Transplant Monitoring Kits Market By Product Type (Reagents & Consumables, Instruments, Software & Services, By Technology, Molecular Assay Technologies and Non-Molecular Assay Technologies), By Transplant Type (Solid Organ, Stem Cell, Soft Tissue), By End-User (Independent Reference Laboratories, Hospitals & Transplant Centres, and Research Laboratories & Academic Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167455

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

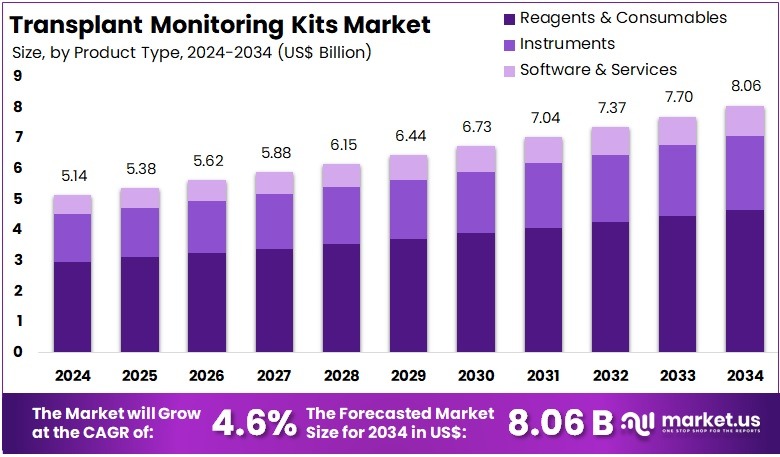

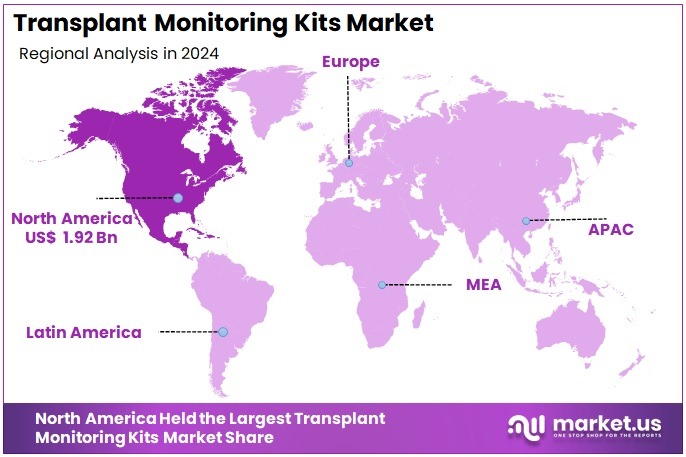

The Transplant Monitoring Kits Market size is expected to be worth around US$ 8.06 billion by 2034 from US$ 5.14 billion in 2024, growing at a CAGR of 4.6% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 37.4% share and holds US$ 1.92 Billion market value for the year.

The Transplant Monitoring Kits Market is expanding rapidly as precision diagnostics become increasingly central to transplant medicine. Monitoring tools are now essential for evaluating graft function, immune activity, donor-derived cell-free DNA (dd-cfDNA), antibody levels, molecular mismatches, chimerism, and infection risk. These kits support early detection of rejection, optimize immunosuppression, and improve long-term graft survival.

The market is benefiting from rising global transplant procedures, accelerated adoption of non-invasive testing, wider implementation of molecular workflows, and the shift toward personalized post-transplant care. For instance, global transplantation procedures have experienced a significant rise in recent years, with 2023 witnessing a record total of approximately 172,397 organ transplants performed worldwide—a 9.5% increase compared to 2022 numbers.

The Americas lead globally in the volume of organ transplants, with nearly 62,180 performed in 2022, followed by Europe (40,337) and the Western Pacific region (29,014). Spain and the U.S. have the highest transplant rates per million, with Spain consistently recognized for its efficient donation and transplantation system.

Clinicians increasingly rely on molecular assays, sequencing platforms, and integrated software to interpret transplant-specific biomarkers faster and more accurately. The ongoing transition from biopsy-based evaluation to blood-based molecular monitoring further strengthens market adoption.

Growing investments in molecular laboratories, expansion of transplant programs in Asia, digital reporting workflows, and continuous innovations in dd-cfDNA testing underpin strong market momentum through 2034.

Key Takeaways

- In 2024, the market generated a revenue of US$ 14 billion, with a CAGR of 4.6%, and is expected to reach US$ 8.06 billion by the year 2034.

- The Product Type segment is divided into Reagents & Consumables, Instruments, and Software & Services, with Reagents & Consumables taking the lead in 2024 with a market share of 57.8%

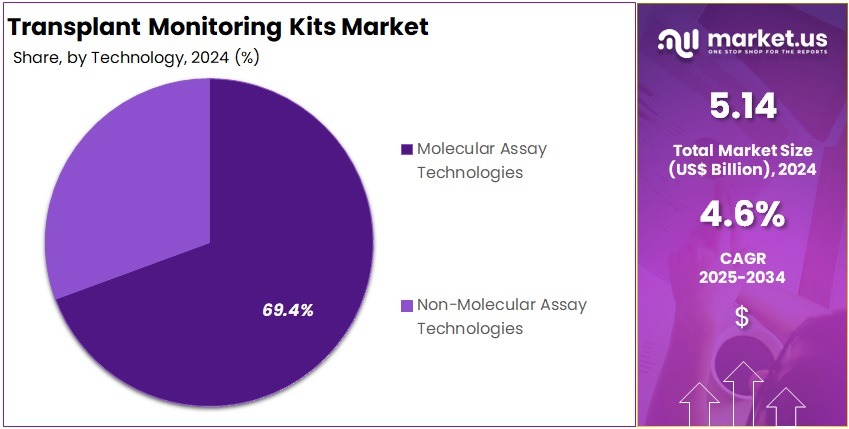

- The Technology segment is divided into Molecular Assay Technologies, and Non-Molecular Assay Technologies, with Molecular Assay Technologies taking the lead in 2024 with a market share of 69.4%

- The Transplant Type segment is divided into Solid Organ, Stem Cell, and Soft Tissue, with Solid Organ taking the lead in 2024 with a market share of 65.5%.

- The End-User segment is bifurcated into Independent Reference Laboratories, Hospitals & Transplant Centres, and Research Laboratories & Academic Institutes, with Hospitals & Transplant Centres taking the lead in 2024 with a market share of 52.4%

- North America led the market by securing a market share of 37.4% in 2024.

Product Type Analysis

Reagents & consumables dominated the market with 57.8% market share due to their central role in every transplant monitoring workflow. These include PCR reagents, extraction kits, sequencing consumables, HLA typing kits, dd-cfDNA reagents, immunoassay kits, and crossmatch reagents. Post-transplant monitoring requires repeated sample evaluation, often weekly or monthly, particularly during the first year after transplantation. This repeated testing generates consistent, high-volume reagent consumption.

The development of high-sensitivity molecular kits has further increased reagent utilization, as newer tests require more advanced buffers, primers, and calibration materials. In October 2024, QIAGEN expanded its automated liquid biopsy portfolio to enhance organ transplant applications with new kits (e.g., QIAsymphony DSP Circulating DNA Kits) for extracting ccfDNA from large sample volumes, which is crucial for sensitive monitoring.

Instruments include PCR analyzers, NGS systems, microarray platforms, flow cytometers, digital PCR systems, and fully automated analyzers used for antibody detection, chimerism assessment, and viral load testing. Software & services play an increasingly critical role as transplant programs adopt digital graft-health dashboards, AI-assisted immune-risk scoring, and cloud-integrated reporting platforms. Many systems support real-time interpretation of molecular signals, longitudinal monitoring of graft function, and automated alerts for early signs of rejection.

Technology Analysis

Molecular assays are the foundation of modern transplant monitoring and hence accounted for 69.4% market share in 2024. These include PCR, real-time PCR, digital PCR, next-generation sequencing, gene-expression profiling, donor-derived cfDNA quantification, HLA sequencing, and pathogen molecular diagnostics. These technologies outperform traditional methods by detecting minute molecular signals that precede clinical symptoms or biopsy-detectable rejection.

In October 2025, Thermo Fisher Scientific introduced a new laboratory-developed test for post-transplant biopsy assessment, engineered to enhance the detection of lung transplant rejection and tissue injury. The test provides quantifiable results aimed at improving diagnostic confidence and supporting more timely and informed treatment decisions.

dd-cfDNA tests are particularly transformative because they allow non-invasive tracking of graft injury using blood samples, making them highly attractive for kidney and heart transplant patients. Molecular HLA typing and NGS-based compatibility testing further enhance donor-recipient matching accuracy. Their precision, non-invasive nature, and predictive abilities position molecular assays as the preferred monitoring approach worldwide.

Transplant Type Analysis

Solid organ transplantation (kidney, liver, heart, lung, pancreas) accounts for the majority of global demand with 65.5% market share, driven largely by kidney transplant volume worldwide. Monitoring graft integrity is critical due to high rates of acute and chronic rejection, especially during the first year.

Solid organ transplant recipients undergo continuous biomarker evaluation, HLA testing, antibody screening, viral monitoring, and dd-cfDNA testing, making this the largest and most consistent demand segment. For example, the United States performed over 48,000 transplants in 2024 alone, maintaining its top position in both total numbers and procedures per million population. Liver and heart transplants are the next most common, with 2023 setting records for more than 10,000 liver transplants and over 4,500 heart transplants in the U.S. alone.

Stem cell transplantation relies on chimerism testing, GVHD biomarker detection, viral reactivation tests, and immune reconstitution monitoring. Molecular assays (e.g., STR-based chimerism analysis, NGS chimerism, T-cell profiling) are increasingly used to monitor engraftment quality. Growth in cell and gene therapy, CAR-T programs, and hematopoietic stem cell transplants supports rising demand in specialized diagnostic centers. Soft tissue transplantation includes corneal transplants, vascular tissue, skin grafts, and musculoskeletal tissues.

End-User Analysis

Hospitals and specialized transplant centres form the largest customer base covering 52.4% market share, as they handle transplantation procedures, immediate postoperative care, and routine follow-up. These centres require high-throughput HLA typing, antibody monitoring, viral load testing, and dd-cfDNA analysis. Rising adoption of rapid molecular workflows and point-of-care compatible kits strengthens this segment.

Reference labs conduct large-scale transplant monitoring for hospitals lacking advanced molecular infrastructure. They offer centralized services for NGS HLA typing, chimerism analysis, gene expression profiling, and dd-cfDNA tests. Academic settings focus on innovation, biomarker research, and next-generation assay development. They contribute significantly to early-phase clinical validation of molecular rejection signatures and immune-profiling technologies.

Key Market Segments

By Product Type

- Reagents & Consumables

- Instruments

- Software & Services

By Technology

- Molecular Assay Technologies

- Non-Molecular Assay Technologies

By Transplant Type

- Solid Organ

- Stem Cell

- Soft Tissue

By End-User

- Independent Reference Laboratories

- Hospitals & Transplant Centres

- Research Laboratories & Academic Institutes

Drivers

Rising global transplant procedures and growing patient survival rates

Global transplant activity continues to rise as more patients with end-stage organ failure gain access to advanced surgical programs, donor registries, and long-term immunosuppressive care. According to the Global Observatory on Donation and Transplantation, more than 146,000 solid organ transplants were performed worldwide in a recent year, reflecting steady annual growth across kidney, liver, heart, and lung procedures.

Kidney transplantation remains the most common, with over 100,000 cases annually, driven by rising incidence of diabetes and hypertension. Improvements in organ preservation, genomic donor matching, and post-operative infection control have enhanced survival outcomes dramatically. For example, one-year survival rates for kidney transplants frequently exceed 93%, while heart transplant survival has reached 85% in many leading programs. As survival extends beyond the first year, the need for continuous monitoring increases because chronic rejection often emerges gradually over time.

Every transplant patient requires regular assessment of donor-specific antibodies, dd-cfDNA levels, viral reactivation markers, and immune activity. Countries like the US, Spain, and South Korea have expanded donor programs significantly, adding thousands of new transplant candidates every year. As global programs grow, so does the number of patients requiring lifelong molecular and immunological monitoring, reinforcing sustained demand for advanced transplant monitoring kits.

Restraints

High cost of molecular and sequencing-based assays

Advanced transplant diagnostics, particularly NGS-based HLA sequencing, digital PCR assays, and donor-derived cell-free DNA (dd-cfDNA) testing, involve substantial cost burdens for laboratories and transplant centers. Sequencing reagents, specialized enzymes, consumables, and high-precision cartridges contribute significantly to overall test pricing.

For instance, a single NGS-based HLA typing run may require hundreds of dollars in reagent and consumable inputs, while dd-cfDNA assays rely on sophisticated workflows that demand premium extraction kits, barcoded sequencing libraries, and high-fidelity polymerases. Beyond consumables, the instrumentation required—such as digital PCR systems or high-throughput sequencers—can cost hundreds of thousands of dollars, often making adoption difficult for mid-sized or resource-limited hospitals.

Skilled personnel are also needed to operate these platforms, adding to operational expenditure. In many regions, reimbursement for molecular transplant tests remains inconsistent, leading to out-of-pocket burdens for patients. For example, some healthcare systems cover viral load assays but not gene-expression profiling or dd-cfDNA surveillance, creating financial gaps in post-transplant care. Because transplant patients require frequent monitoring—sometimes weekly in the early months—cost barriers can slow clinical adoption.

Consequently, centers in low- and middle-income countries may continue relying on older immunoassays, limiting broader implementation of cutting-edge molecular diagnostics. In September 2025, Insight Molecular Diagnostics announced enrolment of the first patient in its GraftAssureDx clinical trial for a kit intended for IVD use in clinical decision-making.

Opportunities

Integration of AI-enabled immune-risk scoring platforms

AI-driven immune-risk scoring represents a major opportunity for next-generation transplant monitoring. Traditional monitoring relies on isolated markers—donor-specific antibodies, biopsy histology, dd-cfDNA levels, or viral PCR results. AI platforms integrate dozens of variables simultaneously, including molecular signatures, clinical history, medication adherence, comorbidities, and immunological mismatches.

Studies from major transplant programs show that machine-learning models can identify rejection risk weeks before clinical symptoms or biopsy changes appear. For instance, algorithms analyzing dd-cfDNA trends combined with serum creatinine can predict kidney graft injury with sensitivity greater than 85%. AI can also improve immunosuppression dosing by analyzing patient-specific pharmacokinetic patterns, reducing toxicity and infection risk.

In cardiac transplantation, predictive models have been used to detect early signs of acute rejection using gene-expression profiles integrated with hemodynamic data. AI tools also support high-throughput HLA eplet mismatch analysis, helping clinicians assess the likelihood of chronic rejection.

Cloud-based dashboards allow real-time monitoring across large patient cohorts, reducing hospital admissions and enabling earlier intervention. As transplant registries expand and more molecular datasets become available globally, AI models will gain accuracy, transforming post-transplant management into a personalized, data-driven ecosystem. This creates significant potential for diagnostic companies offering AI-linked monitoring kits.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical conditions play a significant role in shaping the availability, cost, and adoption of transplant monitoring kits. Economic slowdowns often reduce hospital budgets, delaying investments in high-cost molecular platforms such as NGS sequencers, digital PCR systems, and automated immunoassay analyzers. Inflationary pressures further increase reagent and consumable costs, especially for enzymes, extraction kits, microfluidic cartridges, and specialized plastics that depend heavily on international supply chains.

During periods of geopolitical tension, restrictions on the export of biological materials, semiconductor components, and laboratory-grade chemicals can disrupt production of key assay components. For example, global shortages of pipette tips and PCR reagents during the pandemic demonstrated the vulnerability of diagnostic supply chains, directly affecting transplant laboratories that rely on continuous molecular testing for dd-cfDNA, HLA typing, viral load monitoring, and antibody assessment.

Energy price volatility affects cold-chain logistics required for transporting temperature-sensitive reagents, impacting availability in regions with limited storage infrastructure. Geopolitical instability also reduces cross-border collaborative research, slowing clinical validation studies that support new biomarker panels.

Latest Trends

Increasing use of multi-omic transplant profiling

Multi-omic profiling has become a transformative trend in transplant diagnostics by combining genomics, transcriptomics, proteomics, metabolomics, and immune-cell profiling to achieve a deeper understanding of graft health. Unlike single-marker tests, multi-omic approaches analyze thousands of biological signals simultaneously, capturing early molecular disturbances that precede clinical rejection.

Research programs report that integrating gene-expression signatures with proteomic markers can improve rejection detection accuracy to over 90%, outperforming traditional biopsy findings. For example, transcriptomic panels analyzing over 500 immune-regulation genes have been validated for identifying subclinical rejection in kidney and heart transplants, reducing unnecessary biopsies.

Proteomic profiling of complement activation fragments, chemokines, and injury-response proteins provides additional layers of insight into whether the immune system is initiating antibody-mediated or T-cell–mediated injury. Metabolomic profiling can detect early metabolic shifts in graft tissues, helping differentiate between ischemic injury and immune-driven damage.

Combined single-cell sequencing and immune-cell phenotyping are now used to characterize T-cell exhaustion, regulatory T-cell function, and NK-cell activity following transplantation. This multi-layered approach enables more precise diagnosis, earlier intervention, and personalized immunosuppression strategies. As multi-omic platforms become more affordable and integrated with AI analytics, they are expected to redefine the standard of post-transplant surveillance.

Regional Analysis

North America is leading the Transplant Monitoring Kits Market

North America leads the global market due to high transplant volumes, advanced pathology infrastructure, strong reimbursement pathways, and widespread adoption of molecular transplant diagnostics. The region has a high penetration of dd-cfDNA technologies, digital pathology platforms, and integrated clinical-molecular transplant programs. Strong presence of diagnostic manufacturers and research collaborations further support dominance.

In December 2024, Oncocyte Corp., a diagnostics technology company, announced new favorable data on its lead assay, VitaGraft™, published in the journal Nephrology Dialysis Transplantation. VitaGraft Kidney™ measures the level of donor-derived DNA fragments circulating in a transplant patient’s blood, a critical biomarker for evaluating graft health. This donor-derived cell-free DNA (dd-cfDNA) testing approach is widely used in clinical settings to monitor transplant outcomes.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region experiences rapid growth driven by expanding healthcare investments, rising organ failure prevalence, establishment of transplant programs in India, China, Japan, and South Korea, and increasing molecular laboratory adoption. Growing awareness of graft survival optimization and rising availability of cost-effective molecular kits support strong regional expansion. E-health and telepathology infrastructure accelerate uptake, especially in urban centers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd., Abbott Laboratories, Danaher Corporation, Illumina Inc., QIAGEN N.V., Hologic Inc., Natera Inc., Bio-Rad Laboratories, Inc., Eurofins Scientific SE, JETA Molecular (UK), Biogenuix Medsystems Inc., and Other key players.

Thermo Fisher provides advanced PCR, qPCR, and NGS workflows widely used in transplant monitoring for HLA typing, viral load assessment, and donor-derived cfDNA analysis. Its instruments, reagents, and analytics platforms support high-sensitivity molecular testing across leading transplant laboratories.

Roche delivers comprehensive transplant diagnostics through its molecular PCR systems, immunoassay platforms, and CMV/EBV viral monitoring kits. Its Cobas molecular solutions enable reliable, automated assessment of rejection-related markers and post-transplant infection risks in hospital and reference laboratory settings.

Abbott supports transplant monitoring through its immunoassay analyzers, viral load testing systems, donor-specific antibody assays, and molecular platforms. Its Alinity and m2000 systems are routinely used for CMV, EBV, and BK virus surveillance, essential for long-term graft management.

Top Key Players in the Transplant Monitoring Kits Market

- Thermo Fisher Scientific Inc.

- Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Danaher Corporation

- Illumina Inc.

- QIAGEN N.V.

- Hologic Inc.

- Natera Inc.

- Bio-Rad Laboratories, Inc.

- Eurofins Scientific SE

- JETA Molecular (UK)

- Biogenuix Medsystems Inc.

- Other key players

Recent Developments

- In May 2024: Omixon announced the launch of HoloGRAFT ONE, a research-use donor-derived cell-free DNA kit and software for post-transplant monitoring. The new format uses single-use dry reagents in a strip-of-12-tube format to simplify workflow.

- In October 2024: QIAGEN expanded its automated liquid biopsy portfolio to include organ-transplant applications. The update introduced new ccfDNA kits and enhanced automated workflows (EZ1/EZ2 platforms) designed to improve organ-transplant sample processing.

- In July 2025: Insight Molecular Diagnostics (“iMDx”) announced that its dd-cfDNA combination model achieved a positive predictive value of 79% (at 25% rejection prevalence) for kidney transplant rejection vs ~48% for standard methods.

Report Scope

Report Features Description Market Value (2024) US$ 5.14 billion Forecast Revenue (2034) US$ 8.06 billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents & Consumables, Instruments, Software & Services, By Technology, Molecular Assay Technologies and Non-Molecular Assay Technologies), By Transplant Type (Solid Organ, Stem Cell, Soft Tissue), By End-User (Independent Reference Laboratories, Hospitals & Transplant Centres, and Research Laboratories & Academic Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd., Abbott Laboratories, Danaher Corporation, Illumina Inc., QIAGEN N.V., Hologic Inc., Natera Inc., Bio-Rad Laboratories, Inc., Eurofins Scientific SE, JETA Molecular (UK), Biogenuix Medsystems Inc., and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Transplant Monitoring Kits MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Transplant Monitoring Kits MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Danaher Corporation

- Illumina Inc.

- QIAGEN N.V.

- Hologic Inc.

- Natera Inc.

- Bio-Rad Laboratories, Inc.

- Eurofins Scientific SE

- JETA Molecular (UK)

- Biogenuix Medsystems Inc.

- Other key players