Global Therapeutic Respiratory Devices Market Analysis By Product Type (Positive Airway Pressure (PAP) devices, Ventilators, Oxygen therapy devices, Nebulizers, Humidifiers, Airway clearance devices, Others), By Application (Chronic Obstructive Pulmonary Disease (COPD), Obstructive Sleep Apnea (OSA), Asthma, Respiratory distress syndrome, Others), By Patient Type (Pediatric, Adult, Geriatric), By End-User (Hospitals, Homecare settings, Specialty clinics, Emergency/Transport care, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167404

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

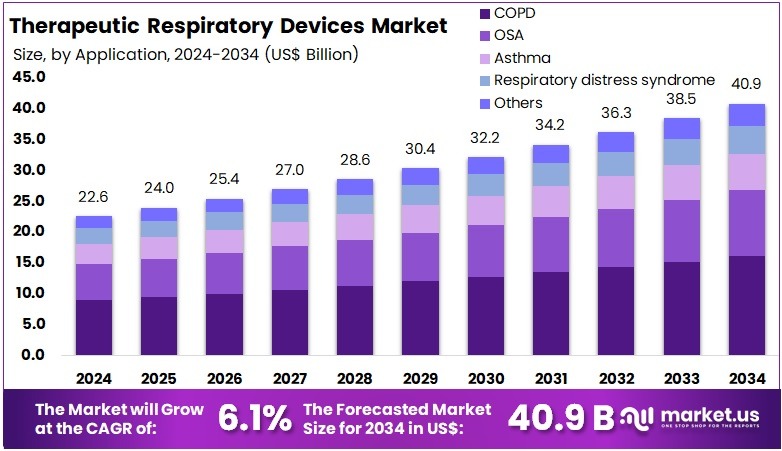

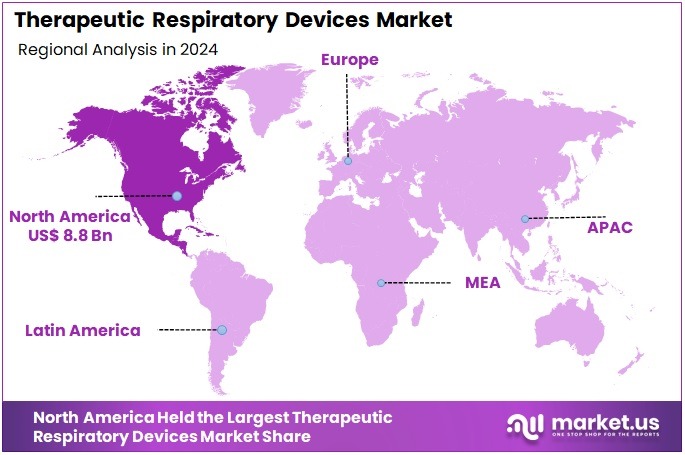

The Global Therapeutic Respiratory Devices Market size is expected to be worth around US$ 40.9 Billion by 2034, from US$ 22.6 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39.1% share and holds US$ 8.8 Billion market value for the year.

Therapeutic respiratory devices are used to support and improve lung function in patients with many conditions. These include asthma, COPD, sleep apnea, and acute respiratory failure in hospitals and at home. According to WHO estimates, more than 3 million people die from COPD each year, and about 3.5 million deaths were recorded in 2021, equal to 5% of all deaths. For example, COPD affects over 380 million people, while asthma affects 250–260 million and caused 455,000 deaths in 2019.

Demand for these devices is shaped by long-term disease management needs and changing care models. Patients are moving from hospital-based to home-based therapies as systems seek to cut costs and avoid readmissions. According to clinical practice trends, this shift favors inhalers, nebulizers, oxygen concentrators, humidifiers, CPAP/BiPAP systems, and non-invasive ventilators that can be safely used at home. For instance, this pattern supports recurring demand for device replacement, consumables, and remote monitoring solutions.

Population ageing is a core structural driver for the therapeutic respiratory devices market. Older adults show higher rates of COPD, asthma, sleep apnea, and chronic infections and often need support. According to WHO, 1 billion people were aged 60 or older in 2019, rising to 1.4 billion by 2030 and 2.1 billion by 2050. By 2030 one in six people will be 60 or above, and the share in South-East Asia is expected to almost double between 2024 and 2050.

Environmental exposures add further pressure on respiratory health and device demand. Many households still rely on solid fuels and inefficient stoves, especially in low- and middle-income countries. According to WHO, around 2.1 billion people, equal to about one third of the world’s population, cook with polluting fuels that generate hazardous indoor air. For instance, household air pollution caused an estimated 3.2 million deaths in 2020, including more than 237,000 deaths in children under five.

Evolving Demand Patterns and Strategic Growth Determinants

Tobacco use and lifestyle factors reinforce these trends in a significant way. Smokers face higher risks of COPD, lung cancer, and cardiovascular disease, which often require oxygen therapy and ventilatory support. Study by global health agencies indicates that about 1.3 billion people use tobacco, and nearly 80% of them live in low- and middle-income countries where COPD burden is rising. For example, this concentration of risk is expected to sustain demand for inhalers, oxygen devices, and airway clearance systems.

Respiratory infections and epidemic threats are also shaping investment decisions. Health systems remain concerned about surge capacity for intensive care and emergency departments. According to global mortality data, lower respiratory infections were the fifth leading cause of death in 2021, highlighting the persistent burden beyond chronic disease. For instance, the COVID-19 pandemic pushed hospitals and governments to expand fleets of ventilators, high-flow oxygen systems, and advanced monitoring devices for respiratory support.

Health policies and global initiatives are providing an additional layer of support for market growth. Chronic respiratory diseases have been placed by WHO in the core group of noncommunicable diseases that require priority action. Study by WHO notes that asthma inhalers are now recognized as essential medicines and included in many national primary care packages. For example, public procurement and reimbursement programs are widening access to nebulizers, oxygen therapy devices, and cost-effective inhaled treatments, especially in low- and middle-income countries.

Diagnostic gaps and care-model innovation are influencing the future outlook of this sector. Many countries still have limited access to spirometry and point-of-care lung function testing in primary care. As programs expand screening and standardize diagnostic protocols, more patients are likely to receive earlier and continuous treatment using home-care respiratory devices. For instance, urbanization and rising incomes are encouraging adoption of digital inhalers, portable oxygen concentrators, sleep apnea devices, and remote monitoring tools that support home-based respiratory care.

Key Takeaways

- The market is projected to reach nearly US$ 40.9 Billion by 2034, rising from US$ 22.6 Billion in 2024, supported by a steady 6.1% growth rate.

- Positive Airway Pressure devices were noted as the leading product type in 2024, accounting for over 34.3% of total global revenue share.

- Chronic Obstructive Pulmonary Disease applications represented the largest application segment in 2024, contributing more than 39.5% of the overall market demand.

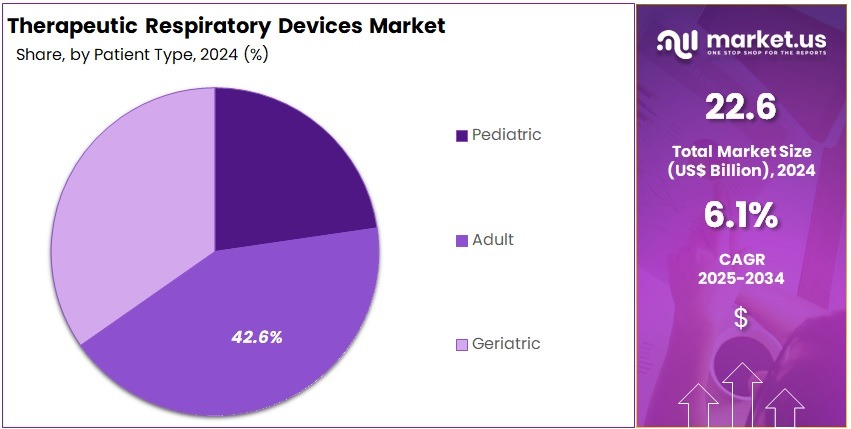

- Adult patients formed the dominant patient group in 2024, with this segment securing over 42.6% of the total market share.

- Hospitals served as the primary end-user group in 2024, capturing more than 53.0% of total utilization within the therapeutic respiratory devices landscape.

- North America emerged as the leading regional market in 2024, commanding over 39.1% share and generating approximately US$ 8.8 Billion in value.

Product Type Analysis

In 2024, the Positive Airway Pressure (PAP) devices held a dominant market position in the Product Type Segment of the Therapeutic Respiratory Devices Market, and captured more than a 34.3% share. This lead was driven by high adoption in home-care settings. Strong clinical effectiveness also supported patient use. Demand increased with rising sleep apnea cases. Broader reimbursement access encouraged device selection. Continued design improvements strengthened segment preference. Market awareness continued to rise.

The ventilators segment showed strong progress. Demand increased due to higher cases of chronic respiratory failure. Intensive care units used advanced systems for better support. Portable models improved treatment access. Oxygen therapy devices also expanded steadily. Growth was driven by rising COPD prevalence. Home-based therapy gained acceptance. Lightweight designs improved patient comfort. Continuous improvements enhanced clinical outcomes. Broader use in long-term care settings supported additional market growth. Adoption continued to rise.

The nebulizers segment recorded steady demand. Rising asthma cases increased product use. Simple operation supported patient adherence. Compact designs improved home-care use. The humidifiers segment also grew. Better humidification reduced airway irritation. Integration with PAP and ventilator systems expanded usage. Airway clearance devices advanced gradually. Higher cases of cystic fibrosis and bronchiectasis increased need. Non-invasive designs supported acceptance. The others segment included supportive tools. Broader adoption reflected increasing focus on integrated respiratory care. Market demand remained stable.

Application Analysis

In 2024, the ‘Chronic Obstructive Pulmonary Disease (COPD)’ held a dominant market position in the Application Segment of the Therapeutic Respiratory Devices Market and captured more than a 39.5% share. This leadership was driven by the high burden of chronic respiratory diseases. The demand for long-term ventilation and oxygen therapy supported growth. Adoption of advanced non-invasive systems increased steadily. Rising diagnosis rates also strengthened segment performance. Continuous clinical need ensured stable device utilization across diverse care settings.

The Obstructive Sleep Apnea segment showed solid expansion. Growth was supported by the rising incidence of sleep-related breathing disorders. CPAP and BiPAP systems were widely used for effective treatment. Awareness programs encouraged early detection. This shift contributed to higher device uptake. The Asthma segment also recorded steady progress. Increased prevalence in children and adults supported device demand. Smart inhalation and monitoring tools improved outcomes. These tools enhanced treatment adherence and supported market stability.

The Respiratory Distress Syndrome segment gained attention in neonatal units. The need for early respiratory support increased. Oxygen therapy and surfactant systems were used more often. This trend improved survival outcomes. The Others segment included various conditions that required respiratory care. Use of oxygen concentrators and humidifiers grew across emergency and home-care settings. Broader applications supported overall market expansion. These combined trends helped maintain steady growth across all application segments.

Patient Type Analysis

In 2024, the ‘Adult’ held a dominant market position in the Patient Type Segment of the Therapeutic Respiratory Devices Market, and captured more than a 42.6% share. This segment showed strong demand. Chronic respiratory diseases were widely reported in adults. Rising pollution exposure increased device usage. Home-care breathing support also expanded adoption. Smoking-related disorders pushed demand upward. The segment benefited from better access to diagnostic tools and improved treatment awareness.

The pediatric segment showed moderate growth. Rising cases of asthma increased device needs. Early diagnosis improved treatment demand. Neonatal respiratory issues supported the use of specialized systems. Child-friendly interfaces enhanced adherence. Hospitals adopted advanced inhalation devices for better care. Awareness programs encouraged early intervention. The segment’s expansion was linked to improved healthcare access and rising parental focus on timely respiratory support. Steady innovation in low-pressure ventilation solutions strengthened its long-term outlook.

The geriatric segment recorded notable growth. Age-related decline in lung function increased reliance on therapeutic devices. COPD prevalence remained high in older groups. Portable oxygen units saw strong uptake. Non-invasive ventilation gained acceptance due to ease of use. Better home-care infrastructure improved device adoption. Supportive reimbursement systems encouraged wider usage. The segment benefited from an expanding elderly population and growing awareness of early respiratory management. Continuous technological progress strengthened long-term demand.

End-User Analysis

In 2024, the “Hospitals” held a dominant market position in the End-User Segment of the Therapeutic Respiratory Devices Market, and captured more than a 53.0% share. Hospitals reported strong demand due to advanced equipment use. High patient inflow increased the need for reliable respiratory support. Standard treatment protocols enhanced device adoption. Skilled staff improved clinical outcomes. This supported steady utilization. These factors maintained the hospital segment’s leading role in the market.

Homecare settings recorded rising adoption. The demand was driven by portable respiratory devices. Patients preferred convenient care at home. Remote monitoring improved treatment adherence. Cost efficiency supported the shift away from hospital use. Specialty clinics also expanded their role. Focused respiratory services improved therapy accuracy. The presence of trained specialists enhanced care delivery. Demand increased due to chronic disease burden. Device accessibility improved patient outcomes. These factors strengthened growth across homecare and specialty clinic environments.

Emergency and transport care showed consistent usage. The need for rapid respiratory support increased device adoption. Portable ventilators were used widely in critical cases. Rising trauma incidents supported demand. Other end-users included long-term care centers and rehabilitation facilities. These settings required reliable systems for chronic disease management. Preventive care initiatives encouraged early therapy use. Growing awareness improved adoption. These combined factors supported stable growth across emergency, transport, and other care environments.

Key Market Segments

By Product Type

- Positive Airway Pressure (PAP) devices

- Continuous PAP (CPAP) Machines

- Bilevel PAP (BiPAP/BPAP) Machines

- Autotitrating (adjustable) PAP (APAP)

- Ventilators

- Invasive Ventilation

- Non-Invasive Ventilation

- Oxygen therapy devices

- Stationary Oxygen Concentrators

- Portable Oxygen Concentrators

- Nebulizers

- Jet Nebulizers

- Ultrasonic Nebulizers

- Mesh Nebulizers

- Humidifiers

- Central Humidifiers

- Evaporators

- Impeller Humidifiers

- Steam vaporizers

- Ultrasonic Humidifiers

- Airway clearance devices

- Laryngeal Mask Airways (LMAs)

- Endotracheal Tubes (ETTs)

- Others

- Others

By Application

- Chronic Obstructive Pulmonary Disease (COPD)

- Obstructive Sleep Apnea (OSA)

- Asthma

- Respiratory distress syndrome

- Others

By Patient Type

- Pediatric

- Adult

- Geriatric

By End-User

- Hospitals

- Homecare settings

- Specialty clinics

- Emergency/Transport care

- Others

Drivers

Rapid Expansion Of Remote Monitoring And Tele-Health Integration In Respiratory Care

The expansion of remote monitoring and tele-health integration has been reshaping clinical expectations in respiratory care. The shift toward home-based supervision has increased the importance of devices that support continuous assessment, data transmission and proactive intervention. This transition has encouraged healthcare systems to prioritise technologies that enhance patient engagement and reduce hospital visits. According to industry observations, the surge in connected care models has elevated the strategic importance of digital features in therapeutic respiratory devices and strengthened demand for intelligent, interoperable solutions across care settings.

The adoption of digital platforms has transformed how chronic respiratory conditions are managed outside hospitals. The ability to observe patients in real time has supported early detection of deterioration and improved adherence to therapy. These capabilities have reinforced the need for devices that integrate seamlessly with tele-health workflows. According to recent reviews, digital health solutions such as home spirometry systems, wearables and remote monitoring tools have become widely utilised in respiratory medicine, reflecting a strong shift toward structured and technology-enabled care delivery.

The evolution of standardised monitoring frameworks has further strengthened this trend. Health systems have increasingly relied on structured data to guide decisions, improve follow-up and maintain treatment precision. This development has highlighted the requirement for therapeutic respiratory devices that can produce reliable data and integrate with clinical dashboards. According to a 2024 review, home-based monitoring for chronic lung diseases has been standardised through the PANACEA framework, which has improved consistency and supported broader adoption of remote respiratory management models.

The feasibility and clinical value of connected monitoring systems have also been demonstrated through practical implementations. Real-world applications have shown that continuous oversight supports timely intervention and enhances patient outcomes. These findings have encouraged manufacturers to embed smart sensors, wireless connectivity and analytics functions into therapeutic devices. For example, a study by Formative in 2023 confirmed that a remote monitoring programme enabled real-time data collection and clinician feedback, proving the effectiveness of digitally supported respiratory care and reinforcing demand for advanced, connected therapeutic respiratory devices.

Restraints

Suboptimal Device Usage And Poor Patient Inhaler Technique Limit The Effective Demand For Advanced Devices

The market has been constrained by persistent gaps in patient proficiency and device handling. Suboptimal inhaler technique has reduced therapeutic success and limited the real impact of advanced respiratory systems. The restraint has been reinforced by challenges in training, inconsistencies in patient adherence, and variations in device design. As a result, the effective demand for technologically advanced inhalers has not matched the pace of product development. This gap has influenced adoption trends and has slowed the expected expansion of therapeutic respiratory devices.

The prevalence of incorrect usage has been recognized as a major clinical barrier. Many patients continue to struggle with operational steps, dose coordination, and breathing synchronization. These issues have affected treatment efficiency and have created a disconnect between device availability and real-world outcomes. According to several assessments, the persistence of poor technique has reduced the clinical value of new technologies. This limitation has also heightened the need for continuous patient education and consistent provider support.

Evidence from observational research has reinforced the magnitude of incorrect use. For instance, a study by PMC involving 764 COPD patients showed that 28% to 68% of users employed their inhalers incorrectly. The widespread nature of these errors has affected disease control and has contributed to poorer therapeutic responses. The data indicated that even well-designed products perform below expectations when patients are unable to follow correct operational steps. This pattern has contributed to restrained device demand and cautious adoption.

Economic studies have highlighted additional financial consequences of inhaler misuse. For example, an assessment reported by PMC estimated that non-adherence and misuse led to excess annual costs of about €923 per COPD patient and €263 per asthma patient in Spain. According to the same analysis, added expenses were also linked to device switching for non-clinical reasons. These financial burdens have discouraged rapid transitions to newer devices and have reinforced the restraint in the therapeutic respiratory devices market.

Opportunities

Growing Burden Of Chronic Respiratory Diseases In Underserved Regions With Unmet Device Access

The expanding incidence of chronic respiratory conditions is creating a strong growth window for therapeutic respiratory devices. The rising patient pool is driving the need for accessible and efficient treatment tools, particularly in regions where diagnosis and care remain limited. The opportunity is reinforced by increased interest in home-based and ambulatory care, where lower-cost devices support continuous management. The growing emphasis on early intervention and long-term disease control is expected to accelerate the adoption of devices that improve patient outcomes and reduce healthcare system pressures.

Large underserved populations further strengthen this opportunity. Many low- and middle-income countries continue to face gaps in diagnosis, treatment availability, and affordability. This unmet need can be addressed through portable, user-friendly, and economically viable therapeutic respiratory devices. Manufacturers able to deliver such solutions are positioned to expand their footprint. The shift toward decentralized care models is likely to increase demand for products that enable regular monitoring and consistent therapy at home or in community settings.

According to the World Health Organization, the global asthma burden reached roughly 262 million people in 2019, while around 455,000 deaths were reported. These figures illustrate the significant pressure created by chronic respiratory diseases and the urgent requirement for broader access to effective therapies. For example, populations with limited healthcare infrastructure often rely on devices that offer reliability, simplicity, and low maintenance. This dynamic establishes a favorable environment for companies that offer adaptable devices suited for diverse clinical and household applications.

A study by the World Health Organization also estimated that about 81.7 million people in the WHO European Region were living with chronic respiratory diseases in 2021. CRDs were reported as the sixth leading cause of death in that region. For instance, rising disease prevalence in both advanced and emerging markets increases the need for scalable device solutions. These statistics highlight the magnitude of demand and reinforce the long-term market potential for therapeutic respiratory devices designed to improve access, enhance care quality, and support preventive management.

Trends

Shift Toward Non-Invasive, Single-Device, Patient-Centric Therapy Systems Combining Inhalation Devices And Adherence Monitoring

A notable trend is emerging toward non-invasive and patient-centric therapy systems in the therapeutic respiratory devices market. The adoption of single-device platforms that integrate inhalation delivery and adherence monitoring has been increasing. The shift has been driven by the need for simplified treatment pathways and improved patient outcomes. The growth of connected solutions has supported continuous therapy oversight. This trend has been reinforced by rising focus on home-based care. The overall direction indicates sustained demand for streamlined respiratory therapy systems.

The integration of digital adherence tools with inhalation devices has improved treatment effectiveness. The approach has enabled real-time tracking and personalized intervention. The movement toward unified systems has reduced patient burden and minimized device complexity. For instance, smart sensors embedded in inhalers have been used to monitor dosage accuracy and inhalation patterns. The use of non-invasive formats has also supported better tolerability. Study by several clinical research groups indicated improved compliance when digital monitoring features were included.

According to industry assessments, connected inhalation platforms have shown an ability to reduce exacerbations in chronic respiratory conditions. The systems have combined medication delivery, symptom tracking, and feedback loops in one device. For example, companies developing smart inhalers have reported higher patient engagement levels. The integration of cloud-based analytics has allowed clinicians to adjust therapy remotely. The trend has aligned with broader digital health adoption. The emphasis on remote monitoring has strengthened the position of integrated respiratory devices.

Market evaluations suggested that the demand for unified respiratory therapy systems will continue to expand. According to multiple surveys, patients have expressed preference for single-device solutions that simplify disease management. For instance, digital inhalers supported by adherence-tracking algorithms have shown promising results in long-term management of asthma and COPD. Study by technology developers demonstrated enhanced data accuracy through device-embedded sensors. This direction reflects a cautiously optimistic outlook for advanced, non-invasive respiratory therapeutics.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 39.1% share and holds US$ 8.8 Billion market value for the year. Strong healthcare systems supported this leadership. High awareness of chronic respiratory diseases increased the use of therapeutic devices. The growing elderly population added further pressure on respiratory care needs. Early adoption of advanced technologies strengthened device penetration. These factors created a stable growth environment and kept demand high across clinical and home-care settings.

The region’s growth was driven by the high prevalence of asthma, COPD, and sleep-related breathing disorders. These conditions supported strong demand for ventilators, nebulizers, and non-invasive systems. Healthcare spending remained high in the United States and Canada. This encouraged rapid adoption of respiratory solutions across hospitals and home settings. Supportive reimbursement policies improved patient access. Insurance coverage for home-based therapies helped increase use. Skilled respiratory therapists improved treatment compliance and enhanced overall patient outcomes.

Technology adoption continued to strengthen the regional landscape. Digital monitoring tools and connected respiratory systems gained wider acceptance. These systems improved patient management and supported better long-term care. The region benefited from strong clinical expertise and early diagnosis practices. This helped maintain steady product usage across diverse care settings. Combined with high awareness and supportive healthcare policies, these factors ensured that North America remained the largest revenue contributor and influenced global trends in therapeutic respiratory devices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The therapeutic respiratory devices market is shaped by established global leaders. Philips, Medtronic, and GE HealthCare maintain strong positions in acute and non-acute respiratory care. Their portfolios cover ventilators, monitoring technologies, and connected respiratory systems. Growth has been supported by rising demand for integrated ICU solutions. These companies benefit from extensive global networks and long-term hospital partnerships. Their strategies remain focused on digitization, data integration, and expansion in high-growth markets. The competitive strength of these firms continues to influence market consolidation and technology standards.

Specialized respiratory care companies also contribute significantly to market growth. ResMed leads the home-care segment with advanced PAP devices and digital monitoring platforms. Fisher & Paykel Healthcare strengthens its presence through humidification and high-flow therapy systems supported by clinical evidence. Drägerwerk focuses on ICU ventilation and anesthesia devices with strong emphasis on safety and reliability. Hamilton Medical enhances the market through intelligent ventilation technologies. These companies drive innovation in both hospital and home-based respiratory management, improving therapeutic outcomes.

Home-care oxygen therapy manufacturers play a crucial role in expanding respiratory treatment access. CAIRE Inc., Inogen Inc., and Invacare Corporation provide portable and stationary oxygen concentrators designed for long-term use. Their offerings support the shift toward home-based care and improved patient mobility. O₂ Concepts strengthens this segment with hybrid concentrators that combine continuous and pulse-dose delivery. Drive DeVilbiss Healthcare positions itself as a value-focused supplier. These players support market growth through cost-effective devices and strong distribution networks across developed and emerging regions.

Several adjacent and niche players broaden the competitive landscape. Vyaire Medical maintains a strong ventilator portfolio, while Teleflex supports demand through respiratory consumables and airway management products. ICU Medical contributes through critical-care ventilation solutions. Shenzhen Mindray Bio-Medical advances rapidly in emerging markets with feature-rich ventilators. Hillrom and Löwenstein Medical enhance the market with specialized respiratory and sleep therapy devices. Collectively, these companies diversify product offerings, strengthen supply stability, and support wider adoption of advanced respiratory therapies.

Market Key Players

- ResMed

- Koninklijke Philips N.V.

- Medtronic

- GE HealthCare

- Drägerwerk AG & Co. KGaA

- Fisher & Paykel Healthcare

- Hamilton Medical

- Vyaire Medical

- Drive DeVilbiss Healthcare

- CAIRE Inc.

- Invacare Corporation

- O₂ Concepts

- Inogen Inc.

- Teleflex Incorporated

- ICU Medical

- Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

- Hillrom

- Löwenstein Medical SE

Recent Developments

- In February 2024: ResMed launched the AirCurve 11 bilevel PAP devices (including AirCurve 11 VAuto) for obstructive sleep apnea. The devices provide higher pressure during inhalation and lower pressure during exhalation to better match natural breathing and improve comfort and adherence, and are integrated into ResMed’s connected digital ecosystem for therapy monitoring.

- In February 2024: Medtronic abandoned the PMRI spin-off plan and decided instead to exit its ventilator product line while consolidating patient monitoring and remaining respiratory activities into a restructured business unit. The change in strategy was disclosed together with fiscal 2024 results and was described as a response to the ventilator line’s weak profitability and changing post-pandemic demand.

- In January 2024: Philips agreed with the US Department of Justice and FDA on the terms of a consent decree focused on its Respironics sleep and respiratory care business. Under this agreement, Philips Respironics will not sell new CPAP, BiPAP or other respiratory care devices in the United States until defined remediation and quality-system requirements are met, although servicing of existing devices and supply of accessories and consumables continues.

- In January 2024: GE HealthCare issued an Urgent Medical Device Correction regarding optional EVair and Jun-Air compressors used with its CARESCAPE R860 and Engström Carestation/Pro ventilators, after preliminary testing indicated potential for elevated formaldehyde levels. The communication, subsequently highlighted by the FDA and trade press, advised users on mitigation steps while the company investigated and addressed the issue across affected ventilator installations.

Report Scope

Report Features Description Market Value (2024) US$ 22.6 Billion Forecast Revenue (2034) US$ 40.9 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Positive Airway Pressure (PAP) devices, Ventilators, Oxygen therapy devices, Nebulizers, Humidifiers, Airway clearance devices, Others), By Application (Chronic Obstructive Pulmonary Disease (COPD), Obstructive Sleep Apnea (OSA), Asthma, Respiratory distress syndrome, Others), By Patient Type (Pediatric, Adult, Geriatric), By End-User (Hospitals, Homecare settings, Specialty clinics, Emergency/Transport care, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ResMed, Koninklijke Philips N.V., Medtronic, GE HealthCare, Drägerwerk AG & Co. KGaA, Fisher & Paykel Healthcare, Hamilton Medical, Vyaire Medical, Drive DeVilbiss Healthcare, CAIRE Inc., Invacare Corporation, O₂ Concepts, Inogen Inc., Teleflex Incorporated, ICU Medical, Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Hillrom, Löwenstein Medical SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Therapeutic Respiratory Devices MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Therapeutic Respiratory Devices MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ResMed

- Koninklijke Philips N.V.

- Medtronic

- GE HealthCare

- Drägerwerk AG & Co. KGaA

- Fisher & Paykel Healthcare

- Hamilton Medical

- Vyaire Medical

- Drive DeVilbiss Healthcare

- CAIRE Inc.

- Invacare Corporation

- O₂ Concepts

- Inogen Inc.

- Teleflex Incorporated

- ICU Medical

- Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

- Hillrom

- Löwenstein Medical SE