Global Travel Guard Insurance Market Size, Share, Industry Analysis Report By Insurance Coverage Plan Type (Single-Trip Insurance, Annual Multi-Trip Insurance, Group Travel Insurance, Others), By Coverage Scope (Trip Cancellation & Interruption, Emergency Medical & Dental, Medical Evacuation & Repatriation, Baggage Loss/Delay, Others), By Distribution Channel (Travel Intermediaries, Insurance Intermediaries, Direct Sales, Bundled Sales), By End-User (Senior Citizens, Families & Vacationers, Business Travelers, Backpackers & Adventure Travelers, International Students & Scholars), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163216

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Insurance Coverage Plan Type Analysis

- Coverage Scope Analysis

- Distribution Channel Analysis

- End-User Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

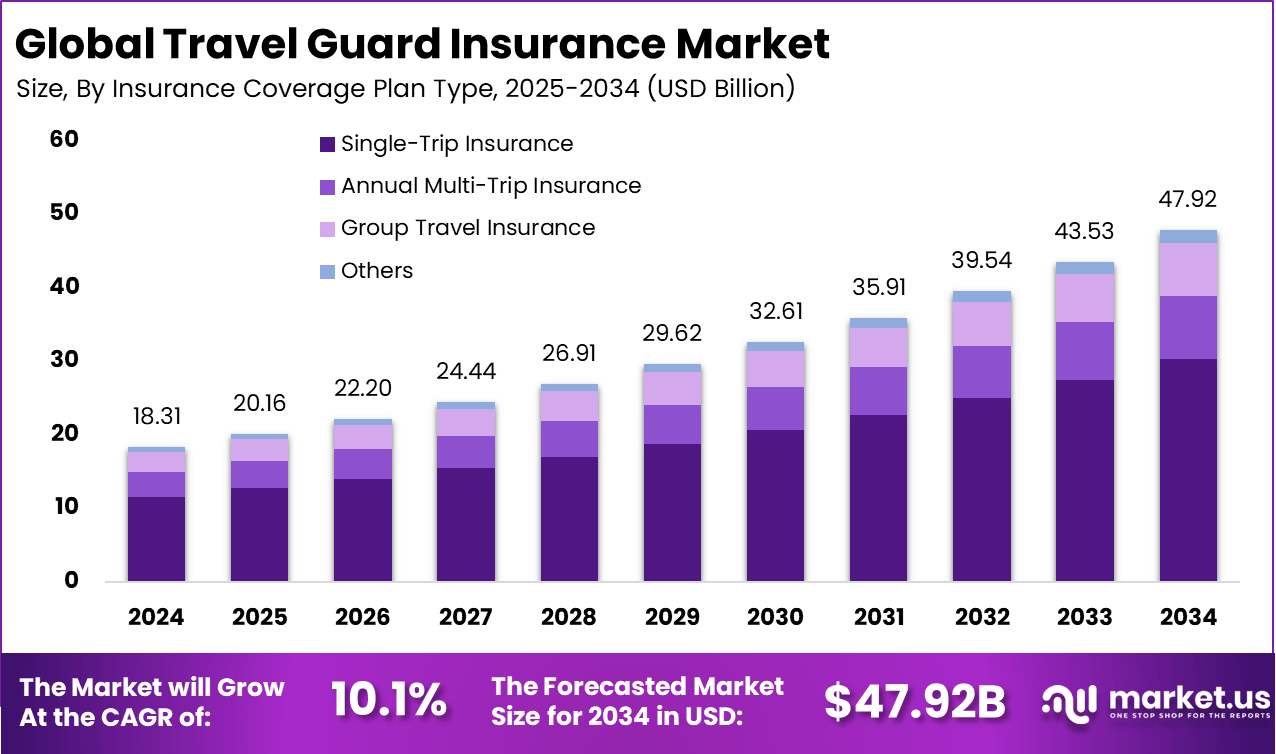

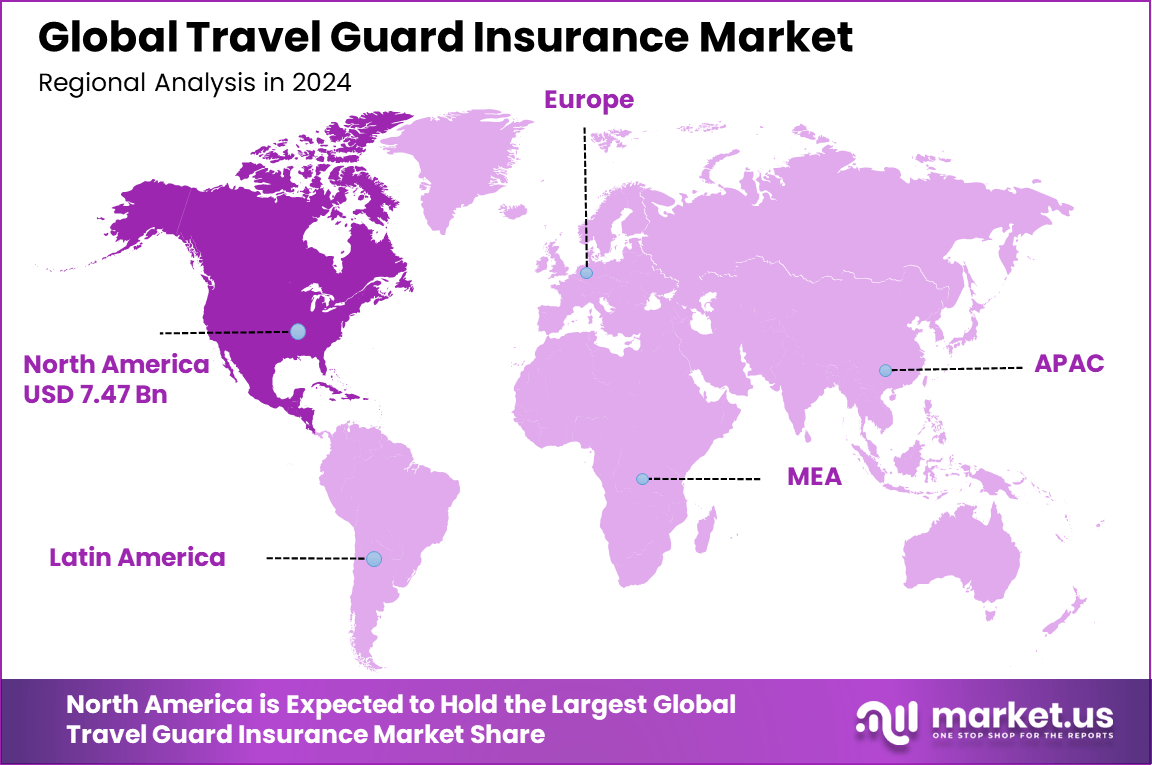

The Global Travel Guard Insurance Market size is expected to be worth around USD 47.92 billion by 2034, from USD 18.31 billion in 2024, growing at a CAGR of 10.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.8% share, holding USD 7.47 billion in revenue.

The Travel Guard Insurance Market offers various insurance products designed to protect travelers from unforeseen risks such as trip cancellations, medical emergencies overseas, lost luggage, and travel disruptions. This market includes different types of coverage like single-trip, annual multi-trip, and specialized adventure travel insurance aimed at different traveler groups, including leisure tourists, business travelers, families, and senior citizens.

Top driving factors include the rebound of international travel following pandemic restrictions, rising disposable incomes, and heightened awareness of travel-related risks among consumers. The growing preference for digitally accessible insurance products has fueled market expansion, with online sales channels increasing policy reach by more than 40%.

The market for Travel Guard Insurance is primarily driven by the increasing popularity of international travel, as more people seek protection against unforeseen events like medical emergencies and trip cancellations. Growing disposable incomes and the relaxation of travel restrictions enhance this trend. Additionally, tightening visa regulations and mandatory insurance requirements in various countries boost demand.

Demand analysis reveals that medical coverage and trip cancellation protections lead consumer interest. As travel frequency rises, multi-trip and annual plans are gaining popularity, especially among frequent travelers who account for more than 35% of policies sold in developed markets. Digital distribution channels have played a pivotal role, with digital policy purchases now constituting a majority in top industry regions.

For instance, in September 2025, UnitedHealthcare introduced SafeTrip travel insurance plans for Compass Rose Health Plan members, offering flexible coverage options including trip cancellation, emergency medical coverage up to $1 million, and evacuation services, aimed at providing an extra layer of security on international trips.

Key Takeaway

- The Single-Trip Insurance segment dominated with 63.2%, reflecting higher adoption among leisure travelers and one-time vacationers seeking short-term coverage.

- Trip Cancellation & Interruption coverage accounted for 41.4%, driven by increasing travel disruptions and growing awareness of financial protection benefits.

- Insurance Intermediaries (Aggregators/Brokers) held 34.5%, underscoring their key role in policy distribution through digital platforms and multi-brand offerings.

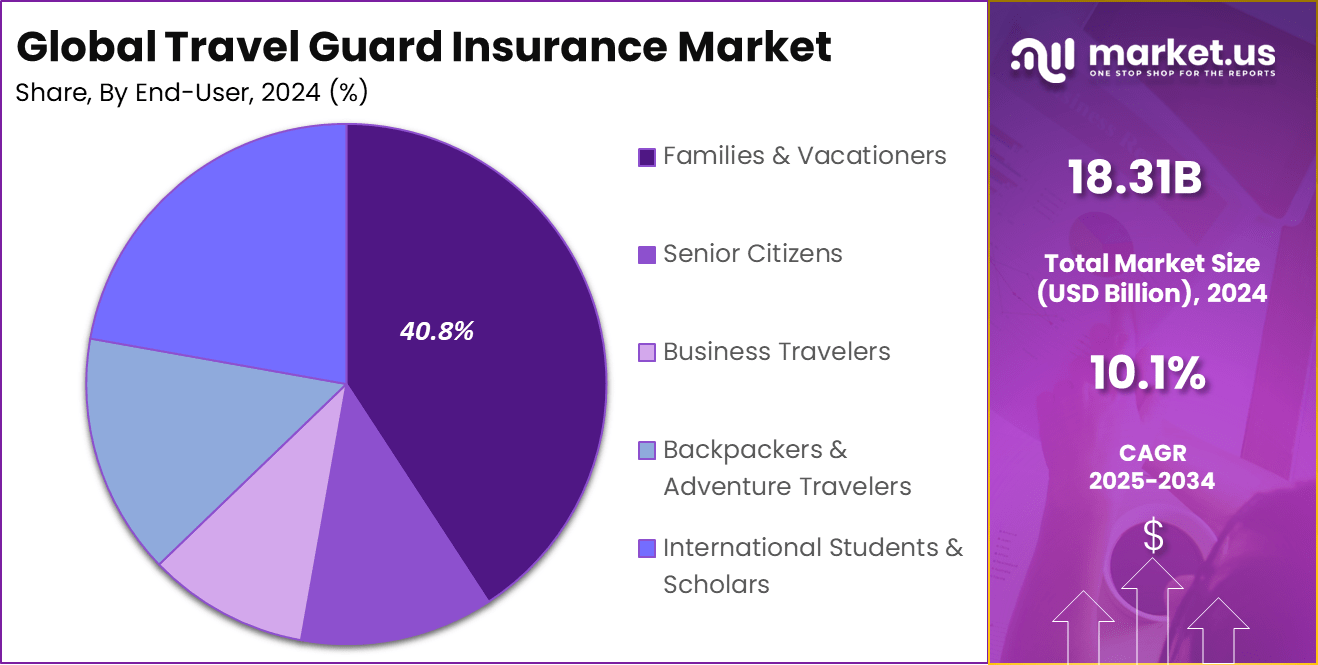

- The Families & Vacationers segment led with 40.8%, supported by rising demand for comprehensive coverage among group travelers and family holiday packages.

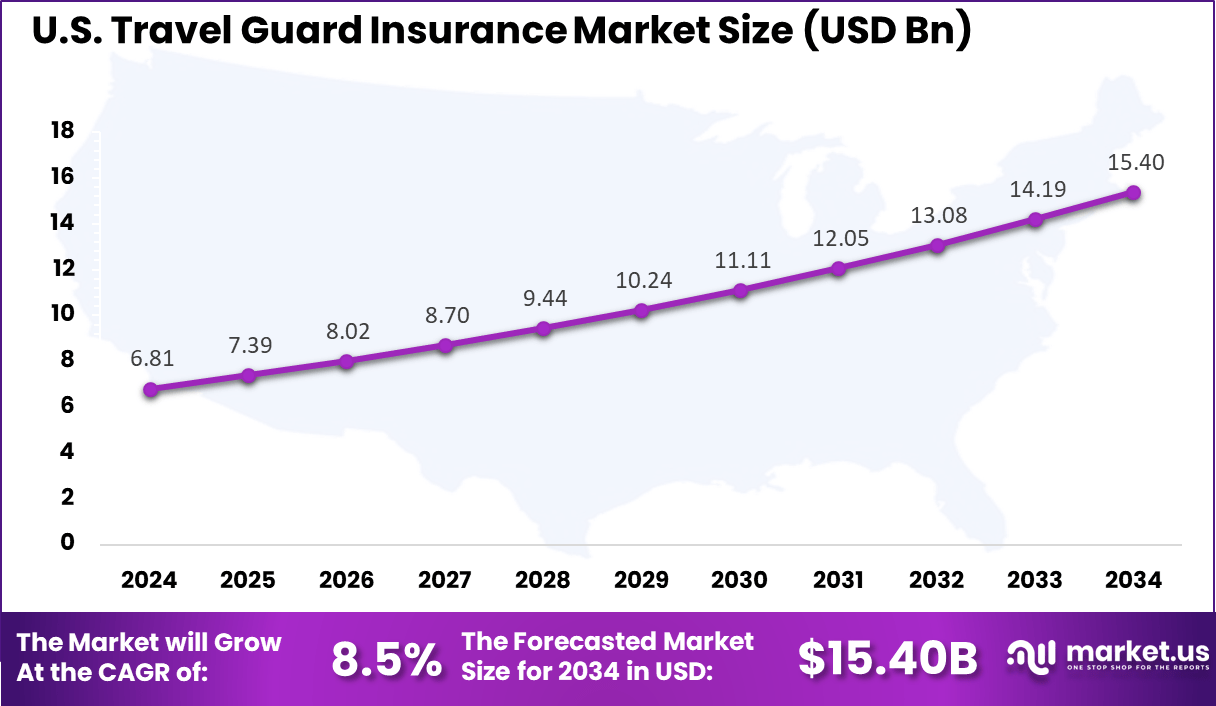

- The US market reached USD 6.81 Billion in 2024, recording a strong 8.5% CAGR, fueled by post-pandemic recovery in tourism and increased emphasis on travel safety.

- North America maintained dominance with a 40.8% share of the global market, supported by mature insurance infrastructure, high outbound travel volumes, and strong consumer awareness of travel protection plans.

Role of Generative AI

Generative AI is transforming how Travel Guard Insurance operates by improving efficiency and personalization. It automates claims processing and risk assessment, cutting settling times by up to 50% and reducing operational costs by 20-50%.

With AI, insurers can analyze vast amounts of travel data rapidly, helping them offer coverage that fits the traveler’s specific risks and needs. AI also helps detect fraudulent claims, making the process fairer and faster for honest customers. About 60% of travel insurers are already using AI systems extensively, and many more are scaling usage as they see clear benefits in service speed and accuracy.

Beyond automation, generative AI enhances customer support by providing 24/7 virtual assistants that guide travelers through policy choices and claims filing. These assistants tailor responses based on the user’s history and preferences, making the experience more personal and less frustrating. AI also enables real-time monitoring of travel conditions like weather, health risks, and political events.

Investment and Business Benefits

Investment opportunities lie in developing advanced digital platforms, AI-driven risk management tools, telehealth integration, and seamless policy distribution solutions. Insurtech partnerships and embedded insurance models in travel booking platforms open new revenue channels. Also, sustainable travel insurance solutions aligned with ecological trends offer emerging growth potential.

Markets in Asia-Pacific, with rising middle-class travel adoption and relatively low insurance penetration, attract significant investment interest. Data analytics and cyber risk management for travel insurance constitute additional promising areas.

Business benefits include diversified income streams by embedding insurance within travel ecosystems such as airlines and hotels, and operational efficiency gains from automation and AI. Digital engagement improves brand recognition and customer retention. Offering innovative, tech-enabled products creates differentiation opportunities and supports premium pricing. Efficient claim processing improves cash flow, while customized risk products allow better underwriting and lower loss ratios.

U.S. Market Size

The market for Travel Guard Insurance within the U.S. is growing tremendously and is currently valued at USD 6.81 billion, the market has a projected CAGR of 8.5%. The market is growing due to increasing outbound leisure travel and heightened risk awareness among consumers.

Travelers are proactively seeking protection against trip cancellations, medical emergencies, and unexpected disruptions, which has elevated demand for comprehensive insurance plans. Digital platforms and customizable policies are simplifying the insurance purchase process, appealing to younger and cost-conscious consumers.

For instance, in September 2025, UnitedHealthcare launched its SafeTrip travel insurance plans tailored for Compass Rose Health Plan members. The plans offer flexible coverage, including trip cancellation, emergency medical coverage up to $1 million, and evacuation services, catering to the increasing demand for comprehensive international travel protection.

In 2024, North America held a dominant market position in the Global Travel Guard Insurance Market, capturing more than a 40.8% share, holding USD 7.47 billion in revenue. This dominance is due to several factors, including a high volume of both domestic and international travel, robust consumer awareness about travel risks, and strong demand for comprehensive insurance coverage.

North America benefits from advanced digital insurance platforms that simplify policy purchase and claims processing, coupled with a diverse traveler base that values personalized, flexible plans. Increasing disposable incomes and frequent travel further support the market’s strong performance.

For instance, in May 2025, Aetna introduced a new travel health insurance benefit as part of its expanded Medicare Advantage plans. The benefit includes coverage for emergency medical services during travel, addressing the rising need for health protection among senior travelers.

Insurance Coverage Plan Type Analysis

In 2024, The Single-Trip Insurance segment held a dominant market position, capturing a 63.2% share of the Global Travel Guard Insurance Market. Single-trip insurance is clearly the most popular plan type. This coverage appeals especially to travelers taking occasional trips who prefer insurance tailored for just one journey rather than an annual plan.

The simplicity and targeted nature of single-trip insurance make it an attractive, cost-effective choice for many travelers. It offers coverage for key travel risks like cancellations, medical emergencies, and interruptions limited to the specific trip, providing peace of mind without long-term commitments.

This preference reflects increasing travel volumes and traveler awareness of trip-specific risks. Single-trip insurance is favored for its ease of purchase and clear benefits, especially for leisure and business travelers who plan isolated trips and want straightforward protection just for those dates.

For Instance, in October 2025, AXA continued to highlight its single-trip insurance offerings with its Platinum plan recognized as one of the highest-rated by Forbes Advisor. The plan delivers focused protection for individual trips, including trip cancellation, medical emergencies, and trip interruption benefits tailored to single journeys, enhancing traveler confidence and convenience.

Coverage Scope Analysis

In 2024, the Trip Cancellation & Interruption segment held a dominant market position, capturing a 41.4% share of the Global Travel Guard Insurance Market. This dominance is due to its importance to travelers concerned about unforeseen disruptions. This coverage protects travelers financially if plans change due to illness, natural disasters, or emergencies.

Its appeal lies in reducing the risks and losses from sudden trip cancellations or interruptions, which have become more prevalent with global uncertainties. Travelers appreciate this coverage, as it provides reassurance against costly disruptions, enabling more confident travel planning. It is a key factor in travel insurance decisions due to rising travel costs and the complexity of modern itineraries.

For instance, in September 2025, UnitedHealthcare launched SafeTrip travel insurance plans offering extensive trip cancellation and interruption coverage. Their plans cover unexpected trip disruptions and provide emergency medical and dental support, ensuring travelers are protected financially if plans change unexpectedly.

Distribution Channel Analysis

In 2024, The Insurance Intermediaries (Aggregators/Brokers) segment held a dominant market position, capturing a 34.5% share of the Global Travel Guard Insurance Market. These intermediaries connect consumers with multiple insurance options, helping them compare policies and prices easily. Their role enhances accessibility and transparency for buyers, who benefit from expert guidance and competitive offers on a single platform.

Consumers trust intermediaries for personalized advice and convenience, particularly when navigating a crowded market. These channels are favored due to the breadth of choices and simplified purchasing experience they provide.

For Instance, in 2025, Allianz Partners continued strengthening its partnerships with brokers and intermediaries worldwide, aiming to simplify policy migration and enhance broker-supported sales channels. Their focus on consistency and flexibility for brokers ensures travelers can easily access and compare travel insurance products through familiar intermediaries.

End-User Analysis

In 2024, The Families & Vacationers segment held a dominant market position, capturing a 40.8% share of the Global Travel Guard Insurance Market. This dominance is due to the high demand for comprehensive travel protection among leisure travelers. This segment prioritizes coverage that protects against common travel risks like medical emergencies, trip cancellations, and lost luggage for all family members on vacation.

The prominence of families and vacationers reflects the growing trend of group and leisure travel, where the need for insurance is heightened by the number of people and financial commitments involved. They offer broad, reliable coverage tailored to family travel needs, contributing significantly to overall market growth.

For Instance, in June 2025, Prudential General Insurance Hong Kong upgraded the PRUChoice Travel Insurance plan targeting families and vacationers, including new protections like travel interruption due to kidnapping and overseas medical coverage for pets traveling with owners. This addresses the evolving needs of family travelers who seek inclusive coverage for all members.

Emerging trends

Emerging trends in Travel Guard Insurance show a strong move towards digital, flexible policies. Travelers increasingly want options to buy insurance online with the ability to customize coverage for short trips or specific activities. Pay-per-day or usage-based insurance models now make up about 15% of new travel insurance offers, appealing especially to younger or less frequent travelers.

Another notable trend is the increase in 24/7 travel assistance services integrated into insurance packages. Around 45% of travel insurance plans now offer emergency medical support and instant claims help through mobile apps, providing peace of mind to travelers anywhere in the world. This integration of convenient digital tools with traditional coverage is driving wider adoption of Travel Guard Insurance among global travelers.

Growth Factors

Growth in Travel Guard Insurance is driven by more people traveling internationally and their increasing awareness of travel risks. As global travel rises, more travelers see insurance as a necessary part of trip planning. Many look for broad protection that includes medical emergencies, trip cancellations, and luggage loss.

Additionally, advances in technology help insurers offer quicker claims processing and tailored pricing, attracting more customers. Over 70% of claims now use AI-assisted systems to speed resolution while keeping customer satisfaction high. Another important growth factor is the rise of technology-enabled customer services.

AI and data analytics allow insurance providers to create personalized plans based on traveler profiles and travel history. This customization, plus the ease of buying insurance digitally, makes travel insurance more accessible and user-friendly. The shift to online insurance purchase is an important development, meeting the expectations of today’s tech-savvy travelers.

Key Market Segments

By Insurance Coverage Plan Type

- Single-Trip Insurance

- Annual Multi-Trip Insurance

- Group Travel Insurance

- Others

By Coverage Scope

- Trip Cancellation & Interruption

- Emergency Medical & Dental

- Medical Evacuation & Repatriation

- Baggage Loss/Delay

- Others

By Distribution Channel

- Travel Intermediaries

- Insurance Intermediaries

- Direct Sales

- Bundled Sales

By End-User

- Senior Citizens

- Families & Vacationers

- Business Travelers

- Backpackers & Adventure Travelers

- International Students & Scholars

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising International Travel

The Travel Guard Insurance market benefits significantly from the rise in international travel. More people are venturing abroad for leisure, business, and other purposes, which increases the demand for protection against unexpected incidents such as medical emergencies and trip cancellations. Growing disposable income and easier access to global destinations encourage a larger pool of travelers to consider insurance for peace of mind when traveling overseas.

This trend creates a strong foundation for market growth as travelers become more aware of risks and look for safeguards. Growing regulatory requirements in certain regions mandating travel insurance for visa approvals also boost demand. Overall, the increase in global travel volume directly translates into higher adoption rates for travel guard insurance products as people seek peace of mind when abroad.

For instance, in May 2025, AXA launched a new range of Schengen travel insurance plans specifically designed for US residents traveling to Europe. This move addresses the increased demand for travel protection as international travel volumes grow, especially with new European travel regulations and visa requirements.

Restraint

Low Awareness and Policy Complexity

Awareness remains a major barrier slowing the Travel Guard Insurance market. Many potential customers, particularly in developing regions, still lack an understanding of what travel insurance covers and why it is important. This gap in awareness causes hesitation and sometimes outright refusal to purchase insurance, limiting the market’s reach.

Complex policy terms add to this challenge. Travelers often find the variety of coverage options confusing, feeling uncertain about what benefits they are actually buying. The perception that insurance is expensive or difficult to understand makes it harder for providers to convert interest into actual sales and showcases the need for simpler, clearer products and better consumer education.

For instance, in June 2025, AXA faced some customer backlash over claims processing delays in the UK reported by media outlets. This reflects challenges insurers face with consumer dissatisfaction when policy terms and claims procedures are perceived as complex or opaque. Such incidents reinforce how low awareness about policy details and difficulties in claims navigation restrain growth in some markets.

Opportunities

Technology-Driven Customization

Technology offers a promising pathway for the Travel Guard Insurance market to expand. Digital platforms enable insurers to provide tailored policies that fit individual travel behaviors and preferences. Customers can pick and choose coverage elements that meet their specific needs, making insurance more relevant and attractive to modern travelers.

The use of AI and data analytics enhances risk assessment and pricing, allowing insurers to optimize policies for different demographics and travel types. Additionally, mobile apps and online sales make buying and managing insurance easier and faster, attracting a younger and more tech-savvy customer base eager for convenience and personalized solutions.

For instance, in September 2025, UnitedHealthcare launched the SafeTrip travel insurance product, providing flexible coverage options for Compass Rose Health Plan members traveling domestically and internationally. The digital platform offers medical, evacuation, and trip cancellation coverages that customers can tailor to their needs, demonstrating how technology-driven customization enhances product appeal and customer satisfaction.

Challenges

Intense Market Competition

Competition in the Travel Guard Insurance market is fierce, with large global insurers, regional firms, and nimble insurtech startups all vying for market share. Established companies leverage brand trust and widespread networks, while smaller players compete by targeting niche segments with specialized offerings and competitive pricing.

This crowded landscape pressures margins and forces constant innovation. Insurers must invest in technology and customer service upgrades to differentiate themselves. Furthermore, diverse regulatory requirements across countries add complexity, requiring adaptability from companies trying to grow their presence internationally while managing evolving market conditions efficiently.

For instance, in August 2025, AXA partnered with MOTOGO to launch a new typhoon parametric and cross-boundary travel insurance product in Hong Kong and Macau. This partnership highlights intense competition driving innovation and specialized service offerings to differentiate product portfolios.

Key Players Analysis

The Travel Guard Insurance Market is led by global insurers such as AXA, Allianz SE, Zurich Insurance Group, and Generali, which provide comprehensive travel protection covering trip cancellations, medical emergencies, and lost baggage. Their strong financial capabilities and international assistance networks enable them to serve both individual and corporate travelers.

Prominent market participants including Kaiser Permanente, UnitedHealthcare, Berkshire Hathaway, Prudential, Aetna, and MetLife focus on integrating health and travel insurance solutions for international travelers. Their offerings combine medical coverage, evacuation support, and cross-border healthcare access.

Additional contributors such as Ping An Insurance, China Taiping Insurance Group, Nippon Life, AIA Group, TATA AIG, Travel Guard, Travelex, Seven Corners, Cover-More, People’s Insurance Company, and other key players are expanding their global reach through partnerships with airlines, tour operators, and digital aggregators.

Top Key Players in the Market

- AXA

- Allianz SE

- Generali

- Kaiser Permanente

- UnitedHealthcare

- Berkshire Hathaway

- Prudential

- Aetna

- Ping An Insurance

- China Taiping Insurance Group

- Nippon Life

- AIA Group

- Zurich Insurance Group

- MetLife

- Travel Guard

- TATA AIG

- Seven Corners

- Travelex

- Cover-More

- People’s Insurance Company

- Others

Recent Developments

- In April 2025, AXA launched “AXA Travel Eye,” a travel risk management platform focused on real-time risk intelligence, emergency support, and crisis management for business travelers. This app integrates travel management features with enhanced privacy controls and 24/7 assistance, showing AXA’s push into connected travel safety services.

- In October 2025, Generali Global Assistance was recognized by Better Business Advice as a leading provider of travel insurance for seniors, highlighting its Premium Plan’s comprehensive medical and trip protection benefits. This plan caters specifically to the needs of older travelers with high coverage limits and senior-friendly features.

Report Scope

Report Features Description Market Value (2024) USD 18.31 Billion Forecast Revenue (2034) USD 47.92 Billion CAGR(2025-2034) 10.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Insurance Coverage Plan Type (Single-Trip Insurance, Annual Multi-Trip Insurance, Group Travel Insurance, Others), By Coverage Scope (Trip Cancellation & Interruption, Emergency Medical & Dental, Medical Evacuation & Repatriation, Baggage Loss/Delay, Others), By Distribution Channel (Travel Intermediaries, Insurance Intermediaries, Direct Sales, Bundled Sales), By End-User (Senior Citizens, Families & Vacationers, Business Travelers, Backpackers & Adventure Travelers, International Students & Scholars) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AXA, Allianz SE, Generali, Kaiser Permanente, UnitedHealthcare, Berkshire Hathaway, Prudential, Aetna, Ping An Insurance, China Taiping Insurance Group, Nippon Life, AIA Group, Zurich Insurance Group, MetLife, Travel Guard, TATA AIG, Seven Corners, Travelex, Cover-More, People’s Insurance Company, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Travel Guard Insurance MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Travel Guard Insurance MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AXA

- Allianz SE

- Generali

- Kaiser Permanente

- UnitedHealthcare

- Berkshire Hathaway

- Prudential

- Aetna

- Ping An Insurance

- China Taiping Insurance Group

- Nippon Life

- AIA Group

- Zurich Insurance Group

- MetLife

- Travel Guard

- TATA AIG

- Seven Corners

- Travelex

- Cover-More

- People’s Insurance Company

- Others