Global Tracking as a Service Market Size, Share Analysis By Component (Software, Services), By Deployment (On-premises, Cloud-based), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Asset Type (Electronics & IT Assets, In-transit Equipment, Manufacturing Assets, Others), By Industry (Transportation & Logistic, Manufacturing, Healthcare, Food & Beverage, Retail, IT & Telecom, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155177

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Role of AI in TaaS Market

- U.S. TaaS Market Size

- Top Growth Factors

- Component Analysis

- Deployment Analysis

- Enterprise Size Analysis

- Asset Type Analysis

- Industry Analysis

- Top Trends and Innovations

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Regional Highlights: A Global Perspective

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

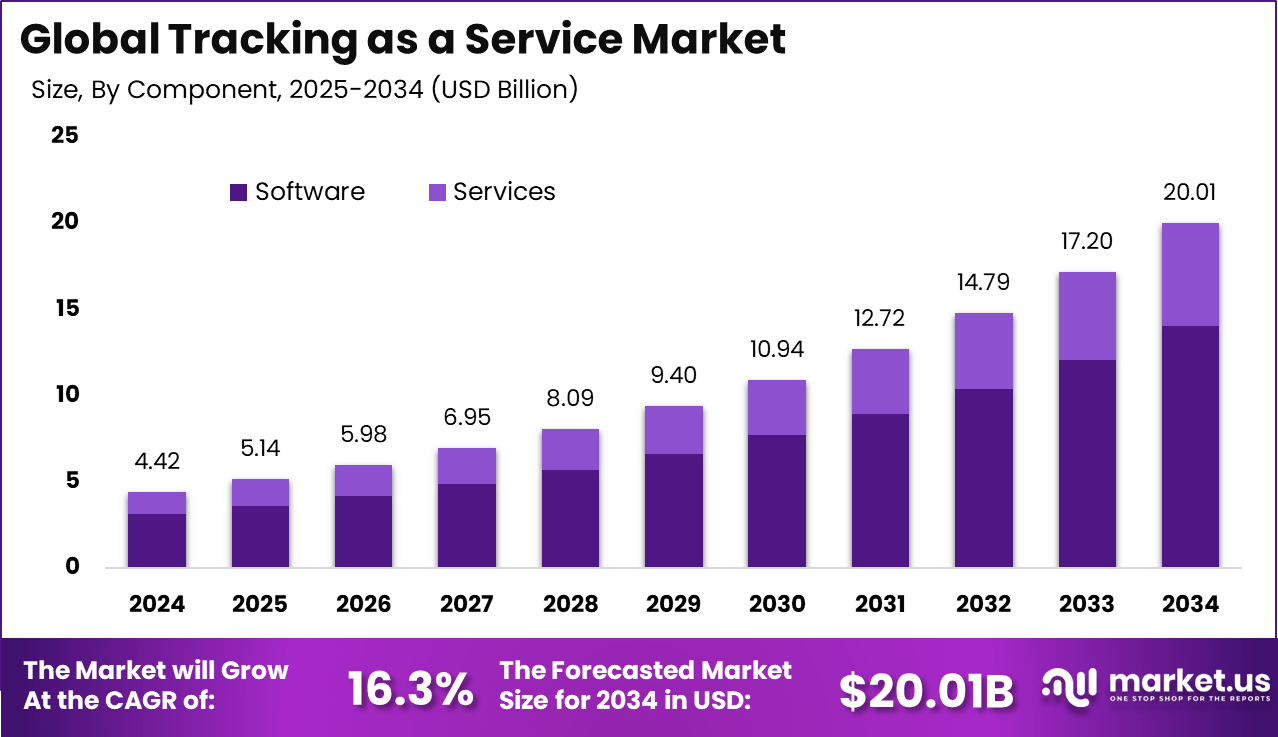

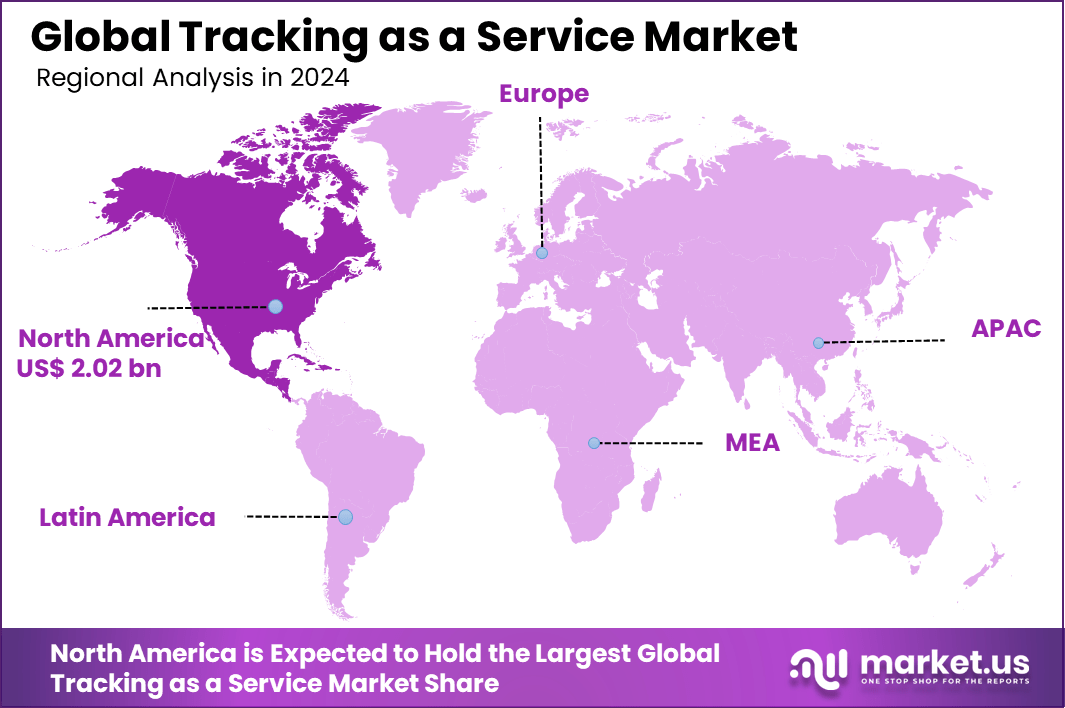

The Global Tracking as a Service Market size is expected to be worth around USD 20.01 billion by 2034, from USD 4.42 billion in 2024, growing at a CAGR of 16.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45.8% share, holding USD 2.02 billion in revenue.

The Tracking as a Service (TaaS) Market is emerging as a vital segment within the digital transformation landscape, providing cloud-based platforms that enable real-time tracking and monitoring of assets, vehicles, inventory, and personnel across various industries. This service leverages advances in Internet of Things (IoT) connectivity, GPS, data analytics, and cloud computing to offer seamless and scalable tracking solutions that improve operational efficiency,

Key Takeaways

- By component, Software led with a 70.3% share, driven by demand for real-time analytics, asset monitoring, and integration with enterprise systems.

- Cloud-based deployment accounted for 65.8%, reflecting the need for scalable, accessible, and cost-efficient tracking solutions.

- Large enterprises represented 58.1% of the market, adopting tracking platforms to manage complex, high-volume asset flows across global operations.

- By asset type, Manufacturing Assets held 35.4%, underscoring the focus on optimizing production efficiency and minimizing downtime.

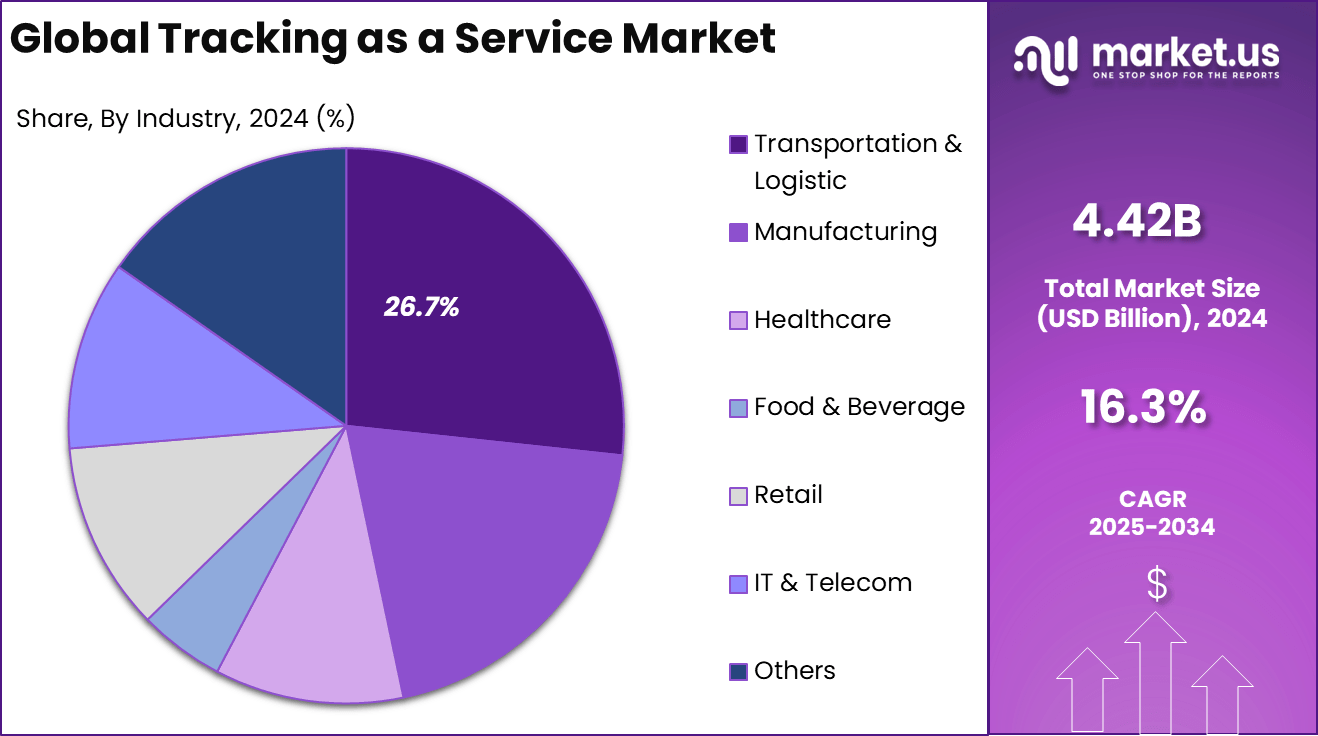

- The Transportation & Logistics industry led by end-use with a 26.7% share, leveraging tracking services for supply chain visibility, fleet monitoring, and delivery optimization.

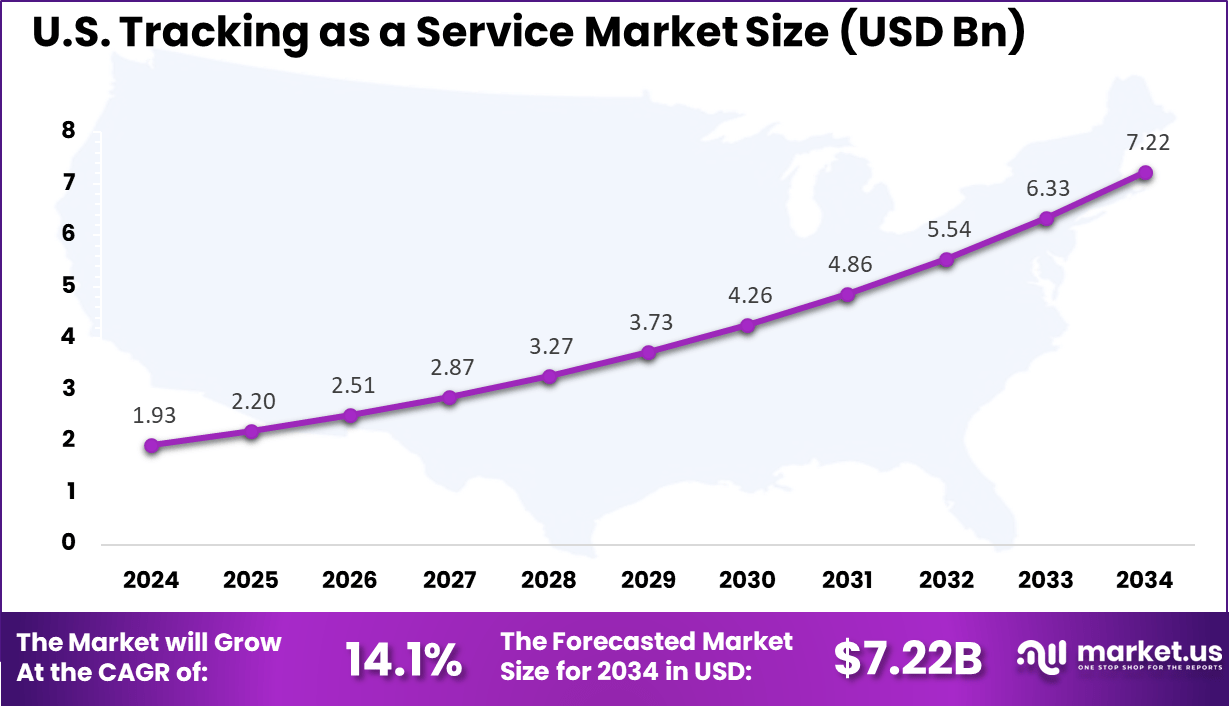

- The U.S. market was valued at USD 1.93 billion in 2024, expected to grow at a CAGR of 14.1%, driven by digital supply chain initiatives and IoT adoption.

- North America dominated globally with a 45.8% share, generating USD 2.02 billion in revenue, supported by advanced logistics infrastructure and strong cloud adoption rates.

Market Size and Growth

Metric Statistic / Value Market Value (2024) USD 4.42 Bn Forecast Revenue (2034) USD 20.01 Bn CAGR(2025-2034) 16.3% Leading Segment By Component: Software: 70.3% Key driving factors for the Tracking as a Service Market include the intensifying demand for real-time monitoring and enhanced visibility in logistics, transportation, manufacturing, healthcare, retail, and e-commerce sectors. The proliferation of IoT devices and sensor technologies has significantly lowered the cost and complexity of deploying tracking systems.

The latest Accenture research on digital maturity in the logistics industry dates from June 19, 2022. This research involved interviews with 14 industry experts and surveys of over 600 logistics executives. It confirmed that digital leaders invest about 2.5 times more in innovation and digital capabilities than laggards, achieving a digital maturity score around 4.6 out of 5, reflecting a balanced and advanced digital transformation approach.

Additionally, growing emphasis on digitalization and automation in enterprise operations pushes businesses toward adopting cloud-hosted tracking solutions that reduce upfront investments and enable flexible scalability. The acceleration of 5G networks and edge computing further fuels the capability of TaaS platforms to deliver faster, more accurate tracking data.

For instance, in August 2025, JFK Airport piloted the world’s first mobility cart tracking service, utilizing Tracking as a Service (TaaS) technology. This innovative service provides real-time tracking of mobility carts used by passengers with reduced mobility, ensuring their availability and efficient deployment across the airport.

Analysts’ Viewpoint

Organizations adopt tracking as a service primarily to achieve operational excellence, reduce costs related to asset loss and downtime, and gain competitive advantage through enhanced supply chain visibility. This service model supports rapid scaling and easy customization to specific business needs, improving fleet management efficiency and inventory control.

Tracking solutions also contribute to sustainability goals by optimizing routes and reducing fuel consumption. Investment opportunities in the TaaS market are robust, propelled by rapid digital transformation across industries and heightened demand for automated solutions. The growing adoption of IoT and AI, coupled with increasing investments in smart logistics and supply chain management, fuels venture interest in innovative tracking technologies.

Business benefits realized from tracking as a service include increased asset utilization, enhanced operational transparency, minimized theft and loss, and improved compliance with regulations. Such advantages translate into reduced insurance costs, better resource allocation, and improved customer service quality. For providers, TaaS offers recurring revenue streams through subscriptions while fostering long-term client relationships through continuous platform upgrades and analytics services.

Role of AI in TaaS Market

Role/Function Description Real-Time Data Analytics AI processes vast data from GPS, RFID, IoT sensor networks to provide timely location and operational insights Predictive Tracking & Maintenance Machine learning predicts potential failures, route deviations, and traffic/weather conditions enabling proactive interventions Optimization of Routes & Resources AI optimizes delivery routes and fleet scheduling, reducing fuel consumption and enhancing operational efficiency Anomaly & Fraud Detection AI spots irregularities such as route divergences, theft attempts, or unauthorized access in assets and shipments Integration with IoT & Cloud AI supports scalable cloud platforms and IoT connectivity for seamless tracking across distributed and mobile assets Enhanced Security & Privacy AI implements encryption and secure protocols to protect sensitive location and tracking data U.S. TaaS Market Size

The market for Tracking as a Service within the U.S. is growing tremendously and is currently valued at USD 1.93 billion, the market has a projected CAGR of 14.1%. The market’s rapid growth is attributed to the robustness of the online shopping industry in the country, which necessitates efficient supply chain management and timely tracking.

The need for TaaS is essential as major shipping companies and stores are constantly enhancing their ability to deliver items quickly and manage their inventory. The increasing utilization of AI, the Internet of Things, and cloud technology contributes to this expansion by enabling businesses to optimize transportation planning and reduce expenses while improving customer satisfaction.

For instance, in October 2024, Pro Carrier announced a new end-to-end U.S. partnership for tracking services, further solidifying the dominance of the U.S. in the Tracking as a Service (TaaS) market. The partnership aims to enhance last-mile delivery solutions by integrating advanced tracking technologies that provide real-time visibility, optimize routes, and improve operational efficiency.

In 2024, North America held a dominant market position in the Global Tracking as a Service Market, capturing more than a 45.8% share, holding USD 2.02 billion in revenue. This dominance is due to its advanced technological infrastructure, strong adoption of e-commerce, and well-established logistics networks.

The region’s businesses prioritize operational efficiency and customer satisfaction, driving the demand for real-time tracking solutions. Additionally, the integration of AI, IoT, and cloud technologies further fueled the widespread adoption of Tracking as a Service across North America.

For instance, in November 2024, Dot Ai and Würth Industry North America announced an exclusive partnership to deploy Dot Ai’s AI-driven tracking solutions in the manufacturing industry. This partnership aims to leverage advanced AI and tracking technologies to optimize asset management, inventory tracking, and supply chain operations across North America.

Top Growth Factors

Growth Factor Description Expansion of E-commerce & Logistics Rapid growth in online retail and increasing delivery demands drive adoption of tracking solutions Increasing Demand for Real-Time Visibility Businesses require real-time asset and shipment monitoring to improve supply chain transparency and efficiency Government Initiatives & Regulations Investments and regulations promoting GPS tracking in transportation and public infrastructure boost adoption Technological Advancement & IoT Adoption Advances in sensor tech, cloud computing, 5G connectivity, and AI analytics enhance TaaS capabilities Rising Emphasis on Operational Efficiency Companies seek cost savings, route optimization, and predictive maintenance to enhance fleet and asset use Component Analysis

In 2024, The Software segment held a dominant market position, capturing a 70.3% share of the Global Tracking as a Service Market. This dominance is due to the increasing reliance on cloud-based platforms and advanced analytics for real-time tracking, route optimization, and asset management.

Software solutions enable businesses to efficiently manage their operations, providing seamless integration with IoT devices and other technologies. Additionally, the growing demand for scalable, customizable, and user-friendly tracking solutions has further driven the adoption of software in TaaS.

For Instance, in February 2025, Force Fleet Tracking and Jobber teamed up to simplify dispatching with integrated fleet tracking for home service professionals. This collaboration combines Force Fleet Tracking’s advanced real-time tracking capabilities with Jobber’s service management software, creating a seamless solution for managing mobile workforces.

Deployment Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing a 65.8% share of the Global Tracking as a Service Market. The dominance is due to the flexibility, scalability, and cost-efficiency offered by cloud-based solutions.

These platforms allow businesses to easily manage large volumes of tracking data, access real-time insights, and scale operations as needed without the need for heavy on-site infrastructure. Cloud-based TaaS also enhances collaboration, ensures seamless updates, and supports remote access, making it highly attractive to companies across various industries.

For instance, in May 2025, Microsoft announced the migration of its IT infrastructure management to the cloud with Microsoft Azure. This move enhances its ability to offer scalable, cloud-based solutions, including Cloud-Based Tracking as a Service (TaaS).

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 58.1% share of the Global Tracking as a Service Market. This dominance is due to the greater financial resources and complex logistical needs of large organizations.

These companies require advanced tracking solutions to manage vast supply chains, ensure real-time visibility, and optimize operations across multiple regions. Additionally, large enterprises can invest in scalable, customizable TaaS solutions, driving the widespread adoption of these technologies to improve efficiency and reduce costs.

For Instance, in February 2025, Tradlinx unveiled its unlimited vessel tracking service, designed to empower logistics professionals worldwide. This service offers real-time tracking capabilities, enabling large enterprises in the shipping and logistics sectors to monitor vessels, optimize routes, and improve supply chain visibility.

Asset Type Analysis

In 2024, The Manufacturing Assets segment held a dominant market position, capturing a 35.4% share of the Global Tracking as a Service Market. This dominance is due to the growing need for real-time visibility and management of equipment, machinery, and raw materials in manufacturing environments.

Tracking solutions help manufacturers optimize asset utilization, reduce downtime, and improve maintenance schedules. Additionally, the increasing focus on operational efficiency, cost reduction, and minimizing disruptions in the production process has driven widespread adoption of TaaS for managing manufacturing assets.

For Instance, in October 2024, IFS accelerated its industrial AI capabilities with the release of IFS Cloud 24R2. This update integrates advanced AI-driven features designed to enhance asset management and real-time tracking in manufacturing environments. By leveraging IFS Cloud’s capabilities, manufacturers can track and optimize their assets more efficiently, improving operational visibility and reducing downtime.

Industry Analysis

In 2024, the Transportation & Logistics segment held a dominant market position, capturing a 26.7% share of the Global Tracking as a Service Market. This dominance is driven by the growing demand for real-time tracking of shipments, vehicles, and cargo across extensive supply chains. TaaS allows transportation and logistics companies to optimize routes, minimize delays, and enhance inventory management, boosting customer satisfaction.

Additionally, government initiatives supporting digital logistics infrastructure and the surge in e-commerce activities further strengthen the segment’s position. With a strong focus on cost efficiency, timely deliveries, and end-to-end visibility, TaaS has become crucial for operational success in the transportation and logistics sector.

For Instance, in September 2024, Geotab released its latest MyGeotab updates, further enhancing its fleet management platform. These updates focus on improving tracking capabilities, offering better visibility into vehicle and asset performance. Geotab’s new features include advanced data analytics, more robust reporting tools, and enhanced integration with other IoT devices.

Top Trends and Innovations

Trend/Innovation Description AI-Driven Predictive Analytics AI-powered platforms deliver actionable intelligence on asset health, delays, and risk mitigation IoT-Enabled Tracking Systems Integration of IoT devices for comprehensive monitoring and environmental sensing Cloud-Based, Scalable Platforms Flexible solutions accessible remotely with real-time data synchronization across geographies 5G Network Integration Enhanced connectivity enables faster data transmission and more reliable tracking performance Increased Focus on Data Security Deployment of encryption, access control, and privacy-compliant protocols to secure tracking data Sector Expansion into Healthcare & Agriculture Growing use in patient monitoring, medical device tracking, crop monitoring, and resource optimization Key Market Segments

By Component

- Software

- Services

By Deployment

- On-premises

- Cloud-based

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Asset Type

- Electronics & IT Assets

- In-transit Equipment

- Manufacturing Assets

- Others

By Industry

- Transportation & Logistic

- Manufacturing

- Healthcare

- Food & Beverage

- Retail

- IT & Telecom

- Others

Drivers

E-commerce Growth

A major driver for the TaaS market is the surge in e-commerce and logistics activities requiring precise real-time tracking to fulfill demand for faster deliveries and better customer satisfaction. The rising need to improve fleet operators’ efficiency through route optimization, fuel management, and driver behavior monitoring is pushing widespread adoption.

Additionally, the proliferation of connected devices and smart infrastructure, fueled by IoT growth and adoption of 5G, enables seamless communication and tracking of assets across complex supply chains. Regulatory mandates for GPS tracking and safety compliance in sectors like transportation and healthcare also stimulate market growth.

For instance, In October 2024, DHL Express introduced proactive tracking and direct signature services to enhance e-commerce deliveries. These solutions provide real-time tracking updates, improving customer visibility throughout the delivery process. By integrating Tracking as a Service into its offerings, DHL helps businesses boost supply chain transparency, optimize delivery operations, and increase customer satisfaction.

Restraint

Data Privacy Concerns

Despite positive outlooks, the market faces challenges, chiefly the high initial implementation costs and technological complexities associated with integrating advanced tracking solutions into legacy systems. Smaller businesses with limited budgets often hesitate to invest in comprehensive TaaS platforms due to hardware, software, and maintenance expenses.

Data privacy and cybersecurity concerns are prominent restraints because tracking services handle sensitive location and movement data. Compliance with diverse regulations like GDPR or CCPA increases operational costs and complexity for providers. Infrastructure limitations in certain regions, such as poor internet connectivity or GPS coverage, hinder the effective deployment of tracking solutions.

For instance, in April 2025, a Florida driver filed a lawsuit against Toyota and Progressive over concerns regarding data sharing through connected analytic services. The lawsuit highlights the growing issue of data privacy in the context of Tracking as a Service (TaaS) solutions.

Opportunities

Expansion into Emerging Markets

As digital infrastructure improves in developing regions, there is a growing opportunity for Tracking as a Service (TaaS) to expand. The expansion of industries and online shopping sectors in Asia-Pacific, Africa, and Latin America is driving a surge in demand for logistics and tracking services in new markets.

TaaS providers can leverage this expansion to enhance supply chain visibility and optimize logistics for businesses in these regions, fostering growth and increasing operational efficiency as they modernize their infrastructures.

For instance, in May 2025, Africa welcomed a new dollar billionaire from the world of car tracking technology. This individual’s success highlights the rapid growth of the Tracking as a Service (TaaS) market, particularly in regions like Africa, where the demand for vehicle tracking and fleet management solutions is increasing.

Challenges

Market Competition

The TaaS market is becoming more competitive, with many companies entering to meet the increasing demand. This leads to increased price pressure, which also prompts businesses to continuously innovate in pursuit of their objectives.

Businesses can only compete if they offer exclusive features, integrated systems, or more detailed analytics to stay ahead of the competition. TaaS providers must adapt to the changing market and customer preferences to remain competitive.

For instance, in August 2025, Papa John’s launched a new app and pizza delivery tracking service, reflecting the increasing market competition in the Tracking as a Service (TaaS) sector. With more companies offering real-time tracking solutions to enhance customer experience, the competition in the TaaS market has intensified.

Regional Highlights: A Global Perspective

Asia-Pacific has emerged as the fastest-growing region for TaaS, supported by rapid industrialization, a booming e-commerce sector, and large-scale investments in IoT, AI, and blockchain-enabled smart logistics. Governments and enterprises in China, India, Japan, and South Korea are modernizing supply chains through innovative initiatives such as blockchain-based port logistics.

Europe is maintaining steady TaaS market expansion, driven by stringent regulations that promote supply chain transparency, sustainability, and advanced tracking adoption, including 5G-enabled solutions. Leading economies such as Germany, the UK, France, Italy, and Spain are investing in warehouse automation, logistics management platforms, and cloud-native tracking systems.

Latin America is progressing toward broader TaaS adoption, supported by growing e-commerce, transportation, and manufacturing sectors. Efforts are concentrated on improving supply chain visibility, especially in last-mile delivery. Global tracking technology providers are expanding through distribution partnerships and local manufacturing, enabling faster modernization.

The Middle East & Africa show significant growth potential, fueled by logistics, healthcare, and manufacturing industries adopting GPS and real-time tracking technologies to improve performance. Large-scale infrastructure investments in the UAE, Saudi Arabia, and Oman are accelerating implementation, while in Africa, the adoption of cloud-based tracking services is rapidly increasing.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading players in the Tracking as a Service market are focusing on advanced IoT integration, real-time analytics, and cloud-based solutions to enhance operational visibility. Companies such as Motorola Solutions, Wabco Holdings Inc., AT&T Inc., and Zebra Technologies Corp. are investing in AI-driven tracking systems and scalable software platforms.

Prominent technology providers, including Verizon Communications, Geotab Inc., Blackline Safety Corp., and Spider Tracks Limited, are emphasizing safety compliance, predictive maintenance, and connected fleet management. Their platforms integrate GPS tracking, telematics, and advanced reporting tools to support industries such as transportation, oil and gas, and manufacturing.

Software-focused vendors like MicroMain, Sortly, EZO, Finale Inventory, and Infor are concentrating on inventory management, workflow automation, and user-friendly interfaces. These solutions are designed for small, medium, and large enterprises, enabling real-time asset tracking with minimal manual intervention. Trimble Inc., Rockwell Automation, Midmark Co., Mojix, and PCCW Solutions are advancing RFID, barcode scanning, and sensor network innovations.

Top Key Players in the Market

- Motorola Solutions

- Wabco Holdings Inc.

- AT&T Inc.

- Zebra Technologies Corp.

- Verizon Communications

- Geotab Inc.

- Blackline Safety Corp.

- Spider Tracks Limited

- Honeywell International Inc.

- Trimble Inc.

- Rockwell Automation

- MicroMain

- Sortly

- EZO

- Finale Inventory

- Infor

- Midmark Co.

- Mojix

- PCCW Solutions

- Others

Recent Developments

- In March 2025, Geotab released its 2024 Sustainability and Impact Report, highlighting its efforts in promoting sustainable practices through its fleet management solutions. The report emphasizes the integration of environmentally friendly technologies into its TaaS offerings, including energy-efficient routing, reduced emissions, and advanced data analytics.

- In April 2024, Verizon reported strong wireless service revenue growth, solid cash flow, and continued momentum in its business. The company highlighted its commitment to expanding its digital infrastructure, which supports the growth of Tracking as a Service (TaaS) solutions.

- In January 2024, GlobalNav Satellite Systems introduced a new Real-Time Asset Tracking solution that combines IoT and satellite technology to deliver highly accurate and reliable tracking across industries such as logistics and transportation. This development strengthens operational visibility and efficiency for businesses seeking advanced tracking capabilities.

- In March 2024, GeoTab formed a strategic partnership with Orbcomm to integrate telematics and advanced Tracking as a Service solutions. This collaboration expands their market reach and enhances fleet management offerings, enabling customers to benefit from improved connectivity and comprehensive asset monitoring.

- In May 2024, Trimble secured ~USD 500.2 million in funding to accelerate the growth of its Tracking as a Service offerings and advance its Geospatial Cloud platform. This investment positions the company to deliver greater value to sectors like agriculture, construction, and transportation, while reinforcing its competitive standing in the market.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment (On-premises, Cloud-based), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Asset Type (Electronics & IT Assets, In-transit Equipment, Manufacturing Assets, Others), By Industry (Transportation & Logistic, Manufacturing, Healthcare, Food & Beverage, Retail, IT & Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Motorola Solutions, Wabco Holdings Inc., AT&T Inc., Zebra Technologies Corp., Verizon Communications, Geotab Inc., Blackline Safety Corp., Spider Tracks Limited, Honeywell International Inc., Trimble Inc., Rockwell Automation, MicroMain, Sortly, EZO, Finale Inventory, Infor, Midmark Co., Mojix, PCCW Solutions, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Tracking as a Service MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Tracking as a Service MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Motorola Solutions

- Wabco Holdings Inc.

- AT&T Inc.

- Zebra Technologies Corp.

- Verizon Communications

- Geotab Inc.

- Blackline Safety Corp.

- Spider Tracks Limited

- Honeywell International Inc.

- Trimble Inc.

- Rockwell Automation

- MicroMain

- Sortly

- EZO

- Finale Inventory

- Infor

- Midmark Co.

- Mojix

- PCCW Solutions

- Others