Transplant Diagnostics Market- By Technology (Molecular Assay and Non-Molecular Assay), By Product & Service (Instrument, Reagent, Software, and Other Product & Services), By Transplant Type (Solid Organ Transplantation, Stem Cell Transplantation, Soft Tissue Transplantation, and Other Transplants), By End-User (Research Laboratories & Academic Institutes, Hospital & Transplant Centers, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2024

- Report ID: 103148

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

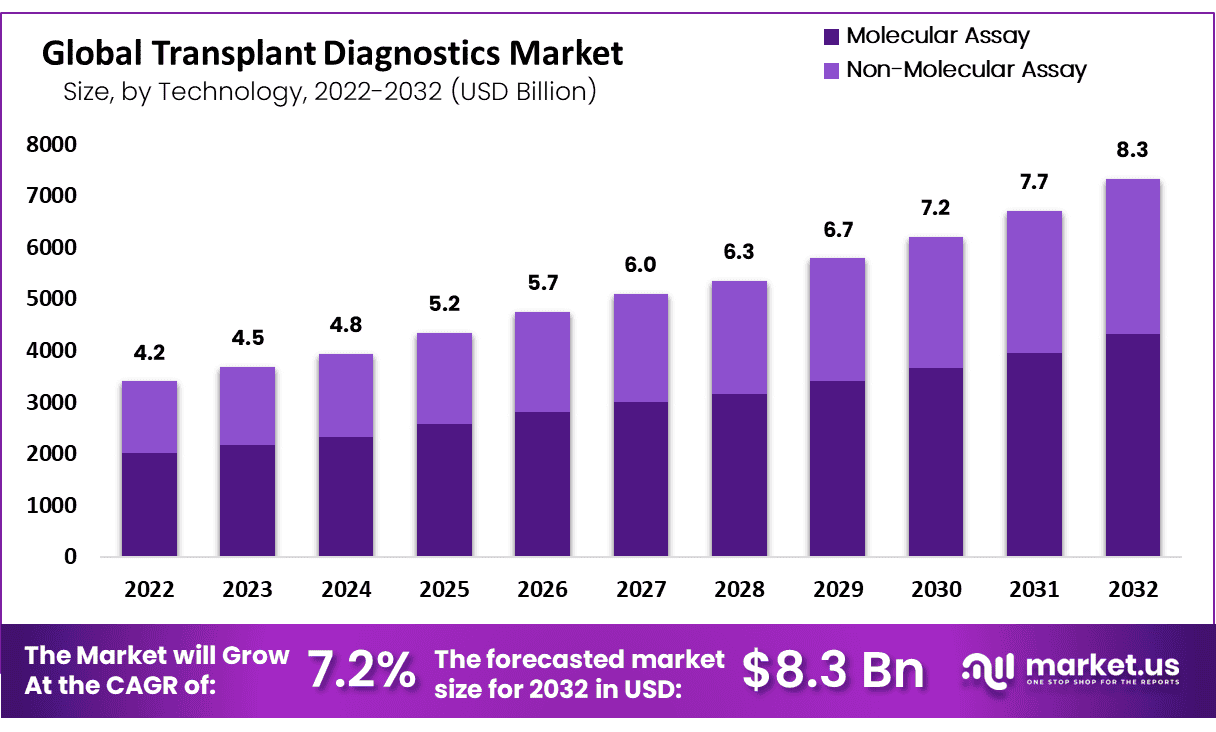

The Transplant Diagnostics Market size is expected to be worth around USD 8.3 Billion by 2032 from USD 4.2 Billion in 2022, growing at a CAGR of 7.2% during the forecast period from 2023 to 2032

There is a rise in demand for transplant procedures due to an increasing number of patients with chronic diseases that frequently result in organ failure. Also, the use of personalized medicine and stem cell therapy is growing. Thus, pre-procedure diagnostics are in high demand. Improved and sophisticated diagnostic tools are required due to the complexity and risks of organ transplants. The supply of organs has always been higher than the demand for transplants. However, the market is likely to benefit from extensive field research and analysis to close this gap.

Donated organs are now readily available as a result of the European Commission’s efforts to harvest organs. The rate of organ donation has also increased in the region due to the availability of the European donor card and rising public awareness. In a similar vein, as public awareness has grown, organ donations in the United States have significantly increased.

Key Takeaways

- Organ transplant is often a necessity for patients with chronic illnesses. The transplant diagnostics market is experiencing a period of rapid growth.

- By molecular assay technology, the PCR-based assays segment generated 34% revenue in 2022.

- By products and services segment, reagents generated the highest revenue in the market and is projected to grow at the highest CAGR.

- By type of transplant, the segment of solid transplants had the largest share.

- In terms of end users, the research laboratories and academic institutions segment accounted for the largest market share.

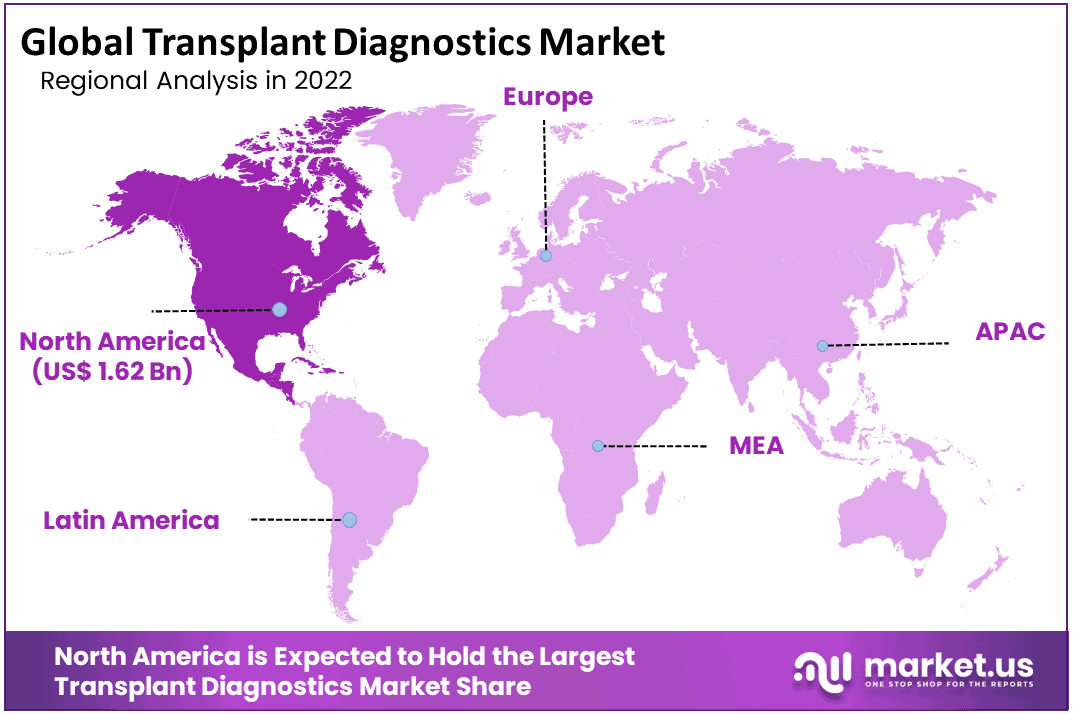

- In 2022, North America continues to be the largest donor, with a significant turnover share of 38.7%.

- Asia Pacific is projected to grow at the fastest CAGR during the forecast period.

Technology Analysis

The molecular assay segment accounted for the largest revenue share of 59%. Pre-transplant analysis methods are used to make sure procedures are effective and safe. In the future, it is anticipated that factors such as the rapid adoption of technologically advanced tools and the rising awareness among physicians will drive the growth of the market.

When compared to non-molecular assays, physicians prefer molecular assays. In addition, due to its efficacy, accuracy, and lower risk, HLA typing has gradually replaced serological assays as the preferred method. Due to its numerous applications, the PCR-based assay segment currently holds the largest market share.

During the forecast period, it is anticipated that the sequencing-based assay segment will expand at the quickest rate. Stringent regulatory protocols, inadequate reimbursement policies for organ transplants, slower approval processes, and social and ethical controversies in various parts of the world could hinder the expansion of the market.

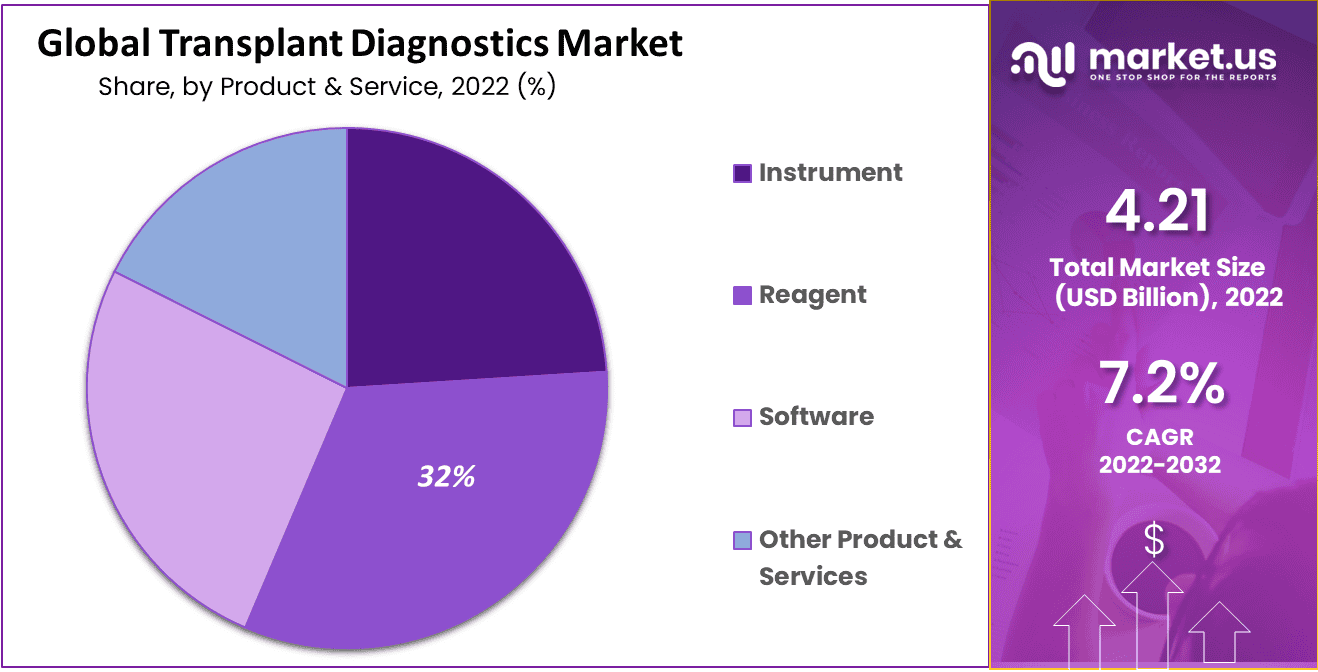

Product & Service Analysis

Instruments, reagents, software, and others are the segments that make up the market for transplant diagnostics. The reagent segment dominated the market with 32% of revenue share. Purchase contracts for reagents and consumables are one method that diagnostic product manufacturers are employing. In addition, repeat purchases of they are the primary driver of adoption. Consequently, the segment is anticipated to maintain its dominance throughout the forecast period and contributed the most revenue.

In terms of growth, it is anticipated that the services and software market will follow reagents and consumables. This market is growing because more and more sophisticated instruments are being used, which means there is a greater demand for training sessions to teach technical staff how to use and handle them. In addition, growth in the segment is being driven by factors like frequent software updates and enhanced services provided by market players to remain competitive.

Transplant Type Analysis

The Solid Organ Transplant Segment Is Expected to Hold a Major Share Over the Forecast Period. In the transplant type the solid organ transplant segment was accounted for the majority of market share.

In the 20th century, solid-organ transplantation began as an experimental method and is now regarded as a better treatment option for patients with end-stage organ dysfunction. The kidneys receive the maximum transplants after the liver transplantation.

End-User Analysis

Research Laboratories & Academic Institutes Accounted for The Largest Share of the Market

The market is segmented into commercial service providers, academic and research institutes, hospitals and transplant centers, and others. The majority of the market was held by research laboratories & academic institutes.

The rapid modernization & automation of diagnostic laboratories, the rising number of research and development activities outsourced to independent reference laboratories by pharmaceutical and biotechnology companies, and the rising number of organ transplant procedures account for a significant portion of this market.

Key Market Segments

Based on Technology

- Molecular Assay

- PCR-Based Molecular Assay

- Sequencing-Based Molecular Assay

- Non-Molecular Assay

- Serological Assay

- Mixed-Lymphocyte Culture Assay

Based on Product & Service

- Instrument

- Reagent

- Software

- Other Product & Services

Based on Transplant Type

- Solid Organ Transplantation

- Stem Cell Transplantation

- Soft Tissue Transplantation

- Bone Marrow Transplantation

- Other Transplants

Based on End-User

- Research Laboratories & Academic Institutes

- Hospital & Transplant Centers

- Commercial Service Providers

- Other End-Users

Drivers

Increasing Transplantation Number

Because of the increased prevalence of improved post-transplant outcomes and vital organ failure, the demand for organ transplants has been boosted worldwide over the past decade. Transplants of the lungs, heart, liver, and kidneys are in high demand. Organ failure is primarily caused by alcohol consumption, drug abuse, and lack of exercise. The COVID-19 pandemic has had an effect on the number of transplants from living donors. However, the number of transplants from living donors will rise over the forecast period.

Additionally, organ transplantation has the socioeconomic burden of organ failure and a significant impact on public health, as well as increases patient survival and quality of life. Europe is a leader in this field because it has developed national programs, well-defined exchange policies, international systems to drive organ sharing, and a relatively uniform & structured approach to organ transplantation. The global market is anticipated to expand as a result of the increasing number of transplant procedures and successful transplants.

Restraints

Expensive Organ Transplantation

Products that are extremely technologically advanced are used in organ transplantation therapy. The developing players conduct extensive R&D for these products. As a result, the price of the products and procedures remains high, which in turn drives up the price of testing. Moreover, organ transplants cost a lot because they use a lot of resources, like high-paying doctors, expensive medications, and transportation.

Desensitizing treatments have also been used to transplant from a donor who is incompatible. However, these procedures are very costly and may result in complications or worse outcomes in the long run. As a result, a major impediment to the expansion of the global market will be the high costs associated with advanced treatment and transplantation methods.

Opportunities

Strategic Approach by Major Market Players

The need for smart business ideas grows as the market expands worldwide. It includes company growth, partnership, and other developments. Diagnostic kits for transplants are in high demand due to the rising demand for donor organs. In order to achieve established objectives, market participants are able to align with the functional activities of the organization thanks to the planned strategies. It directs the company’s decision-making and discussions when it comes to figuring out how much money and resources are needed to reach goals and improve operational efficiency.

The major market players’ strategic initiatives, such as agreements, business expansion, and product launches, are anticipated to provide an opportunity for the global market. It is anticipated that the strategic approach will support expansion and enhance the product portfolio of the business, leading to increased revenue generation. As a result, market players’ strategic initiatives may be viewed as an opportunity to boost the global transplant diagnostics market.

Impact of Macroeconomic Factors

Inflation is one of the most significant factors influencing the transplant diagnostics market. Rising inflation is accompanied by increased costs of living, and by extension rising healthcare costs. Increase in cost of medical services can discourage patients from seeking medical care. Inflation can cause financial burden, which forces people to spend on necessities and putting off medical expenses.

Trends

Using pluripotent stem cells extracted from the patients to create organs is an avenue that researchers and medical professional alike are exploring. Further, advances in immunotherapy have ushered in novel immunosuppressants, which are assisting post-operational recovery.

Such immunosuppressants are being used by medical professional since they aid in lowering chances of organ rejection. Use of innovative preservative solutions facilitates enanced organ preservation with notablyless tissue damage.

Regional Analysis

North America Dominates the Global Transplant Diagnostics Market During the Forecast Period

The global transplant diagnostics market is classified into North America, Asia Pacific, Europe, and the Rest of the world. North America had the largest revenue share of 38.7%. The widespread use of treatment methods and cutting-edge diagnostics, rising healthcare costs, and the availability of skilled professionals are among the primary drivers. Due to factors like highly developed healthcare infrastructure and the availability of skilled professionals, the United States holds the largest market share.

In addition, the widespread use of soft tissue transplants, stem cell therapies, and personalized medicines is contributing to the expansion of the regional market. In the global transplant diagnostics industry, China and India are the two markets in the Asia-Pacific region with the fastest growth rates over the forecast period.

Key Regions

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Eurobio Scientific, a France-Based Biotechnology Company, acquired GenDx

There is moderate competition in the transplant diagnostics market. In terms of clinician decision-making and raising awareness, technological advancements, affordability, reagent efficacy, and appropriate organ preservation facilities are some of the current challenges and opportunities that businesses are anticipated to overcome over the forecast period.

For instance, GenDx was purchased by Eurobio Scientific, a biotechnology company based in France. Eurobio would be able to expand its transplantation research with the assistance of the acquisition. Genome Dx is a molecular diagnostics startup based in the Netherlands.

A few major players in the market are QIAGEN N.V., Thermo Fisher Scientific Inc., Luminex Corporation, Becton Dickinson and Company, Olerup SSP AB, Alpha Laboratories, Takara Bio Inc., CareDx Inc., and other major companies. Listed below are some of the most prominent global transplant diagnostics market players.

Market Key Players

- Becton Dickinson and Company

- Abbott Laboratories

- Qiagen NV

- Biomérieux SA

- Bio-Rad Laboratories, Inc.

- Hoffman-La Roche AG

- Immucor, Inc

- Affymetrix, Inc.

- Illumina, Inc.

- Omixon, Inc.

- Other Key Players

Recent developments

- September 2023: Abbott Laboratories announced plans to collaborate with mAbxience Holdings S.L., a Spain-based biotech firm. The partnership aims to carry out commercialization of biosimilars.

- October 2023: QIAGEN revealed plans to expand QIAGEN Clinical Insight Interpret, also called QCI Interpret. The platform is a clinical decision support software. The expansion will improve the software by including coverage of rare disease genes, which will be further enhanced by AI.

Report Scope

Report Features Description Market Value (2022) USD 4.2 Bn Forecast Revenue (2032) USD 8.3 Bn CAGR (2023-2032) 7.2% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology- Molecular Assay, and Non-Molecular Assay; By Product & Services- Instrument, Reagent, Software, and Other Product & Services; By Transplant Type- Solid Organ Transplantation, Stem Cell Transplantation, Soft Tissue Transplantation, Bone Marrow Transplantation, and Other Transplants; and By End-User- Research Laboratories & Academic Institutes, Hospital & Transplant Centers, Commercial Service Providers, and Other End-Users. Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA. Competitive Landscape Becton Dickinson and Company, Abbott Laboratories, Qiagen NV, Biomérieux SA, Bio-Rad Laboratories, Inc., F. Hoffman-La Roche AG, Immucor, Inc, Affymetrix, Inc., Illumina, Inc., Omixon, Inc., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Transplant Diagnostics MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample

Transplant Diagnostics MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Becton Dickinson and Company

- Abbott Laboratories

- Qiagen NV

- Biomérieux SA

- Bio-Rad Laboratories, Inc.

- Hoffman-La Roche AG

- Immucor, Inc

- Affymetrix, Inc.

- Illumina, Inc.

- Omixon, Inc.

- Other Key Players