Global Terpenes Market By Product Type (Myrcene, Limonene, Pinene, Linalool, and Other Product Types) By Source (Natural and Synthetic) By Application (Cosmetics & Personal Care, Food & Beverage, Pharmaceuticals, and Other Applications) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 19301

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

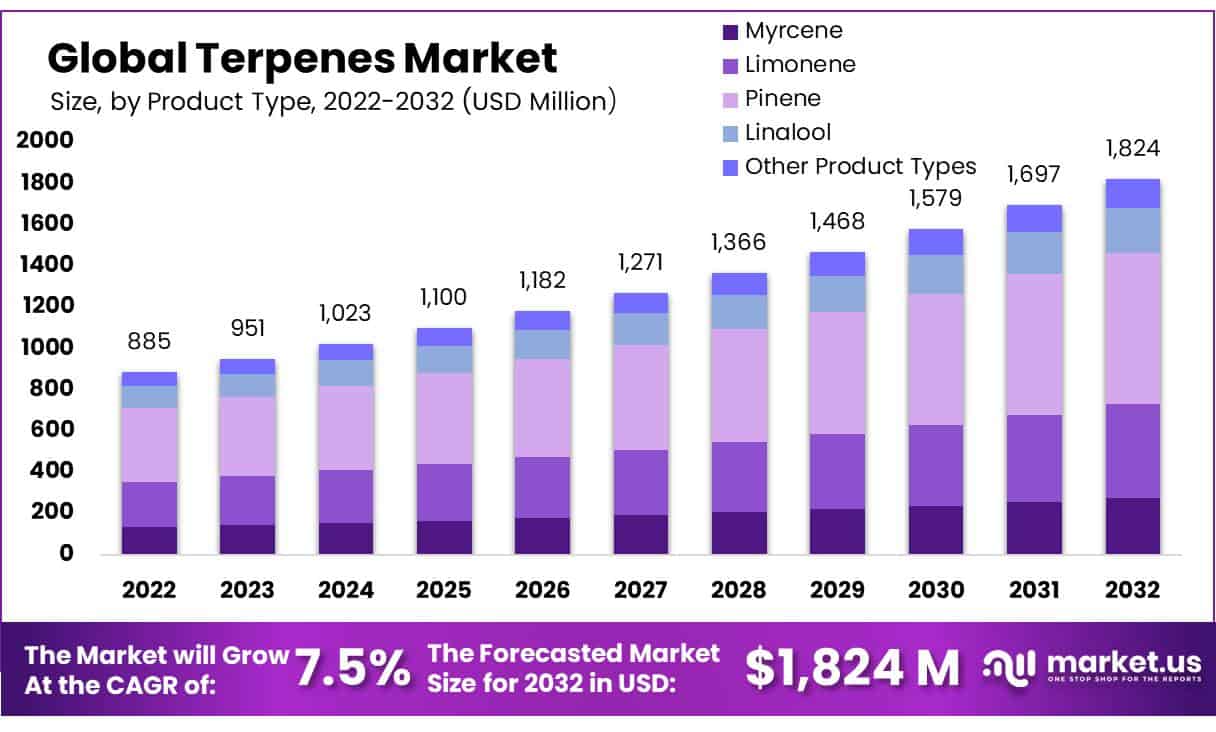

In 2022, the Global Terpenes Market was valued at USD 885.1 Million, this market is estimated to reach USD 1,824.2 Million in 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 7.5%.

Terpenes are an organic class of compounds found in various plants, such as cannabis, pine trees, and citrus fruits, contributing to their distinctive aroma and flavor profiles. Terpenes play an integral part in nature by attracting pollinators while deterring herbivores; additionally, they have numerous applications in industries such as fragrance, food production, and pharmaceutical production.

One key driver driving global terpenes market growth is consumer preference for natural flavors and fragrances in various industries, particularly food, beverages, cosmetics, and pharmaceuticals. Terpenes derived from plants are highly esteemed for their aromatic qualities and used widely across these fields as natural and authentic flavors or fragrances are preferred over synthetic ones.

Furthermore, potential therapeutic uses are being investigated, further fueling their market expansion. It is expected to expand as industries search for sustainable yet natural solutions that meet consumers’ expectations.

Key Takeaways

- The Global Terpene Market is valued at USD 1 Million in 2022.

- By Product Type, the Pinene segment dominated the market with a market share of 2% in 2022.

- By Source, the Natural segment dominated the market with more than 60% market share in 2022.

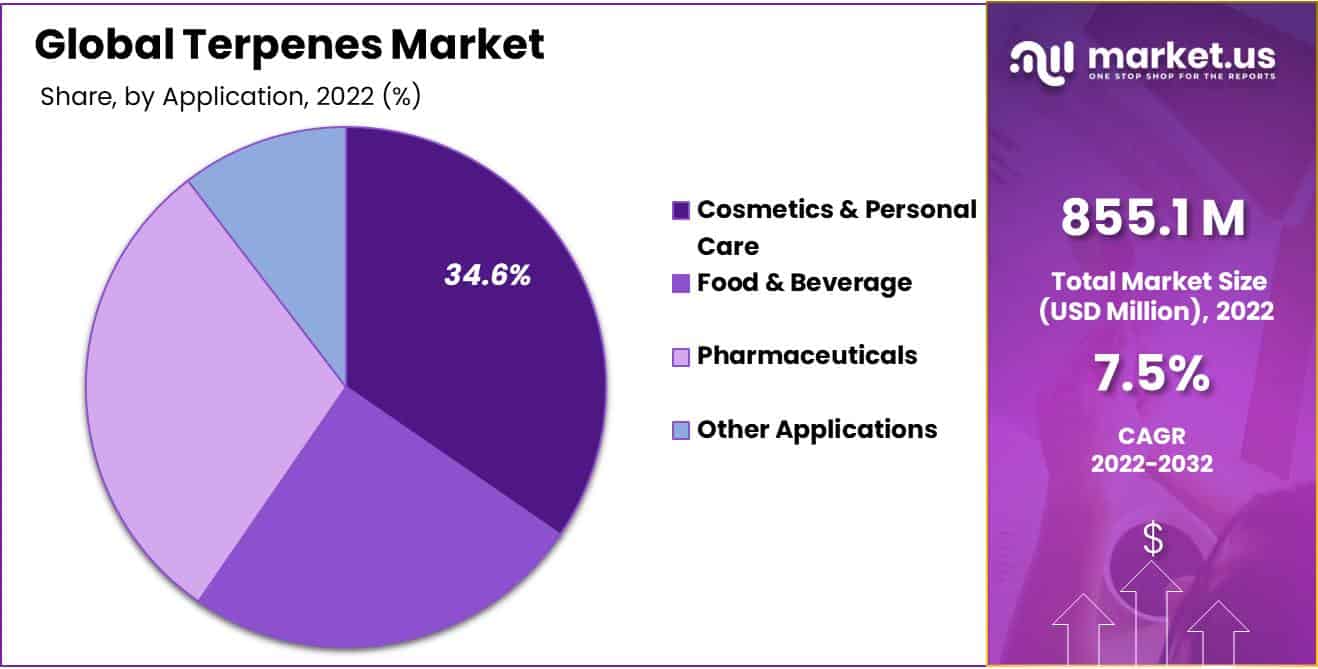

- The Application, Cosmetics & Personal Care segment led the market in 2022 with a market share of 34.6%.

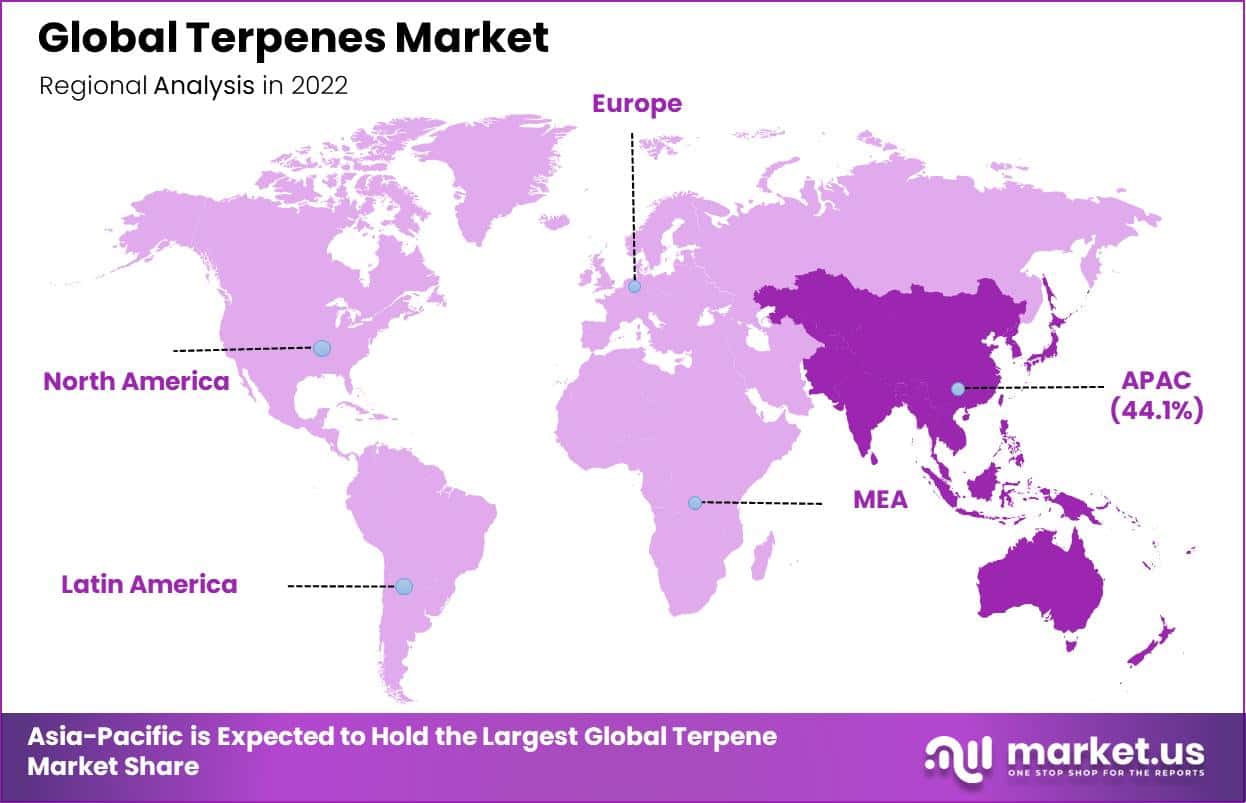

- In 2022, the Asia-Pacific region is the dominant region in the global Terpene market, with a market share of 44.1% of global revenue.

- France is currently the largest producer of raw cannabis and industrial cannabis in the world, followed by China.

Actual Numbers Might Vary in the Final Report.

Driving Factors

Growing Demand for Natural Flavors and Fragrances

The global terpenes market is experiencing rapid expansion due to consumer demand for natural flavors and fragrances in various industries. Consumers have become more health-conscious, seeking products made with natural ingredients. Terpenes, found naturally in plants, offer an extensive array of aromatic and flavoring properties.

Terpenes have long been utilized by food and beverage industries for increasing the taste and aroma of products such as confectionery, beverages, and sauces; additionally, they are increasingly being adopted in cosmetics and personal care applications to boost natural scent enhancement properties – another key driver behind the growth of the Terpenes market.

Expanding Applications in Cannabis Industry

Legalization and rising acceptance of cannabis for medicinal and recreational use across various regions, such as North America and parts of Europe, has driven terpene demand exponentially.

Terpenes play an integral part in shaping cannabis strain flavors and aromas as well as contributing to an entourage effect that enhances therapeutic benefits; hence, cannabis has become a significant market driver. Further amplifying this growth are products such as oils, edibles, and vape pens, which incorporate terpenes for consumer preference-matching purposes.

Restraining Factors

Regulatory Challenges

The terpenes industry faces considerable regulatory barriers due to its close association with the cannabis and hemp industries. Several countries impose stringent rules regarding cultivation, extraction, and use of terpenes from these plants, thus creating regulatory ambiguity for businesses operating within this market that must adhere to complex webs of laws and guidelines while expanding internationally with their market expansion strategy.

Supply Chain Vulnerabilities

Terpenes are typically made from natural plant materials, making them susceptible to supply chain disruption due to weather conditions, pests, and diseases. Citrus terpenes used in various industries may be affected by crop failure due to diseases like citrus greening; such disruptions could cause price fluctuations and supply shortages that negatively affect businesses relying on them as key ingredients. Furthermore, extraction processes themselves can be resource intensive, leaving terpene extraction vulnerable to supply chain interruption due to energy availability or costs.

Growth Opportunity

Expanding Applications in Pharmaceuticals

The global terpenes market holds considerable promise in the pharmaceutical sector. Terpenes, natural aromatic compounds found in various plants, are rapidly gaining recognition for their therapeutic applications. Pharmaceutical companies are taking greater advantage of terpene’s potential in drug development, mainly to develop novel treatments for various conditions.

Terpenes possess anti-inflammatory, analgesic, and antimicrobial properties, making them good candidates for pharmaceutical formulations. Terpenes also play a pivotal role in increasing the bioavailability and efficacy of certain drugs, making them invaluable components in drug formulation processes.

Terpenes provide a promising avenue for pharmaceutical researchers to investigate innovative therapies and treatment methods, making this market attractive for innovative pharmaceutical companies looking to take advantage of this natural resource.

Latest Trends

Emerging Sustainability Focus

Over recent years, sustainability has taken on greater significance within the global terpenes market, becoming an increasingly prevalent trend. This trend demonstrates a growing awareness among both consumers and industry players regarding the environmental impact of terpene production.

Companies across the terpene value chain, from extraction to formulation, are making efforts to reduce their carbon footprint and adopt eco-friendly practices. Notably, terpene producers are increasingly turning to green methods like supercritical CO2 extraction as an efficient and eco-friendly option for their production processes.

As more consumers desire eco-conscious products, more companies have adopted sustainable packaging materials, and recycled plastic recycling is rising. This trend aligns with consumer preference and positions the terpene industry for long-term growth in our increasingly eco-conscious world.

By Product Type Analysis

The Pinene Segment Held the Largest Market Share in 2022 Due to its Natural Abundance and Cost-Effectiveness From Renewable Sources.

The global terpenes market is segmented based on product type into Myrcene, Limonene, Pinene, Linalool, and Other Product Types. Among these product types, the pinene segment was the most lucrative in the global terpene market, with a market share of 40.2% in 2022. Pinene is one of the most prevalent terpenes due to its natural presence in various plant species, such as pine trees and cannabis.

Due to this naturally abundant source, many manufacturers find pinene to be cost-effective as it comes from renewable resources. Pinene comes into two main isomers: alpha-pinene and beta-pinene, each providing distinct aromatic profiles for use across various applications. Regulatory authorities of many countries have recognized Pinene as being generally safe (GRAS), making it easier for manufacturers to incorporate it into food and cosmetic products, as well as cleaning/disinfectant solutions.

Limenone has emerged as the fastest-growing segment in the global terpenes market. Limonene can be found naturally in citrus fruit, and its pleasant citrus scent makes it a highly prized fragrance and flavor additive.

Limonene’s widespread application includes pharmaceutical and food industries; for example, as a flavoring agent in beverages, baked goods, and confectionery to add a refreshing citrus taste or as an anti-inflammatory and antioxidant agent in pharmaceutical products or dietary supplements. In addition, its eco-friendly nature has contributed significantly to its rapid expansion.

Source Analysis

The Natural Segment Held the Largest Market Share in 2022 Due to their Organic Origin, Perceived Ecological Benefits, and Safety

Based on the source, the global terpenes market is segmented into Natural and Synthetic. Among them, natural was the most lucrative in the global terpenes market. Natural terpenes are derived from organic sources such as plants, fruits, and trees.

This natural origin appeals to consumers who are increasingly seeking products with minimal chemical additives and a focus on sustainability and eco-friendliness. As awareness of environmental issues grows, natural terpenes have gained favor due to their perceived ecological benefits and minimal environmental impact compared to synthetic alternatives.

Moreover, natural terpenes are often considered safer than their synthetic counterparts since their production requires harsh chemicals and processes, which may leave behind residual impurities or unwanted byproducts. Both consumers and businesses have become more vigilant regarding product quality and purity; hence, there is a preference for natural terpenes over synthetics.

Additionally, natural terpenes often offer more complex and authentic aroma and flavor profiles than synthetic alternatives, making them invaluable in industries such as food and beverages, cosmetics, and aromatherapy, where sensory experiences play an integral part in product design and consumer satisfaction.

Application Analysis

The Cosmetics & Personal Care Segment Held the Largest Market Share in 2022 Due to Increasing Consumer Demand for Natural, Organic, and Sustainable Beauty Products.

The global terpenes market is segmented based on application into Cosmetics & Personal Care, Food & Beverage, Pharmaceuticals, and Other Applications. Among these applications, the cosmetic & personal care segment was the most lucrative in the global terpenes market, with a market share of 34.6% in 2022.

Consumers are increasingly seeking natural and organic ingredients in their daily haircare, skincare, and personal care routine. Terpenes fit this demand perfectly, as they are derived from natural sources and are considered safe for cosmetic applications. Their ability to impart pleasing scents to products without the need for synthetic fragrances aligns with the growing trend toward clean beauty and sustainable cosmetic choices.

Furthermore, terpenes offer various potential benefits for skincare. Some terpenes possess anti-inflammatory, antioxidant, and antimicrobial properties, making them highly desirable in skincare formulations.

Pharmaceuticals have emerged as the fastest growing segment in the global terpenes market. Terpenes are used as active ingredients in pharmaceutical formulations to increase certain drugs’ solubility and absorption rates while improving their bioavailability efficacy.

Additionally, the regulatory environment in the pharmaceutical industry has become more compliant towards natural ingredients and botanical extracts. Regulatory agencies acknowledge terpene as a safe and effective component in pharmaceutical formulations, creating new opportunities for their use in medicine.

Actual Numbers Might Vary in the Final Report.

Market Key Segmentation

Based on the Product Type

- Myrcene

- Limonene

- Pinene

- Linalool

- Other Product Types

Based on the Source

- Natural

- Synthetic

Based on the Application

- Cosmetics & Personal Care

- Food & Beverage

- Pharmaceuticals

- Other Applications

Geopolitics and Recession Impact Analysis

Geopolitical Factors:

Trade Policies and Tariffs: The production of terpenes is predominantly concentrated in regions where specific flora grow abundantly, such as Southeast Asia for citral-based terpenes (lemongrass) and North America for pinene-based terpenes (pine trees). Trade relations, therefore, are pivotal for sourcing raw materials and distributing final products. Tariffs or trade embargoes can have significant implications.

- In 2020, the U.S.-China trade war led to a 50% tariff on Chinese imports, causing a 38% drop in imports compared to the previous year.

- The exports of acyclic terpene alcohols from the United States decreased by $-3.03M (-57%) from $5.31M to $2.29M between April 2022 and April 2023

Regulatory Guidelines: The terpenes industry is highly regulated due to safety concerns. Geopolitical shifts can lead to regulation changes, affecting market access and compliance costs.

- In 2021, the European Union introduced stringent emissions regulations targeted at terpene extraction installations, engendering a heightened compliance burden that impinged upon profit margins.

Global Supply Chains: As with several commodities, the terpenes market is also subject to the vulnerabilities of global supply chains. Geopolitical instability, such as conflicts or sanctions, can disrupt the supply chain, causing price volatility.

- In 2020, supply chain disruptions due to the COVID-19 pandemic caused a temporary 15% reduction in terpene production worldwide.

Recession Impact:

Consumer Frugality: During recessions, consumer spending typically contracts. This contraction affects the terpenes market as it relies heavily on consumer goods, such as fragrances, cosmetics, and food products, which incorporate terpenes for their aromatic and flavor-enhancing properties. A decline in demand for these products can lead to.

Investment and Research Cutbacks: Recessions often lead to reduced investments in research and development (R&D). Since terpenes market growth can benefit from innovations in extraction and synthesis methods, reduced R&D spending can slow down advancements in the industry.

Regional Analysis

APAC is the Dominant Region in the Global Terpene Market in 2022 Due to its Abundance of Plant Species, Cost-Effective Natural Resources, Skilled Labor, and Technical Expertise.

In 2022, APAC held the leading position in the global market, with a significant market share of 44.1%. APAC countries boast an abundance of plant species containing terpenes. From Southeast Asian rainforests to Himalayan foothills, APAC offers an abundance of botanical resources from which terpenes can be extracted.

Natural resources offer a steady and cost-effective source of raw materials for extracting terpenes, significantly cutting production costs. Furthermore, the availability of skilled labor at competitive wages in APAC countries has made it a preferred destination for terpene extraction and processing.

With a well-developed chemical industry and a history of herbal medicine and traditional remedies, APAC nations have the technical know-how to extract and utilize terpenes effectively.

Additionally, the relatively lax regulatory environment in some APAC countries has facilitated the growth of the cannabis industry, which heavily relies on terpenes for product differentiation. North America has emerged as the fastest-growing segment in the global terpene market.

North America benefits from having an established cannabis industry, particularly in the United States and Canada. Legalization for medical and recreational purposes has created increased demand for terpene products.

Furthermore, North American consumers increasingly favor natural and organic products across various industries, such as food and beverages, cosmetics, and personal care. These natural plant compounds align perfectly with consumers’ preferences, leading to their incorporation in these fields.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the global terpene market include Givaudan, The Archer-Daniels-Midland Company, Symrise AG, Firmenich International SA, True Terpenes, International Flavors & Fragrances Inc., and more. Key players are focussing on expanding their product portfolios through research and development efforts, aiming to capture a broader range of end-use industries.

Others prioritize vertical integration, securing their supply chains and ensuring a consistent quality of terpene products. Additionally, partnerships and collaborations with research institutions and downstream manufacturers are common strategies to drive innovation and market penetration. Furthermore, marketing and branding efforts emphasizing the natural and sustainable aspects of terpenes have been deployed to cater to the growing demand for eco-friendly products.

Market Key Players

- The Archer-Daniels-Midland Company

- Givaudan

- Symrise AG

- Firmenich International SA

- True Terpenes

- International Flavors & Fragrances Inc.

- Merck KGaA

- Thermo Scientific Chemicals

- Floraplex Terpenes

- True Extracts Terpenes

- Arora Aromatics Pvt. Ltd.

- Isodiol International Inc.

- Medical Marijuana Inc.

- Mentha & Allied Products

- Treatt PLC

- Other Key Players

Recent Developments

In March 2023, The Terpene Store launched a new natural terpene line in collaboration with The Werc Shop and Dr. Jeffrey C. Raber.

In January 2021, Extract Consultants launched a new powdered terpene line created from 100% legal botanical sources and designed to mimic the terpene profiles of various strains.

Report Scope

Report Features Description Market Value (2022) USD 885.1 Mn Forecast Revenue (2032) USD 1,824.2 Mn CAGR (2023-2032) 7.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Myrcene, Limonene, Pinene, Linalool, and Other Product Types), By Source (Natural and Synthetic), By Application (Cosmetics and Personal Care, Food and beverage, Pharmaceuticals, and Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape The Archer-Daniels-Midland Company, Givaudan, Symrise AG, Firmenich International SA, True Terpenes, International Flavors & Fragrances Inc., Merck KGaA, Thermo Scientific Chemicals, Floraplex Terpenes, True Extracts Terpenes, Arora Aromatics Pvt. Ltd., Isodiol International Inc., Medical Marijuana Inc., Mentha & Allied Products, Treatt PLC, The Terpene Store, Extract Consultants, and Other Key Players. Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are terpenes Market, and what role do they play in plants and nature?Terpenes are a diverse class of organic compounds produced by various plants, including cannabis, fruits, and herbs. They contribute to the aroma, flavor, and physiological effects of the plants. In nature, terpenes play a role in attracting pollinators and deterring predators.

What are some common terpenes and their characteristic aromas?Common terpenes include myrcene (earthy, musky), limonene (citrus), pinene (pine), linalool (floral, lavender), and caryophyllene (spicy, peppery). Each terpene has a distinct aroma and may offer specific therapeutic effects.

-

-

- The Archer-Daniels-Midland Company

- Givaudan

- Symrise AG

- Firmenich International SA

- True Terpenes

- International Flavors & Fragrances Inc.

- Merck KGaA

- Thermo Scientific Chemicals

- Floraplex Terpenes

- True Extracts Terpenes

- Arora Aromatics Pvt. Ltd.

- Isodiol International Inc.

- Medical Marijuana Inc.

- Mentha & Allied Products

- Treatt PLC

- Other Key Players