Global Textile Market Size, Share, Growth Analysis By Raw Material (Synthetic Fibers [Polyester, Nylon, Rayon/Viscose, Acrylic, Polypropylene], Natural Fibers [Cotton, Wool, Silk], Recycled Fibers, Others),By Process/Technology (Woven, Knitted, Non-woven [Spunlaid (Spunbond/Melt-blown), Dry-laid Hydro-entangled, Wet-Laid, Needle-punched], 3-D Weaving & Spacer Fabrics),By Application (Fashion & Clothing [Apparel, Ties & Clothing, Handbags, Others], Household [Bedding, Kitchen, Upholstery, Towel, Others], Technical [Construction, Transport, Medical, Protective], Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174527

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

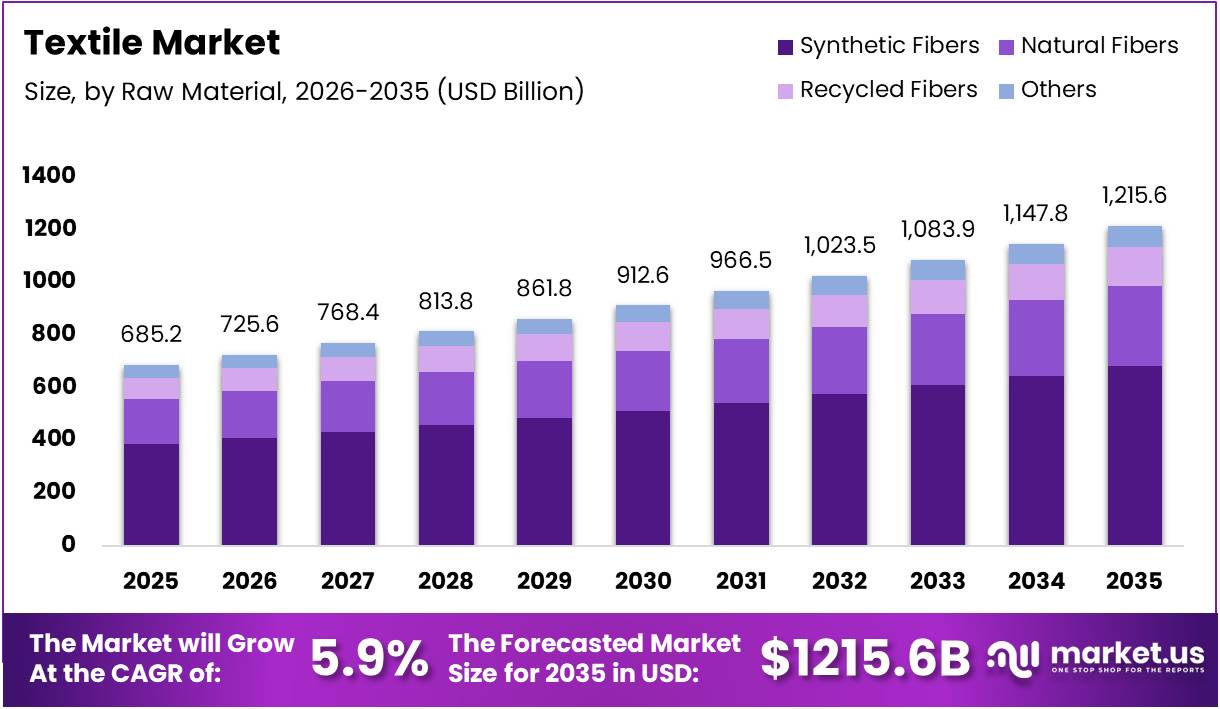

The Global Textile Market size is expected to be worth around USD 1215.6 Billion by 2035, from USD 685.2 Billion in 2025, growing at a CAGR of 5.9% during the forecast period from 2026 to 2035.

The textile market represents a fundamental pillar of global manufacturing, encompassing fabric production, fiber processing, and finished goods creation. This industry transforms raw materials into wearable products and home furnishings through intricate supply chains. Consequently, understanding market dynamics becomes essential for strategic planning and investment decisions in this evolving sector.

Currently, the textile industry demonstrates robust growth potential driven by rising consumer demand and population expansion. Emerging markets particularly fuel this upward trajectory as disposable incomes increase steadily. Moreover, shifting fashion trends and fast-fashion consumption patterns create continuous opportunities. Therefore, manufacturers continuously adapt production capabilities to meet diverse consumer preferences and market requirements.

Digital transformation presents significant opportunities as companies embrace technological innovation to enhance operational efficiency. Advanced manufacturing technologies streamline production processes while reducing waste and improving quality control. Additionally, automation enables faster turnaround times and better inventory management. Subsequently, forward-thinking organizations gain competitive advantages through strategic technology investments and modernized infrastructure.

Government initiatives increasingly support textile manufacturing through policy frameworks and financial incentives. Regulatory bodies implement sustainability standards that reshape production methodologies and material sourcing decisions. Furthermore, trade agreements facilitate cross-border commerce while protecting domestic manufacturing interests. Hence, industry players must navigate complex regulatory landscapes while capitalizing on available governmental support mechanisms.

Consumer preferences reveal compelling insights into purchasing behavior and material selection patterns. According to research, 71% cite trying on clothes while 56% cite fabric feel as reasons for in-store purchase behavior. Environmental consciousness drives material choices, with 83% considering cotton and other natural fibers safe compared with less than 50% for polyester and rayon. Additionally, 67% globally rate cotton as the most comfortable fiber for everyday wear, demonstrating clear preference for natural materials.

Technological adoption continues reshaping operational frameworks across manufacturing facilities. Notably, approximately 45% of textile companies worldwide have adopted digital transformation technologies, including IoT, digital workflows, and automation systems. This technological integration fundamentally transforms production capabilities and market competitiveness in today’s digitally-driven landscape.

Key Takeaways

- The Global Textile Market is projected to grow from USD 685.2 Billion in 2025 to USD 1215.6 Billion by 2035, registering a CAGR of 5.9% during 2026–2035.

- By raw material, Synthetic Fibers lead the market with a dominant share of 56.2% in 2025, driven by large-scale adoption across apparel and industrial applications.

- By process/technology, Woven textiles account for the largest share at 44.9% in 2025, supported by established manufacturing infrastructure and broad end-use demand.

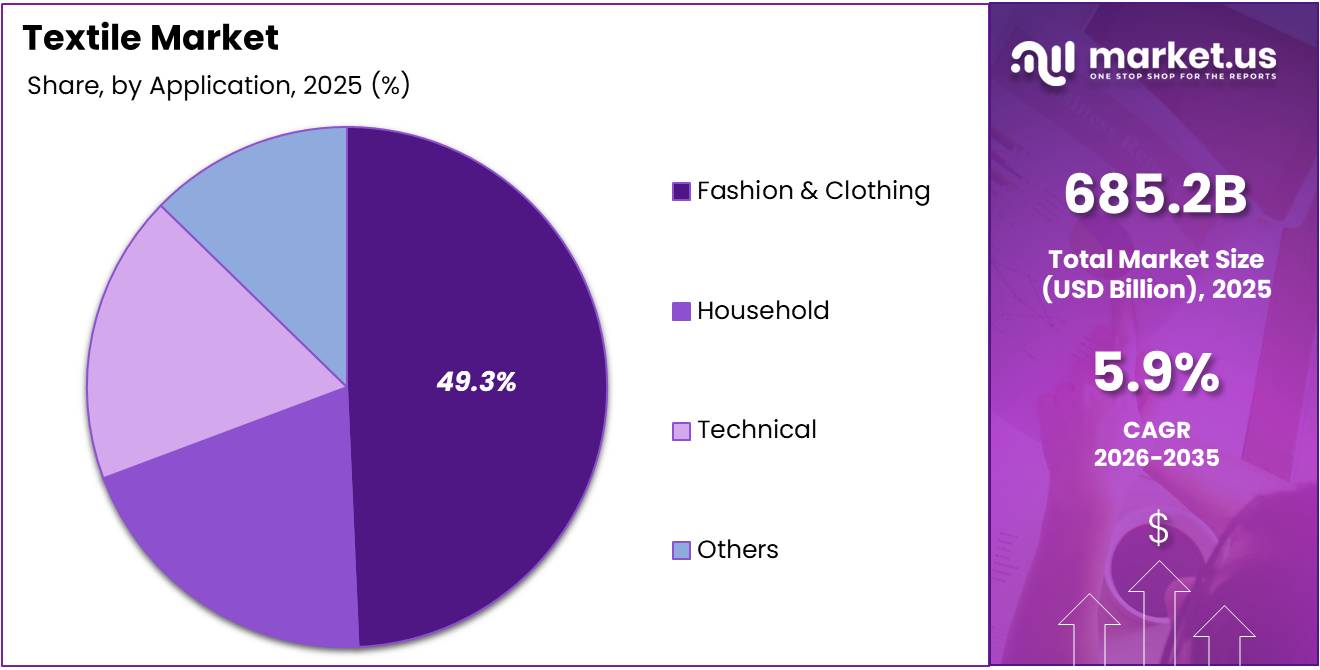

- By application, Fashion & Clothing remains the largest segment with a market share of 49.3% in 2025, reflecting consistent global consumer demand for apparel.

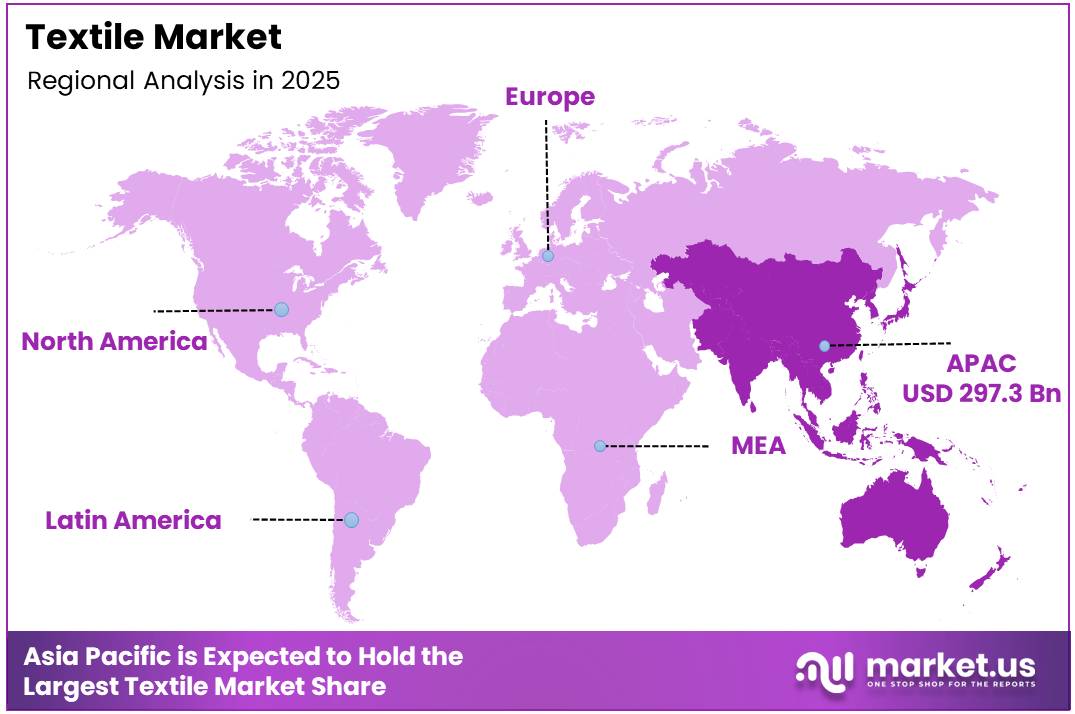

- Asia Pacific dominates the global textile market with a 43.4% share, valued at USD 297.3 Billion, positioning it as the leading production and consumption hub.

By Raw Material Analysis

Synthetic Fibers dominate with 56.2% due to their versatility and cost-effectiveness.

In 2025, Synthetic Fibers held a dominant market position in the By Raw Material Analysis segment of Textile Market, with a 56.2% share. This commanding presence stems from their exceptional versatility, durability, and affordability compared to traditional alternatives. Synthetic materials offer superior resistance to wear, wrinkles, and environmental factors while maintaining consistent quality across large-scale production.

Natural Fibers maintain significant relevance despite synthetic competition. Cotton, wool, silk, and linen appeal to eco-conscious consumers seeking sustainable, biodegradable options with superior breathability and comfort. The premium segment particularly values these materials for their luxurious feel and traditional craftsmanship, ensuring sustained demand in quality-focused and sustainability-driven niche markets.

Recycled Fibers represent the fastest-growing category, driven by circular economy initiatives and environmental regulations. Brands increasingly incorporate post-consumer waste and regenerated materials into their production lines, responding to consumer pressure for sustainable practices. This segment benefits from technological advancements that improve recycled fiber quality.

Others encompass specialty fibers including blends, bio-based innovations, and experimental materials such as bamboo, hemp, and recycled composites. These alternatives cater to specific technical requirements and emerging applications in performance wear, medical textiles, and sustainable fashion, supporting continuous textile industry evolution and meeting niche market demands.

By Process/Technology Analysis

Woven dominates with 44.9% due to its widespread application and established manufacturing infrastructure.

In 2025, Woven textiles dominated the Textile Market’s process segment with a 44.9% share, reflecting the technique’s reliability and versatility. Woven fabrics offer exceptional strength, stability, and diverse patterns through interlacing threads. Their durability and professional appearance make them essential across apparel and home furnishings, supported by mature production technologies ensuring consistent quality and cost efficiency.

Knitted technology offers distinct advantages through flexibility, stretchability, and comfort properties. This process creates fabrics with superior elasticity and shape retention, making them ideal for activewear, undergarments, and casual clothing. Knitted materials require less raw material waste during production and adapt quickly to fashion trends through rapid manufacturing capabilities, appealing to fast-fashion brands and performance apparel manufacturers.

Non-woven processes revolutionize textile production by bonding fibers mechanically, chemically, or thermally without traditional weaving or knitting. These techniques produce cost-effective materials for disposable products, medical applications, filters, and geotextiles. Non-woven fabrics offer customizable properties and rapid production speeds, addressing specialized industrial requirements.

3-D Weaving & Spacer Fabrics represent advanced technologies creating complex three-dimensional structures with enhanced performance characteristics. These innovations serve technical textiles, automotive interiors, aerospace applications, and sports equipment where lightweight strength and cushioning properties prove essential.

By Application Analysis

Fashion & Clothing dominates with 49.3% due to continuous consumer demand and trend-driven purchasing behavior.

In 2025, Fashion & Clothing held a dominant market position in the By Application Analysis segment of Textile Market, with a 49.3% share. This segment’s dominance reflects the fundamental human need for apparel combined with fashion’s dynamic nature driving constant renewal. Consumers across demographics continuously purchase clothing for practical needs, style expression, and social positioning.

Household applications encompass home textiles including bedding, curtains, upholstery, towels, and decorative fabrics. This segment benefits from home improvement trends, interior design evolution, and lifestyle upgrades. Consumers invest in quality household textiles for comfort enhancement, aesthetic appeal, and functional performance.

Technical textiles serve specialized industrial, medical, automotive, construction, and protective applications requiring specific performance characteristics. This segment experiences robust growth through innovation-driven demand across sectors needing advanced materials with properties like flame resistance, waterproofing, antimicrobial protection, and high tensile strength.

Others include agricultural textiles, sports and leisure applications, protective gear, filtration systems, and emerging niche markets such as smart textiles and wearable technology. These applications address specific functional requirements like UV resistance, moisture management, and performance enhancement, representing opportunities for specialized manufacturers developing targeted solutions for evolving market needs and innovative end-use sectors.

Key Market Segments

By Raw Material

- Synthetic Fibers

- Polyester

- Nylon

- Rayon/Viscose

- Acrylic

- Polypropylene

- Natural Fibers

- Cotton

- Wool

- Silk

- Recycled Fibers

- Others

By Process/Technology

- Woven

- Knitted

- Non-woven

- Spunlaid (Spunbond/Melt-blown)

- Dry-laid Hydro-entangled

- Wet-Laid

- Needle-punched

- 3-D Weaving & Spacer Fabrics

By Application

- Fashion & Clothing

- Apparel

- Ties & Clothing

- Handbags

- Others

- Household

- Bedding

- Kitchen

- Upholstery

- Towel

- Others

- Technical

- Construction

- Transport

- Medical

- Protective

- Others

Drivers

Strong Demand for Synthetic and Blended Fibers Drives Market Growth

The textile market is experiencing robust growth driven by increasing preference for synthetic and blended fibers. These materials offer superior durability, cost-effectiveness, and versatility compared to traditional options. Industries beyond fashion are adopting these fibers for technical applications including automotive components, construction materials, and protective gear.

The global fashion industry continues expanding rapidly, fueled by constant product innovation and changing consumer preferences. Designers and manufacturers are introducing new textures, patterns, and functional fabrics at unprecedented speeds. Fast fashion trends and seasonal collections create continuous demand for diverse textile materials. E-commerce growth has further accelerated market expansion by connecting manufacturers with global consumers.

Textiles are penetrating non-traditional sectors at remarkable rates. Infrastructure projects increasingly incorporate geotextiles for soil stabilization and drainage systems. The automotive industry uses advanced textiles for interior components and lightweight structural elements. Healthcare facilities depend on specialized medical textiles for surgical supplies, wound care products, and patient comfort items.

Restraints

Environmental Impact Concerns Restrain Market Expansion

The textile industry faces significant challenges regarding environmental sustainability. Fiber production processes consume massive amounts of water, energy, and chemicals, generating substantial pollution. Textile waste has become a critical global issue as millions of tons end up in landfills annually. Fast fashion culture exacerbates this problem by encouraging rapid disposal of garments.

Consumer awareness about ecological damage is shifting purchasing behaviors away from conventional textiles. Brands face mounting pressure to demonstrate environmental responsibility throughout their supply chains. The carbon footprint associated with synthetic fiber production draws particular criticism from sustainability advocates.

Natural fiber supply presents inherent vulnerabilities that constrain market stability. Cotton, wool, and linen production depends heavily on favorable weather conditions and seasonal growing patterns. Climate change introduces unpredictability through droughts, floods, and temperature extremes that damage crops. Geographic concentration of natural fiber production in specific regions creates supply chain risks.

Growth Factors

Rising Adoption of Recycled and Bio-Based Fibers Creates Growth Opportunities

The textile market is witnessing transformative opportunities through sustainable fiber innovations. Recycled materials from plastic bottles, ocean waste, and post-consumer textiles are gaining commercial traction. Bio-based fibers derived from bamboo, hemp, and agricultural waste offer renewable alternatives to conventional options. Brands across all segments are incorporating these materials to meet sustainability goals and consumer expectations.

Medical and hygiene sectors present exceptional growth potential for non-woven textiles. Disposable medical products including surgical gowns, masks, and sterile drapes require reliable non-woven materials. Personal hygiene items such as diapers, sanitary products, and wet wipes depend entirely on specialized non-woven fabrics. The healthcare industry’s expansion in emerging markets drives demand for affordable medical textiles.

Advanced textile technologies are opening entirely new market segments. Three-dimensional fabrics provide enhanced cushioning and breathability for automotive seating and athletic footwear. Spacer fabrics create lightweight structural solutions for aerospace and sports equipment applications. These innovations command premium pricing while addressing specific performance requirements that conventional textiles cannot meet effectively.

Emerging Trends

Rapid Shift Toward Sustainable Materials Shapes Market Trends

Sustainability has emerged as the dominant trend reshaping the textile industry. Circular economy principles are influencing how companies design, produce, and recycle textile products. Brands are establishing take-back programs and closed-loop systems to minimize waste. Transparent supply chains allow consumers to trace fiber origins and manufacturing processes. Certifications for organic, recycled, and responsibly sourced materials are becoming standard market requirements.

Non-woven fabrics are expanding rapidly across industrial and consumer applications. Automotive manufacturers use non-wovens for sound insulation, filtration systems, and interior trim components. Construction projects incorporate them for insulation, moisture barriers, and protective coverings. Consumer products ranging from furniture upholstery to cleaning wipes increasingly rely on non-woven technology.

Smart textiles represent the cutting edge of market innovation. Sportswear integrates sensors that monitor heart rate, body temperature, and muscle activity during exercise. Functional apparel includes fabrics with embedded heating elements, moisture management systems, and antibacterial properties. Wearable technology continues merging with textile manufacturing to create garments that enhance performance and user experience.

Regional Analysis

Asia Pacific Dominates the Textile Market with a Market Share of 43.4%, Valued at USD 297.3 Billion

Asia Pacific commands the global textile market with a dominant share of 43.4%, valued at USD 297.3 billion, driven by its robust manufacturing infrastructure and cost-effective production capabilities. The region serves as the world’s textile manufacturing hub, with countries like China, India, Bangladesh, and Vietnam leading in cotton, synthetic, and technical textiles production. Rising domestic consumption, growing middle-class populations, government support for textile exports, and expansion of e-commerce platforms continue to propel the region’s market dominance.

North America Textile Market Trends

North America represents a significant textile market characterized by high demand for technical textiles, sustainable fabrics, and performance materials across automotive, healthcare, and industrial sectors. The region’s growth is supported by technological advancements in manufacturing, increasing consumer preference for eco-friendly textiles, and strong investments in textile innovation and smart fabric technologies.

Europe Textile Market Trends

Europe maintains a strong position in the textile market, focusing on high-quality, sustainable, and luxury textile products with emphasis on circular economy principles. The region is driven by stringent environmental regulations, growing demand for organic and recycled textiles, advanced textile technologies, and a well-established fashion and apparel industry centered around premium and designer segments.

Middle East and Africa Textile Market Trends

The Middle East and Africa textile market is experiencing steady growth driven by expanding domestic manufacturing capabilities, rising population, and increasing investments in textile infrastructure. The region benefits from growing demand for traditional and modest fashion, government initiatives to reduce import dependency, and emerging opportunities in technical textiles for construction and industrial applications.

Latin America Textile Market Trends

Latin America’s textile market demonstrates moderate growth supported by domestic cotton production, expanding apparel manufacturing, and increasing nearshoring opportunities for North American brands. The region is characterized by growing demand for affordable fashion, investments in textile modernization, and rising consumer awareness toward sustainable and locally-produced textile products.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Textile Company Insights

In the evolving global textile landscape, Hengli Petrochemical Co., Ltd. continues to leverage its integrated petrochemical and textile value chain to strengthen competitive advantage. Its strategic focus on polyester and high-performance fibers positions the company to benefit from growing demand in apparel and industrial applications. Hengli’s capacity investments and forward integration enhance cost efficiency and resilience against raw material volatility.

Shenzhou International Group Holdings Ltd remains a leading contract manufacturer with a robust footprint across Asia. Its disciplined operations and strong customer relationships with global brands support stable revenue flows amid fluctuating market conditions. Shenzhou’s emphasis on quality control and supply chain flexibility is likely to sustain its appeal to international buyers pursuing reliability and scalability.

Toray Industries, Inc. is increasingly recognized for innovation in advanced materials and sustainable solutions. Its R&D focus on functional fibers, carbon-based textiles, and eco-friendly processes positions Toray to capture growth in technical textile segments and environmentally conscious markets. Strategic diversification beyond traditional apparel applications helps mitigate cyclical pressures while meeting emerging demand in mobility and healthcare.

In fast fashion and retail, Inditex drives market dynamics through its agile business model and global brand portfolio. The company’s investments in digital integration, inventory optimization, and sustainable sourcing reinforce competitive strengths. Inditex’s ability to translate fashion trends quickly into market-ready products enhances consumer engagement and supports growth across regions, even as macroeconomic challenges persist.

Top Key Players in the Market

- Hengli Petrochemical Co., Ltd.

- Shenzhou International Group Holdings Ltd

- Toray Industries, Inc.

- Inditex

- Chargeurs SA

- Far Eastern New Century Corporation

- Sasa Polyester Sanayi A.Ş.

- Eclat Textile Co. Ltd

- TJX Companies

- Vardhman Textiles

Recent Developments

- In January 2026, Davis Polk advised Cornell Capital LLC and its portfolio company PureStar on the acquisition of Emerald Textiles, supporting PureStar’s strategic expansion in textile processing and industrial laundry services.

- In September 2025, global diversified manufacturer Milliken & Company acquired the assets of Highland Industries, Inc. in Cheraw, South Carolina, strengthening its domestic manufacturing footprint and capabilities in technical textiles.

- In July 2025, Altri SGPS S.A. signed an agreement to acquire a majority stake in AeoniQ, marking a strategic move into sustainable textiles through next-generation cellulosic fiber innovation.

Report Scope

Report Features Description Market Value (2025) USD 685.2 Billion Forecast Revenue (2035) USD 1215.6 Billion CAGR (2026-2035) 5.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Synthetic Fibers [Polyester, Nylon, Rayon/Viscose, Acrylic, Polypropylene], Natural Fibers [Cotton, Wool, Silk], Recycled Fibers, Others),By Process/Technology (Woven, Knitted, Non-woven [Spunlaid (Spunbond/Melt-blown), Dry-laid Hydro-entangled, Wet-Laid, Needle-punched], 3-D Weaving & Spacer Fabrics),By Application (Fashion & Clothing [Apparel, Ties & Clothing, Handbags, Others], Household [Bedding, Kitchen, Upholstery, Towel, Others], Technical [Construction, Transport, Medical, Protective], Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Hengli Petrochemical Co., Ltd., Shenzhou International Group Holdings Ltd, Toray Industries, Inc., Inditex, Chargeurs SA, Far Eastern New Century Corporation, Sasa Polyester Sanayi A.Ş., Eclat Textile Co. Ltd, TJX Companies, Vardhman Textiles Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hengli Petrochemical Co., Ltd.

- Shenzhou International Group Holdings Ltd

- Toray Industries, Inc.

- Inditex

- Chargeurs SA

- Far Eastern New Century Corporation

- Sasa Polyester Sanayi A.Ş.

- Eclat Textile Co. Ltd

- TJX Companies

- Vardhman Textiles