Global Touch Controller IC Market Size, Share, Growth Analysis By Type (Resistive Touch Controller IC, Capacitive Touch Controller IC, Optical Touch Controller IC, Infrared Touch Controller IC), By Touch Panel Size (Small Touch Panels, Medium Touch Panels, Large Touch Panels), By Features (Multi-Touch Support, Gestures Support, Pressure Sensitivity, Waterproof & Dustproof), By Application (Smartphones & Tablets, Smart Appliances, Automotive Displays, Point-of-Sale (POS) Systems, Interactive Kiosks, Wearable Devices), By End-Use Industry (Consumer Electronics, Automotive, Healthcare, Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174926

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

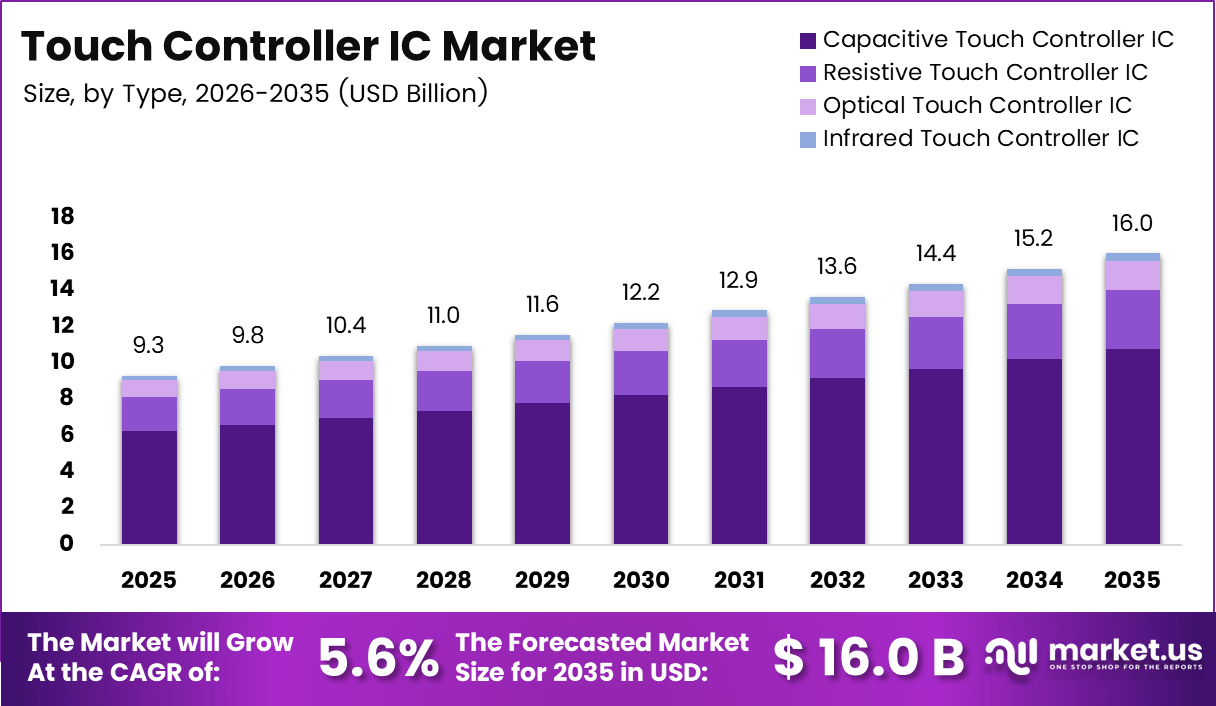

The Global Touch Controller IC Market size is expected to be worth around USD 16.0 billion by 2035, from USD 9.3 billion in 2025, growing at a CAGR of 5.6% during the forecast period from 2026 to 2035.

The Touch Controller IC market represents the enabling semiconductor layer that translates physical touch inputs into digital signals for electronic systems. Fundamentally, these integrated circuits manage sensing accuracy, signal conversion, and interface compatibility across devices. As touch-based human machine interfaces expand, demand remains structurally strong across consumer, industrial, and embedded environments.

In practical terms, a Touch Controller IC functions as the intelligence behind resistive, capacitive, optical, and infrared touch technologies. It interprets electrical variations caused by touch and converts them into usable coordinates. Consequently, manufacturers increasingly prioritize reliability, low latency, and multi-interface support to serve smartphones, kiosks, medical panels, and industrial terminals efficiently.

From a market growth perspective, adoption continues to accelerate due to touchscreen standardization across digital ecosystems. Moreover, increasing automation, smart appliance penetration, and in-vehicle display integration strengthen long-term demand. Governments also indirectly support growth through investments in digital infrastructure, smart manufacturing programs, and electronics localization policies that encourage domestic semiconductor integration.

Opportunities further expand as industrial and healthcare environments favor robust touch solutions over mechanical interfaces. Therefore, resistive and hybrid touch controller ICs remain relevant where gloves, moisture, or dust are present. Additionally, regulatory emphasis on device safety and electromagnetic compliance continues to shape controller design requirements across regulated sectors.

According to Pen Mount technical documentation, resistive touch screen controller ICs are designed for direct integration into customer systems, supporting both RS-232 and USB interfaces. These controller ICs are compatible with 4, 5, and 8 wire resistive touch screens, enabling flexibility across diverse screen architectures and deployment environments.

Furthermore, according to PenMount product specifications, the PenMount 6000 series supports both RS-232 and USB interfaces, while the PenMount 9000 series supports RS-232 interfaces exclusively. The PenMount 9000 integrates an on-chip A/D converter, positioning it as an all-in-one solution optimized for stable performance and simplified system design.

For larger screen areas, according to PenMount application notes, designers often adopt 8 or 5 wire resistive touch structures instead of 4 wire configurations. This approach improves compensation accuracy and signal stability. Overall, these technical characteristics illustrate how Touch Controller IC market innovation aligns with evolving application complexity and system-level performance expectations.

Key Takeaways

- The Global Touch Controller IC Market is projected to reach USD 16.0 billion by 2035, rising from USD 9.3 billion in 2025, at a CAGR of 5.6% during 2026–2035.

- By type, Capacitive Touch Controller IC leads the market with a dominant share of 67.3%, reflecting widespread adoption across touch-enabled devices.

- By touch panel size, Medium Touch Panels hold the largest share at 49.9%, driven by balanced usage across consumer, automotive, and commercial displays.

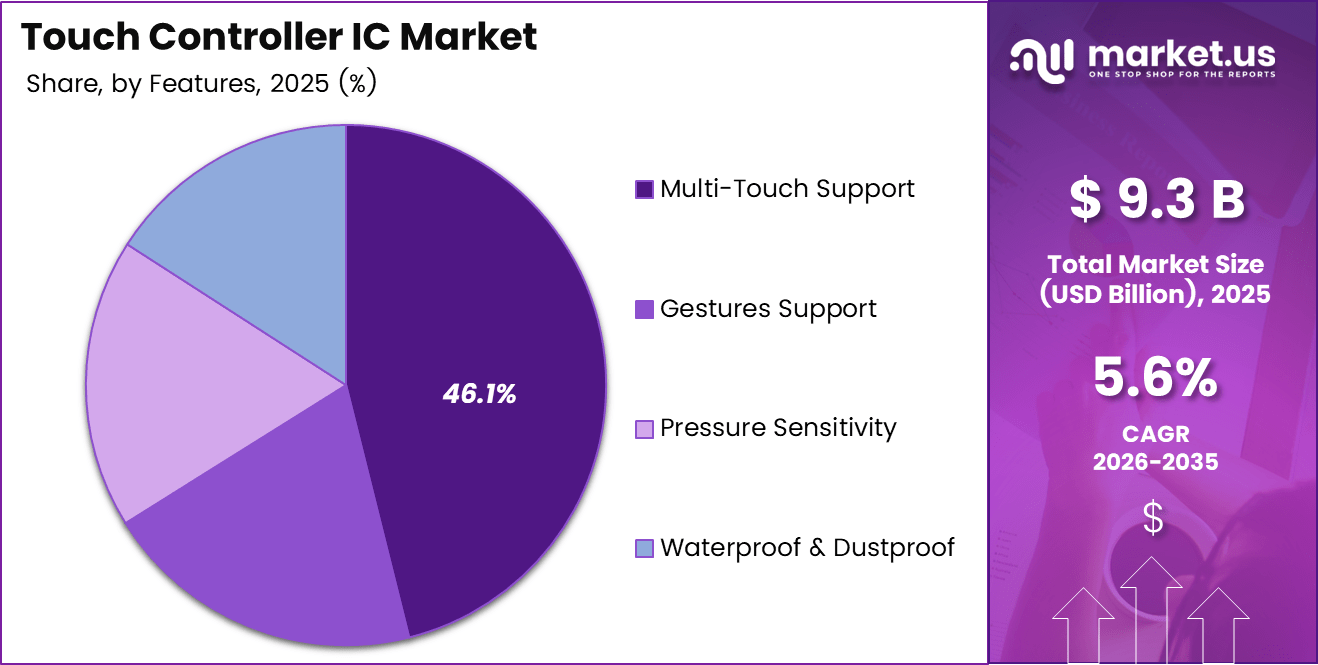

- By features, Multi-Touch Support accounts for the highest share of 46.1%, highlighting strong demand for advanced and intuitive touch interactions.

- By application, Smartphones and Tablets represent the leading segment with a market share of 44.6%, supported by high device penetration.

- By end-use industry, Consumer Electronics dominates with 59.8%, underscoring the central role of touch interfaces in everyday digital products.

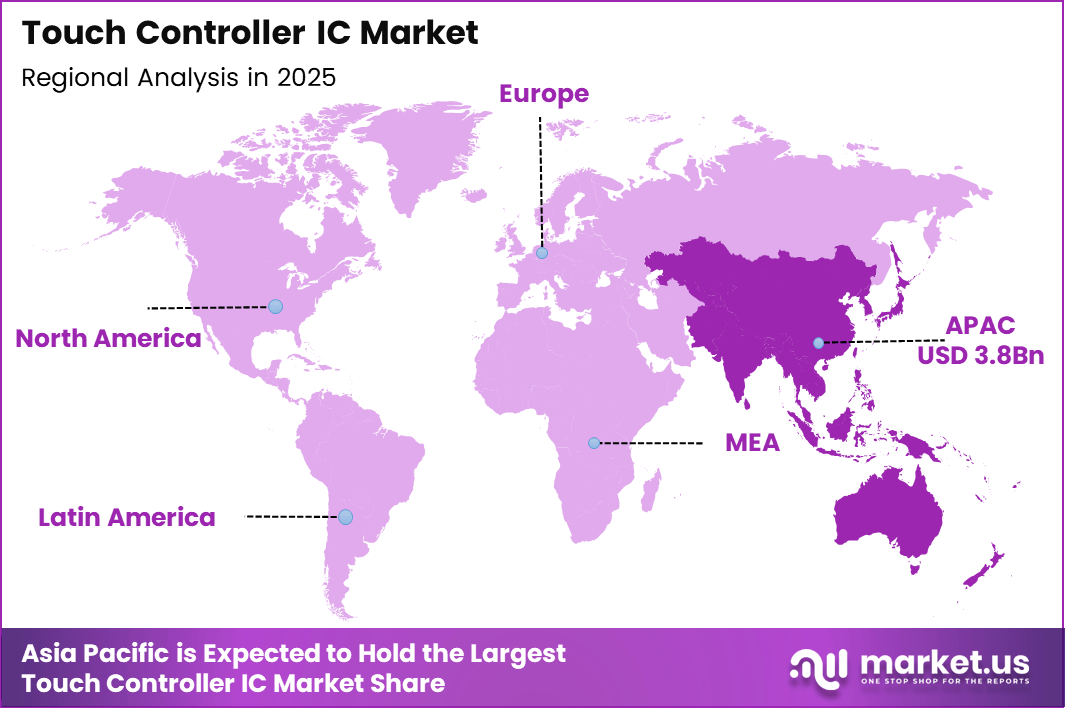

- Regionally, Asia Pacific leads the global market with a 41.3% share, valued at USD 3.8 billion, supported by strong electronics manufacturing activity.

By Type Analysis

Capacitive Touch Controller IC dominates with 67.3% due to its superior accuracy, durability, and widespread adoption across modern touch-enabled devices.

In 2025, Capacitive Touch Controller IC held a dominant market position in the By Type segment of Touch Controller IC Market, with a 67.3% share. This dominance is supported by rising usage in smartphones, tablets, and automotive displays. Moreover, capacitive controllers offer faster response, multi-touch capability, and enhanced user experience across consumer electronics.

Resistive Touch Controller IC continues to maintain relevance in industrial and healthcare environments. These controllers perform reliably under harsh conditions such as dust, moisture, and glove usage. Consequently, they remain preferred in applications where durability and cost efficiency outweigh advanced gesture functionality.

Optical Touch Controller IC adoption remains steady in large-format displays. These controllers enable precise touch detection using light-based sensing. Therefore, they are increasingly deployed in interactive kiosks and public information systems where physical contact layers are minimized.

Infrared Touch Controller IC supports touch interaction through infrared grids around the display surface. This technology benefits applications requiring high durability and scalability. As a result, infrared controllers are utilized in rugged commercial and outdoor display environments.

By Touch Panel Size Analysis

Medium Touch Panels dominate with 49.9% driven by balanced usability across consumer, automotive, and commercial display applications.

In 2025, Medium Touch Panels held a dominant market position in the By Touch Panel Size segment of Touch Controller IC Market, with a 49.9% share. These panels offer an optimal balance between screen visibility and device portability. Consequently, they are widely integrated into tablets, infotainment systems, and POS terminals.

Small Touch Panels remain essential for compact devices such as wearables and handheld electronics. Their demand is supported by miniaturization trends and growing adoption of smart accessories. Additionally, these panels require low power consumption and precise touch sensitivity.

Large Touch Panels serve interactive kiosks, digital signage, and collaborative displays. Although volume adoption is lower, these panels demand high-performance controllers to maintain accuracy. Therefore, they contribute steadily to commercial and public infrastructure deployments.

By Features Analysis

Multi-Touch Support dominates with 46.1% due to rising demand for intuitive and responsive user interactions.

In 2025, Multi-Touch Support held a dominant market position in the By Features segment of Touch Controller IC Market, with a 46.1% share. This feature enables simultaneous touch inputs, improving usability in smartphones and automotive interfaces. As user expectations rise, multi-touch functionality becomes a standard requirement.

Gestures Support enhances user interaction through swipe, pinch, and rotate commands. These capabilities improve navigation efficiency across consumer electronics. Consequently, gesture-enabled controllers gain traction in premium devices and interactive applications.

Pressure Sensitivity allows detection of varying touch force levels. This feature supports advanced input functionality in creative and industrial tools. Therefore, it remains relevant in specialized professional and design-focused devices.

Waterproof & Dustproof features support device reliability in challenging environments. These controllers are essential in outdoor, industrial, and healthcare settings. As durability requirements increase, such features gain importance across rugged applications.

By Application Analysis

Smartphones & Tablets dominate with 44.6% supported by continuous demand for advanced touch interfaces.

In 2025, Smartphones & Tablets held a dominant market position in the By Application segment of Touch Controller IC Market, with a 44.6% share. High device penetration and frequent upgrades sustain demand. Moreover, manufacturers prioritize responsive and power-efficient touch controllers.

Smart Appliances integrate touch interfaces to enhance usability and aesthetics. These controllers support intuitive control panels in home electronics. As smart homes expand, touch-enabled appliances gain wider acceptance.

Automotive Displays rely on touch controllers for infotainment and control systems. These applications require stability and responsiveness under varying conditions. Consequently, automotive-grade touch IC demand continues to grow.

Point-of-Sale Systems depend on reliable touch input for transaction efficiency. Controllers ensure accuracy and durability in high-usage retail environments. Therefore, POS adoption remains consistent across commercial sectors.

Interactive Kiosks utilize touch controllers for public engagement and self-service operations. These systems prioritize robustness and responsiveness. As digital public services expand, kiosk deployment increases steadily.

Wearable Devices require compact and low-power touch controllers. These controllers support user interaction on small screens. As wearable adoption rises, this segment continues to evolve.

By End-Use Industry Analysis

Consumer Electronics dominate with 59.8% driven by extensive use of touch-enabled devices.

In 2025, Consumer Electronics held a dominant market position in the By End-Use Industry segment of Touch Controller IC Market, with a 59.8% share. High demand for smartphones, tablets, and smart devices supports this dominance. Touch controllers remain central to user experience enhancement.

Automotive applications use touch controllers in infotainment and control panels. These systems demand reliability and precision. As vehicle digitalization increases, automotive usage grows steadily.

Healthcare applications adopt touch controllers in diagnostic and monitoring equipment. These devices require accuracy and hygiene compatibility. Consequently, healthcare demand supports niche growth.

Retail environments depend on touch-enabled POS and kiosks. These systems improve transaction efficiency and customer engagement. Retail adoption remains stable with digital transformation trends.

Other industries include industrial automation and public infrastructure. These applications require rugged and adaptable touch solutions. Therefore, they contribute consistently to overall market demand.

Key Market Segments

By Type

- Resistive Touch Controller IC

- Capacitive Touch Controller IC

- Optical Touch Controller IC

- Infrared Touch Controller IC

By Touch Panel Size

- Small Touch Panels

- Medium Touch Panels

- Large Touch Panels

By Features

- Multi-Touch Support

- Gestures Support

- Pressure Sensitivity

- Waterproof & Dustproof

By Application

- Smartphones & Tablets

- Smart Appliances

- Automotive Displays

- Point-of-Sale (POS) Systems

- Interactive Kiosks

- Wearable Devices

By End-Use Industry

- Consumer Electronics

- Automotive

- Healthcare

- Retail

- Others

Drivers

Rising Integration of Multi Touch Displays Across Consumer Devices Drives Market Growth

The Touch Controller IC Market is strongly driven by the rising integration of multi touch displays in smartphones, tablets, and wearable devices. Consumers increasingly expect smooth gestures, fast response, and accurate touch recognition, which raises the need for advanced touch controller solutions. As screen sizes expand and display quality improves, touch ICs play a key role in delivering a reliable user experience across daily-use electronics.

Another important driver is the expanding adoption of touch interfaces in automotive infotainment and digital cockpit systems. Modern vehicles now feature large touchscreens for navigation, entertainment, and climate control. This shift toward software driven vehicle interiors increases demand for touch controller ICs that can operate reliably under vibration, temperature changes, and long usage cycles.

Growing demand for compact and low power ICs in battery operated electronics also supports market growth. Manufacturers focus on energy efficiency to extend battery life in wearables and portable devices. Touch controller ICs designed with low power consumption help meet these requirements while maintaining performance.

In addition, increasing penetration of smart home appliances with capacitive touch controls boosts adoption. Touch panels are replacing mechanical buttons in appliances, offering better design flexibility and ease of use.

Restraints

High Design Complexity and Calibration Challenges Restrain Market Expansion

One key restraint in the Touch Controller IC Market is the high design complexity involved in supporting multi layer and curved touch panels. As displays become thinner and more flexible, ensuring accurate touch sensing across the entire surface becomes more difficult. Calibration issues can affect sensitivity and accuracy, leading to higher development time and costs for manufacturers.

Another challenge comes from the need to support different materials and screen structures. Touch controller ICs must work with various glass thicknesses, display stacks, and sensor layouts. This increases testing requirements and slows down product development cycles, especially for customized applications.

Supply chain volatility in semiconductor fabrication and packaging also restrains market growth. Fluctuations in wafer availability, longer lead times, and capacity constraints can disrupt production schedules. These issues make it difficult for vendors to meet rising demand consistently.

Pricing pressure further impacts the market, as device manufacturers expect cost reductions while demanding higher performance. Balancing advanced features with competitive pricing remains a challenge, particularly for suppliers targeting mass market consumer electronics.

Growth Factors

Accelerating Use of Touch Controllers in Electric Vehicles Creates New Opportunities

The growing use of touch controller ICs in electric vehicles creates strong growth opportunities for the market. Electric vehicles rely heavily on digital interfaces for driving information, battery status, and vehicle controls. This increases demand for reliable touch solutions that can operate smoothly in automotive environments.

Another opportunity comes from the expanding deployment of touch enabled medical devices and diagnostic equipment. Healthcare providers prefer touch interfaces for easy cleaning and intuitive operation. Touch controller ICs used in medical settings must deliver high accuracy and stable performance, opening space for specialized solutions.

Industrial automation also supports market expansion. Control panels used in factories require rugged and high precision touch control. Touch controller ICs designed for harsh conditions help improve efficiency and operator interaction in industrial systems.

Rising demand for cost optimized touch solutions in emerging markets presents further opportunities. As affordable smartphones, appliances, and consumer electronics gain popularity, manufacturers seek efficient touch ICs that balance performance and cost.

Emerging Trends

Shift Toward Integrated Touch and Display Driver ICs Shapes Market Trends

One major trend in the Touch Controller IC Market is the shift toward in display fingerprint sensing and integrated touch plus display driver ICs. Combining multiple functions into a single chip helps reduce space, simplify design, and lower overall system cost for device makers.

There is also an increasing focus on ultra low latency and high refresh rate touch response. Users expect instant feedback during gaming, scrolling, and multitasking. Touch controller ICs are being optimized to deliver smoother and faster interaction experiences.

Adoption of AI based noise filtering and palm rejection is another key trend. These features improve touch accuracy by reducing false inputs, especially on large screens and multi touch surfaces. This enhances usability across smartphones, tablets, and automotive displays.

Finally, growing preference for flexible and foldable display compatible touch IC architectures influences product development. As foldable devices gain traction, touch controllers must adapt to new form factors and bending requirements.

Regional Analysis

Asia Pacific Dominates the Touch Controller IC Market with a Market Share of 41.3%, Valued at USD 3.8 Billion

Asia Pacific holds a dominant position in the Touch Controller IC Market due to its strong electronics manufacturing base and high consumption of smartphones and consumer devices. In this region, the market accounted for a 41.3% share, valued at USD 3.8 Billion, supported by large scale production of mobile devices, displays, and smart appliances. Rapid urbanization and rising adoption of electric vehicles further strengthen demand for touch based interfaces. The presence of integrated supply chains also supports faster innovation and cost efficiency.

North America Touch Controller IC Market Trends

North America shows steady growth driven by advanced automotive infotainment systems and high penetration of premium consumer electronics. The region benefits from strong demand for touch enabled interfaces in electric vehicles, medical devices, and smart home technologies. Continuous investment in user experience innovation supports adoption of high performance touch controller solutions. Focus on energy efficient and responsive interfaces remains a key growth factor.

Europe Touch Controller IC Market Trends

Europe’s market growth is supported by rising adoption of digital cockpit systems and industrial automation panels. Automotive manufacturers increasingly integrate touch based controls to improve driver interaction and interior design. The region also sees demand from healthcare and industrial equipment requiring reliable and precise touch performance. Regulatory focus on safety and quality further influences technology adoption.

Middle East and Africa Touch Controller IC Market Trends

The Middle East and Africa region experiences gradual growth, driven by smart infrastructure projects and increasing use of modern consumer electronics. Touch interfaces are gaining popularity in appliances, kiosks, and building automation systems. Expanding investments in smart cities and digital public services support long term market potential. Adoption remains selective but shows consistent improvement.

Latin America Touch Controller IC Market Trends

Latin America demonstrates moderate growth supported by rising smartphone usage and improving access to consumer electronics. Manufacturers focus on cost optimized touch controller ICs to meet price sensitive demand. Growth in automotive infotainment and home appliances also contributes to adoption. Economic recovery and digitalization trends are expected to support steady market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Touch Controller IC Company Insights

In 2025, the global Touch Controller IC market continues to be shaped by innovation and competitive differentiation, with key players driving performance and integration capabilities across consumer electronics and industrial applications.

Synaptics Inc. remains at the forefront with its advanced touch and display driver integration, leveraging deep expertise in human interface solutions to address growing demand for responsive and low-power interfaces in smartphones and IoT devices. The company’s focus on seamless user experiences positions it strongly amid intensifying competition.

Texas Instruments Inc. brings robust analog and embedded processing capabilities to the touch controller landscape, emphasizing scalable solutions that support both capacitive and resistive touch technologies. TI’s broad product portfolio and strong global support infrastructure help it serve automotive, industrial, and consumer markets with reliable and customizable touch controller ICs that meet stringent safety and performance standards.

NXP Semiconductors N.V. leverages its system-level expertise to offer touch controller ICs that integrate secure connectivity and sophisticated signal processing, catering to applications where security and responsiveness are critical. NXP’s continued investments in edge computing and smart sensing technologies bolster its competitive edge, particularly in automotive infotainment and smart home segments where intuitive touch interaction is increasingly essential.

ROHM Semiconductors distinguishes itself through energy-efficient designs and high noise immunity, addressing the needs of applications in harsh electrical environments. With a focus on miniaturization and enhanced performance, ROHM’s touch controller IC offerings are well suited for compact consumer gadgets and industrial control panels, reinforcing the company’s reputation for quality and innovation in semiconductor components.

Top Key Players in the Market

- Synaptics Inc.

- Texas Instruments Inc.

- NXP Semiconductors N.V.

- ROHM Semiconductors

- Samsung Electronics Co. Ltd.

- STMicroelectronics

- Integrated Device Technology Inc.

- Analog Devices Inc.

- Melfas Inc.

- Focal tech systems co. Ltd.

Recent Developments

- In February 2025, SEALSQ entered into exclusive negotiations to acquire 100% of IC’ALPS SAS, an ASIC design specialist based in Grenoble, France, strengthening its capabilities across semiconductors, PKI, and post-quantum technology hardware and software solutions.

- In December 2025, Cyient Ltd., through its wholly owned subsidiary Cyient Semiconductor, acquired a majority stake of over 65% in U.S.-based Kinetic Technologies for $93 million, marking a strategic expansion of its semiconductor design and supply capabilities.

Report Scope

Report Features Description Market Value (2025) USD 9.3 billion Forecast Revenue (2035) USD 16.0 billion CAGR (2026-2035) 5.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Resistive Touch Controller IC, Capacitive Touch Controller IC, Optical Touch Controller IC, Infrared Touch Controller IC), By Touch Panel Size (Small Touch Panels, Medium Touch Panels, Large Touch Panels), By Features (Multi-Touch Support, Gestures Support, Pressure Sensitivity, Waterproof & Dustproof), By Application (Smartphones & Tablets, Smart Appliances, Automotive Displays, Point-of-Sale (POS) Systems, Interactive Kiosks, Wearable Devices), By End-Use Industry (Consumer Electronics, Automotive, Healthcare, Retail, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Synaptics Inc., Texas Instruments Inc., NXP Semiconductors N.V., ROHM Semiconductors, Samsung Electronics Co. Ltd., STMicroelectronics, Integrated Device Technology Inc., Analog Devices Inc., Melfas Inc., Focal tech systems co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Synaptics Inc.

- Texas Instruments Inc.

- NXP Semiconductors N.V.

- ROHM Semiconductors

- Samsung Electronics Co. Ltd.

- STMicroelectronics

- Integrated Device Technology Inc.

- Analog Devices Inc.

- Melfas Inc.

- Focal tech systems co. Ltd.