Global Transient Protein Expression Market By Expression System (Mammalian Expression Systems, Yeast Expression Systems, Insect Expression Systems, Bacterial Expression Systems and Others), By Protein Type (Antibodies, Hormones, Enzymes, Cytokines and Others), By Application (Therapeutic Protein Production, Proteomics Research, Vaccine Development, Structural Biology and Others), By Transient Technology (Transient Transfection, Lentivirus-Based Transient Expression, Viral Vector-Based Transient Expression and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175121

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Expression system Analysis

- Protein type Analysis

- Application Analysis

- Transient technology Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

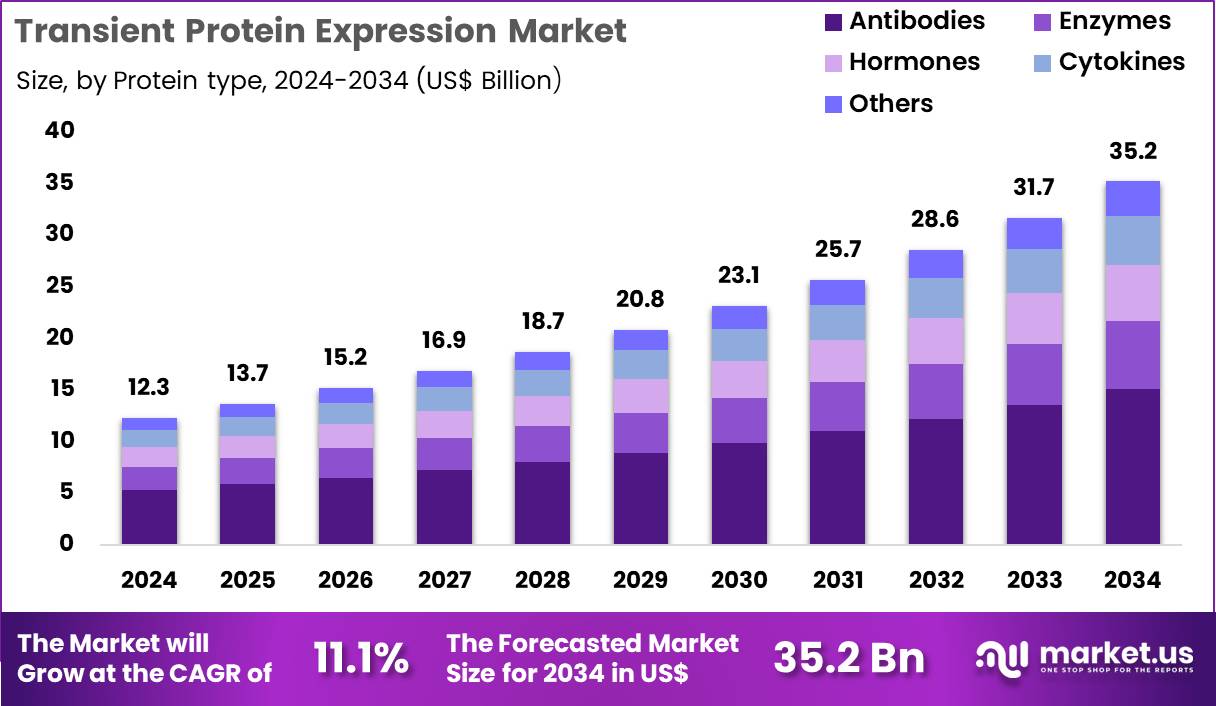

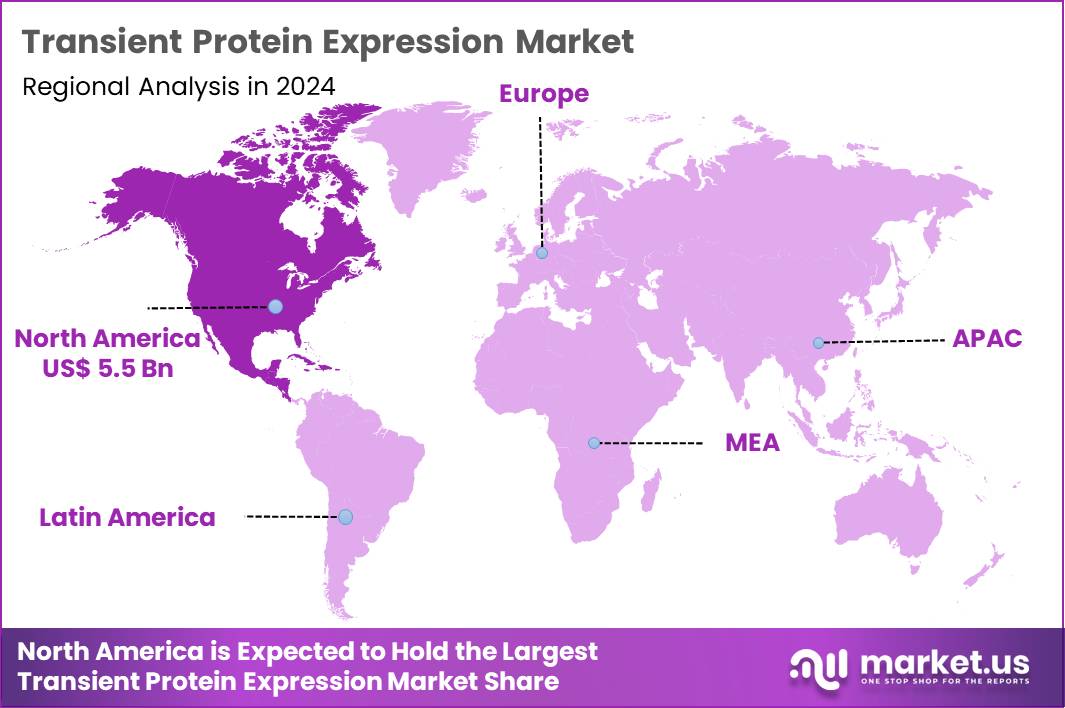

The Global Transient Protein Expression Market size is expected to be worth around US$ 35.2 Billion by 2034 from US$ 12.3 Billion in 2024, growing at a CAGR of 11.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 44.5% share with a revenue of US$ 5.5 Billion.

Increasing demand for rapid protein production in research and early development stages propels the transient protein expression market as laboratories seek efficient systems that generate milligram-to-gram quantities of recombinant proteins without stable cell line development. Scientists increasingly employ transient transfection of mammalian cells, such as HEK293 and CHO variants, to produce monoclonal antibodies for preclinical immunogenicity and functional studies.

These methods support vaccine antigen generation by expressing viral spike proteins or envelope glycoproteins within days, accelerating candidate screening during emerging infectious disease outbreaks. Researchers utilize transient expression in insect cells via baculovirus systems to manufacture complex glycoproteins and virus-like particles for structural biology and immunogenicity assays.

Transient platforms enable quick production of soluble receptors and enzymes for high-throughput screening in drug discovery, providing sufficient material for biochemical and biophysical characterization. These approaches facilitate bispecific antibody prototyping and fusion protein evaluation, allowing iterative design modifications before committing to resource-intensive stable cell line creation.

Manufacturers pursue opportunities to optimize transfection reagents and expression vectors that boost yields and reduce costs, expanding applications in gene therapy vector production where transient systems generate high-titer adenoviral or lentiviral particles for preclinical toxicology.

Developers advance serum-free and chemically defined media formulations that enhance protein quality and scalability, supporting transition from research-grade to GMP-like material for toxicology and early clinical studies. These innovations facilitate high-throughput expression screening of antibody libraries, accelerating discovery of therapeutic candidates in oncology and autoimmune indications.

Opportunities emerge in integrating transient expression with cell-free systems for rapid prototyping of difficult-to-express proteins, including membrane-bound targets and multi-subunit complexes. Companies invest in automated transfection platforms that streamline parallel expression workflows, enabling faster iteration in biologics pipeline development. Recent trends emphasize hybrid approaches that combine transient and stable expression strategies, optimizing speed, cost, and quality across the drug development continuum.

Key Takeaways

- In 2024, the market generated a revenue of US$ 12.3 Billion, with a CAGR of 11.1%, and is expected to reach US$ 35.2 Billion by the year 2034.

- The expression system segment is divided into mammalian expression systems, yeast expression systems, insect expression systems, bacterial expression systems and others, with mammalian expression systems taking the lead with a market share of 46.3%.

- Considering protein type, the market is divided into antibodies, hormones, enzymes, cytokines and others. Among these, antibodies held a significant share of 42.8%.

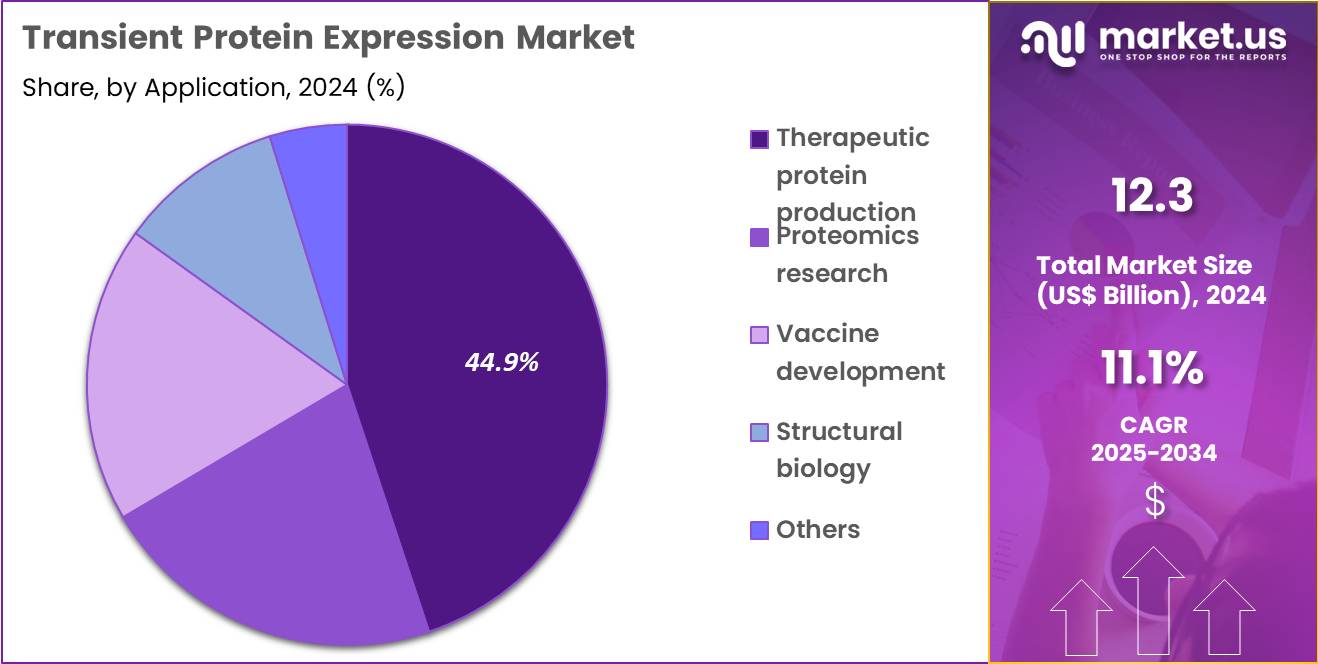

- Furthermore, concerning the application segment, the market is segregated into therapeutic protein production, proteomics research, vaccine development, structural biology and others. The therapeutic protein production sector stands out as the dominant player, holding the largest revenue share of 44.9% in the market.

- The transient technology segment is segregated into transient transfection, lentivirus-based transient expression, viral vector-based transient expression and others, with the transient transfection segment leading the market, holding a revenue share of 53.7%.

- North America led the market by securing a market share of 44.5%.

Expression system Analysis

Mammalian expression systems generated 46.3% of growth within expression systems and remain the leading platform in the transient protein expression market due to their ability to produce complex, human-like proteins. Biopharma teams rely on mammalian cells because they deliver correct folding and post-translational modifications that many therapeutic proteins require. Antibody and Fc-fusion workflows particularly favor mammalian hosts since glycosylation patterns influence efficacy and stability.

Research groups also choose mammalian systems for higher relevance in downstream functional assays, especially when targets involve receptors, signaling proteins, or membrane interactions. Rapid protein turnaround matters in modern development cycles, and mammalian transient expression supports fast proof-of-concept batches without creating stable cell lines.

Improved media formulations and chemically defined systems increase expression efficiency and reproducibility. Scalable suspension cultures enable production across different volumes, supporting both lab-scale screening and pilot batches.

Demand grows further as biologics pipelines expand across oncology, immunology, and rare diseases. CROs and CDMOs invest in mammalian transient platforms to serve multiple clients with quick timelines. Standardized CHO and HEK systems improve process familiarity and reduce troubleshooting time.

Automation adoption in cell culture workflows increases throughput and strengthens system usage. Quality expectations also push adoption because mammalian hosts support cleaner product profiles for sensitive applications. The segment is anticipated to retain leadership due to biological relevance, scalability, and strong alignment with therapeutic development needs.

Protein type Analysis

Antibodies accounted for 42.8% of growth within protein type and act as the most commercially significant output in the transient protein expression market. Therapeutic antibody pipelines continue to expand, driving ongoing demand for rapid expression during discovery and preclinical stages. Developers require fast antibody production for binding screens, epitope mapping, and functional assays, and transient expression supports this speed advantage.

High-throughput antibody engineering programs increase the number of variants tested, raising expression volume requirements. Mammalian transient systems support correct glycosylation, which helps teams evaluate effector functions early in development. Antibody formats also diversify into bispecifics and fragments, increasing the need for flexible expression platforms. Early developability checks depend on quick material generation, and transient antibody production fits this workflow.

CRO-based discovery models further strengthen demand since service providers run multiple antibody projects in parallel. Faster expression reduces project timelines and improves decision-making pace. Improved purification toolkits support efficient antibody recovery from transient cultures. Demand also rises from diagnostic antibody development for research use and assay kits. The segment is projected to remain dominant due to strong biologics momentum and the need for rapid screening material across antibody programs.

Application Analysis

Therapeutic protein production represented 44.9% of growth within application and remains the largest use case for transient protein expression due to the constant need for biologic candidates and development samples. Companies use transient expression to generate early-stage materials for in vitro and in vivo testing before committing to stable production platforms. This approach reduces time spent on candidates that fail performance or safety screens.

Biopharma pipelines increasingly include complex proteins, and transient expression supports flexible production across different constructs. Rapid delivery of milligram-to-gram quantities supports pharmacology studies and formulation assessments. Process development teams use transient systems to evaluate expression feasibility and product quality. This early data helps teams select the best leads and optimize sequences.

Increasing use of biologics in oncology and autoimmune diseases strengthens demand for therapeutic protein workflows. Outsourced development models also increase transient production volumes as CROs support sponsor timelines. Accelerated programs rely on fast material availability, and transient expression aligns with this requirement. The segment is expected to remain dominant due to high biologics pipeline activity and the need for quick development material.

Transient technology Analysis

Transient transfection accounted for 53.7% of growth within transient technology and remains the most widely used method because it delivers fast expression without long cell line development timelines. Research teams prefer transfection due to straightforward workflows and broad compatibility with mammalian hosts.

Modern reagents improve transfection efficiency while reducing cytotoxicity, supporting higher yields and healthier cultures. Plasmid-based systems enable rapid construct swapping, which benefits iterative engineering cycles.

High-throughput screening programs depend on transient transfection because it supports parallel testing of many variants. The method also scales from small flasks to bioreactors, enabling flexible output levels. Laboratories integrate transfection into standard protocols for antibody and protein production.

Improved automation and liquid handling strengthen adoption in core facilities. Reduced turnaround time supports urgent project timelines in discovery and early development. Quality requirements remain manageable for research and preclinical production, supporting widespread use. The segment is projected to retain dominance due to speed, flexibility, and ongoing improvements in transfection chemistries and scalability.

Key Market Segments

By Expression System

- Mammalian Expression Systems

- Yeast Expression Systems

- Insect Expression Systems

- Bacterial Expression Systems

- Others

By Protein Type

- Antibodies

- Hormones

- Enzymes

- Cytokines

- Others

By Application

- Therapeutic Protein Production

- Proteomics Research

- Vaccine Development

- Structural Biology

- Others

By Transient Technology

- Transient Transfection

- Lentivirus-Based Transient Expression

- Viral Vector-Based Transient Expression

- Others

Drivers

The rapid growth of the biologics pipeline is driving the market

The surging demand for complex biologics and biosimilars is the primary driver for the transient protein expression market, as these systems provide the speed necessary for early-stage drug discovery. Unlike stable cell line development, which can take several months, transient expression allows for the production of milligram-to-gram quantities of recombinant proteins within days. In 2024, the FDA’s Center for Drug Evaluation and Research (CDER) approved 50 novel drugs, including a record 13 monoclonal antibodies, many of which rely on transient systems for rapid lead optimization.

Key players have reported significant growth in their life sciences and bioprocessing divisions to accommodate this demand; for instance, Thermo Fisher Scientific reported that its full-year 2024 revenue reached US$ 42.88 billion. While overall growth was flat compared to 2023, the core organic revenue in its fourth quarter grew by 5%, reflecting a stabilization in bioprocess demand.

Sartorius also noted that its order intake for the full year 2024 increased by 12.3% to reach €2.78 billion, signaling a recovery in biopharmaceutical infrastructure investments. The high throughput required for screening these new candidates makes transient mammalian expression systems, such as HEK293 and CHO cells, indispensable.

Government support for rare disease research further fuels this, as evidenced by the FDA’s 2024 approval of 26 novel therapies with orphan drug designations. Consequently, as the biopharmaceutical industry shifts toward more diverse and specialized molecules, the reliance on rapid protein production platforms continues to intensify.

Restraints

High production costs and yield variability are restraining the market

The transient protein expression market faces significant restraints due to the high costs of specialized reagents and the inherent variability in protein yields across different batches. The expensive nature of high-quality plasmid DNA and transfection reagents can make large-scale transient production cost-prohibitive for smaller academic and research institutions.

In 2024, major industry providers noted that while demand is high, macroeconomic headwinds have forced some customers to be more selective with capital expenditures. For example, 10x Genomics, a significant player in the broader “omics” and protein analysis space, reported a 23% decrease in instrument revenue for 2024 as labs reduced spending on new high-cost hardware.

Technical challenges also persist, as transient expression often leads to inconsistent post-translational modifications compared to stable cell lines. These inconsistencies can complicate downstream purification processes and lead to higher waste rates during the development phase. Furthermore, the reliance on high-performance fetal bovine serum (FBS) or specialized serum-free media adds to the operational burden, especially as supply chains remain sensitive.

Regulatory agencies have also increased scrutiny over the quality and safety of raw materials used in bioproduction, requiring more extensive documentation. These financial and technical hurdles collectively slow the adoption of transient systems for pilot-scale manufacturing in emerging markets. Despite technological improvements, the gap between small-scale speed and large-scale cost-efficiency remains a critical barrier.

Opportunities

The expansion of personalized medicine and rare disease research is creating growth opportunities

The rise of personalized medicine and targeted therapies for rare diseases provides a massive growth opportunity for the transient protein expression market. Transient systems are uniquely suited for the “just-in-time” production of patient-specific proteins and antigens needed for personalized vaccines and cell therapies.

In late 2024, the National Institutes of Health (NIH) launched several funding opportunities, such as the PAR-25-122 initiative, specifically targeting pilot projects for understudied proteins associated with rare diseases. This government backing encourages researchers to utilize rapid expression systems to characterize new therapeutic targets that currently have no treatment options.

Additionally, the FDA’s “A Record Year for Biosimilar Approvals” report in 2024 highlighted the approval of 18 biosimilars, a milestone that requires extensive protein characterization often performed through transient methods. The global focus on mRNA-based therapies also opens doors for transient expression as a tool for validating the proteins encoded by these new vaccine platforms.

Manufacturers are responding by launching modular and scalable transfection kits that can be adapted for diverse cell types. The increasing use of transient expression in structural biology and proteomics research further diversifies the market’s potential beyond just therapeutic leads. As healthcare moves toward precision diagnostics, the demand for high-quality, rapidly produced reference proteins will only continue to rise.

Impact of Macroeconomic / Geopolitical Factors

Global economic growth channels increased capital into biotechnology research, energizing the transient protein expression market as laboratories accelerate rapid recombinant protein production for vaccine development and preclinical studies in thriving economies. Executives pursue collaborations in high-investment regions, which expands utilization of mammalian and insect cell systems amid favorable funding environments.

Nevertheless, persistent inflationary trends worldwide elevate reagent and equipment expenditures, obliging providers to confront constrained budgets in competitive research landscapes. Geopolitical frictions in biotechnology supply zones disrupt access to critical vectors and media components, testing operational continuity for cross-border service providers.

Strategists mitigate these vulnerabilities by establishing diversified procurement channels in secure partnerships, which refines resource reliability and promotes innovative workflow adaptations. Current US tariffs on imported biotechnology reagents and equipment from major exporters impose additional cost layers, complicating affordability for international suppliers targeting U.S. clients.

Domestic innovators capitalize on this dynamic by strengthening local capabilities, which accelerates technology localization and aligns with strategic independence goals. Advancing platforms in scalable transient systems persistently invigorate the sector, ensuring dynamic progress and enhanced productivity for biopharmaceutical pipelines worldwide.

Latest Trends

The integration of AI and automated workflows is a recent trend

A defining trend in late 2024 and 2025 is the widespread adoption of AI-driven automation to optimize transient protein expression workflows and eliminate manual bottlenecks. Researchers are increasingly using machine learning algorithms to predict optimal transfection conditions and media formulations, significantly reducing the “trial and error” phase.

In 2024, studies published in Frontiers in Molecular Biosciences highlighted how AI is being applied to Cryo-EM and other structural biology tools to interpret protein data generated via transient expression. Furthermore, the industry is moving toward “plug-and-play” robotic platforms that can automate the entire cycle from plasmid preparation to protein purification.

These systems are capable of processing hundreds of proteins in parallel, with some automated platforms projected to purify up to 384 proteins per week as of 2025. This shift is also characterized by the integration of Laboratory Information Management Systems (LIMS) to track real-time yield and quality metrics across global research sites.

Major bioprocess companies are now offering “smart” bioreactors equipped with sensors that use AI to maintain optimal cellular health during the short expression window. This technological convergence not only increases throughput but also improves the reproducibility of results, a long-standing challenge in the field. As digital transformation becomes standard in life sciences, these intelligent, automated systems are setting a new benchmark for efficiency in protein production.

Regional Analysis

North America is leading the Transient Protein Expression Market

North America maintains a 44.5% share of the global transient protein expression market, exhibiting continued advancement in 2024 owing to extensive utilization in accelerating biopharmaceutical research and preclinical development. Pioneering companies such as Thermo Fisher Scientific and Merck have refined transfection reagents and mammalian cell platforms to achieve higher yields and protein quality for antibody and vaccine candidates.

This region’s leadership emerges from dense clusters of biotechnology firms and academic laboratories focused on rapid protein production for drug discovery. Enhanced capabilities in HEK293 and CHO-based systems have supported swift iteration in therapeutic protein engineering amid demands for biologics. Substantial federal investments sustain innovation by backing projects that rely on transient methods for functional studies and structural biology.

Partnerships between industry and research entities expedite translation from bench to clinical candidates, bolstering commercial confidence. Streamlined protocols and automated workflows have reduced timelines, attracting increased adoption in high-throughput screening.

In 2023, the National Institutes of Health supported recombinant protein-related research through allocations within its broader biologics funding, with specific grants advancing transient expression techniques in vaccine and therapeutic contexts.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Biotechnology enterprises and institutions pursue vigorous advancement in rapid recombinant protein production across the Asia Pacific region throughout the forecast period, driven by expanding capabilities in biopharmaceutical manufacturing. China and India prioritize domestic innovation to meet escalating needs for therapeutic proteins and biosimilars in response to healthcare demands.

National policies channel resources toward strengthening life sciences infrastructure, enabling local firms to scale transient methodologies efficiently. Collaborations with international technology providers facilitate transfer of optimized transfection platforms and cell culture optimizations. Researchers apply these approaches to accelerate discovery pipelines for oncology and infectious disease targets.

Pharmaceutical organizations incorporate high-throughput expression in candidate screening to shorten development cycles. Government-backed programs cultivate skilled talent and facility upgrades essential for competitive output. In 2023, China’s Ministry of Science and Technology invested significantly in biotechnology R&D, including recombinant technologies, as part of broader initiatives exceeding hundreds of billions in yuan for life sciences advancement (verifiable through official ministry announcements and policy documents).

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Transient Protein Expression market drive growth by enabling rapid, high-yield production of recombinant proteins for early research, antibody discovery, and preclinical studies. Companies expand adoption by offering optimized cell lines, transfection reagents, and media systems that improve titer and shorten turnaround time from DNA to protein.

Commercial strategies focus on bundled workflow solutions and technical services that help labs standardize results across projects and sites. Innovation priorities include scalable suspension cultures, chemically defined formulations, and automation-friendly protocols that support higher throughput screening.

Market expansion targets biopharma and CRO customers seeking faster proof-of-concept data and accelerated biologics development. Lonza operates as a leading participant with deep bioprocess expertise, advanced expression platforms, and global service capabilities that support rapid protein production for research and development programs.

Top Key Players

- Thermo Fisher Scientific

- Merck KGaA

- Lonza

- Promega Corporation

- Takara Bio Inc.

- QIAGEN

- Bio Rad Laboratories, Inc.

- New England Biolabs

- GenScript Biotech Corporation

- Agilent Technologies, Inc.

Recent Developments

- In its 2024 and 2025 financial disclosures, Merck KGaA reported steady performance from its Life Science division, which generated approximately US$ 4.7 billion in revenue in 2024. Within this business, the company continues to strengthen transient transfection workflows by expanding the use of its Novagen and Ex-Cell cell culture media. A key growth driver has been Merck’s focus on chemically defined, animal-component-free media, which enables reproducible, high-titer protein expression while meeting increasingly strict regulatory and quality expectations in biopharmaceutical research and development.

- Lonza has continued to embed transient protein expression services into its early development and CDMO offerings as demand for rapid biologics development accelerates. In its 2025 half-year update, the company highlighted ongoing growth in the Biologics segment, driven by customers seeking fast proof-of-concept material for candidate screening and preclinical studies. Lonza’s ability to scale transient expression systems into larger bioreactor formats, reaching volumes of 50 liters and beyond, is helping bridge early discovery work with downstream clinical manufacturing, making transient expression a more integral part of accelerated biologics pipelines.

Report Scope

Report Features Description Market Value (2024) US$ 12.3 Billion Forecast Revenue (2034) US$ 35.2 Billion CAGR (2025-2034) 11.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Expression System (Mammalian Expression Systems, Yeast Expression Systems, Insect Expression Systems, Bacterial Expression Systems and Others), By Protein Type (Antibodies, Hormones, Enzymes, Cytokines and Others), By Application (Therapeutic Protein Production, Proteomics Research, Vaccine Development, Structural Biology and Others), By Transient Technology (Transient Transfection, Lentivirus-Based Transient Expression, Viral Vector-Based Transient Expression and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Merck KGaA, Lonza, Promega Corporation, Takara Bio Inc., QIAGEN, Bio Rad Laboratories, Inc., New England Biolabs, GenScript Biotech Corporation, Agilent Technologies, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Transient Protein Expression MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Transient Protein Expression MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Merck KGaA

- Lonza

- Promega Corporation

- Takara Bio Inc.

- QIAGEN

- Bio Rad Laboratories, Inc.

- New England Biolabs

- GenScript Biotech Corporation

- Agilent Technologies, Inc.