Global Travel Now Pay Later Services Market Based on Type (Leisure, Business, Adventure, Family Travel, Other Types), Based on Destination (Domestic, International), Based on the Payment Plan (Installment Plan, Deferred Payment Plan, Other Payment Plans), Based on the Distribution Channel (Travel Agencies, Airlines, Hotels, Tour Operators, Other Distribution Channel), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 102848

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Based on Type Analysis

- Based on Destination Analysis

- Based on the Payment Plan Analysis

- Based on the Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

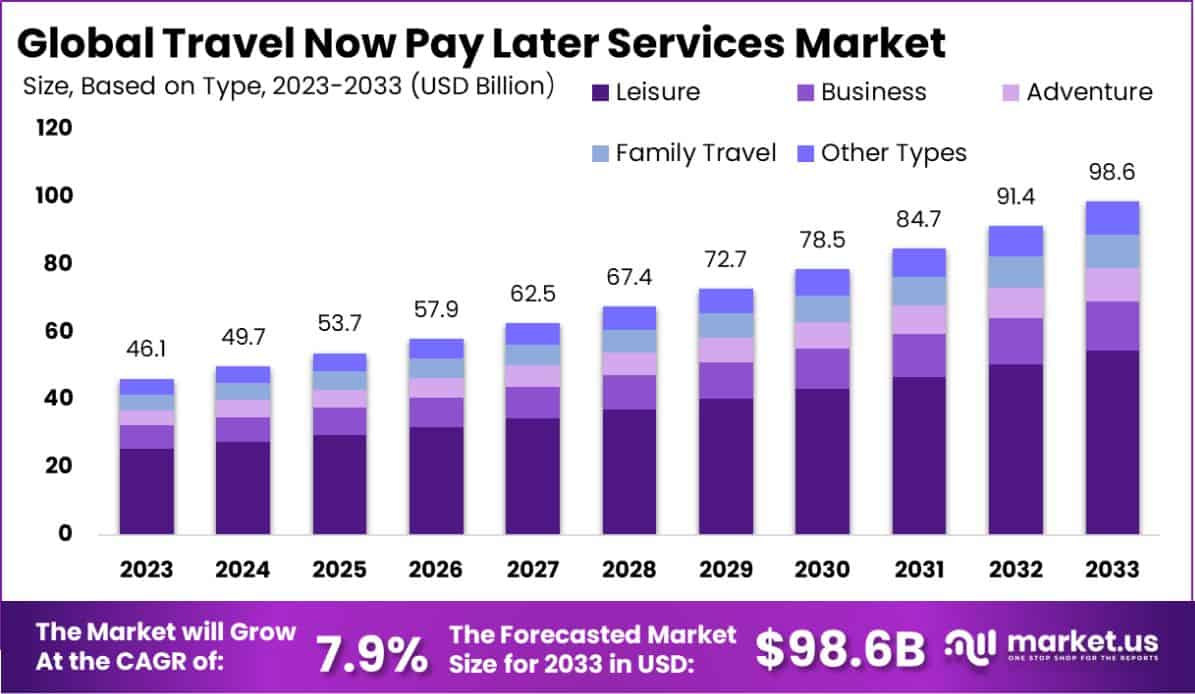

The Global Travel Now Pay Later Services Market is expected to be worth around USD 98.6 billion by 2033, up from USD 46.1 billion in 2023, growing at a CAGR of 7.9% during the forecast period from 2024 to 2033.

Travel Now Pay Later services are financial solutions that allow travelers to book and enjoy trips immediately while paying for them over time. These services offer flexible payment plans, often without interest, enabling consumers to manage their travel budgets better without upfront costs.

The Travel Now Pay Later Services Market refers to the industry surrounding the provision of deferred payment options for travel-related expenses. This market has grown as more consumers seek flexible and accessible ways to finance their travel experiences, supported by digital platforms that integrate seamlessly with travel booking systems.

The market’s growth is propelled by the increasing adoption of digital payment solutions and a rising preference for managing financial commitments without restricting travel desires. Enhanced consumer confidence in installment payment facilities also contributes significantly to market expansion.

Demand in this market is driven by millennials and Gen Z travelers, who value experiences over material goods but often require financial flexibility. Economic uncertainties and the appeal of managing cash flow more effectively also boost demand for such services, as travelers can spread out expenses over time.

There is substantial opportunity for expansion into emerging markets where credit systems are less established but digital and mobile penetration is high. Partnerships with major travel agencies and airlines offer avenues for growth, as well as the integration of loyalty rewards programs that encourage repeat usage of financing options.

The Travel Now Pay Later (TNPL) services market has emerged as a significant financial tool in the tourism industry, facilitating spontaneous travel experiences without the immediate burden of expenditure. Such services have capitalized on the consumer shift towards flexible payment solutions, especially during periods of economic fluctuation where upfront cash flow may be limited.

According to a recent Bankrate survey, 39% of U.S. adults have utilized Buy Now, Pay Later (BNPL) schemes at checkout, reflecting a robust adoption rate within consumer financial behavior. However, the rapid uptake of TNPL services is not without its challenges.

The same survey indicates that 56% of BNPL users have encountered difficulties, including overspending and missing payments, highlighting potential risks associated with these financial products.

This backdrop of consumer enthusiasm tempered by financial prudence presents a nuanced landscape for TNPL providers. As they navigate through these market dynamics, providers must address these challenges by enhancing consumer awareness and integrating stricter spending controls to maintain a sustainable growth trajectory in the TNPL market sector.

Key Takeaways

- The Global Travel Now Pay Later Services Market is expected to be worth around USD 98.6 billion by 2033, up from USD 46.1 billion in 2023, growing at a CAGR of 7.9% during the forecast period from 2024 to 2033.

- In 2023, Leisure held a dominant market position in the Based on Type segment of Travel Now Pay Later Services Market, with a 55.3% share.

- In 2023, International held a dominant market position in the Based on Destination segment of Travel Now Pay Later Services Market, with a 65.1% share.

- In 2023, Installment Plans held a dominant market position in Based on the Payment Plan segment of the Travel Now Pay Later Services Market, with a 52.4% share.

- In 2023, Travel Agencies held a dominant market position Based on the Distribution Channel segment of Travel Now Pay Later Services Market, with a 33.3% share.

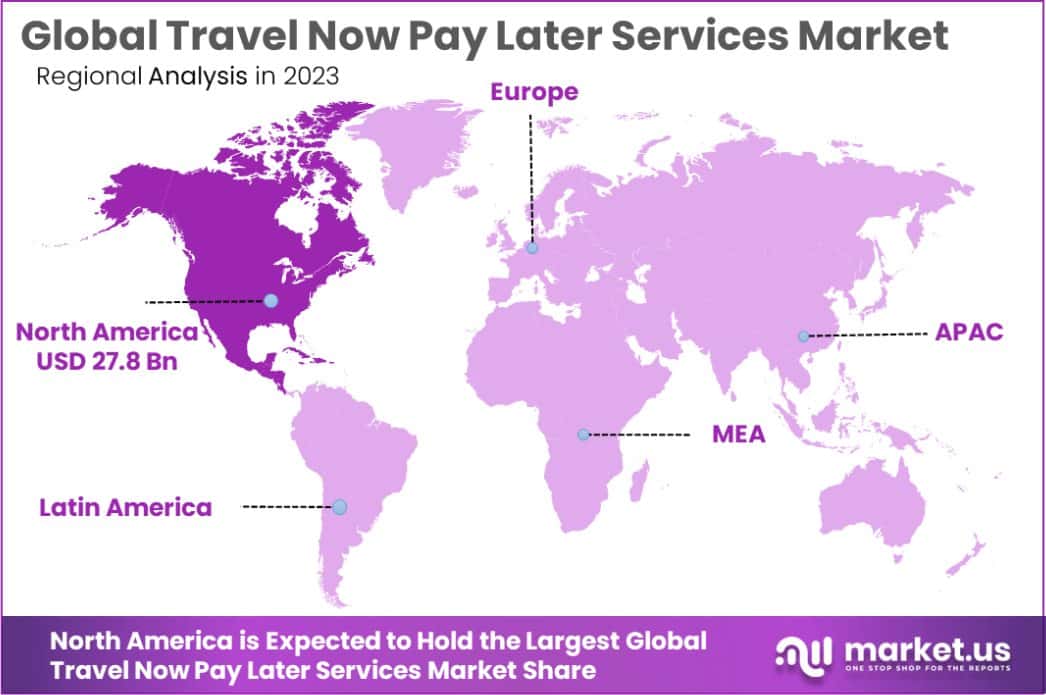

- North America dominated a 60.4% market share in 2023 and held USD 27.8 Billion in revenue from the Travel Now Pay Later Services Market.

Based on Type Analysis

In 2023, the Travel Now Pay Later Services Market saw significant segmentation based on travel type, with Leisure, Business, Adventure, Family Travel, and Other Types as key categories. Leisure travel emerged as the dominant segment, holding a substantial 55.3% market share, reflecting a strong consumer preference for leisure activities facilitated by flexible payment solutions.

Business travel accounted for 20.1% of the market, driven by corporate travel needs and the increasing adoption of pay-later services for business trips. Adventure travel, appealing to niche but enthusiastic demographics, captured 10.2%, indicating a growing trend towards experiential and adventure-based vacations.

Family travel contributed 9.4%, supported by the rising demand for family-oriented travel experiences that benefit from deferred payment options. The remaining 5% was attributed to Other Types, encompassing various emerging travel niches that are beginning to leverage pay-later services.

This segmentation underscores a diverse market landscape where travel preferences align closely with financial convenience and accessibility, allowing consumers to indulge in their desired travel experiences without upfront financial burdens.

Based on Destination Analysis

In 2023, the Travel Now Pay Later Services Market experienced notable segmentation based on the destination of travel, categorized into Domestic and International segments. International travel held a commanding lead, capturing a dominant 65.1% market share.

This prevalence is indicative of a robust demand for international travel experiences, facilitated by the financial flexibility that pay-later services offer, allowing travelers to explore global destinations without the immediate financial strain. Domestic travel accounted for the remaining 34.9% of the market.

This segment benefits from shorter travel periods and lower costs, appealing to budget-conscious consumers who prefer to travel within their own country but still take advantage of deferred payment plans.

The clear preference for international travel over domestic highlights a significant trend in consumer behavior, where more travelers are opting to explore new cultures and distant locations, underpinned by the financial ease provided by travel now, pay later options.

These insights reflect a dynamic market where destination preferences are closely tied to the availability of innovative financial services that enhance accessibility to broader travel experiences.

Based on the Payment Plan Analysis

In 2023, the Travel Now Pay Later Services Market was distinctly segmented based on payment plans, with Installment Plan, Deferred Payment Plan, and Other Payment Plans as the primary categories. The Installment Plan segment held a dominant position, commanding a 52.4% share of the market.

This preference underscores the appeal of structured payments, allowing consumers to budget their expenses over time, which is particularly advantageous for managing travel costs effectively. The Deferred Payment Plan followed, capturing 32.6% of the market.

This plan attracts travelers who prefer a short delay before initiating payments, offering immediate financial relief post-travel. Other Payment Plans comprised the remaining 15% of the market, encompassing a variety of less conventional or emerging payment structures that cater to niche consumer needs.

The prominence of the Installment Plan in the market highlights its role as a facilitator for broader access to travel, enabling more consumers to explore travel opportunities that were previously financially out of reach, thus expanding the market’s customer base and fostering growth in the travel sector.

Based on the Distribution Channel Analysis

In 2023, the Travel Now Pay Later Services Market was segmented by distribution channel, including Travel Agencies, Airlines, Hotels, Tour Operators, and Other Distribution Channels. Travel Agencies emerged as the leading segment, securing a dominant 33.3% market share.

This prominence is attributed to the comprehensive services they offer, integrating travel now pay later options seamlessly into their customer service, enhancing the accessibility of travel for diverse consumer segments. Airlines followed closely, accounting for 25.7% of the market, as more passengers opted to book flights with flexible payment terms directly through carriers.

Hotels captured 20.5% of the market share, appealing to travelers seeking to manage accommodation expenses over time. Tour Operators were responsible for 13.2%, benefiting from offering packaged travels that include various travel services under flexible payment conditions.

Other Distribution Channels, which include online travel aggregators and booking platforms, held 7.3% of the market, indicating a smaller yet significant role in distributing these financial services.

The dominance of Travel Agencies underscores their pivotal role in facilitating travel financing solutions that cater to the evolving financial needs and preferences of modern travelers, significantly impacting market dynamics and consumer travel behaviors.

Key Market Segments

Based on Type

- Leisure

- Business

- Adventure

- Family Travel

- Other Types

Based on Destination

- Domestic

- International

Based on the Payment Plan

- Installment Plan

- Deferred Payment Plan

- Other Payment Plans

Based on the Distribution Channel

- Travel Agencies

- Airlines

- Hotels

- Tour Operators

- Other Distribution Channel

Drivers

Rising Demand for Flexible Payments

Travel now, and pay later services are growing in popularity due to several key drivers. Firstly, they offer greater flexibility in managing travel budgets, allowing consumers to book vacations without the immediate financial burden.

This is particularly appealing to younger travelers who prefer not to delay travel plans but may not have the funds readily available. Secondly, these services enhance customer experience by simplifying the booking process through seamless, integrated payment solutions.

Economic uncertainties and fluctuating travel costs also push travelers towards these services, as they can lock in prices and pay in installments at no additional cost. This financial flexibility is a crucial factor driving the adoption of travel now, pay later options, making travel more accessible to a broader audience.

Restraint

Concerns Over Debt and Defaults

A significant restraint in the travel now, pay later services market is the potential for increased consumer debt. These services may encourage spending beyond one’s means, leading to financial strain and higher default rates among users.

Additionally, there’s a concern about the lack of stringent credit checks, which could lead to irresponsible lending practices. This could result in regulatory scrutiny and tighter controls, potentially limiting market growth.

Furthermore, economic downturns or travel disruptions, like those seen during global health crises, heighten the risk of defaults, which could negatively impact the financial stability of companies offering these services. Such financial risks are a major concern for both providers and regulators in the travel now, pay later sector.

Opportunities

Expanding Market with Tech Integration

The travel now, pay later services market is poised for significant growth, driven by opportunities in technology integration and strategic partnerships. As more travel businesses adopt digital and mobile solutions, these services can be seamlessly integrated, offering a smoother, more user-friendly payment experience.

This ease of use can attract a larger customer base, particularly among tech-savvy younger travelers who value simplicity and flexibility in financial transactions. Moreover, partnerships with major travel agencies, airlines, and hotels can expand service availability, enhancing visibility and user trust in pay-later options.

These collaborations could also introduce loyalty programs, combining travel benefits with financial flexibility, further enticing customers to choose pay-later services for their travel needs. Such opportunities for expansion and integration present a promising horizon for the travel now, pay later market.

Challenges

Navigating Regulations and Trust Issues

The travel now, pay later services market faces significant challenges, particularly regarding regulatory compliance and consumer trust. As these services grow, they attract greater scrutiny from financial regulators concerned about lending practices and consumer protection.

Ensuring compliance with evolving financial regulations across different regions can be complex and costly for providers. Additionally, establishing and maintaining consumer trust is crucial yet challenging. Potential customers may be skeptical about the terms of payment deferrals and the transparency of any associated fees or interest rates.

Misunderstandings or perceived lack of transparency can lead to reluctance in adoption, affecting market growth. Furthermore, fluctuations in the global travel industry, such as those caused by health crises or economic downturns, pose persistent challenges to the stability and predictability of this market.

Growth Factors

Flexibility Spurs Market Expansion

The travel now, pay later services market is experiencing growth due to several factors. Key among these is the increasing demand for financial flexibility in travel planning, which allows consumers to spread the cost of their trips over time without immediate financial pressure.

This is especially appealing in uncertain economic times when travelers desire more control over their budgets. Additionally, the integration of these services into popular online booking platforms enhances their accessibility, making it easier for consumers to opt for payment plans at the point of purchase.

The rise of digital payment solutions also supports the growth of this market, as more consumers are comfortable with and prefer online transactions. Lastly, aggressive marketing by service providers, highlighting the convenience and benefits of pay-later options, has successfully attracted a younger demographic eager to travel but who may not have the funds readily available.

Emerging Trends

New Trends Reshape Payment Options

Emerging trends in the travel now, pay later services market are significantly shaping consumer behavior and service offerings. A notable trend is the increasing use of mobile applications to manage travel expenses, providing users with convenient access to pay later options directly from their smartphones.

These apps often come with budget management tools, pushing the appeal of deferred payments to a broader audience. Additionally, there’s a growing preference for more transparent and flexible payment terms, with providers innovating to offer zero-interest plans and no-fee options to distinguish themselves in a competitive market.

Another emerging trend is the integration of loyalty and rewards programs, where travelers earn points or discounts when opting for pay-later services, enhancing the overall value proposition. These trends not only cater to the immediate financial needs of travelers but also build long-term customer engagement and loyalty.

Regional Analysis

The Travel Now Pay Later Services Market has witnessed diverse regional dynamics, with North America leading the charge, capturing a dominant 60.4% market share valued at USD 27.8 billion. This substantial penetration is attributed to the high consumer confidence in digital payment solutions and the presence of numerous fintech innovators in the region.

Europe follows, with a mature market characterized by stringent consumer finance regulations that ensure transparent and secure transactions, fostering steady growth. The Asia Pacific region is experiencing rapid expansion due to rising disposable incomes and an increase in digital literacy, making these services more accessible to a growing middle-class population.

Meanwhile, the Middle East & Africa, and Latin America are gradually embracing these services, driven by increasing internet penetration and a shift towards online travel bookings. In these emerging markets, partnerships with local travel and financial services are pivotal in overcoming traditional payment barriers and setting the stage for future growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Travel Now Pay Later (TNPL) services market, key players such as Afterpay, PayPal Holdings, Inc., and Splitit have played pivotal roles in shaping the landscape in 2023.

Afterpay has made significant strides by integrating its services seamlessly with major travel and retail platforms, appealing especially to millennials and Gen Z consumers who favor its straightforward, interest-free installment payment structure.

This approach has not only boosted its user base but also enhanced brand loyalty and spending per user, driving substantial revenue growth.

PayPal Holdings, Inc. continues to leverage its vast user network and robust payment infrastructure to expand its ‘Pay in 4’ service. PayPal’s trusted brand and extensive merchant relationships provide a competitive edge, allowing it to penetrate various segments of the travel market deeply.

The company’s strategy to offer TNPL services as part of a broader suite of financial products helps in maintaining a high engagement rate with its existing customers while attracting new ones looking for flexible payment solutions.

Splitit differentiates itself by allowing consumers to use their existing credit lines for installment payments, thus avoiding additional debt. This unique approach has enabled Splitit to carve out a niche in the TNPL market, particularly among credit-savvy consumers who are wary of accumulating new debt but are comfortable managing their cash flows.

The company’s focus on transparency and consumer control aligns well with the increasing demand for financial products that offer flexibility without hidden costs.

As of 2023, these companies are not only advancing their technological capabilities to enhance the customer experience but are also strategically navigating regulatory landscapes to sustain growth in a competitive market. Their ability to innovate and adapt to consumer preferences and regulatory changes will be crucial in maintaining their leadership positions in the TNPL services sector.

Top Key Players in the Market

- Afterpay

- PayPal Holdings, Inc.

- Splitit

- Sezzle

- Perpay Inc.

- Openpay

- Quadpay, Inc.

- LatitudePay

- Other Key Players

Recent Developments

- In September 2024, UATP and Klarna announced a partnership to offer BNPL options for airlines, integrating Klarna’s payment solutions into UATP’s network, and enhancing affordability and flexibility for travelers.

- In September 2019, Latitude Financial partnered with Luxury Escapes, enabling payment over 10 weekly installments via LatitudePay for deals under $1000.

Report Scope

Report Features Description Market Value (2023) USD 46.1 Billion Forecast Revenue (2033) USD 98.6 Billion CAGR (2024-2033) 7.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Type(Leisure, Business, Adventure, Family Travel, Other Types), Based on Destination(Domestic, International), Based on the Payment Plan(Installment Plan, Deferred Payment Plan, Other Payment Plans), Based on the Distribution Channel(Travel Agencies, Airlines, Hotels, Tour Operators, Other Distribution Channel) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Afterpay, PayPal Holdings, Inc., Splitit, Sezzle, Perpay Inc., Openpay, Quadpay, Inc., LatitudePay, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Travel Now Pay Later Services MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Travel Now Pay Later Services MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Afterpay

- PayPal Holdings, Inc.

- Splitit

- Sezzle

- Perpay Inc.

- Openpay

- Quadpay, Inc.

- LatitudePay

- Other Key Players