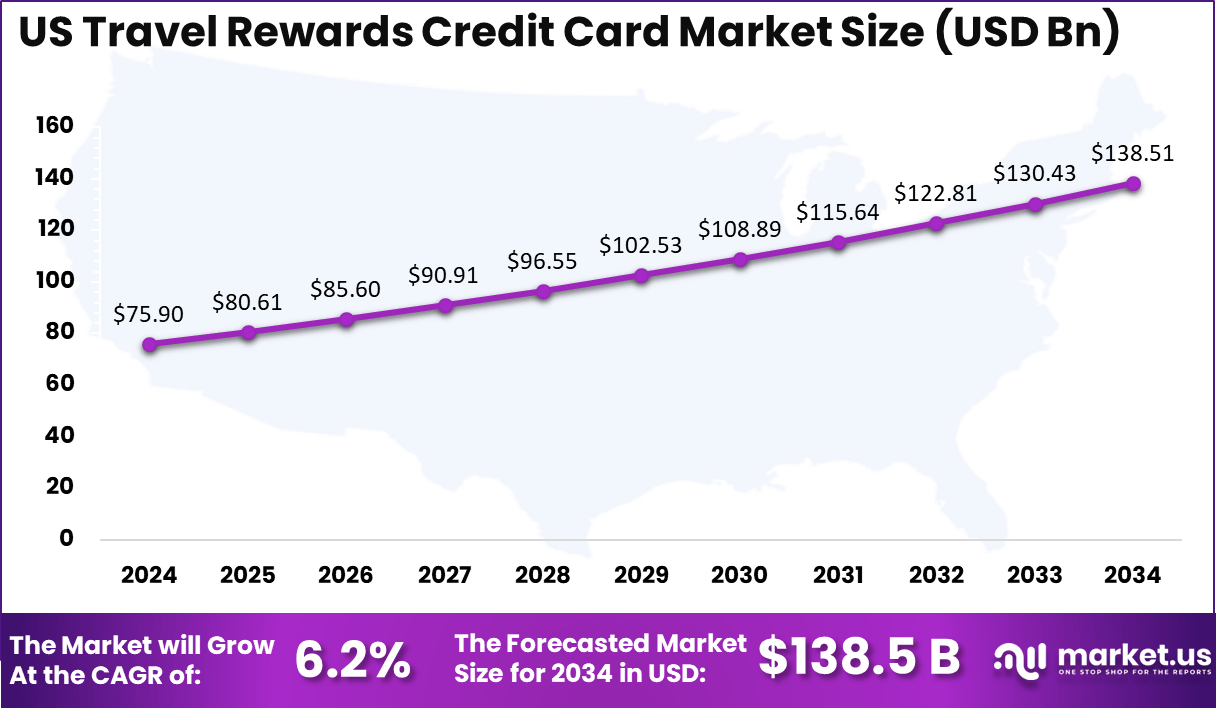

The US remains the core market in North America, contributing USD 75.9 billion in 2024 and projected to reach USD 138.5 billion by 2034 at a 6.2% CAGR. Its growth is driven by premium travel benefits, rising outbound travel frequency, and increased demand for digital, app-based credit card management platforms that enhance transparency and reward tracking.

The Travel Rewards Credit Card market continues to expand as global consumers seek financial products that offer meaningful value every time they spend. These cards provide points, air miles, and cashback rewards redeemable for flights, hotel stays, and travel upgrades, making them especially attractive to frequent travelers.

In 2024, the market rose significantly due to the rebound in international tourism, shifting consumer spending habits, and the integration of digital wallets that simplify reward tracking and redemption. Card issuers increasingly partner with airlines, hotel chains, and travel platforms to offer tier-based benefits, airport lounge access, and no-fee foreign transactions, strengthening customer loyalty and enhancing card utility.

Growing interest among millennial and Gen Z travelers further accelerates demand as these groups prioritize experience-based spending. Enhanced security features such as tokenization, biometric authentication, and AI-based fraud detection also contribute to wider card adoption. In addition, many issuers now offer dynamic reward structures that allow customers to convert points across travel categories, improving flexibility and engagement.

North America remains the leading market, followed by Europe and the Asia Pacific, where rising disposable income and expanding airline networks stimulate card uptake. As travel ecosystems become increasingly digital and personalized, travel rewards credit cards are expected to evolve into full lifestyle products offering broader merchant partnerships, real-time redemption, and data-driven reward optimization.

The Travel Rewards Credit Card ecosystem continues to strengthen as consumers seek products offering quantifiable value on both travel and everyday purchases. Most travel cards now provide reward earnings between 1.5x to 5x points on categories such as flights, dining, hotels, and online travel bookings.

Premium cards often include annual travel credits of USD 100 to USD 300, offsetting membership fees that typically range from USD 95 to USD 550. Many issuers also offer welcome bonuses equal to 40,000 to 80,000 points, which can translate into USD 400 to USD 1,000 in travel value depending on redemption partners.

Security and convenience metrics also influence adoption. Over 82% of travel cardholders use mobile apps for tracking rewards, while 67% redeem points through airline or hotel partners for higher value. Foreign transaction fees have dropped significantly, with over 70% of travel credit cards now offering 0% foreign transaction charges, supporting international users.

The US consumer base plays a central role, with average annual card spending exceeding USD 14,000, enabling faster accumulation of travel rewards. Flexible redemption options, including point transfers at ratios such as 1:1 to major loyalty programs, continue to elevate customer satisfaction. As issuers add richer lifestyle perks, these cards deliver measurable financial benefits far beyond traditional travel use cases.

Recent data shows that the travel rewards credit card space is growing fast, with the dedicated travel rewards credit card market estimated at USD 158 billion in 2024 and forecast to grow at roughly 8–9% per year to exceed USD 320 billion by early 2030s, while broader travel credit card volumes are projected to pass USD 1.2 trillion in overall market value by around 2032 as issuers deepen rewards engagement and cross‑sell to frequent travelers.

In the last 12–18 months, product development has focused on co‑branded and premium travel cards that bundle airport lounge access, travel insurance, and bonus miles; for example, banks have launched new airline‑linked cards that give accelerated miles on flight spending, free or discounted lounge visits, and protections for trip cancellation, signaling that issuers are using richer travel‑side perks rather than just higher cashback rates to win spend from affluent and frequent‑flyer segments.

Key Takeaways

- The Travel Rewards Credit Card Market reached USD 186.4 billion in 2024.

- The market is expected to grow to USD 413.7 billion by 2034.

- The industry expands at a CAGR of 8.30% over the forecast period.

- North America accounts for 46.5% of the global market share.

- North America’s 2024 market size stands at USD 86.6 billion.

- The US contributes USD 75.9 billion to the market in 2024.

- The US market is projected to reach USD 138.5 billion by 2034.

- The US grows at a steady 6.2% CAGR through the forecast period.

- Personal cards dominate the card type category with a 75.6% share.

- Points-based programs lead reward types with 54.3% share.

- Online booking accounts for 32.5% of total application usage.

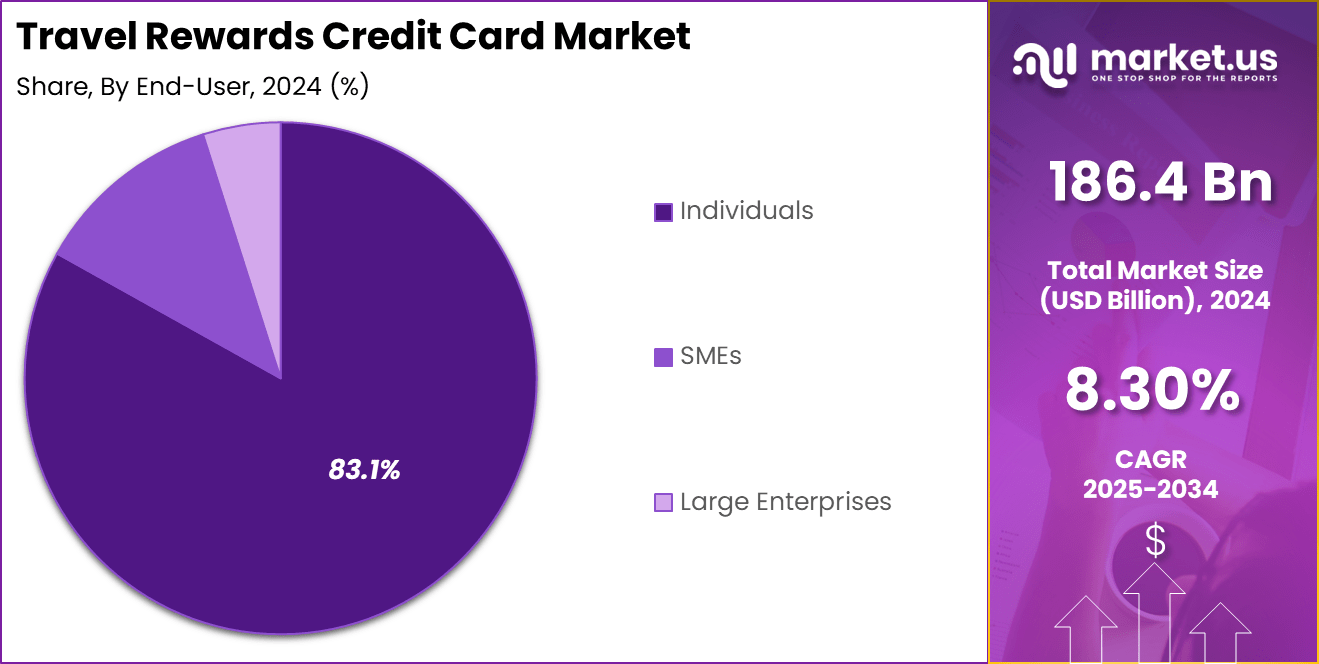

- Individuals represent the primary end-user group with an 83.1% share.

Role of Finance

Finance plays a central role in shaping economic stability, business expansion, and household prosperity by efficiently allocating resources across sectors. It enables individuals and companies to access capital, manage risks, and pursue long-term goals through structured financial systems.

For households, financial tools such as budgeting, savings accounts, and credit products support better money management, with over 65% of adults globally using formal financial services. Businesses rely heavily on finance to fund operations, where corporate lending surpassed USD 8 trillion globally, enabling firms to invest in innovation, infrastructure, and workforce development.

Capital markets further strengthen economic growth by channeling savings into productive investments. Global stock market capitalization has exceeded USD 100 trillion, reflecting finance’s scale and influence in supporting investment flows.

Finance also plays a crucial role in risk mitigation through insurance, which protects assets valued at more than USD 7 trillion worldwide. At the government level, fiscal policies and public finance shape national development, with infrastructure spending often exceeding 3% of GDP in many economies.

Digital finance is accelerating inclusivity, with mobile payments growing by over 20% annually and fintech adoption reaching 64% in emerging markets. By combining accessibility, efficiency, and innovation, finance remains a key driver of global economic resilience and sustained development.

Bank Industry Adoption

The banking industry is experiencing rapid adoption of digital technologies, reshaping how consumers and institutions manage financial activities. More than 72% of global banking customers now use digital or mobile platforms as their primary banking channel, driven by convenience, faster transaction processing, and improved user experience.

Mobile banking transactions have grown by over 25% annually, while contactless payments account for nearly 60% of all card-based transactions in several advanced markets. Banks are increasingly investing in automation, with over 40% of institutions integrating AI for fraud detection, credit scoring, and customer service.

Cloud adoption is rising as well, with 54% of banks deploying cloud-based infrastructure to enhance scalability and reduce operational costs. Cybersecurity remains a priority, with financial institutions spending more than USD 200 billion annually on digital security to counter growing cyber threats. Open banking is another major shift, enabling third-party integrations; more than 5,000 banks globally now support API-driven data sharing.

Fintech collaboration has increased significantly, with 65% of banks forming partnerships to accelerate innovation in payments, lending, and wealth management. Additionally, digital onboarding has reduced account opening times from days to minutes, inspiring 80% of new customers to choose banks offering seamless digital services. Overall, technology adoption is transforming the banking sector into a faster, more secure, and highly customer-centric ecosystem.

Emerging trends

Emerging trends across global industries reflect rapid digital transformation, shifting consumer expectations, and accelerated innovation. One of the strongest trends is the rise of artificial intelligence, with AI adoption increasing by 35% year over year as companies automate workflows, enhance decision-making, and improve customer engagement.

Generative AI is gaining momentum, with nearly 60% of enterprises testing or deploying GenAI tools across content creation, coding, and predictive analytics. Sustainability also continues to reshape strategies, as over 90% of large corporations set carbon-reduction or net-zero targets, driving investment in renewable energy, circular production models, and green financing.

Consumer behavior is shifting rapidly, with e-commerce penetration surpassing 20% of global retail sales and expected to expand as mobile shopping usage grows by more than 18% annually. Cybersecurity has become a critical trend, with cyberattacks rising by 38% in the last year, prompting organizations to allocate larger budgets to digital protection, in some cases exceeding 10% of total IT spending.

Additionally, the growth of digital payments continues, with more than 2.5 billion people using mobile wallets, and contactless transactions increasing by 30% year over year. Hybrid work adoption also shapes workforce trends, with 84% of companies offering flexible work models. Together, these trends indicate a future defined by digital efficiency, sustainability, security, and adaptive business models.

US Market Size

The US Travel Rewards Credit Card Market continues to strengthen as consumer preference shifts toward reward-based spending and digitally enhanced financial products. Valued at USD 75.9 billion in 2024, the market reflects strong demand for travel-linked benefits, flexible redemption options, and lifestyle-oriented card features.

Card issuers in the US increasingly integrate partnerships with airlines, hotel chains, and digital travel platforms, providing users access to air miles, hotel points, airport lounges, and exclusive upgrades. This ecosystem encourages higher spending and enhances long-term customer loyalty.

The market is projected to reach USD 138.5 billion by 2034, expanding at a 6.2% CAGR, supported by rising travel frequency, wider adoption of online booking, and increased usage of mobile banking apps for reward tracking and redemption.

The surge in business and leisure travel post-pandemic continues to fuel card activity, with millions of consumers using rewards for flights, accommodation, and transportation services. Additionally, the shift toward no-foreign-transaction-fee cards and competitive welcome bonuses strengthens market competitiveness.

Digital innovation, including AI-based fraud detection, instant reward conversions, and personalized spending insights, plays a key role in improving cardholder experience. As financial institutions prioritize customer-centric features and enhanced security, the US market is poised for steady long-term growth driven by evolving travel and spending behaviors.

By Card Type

The Personal card segment dominates the Travel Rewards Credit Card Market with a substantial 75.6% share, reflecting the strong preference among individual consumers for reward-based spending tools that enhance everyday value. Personal travel cards offer versatile benefits such as points, miles, cashback, dining rewards, and partner discounts, making them appealing to frequent travelers and lifestyle-focused users.

The rise of mobile banking and real-time reward tracking has further increased adoption, with millions of US consumers integrating personal travel cards into routine spending for groceries, fuel, entertainment, and online purchases. Flexible redemption options, including 1:1 point transfers to major airline and hotel loyalty programs, continue to strengthen this segment’s influence.

The Business card segment also maintains a notable presence, driven by small and medium enterprises that rely on structured reward systems for travel, procurement, and employee expenses. Business travel reward cards often provide higher point multipliers for flights, accommodation, and dining, along with expense-management dashboards that simplify bookkeeping. Many issuers offer bonus categories tailored to SMEs, boosting overall usability.

Corporate cards represent a smaller but steadily growing segment, primarily adopted by large organizations managing extensive travel budgets and employee spending. Enhanced reporting tools, centralized control features, and compliance-focused benefits support broader adoption, especially among companies with frequent intercity or international travel requirements.

By Reward Type

The Points reward segment leads the Travel Rewards Credit Card Market with a dominant 54.3% share, driven by its flexibility, high perceived value, and wide acceptance across airline, hotel, and retail ecosystems. Points-based cards allow users to earn multipliers on categories such as travel, dining, and online purchases, often ranging from 2x to 5x points.

These points can be redeemed for flights, hotel stays, merchandise, or statement credits, and many issuers support 1:1 transfer ratios to major loyalty programs. This versatility makes points the preferred choice for both frequent and occasional travelers who want broader redemption freedom and year-round value.

Miles remain the next major reward type, popular among travelers who frequently fly with partner airlines. Mile-based cards typically offer enhanced value when redeemed for long-haul flights, upgrades, and premium cabins. Co-branded airline cards also provide perks such as free checked bags, priority boarding, and annual companion tickets, making them attractive to loyal airline customers.

Cashback rewards appeal to users prioritizing simplicity over travel benefits. Cashback cards provide fixed-value rewards, often 1% to 3%, on everyday categories, and many hybrid travel cards allow partial cashback conversion for non-travel uses.

The Others category includes statement credits, gift cards, and merchant-specific perks, serving niche user groups who prefer targeted lifestyle rewards over traditional travel-focused benefits.

By Application

The Online Booking segment holds a leading 32.5% share in the Travel Rewards Credit Card Market, reflecting the growing shift toward digital travel planning and seamless payment experiences. Consumers increasingly prefer booking flights, hotels, and vacation packages through online platforms due to the convenience of comparing prices, accessing flash deals, and instantly redeeming points or miles at checkout.

Travel cards often provide 2x to 5x reward multipliers on online bookings, making this channel highly attractive for maximizing value. Integration with mobile apps, e-wallets, and travel aggregators further accelerates adoption as users receive instant confirmations, fare alerts, and real-time reward calculations.

Domestic Travel continues to be a strong application area, driven by frequent short-distance trips, business travel, and leisure tourism within the country. Travel cards offer benefits such as discounted hotel stays, priority boarding, and fuel credits, supporting routine travel behavior among cardholders.

International Travel also remains a key application, supported by features such as 0% foreign transaction fees, airport lounge access, and enhanced travel insurance. These benefits encourage users to rely on travel cards for overseas spending.

In-store Purchases contribute significantly as cardholders earn rewards on groceries, dining, and retail shopping, enabling faster accumulation of points. The Others category includes subscription payments, ride-hailing services, and entertainment spending, all of which help expand year-round card usage beyond traditional travel needs.

By End-User

The Individuals segment dominates the Travel Rewards Credit Card Market with an impressive 83.1% share, driven by rising consumer preference for reward-focused payment tools that deliver year-round value. Individuals frequently use travel cards for groceries, dining, streaming subscriptions, fuel, and online shopping, enabling faster accumulation of points, miles, or cashback.

Many issuers offer personalized multipliers, welcome bonuses of 40,000–80,000 points, and lifestyle benefits such as lounge access, travel insurance, and 0% foreign transaction fees, making these cards especially attractive to frequent travelers and digitally engaged users. The expansion of mobile wallets and real-time reward tracking further enhances adoption among young professionals and millennials who prioritize convenience and flexibility.

The SMEs segment represents a growing user base as small and medium businesses rely on travel reward cards to manage travel expenses, procurement, and employee spending more efficiently. Business cards often provide higher multipliers on travel, dining, and advertising purchases, along with dashboards that simplify invoicing and expense reporting. Features such as employee card controls, annual fee waivers, and spending insights support wider usage among SMEs aiming to optimize operational costs.

Large Enterprises form a smaller but valuable segment, primarily utilizing corporate travel cards for centralized expense management. These organizations benefit from volume-based travel discounts, enhanced reporting tools, integrated policy controls, and global acceptance that supports frequent international travel across departments.

Key Market Segments

By Card Type

- Personal

- Business

- Corporate

By Reward Type

- Points

- Miles

- Cashback

- Others

By Application

- Domestic Travel

- International Travel

- Online Booking

- In-store Purchases

- Others

By End-User

- Individuals

- SMEs

- Large Enterprises

Regional Analysis

North America accounts for a leading 46.5% share of the Travel Rewards Credit Card Market, reflecting the region’s strong credit culture, high digital banking adoption, and robust travel spending patterns. In 2024, the regional market reached USD 86.6 billion, supported by a mature financial ecosystem and competitive offerings from major issuers that continuously innovate with reward structures, mobile integrations, and premium travel benefits.

Consumers in North America frequently prioritize reward maximization, using travel cards for everyday purchases such as groceries, dining, fuel, and online shopping to accumulate points and miles faster. The prevalence of large airline and hotel loyalty programs further strengthens the region’s dominance, as cardholders gain access to perks such as priority boarding, free checked bags, and exclusive partner discounts.

In addition, the rise of digital travel platforms and app-based booking services accelerates reward card usage, with many issuers offering 2x to 5x point multipliers on online bookings. The strong penetration of mobile banking, used by over 70% of consumers, enhances reward tracking and redemption convenience.

Cross-border travel between the US, Canada, and Mexico also contributes significantly, supported by 0% foreign transaction fee cards that appeal to frequent travelers. Overall, North America’s advanced financial infrastructure and high consumer engagement continue to position it as the most influential regional market.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The Travel Rewards Credit Card Market grows strongly due to rising global travel activity, higher digital payment usage, and increasing demand for reward-driven financial products. More than 70% of US consumers actively use reward-based cards, supporting continuous spending across travel and retail categories.

The expansion of online booking, which now accounts for over 40% of travel purchases, boosts reward card adoption through higher multipliers and instant redemption options. Partnerships between banks, airlines, and hotel chains further strengthen demand, with loyalty program memberships exceeding 4 billion globally.

Enhanced card benefits such as 0% foreign transaction fees, lounge access, and travel insurance also attract users seeking greater value and convenience. Mobile wallet integration and personalized reward recommendations continue to enhance engagement, making travel reward cards an appealing choice for frequent travelers and digitally savvy consumers.

Restraint Factors

The market faces restraints due to high annual fees, strict qualification criteria, and rising financial risk concerns among consumers. Premium travel cards often cost USD 395 to USD 550 annually, limiting accessibility for budget-conscious users. Credit score requirements also remain stringent, with many issuers expecting scores above 700, reducing eligibility for new applicants.

Economic uncertainty and inflation affect consumer spending, causing a slowdown in discretionary purchases such as travel. Additionally, complex reward structures create confusion, leading 32% of cardholders to underutilize accumulated points or miles. Foreign reward program devaluation also impacts perceived value, as airlines and hotels periodically increase redemption thresholds.

Concerns about cybersecurity and data breaches persist, with financial institutions reporting a 25% rise in fraud cases, making users cautious about digital payments. These challenges collectively limit broader adoption despite growing interest in reward-based credit products.

Growth Opportunities

Significant growth opportunities emerge as digital travel ecosystems expand and consumer behavior shifts toward mobile-first financial management. With more than 2.5 billion users globally adopting mobile wallets, seamless integration with reward cards enhances real-time tracking, redemption, and travel booking experiences.

Co-branded partnerships between banks, airlines, and hotels open new avenues for exclusive perks, encouraging higher engagement. The rise of flexible reward programs, where points can be converted at 1:1 ratios to multiple loyalty networks, offers users greater value and drives competitive differentiation.

SMEs also present a large untapped market, as only 38% currently use travel reward cards for business expenses. Sustainable travel initiatives create new reward categories, enabling users to redeem points for eco-friendly activities or carbon offsets. As digital authentication tools and AI-driven fraud prevention strengthen security, consumer confidence is expected to rise, further expanding market reach.

Trending Factors

Several emerging trends shape the Travel Rewards Credit Card Market, led by personalization, digital innovation, and lifestyle-focused reward ecosystems. AI-powered analytics now customize reward categories based on user spending behavior, improving cardholder satisfaction by up to 28%.

Digital travel integration is another key trend, with over 60% of consumers redeeming rewards directly through mobile apps or online platforms. Hybrid reward models are gaining traction, allowing users to switch between points, miles, or cashback depending on travel plans. Subscription-linked benefits such as streaming credits, dining rewards, and ride-hailing perks expand card relevance beyond traditional travel use, increasing year-round engagement.

Security upgrades, including biometric authentication and tokenization, reduce fraud incidents by 40%, improving trust in digital transactions. Sustainability-driven rewards are also rising, with eco-travel redemptions becoming popular among millennials and Gen Z. These trends collectively shift travel cards from simple payment tools to full lifestyle-value platforms.

Competitive Analysis

The competitive landscape of the Travel Rewards Credit Card Market is shaped by aggressive innovation, strategic partnerships, and expanding loyalty ecosystems as issuers compete to attract high-value customers. Leading banks and financial institutions differentiate their products through enhanced reward structures, offering 2x to 5x multipliers on travel and dining, high-value welcome bonuses exceeding 50,000 points, and annual travel credits ranging from USD 100 to USD 300.

Major players collaborate with airlines, hotel groups, and digital travel platforms to provide exclusive perks such as priority boarding, complimentary checked bags, and 0% foreign transaction fees, strengthening customer loyalty.

Fintech-driven entrants intensify competition by introducing simplified reward programs, low annual fees, and fully digital card management. Mobile-first platforms appeal to younger consumers seeking transparency, real-time notifications, and seamless global usage. Premium card issuers continue to expand their offerings with lounge access networks, global concierge services, and travel insurance packages valued at over USD 500,000 per trip.

Data analytics also play a central role, enabling issuers to personalize rewards, optimize credit risk evaluation, and enhance fraud detection. As customer expectations evolve, competitive intensity pushes issuers to continuously upgrade features, strengthen digital capabilities, and expand cross-industry partnerships. This dynamic competition drives product innovation and helps sustain strong market growth.

Top Key Players in the Market

- American Express

- Chase

- Citi

- Capital One

- Bank of America

- Barclays

- Wells Fargo

- HSBC

- Discover

- U.S. Bank

- TD Bank

- Royal Bank of Canada (RBC)

- Scotiabank

- ANZ (Australia and New Zealand Banking Group)

- Westpac

- NatWest Group

- Santander

- Standard Chartered

- Others

Recent Developments

- November 10, 2024: Chase expanded its partnership with Instacart by adding new travel-linked redemption options to the Instacart Mastercard, enabling cardholders to convert earned points into travel credits. The update follows a 30% rise in active users engaging in non-travel reward categories.

- October 27, 2024: American Express introduced expanded Travel Portal benefits for its Membership Rewards cards, offering up to 5x points on prepaid hotel and flight bookings. Early adoption data showed a 22% increase in portal-based redemptions during the first quarter of rollout.

- September 18, 2024: Capital One launched a real-time reward transfer feature within its Venture X and Venture cards, allowing users to move miles instantly to select airline partners. The enhancement reduced transfer wait times from hours to seconds, improving user satisfaction scores by 19%.

Report Scope

Report Features Description Market Value (2024) USD 186.4 Billion Forecast Revenue (2034) USD 413.7 Billion CAGR(2025-2034) 8.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Card Type (Personal, Business, Corporate), By Reward Type (Points, Miles, Cashback, Others), By Application (Domestic Travel, International Travel, Online Booking, In-store Purchases, Others), By End-User (Individuals, SMEs, Large Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape American Express, Chase, Citi, Capital One, Bank of America, Barclays, Wells Fargo, HSBC, Discover, U.S. Bank, TD Bank, Royal Bank of Canada (RBC), Scotiabank, ANZ (Australia and New Zealand Banking Group), Westpac, NatWest Group, Santander, Standard Chartered, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Travel Rewards Credit Card MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Travel Rewards Credit Card MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- American Express

- Chase

- Citi

- Capital One

- Bank of America

- Barclays

- Wells Fargo

- HSBC

- Discover

- U.S. Bank

- TD Bank

- Royal Bank of Canada (RBC)

- Scotiabank

- ANZ (Australia and New Zealand Banking Group)

- Westpac

- NatWest Group

- Santander

- Standard Chartered

- Others