Global Thermal Paper Market By Printing Technology (Direct Thermal, Thermal Transfer, Others), By Width (2.25” (57mm) and 3.125” (80mm)), By Application (Lottery & Gaming, Point of Sale (PoS), and Tags & Labels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 18414

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

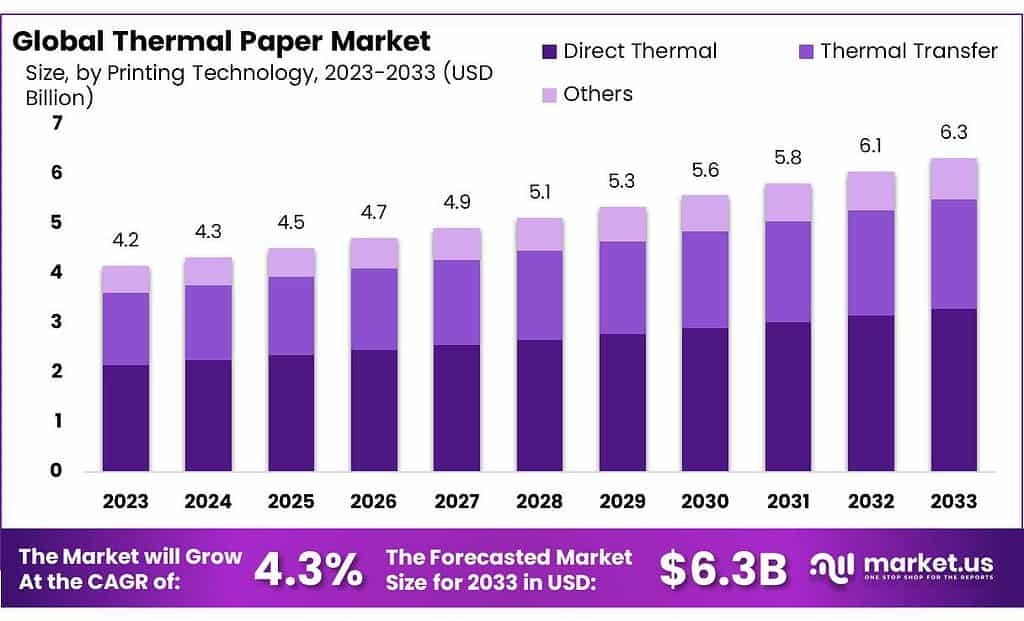

The global Thermal paper market size is expected to be worth around USD 6.3 billion by 2033, from USD 4.15 billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

Market growth is expected to be driven by the increasing popularity of Point of Sale (PoS), machines that allow retail transactions to take place.

Product demand will also be driven by the increasing importance of labeling/providing detailed descriptions of ingredients in the food products and beverage industries. This is to prevent adulteration practices.

In the near future, industry growth will be aided by the increasing use of Radio-Frequency Identification tags (RFID) in the healthcare sector. The thermal paper market report gives an overview of the market growth, size, and other key factors.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Size: Expected to reach USD 6.3 billion by 2033, growing at a CAGR of 4.3% from USD 4.15 billion in 2023.

- Driving Factors: Increased use in Point of Sale (PoS) machines, labeling for food & beverages, and RFID integration in healthcare.

- Printing Technologies Dominance: In 2023, direct thermal printing held over 51% market share due to its widespread use in receipts and tickets. Competing Tech: Thermal Transfer, though smaller, lasted longer and found applications in barcode labels for stocks.

- Width Analysis: Popular Sizes: 3.125” (80mm) papers are highly demanded, especially in POS terminals and lottery tickets. Diverse Usage: 2.25” width paper is extensively used in ticketing, labeling, and card payment terminals.

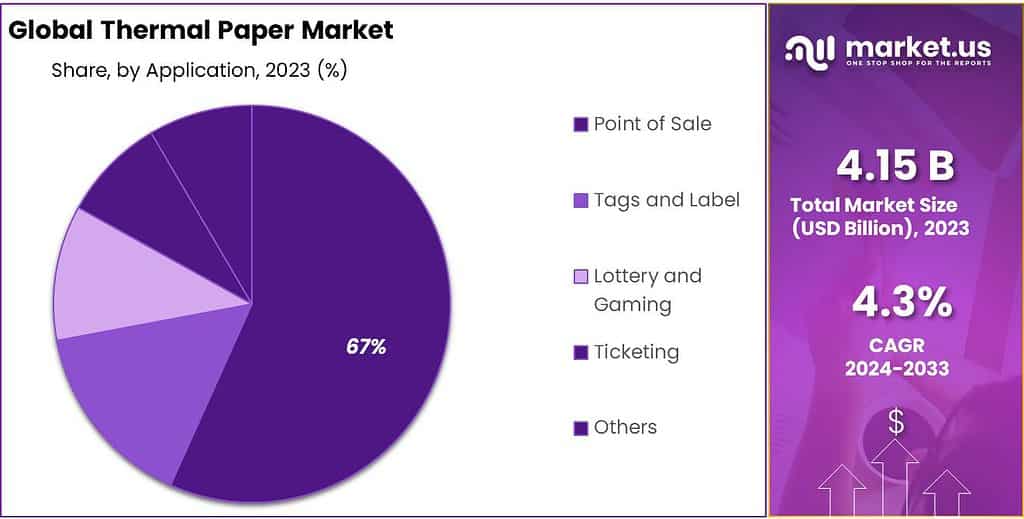

- Applications: POS Dominance: Accounting for 67% of the market in 2023, PoS applications are driven by ease of printing and expanding mobile PoS usage. Growing Segments: Tags and labels show the fastest expected CAGR of 6.9%, driven by retail, food, pharmaceuticals, and detailed labeling needs.

- Market Drivers: Retail Expansion Growth in retail sectors and the surge in e-commerce drive demand for thermal paper. Convenience & Speed Thermal printing’s quick capabilities and inkless nature attract various applications.

- Challenges and Concerns: Environmental Impact Chemicals used in production raise environmental and health concerns, impacting recycling and eco-friendliness.

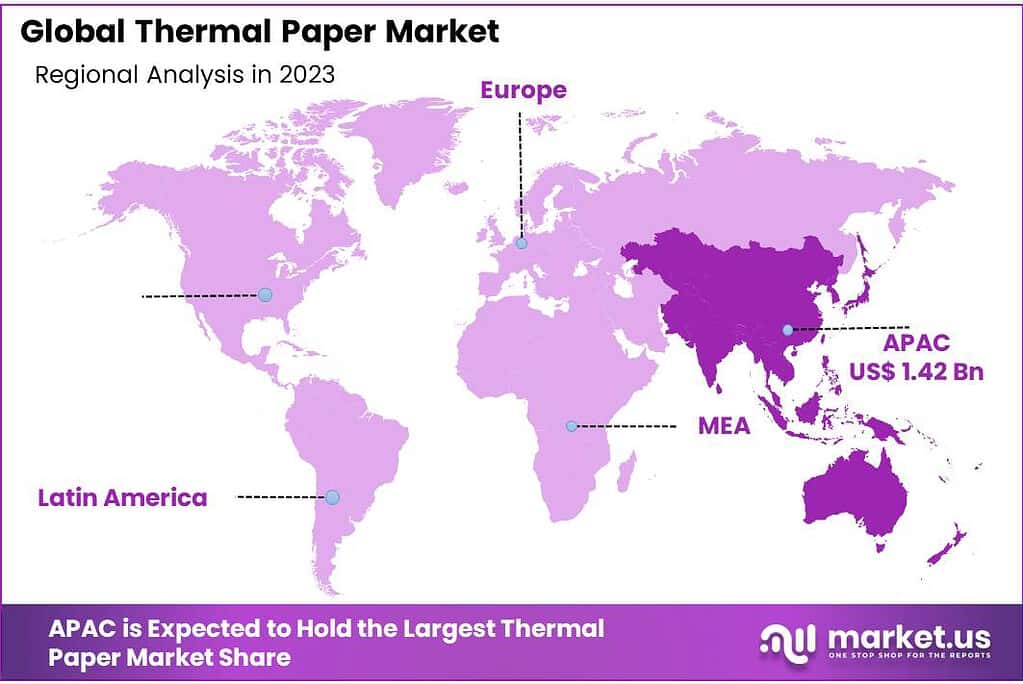

- Regional Analysis Asia-Pacific Dominance Accounting for over 34.2% of revenue in 2023 due to retail growth and rising healthcare product demand.

- Key Players and Recent Developments: Industry Innovations: Companies are investing in eco-friendly solutions and technological advancements.

- Future Opportunities: Innovation & Sustainability Developing eco-friendly alternatives and exploring new applications beyond receipts and labels offer growth potential. International Expansion Exploring markets in developing countries experiencing digital transaction growth could create new opportunities.

By Printing Technology

Thermal Transfer was a smaller part of the market, but it lasted longer and was tougher than direct thermal printing. It found fans in things like barcode labels for stocks and signs outside.

In 2023, Direct Thermal printing was king in the thermal paper world, with different widths for different jobs. The fight between direct thermal and thermal transfer keeps pushing for better thermal paper that’s better quality and cheaper.

Width analysis

There are three categories for the market: 2.25″ (57mm), 3.125″ (80mm), and others. Thermal paper producers make these sheets in a variety of widths ranging from 1.46″ (37mm) to 4.33″ (110mm), as well as in full-scape and bespoke sizes.

Because there is such high demand for the 3.125″ type of paper for use in POS terminals and lottery tickets, they are used in the highest amount out of all of these widths.

Due to the rise in supermarkets and hypermarkets as well as the use of digital billing counters in brick-and-mortar stores, there is a high demand for this type of paper form in this market sector.

However, the 2.25″ width category also accounts for a sizeable portion of the market trends due to its widespread use in ticketing and labeling applications.

Additionally, 2.25″ thermal paper is used in Card payment terminals, and throughout the course of the projection period, it is predicted that the market insights for 2.25″ paper will continue to grow steadily due to the growth in cashless transactions in developing nations.

Application analysis

Point-of-Sale (PoS), which accounted for 67% of the global revenue share in 2023, led the thermal paper market share. Because of its ease of printing, the product is popular in PoS machines. The segment has also seen a wide range of mobile PoS Terminals used in public utilities, transportation, and retail markets.

The demand for PoS transactions is increasing in emerging economies like India, China, and Vietnam. The market growth will be slowed by the gradual adoption of electronic receipts.

The fastest expected CAGR for tags & labels is 6.9% during the forecast period. The primary drivers of segment growth are likely to be the growing use of tags and labels in the retail industry, food & drink, and pharmaceutical industries.

The segment will also be driven by the increasing adoption of detailed labeling within the pharmaceutical industry. These labels can be found in both the type of paper and hallmark forms.

They provide details about the nutritional ingredients as well as avoid duplication. It is used in the pharmaceutical industry to provide information about manufacturing, expiry dates, composition, bar codes, and other related data for products such as drugs, injections, and pharmaceutical equipment.

End uses of Thermal papers are retail stores, supermarkets, and warehouses. Also, in the labeling and packaging sector are the industrial and logistical end-uses.

Note: Actual Numbers Might Vary In the Final Report

Кеу Маrkеt Ѕеgmеntѕ

By Printing Technology

- Direct Thermal

- Thermal Transfer

- Others

By Width

- 2.25” (57mm)

- 3.125” (80mm)

- Other Widths

By Application

- Lottery & Gaming

- Point of Sale (PoS)

- Tags & Labels

- Other Applications

Drivers

Thermal paper, largely used in receipts and labels, has various drivers influencing its market

- Retail and Point-of-Sale (POS) Expansion: The growth in retail sectors and the increasing use of POS systems significantly drive the demand for thermal paper in receipt printing.

- Growing E-commerce: The rise in online shopping boosts the demand for shipping labels, packing slips, and invoices, driving the usage of thermal paper in logistics.

- Regulatory Requirements: Stringent regulations for accurate record-keeping and transaction documentation further propel the demand for thermal paper in industries adhering to specific record-keeping standards.

- Advantages in Convenience and Speed: Thermal printing offers quick printing capabilities and requires no ink or ribbons, enhancing its appeal for various applications.

- Technological Advancements: Continuous technological innovations in printing equipment and thermal paper coatings contribute to improved print quality, durability, and eco-friendliness, supporting market growth.

- Demand for Eco-friendly Solutions: There’s a growing shift toward eco-friendly thermal paper options, such as those free from bisphenol compounds (BPA), in response to environmental concerns. This aligns with the market’s increasing focus on sustainability.

- Health and Safety Concerns: Ongoing research on the health impacts of certain chemicals used in thermal paper production might influence consumer preferences and industry practices, affecting market dynamics.

Restraints

A big problem for thermal paper is how its production and disposal impact the environment. The chemicals, especially BPA, used in making it raise worries about the environment and people’s

health. These chemicals also make it hard to recycle thermal paper, making it less eco-friendly.Plus, more folks switching to digital receipts means less need for paper ones, affecting the demand for thermal paper. Also, the costs of the materials used and worries about exposure to these chemicals could slow down how much the market grows.

Opportunities

- Innovation in Eco-friendly Solutions: There’s a big opportunity to develop thermal paper that’s more environment-friendly, without using harmful chemicals. Companies exploring safer alternatives

can capture this growing market demand. - Technological Advancements: With advancements, there’s room to make better quality thermal paper, with improved printing and durability. Creating papers that work even better with new

printing technology can boost its appeal. - Specialized Applications: Finding new uses for thermal paper beyond receipts and labels, like in healthcare or shipping, can open up new markets and drive growth.

- Sustainable Initiatives: Embracing sustainability trends and promoting recyclable or biodegradable thermal paper can attract environmentally-conscious consumers and industries.

- Health-Conscious Alternatives: Developing thermal paper free from potentially harmful chemicals can address health concerns, appealing to those looking for safer options.

- International Expansion: Exploring markets in developing countries where digital transactions are still growing can create new opportunities for thermal paper usage.

Challenges

- Image Fading: The pictures or words on thermal paper can vanish over time due to heat, light, or moisture. This makes important records hard to read, especially for keeping them a long time.

- BPA Worries: Some thermal paper has a chemical called BPA, which can cause health issues. It might get on your skin or into food, causing potential problems.

- Harming the Environment: Making thermal paper uses chemicals and energy, which isn’t good for the environment. And when we get rid of it, it can harm nature if not handled properly.

- Digital Takeover: More people are using digital receipts and records instead of paper ones, which means less need for thermal paper. This is tough for the thermal paper industry.

- Cost Changes: The stuff used to make thermal paper can sometimes get really expensive or cheap suddenly. This makes planning and pricing hard for companies.

- Fake Copies: It’s easy to copy thermal paper, especially for important things like money or official papers. This could lead to problems like losing money or security issues.

- Handling Needs: Storing and handling thermal paper well is super important. If it’s in extreme temperatures or light, the pictures or words can vanish faster.

- Finding Eco-friendly Options: People are looking for better alternatives to thermal paper that are kinder to the environment. But finding ones that work well, don’t cost a lot, and everyone likes is tricky.

Regional Analysis

The Asia Pacific region was the dominant market, accounting for more than 34.2% of total revenue in 2023. Due to rapid growth in the retail sector and rising demand for healthcare products, billing operations have seen a rise in product utilization. The market has also seen a rise in cashless payments and contactless payments. Europe is now a major manufacturing center for nutritional supplements and other products.

This is due to the presence of prebiotic manufacturers such as Friesland Campina Doo (The Netherlands) and Beneo (Belgium). These companies are gradually adopting labels and tags in order to comply with the labeling standards and prevent adulteration. From 2023 to 2032, the MEA regional market will experience the second-highest average CAGR.

This is due to high product demand, which has been attributed to an increase in the number of shopping malls and retail stores in Saudi Arabia. Over the forecast period, U.S. product demand is expected to increase at a 4.6% CAGR. Major food and beverage products companies such as Tyson Foods, Cargill Foods, and JBF are expected to increase the use of printed labels and tags. This will likely fuel product demand.

A detailed analysis of key regions is given below including North America, Europe, Asia- Pacific, South America, and Middle East & Africa.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global market is highly oligopolistic and fierce price competition exists between companies. This market is highly competitive and has tight margins. Companies’ profitability is heavily dependent on the price of raw materials as well as the automation required to make the production process more efficient. The industry profit margins also vary depending on the level of integration.

Market key players are given including Oji Holdings Corp., Appvion Inc, Koehler Group, Mitsubishi Paper Mills Ltd., Hansol Paper Co. Ltd., Gold Huasheng Paper Co. Ltd., Henan Province JiangHe Paper Co. Ltd., Thermal Solutions International Inc., Iconex LLC, Twin Rivers Paper Company, Rotolificio Bergamasco Srl, Jujo Thermal Ltd and other key companies, and key trends.

Маrkеt Кеу Рlауеrѕ

- Oji Holdings Corp.

- Appvion Inc

- Koehler Group

- Mitsubishi Paper Mills Ltd.

- Hansol Paper Co. Ltd.

- Gold Huasheng Paper Co. Ltd.

- Henan Province JiangHe Paper Co. Ltd.

- Thermal Solutions International Inc.

- Iconex LLC

- Twin Rivers Paper Company

- Rotolificio Bergamasco Srl

- Jujo Thermal Ltd

Recent Development

June 2023: Appvion introduces its new, sustainable, patent-pending Next Generation technology direct thermal coating that is free of phenolic developers, including BPA, BPS, and other phenols.

Next Generational Technology coating creates heat-stable, legible, dark images on paper and film labels, tickets, tags, and point-of-sale applications while complying with environmental regulations

and corporate sustainability initiatives.March 2023: Twin Rivers announced that it finalized the sale of Plaster Rock Lumber Corporation, its softwood lumber mill in Plaster Rock, New Brunswick, to eastern Canadian lumber manufacturer and

North American forest products leader Groupe Lebel. The sale advances Twin Rivers’ strategy of investing in and growing its core business of specialty and kraft paper production.Report Scope

Report Features Description Market Value (2023) USD 4.15 Billion Forecast Revenue (2033) USD 6.3 Billion CAGR (2023-2032) 4.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Printing Technology (Direct Thermal, Thermal Transfer, Others), By Width (2.25” (57mm) and 3.125” (80mm)), By Application (Lottery & Gaming, Point of Sale (PoS), and Tags & Labels) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Oji Holdings Corp., Appvion Inc, Koehler Group, Mitsubishi Paper Mills Ltd., Hansol Paper Co. Ltd., Gold Huasheng Paper Co. Ltd., Henan Province JiangHe Paper Co. Ltd., Thermal Solutions International Inc., Iconex LLC, Twin Rivers Paper Company, Rotolificio Bergamasco Srl, Jujo Thermal Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is thermal paper?Thermal paper is a specialty paper coated with a chemical that changes color when exposed to heat. It doesn't require ink or toner for printing and is commonly used in various applications such as receipts, tickets, labels, and fax machines.

What are the primary advantages of thermal paper?Thermal paper offers several advantages, including fast printing speeds, no need for ink or ribbons, producing high-quality prints, and being cost-effective for certain applications.

What are the different types of thermal paper available?There are mainly three types of thermal paper: top-coated, standard thermal, and synthetic. Top-coated paper provides improved print quality and durability, standard thermal paper is commonly used for general purposes, and synthetic paper offers enhanced durability and resistance to environmental factors.

What industries use thermal paper?Thermal paper finds widespread use in various sectors such as retail (for receipts), transportation (for tickets), healthcare (for patient monitoring), banking (for ATM receipts), and entertainment (for event tickets and gaming).

-

-

- Oji Holdings Corp.

- Appvion Inc

- Koehler Group

- Mitsubishi Paper Mills Ltd.

- Hansol Paper Co. Ltd.

- Gold Huasheng Paper Co. Ltd.

- Henan Province JiangHe Paper Co. Ltd.

- Thermal Solutions International Inc.

- Iconex LLC

- Twin Rivers Paper Company

- Rotolificio Bergamasco Srl

- Jujo Thermal Ltd