Global Textile Chemicals Market Report By Process (Pre Treatment (De-sizing Agents, Bleaching Agents, Scouring Agents, Others), Coating (Anti-piling, Water Proofing, Protection, Water Repellant, Others), Treatment of Finished Products (Softening, Stiffening, Others)), By Product (Coating & Sizing Chemicals (Colorants & Auxiliaries, Dispersants/levelant, Fixative, UV Absorber, Other), Finishing Agents (Repellent & Release, Flame Retardants, Antimicrobial Or Anti-inflammatory, Other), Surfactants, By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 123316

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

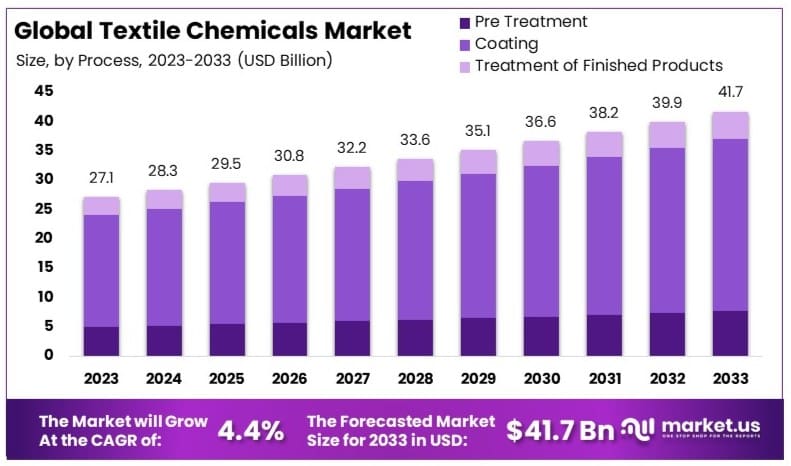

The Global Textile Chemicals Market size is expected to be worth around USD 41.7 Billion by 2033, from USD 27.1 Billion in 2023, growing at a CAGR of 4.4% during the forecast period from 2024 to 2033.

The Textile Chemicals Market encompasses a diverse range of chemicals and finishing agents used in the processing and production of textiles. These chemicals enhance the performance, functionality, and aesthetic appeal of textiles across various applications, including clothing, home furnishing, and industrial textiles.

Key products within this market include dyes, bleaching agents, and finishing compounds that improve attributes like colorfastness, shrink resistance, and fabric softness. As the textile industry evolves, the demand for eco-friendly and sustainable chemicals is rising, driven by consumer preferences and stringent regulatory standards.

Innovation and strategic developments are key drivers in the textile chemicals industry. Companies are focusing on eco-friendly and sustainable chemical solutions. For example, in May 2023, Dystar introduced eco-advanced indigo dyeing technology, which reduces energy consumption by up to 30% and water usage by up to 90%. Mergers, acquisitions, and partnerships are also prevalent, with companies like RSWM acquiring Ginni Filaments in December 2023 to enhance productivity and product diversity.

The textile chemicals market is experiencing significant investments from both public and private sectors. The Indian government is expecting to attract USD 120 billion worth of foreign investments by 2025, supported by the availability of diverse natural and synthetic fibers and yarns. Additionally, technological advancements and the expansion of manufacturing facilities in key regions are expected to drive market growth further.

The ICAC conducts a survey that covers 92% of world end-use fiber consumption and 97% of world mill consumption of textile fibers, making it the most systematic and complete data source on the topic.

Additionally, the increasing awareness of the benefits of textile chemicals in enhancing fabric performance, such as improved stain resistance, colorfastness, and anti-bacterial properties, is driving market expansion. Strategic collaborations and mergers among key players are facilitating the development of advanced textile chemicals, further boosting market competitiveness.

Key Takeaways

- Textile Chemicals Market was valued at USD 27.1 billion in 2023, and is expected to reach USD 41.7 billion by 2033, with a CAGR of 4.4%.

- Coating leads in process segment with 70.3%, critical for enhancing fabric properties.

- Coating & Sizing Chemicals lead in product with 49.4%, essential for textile finishing and quality.

- APAC dominates the market with 54.6%, driven by its extensive textile manufacturing.

Driving Factors

Increasing Demand for Technical Textiles Drives Market Growth

The rising demand for technical textiles in industries such as construction, automotive, medical, and sports is driving the growth of the textile chemicals market. Technical textiles require specific chemical treatments to achieve properties like durability, water resistance, and flame retardancy. This need necessitates the use of specialized textile chemicals.

Additionally, advancements in technical textile applications further fuel this demand. As industries increasingly adopt technical textiles for their superior properties, the need for specialized textile chemicals continues to rise. This synergy between the growth of technical textiles and the demand for advanced chemical treatments highlights the importance of textile chemicals in various industrial applications.

Growth of the Apparel Industry Drives Market Growth

The expansion of the apparel industry, particularly in developing countries like China, India, and Bangladesh, is fueling the demand for textile chemicals. These chemicals are crucial in various stages of textile processing, such as pre-treatment, dyeing, printing, and finishing, to enhance the quality and performance of fabrics.

Moreover, the rising fashion industry and consumer demand for diverse apparel options further boost the need for textile chemicals. The continuous growth in apparel production and the need for enhanced fabric properties underscore the critical role of textile chemicals in the apparel industry.

Increasing Consumer Awareness and Demand for Eco-Friendly Products Drives Market Growth

Rising environmental concerns and consumer demand for sustainable products are driving textile manufacturers to adopt eco-friendly chemicals and processes. This shift has led to the development of biodegradable, low-impact textile chemicals, significantly contributing to market growth.

Additionally, regulatory pressures and sustainability goals push manufacturers towards greener alternatives. The adoption of eco-friendly textile chemicals aligns with these objectives, promoting sustainable practices in the textile industry. The combined effect of consumer demand and regulatory support highlights the growing importance of eco-friendly chemicals in the textile market.

Restraining Factors

Environmental Regulations and Sustainability Concerns Restrain Textile Chemicals Market Growth

Stringent environmental regulations and increasing awareness about the environmental impact of textile chemicals pose significant challenges to market growth. Many countries have implemented strict regulations on the use of certain chemicals in textile processing due to their potential harm to the environment and human health. This regulatory pressure forces manufacturers to develop and adopt eco-friendly alternatives, which can be both costly and time-consuming.

For instance, compliance with these regulations often requires significant investment in research and development, as well as modifications to existing production processes. These additional costs and the time required for transition can hinder market expansion and reduce profitability for manufacturers.

Availability and Volatility of Raw Materials Restrain Textile Chemicals Market Growth

The textile chemicals market relies heavily on the availability and pricing of raw materials, such as petrochemicals and plant-based materials. Fluctuations in the prices of these raw materials due to factors like supply disruptions, geopolitical tensions, or changes in demand can impact the profitability and growth of the textile chemicals market.

For example, sudden supply chain disruptions can lead to shortages and increased costs of raw materials, squeezing profit margins for manufacturers. These price volatilities create an unpredictable economic environment, making it challenging for companies to plan and sustain long-term growth.

Process Analysis

Coating dominates with 70.3% due to its critical role in enhancing fabric performance and aesthetic qualities.

In the textile chemicals market, the process segment is primarily categorized into Pre-Treatment, Coating, and Treatment of Finished Products. Coating emerges as the dominant process, capturing 70.3% of the market share. This predominance is driven by the demand for textiles that are not only durable but also possess specialized functionalities such as water repellency, anti-piling, and protection against environmental factors.

Coating processes involve the application of a chemical layer that modifies the surface properties of textiles. This includes treatments that make fabrics waterproof, resistant to stains, or less prone to wear and tear. The versatility and essential nature of these functionalities make the Coating process integral to producing high-performance textiles, especially in industries like sportswear and outdoor apparel, where material performance is key.

While the Coating process holds the majority share, Pre-Treatment and Treatment of Finished Products also play significant roles. Pre-Treatment processes such as de-sizing, bleaching, and scouring are critical for preparing fabrics by cleaning and refining them before dyeing and finishing. Treatment of Finished Products includes applications like softening and stiffening, which enhance the feel and structure of the textiles after they are produced.

The growth of the Coating segment is supported by technological advancements in fabric treatment chemicals and processes, which continuously improve the efficiency and effectiveness of textile coatings. The ongoing innovation ensures that Coating remains a vital and expanding part of the textile chemicals industry.

Product Analysis

Coating & Sizing Chemicals dominate with 49.4% due to their essential role in improving fabric quality and functionality.

Within the product segment of the textile chemicals market, Coating & Sizing Chemicals lead with a 49.4% market share. This segment’s prominence is underpinned by the critical role these chemicals play in enhancing the performance and quality of fabrics. Coating and sizing treatments are applied to fibers to protect them during weaving, improve their mechanical strength, and impart desired qualities such as smoothness, weight, and resistance to environmental factors.

Coating & Sizing Chemicals are widely used across various textile applications, including apparel and home furnishings, where they help in achieving the desired end-use characteristics. These chemicals are pivotal in ensuring that textiles not only meet aesthetic requirements but also perform well under specific conditions.

While Coating & Sizing Chemicals hold the largest share, other product types like Finishing Agents and Surfactants also significantly contribute to the market. Finishing Agents, which include repellents, flame retardants, and antimicrobial treatments, add specialized functionalities that increase the textile products’ value. Surfactants improve the processing of textiles in the production phase and play essential roles in cleaning and fabric care.

Application Analysis

Apparel dominates with 45.8% due to the continuous demand for innovative and high-performance clothing.

In the application segment, Apparel is the most significant, holding a 45.8% share of the market. This segment’s dominance is fueled by the consistent demand for clothing that not only meets aesthetic and comfort standards but also incorporates functional properties such as ease of care, durability, and resistance to wear and tear. The use of advanced textile chemicals is critical in meeting these demands, particularly in sectors such as sportswear, outerwear, and innerwear, where performance and comfort are paramount.

Textile chemicals are integral in producing a wide range of apparel products, influencing everything from the color and print patterns to the texture and longevity of the clothing. Innovations in textile treatments have led to the development of fabrics that can resist stains, retain color, and manage moisture, enhancing the wearer’s experience.

Beyond Apparel, other significant applications include Home Furnishing and Technical Textiles, each with specific requirements that are met through various chemical treatments. Home furnishings such as furniture coverings, draperies, and carpets often require chemicals that contribute to aesthetics, functionality, and longevity. Technical textiles, used in more industrial and technical applications, benefit from chemicals that impart properties like fire resistance, strength, and durability.

Key Market Segments

By Process

- Pre Treatment

-

- De-sizing Agents

- Bleaching Agents

- Scouring Agents

- Others

- Coating

-

- Anti-piling

- Water Proofing

- Protection

- Water Repellant

- Others

- Treatment of Finished Products

-

- Softening

- Stiffening

- Others

By Product

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Dispersants/Levelant

- Fixative

- UV Absorber

- Other

- Finishing Agents

- Repellent & Release

- Flame Retardants

- Antimicrobial or Anti-inflammatory

- Other

- Surfactants

- Wetting Agents

- Detergents & Dispersing Agents

- Emulsifying Agents

- Lubricating Agents

- Denim Finishing Agents

- Enzymes

- Resins

- Softeners

- Defoamers

- Bleaching Agents

- Curesh Resistant Agents

- Anti-back Staining Agents

- Others

By Application

- Apparel

-

- Sportswear

- Outerwear

- Innerwear

- Others

- Home Furnishing

-

- Furniture

- Drapery

- Carpet

- Other

- Technical Textiles

-

- Agrotech

- Buildtech

- Geotech

- Medtech

- Mobiltech

- Packtech

- Protech

- Indutech

- Other

Growth Opportunities

Emerging Markets and Industrialization Offer Growth Opportunity

Emerging markets and industrialization present significant growth opportunities for the textile chemicals market. Developing countries such as India, Bangladesh, and Vietnam are experiencing rapid growth in their textile and apparel industries. As these countries industrialize and their economies expand, the demand for textile chemicals rises.

Factors such as increasing disposable income and urbanization drive this demand. The growth of these markets creates opportunities for manufacturers to supply essential chemicals for various stages of textile production, from dyeing to finishing. By tapping into these expanding markets, textile chemical producers can achieve substantial growth and enhance their global presence.

Advanced Textile Applications Offer Growth Opportunity

Advanced textile applications offer significant growth opportunities for the textile chemicals market. The industry is continuously exploring new functionalities, such as smart textiles, protective textiles, and high-performance sportswear. These innovative applications require specialized chemical treatments to achieve desired properties like moisture management, flame resistance, and durability.

This creates a demand for high-performance and innovative textile chemicals. Manufacturers can develop and supply these specialized chemicals to meet the needs of advanced textile applications. By focusing on innovation and high-performance products, textile chemical companies can capitalize on the growing trend towards multifunctional and high-tech textiles, driving market growth.

Trending Factors

Smart and Functional Textiles Are Trending Factors

The trend towards smart and functional textiles is driving growth in the textile chemicals market. Textiles with advanced properties such as moisture-wicking, antimicrobial, and temperature-regulating capabilities are becoming increasingly popular. These innovative textiles require specialized chemical treatments to achieve their unique functionalities.

This demand for advanced properties is fueling the need for innovative textile chemicals. As the market for smart textiles expands, manufacturers are developing new chemical formulations to meet these requirements. This trend is expected to drive significant growth in the textile chemicals market, supporting the production of high-performance fabrics.

Digitalization and Industry 4.0 Are Trending Factors

The adoption of digitalization and Industry 4.0 technologies is influencing the textile chemicals market. The textile industry is embracing automation, data analytics, and smart manufacturing to optimize processes, reduce waste, and improve efficiency.

Advanced chemical formulations play a crucial role in these optimized processes. By integrating digital solutions, manufacturers can enhance the effectiveness of textile chemicals and streamline production. This trend towards digitalization is expected to drive market expansion, as companies seek to improve their manufacturing capabilities and respond to increasing demands for efficient, sustainable, and high-quality textile production.

Regional Analysis

APAC Dominates with 54.6% Market Share in the Textile Chemicals Market

APAC’s commanding 54.6% market share in the textile chemicals market, valued at USD 14.8 billion, is primarily driven by the region’s extensive textile manufacturing base, especially in countries like China, India, and Bangladesh. The availability of raw materials, low labor costs, and supportive government policies have established APAC as a global hub for textile production, heavily relying on textile chemicals for dyeing, finishing, and processing.

The market dynamics in APAC are influenced by the robust demand for textiles from both domestic and international markets. The region’s capability to produce a vast range of textile goods at competitive prices enhances its market position. Additionally, ongoing investments in textile technology and a shift towards more sustainable and eco-friendly chemical solutions are shaping the market’s future.

North America: North America holds a 15.2% market share, translating to a market value of approximately USD 4.116 billion. The region’s market is driven by advanced technological adoption and a shift towards sustainable and eco-friendly textile processing methods. High consumer awareness and stringent environmental regulations also guide the market trends toward safer and greener chemical formulations.

Europe: Europe accounts for 18.4% of the global market, with a value of USD 4.974 billion. Europe’s market is characterized by high standards for quality and sustainability, which influences the demand for textile chemicals that meet strict environmental directives. The region’s strong focus on reducing pollution and energy consumption in textile production further defines its market dynamics.

Middle East & Africa: MEA has a smaller share of 4.0%, valued at USD 1.082 billion. The growth in this region is modest but expanding, driven by an increasing number of textile mills and growing exports to European and Asian markets. The demand for textile chemicals is anticipated to rise with the industrial growth.

Latin America: Latin America represents 7.8% of the market, with a value of USD 2.11 billion. The region is seeing gradual growth, fueled by the development of its textile industry and increasing exports to North America and Europe. Investments in textile production capabilities and a growing focus on value-added textiles enhance the demand for specialized textile chemicals.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Textile Chemicals Market is dominated by several influential companies. Solvay S.A. and Evonik Industries AG lead the market with their extensive product portfolios and strong R&D capabilities. Tanatext Chemicals and Rudolf GmbH leverage their innovative solutions and global reach to maintain competitive positions.

NICCA Chemical Co. Ltd. and Kemin Industries Inc. focus on quality control and expanding their production capacities. JINTEX Ltd. and Sarex Chemicals emphasize sustainable practices and strong customer relationships. Archroma and Huntsman Corporation invest heavily in research and development to drive product innovation.

DIC Corporation and Kiri Industries Ltd. maintain robust market positions through diversified product offerings and strategic partnerships. Covestro AG, Omnova Solutions Inc., and Lubrizol Corporation drive market growth with advanced technologies and strategic initiatives.

These companies collectively ensure a steady supply of high-quality textile chemicals, meeting global demand and promoting industry stability. Their strategic positioning, commitment to innovation, and strong supply chains influence market trends and set industry standards. Through continuous improvement and strategic initiatives, these market leaders shape the future of the textile chemicals market.

Market Key Players

- Solvay S.A.

- Evonik Industries AG

- Tanatext Chemicals

- Rudolf GmbH

- NICCA Chemical Co. Ltd.

- Kemin Industries Inc.

- JINTEX Ltd.

- Sarex Chemicals

- Archroma

- Huntsman Corporation

- DIC Corporation

- Kiri Industries Ltd.

- Covestro AG

- Omnova Solutions Inc.

- Lubrizol Corporation

Recent Developments

- February 2024: On average, Solvay S.A.’s monthly revenue for 2023 was approximately €406 million. This performance reflected consistent challenges in maintaining volumes and pricing amidst a volatile market environment.

- January 2024: Evonik Industries AG reported stable revenue for 2023, with total sales reaching €18.5 billion. The company’s focus on specialty chemicals and sustainable solutions in the textile auxiliaries and dyeing sectors contributed to this steady performance.

Report Scope

Report Features Description Market Value (2023) USD 27.1 Billion Forecast Revenue (2033) USD 41.7 Billion CAGR (2024-2033) 4.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Process (Pre Treatment (De-sizing Agents, Bleaching Agents, Scouring Agents, Others), Coating (Anti-piling, Water Proofing, Protection, Water Repellant, Others), Treatment of Finished Products (Softening, Stiffening, Others)), By Product (Coating & Sizing Chemicals (Colorants & Auxiliaries, Dispersants/levelant, Fixative, UV Absorber, Other), Finishing Agents (Repellent & Release, Flame Retardants, Antimicrobial Or Anti-inflammatory, Other), Surfactants (Wetting Agents, Detergents & Dispersing Agents, Emulsifying Agents, Lubricating Agents, Denim Finishing Agents, Enzymes, Resins, Softeners, Defoamers, Bleaching Agents, Curesh Resistant Agents, Anti-back Staining Agents, Others)), By Application (Apparel (Sportswear, Outerwear, Innerwear, Others), Home Furnishing (Furniture, Drapery, Carpet, Other), Technical Textiles (Agrotech, Buildtech, Geotech, Medtech, Mobiltech, Packtech, Protech, Indutech, Other)) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Solvay S.A., Evonik Industries AG, Tanatext Chemicals, Rudolf GmbH, NICCA Chemical Co. Ltd., Kemin Industries Inc., JINTEX Ltd., Sarex Chemicals, Archroma, Huntsman Corporation, DIC Corporation, Kiri Industries Ltd., Covestro AG, Omnova Solutions Inc., Lubrizol Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market size of the Global Textile Chemicals Market by 2033?The Global Textile Chemicals Market is expected to reach USD 41.7 billion by 2033. The market is expected to grow at a CAGR of 4.4% during this period.

Which region dominates the Textile Chemicals Market?The APAC region dominates the market with a 54.6% share, driven by extensive textile manufacturing in countries like China, India, and Bangladesh.

Who are some key players in the Textile Chemicals Market?Key players include Solvay S.A., Evonik Industries AG, Tanatext Chemicals, Rudolf GmbH, and NICCA Chemical Co. Ltd.

-

-

- Solvay S.A.

- Evonik Industries AG

- Tanatext Chemicals

- Rudolf GmbH

- NICCA Chemical Co. Ltd.

- Kemin Industries Inc.

- JINTEX Ltd.

- Sarex Chemicals

- Archroma

- Huntsman Corporation

- DIC Corporation

- Kiri Industries Ltd.

- Covestro AG

- Omnova Solutions Inc.

- Lubrizol Corporation