Global Tonka Beans Market By Type (Tonka Beans Extract, Tonka Beans Whole), By Application (Luxury Fragrances, Liquor, Fixatives in Dyes, Flavoring Tobacco, Others), By End-use (Cosmetics, Food and Beverages, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158934

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

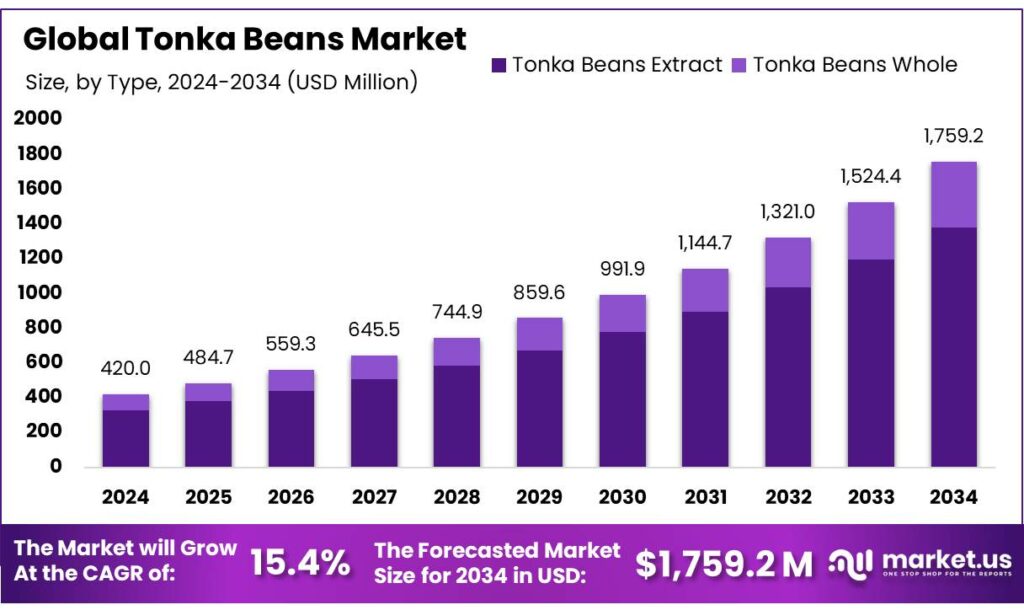

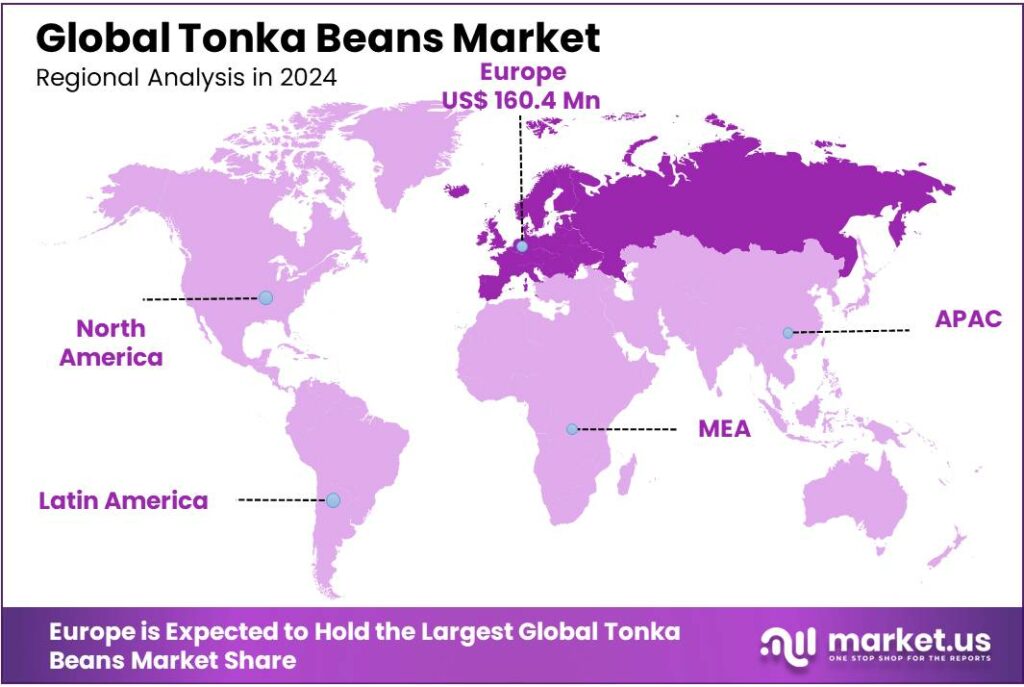

The Global Tonka Beans Market size is expected to be worth around USD 1759.2 Million by 2034, from USD 420.0 Million in 2024, growing at a CAGR of 15.4% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 38.20% share, holding USD 160.4 Million in revenue.

Tonka beans come from the seeds of Dipteryx odorata, a tree native to tropical South America. The beans are valued mainly for their high content of coumarin, which is responsible for their strong vanilla-almond-cherry aroma. The coumarin concentration in the seed is typically 1-3% by weight but in rare instances can reach up to 10%. Because of this chemical profile, tonka beans are used in fragrance, flavour (where legal), cosmetics, fixatives, and occasionally in pharmaceuticals or aromatherapy settings. Use in food is restricted in many jurisdictions (including the USA) due to safety concerns around coumarin.

Governments and regulatory agencies have imposed strict controls on coumarin because of toxicity (liver damage in animal studies) and potential carcinogenicity in experimental settings. For example, in the United States, according to the U.S. Food & Drug Administration (FDA), food containing any added coumarin as such or as a constituent of tonka beans or tonka extract is deemed adulterated under the Federal Food, Drug, and Cosmetic Act. The regulation 21 CFR Part 189.130 explicitly prohibits coumarin in foods. In 1954, the FDA banned use of tonka beans in food because of risk from coumarin.

In Australia, the Therapeutic Goods Administration (TGA) performed a safety review (2019) for topical listed medicines and proposed, and now mandates, that coumarin concentration in listed topical medicines/excipients be no more than 0.001% when used. It also set a tolerable daily intake (TDI) for coumarin exposure from all sources (diet, cosmetics etc.) of 0.1 mg per kg body weight/day.

In the European Union, Regulation (EC) No. 1334/2008 governs flavourings and certain food ingredients with flavouring properties. Under this regulation, direct addition of coumarin to food is prohibited; if present naturally (e.g., via spices or botanicals), maximum levels are defined for various finished food categories. For example, desserts are limited to 5 mg/kg coumarin; “traditional and/or seasonal bakery ware containing a reference to cinnamon in labelling” up to 50 mg/kg.

Key Takeaways

- Tonka Beans Market size is expected to be worth around USD 1759.2 Million by 2034, from USD 420.0 Million in 2024, growing at a CAGR of 15.4%.

- Tonka Beans Extract held a dominant market position, capturing more than a 78.4% share.

- Luxury Fragrances held a dominant market position, capturing more than a 41.2% share.

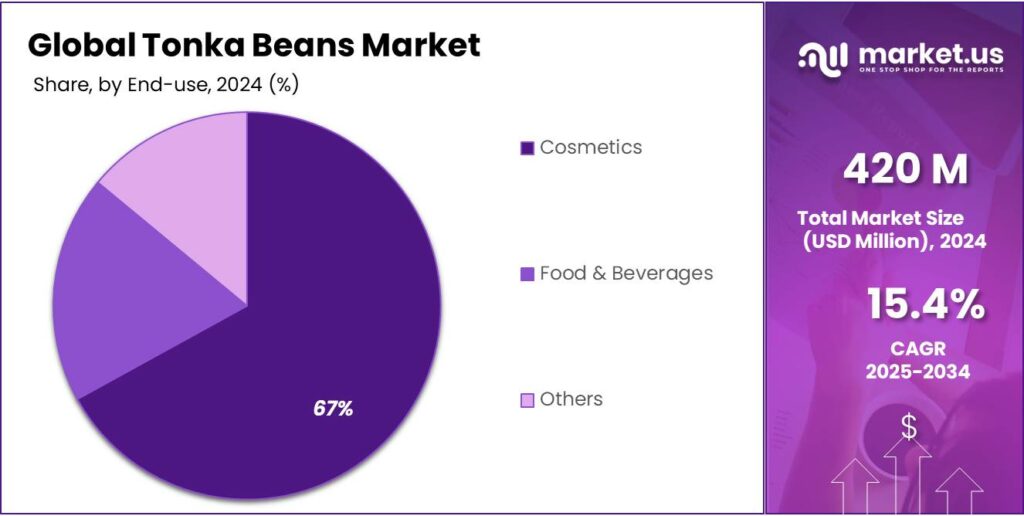

- Cosmetics held a dominant market position, capturing more than a 67.5% share.

- Europe emerged as the leading region in the global tonka beans market, capturing 38.20% of the share with a market value of USD 160.4 million.

By Type Analysis

Tonka Beans Extract dominates with 78.4% share in 2024, driven by strong demand in fragrance and specialty aroma uses.

In 2024, Tonka Beans Extract held a dominant market position, capturing more than a 78.4% share. This reflects the extract’s concentrated use in perfumery, fine fragrances and niche aroma compounds where a small amount delivers pronounced vanilla-like and coumarin notes. Manufacturers favour the extract because it offers consistency, easier dosing, and better stability than whole beans for industrial blending. As a result, processors and ingredient suppliers allocated the bulk of production capacity to extract manufacture, prioritizing quality control and batch-to-batch traceability.

Producers are focusing on compliance testing and developing low-coumarin fractions to widen legal use cases, which supports continued preference for extracts over raw tonka. The dominance of extracts also shifts value capture toward converters who add analytical testing and standardized formulations.

By Application Analysis

Luxury Fragrances dominate with 41.2% share in 2024, led by rising demand for natural aroma ingredients.

In 2024, Luxury Fragrances held a dominant market position, capturing more than a 41.2% share. The warm, rich, and vanilla-like scent of tonka beans has made them a preferred choice for high-end perfumes and colognes. Major fragrance houses rely on tonka bean extract to add depth and sophistication to premium blends, which has boosted its usage in the luxury fragrance segment. This dominance is further supported by growing consumer interest in natural and rare ingredients that enhance exclusivity in personal care products.

Consumer willingness to spend more on perfumes with authentic and unique natural profiles continues to support this application. Additionally, sustainable sourcing and transparent supply chains are becoming important, as luxury consumers increasingly value ethical ingredient origins. With these trends, the role of tonka beans in luxury fragrances is set to remain central, reinforcing their market leadership in the years ahead.

By End-use Analysis

Cosmetics lead the market with 67.5% share in 2024, supported by strong use in skincare and personal care.

In 2024, Cosmetics held a dominant market position, capturing more than a 67.5% share. Tonka bean extracts, with their warm and soft fragrance profile, are widely used in creams, lotions, and body care products to add a natural aroma and enhance product appeal. The segment’s leadership comes from the growing consumer preference for personal care products infused with natural ingredients, where tonka bean fits well due to its distinct scent and premium feel.

The rising demand for clean-label and botanical-based cosmetics further strengthens the use of tonka beans as a natural alternative to synthetic fragrances. As consumer spending on personal care continues to rise, the cosmetics segment is likely to remain the most significant contributor to overall tonka bean demand in the coming years.

Key Market Segments

By Type

- Tonka Beans Extract

- Tonka Beans Whole

By Application

- Luxury Fragrances

- Liquor

- Fixatives in Dyes

- Flavoring Tobacco

- Others

By End-use

- Cosmetics

- Food & Beverages

- Others

Emerging Trends

Increasing Demand for Products Labelled “Natural” / Clean-Label Drives Interest in Botanical Flavours

More and more people are choosing food and cosmetic products with simple, recognizable ingredients. They don’t want artificial stuff. Because tonka beans are botanical, aromatic, and carry natural fragrance and flavour (thanks to coumarin), they stand to benefit if used carefully under regulations. This “clean-label / natural-ingredient” trend is growing in many regions, and the numbers are starting to show how meaningful it is.

For example, in the United States, the share of organic food in consumer purchases has been rising steadily. U.S. sales of organic food products were estimated at USD 38.6 billion (inflation-adjusted) in 2012, and this rose to USD 65.4 billion in 2024. This suggests consumers are willing to spend more on food items they believe are healthier or more natural. That can support demand for natural flavour sources, including exotic ones like tonka. This suggests consumers are willing to spend more on food items they believe are healthier or more natural. That can support demand for natural flavour sources, including exotic ones like tonka.

- According to a USDA Economic Research Service report, in 2018 16.3% of retail food expenditures in the U.S. were for foods labelled “natural”; similarly, 16.9% of items purchased (by number of units) had “natural” labels on them. That means more than one in six dollars spent on food goes toward “natural” products. For tonka beans, using them in products that meet “natural” label standards can help reach that growing segment.

That means for a 70 kg person, safe coumarin intake is about 7 mg per day. Because tonka beans are rich in coumarin, producers who use them in flavourings or perfumes must ensure usage stays safely below this and document it. Such regulation forces producers to be transparent, clean in extraction, accurate in labelling — all features that match clean-label expectations.

Drivers

Growing Consumer & Regulatory Push for Natural Flavours and Clean-Label Products

People are increasingly turning toward foods and beverages that are clean, trustworthy, and closer to nature. They want flavours that come from plants or natural extracts — not synthetic chemicals. That creates a strong pull for ingredients like tonka beans, which are valued for their natural aromatic compound (coumarin), vanilla-like scent, and ability to contribute richness without synthetic flavouring.

Governments and regulatory agencies around the world are reinforcing this trend, both through labelling laws and safety limits. For example, in the United States, the Natural Organic Program (NOP, under USDA) allows non-synthetic natural flavours if they meet the FDA’s definition of “natural flavor” and are used in organic products under section 7 CFR 205.605(a). This means that if a flavour is derived from a real plant part, root, leaf, bark etc., and no synthetic route is used, it can be accepted in organic certified food. That forces flavour producers to use more natural sources.

- Also, U.S. food law, via 21 CFR §101.22, requires transparency about whether a flavour is “natural flavour” or “artificial flavour” on food labels. So manufacturers cannot claim “natural” unless it truly meets FDA’s criteria.

Restraints

Regulatory & Health-Safety Restrictions due to High Coumarin Levels

One of the biggest obstacles for the wider adoption of tonka beans is the strong regulatory restrictions rooted in health safety concerns, especially due to the high and variable levels of coumarin in tonka beans. Coumarin, while natural, can be toxic to the liver in large enough doses. Because of this, many government bodies have imposed strict limits or outright bans, which heavily limit how tonka beans can be used in food, flavouring, or fragrance.

Recent scientific analysis shows that raw tonka beans may contain 20.4 to 43.4 mg of coumarin per gram of bean. For instance, six samples of tonka beans were tested and their coumarin content ranged from about 20.4 ± 0.4 mg/g to 43.4 ± 0.9 mg/g. That’s a very high concentration. Even small doses of tonka-flavoured sugars or pastes show measurable levels: in some vanilla sugar samples flavoured with tonka, about 0.2 mg/g coumarin was found.

- In Europe, for example, under Regulation (EC) No. 1334/2008, maximum levels are set for coumarin in various foods: traditional and seasonal bakery goods can contain up to 50 mg/kg, fine bakery products up to 15 mg/kg, breakfast cereals up to 20 mg/kg, desserts up to 5 mg/kg.

Also, regulatory bodies like the European Food Safety Authority (EFSA) and the German Federal Institute for Risk Assessment (BfR) have established a tolerable daily intake (TDI) of 0.1 mg of coumarin per kg of body weight per day. This means a person weighing 60 kg can consume up to 6 mg of coumarin in a day without expected adverse effects, according to current understanding.

Opportunity

Aligning with Organic & Clean-Label Regulations and Certification+

One of the strongest growth paths for tonka beans lies in tapping into the organic flavour and clean-label sector. As more people care deeply about what they put in their bodies, laws and certification systems are tightening to reward ingredients that are natural, organic, and clearly labelled. Tonka beans, being a botanical, aromatic source, could benefit if producers and users adapt to these stricter requirements and get certified appropriately.

For example, in the United States, the National Organic Program (NOP) under USDA has rules that say organic products must use “organic flavors” when they’re commercially available. Natural (or “non-synthetic”) flavours are allowed only when the fully organic versions are not commercially available.

- This rule was fully implemented on December 27, 2019. In addition, when flavours are used in organic processed foods, they must comply with definitions in regulations 7 CFR Part 205 (especially § 205.605(a)).

Also, organic flavours have to meet a high standard: at least 95% of their ingredients must be organically produced. The remaining up to 5% may be non-organic only if those ingredients are on the National List of Allowed and Prohibited Substances and only if the organic forms are not commercially available.

On the regulatory safety side, the European Food Safety Authority (EFSA) maintains strict guidelines on flavouring substances, including botanical ones like coumarin (present in tonka beans). EFSA sets a tolerable daily intake (TDI) for coumarin of 0.1 mg per kg body weight per day. Producers using tonka beans would need to ensure any products stay well below this exposure. This means careful extraction, precise formulation, accurate labelling. That kind of regulated approach tends to build consumer trust.

Regional Insights

Europe leads the Tonka Beans Market with 38.20% share, valued at USD 160.4 million in 2024

In 2024, Europe emerged as the leading region in the global tonka beans market, capturing 38.20% of the share with a market value of USD 160.4 million. The region’s dominance is strongly tied to its well-established luxury fragrance and cosmetics industry, which continues to integrate tonka bean extracts for their warm vanilla-like and almond notes.

According to Cosmetics Europe, the region’s cosmetics and personal care sector generated over EUR 88 billion in retail sales in 2022, making it the largest market globally, and this directly fuels demand for natural aromatic ingredients such as tonka beans.

Regulatory frameworks in Europe also play an important role in shaping the market. The European Food Safety Authority (EFSA) has set a tolerable daily intake (TDI) for coumarin at 0–0.1 mg per kilogram of body weight, ensuring that tonka use in food applications remains carefully regulated. This has shifted the majority of tonka bean utilization in Europe toward perfumery, cosmetics, and luxury goods, where compliance is easier to maintain.

oreover, the European Union’s sustainability initiatives, such as the European Green Deal, are pushing fragrance and cosmetic brands to adopt traceable and responsibly sourced raw materials, boosting demand for sustainably harvested tonka beans from Latin America.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Givaudan is a leading global flavour & fragrance giant deeply involved in sustainable sourcing of tonka beans. Since 2007, it has partnered with Conservation International in Venezuela’s Caura Basin to protect ~149,400 hectares of forest and support ~92 local families through conservation agreements. It sources wild-grown tonka beans (Dipteryx odorata), helps communities with better drying and storage, and ensures traceability. Its “Tonka Story” emphasizes both environmental protection and securing high-quality supply for luxury fragrances.

Eurovanille is a French purveyor of premium spices, vanilla products, and culinary flavour raw materials. They offer tonka beans (whole) in “professional format” (e.g. 200 g) aimed at pastry, chocolate, ice cream makers. Their beans are described as natural, with intense fragrance, and used by artisans seeking character and subtleness. They highlight origin (Brazil, Venezuela), and that the beans are “spice without additives,” which appeals to buyers in artisan and semi-industrial culinary sectors.

De Hekserij is a Dutch supplier of natural fragrance and aroma raw materials; it offers organic tonka beans for fragrance use (potpourri, tinctures) in small-scale, batch formats. Their product is sold in quantities like 50 g, 250 g, or 1 kg, and is explicitly labelled not for internal use (i.e. food) due to safety concerns (coumarin). They emphasize organic certification and good fragrance-grade quality, focused on non-food industries.

Top Key Players Outlook

- Givaudan

- De Hekserij

- Sambavanilla

- Thiercelin

- Eurovanille

- Kaapi Ingredients

- Symrise

- Biolandes

- Firmenich SA

- Elixens Group

Recent Industry Developments

In 2024 Eurovanille, reported a turnover of €34 million, reflecting its strong presence in over 85 countries.

In 2024, Symrise reported sales of €1,908 million in this segment, marking an 8.9% increase compared to the previous year. Excluding portfolio and currency effects, organic sales growth amounted to 10.2%

Report Scope

Report Features Description Market Value (2024) USD 420.0 Mn Forecast Revenue (2034) USD 1759.2 Mn CAGR (2025-2034) 15.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Tonka Beans Extract, Tonka Beans Whole), By Application (Luxury Fragrances, Liquor, Fixatives in Dyes, Flavoring Tobacco, Others), By End-use (Cosmetics, Food and Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Givaudan, De Hekserij, Sambavanilla, Thiercelin, Eurovanille, Kaapi Ingredients, Symrise, Biolandes, Firmenich SA, Elixens Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Givaudan

- De Hekserij

- Sambavanilla

- Thiercelin

- Eurovanille

- Kaapi Ingredients

- Symrise

- Biolandes

- Firmenich SA

- Elixens Group