Global Transradial Closure Devices Market By Product (Band/Strap based Transradial Closure Devices, Knob based Transradial Closure Devices and Plate based Transradial Closure Devices), By Usage Type (Disposable and Reusable), By Application (Surgical Intervention and Diagnostics), By End User. (Hospitals, Ambulatory Surgical Centers, Specialized Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168695

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

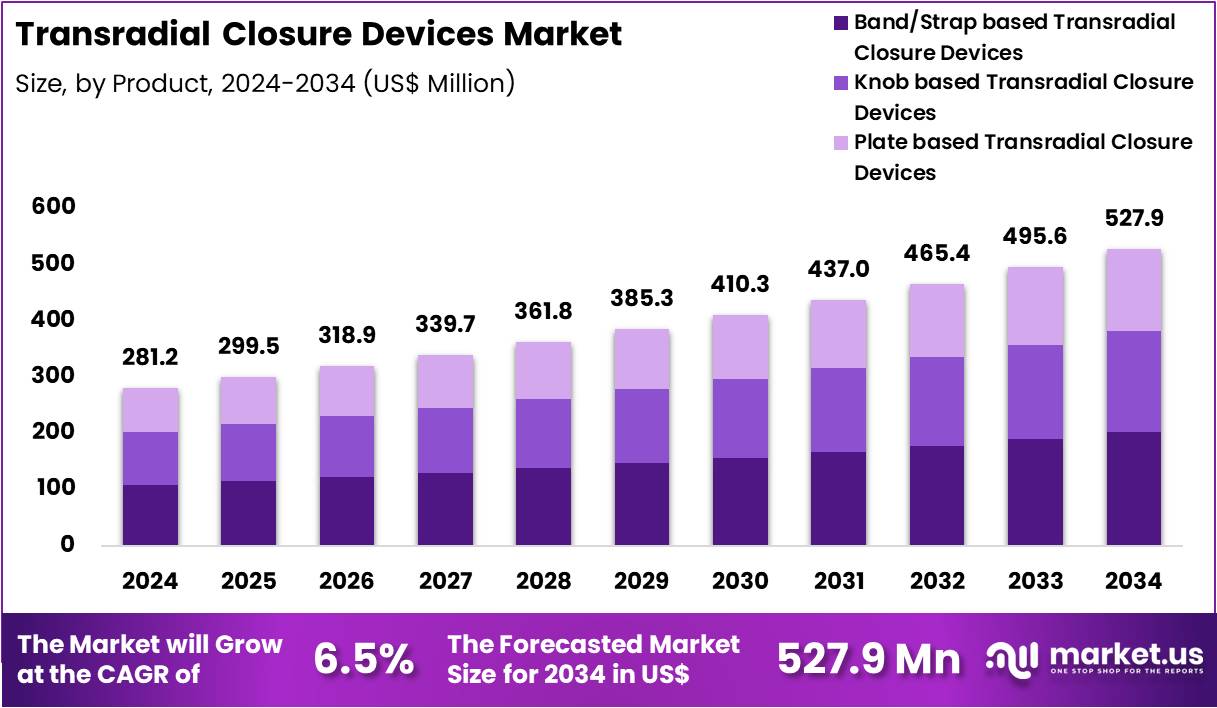

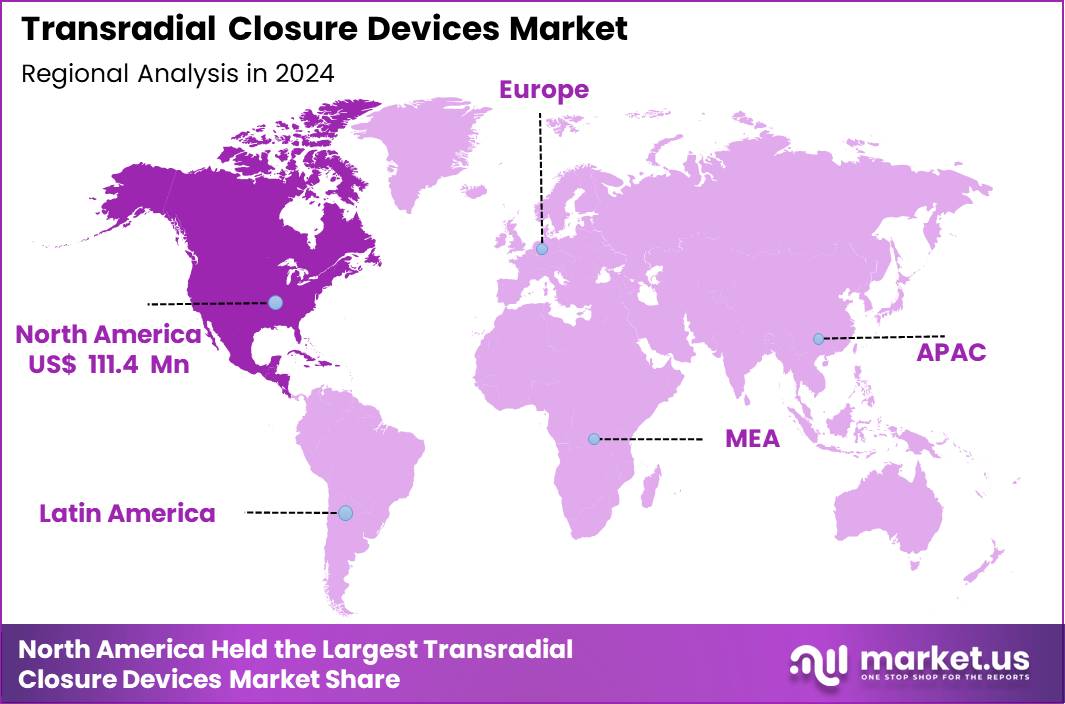

Global Transradial Closure Devices Market size is expected to be worth around US$ 527.9 Million by 2034 from US$ 281.2 Million in 2024, growing at a CAGR of 6.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.6% share with a revenue of US$ 111.4 Million.

The Transradial Closure Devices Market continues gaining traction as hospitals and catheterization centers rapidly adopt radial-access cardiovascular procedures due to improved patient comfort, reduced bleeding risk, and shorter discharge time. These devices are designed to achieve safe and efficient hemostasis following catheter removal from the radial artery, supporting fast recovery and same-day discharge models. Growing preference for radial angiography and angioplasty procedures reinforces the market’s expansion.

Band/strap, knob, and plate-based compression systems are increasingly used because they reduce pressure-related complications, allow precise compression control, and support early ambulation. Manufacturers focus on comfortable materials, transparent plates, quick-release mechanisms, and adjustable compression systems to minimize radial artery occlusion. Rising adoption of outpatient cardiac interventions and day-care procedures further amplifies device utilization across hospitals and ambulatory surgical centers.

The market benefits from rising cardiovascular disease burden, aging demographics, and wider clinical acceptance of radial access over femoral access. Training programs for interventional cardiologists and supportive guidelines from clinical societies accelerate technology uptake. As global healthcare shifts toward minimally invasive cardiovascular care, transradial closure devices remain a critical component of post-procedure recovery pathways.

Key Takeaways

- In 2024, the market generated a revenue of US$ 281.2 Million, with a CAGR of 6.5%, and is expected to reach US$ 527.9 Million by the year 2034.

- The Product segment is divided into Band/Strap based Transradial Closure Devices, Knob based Transradial Closure Devices, and Plate based Transradial Closure Devices, with Band/Strap based Transradial Closure Devices taking the lead in 2024 with a market share of 38.2%

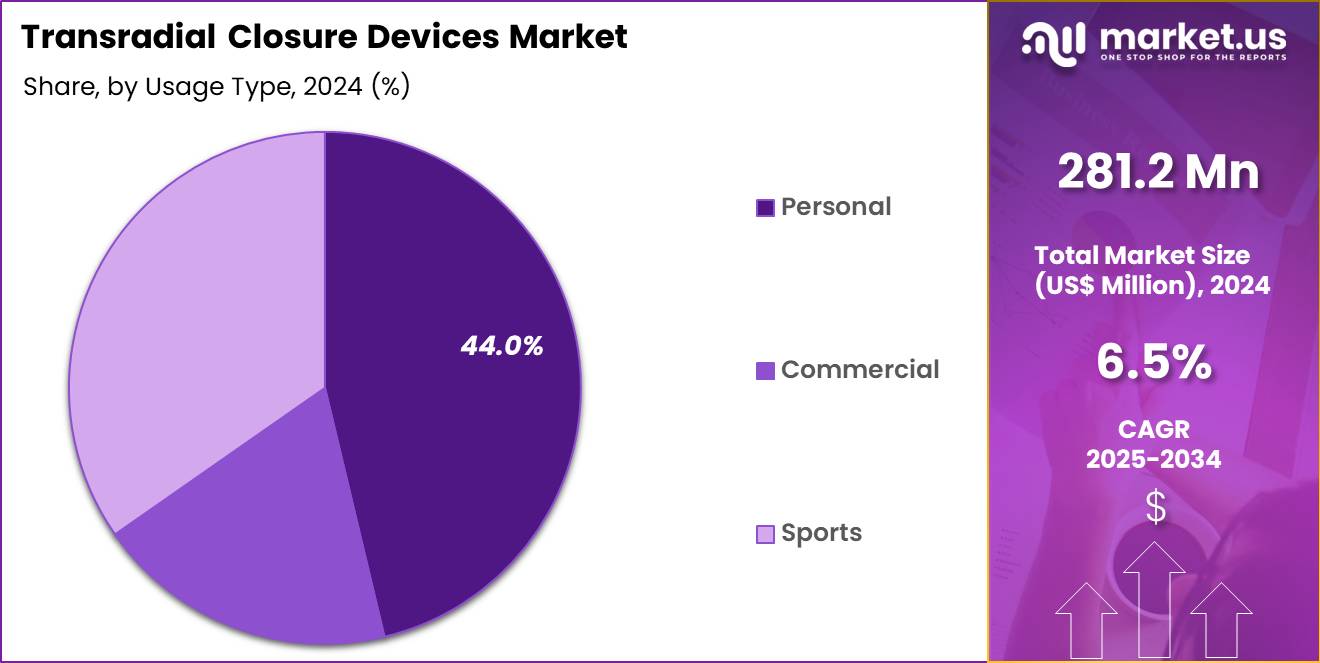

- The Usage Type segment is divided into Disposable, and Reusable, with Disposable, and Reusable taking the lead in 2024 with a market share of 61.4%

- The Application segment is divided into Surgical Intervention, and Diagnostics, with Surgical Intervention taking the lead in 2024 with a market share of 55.8%

- The End-User segment is divided into Hospitals, Ambulatory Surgical Centers, Specialized Clinics, and Others, with Hospitals taking the lead in 2024 with a market share of 58.9%

- North America led the market by securing a market share of 39.6% in 2024.

Product Analysis

Band/strap-based systems serve as the widely used category due to their ease of use , patient comfort, and adjustable compression features accounting for 38.2% market share in 2024. These devices typically utilize inflatable or mechanical strap systems that stabilize hemostasis while enabling clinicians to gradually decrease pressure. Their transparent structures help monitor bleeding, and soft materials reduce the risk of vascular trauma. They are adopted extensively in high-volume catheterization labs.

Knob-based designs allow precise incremental compression control, making them suitable in cases requiring fine pressure adjustments. Their ergonomic design supports uniform pressure distribution, minimizes radial artery occlusion risk, and provides predictable hemostasis during both diagnostic and interventional procedures. Interventional cardiology centers prefer knob-based devices for enhanced operator control and reduced complications.

Usage Type Analysis

Disposable transradial closure devices remain the most widely used accounting for 61.4% market share in 2024 due to their infection-control benefits, convenience, and single-use hygiene standards. They eliminate sterilization needs and reduce cross-contamination risk, making them the preferred option in hospitals and specialized cardiac labs that handle large volumes of angiography and angioplasty procedures. Growth in day-care centers strengthens disposable device adoption.

Reusable devices are adopted primarily in cost-sensitive healthcare settings where sterilization infrastructure is readily available. These devices offer long-term cost advantages, especially for high-volume diagnostic facilities. However, stringent cleaning protocols and concerns regarding re-sterilization cycles influence adoption across advanced healthcare markets.

Application Analysis

Surgical interventions held the largest market share in 2024 of 55.8%, including percutaneous coronary interventions (PCI), radial angioplasty, stent placements, and complex cardiovascular procedures, involve significant usage of transradial closure systems. Preference for radial access over femoral access in interventional cardiology continues expanding, supported by reduced complications and faster mobility. High procedure volumes in tertiary cardiac centers drive this segment.

Diagnostic procedures such as coronary angiography, peripheral vascular assessments, and electrophysiology evaluations increasingly utilize radial access for patient comfort and faster discharge. The diagnostic segment benefits from rising outpatient angiography volumes, as transradial closure devices support rapid hemostasis and short observation time.

End User Analysis

Hospitals account 58.9% market share in 2024 due to the high volume of interventional cardiology and vascular procedures performed in catheterization labs . Most large cardiac centers adopt standardized transradial protocols supported by professional training and guidelines, reinforcing sustained device demand.

Ambulatory centers increasingly perform radial-access cardiovascular diagnostics and selective interventions. Their emphasis on short recovery periods and same-day discharge workflows drives strong adoption of closure devices designed for rapid hemostasis and patient turnover.

Cardiology clinics and dedicated catheterization centers adopt transradial closure devices to support outpatient angiography and interventional procedures. Their preference for minimally invasive techniques and efficient patient management strengthens segment growth.

Key Market Segments

By Product

- Band/Strap based Transradial Closure Devices

- Knob based Transradial Closure Devices

- Plate based Transradial Closure Devices

By Usage Type

- Disposable

- Reusable

By Application

- Surgical Intervention

- Diagnostics

By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialized Clinics

- Others

Drivers

Rising Adoption of Radial-Access Cardiovascular Procedures

The strongest growth driver for the transradial closure devices market is the rapid global shift toward radial-access cardiovascular procedures. Over the past decade, radial access has become the preferred approach in coronary angiography and percutaneous coronary intervention (PCI) due to its superior safety profile and faster patient recovery. According to clinical studies published in the Journal of the American College of Cardiology (JACC), radial access reduces major bleeding complications by nearly 50% compared to femoral access.

The RIVAL Trial, covering more than 7,000 patients across 32 countries, also confirmed radial access significantly lowers vascular complications and mortality in high-risk patients. These advantages directly increase demand for reliable transradial closure devices that ensure safe hemostasis and support same-day discharge.

In high-volume catheterization labs, up to 70–90% of diagnostic angiograms now use radial access, with countries such as Japan and parts of Europe reporting adoption rates above 80%. This trend is expanding in North America and APAC, where large hospital systems are switching to radial-first protocols due to improved patient satisfaction and reduced hospital stay. As procedure volumes continue rising, adoption of band, knob, and plate-based radial closure systems accelerates, strengthening long-term market expansion.

Restraints

Risk of Radial Artery Occlusion and Procedural Limitations

Despite growing adoption, radial artery occlusion (RAO) remains a significant restraint limiting wider penetration of transradial closure devices. RAO occurs when excessive compression or prolonged pressure obstructs arterial blood flow following catheter removal. Clinical literature indicates RAO can affect 5–12% of patients depending on sheath size, procedure duration, and device selection.

Studies published in Circulation: Cardiovascular Interventions highlight that improper pressure application is the primary cause, especially in settings lacking standardized patent-hemostasis protocols. Once occluded, the radial artery becomes unusable for repeat procedures or as a graft for coronary artery bypass surgery, increasing clinician concerns.

Additionally, patient-specific factors such as smaller vessel diameter, radial artery spasm, and anatomical variations make some cases unsuitable for radial access. Complex structural heart procedures requiring larger sheaths often still rely on femoral access, further limiting device utilization.

Training gaps also contribute: data from European Heart Journal surveys show that up to 20–25% of interventional cardiologists feel insufficiently trained in radial hemostasis management. In emerging markets, where catheterization labs vary in experience, inconsistent technique leads to higher RAO rates.

Opportunities

Expansion of Outpatient Cardiac Care and Same-Day Discharge Models

A major opportunity emerges from the global transition toward outpatient cardiac care, where radial access plays a central role. Healthcare systems increasingly promote same-day discharge after angiography and uncomplicated PCI to reduce hospital burden and improve patient throughput. Transradial closure devices enable fast, controlled hemostasis, allowing ambulation within 1–2 hours, which is crucial for ambulatory surgical centers (ASCs) and outpatient catheterization labs.

According to the American College of Cardiology, outpatient PCI procedures have grown by more than 25% over the past five years in the US, with radial access used in the majority of cases. The economic benefits are substantial radial procedures reduce hospital stay costs by $800–1,200 per patient, driving adoption in cost-sensitive regions.

As countries such as China, India, Brazil, and Gulf nations expand cardiovascular day-care infrastructure, demand for easy-to-use, disposable radial closure devices increases sharply. Device manufacturers have an opportunity to develop low-profile, adjustable compression systems tailored for high-volume centers.

Partnerships with outpatient cardiac networks, customized training packages, and region-specific product launches further expand market penetration. With outpatient care expected to grow significantly through 2030, transradial closure devices are positioned to benefit from this structural shift toward minimally invasive, efficiency-driven healthcare delivery models.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the Transradial Closure Devices Market by shaping healthcare spending, supply chain stability, and medical technology adoption cycles. Periods of economic slowdown or inflation directly affect hospital procurement budgets, often delaying purchases of advanced hemostasis devices or shifting preference toward lower-cost disposable products. Rising global inflation has increased the cost of medical polymers, adhesives, silicone materials, and packaging components—adding pressure on manufacturers and potentially increasing end-user pricing.

Geopolitical tensions such as trade restrictions between major manufacturing economies disrupt the supply of critical components, including medical-grade plastics, pressure-control valves, and sterilization materials. During global shipping disruptions, hospitals in Europe and Asia reported longer lead times for radial closure devices, affecting availability during high cardiovascular procedure volumes.

Additionally, fluctuations in currency exchange rates influence import-dependent countries, impacting procurement decisions for high-volume catheterization labs. Healthcare policy responses to geopolitical instability also shape demand—for example, regions prioritizing emergency and critical care may temporarily reduce elective angiography volumes, lowering device utilization.

Latest Trends

Advanced Hemostasis Technologies and Patent Hemostasis Adoption

A key market trend is the evolution toward advanced hemostasis systems designed to achieve “patent hemostasis,” a technique that maintains minimal radial artery blood flow during compression to reduce occlusion risk. Clinical evidence shows that patent hemostasis decreases RAO incidence by up to 70%, driving hospitals to adopt devices with fine pressure-adjustment features.

Manufacturers are developing innovative band and knob systems with transparent plates, pneumatic micro-pressure controls, and real-time visual indicators to help clinicians apply the optimal compression level. For example, new-generation pneumatic closure devices allow controlled deflation cycles and pressure monitoring, improving outcomes for patients with fragile arteries.

Global usage of radial interventions is rising data from JACC report that over 15 million radial angiography procedures occur annually worldwide fueling demand for next-generation closure solutions. Devices are also shifting toward softer materials, curved anatomical designs, and hypoallergenic components to increase comfort in high-volume outpatient settings. Integration of rapid-release valves and pre-calibrated compression modules reduces operator variability, which is especially valuable in emerging markets.

Regional Analysis

North America is leading the Transradial Closure Devices Market

North America represents the largest share of the Transradial Closure Devices Market of 39.6% due to its advanced cardiovascular care infrastructure, high adoption of radial-first protocols, and strong presence of leading device manufacturers. The United States performs millions of coronary angiography and PCI procedures annually, with radial access now used in more than 50–60% of cases across major hospital networks.

Robust training programs offered by the Society for Cardiovascular Angiography and Interventions (SCAI) accelerate radial adoption, strengthening demand for precise hemostasis systems. Hospitals increasingly prefer adjustable band and knob-based devices to support rapid ambulation and same-day discharge, aligning with evolving reimbursement models. Additionally, high patient awareness and the presence of large outpatient cardiac centers expand the use of disposable transradial closure devices.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region in the Transradial Closure Devices Market due to rising cardiovascular disease prevalence, expanding catheterization lab infrastructure, and rapid adoption of cost-effective radial interventions. Countries such as China, Japan, and South Korea report some of the world’s highest radial-access rates, with Japan exceeding 80% usage in diagnostic and interventional cardiology.

Large patient populations, increasing procedural volumes, and government investment in cardiac care enhance demand for reliable closure systems. Growth of ambulatory surgical centers and high-volume public hospitals drives adoption of disposable radial closure devices designed for efficiency and low complication rates. In India and Southeast Asia, training initiatives led by interventional cardiology societies promote radial-first protocols, accelerating technology penetration.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Terumo Corporation, Merit Medical Systems, Inc., Abbott Laboratories, Teleflex Incorporated, Medtronic plc, Vascular Solutions, Advanced Vascular Dynamics, TZ Medical, Inc., Beijing Demax Medical Technology Co., Ltd., Semler Technologies, Inc., Lepu Medical Technology (Beijing) Co., Ltd., CardioFocus, Comed B.V., InSitu Technologies, Shenzhen Comed Medical, MedAsia Biomedical, SMD Medical, Scitech Medical, and Others

Terumo Corporation is a global leader in radial-access solutions, offering industry-standard devices such as TR Band, widely adopted for achieving controlled hemostasis after catheterization. Its strong clinical penetration and radial-first advocacy make it the most influential player.

Merit Medical Systems, Inc. provides reliable radial compression systems including PreludeSYNC, designed for precise pressure control and patient comfort, strengthening its presence in high-volume cath labs. Abbott Laboratories supports radial-access workflows through its vascular intervention portfolio and complementary technologies, enabling seamless integration of closure devices with diagnostic and interventional procedures.

Top Key Players

- Terumo Corporation

- Merit Medical Systems, Inc.

- Abbott Laboratories

- Teleflex Incorporated

- Medtronic plc

- Vascular Solutions

- Advanced Vascular Dynamics

- TZ Medical, Inc.

- Beijing Demax Medical Technology Co., Ltd.

- Semler Technologies, Inc.

- Lepu Medical Technology (Beijing) Co., Ltd.

- CardioFocus

- Comed B.V.

- InSitu Technologies

- Shenzhen Comed Medical

- MedAsia Biomedical

- SMD Medical

- Scitech Medical

- Others

Recent Developments

- In November 2022, Merit Medical Systems, Inc. announced the launch of its PreludeSYNC EZ radial compression device, introducing an enhanced low-profile band designed to improve operator control and reduce radial artery occlusion risk during post-procedure hemostasis.

- In January 2024, Terumo announced upgrades to its TRK product line, integrating softer materials and curved anatomical designs for improved patient comfort. Abbott Laboratories, while not launching a dedicated closure device, released a 2024 communication reaffirming its commitment to radial-first interventional workflows through complementary vascular access and imaging systems that support closure efficiency.

- In 2024, Beijing Demax Medical Technology reported regulatory clearance in multiple APAC markets for its new adjustable radial hemostasis band designed for same-day cardiac discharge programs.

Report Scope

Report Features Description Market Value (2024) US$ 281.2 Million Forecast Revenue (2034) US$ 527.9 Million CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Band/Strap based Transradial Closure Devices, Knob based Transradial Closure Devices and Plate based Transradial Closure Devices), By Usage Type (Disposable and Reusable), By Application (Surgical Intervention and Diagnostics), By End User. (Hospitals, Ambulatory Surgical Centers, Specialized Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Terumo Corporation, Merit Medical Systems, Inc., Abbott Laboratories, Teleflex Incorporated, Medtronic plc, Vascular Solutions, Advanced Vascular Dynamics, TZ Medical, Inc., Beijing Demax Medical Technology Co., Ltd., Semler Technologies, Inc., Lepu Medical Technology (Beijing) Co., Ltd., CardioFocus, Comed B.V., InSitu Technologies, Shenzhen Comed Medical, MedAsia Biomedical, SMD Medical, Scitech Medical, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Transradial Closure Devices MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Transradial Closure Devices MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Terumo Corporation

- Merit Medical Systems, Inc.

- Abbott Laboratories

- Teleflex Incorporated

- Medtronic plc

- Vascular Solutions

- Advanced Vascular Dynamics

- TZ Medical, Inc.

- Beijing Demax Medical Technology Co., Ltd.

- Semler Technologies, Inc.

- Lepu Medical Technology (Beijing) Co., Ltd.

- CardioFocus

- Comed B.V.

- InSitu Technologies

- Shenzhen Comed Medical

- MedAsia Biomedical

- SMD Medical

- Scitech Medical

- Others