Global Ticket Refund Insurance Market Size, Share and Analysis Report By Type (Event Ticket Refund Insurance, Travel Ticket Refund Insurance, Sports Ticket Refund Insurance, Concert Ticket Refund Insurance, Others), By Application (Individuals, Corporates, Event Organizers, Travel Agencies, Others), By Distribution Channel (Online, Insurance Brokers, Direct Sales, Others), By End-User (Individuals, Businesses, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176403

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Statistics and Trends

- Drivers Impact Analysis

- Restraint Impact Analysis

- By Type

- By Application

- By Distribution Channel

- By End User

- Regional Perspective

- Increasing Adoption Technologies

- Investment and Business Benefits

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends Analysis

- Growth Factors Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

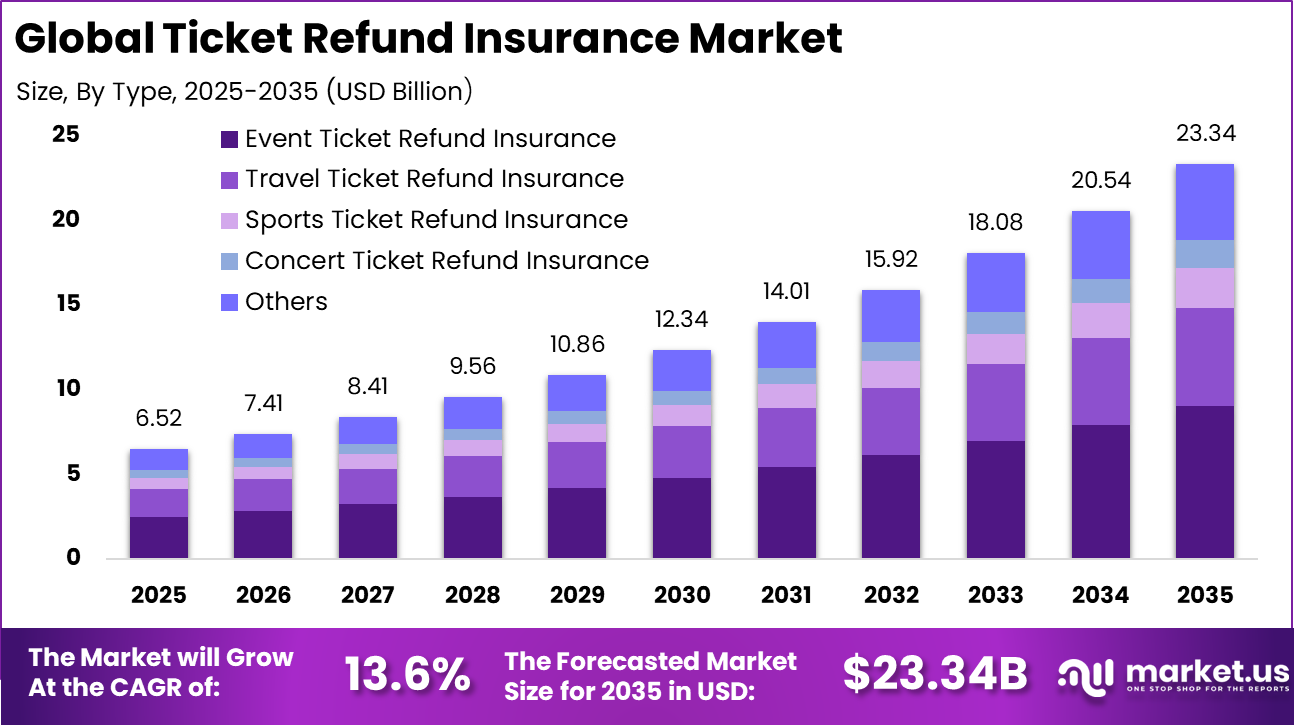

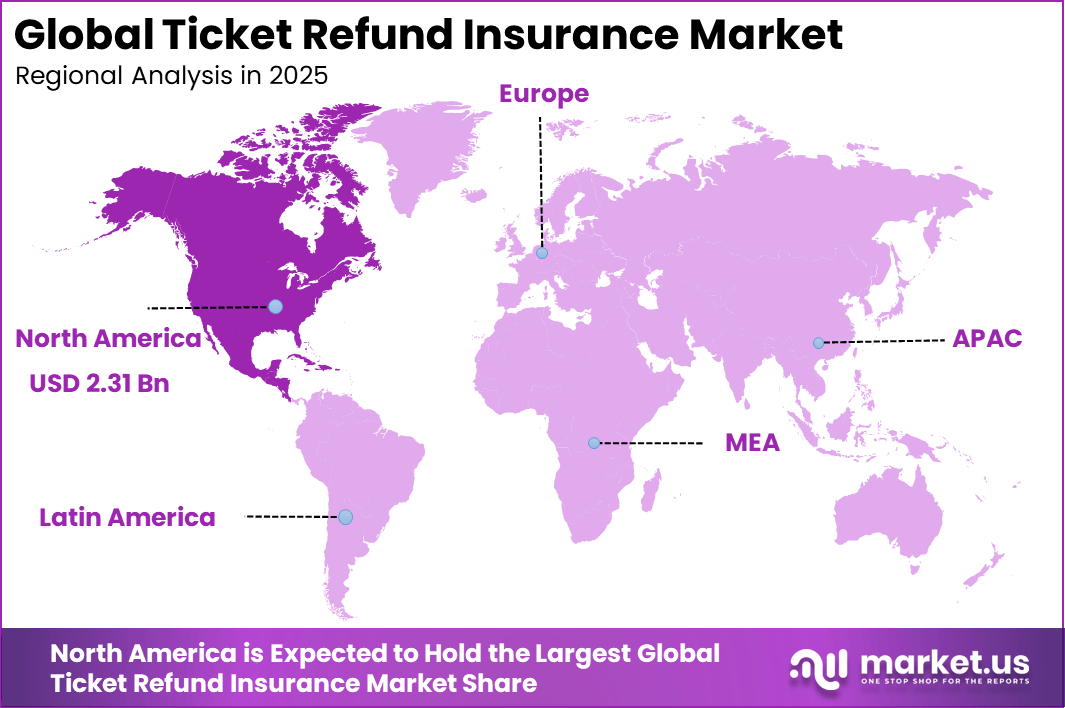

The Global Ticket Refund Insurance Market is expanding steadily, driven by rising demand for consumer protection across travel, entertainment, and live events. The market is projected to grow from USD 6.52 billion in 2025 to approximately USD 23.34 billion by 2035, registering a CAGR of 13.6% over the forecast period. North America led the market, capturing more than 35.5% share and generating USD 2.31 billion in revenue, supported by high event ticket volumes and strong adoption of refund protection products.

The Ticket Refund Insurance Market covers insurance products that protect consumers and event organizers against financial loss caused by canceled, postponed, or disrupted events. This insurance typically applies to tickets for travel, concerts, sports events, festivals, and cultural performances. Coverage is designed to reimburse ticket costs when events cannot be attended due to predefined and unforeseen circumstances. The market has gained importance as ticket prices rise and event planning becomes more complex.

Ticket refund insurance operates at the intersection of consumer protection and event risk management. It reduces uncertainty for buyers while supporting confidence in advance ticket purchases. For organizers and platforms, it helps stabilize demand by lowering buyer hesitation. As digital ticketing becomes more common, refund insurance is increasingly integrated into online purchase flows.

A key driving factor is the growing prevalence of advance ticket purchases for events and travel experiences. Consumers often commit to tickets weeks or months ahead of the event date, increasing exposure to personal or external disruptions. Ticket refund insurance provides a safety net against these uncertainties. This encourages higher conversion rates at the point of sale.

For instance, in January 2025, Berkshire Hathaway Travel Protection: Berkshire Hathaway introduced flexible CFAR upgrades with up to 75% reimbursement on non-refundable tickets, available within 21 days of booking. The policy’s broad coverage cements its dominance in customizable refund protection.

Demand for ticket refund insurance is strongly linked to consumer risk awareness and disposable income levels. Buyers of premium tickets are more likely to seek financial protection due to higher upfront costs. This demand is especially visible in international travel events and high-profile entertainment. Insurance becomes a rational add-on rather than an optional extra.

Key Takeaway

- The event ticket refund insurance segment led the global market with a 38.7% share, driven by rising demand for protection against event cancellations, postponements, and personal schedule conflicts.

- Individuals represented 35.6% of the market by customer type, reflecting growing consumer awareness and preference for optional refund protection at the time of ticket purchase.

- The online distribution channel dominated with a 42.7% share, supported by digital ticketing platforms and embedded insurance offerings during checkout.

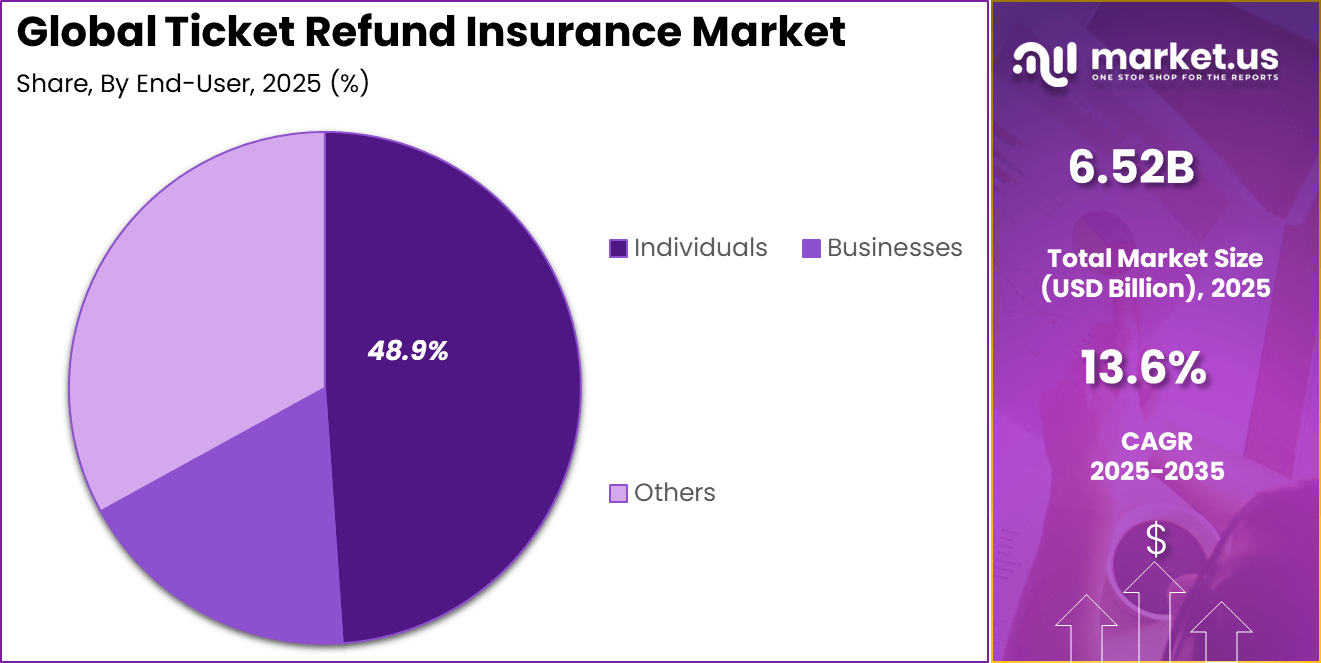

- Individual policy purchases accounted for 48.9%, indicating strong uptake of single ticket or event specific refund coverage rather than bundled or group policies.

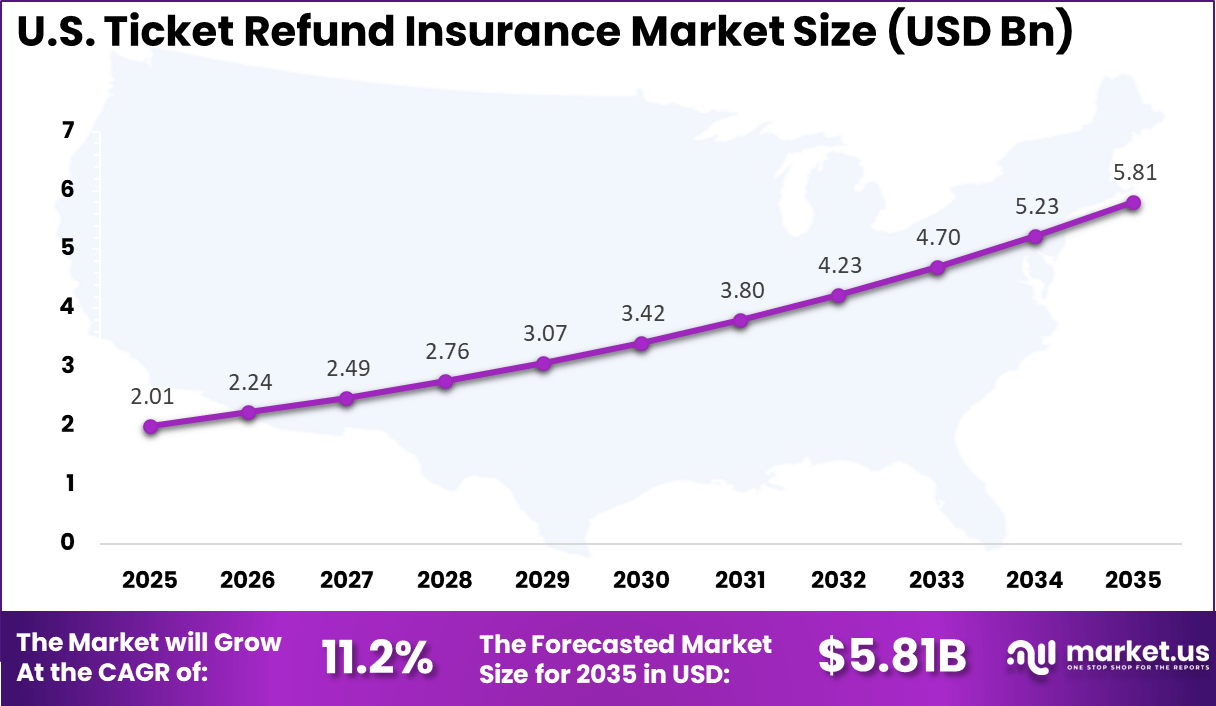

- The US ticket refund insurance market was valued at USD 2.01 billion in 2025 and is expanding at a 11.2% CAGR, supported by high event attendance and digital ticket sales growth.

- North America held more than 35.5% of the global market, driven by mature event ecosystems, strong consumer protection awareness, and widespread online ticketing adoption.

Key Statistics and Trends

- About 60% of travelers are more likely to book flights when CFAR protection is available, compared with 48% when tickets are offered without refund flexibility.

- Travelers are willing to pay up to 133% higher premiums for CFAR coverage than for standard non refundable options.

- Travel providers offering CFAR options report an average 30 point improvement in Net Promoter Score, compared with providers relying solely on non refundable fares.

- Last minute refunds in India proposed ticket insurance programs aim to provide up to 80% refunds for cancellations made within four hours of departure.

- Over the past five years, Indian railways processed 333 claims with total payouts of ₹27.22 crore, while ticket level premiums remained as low as 45 paise.

- The main reasons for buying travel insurance include concerns about delays or disruptions (35%) and health related emergencies (29%).

- Around 55% of insured travelers purchase ticket refund insurance directly through travel booking platforms or providers.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Rising volume of live events, travel bookings, and ticketed experiences +4.1% North America, Europe Short to medium term Growing consumer preference for flexible and refundable purchases +3.5% Global Short term Increased disruption risks from weather, health, and travel uncertainty +2.9% Global Medium term Mandatory refund protection requirements by platforms and organizers +1.8% Europe, North America Medium term Expansion of online ticketing and digital booking platforms +1.6% Global Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Price sensitivity among casual and low-value ticket buyers -2.4% Global Short term Limited awareness of ticket refund insurance benefits -2.0% Asia Pacific, Latin America Medium term Perceived complexity of policy terms and exclusions -1.7% Global Medium term Low attachment rates for low-cost tickets -1.4% Global Short term Regulatory differences in refund obligations -1.1% Europe, Emerging Markets Medium to long term By Type

Event ticket refund insurance represents the leading type within the Ticket Refund Insurance Market, accounting for 38.7% of overall adoption. This dominance is driven by the high frequency of cancellations and schedule changes across concerts, sports events, and live entertainment. Consumers increasingly seek financial protection against non refundable ticket policies.

The preference for event focused refund coverage is further supported by changing event planning dynamics. Weather disruptions, artist cancellations, and venue related issues raise uncertainty for attendees. As a result, event ticket refund insurance remains a primary product choice.

For Instance, in October 2023, Allianz Partners teamed up with Paris 2024 organizers to launch ticket cancellation insurance for Paralympic Games events. Fans could get refunds for illness, weather issues, or travel problems during ticket sales. This move protected buyers from unexpected event misses, boosting confidence in big sports gatherings and showing insurer focus on live events.

By Application

Individuals account for 35.6% of application based demand in the market. This segment includes consumers purchasing insurance for personal attendance at events, travel linked shows, and leisure activities. Rising ticket prices increase the perceived financial risk of non attendance.

Insurance adoption among individuals is influenced by convenience and awareness. Many buyers now add refund protection during the ticket purchase process. This behavior supports steady growth within the individual application segment.

For instance, in April 2025, Travel Guard (AIG) expanded its individual trip protection plans with easier online claims for personal bookings. Solo travelers now file for refunds on flights or events via app, covering family emergencies or health woes. It helps everyday people recover costs fast, fitting the rise in personal leisure trips.

By Distribution Channel

Online distribution channels lead the market with a share of 42.7%. Digital ticketing platforms and event websites frequently offer refund insurance as an integrated option. This simplifies the purchase process and improves customer uptake.

The strength of online channels is also supported by mobile usage and real time purchasing behavior. Consumers value instant policy confirmation and clear refund terms. These factors reinforce the dominance of online distribution.

For Instance, in September 2025, AXA Assistance partnered with Klook to roll out “Klook Travel Care” insurance bought online during activity bookings. Users add one-click coverage for trips and tickets, getting refunds for disruptions like weather or illness. This seamless digital push taps into app-based shopping trends for quick protection.

By End User

Individuals represent the largest end user group, accounting for 48.9% of total demand. Personal users typically face higher exposure to financial loss due to non refundable ticket conditions. Insurance provides reassurance and budget protection. The growth of individual end user demand is closely linked to experiential spending trends. Consumers prioritize flexibility when attending events. This sustains strong adoption across the individual segment.

For Instance, in November 2025, InsureMyTrip updated its CFAR options for individuals, reimbursing up to 75% on personal event tickets canceled anytime. Buyers get quotes online fast, covering mind changes or surprises for non-refundable plans. It meets demand from solo adventurers seeking flexible safeguards without strict rules.

Regional Perspective

North America holds a leading position in the Ticket Refund Insurance Market, accounting for 35.5% of total activity. The region benefits from a large live entertainment industry, high ticket spending, and widespread digital ticketing adoption. Insurance awareness among consumers remains strong.

Regulatory clarity and consumer protection standards further support insurance uptake. Event organizers and platforms increasingly promote refund coverage. These conditions maintain North America’s regional leadership.

For instance, in September 2025, InsureMyTrip highlighted the critical role of travel insurance after the U.S. DOT scrapped proposed airline refund rules. Their policies provide robust trip delay coverage and reimbursement for non-airline expenses like accommodations and tours, protecting 60-80% of trip costs. This development reinforces North American dominance in offering comprehensive ticket refund and cancellation protection.

United States Market Overview

The United States represents the largest contributor within North America, with a market value of USD 2.01 Bn and a growth rate of 11.2% CAGR. High attendance at concerts, sports leagues, and entertainment events drives sustained insurance demand. Online ticket platforms play a central role in policy distribution.

Insurance adoption in the U.S. is influenced by strict refund policies and rising event costs. Consumers seek financial security when purchasing premium tickets. These factors collectively support steady expansion of the U.S. market segment.

For instance, in January 2026, Arch Insurance International launched event cancellation cyber coverage as a policy extension. It protects against cancellation due to cyber attacks or system failures, including third-party infrastructure disruptions. The coverage includes incident response services, demonstrating U.S. innovation in specialized ticket refund insurance for events.

Increasing Adoption Technologies

Digital ticketing platforms play a central role in the adoption of ticket refund insurance. Automated systems allow insurance options to be embedded directly into the purchase process. Claims can also be submitted digitally using ticket verification and event status data. This improves efficiency and reduces administrative burden.

Data analytics is increasingly used to assess cancellation risk and claims patterns. Technology enables dynamic eligibility checks and faster claim validation. This improves customer experience and reduces processing time. Insurers benefit from more accurate risk modeling and operational efficiency.

The primary reason for adopting digital systems is the need for fast and transparent claims handling. Consumers expect quick resolution when events are missed or canceled. Automated workflows support faster reimbursements and reduce dispute rates. This improves trust in insurance products.

Another reason is scalability. Ticket refund insurance involves high volumes of low-value policies that require efficient processing. Manual handling would increase operational cost and delay outcomes. Technology enables insurers and platforms to manage large transaction volumes reliably. This supports sustainable business operations.

Investment and Business Benefits

Investment opportunities exist in platform-integrated insurance solutions that align with digital ticket marketplaces. Insurers that develop seamless application programming interfaces can partner with ticket sellers and event platforms. These integrations allow insurance to be offered at scale with minimal friction. This creates recurring revenue opportunities.

There is also opportunity in product customization based on event type and consumer profile. Flexible coverage conditions can be tailored for travel, sports, or entertainment categories. This segmentation improves relevance and perceived value. Innovation in product design can strengthen competitive positioning.

For consumers, ticket refund insurance offers financial security and peace of mind. It reduces the risk of losing money due to unforeseen circumstances. This protection encourages early purchasing decisions and supports participation in planned events. The benefit is especially relevant for high-cost or non-transferable tickets.

For event organizers and ticket platforms, insurance supports demand stability. Buyers are more willing to commit when refund risk is mitigated. This improves ticket sales predictability and revenue planning. Insurance also reduces refund disputes and customer dissatisfaction.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Travel and event insurance providers High Medium North America, Europe Stable premium growth from bundled products Large commercial insurers Medium Low to Medium Global Portfolio diversification opportunity Digital insurance and insurtech platforms Very High Medium North America Strong upside via embedded insurance Private equity firms Medium Medium North America, Europe Consolidation of niche insurance books Venture capital investors Medium High North America Selective interest in platform-led models Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~)% Primary Function Geographic Relevance Adoption Timeline Embedded insurance APIs in ticketing platforms +3.8% Seamless policy attachment North America, Europe Short term Automated eligibility and refund validation systems +3.1% Faster claim approvals Global Medium term Data-driven pricing based on event and traveler risk +2.6% Improved loss ratios Europe, North America Medium term Mobile-first policy management and claims tools +2.2% Customer convenience Global Medium to long term AI-based fraud detection and claim monitoring +1.7% Reduced claim leakage Global Long term Opportunity Analysis

A major opportunity for the ticket refund insurance market lies in deeper integration with digital ticketing and travel platforms. Embedding refund protection seamlessly into booking journeys improves visibility and simplifies decision making. Automated eligibility checks and real time policy explanations can enhance user confidence at the point of purchase. This integration supports higher conversion rates and broader adoption.

Another opportunity is the expansion of coverage options tailored to specific use cases. Differentiated products for events, air travel, rail travel, and bundled bookings can better match consumer needs. Flexible policies that adjust coverage based on ticket type and risk profile can improve relevance and customer satisfaction. These developments create space for innovation without increasing complexity for end users.

Challenge Analysis

A key challenge for the ticket refund insurance market is balancing simplicity with comprehensive coverage. Consumers prefer easy to understand products, while insurers must account for a wide range of cancellation scenarios. Designing policies that are both clear and sufficiently protective requires careful structuring of terms and exclusions. Failure to achieve this balance may lead to dissatisfaction or underutilization.

Another challenge is managing claims efficiently during periods of widespread disruption. Large scale event cancellations or travel interruptions can trigger high claim volumes in a short time. Insurers must maintain operational readiness to process claims quickly and fairly to preserve trust. Consistent claims handling performance is critical for long term market credibility.

Emerging Trends Analysis

An emerging trend in the ticket refund insurance market is the use of automated claims processing. Digital verification of cancellations and eligibility is reducing claim resolution time and improving user experience. Automation also supports cost efficiency and scalability during high demand periods. This trend aligns with consumer expectations for fast and transparent service.

Another trend is the move toward more flexible coverage definitions. Policies are increasingly designed to cover a broader range of personal disruptions rather than narrow, event specific triggers. This flexibility increases perceived value and aligns refund insurance with modern, dynamic travel and event planning behaviors.

Growth Factors Analysis

One of the main growth factors for the ticket refund insurance market is the continued expansion of online ticket sales. Digital platforms make it easier to offer insurance at the moment of purchase, increasing awareness and uptake. As online booking becomes the dominant channel, refund protection becomes a natural add on rather than a separate decision.

Another growth factor is sustained uncertainty across travel and event environments. Weather volatility, transportation disruptions, and personal schedule changes reinforce the need for financial protection. As consumers prioritize flexibility and risk reduction, ticket refund insurance continues to gain acceptance as a standard planning tool.

Key Market Segments

By Type

- Event Ticket Refund Insurance

- Travel Ticket Refund Insurance

- Sports Ticket Refund Insurance

- Concert Ticket Refund Insurance

- Others

By Application

- Individuals

- Corporates

- Event Organizers

- Travel Agencies

- Others

By Distribution Channel

- Online

- Insurance Brokers

- Direct Sales

- Others

By End-User

- Individuals

- Businesses

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Global travel insurance leaders such as Allianz Global Assistance, Allianz Partners, and AXA Assistance hold strong positions in ticket refund insurance. Their products typically cover trip cancellation, event non-attendance, and covered delays. Strong airline, event, and travel platform partnerships support wide distribution. Digital claims processing and predefined refund triggers improve customer experience.

Specialty insurers and underwriting groups such as AIG Travel, Travel Guard, and Chubb Limited focus on premium coverage and tailored policy structures. Tokio Marine HCC and Arch Insurance Group add underwriting capacity for large events and high-value tickets. These players emphasize risk selection, fraud controls, and global compliance. Adoption remains strong among frequent travelers and event organizers seeking predictable refund outcomes.

Distribution-led platforms and niche providers such as Berkshire Hathaway Travel Protection, Travelex Insurance Services, and Cover Genius expand access through online and embedded channels. InsureMyTrip, Squaremouth, and World Nomads improve transparency and choice. Other providers enhance regional coverage and customization, supporting steady market growth.

Top Key Players in the Market

- Allianz Global Assistance

- AIG Travel

- AXA Assistance

- Zurich Insurance Group

- Chubb Limited

- Travel Guard (AIG)

- Generali Global Assistance

- InsureMyTrip

- Travel Insured International

- Seven Corners

- CSA Travel Protection

- Berkshire Hathaway Travel Protection

- Travelex Insurance Services

- Arch Insurance Group

- Tokio Marine HCC

- Europ Assistance

- Cover Genius

- Squaremouth

- World Nomads

- Allianz Partners

- Others

Recent Developments

- In January 2026, Allianz Partners launched event ticket protection insurance for the Milano Cortina 2026 Winter Olympics, reimbursing fans for sudden illnesses, travel disruptions, or denied entry due to contagious diseases. This move taps into the growing demand for flexible ticket refund coverage as major events rebound, showcasing their expertise in event-specific travel protection.

- In November 2025, Generali Global Assistance was named the top provider for emergency medical and trip cancellation insurance by Better Business Advice, with enhanced ticket refund features for 2025 policies. Their global network and proactive claims support highlight leadership in comprehensive refund solutions for international trips.

Report Scope

Report Features Description Market Value (2025) USD 6.5 Bn Forecast Revenue (2035) USD 23.3 Bn CAGR(2026-2035) 13.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Event Ticket Refund Insurance, Travel Ticket Refund Insurance, Sports Ticket Refund Insurance, Concert Ticket Refund Insurance, Others), By Application (Individuals, Corporates, Event Organizers, Travel Agencies, Others), By Distribution Channel (Online, Insurance Brokers, Direct Sales, Others), By End-User (Individuals, Businesses, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz Global Assistance, AIG Travel, AXA Assistance, Zurich Insurance Group, Chubb Limited, Travel Guard (AIG), Generali Global Assistance, InsureMyTrip, Travel Insured International, Seven Corners, CSA Travel Protection, Berkshire Hathaway Travel Protection, Travelex Insurance Services, Arch Insurance Group, Tokio Marine HCC, Europ Assistance, Cover Genius, Squaremouth, World Nomads, Allianz Partners, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ticket Refund Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Ticket Refund Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz Global Assistance

- AIG Travel

- AXA Assistance

- Zurich Insurance Group

- Chubb Limited

- Travel Guard (AIG)

- Generali Global Assistance

- InsureMyTrip

- Travel Insured International

- Seven Corners

- CSA Travel Protection

- Berkshire Hathaway Travel Protection

- Travelex Insurance Services

- Arch Insurance Group

- Tokio Marine HCC

- Europ Assistance

- Cover Genius

- Squaremouth

- World Nomads

- Allianz Partners

- Others