Global Testosterone Injectable Market By Age Group (Adults, Pediatric and Geriatric), By Application (Hypogonadism, Autoimmune Conditions, Genetic Disorders and Sex Organ Surgeries), By End-User (Hospitals, Specialty Clinics and Homecare), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174061

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

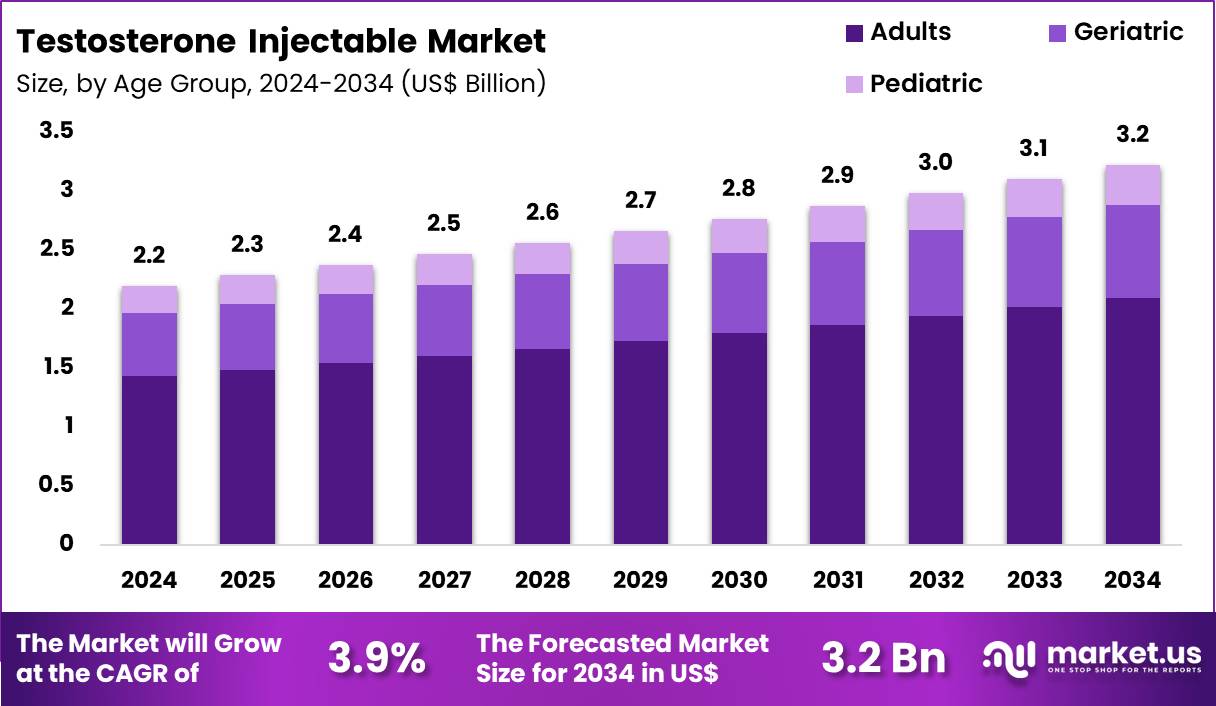

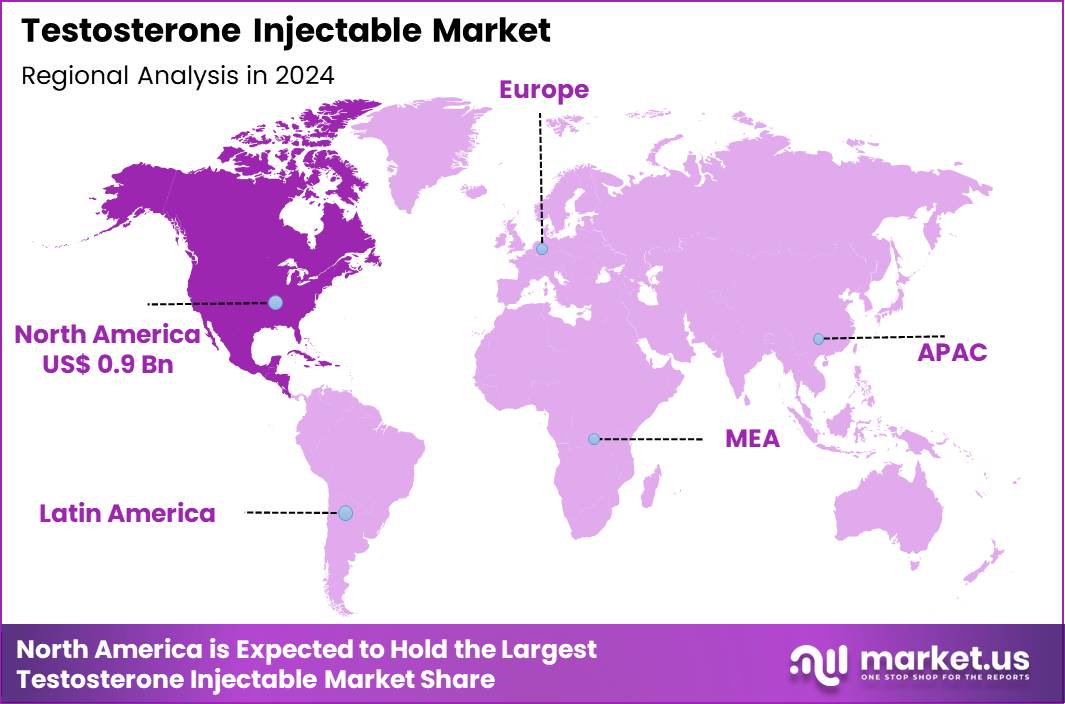

The Global Testosterone Injectable Market size is expected to be worth around US$ 3.2 Billion by 2034 from US$ 2.2 Billion in 2024, growing at a CAGR of 3.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.0% share with a revenue of US$ 0.9 Billion.

Rising incidence of testosterone deficiency in aging male populations accelerates the adoption of injectable testosterone formulations that restore physiologic hormone levels effectively. Endocrinologists prescribe these long-acting esters to treat primary and secondary hypogonadism, alleviating symptoms such as fatigue, reduced libido, and decreased muscle mass.

These therapies support management of delayed puberty in adolescent males, promoting normal virilization and skeletal maturation. Clinicians administer testosterone injectables to address androgen deficiency in patients with pituitary disorders, maintaining bone density and metabolic health. These formulations facilitate hormone replacement in transgender men, inducing secondary male characteristics and suppressing female secondary traits.

In May 2024, Eli Lilly and Company finalized its acquisition of Prevail Therapeutics, gaining access to a gene therapy platform initially developed for neurodegenerative disorders. While not directly commercialized for testosterone deficiency at the time of acquisition, the underlying genetic modulation technologies broaden Lilly’s long-term innovation capacity and open future avenues for advanced, disease-modifying approaches in endocrine and hormone-related conditions.

Manufacturers pursue opportunities to develop novel long-acting injectable depots that extend dosing intervals, enhancing patient adherence in chronic hypogonadism management. Developers engineer formulations with improved pharmacokinetic profiles, reducing peak-trough fluctuations and optimizing symptom control in late-onset hypogonadism. These advancements broaden applications in male infertility treatments, where testosterone injectables support spermatogenesis restoration in select hypogonadotropic cases.

Opportunities emerge in combining injectables with selective estrogen receptor modulators to preserve fertility while addressing low testosterone symptoms. Companies advance sustained-release microspheres that maintain stable serum levels, facilitating use in delayed puberty protocols and gender-affirming care. Firms invest in patient-specific dosing regimens that integrate monitoring of hematocrit and prostate-specific antigen, ensuring safety in long-term replacement therapy.

Industry leaders refine oil-based injectable vehicles to minimize injection-site reactions, improving tolerability for frequent administration in hypogonadism treatment. Developers prioritize bioequivalent generic formulations that maintain therapeutic efficacy, expanding access for patients with age-related testosterone decline.

Market participants advance monitoring protocols that track cardiovascular and prostate health parameters, building evidence for safe use in older men. Innovators explore combination injectables with aromatase inhibitors to prevent estrogen-related side effects in high-dose regimens.

Companies emphasize education initiatives that guide proper self-injection techniques, supporting outpatient management across diverse indications. Ongoing research focuses on next-generation delivery systems that incorporate genetic modulation insights, positioning injectable testosterone as a foundational therapy in evolving endocrine care.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.2 Billion, with a CAGR of 3.9%, and is expected to reach US$ 3.2 Billion by the year 2034.

- The age group segment is divided into adults, pediatric and geriatric, with adults taking the lead in 2024 with a market share of 64.9%.

- Considering application, the market is divided into hypogonadism, autoimmune conditions, genetic disorders and sex organ surgeries. Among these, hypogonadism held a significant share of 52.8%.

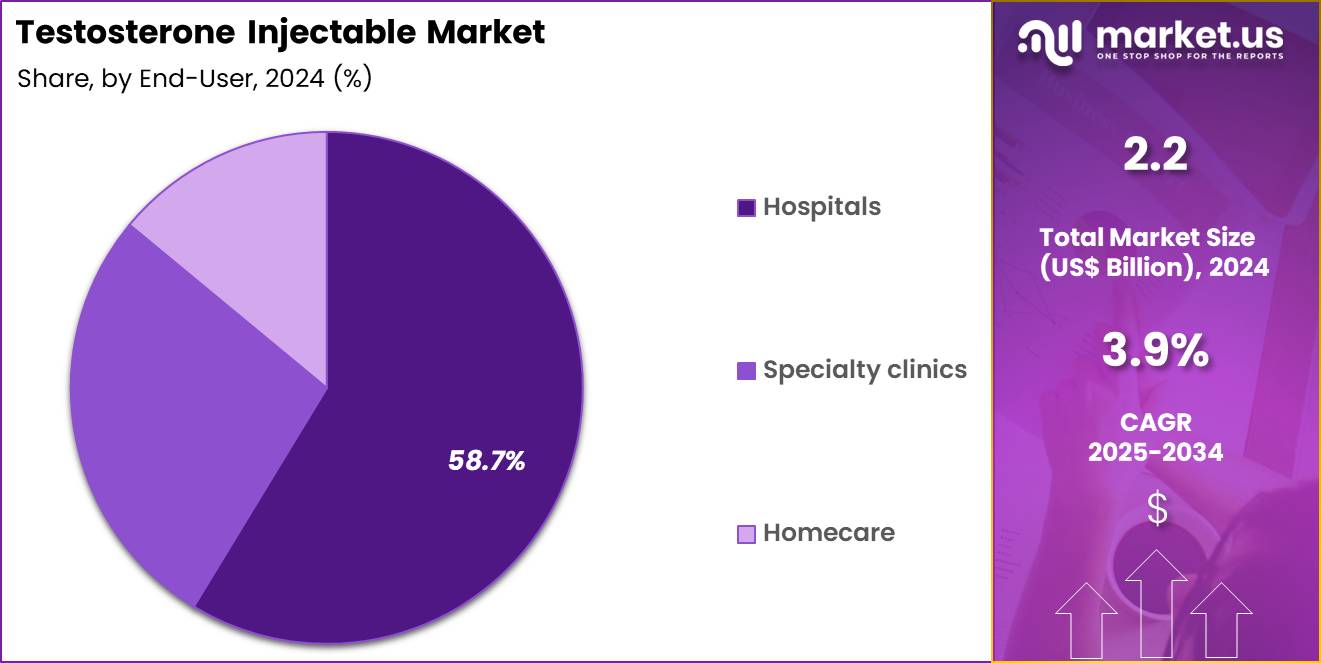

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, specialty clinics and homecare. The hospitals sector stands out as the dominant player, holding the largest revenue share of 58.7% in the market.

- North America led the market by securing a market share of 40.0% in 2024.

Age Group Analysis

Adults accounted for 64.9% of growth within the age group category and represent the largest consumer base in the Testosterone Injectable market. Rising diagnosis rates of testosterone deficiency among adult males drive sustained demand. Lifestyle factors such as obesity, diabetes, and metabolic syndrome increase hypogonadism prevalence in adults. Greater awareness of men’s health encourages medical consultation and testing. Clinicians increasingly screen adult patients presenting fatigue, low libido, and muscle loss.

Injectable testosterone offers predictable absorption and stable serum levels. Adults prefer injectable formulations for long-acting therapeutic effects. Workplace productivity concerns support treatment initiation in working-age populations. Expansion of endocrinology and urology services improves access for adults. Adult patients often require long-term therapy, increasing cumulative consumption.

Insurance coverage frameworks primarily focus on adult hypogonadism treatment. Improved diagnostic criteria reduce underdiagnosis in adults. Hospital-based initiation strengthens treatment adherence. Clinical guidelines emphasize testosterone replacement in symptomatic adult patients. Growing acceptance of hormone therapy supports market growth.

Adult patients tolerate structured dosing schedules effectively. Monitoring protocols improve safety perceptions. Pharmaceutical promotion focuses on adult male health restoration. Demand remains concentrated in adult populations with chronic deficiency. The segment is projected to maintain dominance due to demographic size and clinical need.

Application Analysis

Hypogonadism captured 52.8% of growth within the application category and stands as the primary driver of the Testosterone Injectable market. Testosterone deficiency represents the most established indication for injectable therapy. Improved awareness among healthcare providers increases diagnosis accuracy. Aging male populations expand the hypogonadism patient pool. Chronic conditions affecting endocrine function elevate disease incidence.

Injectable testosterone supports consistent hormone replacement in moderate to severe cases. Clinicians favor injectables for reliable dose delivery. Treatment improves bone density, muscle mass, and sexual function outcomes. Long-term management requirements increase therapy persistence. Medical societies reinforce treatment through clinical recommendations.

Patient demand rises with quality-of-life improvements. Hypogonadism management integrates into routine endocrine care. Reduced stigma around hormone therapy supports adoption. Injectable options suit patients unresponsive to topical formulations. Hospitals and clinics standardize hypogonadism treatment pathways.

Monitoring of serum testosterone improves dosing precision. Expanded laboratory testing access supports early detection. Pharmaceutical pipelines focus on optimized injectable formulations. Reimbursement stability encourages therapy continuity. The segment is anticipated to remain dominant due to clear clinical indication and chronic treatment demand.

End-User Analysis

Hospitals represented 58.7% of growth within the end-user category and dominate the Testosterone Injectable market. Initial diagnosis and therapy initiation frequently occur in hospital settings. Hospitals provide comprehensive endocrine and urology services. Injectable administration often requires clinical supervision during early treatment. Monitoring of hematocrit, PSA, and hormone levels supports hospital-based care. Complex patient profiles concentrate treatment in hospitals.

Hospitals manage adverse event surveillance effectively. Institutional protocols guide testosterone replacement therapy initiation. Multidisciplinary teams support personalized dosing decisions. Hospital pharmacies ensure controlled storage and dispensing. Referral networks direct patients with severe deficiency to hospitals. Insurance authorization processes operate efficiently in hospital systems.

Teaching hospitals promote guideline-based testosterone use. Hospitals manage patients with comorbid cardiovascular and metabolic conditions. Standardized follow-up schedules improve adherence. Hospital outpatient departments expand access to hormone therapy.

Clinical documentation supports long-term therapy management. Hospitals remain trusted centers for injectable hormone treatments. Infrastructure investment strengthens service capacity. Prescriber confidence increases within hospital environments. The segment is expected to retain dominance due to diagnostic complexity and clinical oversight requirements.

Key Market Segments

By Age Group

- Adults

- Pediatric

- Geriatric

By Application

- Hypogonadism

- Autoimmune conditions

- Genetic disorders

- Sex organ surgeries

By End-user

- Hospitals

- Specialty clinics

- Homecare

Drivers

Rising prevalence of testosterone deficiency is driving the market

The testosterone injectable market is driven by the rising prevalence of testosterone deficiency, which necessitates effective replacement therapies to address symptoms such as fatigue, reduced libido, and muscle loss in affected men. Healthcare providers are increasingly prescribing injectable formulations for their reliable absorption and long-lasting effects in managing hypogonadism.

Regulatory agencies like the FDA support the use of testosterone injectables for approved indications, encouraging market growth through ongoing monitoring and guidance. Pharmaceutical companies invest in formulations to meet the needs of an aging male population prone to low testosterone levels. Clinical protocols integrate injectables into hormone replacement regimens, improving quality of life for patients with confirmed deficiency.

Global health organizations track hormonal disorders to inform policy on treatment accessibility. Academic research validates the role of injectables in restoring normal testosterone levels, driving industry innovation. Patient awareness campaigns promote testing and treatment, boosting demand for injectable options.

Economic burdens from untreated deficiency, including productivity loss, further justify market expansion. According to a study published by the National Institutes of Health in 2024, the prevalence of low serum testosterone in men aged 40-69 years is approximately 20-30%, based on data from population surveys.

Restraints

High regulatory scrutiny on cardiovascular risks is restraining the market

The testosterone injectable market is restrained by high regulatory scrutiny on potential cardiovascular risks, which requires extensive labeling warnings and limits prescribing practices. Healthcare professionals must monitor patients for heart-related events, adding to clinical complexity and deterring routine use. Regulatory agencies mandate post-market studies to assess long-term safety, delaying new formulations and increasing development costs.

Pharmaceutical firms face challenges in marketing injectables due to restricted indications for hypogonadism only. Clinical guidelines emphasize risk-benefit assessments, reducing utilization in borderline cases. Global health advisories highlight concerns over stroke and heart attack associations, impacting physician confidence.

Academic analyses of safety data contribute to cautious adoption in older populations. Patient access is limited by insurance requirements for documented deficiency and monitoring. Economic implications include higher liability insurance for manufacturers due to risk perceptions. The U.S. Food and Drug Administration issued class-wide labeling changes for testosterone products in 2024, requiring warnings on abuse and dependence potential.

Opportunities

Expansion of telemedicine for TRT prescriptions is creating growth opportunities

The testosterone injectable market offers growth opportunities through the expansion of telemedicine for testosterone replacement therapy prescriptions, enabling remote consultations and monitoring for patients in underserved areas. Healthcare providers can utilize virtual platforms to assess deficiency and prescribe injectables, improving access and compliance. Regulatory frameworks are adapting to support telehealth for hormone therapy, facilitating market entry in rural regions.

Pharmaceutical companies can partner with telemedicine platforms to distribute injectables through mail-order services. Clinical research explores remote monitoring tools for testosterone levels, enhancing therapy management. Global adoption of digital health aligns with growth in online consultations for men’s health. Academic partnerships refine telehealth protocols to ensure safe prescribing of injectables.

Patient convenience increases with home-based self-administration options enabled by telemedicine. Economic models project cost savings from reduced in-person visits. The Centers for Disease Control and Prevention reported that telehealth visits increased by 154% during the early pandemic period, with sustained growth through 2022-2024.

Impact of Macroeconomic / Geopolitical Factors

Robust worldwide economic recoveries channel resources into endocrine therapies, advancing the testosterone injectable market through rising demand for hormone replacement in mature populations. Companies capitalize on demographic shifts toward longer lifespans, which expands clinical applications and sustains prescription growth in key regions.

Nevertheless, ongoing global inflation drives up costs for active pharmaceutical ingredients and sterile packaging, constraining pricing flexibility for manufacturers serving price-sensitive markets. Escalating geopolitical frictions in sourcing regions disrupt precursor chemical supplies, extending production schedules and increasing uncertainty for global distributors. Industry participants mitigate these challenges by diversifying procurement to stable suppliers, which enhances reliability and fosters innovative formulation partnerships.

Current US tariffs, applying substantial duties on imported injectable formulations from major exporters, raise landed costs and challenge competitiveness for foreign-sourced products. Domestic producers benefit from this environment by expanding local manufacturing capacity, which promotes technological improvements and strengthens supply chain independence. Continued progress in patient-friendly delivery options and bioequivalent developments consistently strengthen the market’s foundation, promising sustained growth and greater therapeutic access in the years ahead.

Latest Trends

FDA panel recommendations to loosen TRT restrictions is a recent trend

In 2025, the testosterone injectable market has demonstrated a prominent trend toward FDA panel recommendations to loosen restrictions on testosterone replacement therapy, potentially expanding indications beyond current approvals for hypogonadism. Healthcare experts are advocating for broader prescribing guidelines based on emerging data on benefits for age-related decline. Regulatory discussions highlight the need to update labeling to reflect real-world usage, influencing market dynamics.

Pharmaceutical firms are preparing for potential label changes that could increase injectable demand in men’s health. Clinical practices are anticipating easier access for patients with low testosterone symptoms not meeting strict criteria. Global health policies are influenced by these recommendations, promoting standardized TRT approaches.

Academic studies are providing evidence to support expanded use, driving innovation in injectable formulations. Patient advocacy groups are pushing for reforms to reduce barriers to therapy. Ethical protocols are ensuring safety in broader applications. The U.S. Food and Drug Administration convened an expert panel in December 2025 to review testosterone replacement therapy restrictions, recommending potential loosening based on current evidence.

Regional Analysis

North America is leading the Testosterone Injectable Market

In 2024, North America held a 40.0% share of the global testosterone injectable market, advanced by growing recognition of hypogonadism symptoms and the expansion of men’s health clinics offering hormone replacement therapies to address low energy, muscle loss, and libido issues in middle-aged populations. Endocrinologists and urologists amplified prescriptions for long-acting formulations like testosterone cypionate and enanthate, supported by clinical evidence highlighting their efficacy in restoring serum levels with fewer fluctuations compared to topical alternatives.

Regulatory adjustments facilitated broader access through telemedicine consultations, enabling remote monitoring to optimize dosing and minimize side effects such as polycythemia. Rising obesity rates and sedentary lifestyles contributed to higher incidence of secondary hypogonadism, prompting integrated wellness programs that incorporate injectables for metabolic improvement.

Pharmaceutical innovations refined auto-injector devices for self-administration, aligning with patient preferences for convenience in busy professional lives. Collaborative guidelines from medical societies endorsed their use in transgender hormone therapy, bridging gaps in specialized care.

Supply enhancements ensured sterile, pre-filled syringes compliant with biosafety standards in high-demand pharmacies. From 2018 to 2022, the prevalence of testosterone therapy increased by 120% among persons aged ≤24 years in the United States.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Healthcare leaders project notable escalation in testosterone injectable solutions across Asia Pacific throughout the forecast period, propelled by demographic aging and urbanization that exacerbate hormone deficiencies amid dietary shifts. Physicians incorporate long-acting variants into hypogonadism management protocols, tailoring regimens to combat fatigue and sarcopenia in elderly men facing occupational stresses.

National authorities subsidize access through public health schemes, equipping district clinics to serve rising caseloads from metabolic syndromes in micronutrient-poor regions. Biotech developers customize depot formulations with improved stability, suiting humid storage conditions for broader distribution. Cross-regional consortia validate efficacy through population studies, fostering confidence in metabolic outcomes for obese cohorts.

Pharmaceutical firms localize production of cypionate esters, complying with pharmacopeial norms to sustain affordability. Community outreach trains general practitioners on administration techniques, extending coverage to peripheral areas grappling with diagnostic barriers. A study reported that the prevalence of clinical hypogonadism among Malaysian T2DM males was 17.5%.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Testosterone Injectable market drive growth by refining long-acting formulations that deliver stable hormone levels and reduce dosing frequency for patients with hypogonadism. Companies expand adoption by aligning products with endocrinology and urology treatment pathways that emphasize consistency, safety monitoring, and patient adherence.

Commercial strategies focus on strengthening hospital and specialty clinic penetration while supporting prescribers through education on appropriate patient selection and therapy management. Innovation priorities include improved carrier oils, optimized injection profiles, and packaging designs that enhance administration convenience.

Market expansion targets regions with rising awareness of men’s health conditions and improving access to hormone replacement therapy. Endo International operates as a notable participant through its established injectable hormone portfolio, regulated manufacturing capabilities, and focused commercial execution within specialty pharmaceutical markets.

Top Key Players

- Bayer AG

- Endo Pharmaceuticals Inc.

- Eli Lilly and Company

- Kyowa Kirin Co., Ltd.

- Pfizer Inc.

- AbbVie Inc.

- Hikma Pharmaceuticals PLC

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Cipla Limited

Recent Developments

- In January 2024, AbbVie received clearance from the US FDA for AndroGel 1%, its topical testosterone replacement therapy indicated for adult men with hypogonadism. The regulatory decision reinforced AbbVie’s position in the testosterone replacement therapy landscape by extending the clinical reach of an established formulation and supporting continued uptake in physician-managed hormone deficiency treatment pathways.

- In March 2024, Pfizer and Merck & Co. formalized a strategic alliance focused on the joint development and commercialization of testosterone replacement therapies across the US and selected European markets. The collaboration was structured to combine Pfizer’s global commercialization scale with Merck’s therapeutic development capabilities, signaling sustained investment by large pharma in hormone replacement portfolios amid rising diagnosis rates of male hypogonadism.

Report Scope

Report Features Description Market Value (2024) US$ 2.2 Billion Forecast Revenue (2034) US$ 3.2 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Age Group (Adults, Pediatric and Geriatric), By Application (Hypogonadism, Autoimmune Conditions, Genetic Disorders and Sex Organ Surgeries), By End-User (Hospitals, Specialty Clinics and Homecare) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bayer AG, Endo Pharmaceuticals Inc., Eli Lilly and Company, Kyowa Kirin Co., Ltd., Pfizer Inc., AbbVie Inc., Hikma Pharmaceuticals PLC, Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Cipla Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Testosterone Injectable MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Testosterone Injectable MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Bayer AG

- Endo Pharmaceuticals Inc.

- Eli Lilly and Company

- Kyowa Kirin Co., Ltd.

- Pfizer Inc.

- AbbVie Inc.

- Hikma Pharmaceuticals PLC

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Cipla Limited