Global Thermal Spray Service Market Size, Share, Growth Analysis By Technology (HVOF (High Velocity Oxy-Fuel Spraying), Combustion Flame Spraying, Plasma Spraying, Vacuum Plasma Spraying, Others), By Coating Material (Metals and Alloys, Ceramics, Composites, Polymers, Others), By End-Use (Aerospace, Automotive, Oil & Gas, Energy & Power, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 160208

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Thermal Spray Service Market size is expected to be worth around USD 4.8 Billion by 2034, from USD 3.2 Billion in 2024, growing at a CAGR of 4.1% during the forecast period from 2025 to 2034.

The Thermal Spray Service Market refers to the industry dedicated to providing coating solutions that enhance surface properties such as wear resistance, corrosion protection, and thermal insulation. These services utilize processes like HVOF, plasma spraying, and flame spraying to deposit advanced materials—metals, ceramics, or carbides—on various industrial components. As a result, thermal spray technologies extend the lifespan and performance of parts across sectors like aerospace, automotive, power generation, and oil & gas.

The Thermal Spray Service Market is witnessing steady expansion, driven by rising demand for surface protection in harsh operating environments. The growing emphasis on energy efficiency and component durability propels industries to adopt thermal coatings as cost-effective alternatives to part replacement.

With increasing automation and high-performance equipment, the need for precision-engineered coatings continues to rise globally. Furthermore, the use of advanced materials such as tungsten carbide and ceramic blends adds superior mechanical strength, fueling market adoption across critical industries.

The rapid industrialization in emerging economies creates favorable conditions for market penetration. Regions such as Asia Pacific are witnessing a surge in aerospace and automotive manufacturing, which drives investments in thermal coating facilities.

Similarly, the renewable energy and power generation sectors are expanding their use of thermal spray coatings for turbines and boilers, boosting demand for specialized service providers.

Government investments in infrastructure modernization and defense manufacturing further stimulate market growth. Programs encouraging local production and technological innovation support the adoption of advanced coating techniques. Regulatory standards emphasizing emission reduction and environmental safety also encourage the use of eco-friendly spray technologies with minimal waste generation and improved energy utilization.

Moreover, stringent quality certifications in aerospace and defense sectors enhance trust in service providers, prompting long-term contracts. As industries prioritize asset integrity and lifecycle cost optimization, the thermal spray service sector stands positioned for sustained growth. Increasing awareness of coating efficiency and material recyclability will likely reinforce its strategic importance across global manufacturing landscapes.

Key Takeaways

- The Global Thermal Spray Service Market is projected to reach USD 4.8 Billion by 2034, growing from USD 3.2 Billion in 2024 at a CAGR of 4.1% (2025–2034).

- In 2024, HVOF (High Velocity Oxy-Fuel Spraying) led the Technology segment with a 37.8% share, favored for its dense, high-adhesion coatings and cost-effectiveness.

- Metals and Alloys dominated the Coating Material segment in 2024 with a 42.4% share, offering superior wear and corrosion resistance across multiple industries.

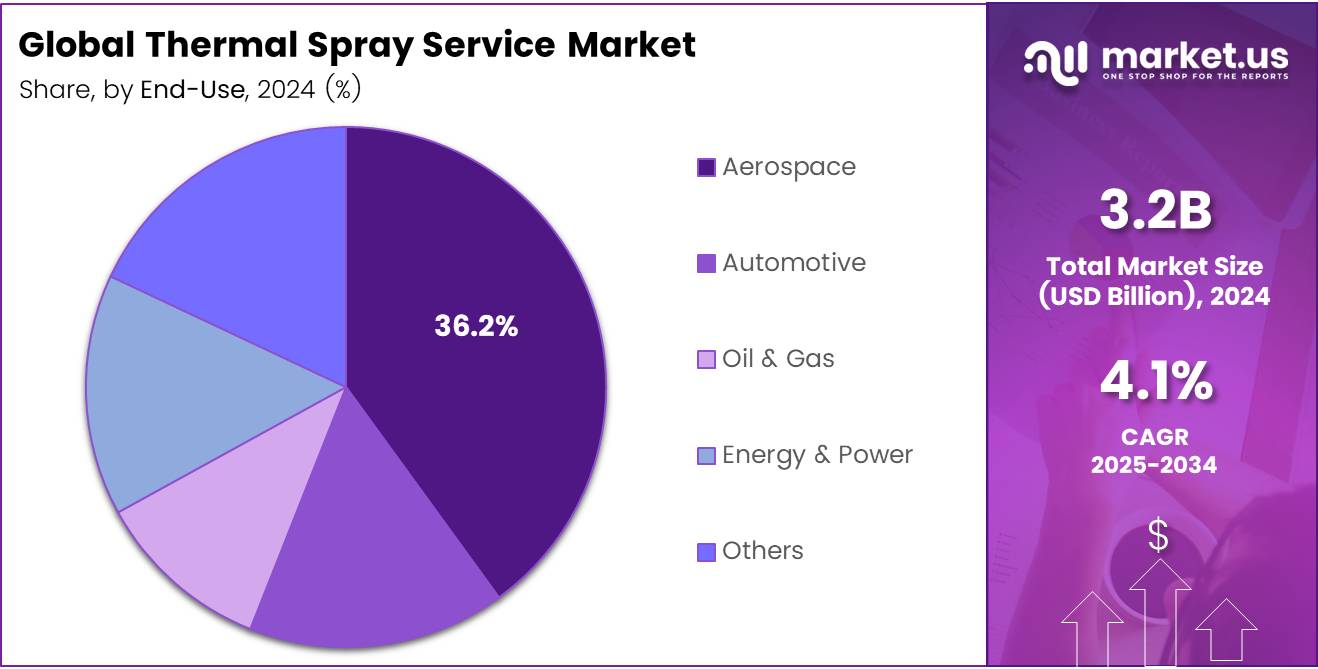

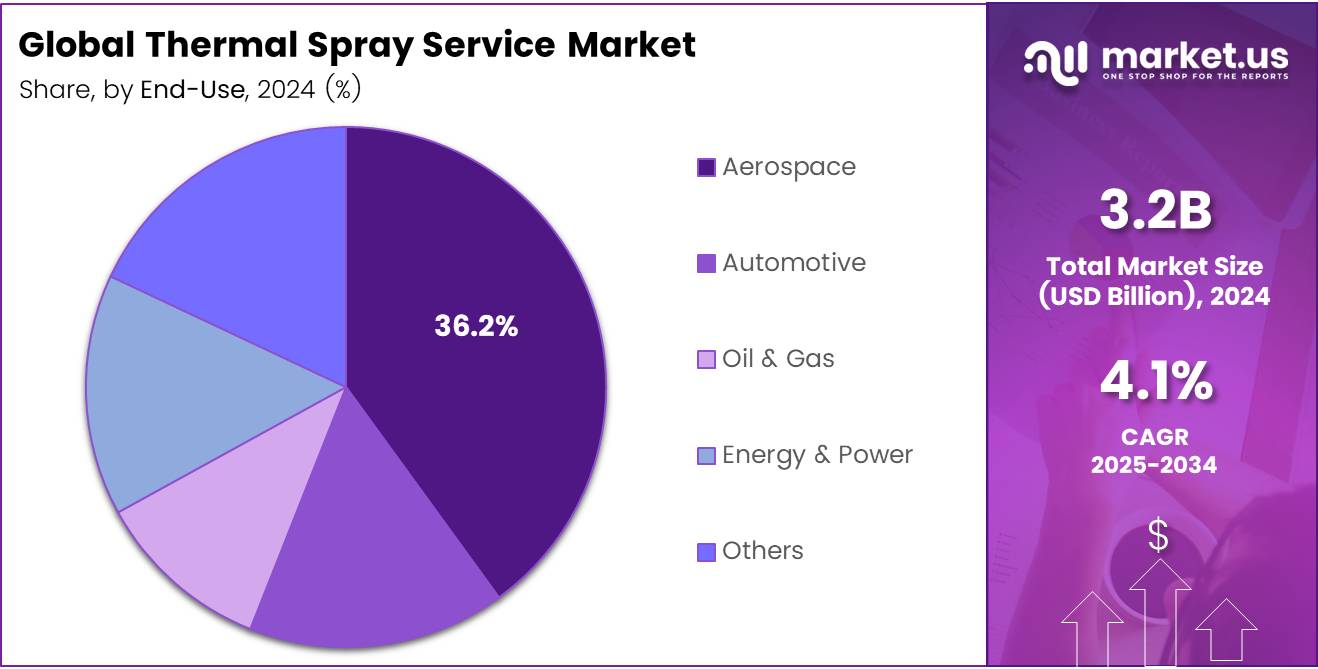

- The Aerospace sector led the End-Use segment in 2024 with a 36.2% share, driven by stringent safety standards and high-performance coating requirements.

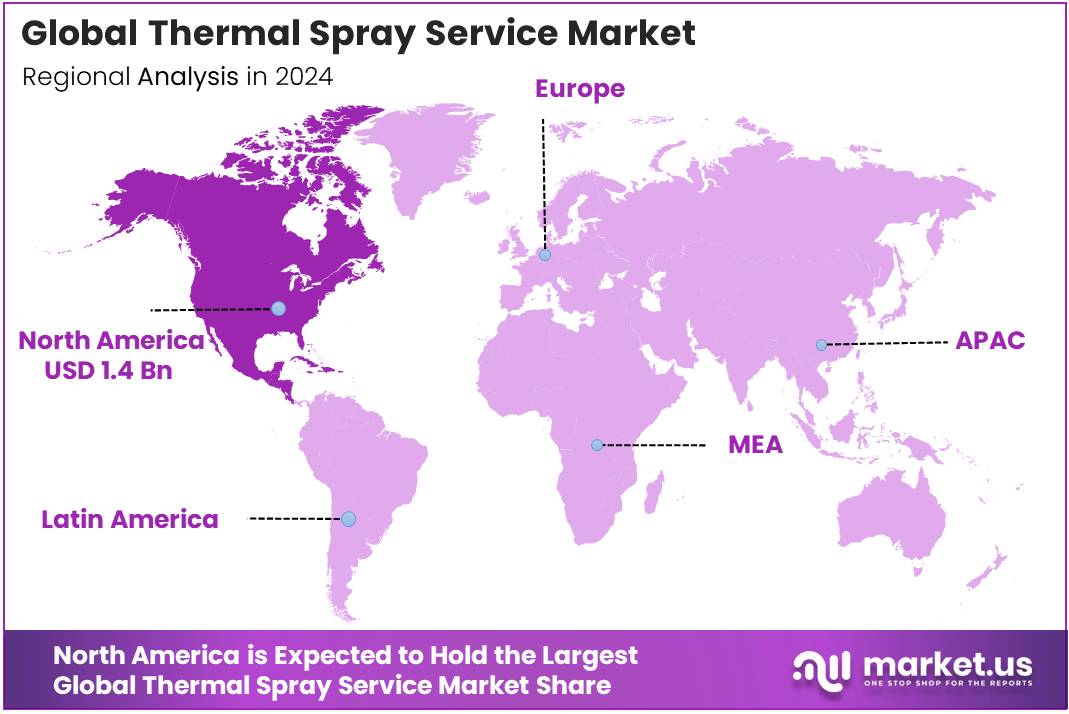

- North America held the largest regional share in 2024 at 43.9%, valued at USD 1.4 Billion, supported by strong aerospace, automotive, and energy industries.

By Technology Analysis

HVOF (High Velocity Oxy-Fuel Spraying) dominates with 37.8% due to its superior coating quality and enhanced wear resistance.

In 2024, HVOF (High Velocity Oxy-Fuel Spraying) held a dominant market position in the By Technology Analysis segment of the Thermal Spray Service Market, with a 37.8% share. This technology delivers dense coatings with excellent adhesion, making it ideal for aerospace, automotive, and industrial components exposed to extreme conditions. Its cost-effectiveness and precision further enhance its adoption across high-performance applications.

The Combustion Flame Spraying segment is gaining steady demand for its simplicity and adaptability across varied surfaces. This method offers cost efficiency and quick application, making it suitable for repair and maintenance tasks. Industries such as oil & gas and manufacturing rely on it for restoring worn parts and reducing downtime.

Plasma Spraying remains a preferred technology for high-temperature and corrosion-resistant coatings. It supports a wide range of materials, including ceramics and metals, offering versatility across aerospace turbine blades and energy equipment. Its ability to produce thick coatings with controlled microstructures drives steady usage.

Vacuum Plasma Spraying provides high-purity coatings with minimal oxidation, crucial for sensitive aerospace and biomedical components. Although capital-intensive, its precision and quality appeal to sectors requiring advanced surface protection.

The Others category includes emerging methods like cold spraying and detonation spraying. These techniques are gaining traction for niche applications where low thermal stress and high bond strength are required, signaling innovation-driven growth.

By Coating Material Analysis

Metals and Alloys dominate with 42.4% owing to their strength, versatility, and wide industrial applicability.

In 2024, Metals and Alloys held a dominant market position in the By Coating Material Analysis segment of the Thermal Spray Service Market, with a 42.4% share. These coatings provide robust wear and corrosion resistance, extending equipment life in aerospace, power, and automotive industries. Their compatibility with multiple spraying techniques enhances their usage versatility.

Ceramics are widely used where thermal insulation and oxidation resistance are critical. They serve key roles in turbine coatings, engine parts, and industrial machinery. With rising demand for high-temperature stability, ceramics are expected to see consistent adoption in aerospace and energy sectors.

The Composites segment combines the benefits of different materials, offering tailored performance such as high hardness and low friction. These coatings support applications demanding multi-functional properties, particularly in advanced manufacturing and engineering components.

Polymers are utilized for coatings requiring electrical insulation and chemical resistance. Their lightweight nature and non-reactivity make them suitable for specific industrial and electronic uses, though limited by lower temperature resistance.

The Others category includes specialized coating materials like carbides and nitrides. These materials are applied where extreme durability and precision are required, especially in tooling and aerospace applications, reflecting a shift toward high-performance surface technologies.

By End-Use Analysis

Aerospace dominates with 36.2% due to extensive use in turbine, engine, and landing gear components.

In 2024, Aerospace held a dominant market position in the By End-Use Analysis segment of the Thermal Spray Service Market, with a 36.2% share. Thermal spray coatings enhance wear, heat, and corrosion resistance, essential for jet engines and structural components. Stringent safety standards and maintenance cycles fuel steady demand in this segment.

The Automotive sector increasingly integrates thermal spray technology for improving engine efficiency, reducing friction, and extending component life. Applications span pistons, gear shafts, and exhaust systems. The focus on lightweight and durable materials accelerates market penetration across OEMs.

In Oil & Gas, coatings safeguard equipment against corrosion, erosion, and high-temperature exposure. Pipelines, valves, and drilling tools benefit from extended operational life. The sector’s push for cost-effective maintenance solutions continues to drive thermal spray adoption.

The Energy & Power segment leverages thermal spray coatings for turbines, boilers, and wind components. Rising energy demand and renewable infrastructure expansion boost this segment’s relevance.

The Others category encompasses industries like marine, medical, and heavy engineering. Here, thermal spray services are adopted for customized surface protection, extending service life and performance under challenging conditions.

Key Market Segments

By Technology

- HVOF (High Velocity Oxy-Fuel Spraying)

- Combustion Flame Spraying

- Plasma Spraying

- Vacuum Plasma Spraying

- Others

By Coating Material

- Metals and Alloys

- Ceramics

- Composites

- Polymers

- Others

By End-Use

- Aerospace

- Automotive

- Oil & Gas

- Energy & Power

- Others

Drivers

Rising Demand for Wear and Corrosion-Resistant Coatings in Aerospace and Automotive Drives Market Growth

The Thermal Spray Service Market is witnessing robust growth due to the rising demand for wear- and corrosion-resistant coatings in aerospace and automotive sectors. These coatings extend component life, reduce maintenance costs, and enhance fuel efficiency. Industries are increasingly turning to thermal spray solutions to improve performance under harsh operational environments.

Furthermore, the increasing adoption of thermal spray in power generation equipment maintenance is driving market expansion. Gas turbines, boilers, and combustion chambers frequently use these coatings for heat and oxidation resistance. Power plants rely on these services to enhance operational efficiency, extend component durability, and reduce downtime in high-temperature applications.

Additionally, the growing utilization of advanced materials like ceramics and carbides in coating processes is transforming market dynamics. These high-performance materials provide superior hardness, thermal stability, and chemical resistance. As industries seek longer-lasting and more reliable coatings, demand for such advanced materials continues to rise, fueling service innovation and technology integration.

Moreover, the expansion of industrial manufacturing and heavy engineering applications significantly boosts market growth. Sectors such as oil & gas, mining, and metallurgy employ thermal spray coatings to protect expensive machinery. With the resurgence of global manufacturing and infrastructure projects, the need for high-performance coating services is expected to accelerate further.

Restraints

Limited Skilled Workforce and Technical Expertise in Coating Application Restrains Market Growth

The Thermal Spray Service Market faces notable challenges due to a limited skilled workforce. Applying thermal spray coatings requires precision and specialized expertise, and the shortage of trained professionals often leads to inconsistent quality. This skill gap slows service scalability and impacts operational efficiency across several industries.

Additionally, environmental and safety concerns related to spray emissions and waste management act as key restraints. Thermal spray processes produce metallic dust, fumes, and particulate matter, prompting strict environmental regulations. Companies must invest heavily in emission control systems and compliance measures, which increases overall operational costs and limits small-scale adoption.

Furthermore, competition from alternative surface treatment technologies such as PVD, CVD, and laser cladding presents a market challenge. These alternatives offer cost advantages, smoother finishes, and sometimes simpler processes. As industries evaluate performance versus cost, the adoption of competing technologies may limit the expansion of traditional thermal spray services.

Overall, while demand remains strong, addressing workforce shortages, enhancing process sustainability, and differentiating against alternative coatings will be critical to overcoming these barriers.

Growth Factors

Integration of Robotics and Automation in Thermal Spray Coating Operations Creates Growth Opportunities

The Thermal Spray Service Market is entering a transformative phase through the integration of robotics and automation. Automated spray systems deliver superior precision, repeatability, and reduced human error. Industries benefit from enhanced consistency, lower waste, and improved productivity, encouraging large-scale adoption of automated coating technologies.

The development of eco-friendly and energy-efficient spray technologies is also emerging as a strong growth catalyst. Innovations such as cold spray and plasma-based solutions minimize heat generation and emissions. Companies investing in green coating technologies can align with global sustainability mandates while reducing operational energy costs.

In addition, the increasing outsourcing of coating services by OEMs to specialized vendors opens new opportunities. Manufacturers prefer partnering with experts for advanced coatings to reduce in-house capital investment. This trend is fostering a thriving ecosystem of contract service providers offering turnkey coating solutions across multiple industries.

Finally, the rising demand for coatings in renewable energy components—especially in wind turbines and solar equipment—presents a significant growth avenue. Protective coatings improve durability against corrosion, erosion, and extreme weather, ensuring longer lifecycle performance for renewable infrastructure.

Emerging Trends

Adoption of Cold Spray Technology for High-Precision and Low-Heat Applications Emerging as a Key Trend

A major trend shaping the Thermal Spray Service Market is the adoption of cold spray technology. This low-heat process enables coating of temperature-sensitive substrates while maintaining structural integrity. Industries such as aerospace and electronics favor cold spray for high-precision and repair applications.

Additionally, growing research on nano-structured coatings is driving performance enhancements. Nano-coatings offer improved hardness, adhesion, and corrosion resistance. Continuous R&D efforts are leading to breakthrough solutions that deliver superior wear protection and surface smoothness, opening pathways for premium industrial applications.

There is also a shift toward custom coating solutions tailored for niche industrial requirements. Sectors like biomedical, energy, and electronics increasingly seek specialized coatings that address unique mechanical or chemical challenges. This customization trend fosters innovation and differentiates service providers in a competitive landscape.

Moreover, the expansion of 3D printing and additive manufacturing using thermal spray processes is redefining material engineering. By integrating thermal spray, manufacturers achieve enhanced surface properties and build hybrid components with superior functionality, strengthening market opportunities across advanced manufacturing domains.

Regional Analysis

North America Dominates the Thermal Spray Service Market with a Market Share of 43.9%, Valued at USD 1.4 Billion

In 2024, North America emerged as the leading region in the global Thermal Spray Service Market, accounting for 43.9% of the total share and valued at USD 1.4 Billion. The region’s dominance is driven by its strong aerospace, automotive, and energy industries, where demand for wear-resistant coatings is accelerating. Additionally, continuous investments in advanced coating technologies and sustainable manufacturing practices strengthen its regional growth outlook.

Europe Thermal Spray Service Market Trends

Europe represents a mature market for thermal spray services, supported by its robust engineering, defense, and industrial manufacturing sectors. The region emphasizes eco-friendly coating solutions and strict emission norms, pushing industries to adopt cleaner thermal spray technologies. Growth is further supported by refurbishment of aging power infrastructure and adoption of advanced material coatings.

Asia Pacific Thermal Spray Service Market Trends

Asia Pacific is witnessing rapid growth owing to expanding industrialization, infrastructure development, and demand from automotive and aerospace sectors. Countries such as China, Japan, and India are increasing investments in energy and heavy machinery sectors. Moreover, rising awareness about equipment longevity and cost-effective maintenance is fueling adoption of thermal spray services.

Middle East and Africa Thermal Spray Service Market Trends

The Middle East and Africa market is gradually expanding, supported by growth in oil & gas, petrochemical, and power generation industries. Increasing focus on corrosion protection in harsh environments and refurbishment of industrial components are key growth contributors. Infrastructure development projects further create steady demand for coating services.

Latin America Thermal Spray Service Market Trends

Latin America shows steady growth, with demand driven by automotive, mining, and energy equipment maintenance sectors. Brazil and Mexico are leading adopters, focusing on extending machinery lifespan and reducing operational costs. The region’s shift toward industrial modernization and repair-based coating solutions supports future market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Thermal Spray Service Company Insights

In 2024, leading players in the Global Thermal Spray Service Market focused on expanding their service portfolios, integrating advanced coating materials, and catering to industries such as aerospace, automotive, and energy. These companies emphasized innovation, durability, and precision engineering to strengthen their market position across key applications.

A&A Coatings continued to be a major player with its broad service range in wear- and corrosion-resistant coatings. The company’s strong expertise in plasma and HVOF spraying allowed it to deliver customized solutions for aerospace and industrial components. Its focus on advanced material compatibility enhanced its reputation for precision surface engineering.

APS Materials, Inc. leveraged its deep expertise in biomedical and aerospace coatings, offering plasma-sprayed surfaces that extend equipment lifespan. Its advanced surface technology solutions supported performance in high-temperature and corrosive environments, strengthening its relationships with OEMs and industrial manufacturers.

ASB Industries, Inc. stood out for its cost-efficient coating services and sustainable operations. The company’s continuous investment in robotic spray systems and environmentally responsible techniques positioned it well among industrial clients demanding consistency and energy efficiency in large-scale applications.

Bodycote plc, a global leader in thermal processing, expanded its thermal spray service offerings through integrated material treatments. Its strong global footprint and expertise in metallurgy allowed it to cater to a diverse industrial base, ensuring consistent coating quality and adherence to international performance standards across sectors like energy, defense, and aerospace.

Top Key Players in the Market

- A&A Coatings

- APS Materials, Inc.

- ASB Industries, Inc.

- Bodycote plc

- Curtiss-Wright Surface Technologies

- F.W. Gartner Thermal Spraying

- Flame Spray SpA

- Höganäs AB

- Kennametal Stellite

- Oerlikon Metco

Recent Developments

- In October 2024, Integrated Global Services (IGS) acquired the thermal spray business unit of Liquidmetal Industrial Solutions to enhance its surface enhancement and asset integrity capabilities. This acquisition strengthens IGS’s service portfolio in high-performance coating and industrial asset longevity.

- In October 2024, Aalberts N.V. acquired all shares in Steel Goode Products, a leading provider of thermal spray coating and finishing services. The move expands Aalberts’ footprint in precision engineering and strengthens its industrial surface treatment expertise.

- In December 2024, Kymera International acquired CCC, a German specialist in thermal spray and precision machining. The deal integrates a European HVOF service center, broadening Kymera’s advanced materials and coating capabilities in Europe.

- In July 2024, Wall Colmonoy (USA) acquired Indurate Alloys Ltd. (Canada), a supplier of thermal spray and hardfacing powders. This strategic move strengthens Wall Colmonoy’s material feedstock base and reinforces its leadership in high-performance coating materials.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Billion Forecast Revenue (2034) USD 4.8 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (HVOF (High Velocity Oxy-Fuel Spraying), Combustion Flame Spraying, Plasma Spraying, Vacuum Plasma Spraying, Others), By Coating Material (Metals and Alloys, Ceramics, Composites, Polymers, Others), By End-Use (Aerospace, Automotive, Oil & Gas, Energy & Power, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape A&A Coatings, APS Materials, Inc., ASB Industries, Inc., Bodycote plc, Curtiss-Wright Surface Technologies, F.W. Gartner Thermal Spraying, Flame Spray SpA, Höganäs AB, Kennametal Stellite, Oerlikon Metco Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Thermal Spray Service MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Thermal Spray Service MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- A&A Coatings

- APS Materials, Inc.

- ASB Industries, Inc.

- Bodycote plc

- Curtiss-Wright Surface Technologies

- F.W. Gartner Thermal Spraying

- Flame Spray SpA

- Höganäs AB

- Kennametal Stellite

- Oerlikon Metco