Topical Pain Relief Market By Product Type (Non-opioids (Nonsteroidal anti-inflammatory drug (NSAIDS), Methyl salicylates, Lidocaine, Capsaicin, and Others), Opioids (Buprenorphine, and Fentanyl)), By Formulation (Cream, Spray, Patch, Gel, and Others), By Distribution Channel (Pharmacies & drug stores, Retail & grocery stores, E-Commerce), By Type (Prescription and Over-the-counter), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 156744

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

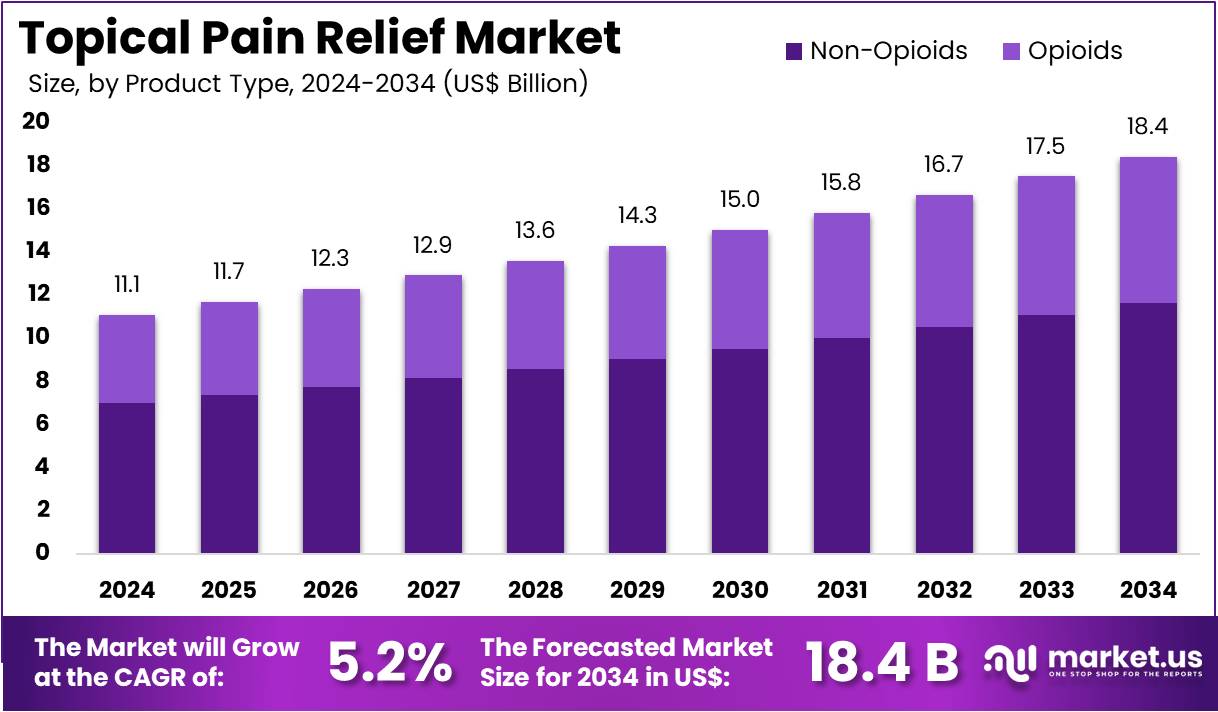

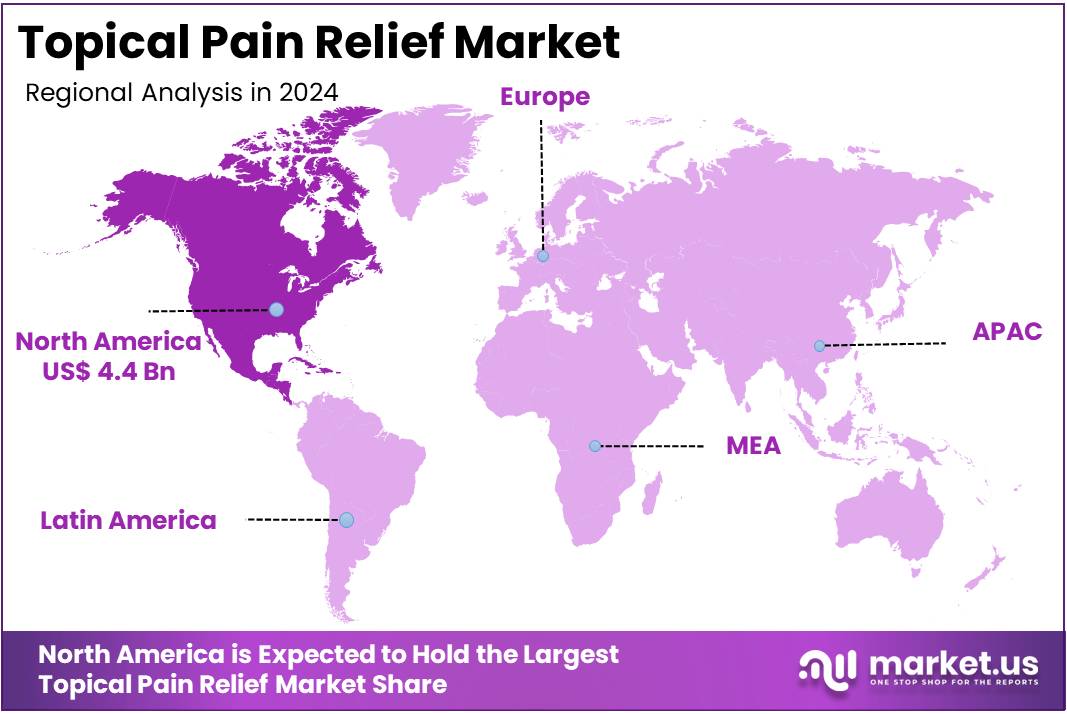

The Topical Pain Relief Market Size is expected to be worth around US$ 18.4 billion by 2034 from US$ 11.1 billion in 2024, growing at a CAGR of 5.2% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.7% share and holds US$ 4.4 Billion market value for the year.

Rising prevalence of musculoskeletal conditions and the growing preference for self-care are key drivers of the topical pain relief market. These products provide a non-invasive, localized alternative to oral medications, which can have systemic side effects. The Centers for Disease Control and Prevention (CDC) reports that approximately 24.3% of US adults, or about 60 million people, experience chronic pain, with a significant portion stemming from joint and muscle conditions. This high patient volume, along with the increasing burden of arthritis—which affects nearly 1 in 4 adults in the US—creates a robust and sustained demand for topical solutions. Consumers find these products convenient and effective for managing pain associated with everything from arthritis and backaches to sports injuries.

Growing product innovation and strategic market expansion are key trends shaping the industry. Manufacturers are developing advanced formulations, including gels, sprays, and patches, that offer faster absorption and longer-lasting relief. Companies are also broadening their market reach through strategic commercial initiatives. For instance, in March 2022, Abbott introduced the Brufen Power spray, a new pain relief solution designed for quick and effective physical pain relief.

Similarly, in June 2022, Troy Healthcare LLC expanded its reach by introducing its Stopain Clinical topical pain relief to the Canadian market, thereby broadening access to its pain management products. This focus on product diversification and geographic expansion is crucial for capturing new consumer segments and increasing market share.

Increasing consumer awareness and a shift towards natural ingredients are creating significant opportunities for market growth. As consumers become more informed about the potential risks of long-term use of oral pain relievers, they are increasingly turning to topical products as a safer alternative. The demand for products containing natural ingredients like menthol, capsaicin, and camphor is rising due to their perceived safety and efficacy.

Furthermore, the high prevalence of sports-related injuries provides a continuous application area for these products. According to the US National Institutes of Health (NIH), musculoskeletal conditions account for over 130 million patient visits to healthcare providers annually, highlighting the immense need for products that can provide immediate, targeted relief and aid in recovery from both acute injuries and chronic conditions.

Key Takeaways

- In 2024, the market for Topical Pain Relief generated a revenue of US$ 11.1 billion, with a CAGR of 5.2%, and is expected to reach US$ 18.4 billion by the year 2034.

- The product type segment is divided into non-opioids and opioids, with non-opioids taking the lead in 2023 with a market share of 63.2%.

- Considering formulation, the market is divided into cream, spray, patch, gel, and others. Among these, cream held a significant share of 35%.

- Furthermore, concerning the distribution channel segment, the market is segregated into pharmacies & drug stores, retail & grocery stores, e-commerce. The pharmacies & drug stores sector stands out as the dominant player, holding the largest revenue share of 41.3% in the Topical Pain Relief market.

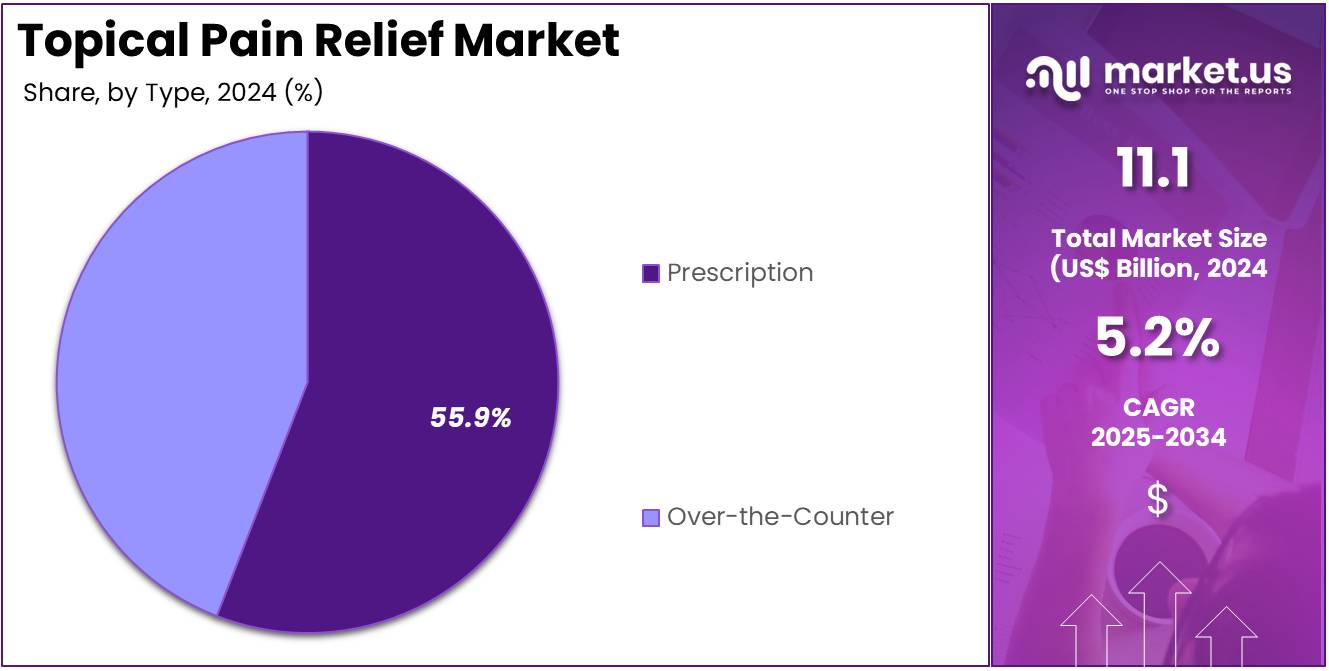

- The type segment is segregated into prescription and over-the-counter, with the prescription segment leading the market, holding a revenue share of 55.9%.

- North America led the market by securing a market share of 39.7% in 2023.

Product Type Analysis

Non-opioid products dominate the topical pain relief market with a 63.2% share. This growth is driven by the increasing awareness of the risks associated with opioid use, such as addiction and dependency. As consumers and healthcare providers seek safer, non-addictive alternatives for pain management, the demand for non-opioid topical pain relief solutions is expected to rise.

Non-opioid products, including anti-inflammatory creams, gels, and sprays, are widely used for conditions such as arthritis, muscle pain, and minor injuries. Their efficacy in providing targeted pain relief without the systemic effects of opioids is a significant factor driving their popularity.

Additionally, the growing focus on natural and holistic treatments, along with innovations in formulation, such as the inclusion of menthol or capsaicin, is likely to further enhance the appeal of non-opioid options. As the regulatory landscape tightens around opioid usage, the non-opioid segment is projected to experience continued growth.

Formulation Analysis

Creams hold the largest share of 35.0% in the formulation segment of the topical pain relief market. Cream-based pain relief products are popular due to their ease of application, quick absorption, and effective relief from localized pain. The growing preference for non-invasive treatments is expected to drive the demand for creams, especially in managing conditions like arthritis, back pain, and muscle soreness.

Creams often combine active ingredients like menthol, lidocaine, or capsaicin, which provide both cooling and heating effects to relieve pain. The convenience of creams, coupled with their non-greasy texture, makes them an attractive option for consumers seeking an easy-to-use pain relief solution.

The rise in the number of chronic pain patients and increasing awareness of topical treatments’ safety are likely to contribute to the growth of this segment. Furthermore, product innovations in cream formulations, such as the inclusion of enhanced delivery systems, are expected to maintain this segment’s market leadership.

Distribution Channel Analysis

Pharmacies and drug stores account for 41.3% of the distribution channel segment in the topical pain relief market. This dominance is attributed to the widespread availability of over-the-counter pain relief products in pharmacies, making them a primary point of purchase for consumers seeking immediate relief.

Pharmacies provide easy access to a variety of topical pain relief products, from creams and gels to sprays and patches. With the increasing consumer preference for self-care and at-home treatment, the demand for convenient pain relief solutions is expected to drive growth in this distribution channel.

Additionally, the ability of pharmacies to offer both prescription and over-the-counter options allows them to cater to a wide range of consumer needs, from minor muscle pain to more severe, chronic conditions. The growth of pharmacy chains and the expansion of online pharmacy services are likely to further support the continued dominance of pharmacies and drug stores as a key distribution channel in the market.

Type Analysis

Prescription-based topical pain relief products represent 55.9% of the type segment in the market. This segment’s growth is expected to continue as prescription-strength products are increasingly used for managing moderate to severe pain, particularly for conditions like osteoarthritis, neuropathic pain, and post-surgical pain. Prescription topical analgesics often contain higher concentrations of active ingredients, such as lidocaine or diclofenac, making them more effective for managing severe pain.

As the healthcare industry continues to focus on reducing opioid dependence and encouraging non-addictive alternatives, prescription topical pain relief products are likely to gain traction. Healthcare providers are expected to increasingly recommend these topical treatments as part of pain management strategies, contributing to the growth of the prescription segment. Additionally, advancements in drug delivery technology, which improve the absorption and effectiveness of topical medications, are projected to further drive the demand for prescription-based pain relief products.

Key Market Segments

By Product Type

- Non-opioids

- Nonsteroidal anti-inflammatory drug (NSAIDS)

- Methyl salicylates

- Lidocaine

- Capsaicin

- Others

- Opioids

- Buprenorphine

- Fentanyl

By Formulation

- Cream

- Spray

- Patch

- Gel

- Others

By Distribution Channel

- Pharmacies & drug stores

- Retail & grocery stores

- E-Commerce

By Type

- Prescription

- Over-the-counter

Drivers

The aging global population and rising chronic pain prevalence are driving the market

The topical pain relief market is being propelled by the demographic shift toward an aging population and the corresponding increase in the prevalence of chronic conditions, particularly those causing musculoskeletal pain. As individuals age, the likelihood of developing conditions like arthritis, back pain, and joint stiffness rises significantly. These conditions often require long-term management of symptoms, and consumers are increasingly seeking effective, non-oral alternatives to manage their discomfort.

The convenience of applying a cream, gel, or patch directly to the site of pain without the systemic side effects associated with oral medications makes these products an attractive option. The US Centers for Disease Control and Prevention (CDC) reports that in 2022, approximately 58 million US adults had doctor-diagnosed arthritis. The sheer scale of this affected population creates a robust and growing consumer base for topical products, which are often a first-line therapy for managing the daily discomfort caused by such chronic inflammatory conditions.

Restraints

The intense competition from oral analgesics is restraining the market

A significant restraint on the market is the intense and long-standing competition from a wide array of oral pain relievers, which have a deeply entrenched position in the consumer market. Medications like ibuprofen, acetaminophen, and naproxen are well-established, widely available, and often perceived as a more potent solution for a broad spectrum of pain. The sheer volume of sales in the oral pain relief category highlights this competitive pressure.

For example, retail sales of over-the-counter (OTC) medicines in the US reached a substantial US$43.4 billion in 2023, with a significant portion of this revenue attributed to systemic analgesics. This formidable market presence makes it challenging for topical products to gain market share, as they must overcome consumer habits and educate them on the benefits of localized application versus systemic relief. The market’s growth is therefore contingent on successfully differentiating these products from their oral counterparts.

Opportunities

The increasing consumer preference for natural ingredients is creating growth opportunities

The market is presented with significant opportunities from a powerful consumer-driven trend toward natural and plant-based ingredients. Consumers are becoming more discerning about the products they use and are actively seeking alternatives to synthetic chemicals, particularly for long-term use. This shift in preference has created a receptive environment for products formulated with natural active ingredients like menthol, camphor, arnica, and capsaicin, as well as emerging compounds like cannabidiol (CBD).

The CBD market, in particular, has seen explosive growth due to its perceived anti-inflammatory and pain-relieving properties. This demand provides a strong commercial pathway for companies to innovate with new natural-based formulations and attract a growing segment of health-conscious consumers.

Impact of Macroeconomic / Geopolitical Factors

The topical pain relief market is navigating a complex macroeconomic and geopolitical landscape that affects both consumer purchasing power and the stability of its supply chain. Geopolitical tensions and trade policies add significant cost pressures on the supply chain. A new US tariff implemented in late August 2025, for example, imposed a 50% duty on certain imports from India, which affects a wide range of products including some active pharmaceutical ingredients and other chemicals. Despite these challenges, the market demonstrates resilience in the face of these headwinds.

The US Bureau of Labor Statistics reported that nonprescription drug prices in the US actually declined by 0.3% in 2024, following a previous increase, reflecting the highly competitive nature of the over-the-counter market. This encourages manufacturers to adapt by diversifying their supplier bases and streamlining production to ensure a more stable supply of topical pain relief solutions.

Latest Trends

The development of targeted, long-lasting pain relief formulations is a recent trend

A significant trend in 2024 is the accelerated development of advanced, targeted formulations designed for specific types of pain and with prolonged therapeutic effects. Manufacturers are moving beyond general-purpose creams and gels to create products for conditions like arthritis, nerve pain, and sports-related injuries. This is being achieved through the use of innovative delivery systems and active ingredients that provide longer-lasting relief. A key development in this area is the increase in patent filings for advanced formulations.

According to data from the US Patent and Trademark Office (USPTO), the number of patents issued for topical pain relief products with specific, long-acting mechanisms, such as sustained-release patches and transdermal technologies, saw a noticeable increase throughout 2023 and 2024. This trend signifies a shift toward more specialized, efficacy-focused products that offer a distinct value proposition to consumers seeking a solution for their specific pain concerns.

Regional Analysis

North America is leading the Topical Pain Relief Market

The North American market for topical pain relief held a commanding 39.7% share of the global market in 2024. This leadership is directly attributed to the high prevalence of chronic pain conditions, particularly among a rapidly aging population, and a strong consumer preference for effective, non-oral pain management solutions.

The United States faces a significant burden from musculoskeletal disorders like arthritis. The Centers for Disease Control and Prevention (CDC) reported that in 2022, the age-adjusted occurence of diagnosed arthritis in adults aged 18 and older was 18.9%, with that figure rising sharply to 53.9% among those aged 75 and older. This consistent and growing need for localized relief drives demand for various topical formulations.

Furthermore, the high incidence of sports-related injuries fuels the market, as consumers seek convenient products for immediate care. The National Safety Council reported that over 4.4 million people received treatment in emergency departments for injuries involving sports and recreational equipment in 2024. These factors, combined with a robust retail infrastructure, ensure a stable and growing market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific topical pain relief market is anticipated to experience robust growth during the forecast period. This is largely a result of a rapidly aging population, increasing disposable incomes, and the expansion of healthcare infrastructure in emerging economies. The region is home to a significant portion of the world’s elderly population, a key demographic for conditions requiring pain management.

The World Health Organization (WHO) highlights that the number of people aged 65 and over in Asia and the Pacific nearly tripled from 168 million in 1990 to 503 million in 2024. This demographic shift is likely to create a significant and sustained demand for pain management products as age-related conditions become more common.

The market’s expansion is further supported by a cultural affinity for traditional and natural remedies, which aligns well with the composition of many topical products that contain essential oils and herbal extracts. Governments throughout the region are also actively investing in healthcare, which is likely to increase product accessibility for a broader consumer base.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the topical pain relief market are driving growth through several key strategies. They are heavily investing in product innovation, particularly by incorporating natural and herbal ingredients to appeal to wellness-conscious consumers. Companies are also pursuing aggressive digital marketing and e-commerce expansion to reach a broader, tech-savvy audience and leverage the convenience of online shopping.

Furthermore, they are broadening their product portfolios to offer solutions for a wider range of conditions, such as headaches and stress, effectively increasing their addressable market. This combination of innovative product development and sophisticated marketing is essential for maintaining a competitive edge.

Sanofi S.A., a global pharmaceutical leader, has a significant presence in the market through its Consumer Healthcare division. The company’s business model is centered on a strong brand portfolio, with flagship products like Icy Hot. Sanofi’s strategy involves leveraging its global distribution network and investing heavily in consumer-focused marketing, including high-profile endorsements from professional athletes, to build brand recognition and credibility. The company also focuses on expanding its product line to include patches, creams, and sprays that cater to diverse consumer needs, solidifying its position as a market leader.

Top Key Players in the Topical Pain Relief Market

- Thermo Fisher Scientific, Inc

- Teva Pharmaceutical Industries Ltd

- Sun Pharmaceutical

- Sanofi

- Procter & Gamble

- Pfizer Inc

- Novartis AG

- Mankind

- Johnson & Johnson

- Glaxosmithkline Plc (GSK)

- Cipla Limited

- Bayer AG

- Amneal Pharmaceuticals LLC.

- Advil

- Abbott Laboratories

Recent Developments

- In September 2024: Mankind Pharma unveiled Nimulid Strong, a topical analgesic gel and spray designed to alleviate neck pain, featuring a formula with double the diclofenac concentration. The product is supported by the #GardanHilaateRaho campaign, emphasizing the significance of neck mobility for effective communication.

- In August 2024: Advil introduced its first topical pain relief solution, Advil Targeted Relief. This fast-acting cream combines four powerful ingredients to provide targeted relief for up to 8 hours, effectively addressing conditions such as back pain, muscle soreness, sprains, strains, and arthritis.

- In January 2024: Sun Pharmaceutical, located in Mumbai, entered into a definitive agreement to acquire all outstanding shares of Taro Pharmaceutical, solidifying its position in the global pharmaceutical market.

- In January 2023: Procter & Gamble (P&G) India launched Vicks NATURA, a new addition to the Vicks product line, bringing a natural solution for health and wellness to the Indian market.

Report Scope

Report Features Description Market Value (2024) US$ 11.1 billion Forecast Revenue (2034) US$ 18.4 billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Non-opioids (Nonsteroidal anti-inflammatory drug (NSAIDS), Methyl salicylates, Lidocaine, Capsaicin, and Others), Opioids (Buprenorphine, and Fentanyl)), By Formulation (Cream, Spray, Patch, Gel, and Others), By Distribution Channel (Pharmacies & drug stores, Retail & grocery stores, E-Commerce), By Type (Prescription and Over-the-counter) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc, Teva Pharmaceutical Industries Ltd, Sun Pharmaceutical, Sanofi, Procter & Gamble, Pfizer Inc, Novartis AG, Mankind , Johnson & Johnson, Glaxosmithkline Plc (GSK), Cipla Limited, Bayer AG, Amneal Pharmaceuticals LLC., Advil , Abbott Laboratories Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific, Inc

- Teva Pharmaceutical Industries Ltd

- Sun Pharmaceutical

- Sanofi

- Procter & Gamble

- Pfizer Inc

- Novartis AG

- Mankind

- Johnson & Johnson

- Glaxosmithkline Plc (GSK)

- Cipla Limited

- Bayer AG

- Amneal Pharmaceuticals LLC.

- Advil

- Abbott Laboratories