Global Aviation Passenger Service System Market Size, Share, Statistics Analysis Report By Component (Software, Services), By Deployment Type (On-premise, Cloud-based), By Application (Reservation Systems, Check-in Systems, Baggage Management Systems, Flight Management Systems), By End User (Airlines, Travel Agencies, Airport Authorities, Ground Handling Services), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145682

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

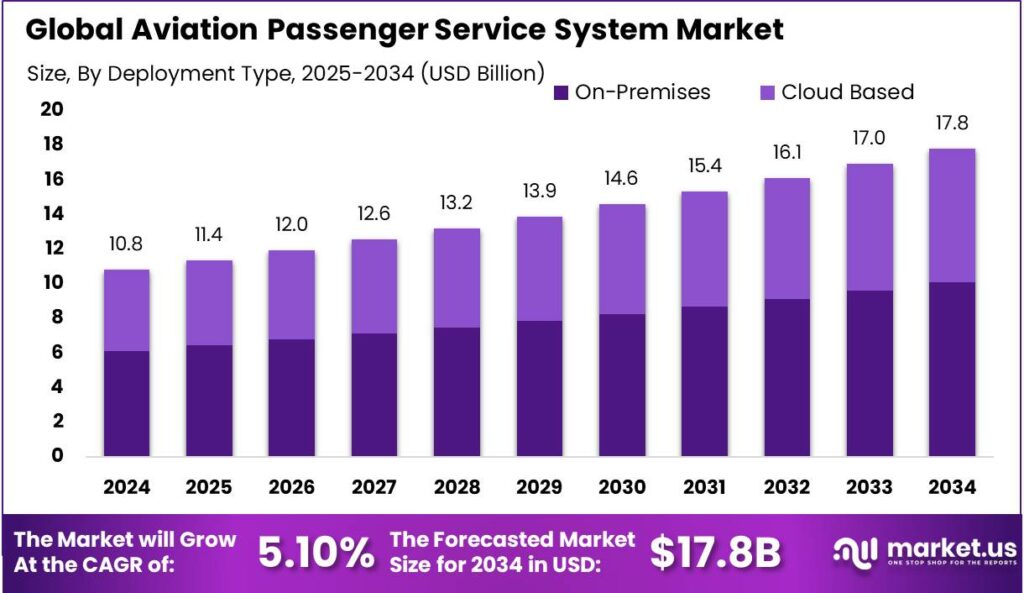

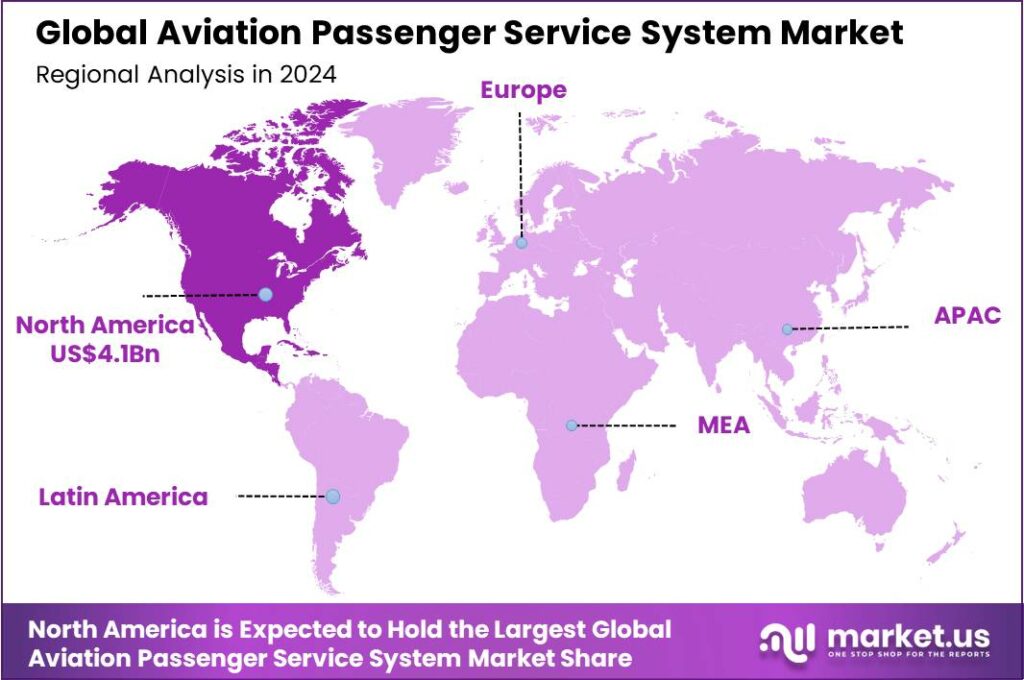

The Global Aviation Passenger Service System Market size is expected to be worth around USD 17.8 Billion By 2034, from USD 10.84 Billion in 2024, growing at a CAGR of 5.10% during the forecast period from 2025 to 2034. North America was the leading region in the Aviation Passenger Service System market in 2024, holding over 38.7% of the market share, with revenues amounting to USD 4.1 billion.

The Aviation Passenger Service System (PSS) encompasses a suite of technology solutions designed to manage various aspects of airline operations related to passengers. These systems are integral for handling reservations, inventory management, departure control, and other customer service functions such as check-in, baggage handling, and in-flight services.

The Aviation Passenger Service System market is experiencing significant growth, driven by the increasing demand for enhanced customer service and operational efficiencies in the aviation industry. This market is strategically important for airlines aiming to optimize every passenger interaction from reservation to post-flight services. The integration of advanced technologies such as cloud computing, CRM systems, and automated kiosks is pivotal in modernizing and improving the functionalities of PSSs

The demand for advanced Passenger Service Systems is being boosted significantly by the growing need for airlines to manage increased passenger traffic efficiently while ensuring a personalized travel experience. The integration of AI and machine learning for predictive analytics and personalized services further stimulates this demand, as airlines seek to tailor their offerings to individual passenger preferences and improve operational decision-making.

Additionally, the robust data analytics offered by these systems help airlines understand customer preferences, enabling tailored services that can increase loyalty and revenue. According to COAX Software, 90% of decision-makers in the airline industry are pursuing digital transformation initiatives to remain relevant in the market.

Current market trends in the Aviation Passenger Service System sector emphasize the adoption of mobile solutions and omnichannel communications, reflecting the industry’s shift towards more integrated and user-friendly passenger interfaces. The increasing reliance on mobile applications allows passengers to manage their travel arrangements more flexibly and access real-time travel updates, thereby enhancing the overall customer experience.

Airlines are adopting these technologies primarily to meet the rising expectations of tech-savvy travelers who demand seamless, personalized service across multiple platforms. Additionally, these technologies facilitate better data management and operational agility, enabling airlines to respond more effectively to dynamic market conditions and emerging challenges such as security and data privacy concerns.

Key Takeaways

- The Global Aviation Passenger Service System (PSS) Market size is projected to reach USD 17.8 Billion by 2034, growing from USD 10.84 Billion in 2024, at a CAGR of 5.10% during the forecast period from 2025 to 2034.

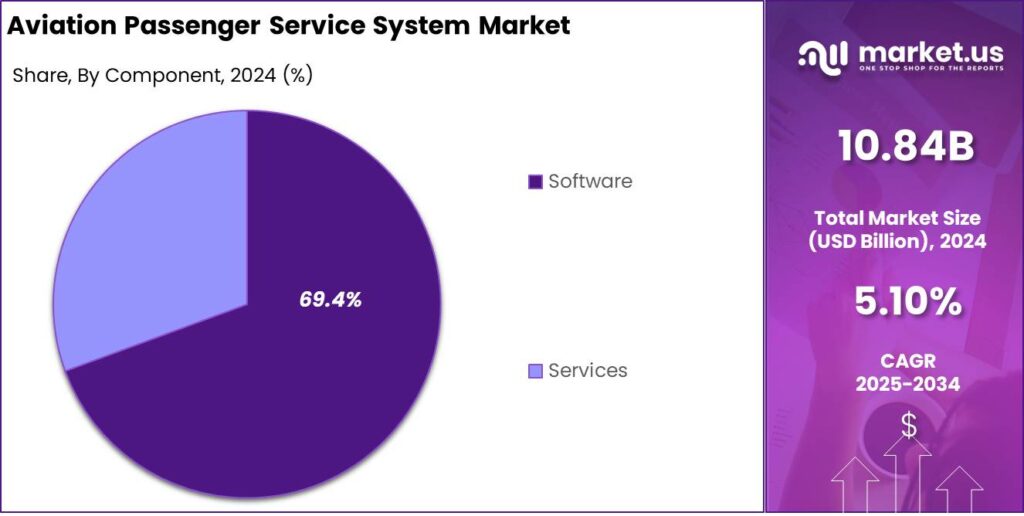

- In 2024, the Software segment of the Aviation Passenger Service System market held a dominant position, capturing more than 69.4% of the global market share.

- The On-premise segment in the Aviation Passenger Service System market was also dominant in 2024, securing more than 56.7% of the market share.

- The Reservation Systems segment led the market in 2024, holding a dominant position with over 42.4% market share.

- In 2024, the Airlines segment captured the largest share of the Aviation Passenger Service System market, accounting for more than 39.7%.

- North America was the leading region in the Aviation Passenger Service System market in 2024, holding over 38.7% of the market share, with revenues amounting to USD 4.1 billion.

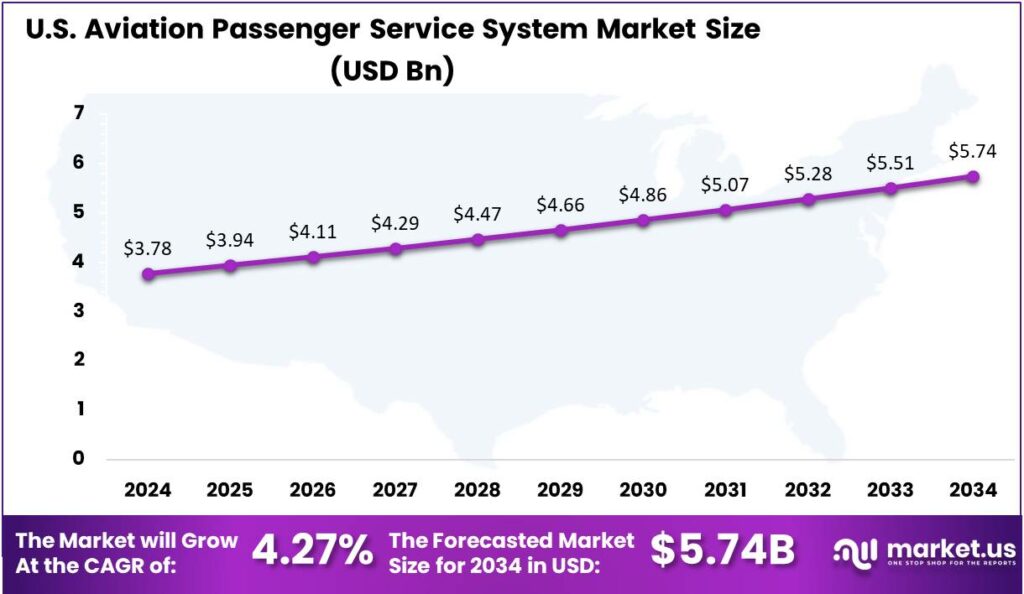

- The U.S. Aviation Passenger Service System market was valued at USD 3.78 billion in 2024 and is projected to grow at a CAGR of 4.27%.

U.S. Market Size

In 2024, the U.S. Aviation Passenger Service System market was estimated to be valued at $3.78 billion. This market is projected to grow at a compound annual growth rate (CAGR) of 4.27%.

The Aviation Passenger Service System (PSS) encompasses a range of services and software solutions that manage passenger operations for airlines, from booking and ticketing to airport check-in and boarding. This system is crucial for ensuring a smooth operational flow, enhancing customer experience, and optimizing revenue streams for airlines.

Technological enhancements in the form of mobile ticketing solutions, self-service kiosks, and biometric systems for secure access and faster processing are driving the market forward. Airlines are increasingly investing in upgrading their PSS platforms to enhance passenger handling and meet the expectations of tech-savvy consumers.

The U.S. Aviation Passenger Service System market is set for steady growth, driven by the airline industry’s recovery from the COVID-19 pandemic and the increasing adoption of digital technologies. As airlines focus on enhancing operational efficiency and passenger satisfaction, the demand for advanced systems is expected to rise, supporting the market’s positive outlook.

In 2024, North America held a dominant market position in the Aviation Passenger Service System (PSS) market, capturing more than a 38.7% share with revenues amounting to USD 4.1 billion. This leadership can be attributed to several factors that uniquely position North America at the forefront of the aviation technology landscape.

The region’s advanced technological infrastructure and the presence of major airline companies and technology providers drive significant investments in PSS solutions. North America is home to some of the world’s largest airlines, which are continually seeking to enhance their operational efficiencies and customer service capabilities.

Furthermore, the regulatory environment in North America, which strongly emphasizes passenger security and data privacy, compels airlines to continually update their systems. Regulations such as the Secure Flight program by the Transportation Security Administration (TSA) mandate airlines to integrate advanced data processing systems to vet passengers against watch lists.

Economic factors also play a critical role. With a steady increase in air travel, both domestically and internationally, there is a continuous need for airports and airlines to upgrade and expand their service systems to handle higher passenger volumes efficiently. The growing trend of airlines merging or forming alliances also demands integrated service systems to ensure seamless service across different carriers, further bolstering the market growth in North America.

Component Analysis

In 2024, the Software segment of the Aviation Passenger Service System (PSS) market held a dominant position, capturing more than a 69.4% share of the global market. This segment encompasses a wide range of solutions including inventory management systems, reservation systems, and departure control systems, all crucial for the core operations.

The Software segment holds a leading position due to the growing automation of airline operations. Airlines are consistently pursuing innovative software that offers real-time data, manages vast amounts of passenger information, and optimizes flight schedules. This shift towards automation helps reduce human errors and boosts operational efficiency, essential in today’s fast-paced travel industry.

The dominance of the Software segment is largely due to the rapid integration of advanced technologies like AI, ML, and cloud computing into PSS solutions. These innovations enhance software functionality and efficiency, allowing airlines to provide personalized services, predictive analytics, and improved customer satisfaction, while boosting operational agility.

The intense competition in the airline industry compels carriers to adopt advanced PSS software that enables them to distinguish their services. By leveraging sophisticated software, airlines can offer customized travel experiences, efficient self-service options, and enhanced loyalty programs, which are key differentiators in attracting and retaining passengers.

Deployment Type Analysis

In 2024, the On-premise segment held a dominant market position in the Aviation Passenger Service System market, capturing more than a 56.7% share. This segment leads due to factors that appeal to large airlines, particularly the on-premise model, which offers enhanced security for handling sensitive passenger data and proprietary operational information.

The preference for on-premise systems among many established airlines also stems from their need for customized solutions that integrate seamlessly with their existing legacy systems. On-premise systems offer airlines greater control over software configuration and customization, allowing them to tailor solutions to their specific operational needs without the limitations of cloud-based options.

Moreover, on-premise systems are perceived to have more predictable costs in the long term compared to cloud-based systems, where ongoing subscription fees can add up. This cost predictability is especially important for airlines operating in a market where profit margins are often thin and budgeting needs to be precise.

The preference for on-premise systems in some regions is driven by data sovereignty laws that mandate data storage within local borders. Airlines in areas with strict data privacy regulations find on-premise solutions more compliant and viable, helping the segment remain resilient despite the global rise of cloud-based systems.

Application Analysis

In 2024, the Reservation Systems segment held a dominant market position in the Aviation Passenger Service System market, capturing more than a 42.4% share. This leading role is primarily due to the critical nature of reservation systems in airline operations, which serve as the backbone for revenue generation and customer engagement in the airline industry.

Reservation systems are crucial for managing bookings and ticket sales, the primary revenue sources for airlines. They facilitate schedule management, fare calculations, ticket reservations, and customer management. As fare structures become more complex and airlines expand routes, the demand for advanced reservation systems capable of handling vast data and optimizing revenues continues to grow.

Additionally, the integration of digital technologies such as artificial intelligence and machine learning has significantly enhanced the capabilities of reservation systems. These technologies help in predicting consumer behavior, personalizing services, and optimizing pricing strategies, which are crucial for staying competitive in the market.

The rise in online bookings, particularly via mobile devices, has increased the need for robust reservation systems that ensure seamless and secure service. Airlines are investing in upgrading platforms to support omni-channel ticket sales, keeping the reservation systems segment at the forefront of the Aviation Passenger Service System market.

End User Analysis

In 2024, the Airlines segment held a dominant position in the Aviation Passenger Service System market, capturing more than a 39.7% share. This segment benefits significantly from the integration of advanced passenger service systems that streamline operations ranging from booking and check-in to boarding and baggage handling.

The reliance on these systems by airlines is driven by the need to enhance passenger experience, optimize operational efficiency, and reduce costs associated with manual processes. The adoption of these technologies has been further accelerated by increasing passenger traffic and the expansion of airline services globally.

The leadership of the Airlines segment can also be attributed to the rising demand for real-time data access and mobile applications. Airlines are increasingly investing in innovative passenger service systems that offer features like mobile check-in, e-boarding passes, and real-time notifications. These features not only improve the passenger experience but also provide a competitive edge in the highly dynamic aviation industry.

Furthermore, the regulatory environment has played a significant role in the dominance of this segment. Regulatory bodies across the globe have been imposing stringent guidelines regarding passenger safety and data security. Compliance with these regulations requires robust passenger service systems that can handle sensitive information securely and efficiently.

Key Market Segments

By Component

- Software

- Services

By Deployment Type

- On-premise

- Cloud-based

By Application

- Reservation Systems

- Check-in Systems

- Baggage Management Systems

- Flight Management Systems

By End User

- Airlines

- Travel Agencies

- Airport Authorities

- Ground Handling Services

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Digital Transformation

The aviation industry’s shift towards digitalization significantly propels the evolution of Passenger Service Systems. Airlines are increasingly adopting advanced technologies to streamline operations and enrich the passenger experience. Mobile applications, artificial intelligence, and contactless solutions are being integrated to facilitate seamless check-ins, personalized services, and efficient boarding processes.

For instance, the implementation of touchless technologies not only enhances hygiene standards but also aligns with passengers’ growing preference for digital interactions. This digital transformation is driven by the need to stay competitive and meet the expectations of tech-savvy travelers.

Restraint

Data Privacy Concerns

Despite the advantages of digitalization, data privacy remains a significant restraint in the adoption of advanced PSS. Airlines collect extensive personal information from passengers, including names, contact details, and payment information.

Ensuring the protection of this data is paramount, as breaches can lead to severe legal and reputational consequences. Regulatory frameworks such as the General Data Protection Regulation (GDPR) impose stringent requirements on data handling practices.

IATA highlights the need for governments to raise awareness of data privacy issues and find multilateral solutions to address them. Compliance with such regulations necessitates substantial investments in secure IT infrastructures and continuous monitoring, posing challenges for airlines, especially smaller carriers with limited resources.

Opportunity

Personalization of Services

The integration of technology within PSS offers airlines the opportunity to deliver personalized services, thereby enhancing passenger satisfaction and fostering loyalty. By leveraging data analytics, airlines can gain insights into individual passenger preferences and behaviors, enabling them to offer tailored promotions, seat selections, and in-flight services.

For example, utilizing Bluetooth beacons and dedicated airport applications allows passengers to receive personalized updates on flight boarding times, facilitating better time management within the airport premises.

Such personalized experiences not only improve customer satisfaction but also open avenues for ancillary revenue through targeted offerings. Mobile apps and personalized notifications keep passengers updated on flight status, gate changes, and baggage claims in real time, boosting convenience and trust.

Challenge

Integration with Legacy Systems

A significant challenge in modernizing PSS is the integration with existing legacy systems. Many airlines rely on outdated legacy systems, making it difficult and resource-heavy to integrate new technologies due to their complexity and deep integration into operations. Addressing these challenges requires meticulous planning, significant investment, and a phased approach to ensure continuity of operations while upgrading to more agile and efficient systems.

Many airlines rely on outdated legacy systems, making it difficult and resource-heavy to integrate new technologies due to their complexity and deep integration into operations. The high cost of upgrading legacy systems and the risk of disrupting operations make airlines hesitant to modernize.

Emerging Trends

The aviation industry is rapidly evolving, with Passenger Service Systems (PSS) at the forefront of enhancing the traveler experience. One significant trend is the integration of biometric technologies, such as facial recognition and fingerprint scanning, into various stages of air travel. These advancements streamline check-ins and boardings, cut wait times, and improve security.

Automation and artificial intelligence (AI) are also transforming airport operations. Self-service kiosks and automated baggage handling systems streamline operations, enhancing efficiency and reducing costs. AI-powered predictive maintenance tools detect potential mechanical issues early, minimizing delays and ensuring safety.

The shift towards cloud-based PSS solutions is another emerging trend. These systems offer unprecedented flexibility and scalability, enabling airlines to update or replace individual components without disrupting entire operations. This modular approach allows for more agile responses to market demands and technological advancements.

Business Benefits

- Enhanced Operational Efficiency: A PSS streamlines airline operations by automating processes such as reservations, inventory management, and departure control. This automation reduces manual errors and accelerates workflows, leading to more efficient use of resources.

- Improved Customer Experience: By integrating various passenger touchpoints, a PSS enables airlines to offer personalized services and seamless interactions. Passengers benefit from smoother check-ins, timely updates, and tailored offers, which enhance satisfaction and loyalty.

- Optimized Revenue Management: With real-time data and analytics, airlines can better manage pricing strategies and seat inventory. A PSS supports dynamic pricing and demand forecasting, allowing carriers to maximize revenue opportunities.

- Effective Resource Allocation: A PSS provides insights into passenger flow and operational demands, facilitating better staff and equipment deployment. This leads to reduced operational costs and improved on-time performance.

- Regulatory Compliance and Reporting: Comprehensive data collection and management within a PSS assist airlines in adhering to aviation regulations and simplifying reporting requirements. Accurate record-keeping ensures compliance and aids in audits and performance assessments.

Key Player Analysis

Hitit Computer Services is a significant player in the aviation PSS industry. Known for its cutting-edge technology and customer-centric approach, Hitit offers a comprehensive suite of solutions, including reservations, ticketing, departure control, and cargo management systems. The company focuses on delivering highly customizable software that can be tailored to the specific needs of airlines, whether large or small.

Airline Software specializes in providing PSS solutions tailored to the unique needs of low-cost and full-service carriers. Their cloud-based platform enables airlines to manage core operations such as bookings, check-ins, and flight management efficiently. Airline Software stands out for its user-friendly interface, real-time data processing capabilities, and seamless integration with other airline systems.

Transoft Solutions is a prominent player offering PSS solutions with an emphasis on improving airport and airline efficiency. Their software is designed to help airlines manage passenger services, including check-in, boarding, and ticketing, in a seamless and efficient manner. Transoft’s unique offering lies in its ability to integrate complex systems and streamline airport operations, which ultimately enhances the passenger experience.

Top Key Players in the Market

- Hitit Computer Services

- Airline Software

- Transoft Solutions

- Sabre Corporation

- Airline Information Systems

- IBS Software Services

- Datalex

- Travelport Worldwide

- SITA

- Amadeus IT Group

- Ultra Electronics

- Radixx International

- Cerner Corporation

- Other Major Players

Top Opportunities for Players

In the evolving landscape of the Aviation Passenger Service System (PSS) market, several opportunities have emerged that could be pivotal for industry players.

- AI-Driven Personalization and Automation: There’s a growing demand for more personalized travel experiences, and AI technology is at the forefront of this transformation. AI-driven systems can offer dynamic pricing, customized travel recommendations, and enhanced customer service, providing a competitive edge to airlines that embrace this technology.

- Cloud-Based PSS Platforms: The shift towards cloud-based solutions is reshaping the PSS landscape. These platforms offer scalability, flexibility, and cost-efficiency, allowing airlines to adapt more swiftly to changing market demands and to manage operational costs more effectively.

- Enhanced Cybersecurity Measures: With the increasing digitization of airline operations, cybersecurity has become a crucial area for investment. Robust cybersecurity frameworks are essential to protect sensitive passenger data and ensure the integrity of flight operations and financial transactions.

- Integration of Sustainable Practices: As environmental concerns gain priority, airlines are under pressure to adopt more sustainable practices. This includes the integration of Sustainable Aviation Fuel (SAF) and the implementation of green airport initiatives to reduce carbon footprint of airline operations.

- Market Expansion in Emerging Regions: Asia-Pacific, in particular, presents a robust growth opportunity due to rising air travel demand and digital transformation in transportation. Investing in these markets could yield substantial returns as more consumers opt for air travel and digital booking solutions.

Recent Developments

- In October 2024, Datalex introduced Stellex, an innovative Offer & Order Management System designed to boost airline revenues, enhance personalization, and improve conversion rates. Stellex is a cloud-based, scalable solution that operates with or without a PSS.

- In December 2024, Sabre Corporation extended its multi-year technology partnership with American Airlines, continuing to provide the SabreSonic® Passenger Service System (PSS). This renewal aims to modernize and innovate American Airlines technology infrastructure.

Report Scope

Report Features Description Market Value (2024) USD 10.84 Bn Forecast Revenue (2034) USD 17.8 Bn CAGR (2025-2034) 5.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Type (On-premise, Cloud-based), By Application (Reservation Systems, Check-in Systems, Baggage Management Systems, Flight Management Systems), By End User (Airlines, Travel Agencies, Airport Authorities, Ground Handling Services) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hitit Computer Services, Airline Software, Transoft Solutions, Sabre Corporation, Airline Information Systems, IBS Software Services, Datalex, Travelport Worldwide, SITA, Amadeus IT Group, Ultra Electronics, Radixx International, Cerner Corporation, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aviation Passenger Service System MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Aviation Passenger Service System MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Hitit Computer Services

- Airline Software

- Transoft Solutions

- Sabre Corporation

- Airline Information Systems

- IBS Software Services

- Datalex

- Travelport Worldwide

- SITA

- Amadeus IT Group

- Ultra Electronics

- Radixx International

- Cerner Corporation

- Other Major Players