Global Textile Coating Market Size, Share, And Enhanced Productivity By Polymer Type (Thermoplastics, Thermosets, Others), By Resin Type (Polyurethane, Epoxy, Acrylic, Polyester, Alkyd, Fluoropolymer, Vinyl, Others), By Technology (Solvent-Borne, Water-Borne, Powder Coating, Others), By End Use (Transportation, Building and Construction, Protective Clothing, Medical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177250

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

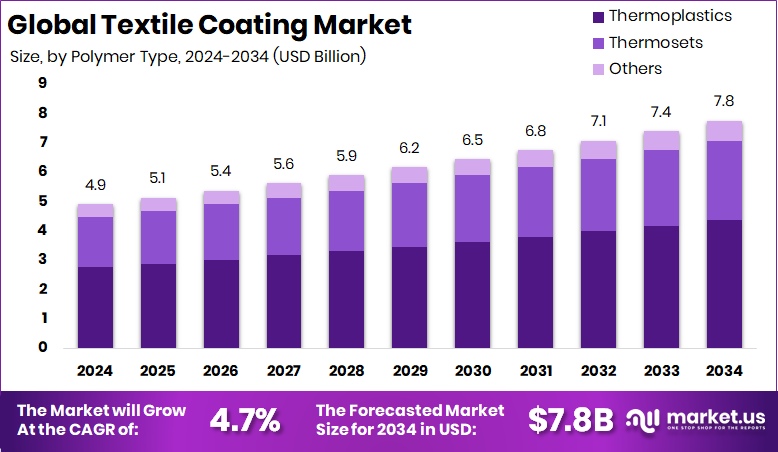

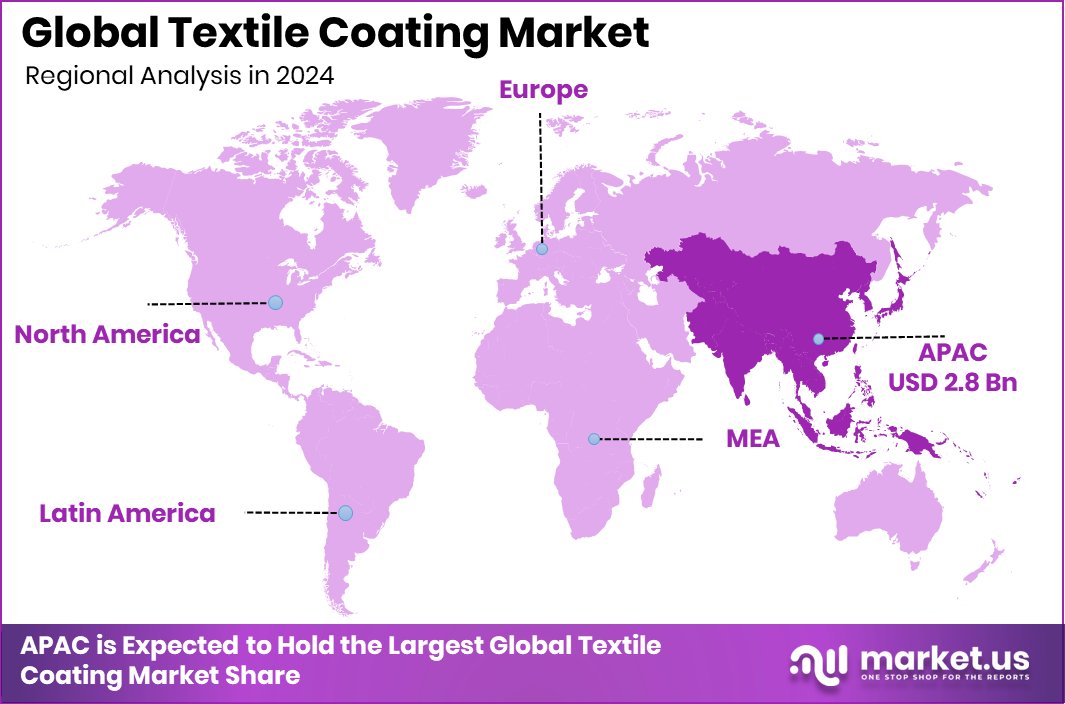

The Global Textile Coating Market is expected to be worth around USD 7.8 billion by 2034, up from USD 4.9 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034. The Asia Pacific region generated USD 2.8 billion from textile coatings, securing 59.1%.

The textile coating market covers a wide set of materials and technologies, including thermoplastics, thermosets, polyurethane, epoxy, acrylic, polyester, alkyd, fluoropolymer, vinyl, and several water-borne, solvent-borne, and powder-based systems. These coatings add performance features such as durability, waterproofing, fire resistance, and chemical protection to fabrics used in transportation, construction, protective clothing, medical surfaces, and many other applications.

Textile coating refers to the process of applying a functional layer over a fabric to improve its strength, appearance, or protective ability. The textile coating market, in turn, represents the global demand, production, and innovation surrounding these coated fabrics across industrial and consumer sectors.

Growth in this market is supported by rising investments and industry transformation. Funding such as FibreCoat securing €20 million, the H&M Foundation doubling its GCA grant, and the Good Fashion Fund’s $2 million loan for a sustainable treatment plant reflects how the sector is shifting toward better performance with lower environmental impact. Increasing demand for coated textiles in transport interiors, construction membranes, and protective gear continues to open new opportunities.

Another strong opportunity emerges from digital and supply-chain modernization, backed by financing such as Fashinza’s $100 million Series B, enabling faster development cycles and better material innovation for next-generation coated fabrics.

Key Takeaways

- The Global Textile Coating Market is expected to be worth around USD 7.8 billion by 2034, up from USD 4.9 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- The Textile Coating Market shows strong growth as thermoplastics dominate applications with a 56.2% share.

- In the Textile Coating Market, polyurethane remains the leading resin type, holding a notable 36.8% share.

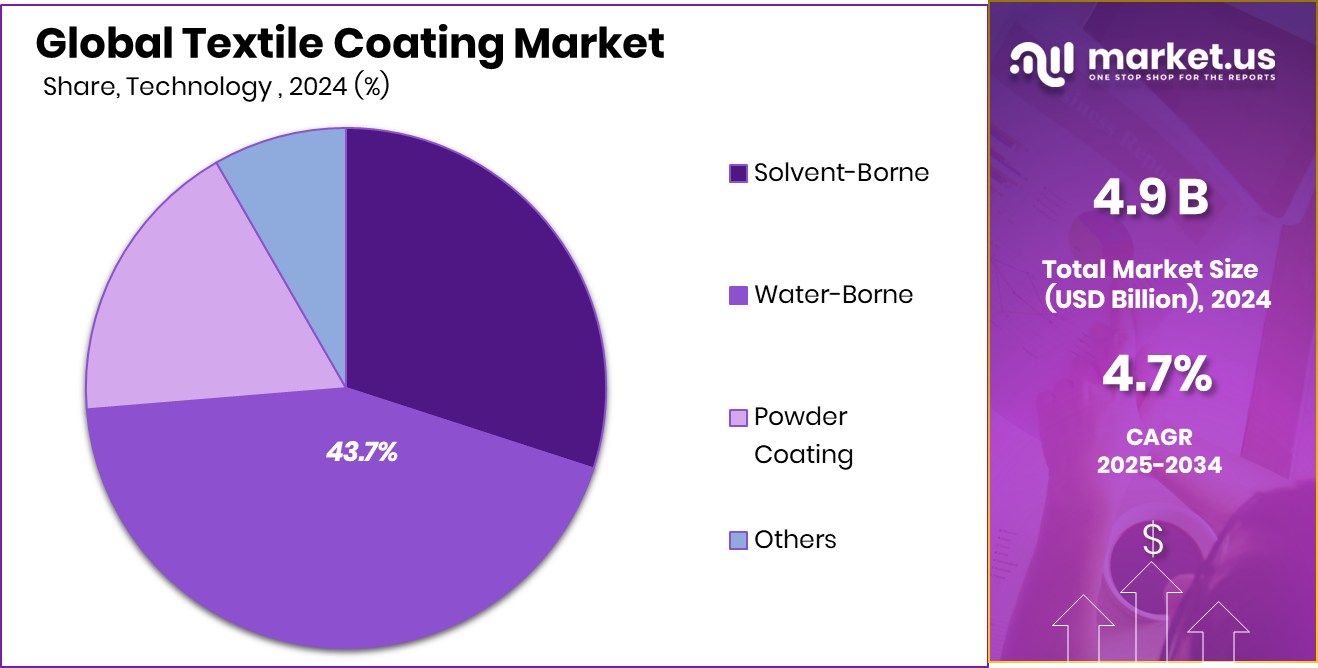

- Water-borne technology leads the Textile Coating Market advancements, accounting for 43.7% of overall usage.

- Transportation end use drives significant expansion in the Textile Coating Market, contributing a 29.3% share.

- Asia Pacific accounted for a 59.1% share, with textile coatings worth USD 2.8 billion.

By Polymer Type Analysis

Thermoplastics dominate the textile coating market with a 56.2% share, driving strong industrial adoption.

In 2024, thermoplastics continued to dominate the textile coating market with a strong 56.2% share, reflecting their versatility and cost-effective performance. Industries are choosing thermoplastic coatings because they can be reshaped with heat, making them ideal for protective clothing, industrial fabrics, automotive textiles, and outdoor materials. Their durability, resistance to chemicals, and ease of processing have made them a preferred option for manufacturers looking to balance performance and sustainability.

Growing demand for lightweight coated textiles in transportation and consumer goods has also pushed thermoplastics forward. As companies focus on reducing production waste and improving recyclability, thermoplastic-based coatings offer a practical path, strengthening their position across global supply chains.

By Resin Type Analysis

Polyurethane resin type leads the textile coating market, securing a 36.8% share.

In 2024, polyurethane resin held a significant 36.8% share of the textile coating market, driven by its superior flexibility, smooth finish, and long-lasting mechanical strength. Manufacturers rely on polyurethane coatings to enhance breathability, abrasion resistance, and waterproofing performance—qualities essential in sportswear, footwear, and protective workwear. The material’s ability to maintain softness while delivering strong protection has helped it become a consistent favorite.

Demand also grew from furniture and automotive upholstery producers seeking coatings that provide durability without compromising comfort. With the industry steadily shifting toward more sustainable chemistries, many producers have expanded bio-based and solvent-reduced polyurethane lines, ensuring the resin remains an important foundation for high-quality textile coatings worldwide.

By Technology Analysis

Water-borne technology holds a 43.7% share, boosting sustainability across global textile coating markets.

In 2024, water-borne technology accounted for 43.7% of the textile coating market as more manufacturers moved away from solvent-heavy systems. Rising environmental standards, workplace safety regulations, and the need to reduce VOC emissions encouraged industries to adopt water-borne coatings for apparel, technical textiles, and home furnishings. These coatings provide strong adhesion, good elasticity, and excellent weatherability without relying on harmful solvents.

Brands focused on sustainability have increasingly chosen water-borne systems to align with eco-labelling requirements and consumer expectations. The technology is now widely used in sectors such as medical textiles, outdoor gear, and automotive interiors. As innovation improves drying speed and performance consistency, water-borne coatings continue gaining momentum globally.

By End Use Analysis

Transportation end-use accounts for a 29.3% share, strengthening the textile coating market demand.

In 2024, the transportation sector held 29.3% of the textile coating market, supported by rising demand for high-performance coated fabrics in automotive, rail, aerospace, and marine applications. Vehicle manufacturers are relying on coated textiles for seat covers, airbags, interior panels, insulation layers, and protective wraps due to their strength, fire resistance, and durability.

Lightweight coated fabrics also help reduce vehicle weight, contributing to better energy efficiency across electric and conventional vehicles. Growth in global mobility, expansion of commercial fleets, and modernization of public transport systems have further strengthened demand. As transportation companies prioritize safety, comfort, and sustainability, coated textiles remain essential to delivering long-lasting and reliable performance.

Key Market Segments

By Polymer Type

- Thermoplastics

- Thermosets

- Others

By Resin Type

- Polyurethane

- Epoxy

- Acrylic

- Polyester

- Alkyd

- Fluoropolymer

- Vinyl

- Others

By Technology

- Solvent-Borne

- Water-Borne

- Powder Coating

- Others

By End Use

- Transportation

- Building and Construction

- Protective Clothing

- Medical

- Others

Driving Factors

Rising demand for durable coated textiles

Rising demand for durable coated textiles continues to strengthen the textile coating market, particularly as industries require fabrics that withstand abrasion, harsh weather, and long-term use. The shift toward advanced materials is also encouraged by financial activity within the broader polyurethane and textile ecosystem. A bio-based polyurethane company securing $5 million in funding highlights the push toward cleaner, stronger coating chemistries.

At the same time, efforts to stabilize operations during the financial crisis, where a PU VC vowed to overcome deficits through digitization, commercialization, and ordering 2.5MW solar projects, signal a deeper commitment to modernizing production environments. These developments support manufacturers looking for reliability, sustainability, and consistent performance in coated technical textiles.

Restraining Factors

High production costs limit wider adoption

High production costs remain a key restraint for wider adoption of textile coatings, especially when precision machinery, raw material stability, and regulatory compliance raise overall expenses. Financial pressures become more visible when public institutions announce large budgets, such as the PU Syndicate approving a Rs 20.16 billion budget with increased scholarships and research grants, or the PU Syndicate recommending a Rs 19.6 billion budget with student scholarships rising from Rs 247 million to Rs 380 million and a Rs 229 million research grant approved. These allocations show that significant funding still goes toward academic and research efforts rather than cost-reduction technologies, indirectly slowing the transition toward more affordable coating solutions for manufacturers.

Growth Opportunity

Sustainability investments accelerate coating innovations

Sustainability investments accelerate coating innovations as industries look for safer, low-impact chemistries and improved textile life cycles. Opportunities grow when researchers secure targeted support, such as a PU faculty member winning a USD 50,000 research grant for air quality, pushing forward scientific insights that eventually influence eco-smart textile treatments.

Expanding interest in cleaner materials is also fueled by funding rounds like Matereal, securing $4.5 million in seed funding to combat toxic plastics, signaling strong market confidence in recyclable and non-hazardous coating technologies. These advancements open the door for manufacturers to develop lighter, greener, and more functional coated textiles that meet global regulations and evolving customer expectations.

Latest Trends

Shift toward water-borne eco-coating technologies

The shift toward water-borne eco-coating technologies continues as industries reduce reliance on solvent-heavy systems and look for safer materials that improve worker health and environmental compliance. Regional business support also plays a role, demonstrated by UMi helping a Morpeth business secure a £174,000 grant to expand and create new jobs, which indirectly supports local innovation pipelines in coated fabrics.

At the institutional level, financial reinforcement shapes research direction, seen in the PU Syndicate approving a Rs 7.727 billion budget with increased research grants and subsidies for students. Together, these developments reflect a trend toward cleaner technologies, improved capacity building, and the steady adoption of coatings designed for responsible and efficient textile production.

Regional Analysis

In the Asia Pacific, textile coatings held a 59.1% share valued at around USD 2.8 billion.

In the textile coating market, regional performance in 2024 showed clear differences across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, with Asia Pacific standing out as the dominant contributor. Asia Pacific held a 59.1% share, representing a value of USD 2.8 billion, driven by large-scale manufacturing activity and strong demand for coated textiles across industrial, apparel, and transportation sectors.

North America continued to show steady growth due to increasing use of coated fabrics in automotive interiors and protective applications, while Europe remained a key market supported by advanced textile technologies and strict quality standards.

The Middle East & Africa saw gradual expansion as infrastructure and industrial textiles gained adoption, and Latin America displayed moderate growth supported by the rising use of coated materials in construction and consumer goods. Among all regions, Asia Pacific remained the leading market, both in scale and influence, backed by strong production capabilities and widespread consumption across end-use industries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arkema continued advancing high-performance polymer solutions, particularly in coatings that demand strong adhesion, durability, and resistance to harsh environmental conditions. Its focus on specialty materials positioned the company as an essential supplier for technical textiles and protective applications.

Clariant’s role remained centered on improving functional additives and chemistry solutions that enhance color stability, surface protection, and coating efficiency. Its emphasis on developing environmentally considerate chemistries aligned well with market trends toward low-emission, safer textile processing. The company’s portfolio supported manufacturers seeking consistency in coating performance across diverse textile substrates.

Covestro AG reinforced its position through advanced polyurethane and water-borne coating technologies used in sportswear, upholstery, and industrial fabrics. Its material solutions addressed the growing demand for flexibility, lightweight performance, and long-lasting mechanical strength. Overall, these three players shaped the market’s technological direction in 2024, with each contributing unique strengths that supported quality, sustainability, and innovation across global textile coating applications.

Top Key Players in the Market

- Arkema

- Clariant

- Covestro AG

- Huntsman International LLC

- Solvay

- OMNOVA North America Inc.

- The Lubrizol Corporation

- Sumitomo Chemical Co. Ltd.

- Tanatex Chemicals B.V.

- Formulated Polymer Products Ltd.

Recent Developments

- In May 2024, Arkema agreed to buy Dow’s flexible packaging laminating adhesives business. This expansion strengthened Arkema’s product portfolio in adhesives and coating solutions, especially for packaging markets, and helped widen its global reach.

- In April 2024, Clariant showcased new AddWorks® additives aimed at improving performance and sustainability in coatings. These products include wetting and dispersing agents and bio-based ingredients to help manufacturers make water-based and industrial coatings more efficient and greener. This development supports textile coating formulators looking for improved performance with a lowered environmental impact.

Report Scope

Report Features Description Market Value (2024) USD 4.9 Billion Forecast Revenue (2034) USD 7.8 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Polymer Type (Thermoplastics, Thermosets, Others), By Resin Type (Polyurethane, Epoxy, Acrylic, Polyester, Alkyd, Fluoropolymer, Vinyl, Others), By Technology (Solvent-Borne, Water-Borne, Powder Coating, Others), By End Use (Transportation, Building and Construction, Protective Clothing, Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arkema, Clariant, Covestro AG, Huntsman International LLC, Solvay, OMNOVA North America Inc., The Lubrizol Corporation, Sumitomo Chemical Co. Ltd., Tanatex Chemicals B.V., Formulated Polymer Products Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Textile Coating MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Textile Coating MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Arkema

- Clariant

- Covestro AG

- Huntsman International LLC

- Solvay

- OMNOVA North America Inc.

- The Lubrizol Corporation

- Sumitomo Chemical Co. Ltd.

- Tanatex Chemicals B.V.

- Formulated Polymer Products Ltd.