Global Trade Credit Insurance Market By Coverage (Whole Turnover Coverage and Single Buyer Coverage), By Application (Domestic and International), By End-Use Industry, By Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023 – 2032

- Published date: Dec. 2024

- Report ID: 103900

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- By Coverage Analysis

- By Application Analysis

- By End-Use Industry Analysis

- Trade Credit Insurance Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Regions and Countries Covered in this Report

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

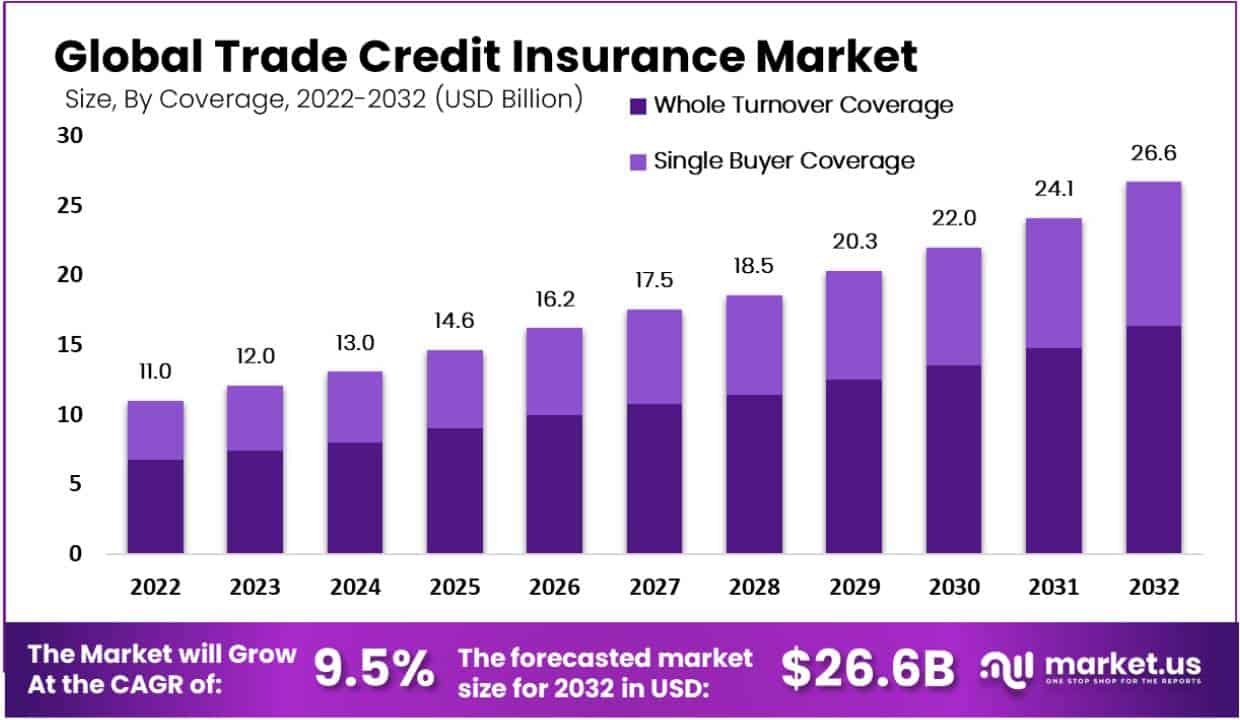

In 2022, the Global Trade Credit Insurance Market was valued at US$ 11 Billion and will reach US$ 26.6 Billion by 2032. Between 2023 and 2032, this market is estimated to register the highest CAGR of 9.5 %.

Trade credit insurance is a specialized type of coverage that protects businesses against the risk of non-payment by their customers. This insurance is particularly crucial for companies that extend credit terms to their buyers, safeguarding them from losses due to customer insolvency or default. Essentially, trade credit insurance ensures that a business will still receive a portion of the money it is owed, even if a customer fails to pay. Coverage can include protection against political risks and other broader economic disruptions that might prevent payment.

The market for trade credit insurance is driven by the need for businesses to manage the risks associated with extending credit to their customers. As businesses look to expand and enter new markets, the demand for trade credit insurance grows, providing them with the confidence to trade with new and existing customers across different regions. The presence of major insurers and offerings by companies like AIG and Zurich Insurance Group underline the global relevance and necessity of this insurance in modern trade practices.

Key drivers of the trade credit insurance market include the increasing level of international trade and the expansion of companies into new geographical markets, which heightens the exposure to customer defaults and insolvencies. The growth in global trade activities necessitates robust risk management tools, among which trade credit insurance is critical.

Additionally, the digital transformation of trade and the increasing reliance on data analytics for risk assessment are also propelling the market forward. Companies are now using sophisticated models to predict customer behavior and potential defaults, thus enhancing the effectiveness of trade credit insurance.

The demand for trade credit insurance is robust among companies that engage in high volumes of trade, especially those involved in international transactions. With global trade tensions and economic uncertainties, businesses are more prone to facing defaults by their customers. Trade credit insurance provides a safety net that allows businesses to manage these risks effectively.

Furthermore, the opportunity to integrate trade credit insurance with technological advancements offers significant growth potential. The use of AI and machine learning in predicting defaults and setting premiums is an area ripe for development, potentially lowering costs and increasing accessibility for smaller businesses.

For instance, In September 2023, Coface launched a new API portal, marking a significant enhancement in digital services for trade credit management. This portal is specifically designed for financial directors and credit managers, offering them direct access to Coface’s expansive services and data on over 188 million companies worldwide. With 26 distinct API products focused on trade credit insurance and business information, this platform integrates seamlessly into various business applications, helping users manage credit risks more efficiently and effectively.

Technological advancements are profoundly impacting the trade credit insurance market. The integration of blockchain technology, for example, ensures transparency and efficiency in the claims process and risk assessment procedures.

AI and machine learning are being increasingly utilized to analyze vast amounts of data to accurately predict risks associated with extending credit to different customers. These technologies not only improve the underwriting process but also enhance the overall customer experience by facilitating faster claim settlements and more personalized insurance offerings.

By Coverage Analysis

Whole Turnover Coverage Leads the Global Trade Credit Insurance Market by Holding Major Revenue Share.

Based on coverage, the global trade credit insurance market is divided into whole turnover coverage and single buyer coverage. From these coverages, the whole turnover coverage dominates the global trade credit insurance market by securing a major revenue share of 61.4%.

This domination of whole turnover coverage is attributed to the policy of whole turnover coverage that allows the policyholder to claim the benefits over the whole payment. The companies prefer to adopt the whole turnover coverage than the single buyer coverage for supporting their credit control management and claim the benefit on total losses. These key factors are driving the growth of whole turnover coverage in the coverage segment of the global trade credit insurance market.

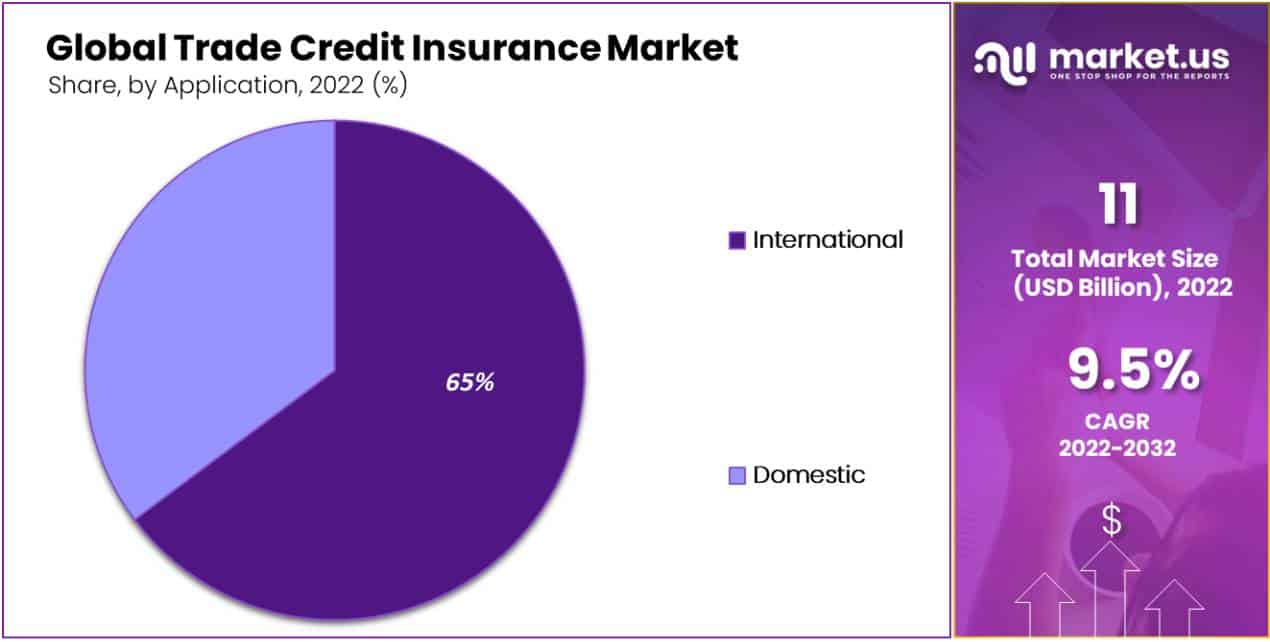

By Application Analysis

International Trade Credit Insurance Leads the Segment by Covering Major Revenue Share in Global Trade Credit Insurance Market.

On the basis of application, the global trade credit insurance market is classified into domestic and international. Among these applications, international holds a major revenue share of 65% to dominate the segment in the global trade credit insurance market. The growth of international trade credit insurance can be attributed to the advantages of trade credit insurance in international trades that, includes trading of major consignments.

It helps to reduce the payment risk for the companies by paying for the losses that occurred due to a foreign buyer is not able to pay. These key factors are boosting the growth of international trade credit insurance in the application segment of the global trade credit insurance market.

By End-Use Industry Analysis

Food & Beverage Dominates the End-Use Industry Segment by Securing Major Revenue Share in Account.

Based on the end-use industry, the global trade credit insurance market is classified into food & beverage, IT & telecom, healthcare, automotive, energy, and other end-use industries. Out of these end-use industries, food & beverage dominates the segment by covering the major revenue share of 18.6%.

This domination of food & beverage is due to the continuously rising food & beverage trade activities and simultaneously rising demand for trade credit insurance for protecting the value of food & beverage products. The rising trade activities across the world for various food and beverage products are positively affecting the growth of the global trade credit insurance market. These key factors are driving the growth of food & beverage in the end-use industry segment of the global trade credit insurance market.

After food & beverage, the automotive industry is expected to grow at the fastest CAGR during the forecast period. Rapid technological advancements and changing consumer preferences are boosting the automotive industry, which is directly expected to increase the demand for trade credit insurance in the market over the forecast period.

Trade Credit Insurance Key Market Segments

Coverage

- Whole Turnover Coverage

- Single Buyer Coverage

Application

- Domestic

- International

End-Use Industry

- Food & Beverage

- IT & Telecom

- Healthcare

- Automotive

- Energy

- Other End-Use Industries

Driver

Expansion of International Trade Activities

The growth of international trade activities serves as a significant driver for the trade credit insurance market. As businesses increasingly engage in cross-border transactions, the complexity and risk associated with these dealings also rise. Trade credit insurance mitigates these risks by providing coverage against non-payment due to customer insolvency or protracted default, essential for maintaining financial stability.

This insurance form becomes crucial for companies venturing into new markets with unfamiliar regulatory environments and economic volatility. Additionally, as global trade volumes expand, the demand for robust risk management solutions like trade credit insurance naturally increases, supporting business continuity and enabling companies to capitalize on international growth opportunities.

This driver is underscored by the rising strategic initiatives among insurers, such as partnerships and digital enhancements, aimed at broadening their global reach and service offerings.

Restraint

High Insolvency Risks

A significant restraint in the trade credit insurance market is the high risk of insolvency among insured clients, particularly in volatile economic climates. Economic downturns and market disruptions, such as those experienced during the COVID-19 pandemic, increase the likelihood of non-payment incidents, thereby elevating claim frequencies and impacting the insurers’ profitability.

These conditions can lead insurers to tighten their underwriting standards or increase premiums, which may restrict market growth by making trade credit insurance less affordable or accessible for some businesses. Moreover, this restraint is exacerbated during periods of rapid economic changes where businesses face heightened financial instability, challenging insurers to maintain balanced risk portfolios without overexposing themselves to potential defaults.

Opportunity

Technological Advancements for Improved Underwriting and Risk Management

Technological advancements present significant opportunities in the trade credit insurance market, particularly through the development and integration of artificial intelligence (AI) and machine learning in risk assessment processes. These technologies enable insurers to analyze vast data sets more efficiently, leading to more accurate underwriting decisions and premium settings.

Additionally, blockchain technology can enhance transparency and reduce fraud risks, providing a more secure and streamlined process for claims and policy management. This technological shift not only improves operational efficiency but also enhances customer service by speeding up claims processing and providing more tailored insurance solutions, thereby attracting more clients and expanding market reach.

Challenge

Intense Competition Among Providers

The trade credit insurance market faces the challenge of intense competition among providers, which pressures profit margins and innovation rates. Insurers are compelled to offer competitive premiums and more customized policy terms to attract and retain clients, which can erode profitability if not managed effectively.

The competitive landscape also forces companies to continuously invest in technological advancements and customer service enhancements to distinguish their offerings from those of competitors. This environment, while beneficial for consumers, poses a strategic challenge for insurers as they balance cost management with the need to innovate and expand their market presence.

Growth Factors

The trade credit insurance market is experiencing robust growth driven by several key factors. Primarily, the expansion of international trade is a major growth catalyst. As businesses increasingly engage in cross-border transactions, the demand for protection against the non-payment risks associated with these activities grows. This demand is further fueled by the rising incidence of buyer insolvency and payment defaults, which are particularly prevalent in volatile economic times.

Additionally, the increasing integration of digital technology in trade finance is enhancing the efficiency and accessibility of trade credit insurance, making it more attractive to a broader range of businesses, from large enterprises to SMEs. Technology not only improves the precision of risk assessment but also streamlines claims processing and policy management, contributing significantly to market growth

Emerging Trends

Emerging trends within the trade credit insurance market include the widespread adoption of advanced analytics and artificial intelligence. These technologies are being leveraged to better predict buyer default risks and to optimize insurance premium pricing models. The market is also seeing a shift towards more customized insurance solutions, catering to specific industry needs such as automotive, energy, and IT & telecom, which vary greatly in terms of risk profiles and coverage requirements.

Furthermore, there is a growing focus on expanding trade credit insurance offerings to cover domestic trade activities, reflecting the increasing risk of non-payment in local transactions as well. The development of new financial instruments and the inclusion of coverage for political risks in some regions are also notable trends, broadening the scope and appeal of trade credit insurance

Business Benefits

Trade credit insurance offers numerous business benefits, chief among them being risk mitigation. By protecting companies against the financial instability of their customers, trade credit insurance helps maintain cash flow stability and reduces the potential for significant financial disruptions caused by unpaid debts. This kind of insurance is particularly beneficial in sectors where transactions are large and credit periods are extended, such as the automotive and manufacturing industries.

Additionally, having trade credit insurance can enhance a company’s borrowing capacity, as lenders often view insured receivables as more secure collateral. This insurance also supports companies in safely expanding their business operations into new and potentially riskier markets by mitigating the risks associated with unknown or less creditworthy customers. Moreover, trade credit insurance is a valuable tool for financial planning and credit management, helping firms to establish more reliable and effective credit policies.

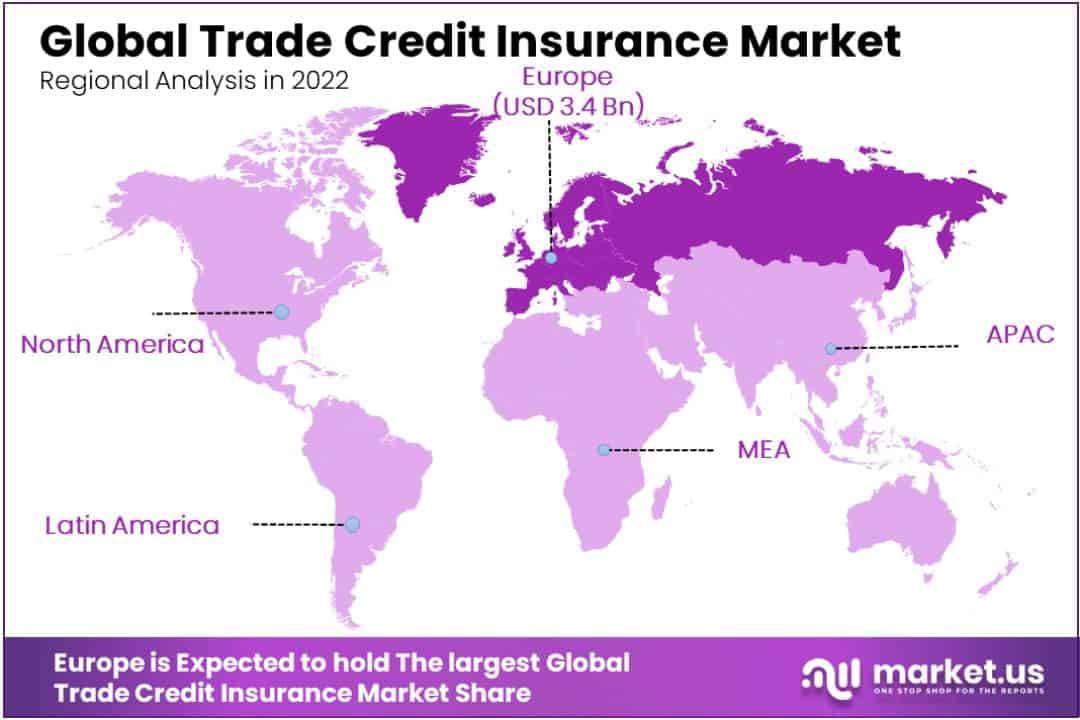

Regional Analysis

Europe leads the Global Trade Credit Insurance Market by Holding Major Revenue Share Account.

The Europe region leads the global trade credit insurance market by holding a major revenue share of 31.6% in the account. It is also anticipated to continue its significant growth over the forecast period. The growth of the Europe region is owing to the presence of major key players within the region and the high adoption of advanced technologies.

The rising trade activities between various countries in the Europe region are increasing the demand for trade credit insurance in the market. Also, the governments of many countries in the Europe region are supporting the adoption of trade credit insurance among companies. These key factors are driving the growth of the trade credit insurance market in the Europe region.

After the Europe region, Asia Pacific is expected to grow at the fastest CAGR during the forecast period. Continuously rising trading activities from the countries like China, India, Japan, Australia, and many others countries are driving the growth of trade credit insurance in the Asia Pacific region. With increasing losses and threats to trade activities, the adoption of trade credit insurance is expected to grow significantly over the forecast period.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

The market is fragmented into many companies offering trade credit insurance. However, the major players are focusing on the adoption of various strategies like acquisition, mergers, collaboration, and partnership to expand their business share in new regions and strengthen their position in the market.

Some of the key players in the global trade credit insurance market are Allianz Trade, Atradius N.V., Coface, American International Group Inc, Zurich, Chubb, Great American Insurance Company, QBE Insurance Group Limited, Aon plc, Credendo, and Other Key Players.

Top Key Players in Trade Credit Insurance Market

- Allianz Trade

- Coface

- Atradius N.V.

- American International Group Inc

- Zurich

- Chubb

- QBE Insurance Group Limited

- Great American Insurance Company

- Aon plc

- Credendo

- Other Key Players

Recent Developments

- In April 2023, Allianz Trade partnered with Singapore-based B2B BNPL provider Bueno.money to strengthen its foothold in the Asia-Pacific B2B e-commerce market. The collaboration enables Bueno.money to offer real-time deferred payment solutions to online merchants, supported by Allianz Trade’s E-commerce Credit Insurance to mitigate credit risks. This move addresses the rising demand for flexible payment options in the region.

- In May 2023, TradeCreditTech joined hands with TreasurUp to digitize trade credit insurance and risk management for SMBs through banks. The partnership allows banks to integrate TreasurUp’s trade credit platform into their commercial banking portals, providing SMBs with easier access to credit solutions and insurance, enhancing trade security and efficiency.

Report Scope

Report Features Description Market Value (2022) US$ 11 Bn Forecast Revenue (2032) US$ 26.6 Bn CAGR (2023-2032) 9.5 % Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Coverage – Whole Turnover Coverage and Single Buyer Coverage; By Application – Domestic and International; By End-Use Industry – Food & Beverage, IT & Telecom, Healthcare, Automotive, Energy, and Other End-Use Industries Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Allianz Trade, Atradius N.V., Coface, American International Group Inc, Zurich, Chubb, Great American Insurance Company, QBE Insurance Group Limited, Aon plc, Credendo, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the Global Trade Credit Insurance Market?The Global Trade Credit Insurance Market was valued at US$ 11 Billion in 2022. It is estimated to reach US$ 26.6 Billion by 2032.

Why is there a growing demand for trade credit insurance in the market?With increasing trade activities across countries, the demand for trade credit insurance is significantly rising. It allows companies to safeguard themselves from potential losses, encouraging many businesses worldwide to adopt trade credit insurance.

Which industries and enterprises are adopting trade credit insurance?Companies ranging from small enterprises to large corporations across various industries, including Food & Beverage, IT & Telecom, Healthcare, Automotive, Energy, and others, are adopting trade credit insurance to guard against and minimize payment risks.

Are there any regions where trade credit insurance is mandatory?Yes, trade credit insurance is mandated in some parts of the world to continue business operations. This requirement is driving companies to adopt trade credit insurance.

Who are some of the key players in the Trade Credit Insurance Market?Key players in the Trade Credit Insurance Market include Allianz Trade, Atradius N.V., Coface, American International Group Inc, Zurich, Chubb, Great American Insurance Company, QBE Insurance Group Limited, Aon plc, Credendo, and other notable players.

Trade Credit Insurance MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Trade Credit Insurance MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz Trade

- Coface

- Atradius N.V.

- American International Group Inc

- Zurich

- Chubb

- QBE Insurance Group Limited

- Great American Insurance Company

- Aon plc

- Credendo