Global Transformer Oil Market by Type (Naphthenic Oils, Silicon-based Oils, Bio-based Oils, and Paraffinic Oil, and Others), By Function, By End-Use, By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 15598

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

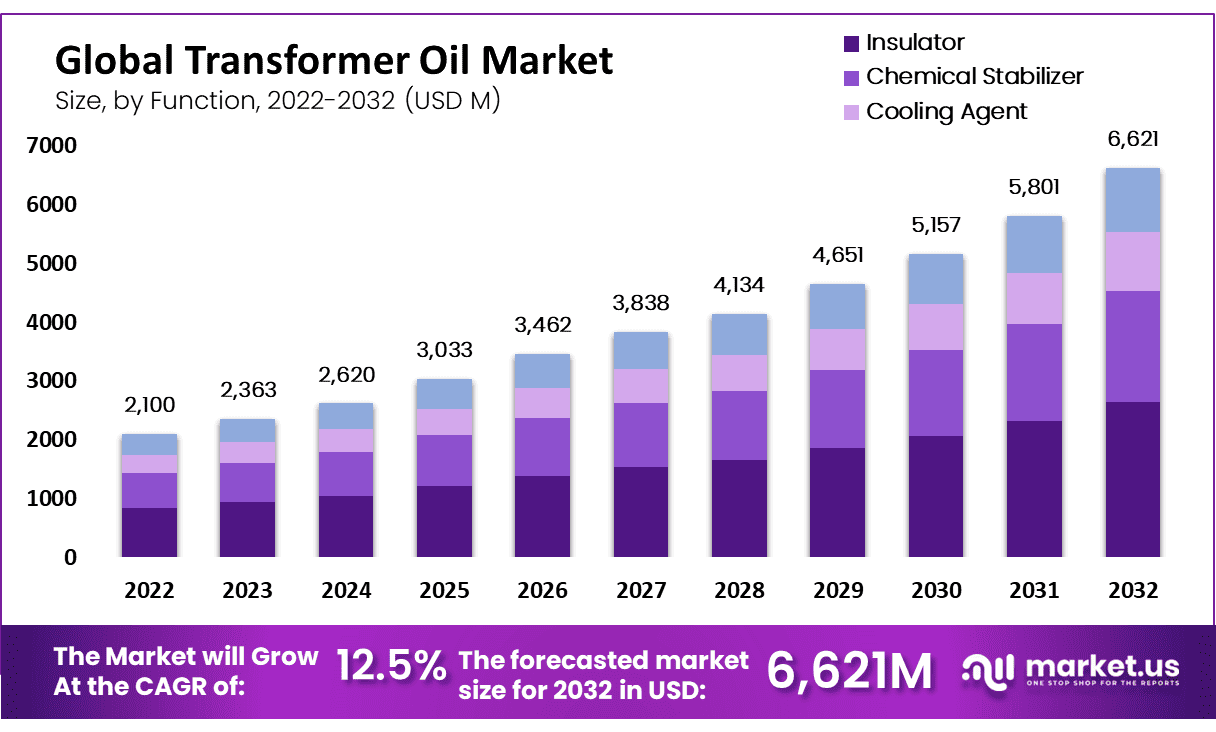

The Global Transformer Oil Market size is expected to be worth around USD 6,621 Million by 2032 from USD 2,100 Million in 2022, growing at a CAGR of 12.50% during the forecast period from 2023 to 2032.

Transformer oil is derived from crude petroleum. In a transformer, the transformer oil performs two main roles, namely: it prevents arcing and dissipates the heat produced by the device. It is additionally utilized as insulation and for chemical stabilization. Transformer oil has improved electrical insulation, is more stable at high temperatures, and inhibits oxidation.

Additionally, the power utilities are concentrating on improving the safety and performance of both new and existing transformers, which is anticipated to raise the global demand for bio-based products. Many transformer oil manufacturers have been able to reduce their raw material costs as a result of the decrease in crude oil prices.

Bio-based products are dependable and cleaner because they are completely non-toxic and free of PCBs, which makes them easier to throw away. It is also anticipated that the worldwide increase in transformer installation will increase demand for bio-based products.

Additionally, the power utilities are concentrating on improving the safety and performance of both new and existing transformers, which is anticipated to raise the global demand for bio-based products. It is anticipated that the primary obstacle to product demand will be stringent government regulation regarding energy waste.

To reduce electricity waste, the Environmental Protection Agency of the United States, for instance, has established stringent regulations regarding oil demand. Also, economies both developed and developing are moving toward green and eco-friendly technologies, which is expected to slow the growth of minerals-based products.

Key Takeaways

- Market Growth: The Transformer Oil Market is projected to experience exponential expansion; by 2032 its size should have expanded from USD 2,100 million in 2022, at an approximate compound annual compound growth rate of 12.5%.

- Transformer Oil’s Role in Transformers: Transformer oil is made up of crude petroleum-derived from crude, and plays an essential part in transformers by preventing arcing, dissipating heat efficiently and providing insulation as well as chemical stabilization and chemical stability. Furthermore, its many known qualities such as improved electrical insulation properties at higher temperatures as well as inhibiting oxidation are all hallmarks of quality transformer oil performance.

- Bio-Based Products: Bio-based transformer oil products have become more in demand due to their non-toxic, PCB-free nature – making them less hazardous to dispose of and making disposal simpler – due to global rise of transformer installations. Their popularity will only continue to expand with an anticipated global surge in transformer installations.

- Energy Consumption: With rapid industrialization and urbanization across Asia-Pacific regions comes increased electricity usage. As such, transformer oil consumption has seen significant expansion due to their use in cooling systems and isolating power equipment.

- Regulations: Strict government regulations on energy waste such as those enforced by the Environmental Protection Agency in the US may present challenges for transformer oil marketers; however, their implementation has contributed significantly towards reduced emissions and energy wastage.

- Type Analysis: Naphthenic oils hold the largest market share by type, thanks largely to rising bio-based transformer oil demand. Mineral-based oils account for an important share, while bio-based ones may experience rapid expansion.

- Function Analysis of Transformer Oil: Transformer oil’s primary purpose lies in insulation due to its use for protecting high voltage electrical infrastructure such as transformers, capacitors and circuit breakers from damage.

- Application Analysis: Small-scale transformers are increasingly common on the market, particularly in regions experiencing rapid urbanization and electrification. Large-scale transformers are expected to experience exponential growth driven by an emphasis on energy efficiency and reduced carbon emissions.

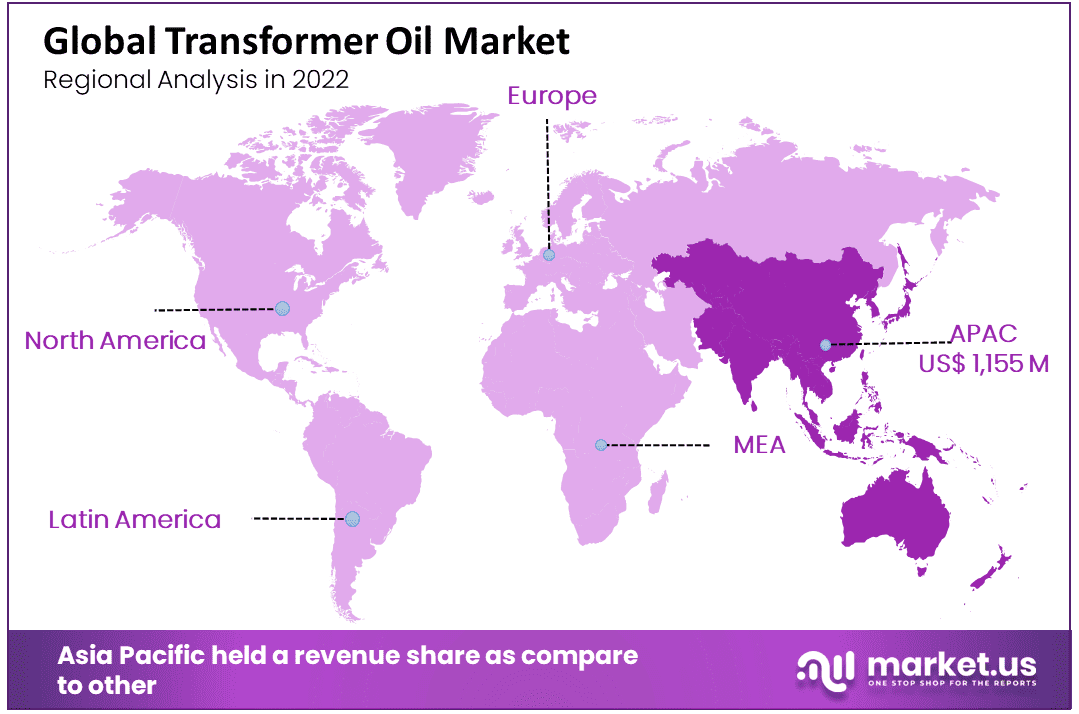

- Regional Analysis: Asia Pacific has the highest revenue share. China and India had seen their demand for transformer oil grow steadily; their domestic manufacturers created barriers against entry for foreign competitors into this market.

- Key Players in the Transformer Oil Industry: Notable companies within this field are taking measures such as capacity and geographic expansion, mergers/acquisitions/R&D to meet growing consumer demands for eco-friendly and innovative products.

Driving Factors

Electricity consumption has increased as a result of drastic industrialization and the rapid urbanization of major rural areas in the Asia-Pacific region. In the past decades, the amount of electricity consumed in this region has nearly doubled. Due to increased demands and the exponential expansion of distribution networks, the industry has experienced rapid expansion. These oils can be used to help cool systems, dissipate heat, and insulate power equipment.

The expansion of developed economies like those in North America, Europe, and Asia has been significantly impacted by modernization and the replacement of out-of-date transformers. Energy waste is strictly regulated by the Electricity & Cogeneration Regulatory Authority, Environmental Protection Agency, and other federal agencies.

They have contributed to the rise in oil demand, which helps cut down on emissions and electric waste. The process of installing transformers can be difficult and costly. Copper and steel’s volatile prices have slowed market expansion.

Restraining Factors

The used oil’s volatility and chemical reaction are the primary market restraints. As the temperature and the moisture level of the oil rise, the oil’s effectiveness as an insulating material decreases. The oil’s color, viscosity, and pH are all altered as a result.

Therefore, in order to prevent a chemical reaction in the container, transformer oil filtering must be performed on a regular basis. The market is also hampered by the fluctuating cost of raw materials and the rising demand for dry transformers. The market’s expansion may be hampered by the high price of transformer oil and the associated costs for maintenance.

The supply chain is impacted by the limited availability of transformer oil’s raw materials, which may result in an increase in oil costs, which is one factor constraining the market. The price of transformer oil can be affected by changes in crude oil prices and the growing use of dry-type transformers, which do not require transformer oil.

The aforementioned factors may impede the market for transformer oil’s expansion. waste. Both the variants of the mineral oil that is paraffinic and naphthenic are highly defined for their property and also redefined, purified, and processed petroleum which makes the mineral oil highly non-biodegradable.

Growth Opportunities

The number of economies participating in cross-border electricity trade has increased over time, and the trade has gained momentum in recent years. In light of these events, the European Union, also known as the European Union, intends to strengthen individual power grids and attempt to establish a pan-European grid.

Recently, the Indian Energy Exchange (IEX), which is also known as the Indian Energy Exchange, has proposed establishing a South Asian regional power market by facilitating cross-border electricity trade between Bhutan, Myanmar, Nepal, and Bangladesh.

This development may be the cause of the establishment of new transmission lines and the expansion of the grid network, which will ultimately lead to an increase in the demand for transformers, switchgear, and transformer oils in the years to come.

Trending Factors

Rapid urbanization, industrialization, and an increase in electricity consumption are driving the market for transformer oil expansion. In addition, the market growth trend is a growing focus on increasing transformer reliance. The expanding global transmission and distribution of electricity are also driving the market’s growth.

Additionally, the market expansion will be fueled by the expansion of the existing grid infrastructure and government efforts to ensure an uninterrupted power supply in emerging nations during the forecast period.

In addition, market expansion in this region is aided by manufacturers focusing on introducing environmentally friendly and safer products in response to the growing awareness of environmental issues worldwide.

The increasing emphasis on increasing the reliance on transformers in power systems and energy grids to ensure an uninterrupted supply of electricity for residential, commercial, and industrial purposes is also encouraging, which should help propel the market’s expansion over the forecast period. In addition, the market’s expansion is driven by the rising demand for transformer oils with improved durability, corrosion resistance, and efficiency.

Type Analysis

The Naphthenic Oil segment owns the largest market share by type in 2020 due to an increase in demand for bio-based transformer oil from electric utilities like transmission systems, power plants, and other industrial applications. The global transformer oil market is assumed to expand in the coming years due to the advantages of mineral oil, such as its high thermal and oxidation durability, low cost, and ease of availability.

Mineral-based oils dominated the market, capturing 81.78 percent of 2021’s volume share. The availability and compatibility of mineral-based oils have contributed to their widespread use in high voltage switches, circuit breakers, capacitors, and circuit breakers, among other applications.

Paraffinic oil is utilized due to its low price and widespread availability. Because crude naphthenic oils are uncommon in nations like China, Brazil, and Australia, it is not widely available on the global market. Bio-based oils are the products that are growing the fastest, with an average CAGR of 14.5 percent between 2023 and 2032. It is anticipated that strict regulations regarding energy consumption and emissions will positively impact the expansion.

Function Analysis

Due to the rising demand for transformer oil to insulate high-voltage electrical infrastructures like transformers, capacitors, switches, and circuit breakers applications in electric utilities, the insulation segment dominated the global market in terms of share in 2020. Due to its high dielectric strength, sufficient viscosity level, temperature flexibility, and other advantages, it is primarily utilized as transformer insulation between windings.

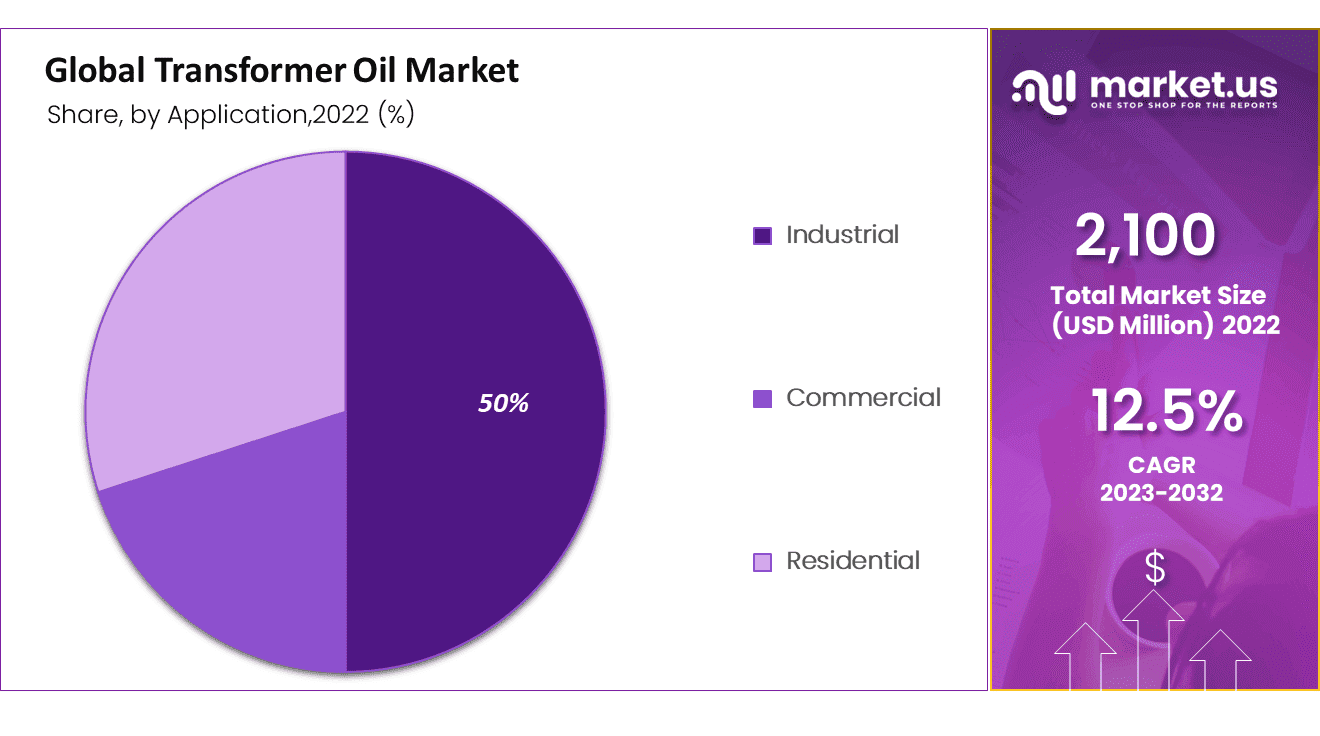

Application Analysis

In 2022, small-scale transformers dominated the market for bio-based transformer oil. These systems are frequently used to meet the rising demand for electricity in rural and small towns. In Southeast Asian countries like India, Sri Lanka, and Bangladesh, rural areas’ increasing urbanization and electrification have significantly impacted segment growth.

Many customers tend to buy in bulk to offset the high costs and increase market volume in order to offset the high filling costs. The large-scale market is anticipated to expand at a rapid CAGR between 2023 and 2032. Eco-friendly transformers are in high demand due to strict rules for greater energy efficiency and low carbon emission.

Technological advancement, increased industrial output, and progressive research and development of energy generation and recovery equipment all contribute to the segment’s expansion. One major use of utilities is the production of renewable energy.

Equipment that can withstand extreme conditions like high moisture and air pressure requires maintenance oils. It is anticipated that this segment will expand at a slower rate than the other two.

End-User Analysis

In 2020, the small transformer category held the most market share by end-use. This is because these systems are used a lot to meet the growing demand for electricity in rural areas. Transformer installation will rise in tandem with an increase in transformer oil demand as power demands rise.

Additionally, the rising cost of producing transformer oil as a result of the drop in demand for transformer oils has resulted in a decrease in the transformer oil’s selling price.

Key Market Segments

By Type

- Silicone-based Oil

- Naphthenic Oil

- Bio-based Oil

- Paraffinic Oil

- Others

By Function

- Insulator

- Chemical Stabilizer

- Cooling Agent

- Lubricant

By End-Use

- Small Transformers

- Distribution Transformers

- Power Transformers

- Utility Transformers

- Large Transformers

- Others

By Application

- Residential

- Industrial

- Commercial

Regional Analysis

In 2022, Asia Pacific held a revenue share of more than 55.0%, making it the market leader. In developing nations like China, India, Japan, and Australia, there is a rise in demand for the Transformer oil market. Additionally, it is expected that the expansion of the commercial and industrial sectors will result in an increase in the number of substations, which will increase the demand for transformers in the not-too-distant future.

Chinese manufacturers are able to enter the market thanks to increased investment in the power sector. Additionally, the demand for the sub-transmission segment is being fueled by significant expansions in renewable capacity in China and India. For foreign markets to enter the Asia-Pacific region, the presence of reputable domestic manufacturers is a significant obstacle.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Latin America

- Colombia

- Chile

- Brazil

- Argentina

- Costa Rica

- Rest of Latin America

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- APAC

- China

- Vietnam

- Japan

- Indonesia

- South Korea

- India

- Australia & New Zealand

- Singapore

- Thailand

- Malaysia

- Philippines

- Rest of APAC

- Middle East & Africa

- Algeria

- Egypt

- United Arab Emirates

- Saudi Arabia

- Kuwait

- Nigeria

- Israel

- South Africa

- Turkey

- Rest of the Middle East and Africa.

Key Players Analysis

Key players in the Transformer Oil industry are concentrating on capacity and geographic expansions, as well as mergers and acquisitions, in order to increase the number of customers they serve. In order to establish an error in the market, these players are also focusing on R&D activities to create novel products.

Prominent players in the market are concentrating on the production of bio-based oils in addition to a variety of strategic initiatives, such as research and development (R&D), to produce eco-friendly oils and innovative products and solutions. To meet the product’s increasing demand, manufacturers are also expanding their capacities.

Market Key Players

- Sinopec Lubricant Company

- Cargill Inc.

- Valvoline

- Nynas AB

- PetroChina Lubricant Company

- Ergon International Inc.

- Apar Industries Ltd.

- Calumet Specialty Products

- Hydrodec Group Plc.

- Engen Petroleum Ltd.

- Other Key Players

Recent Development

- Nynas AB started selling NYTRO BIO 300X transformer oil in the Middle East in February 2020. This is the first high-performance bio-based transformer hydrocarbon fluid made from renewable resources in the world. The problem of keeping transformers cool in the hot Middle Eastern climate is solved by NYTRO BIO 300X.

- Ergon International’s expanded its naphthenic refinery in Vicksburg, in January 2020. This will help the company position itself and ensure the long-term viability of its systems and operations while carrying out the activity.

Report Scope

Report Features Description Market Value (2022) US$ 2,100 Mn Forecast Revenue (2032) US$ 6,621 Mn CAGR (2023-2032) 12.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type: Silicone-based Oil, Naphthenic Oil, Bio-based Oil, Paraffinic Oil, and Others; By Function: Insulator, Chemical Stabilizer, Cooling Agent, and Lubricant; By End-Use: Small Transformer, Distribution Transformers, Power Transformers, Utility Transformers, Large Transformer, and Others; and By Application: Residential, Industrial, and Commercial. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sinopec Lubricant Company, Cargill Inc., Valvoline, Nynas AB, PetroChina Lubricant Company, Ergon International Inc., Apar Industries Ltd., Calumet Specialty Products, Hydrodec Group Plc., Engen Petroleum Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

Frequently Asked Questions (FAQ)

Q: What are the segments covered in the Transformer Oil market report?A: Market.US has segmented the Global Transformer Oil Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into silicone-based oils, mineral-based oils, and bio-based oils. By Application, market has been further divided into utility transformer oils, small-scale transformers, and large-scale transformers.

Q: Who are the key players in the Transformer Oil market?A: Nynas AB, BASF SE, Ergon Inc., Valvoline, Sinopec Corporation, PetroChina Company Ltd., Cargill Inc., and Other Key Players.

Q: Which region is more attractive for vendors in the Transformer Oil market?A: APAC accounted for the highest revenue share of 53.6% among the other regions. Therefore, the Transformer Oil market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Transformer Oil?A: Key markets for Transformer Oil are US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc.

Q: Which segment has the largest share in the Transformer Oil market?A: In the Transformer Oil market, vendors should focus on grabbing business opportunities from the mineral-based oils product segment as it accounted for the largest market share in the base year.

What is the Transformer Oil market size in 2021?The Transformer Oil market size is USD 21.3 Billion in 2022.

What is the CAGR for the Transformer Oil market?The Transformer Oil market is expected to grow at a CAGR of 12.5% during 2023-2032.

-

-

- Sinopec Lubricant Company

- Cargill Inc.

- Valvoline

- Nynas AB

- PetroChina Lubricant Company

- Ergon International Inc.

- Apar Industries Ltd.

- Calumet Specialty Products

- Hydrodec Group Plc.

- Engen Petroleum Ltd.

- Other Key Players