Global Textile Implants Market Analysis By Textile Type [Synthetic (Polyethylene Terephthalate (PET), Polypropylene, Polyester, Polyethylene, Polytetrafluoroethylene (PTFE)), Natural(Collagen-based, Others], By Indication (Cardiovascular Surgery, Orthopedic Surgery, Hernia Repair, Dental grafts, Others), By Application (Hospitals, Clinics, Ambulatory Surgical Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 27877

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

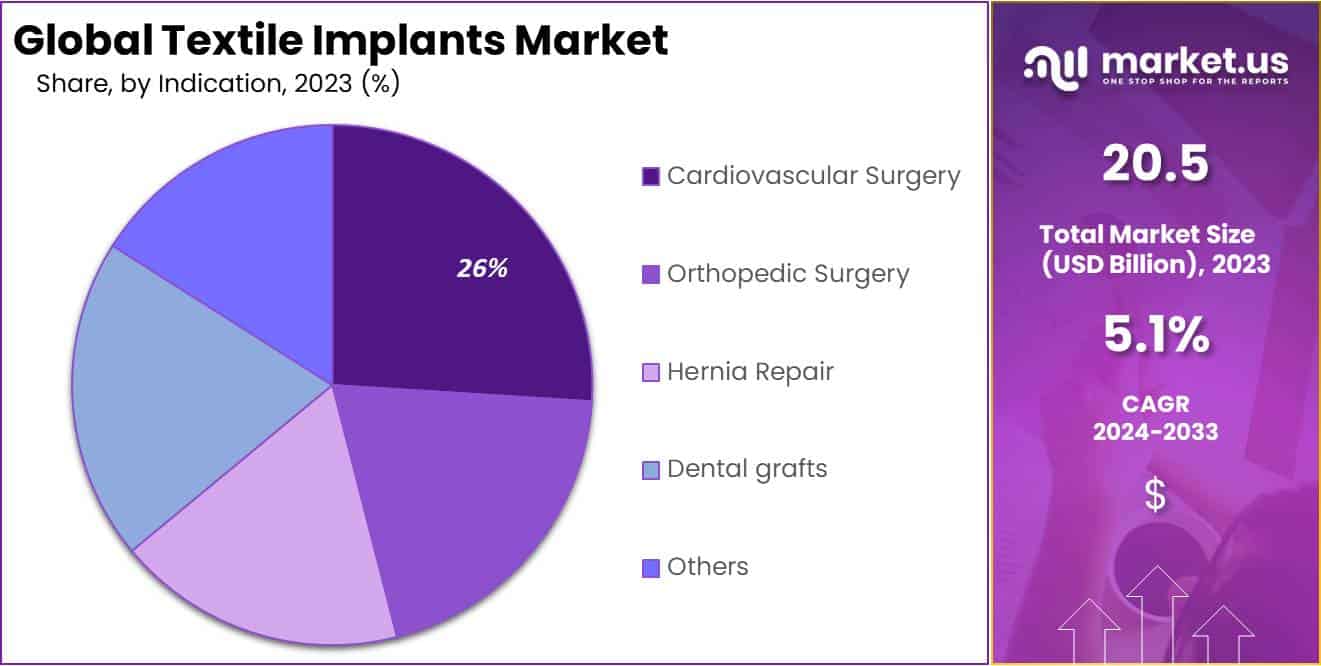

The Global Textile Implants Market size is expected to be worth around USD 37.7 Billion by 2033, from USD 20.5 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

Textile implants are medical devices made from biocompatible fabric materials, designed for integration into the human body to aid various therapeutic purposes. These implants find applications in numerous medical areas, such as vascular grafts, surgical sutures, hernia meshes, and tissue repair, including ligaments and tendons. They are crafted from durable materials like polyester and polypropylene, engineered to support tissue growth and withstand physiological conditions without causing adverse reactions. The flexibility and adaptability of these implants make them vital in regenerative medicine and various surgical procedures, underscoring their significance in contemporary medical practices.

The textile implants market is experiencing significant growth, driven by advancements in medical technology and increasing demand across various healthcare settings. Hospitals, ambulatory surgical centers (ASCs), and specialty clinics are primary consumers of textile implants, utilizing them in a wide range of surgical applications. In the United States alone, about 25% of the 13.7 million elderly hospitalizations annually involve surgeries, emphasizing the extensive use of these devices in hospitals. Additionally, the rise of ASCs, with a growth rate of 2.5% annually and over 6,000 centers, reflects an increasing preference for outpatient surgeries. Specialty clinics also contribute to the market expansion by focusing on specific treatments like hernia repairs and cardiovascular interventions, necessitating specialized textile implants.

Globally, the textile implants market is also influenced by the import-export dynamics among key economic players. According to a 2023 report from Textiles Intelligence, major exporters such as the United States, Germany, and Japan benefit from advanced manufacturing capabilities and strict regulatory standards. Conversely, emerging economies like China and India are significant importers, driven by their rapidly developing healthcare infrastructures. The total global trade in textiles and clothing, which reached $889 billion in 2021, underscores the robust demand and supply interactions on a global scale.

Governments worldwide are enforcing stringent regulations to ensure the safety and efficacy of medical devices, including textile implants. In the United States, the Food and Drug Administration (FDA) classifies these as medical devices and mandates adherence to specific safety standards. The European Union’s Medical Device Regulation also imposes rigorous standards for the approval and monitoring of such devices.

Significant government investments in healthcare infrastructure are further catalyzing the growth of the textile implants market. For instance, India’s Ayushman Bharat scheme, which includes the Pradhan Mantri Jan Arogya Yojana (PM-JAY), aims to provide health coverage to the poorest 40% of the population. This initiative, along with the allocation of Rs. 64,180 crores through the Pradhan Mantri Atma Nirbhar Swasth Bharat Yojana (PM-ABHIM), is expected to boost demand for medical treatments and related products like textile implants through 2025-26. Similarly, China’s Healthy China 2030 plan focuses on enhancing health infrastructure and adopting advanced medical technologies, including textile implants.

Market leaders like Medtronic and Johnson & Johnson are heavily investing in research and development to further innovate in this field. Innovations such as bioabsorbable and antimicrobial implants are improving patient outcomes, while the adoption of 3D printing technology is revolutionizing the market by enabling customized implant solutions. Additionally, strategic acquisitions and public-private partnerships are accelerating growth, exemplified by Becton, Dickinson and Company’s acquisition of C.R. Bard. These developments indicate a robust expansion trajectory for the textile implants market, with a focus on enhancing the effectiveness of treatments and ensuring patient safety.

Key Takeaways

- Market Size and Growth: The global textile implants market is projected to grow from USD 20.5 billion in 2023 to USD 37.7 billion by 2033, exhibiting a CAGR of 5.1% from 2024 to 2033.

- Textile Type: In 2023, the synthetic segment dominated with over a 63% market share, driven by the superior mechanical properties and versatility of synthetic materials like PET and polypropylene.

- Indication: Cardiovascular surgery led the indication segment with over 26% market share, due to the prevalence of cardiovascular diseases and advancements in synthetic textile materials.

- Application: Hospitals captured more than a 51% share, driven by the high volume of surgeries and advanced healthcare infrastructure.

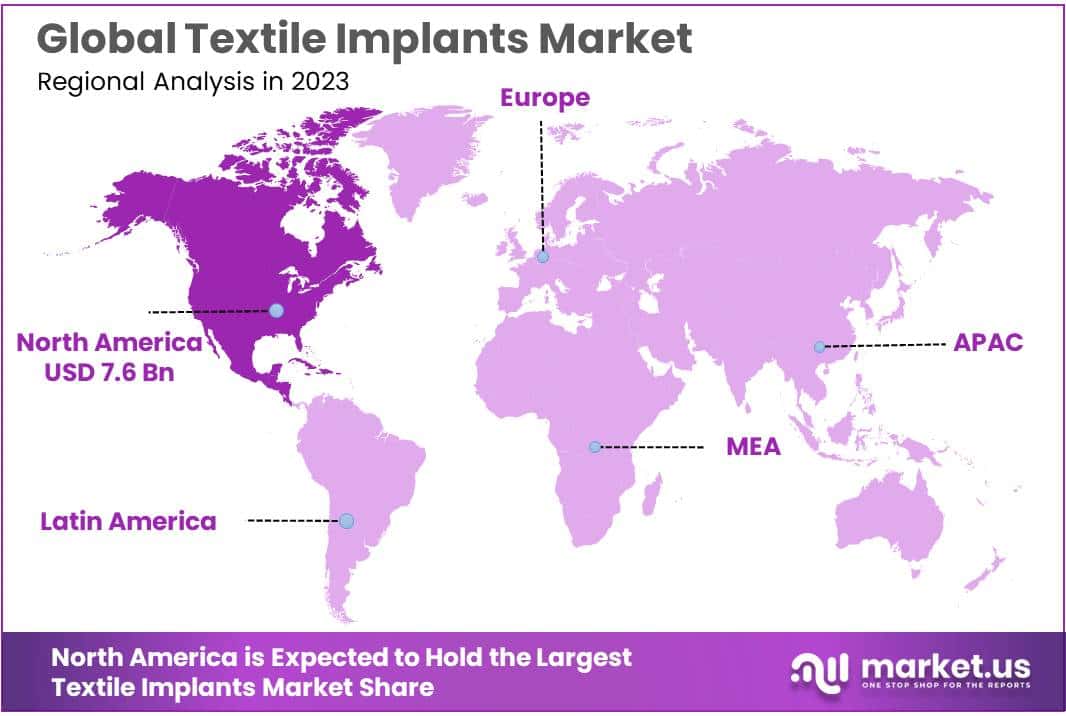

- North America: Dominated the market with over a 37% share in 2023, driven by advanced healthcare infrastructure and significant R&D investments.

Textile Type Analysis

In 2023, the synthetic segment held a dominant market position in the textile material type segment of the textile implants market, capturing more than a 63% share. This predominance is attributed to the superior mechanical properties and versatility of synthetic materials. The synthetic category comprises several key materials, including polyethylene terephthalate (PET), polypropylene, polyester, polyethylene, and polytetrafluoroethylene (PTFE). PET is widely favored for its excellent strength and biocompatibility, making it extensively utilized in vascular grafts and hernia repair meshes. Polypropylene is known for its high tensile strength and resistance to bacterial infections, making it a common choice in sutures and hernia meshes.

Polyester, valued for its durability and ease of manipulation, is primarily employed in cardiovascular and orthopedic applications. Polyethylene’s flexibility and toughness make it suitable for various orthopedic implants, while polytetrafluoroethylene (PTFE) is renowned for its non-reactive nature and low friction, predominantly used in vascular grafts and heart valve implants. The preference for synthetic materials in the textile implants market is driven by their consistent quality, availability, and adaptability to a wide range of medical applications. In contrast, the natural segment, although smaller, plays a crucial role in specific applications, including collagen-based materials, which are favored for their biocompatibility and natural integration with body tissues.

Indication Analysis

In 2023, the Cardiovascular Surgery segment held a dominant position in the Indication Segment of the Textile Implants Market, capturing over 26% share. This significant market share is attributed to the increasing prevalence of cardiovascular diseases, advancements in synthetic textile materials, and the rising demand for minimally invasive surgical procedures. The synthetic materials used in cardiovascular surgery, such as Dacron and expanded polytetrafluoroethylene (ePTFE), offer enhanced biocompatibility, durability, and reduced risk of infection, which are critical factors driving their adoption.

The Orthopedic Surgery segment is projected to witness substantial growth due to the rising incidence of orthopedic disorders, sports injuries, and the growing geriatric population. Textile implants in orthopedic surgery, including synthetic ligaments and tendon grafts, provide improved mechanical properties and faster recovery times, which are pivotal in boosting market demand. Additionally, hernia repair is benefiting from the high prevalence of hernia cases globally, with the demand for synthetic mesh implants expected to propel the segment’s growth. The Dental Grafts segment is also experiencing steady growth, driven by the increasing adoption of dental implants and rising awareness of oral health.

Application Analysis

In 2023, the Hospitals segment maintained a dominant position in the application segment of the Textile Implants Market, capturing more than a 51% share. This dominance is attributed to the high volume of surgical procedures performed in hospital settings, the availability of advanced healthcare infrastructure, and the presence of skilled healthcare professionals. Hospitals are the primary end-users of textile implants due to their capability to handle complex surgeries and provide comprehensive post-operative care. These factors collectively contribute to the significant market share held by hospitals in the textile implants market.

The Clinics segment also played a notable role in the market, driven by the increasing preference for outpatient procedures and the rise of specialty clinics focusing on specific medical conditions. Clinics accounted for a substantial market share due to their growing adoption of minimally invasive surgical techniques and the convenience they offer to patients seeking quick and efficient medical interventions. Additionally, Ambulatory Surgical Centers (ASCs) are emerging as a significant segment, gaining popularity for their cost-effective solutions and shorter patient recovery times. The continuous advancements in medical technology and the increasing demand for efficient healthcare delivery are expected to further drive the adoption of textile implants across various healthcare settings.

Key Market Segments

Textile Type

- Synthetic

- Polyethylene Terephthalate (PET)

- Polypropylene

- Polyester

- Polyethylene

- Polytetrafluoroethylene (PTFE)

- Natural

- Collagen-based

- Others

Indication

- Cardiovascular Surgery

- Orthopedic Surgery

- Hernia Repair

- Dental grafts

- Others

Application

- Hospitals

- Clinics

- Ambulatory Surgical Centers

Drivers

Rising Incidences of Chronic Diseases

A primary driver for the Global Textile Implants Market is the increasing prevalence of chronic diseases such as cardiovascular diseases, diabetes, and obesity, which often necessitate surgical interventions that include implantable textiles. These materials are essential in procedures ranging from vascular grafts to soft tissue repair, driving demand in this sector.

According to the World Health Organization (WHO), chronic diseases such as cardiovascular diseases are the leading cause of mortality globally, accounting for an estimated 17.9 million deaths each year. This high prevalence underscores the growing demand for surgical interventions that utilize textile implants for cardiovascular and other chronic disease treatments.

Restraints

Stringent Regulatory Requirements

The market faces significant restraint due to stringent regulatory requirements for the approval of medical devices, including textile implants. These regulations ensure safety and efficacy but can also extend the time and cost associated with bringing new products to market, potentially hindering the development and availability of innovative textile implants.

The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) highlight the rigorous approval process for medical devices, including textile implants. According to FDA data, the premarket approval process can take up to 90 days for a 510(k) clearance and substantially longer for more complex devices requiring a Pre-Market Approval (PMA), which involves multiple phases of clinical trials.

Opportunities

Advancements in Biocompatible Materials

There is a substantial opportunity in the development and utilization of advanced biocompatible materials in textile implants. Innovations in this area can lead to better patient outcomes, reduced rejection rates, and enhanced integration with human tissue, opening up new applications and markets for textile implants.

Research funded by the National Institutes of Health (NIH) in the United States has reported advancements in biocompatible materials that can reduce rejection rates by 15% and enhance the functional integration of textile implants in the human body. Such innovations are poised to transform patient outcomes and expand the applications of textile implants.

Trends

Increasing Use of 3D Printing Technologies

The increasing use of 3D printing technologies is significantly driving the growth of the textile implants market. This technology allows for the creation of highly customized implants tailored to a patient’s specific anatomical needs, enhancing the effectiveness of medical treatments and reducing recovery times.

According to Market.us, the global Medical 3D Printing Market is expected to grow from USD 1994.6 Million in 2023 to a projected USD 4593.7 Million by 2033, at a CAGR of 19.5%.The rise in demand for personalized medical solutions, supported by advancements in additive manufacturing techniques, is pivotal in this growth. This trend underscores the increasing adoption of 3D printing technology across the medical field, driving innovation and improving patient outcomes by enabling the production of precise, biocompatible, and functional implants.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 37% share and holding USD 7.6 billion market value for the year. The substantial market size can be attributed to advanced healthcare infrastructure, heightened awareness of minimally invasive surgeries, and significant investments in research and development activities within the region. Furthermore, the presence of leading industry players who continuously innovate and expand their product portfolios has fueled the growth of the textile implants market in this area.

Europe follows North America in terms of market share, driven by the region’s strong regulatory framework for medical devices and a growing elderly population susceptible to chronic diseases. The European market is also supported by extensive government funding towards healthcare and an increasing adoption of technologically advanced textile implants.

Asia-Pacific is projected to experience the highest growth rate over the forecast period. This surge is primarily due to the rising healthcare expenditures in emerging economies such as China and India, combined with a growing population base. Additionally, improvements in healthcare infrastructure and an increasing number of surgeries are expected to boost the demand for textile implants in this region.

Latin America and the Middle East & Africa regions, while holding smaller shares of the global market, are anticipated to witness moderate growth. This growth is likely to be spurred by the gradual expansion of healthcare facilities and the slow yet steady adoption of new medical technologies in these regions.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the textile implants market, several key players stand out due to their innovation and market presence. Medtronic plc is renowned for its medical technology, offering a broad range of textile implants for various surgical procedures. Their strong R&D capabilities and extensive distribution network ensure a dominant position. Johnson & Johnson’s Ethicon, specializing in surgical solutions, is noted for its quality and safety, with a robust product portfolio that meets diverse medical needs.

B. Braun Melsungen AG, offering high-quality implants, builds on innovation and strong customer service to maintain a loyal customer base. C.R. Bard, Inc., now part of Becton, Dickinson and Company, focuses on reliable and effective products, catering to specific healthcare professional needs with a robust distribution network. Boston Scientific Corporation emphasizes innovation and technology, providing advanced products and a strong global presence.

Additionally, other companies, including smaller firms and regional players, contribute significantly by focusing on niche markets and leveraging customer-centric approaches, driven by technological advancements and investments in healthcare infrastructure.

Market Key Players

- Medtronic plc

- Johnson & Johnson (Ethicon)

- B. Braun Melsungen AG

- C.R. Bard, Inc.

- Boston Scientific Corporation

- W.L. Gore & Associates Inc.

- Cook Medical

- Atrium Medical Corporation

- Teleflex Incorporated

- Smith & Nephew plc

- Molnlycke Health Care AB

- Integra LifeSciences Corporation

- Biotronik SE & Co. KG

- Coloplast Group

- Arthrex Inc.

- Zimmer Biomet Holdings Inc.

Recent Developments

- April 2024: Johnson & Johnson agreed to acquire Shockwave Medical for $13.1 billion. This acquisition aims to boost Johnson & Johnson’s cardiovascular treatment capabilities with Shockwave’s intravascular lithotripsy (IVL) technology.

- November 2023: Johnson & Johnson MedTech announced plans to submit their OTTAVA robotic surgical system for FDA approval in 2024, aiming to transform surgical procedures with innovative architecture and trusted instrumentation.

- August 2023: Medtronic reported strong Q1 financial results for fiscal year 2024, with significant revenue growth. They also launched the MiniMed 780G diabetes management system and the Micra AV2 and VR2 leadless pacemakers.

- May 2023: Boston Scientific, Medtronic, and Johnson & Johnson considered acquiring Shockwave Medical. This reflects a trend among major medical device companies to expand their cardiovascular treatment portfolios.

Report Scope

Report Features Description Market Value (2023) USD 20.5 Bn Forecast Revenue (2033) USD 33.7 Bn CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Textile Type [Synthetic (Polyethylene Terephthalate (PET), Polypropylene, Polyester, Polyethylene, Polytetrafluoroethylene (PTFE)), Natural(Collagen-based, Others], By Indication[Cardiovascular Surgery, Orthopedic Surgery, Hernia Repair, Dental grafts, Others), By Application[Hospitals, Clinics, Ambulatory Surgical Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Medtronic plc, Johnson & Johnson (Ethicon), B. Braun Melsungen AG, C.R. Bard Inc., Boston Scientific Corporation, W.L. Gore & Associates Inc., Cook Medical, Atrium Medical Corporation, Teleflex Incorporated, Smith & Nephew plc, Molnlycke Health Care AB, Integra LifeSciences Corporation, Biotronik SE & Co. KG, Coloplast Group, Arthrex Inc., Zimmer Biomet Holdings Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Medtronic plc

- Johnson & Johnson (Ethicon)

- B. Braun Melsungen AG

- C.R. Bard, Inc.

- Boston Scientific Corporation

- W.L. Gore & Associates Inc.

- Cook Medical

- Atrium Medical Corporation

- Teleflex Incorporated

- Smith & Nephew plc

- Molnlycke Health Care AB

- Integra LifeSciences Corporation

- Biotronik SE & Co. KG

- Coloplast Group

- Arthrex Inc.

- Zimmer Biomet Holdings Inc.