Global Tempeh Market Size, Share Analysis Report By Type (Frozen, Fresh, Ready-to-Eat), By Source (Soya Beans, Multi-grain, Others), By Distribution Channel ( Hypermarkets and Supermarkets, Foodservice, Retail, Convenience Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159475

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

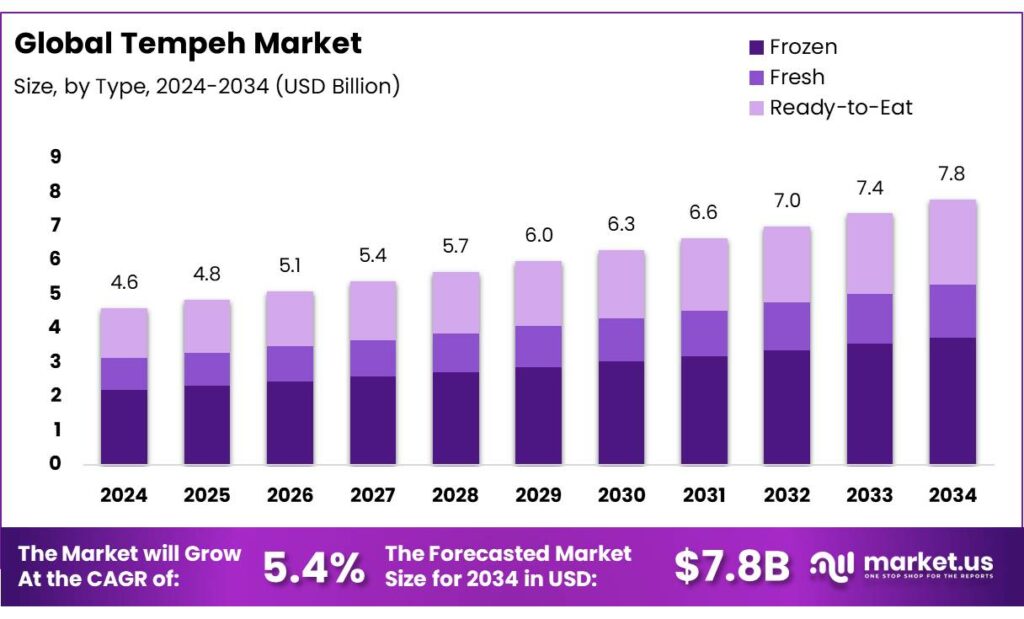

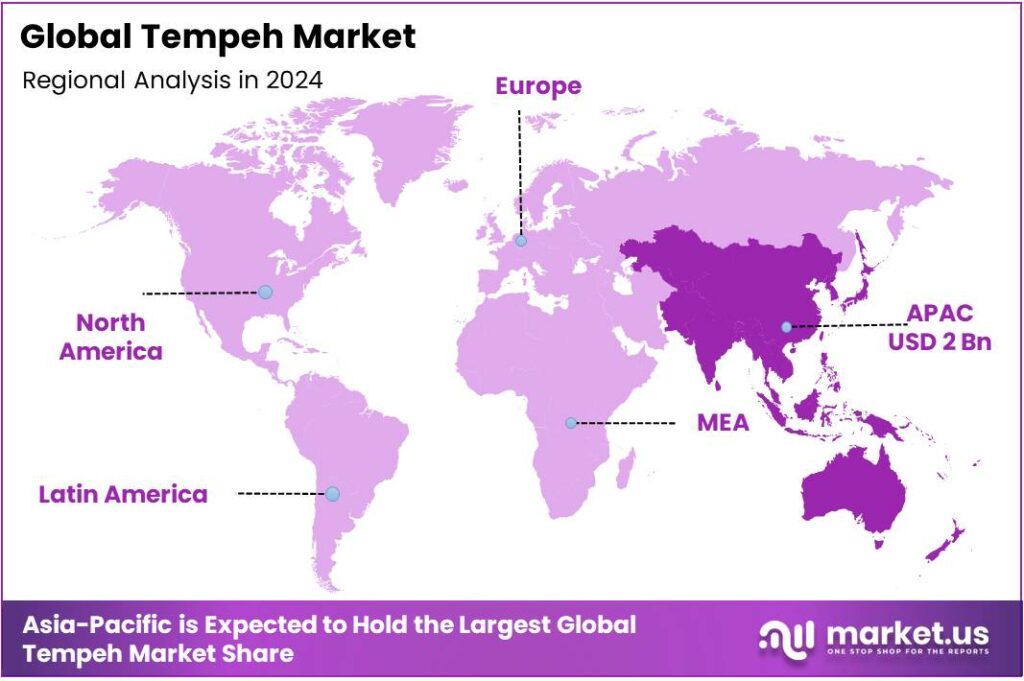

The Global Tempeh Market size is expected to be worth around USD 7.8 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 43.9% share, holding USD 2 Billion in revenue.

Tempeh, a traditional Indonesian fermented soybean product, has evolved into a globally recognized plant-based protein source. Originating from Central Java, Indonesia, tempeh is produced through the fermentation of cooked soybeans by the fungus Rhizopus oligosporus. This process results in a firm, nutty-flavored cake rich in protein, fiber, and essential minerals. Its nutritional profile and versatility have contributed to its increasing popularity among health-conscious consumers and those adopting plant-based diets.

Government initiatives play a crucial role in supporting the tempeh industry. For instance, the U.S. Department of Agriculture (USDA) has facilitated the export of U.S. soybeans to Indonesia, benefiting local tempeh and tofu producers. In 2010, U.S. soybean sales to Indonesia reached a record $805 million, marking a 40% increase over six years.

According to the Plant Based Foods Association, the U.S. plant-based food market alone grew by 27% in 2020, generating $7 billion in revenue. This growth has been bolstered by increased awareness of the health benefits associated with plant-based proteins, including those found in tempeh. The fermentation process in tempeh not only enhances the nutritional profile of soybeans but also provides a unique texture and flavor, making it an appealing alternative to meat for consumers seeking high-protein, low-fat food options.

According to the U.S. Department of Agriculture (USDA), plant-based protein consumption is expected to rise by 20% annually through 2025, signaling strong future demand for products like tempeh. In addition, continued advancements in tempeh production techniques, including innovations in fermentation processes and the development of new flavors and forms, will support market expansion.

Key Takeaways

- Tempeh Market size is expected to be worth around USD 7.8 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 3.6%.

- Frozen tempeh held a dominant market position, capturing more than a 48.2% share of the global market.

- Soya Beans held a dominant market position, capturing more than a 72.4% share of the global tempeh market.

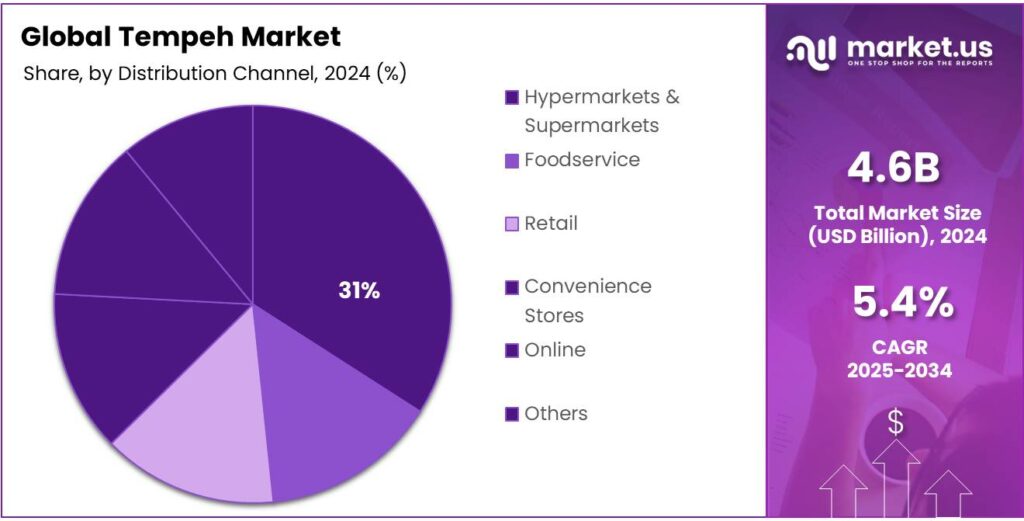

- Hypermarkets & Supermarkets held a dominant market position, capturing more than a 31.5% share of the global tempeh market.

- Asia Pacific dominated the global tempeh market, holding a significant share of 43.90%, valued at approximately USD 2 billion.

By Type Analysis

Frozen Tempeh Dominates with 48.2% Share in 2024 due to Convenience and Shelf-Life Benefits

In 2024, Frozen tempeh held a dominant market position, capturing more than a 48.2% share of the global market. This dominance can be attributed to several factors, most notably the convenience and extended shelf life that frozen tempeh offers. The freezing process helps preserve the product without the need for preservatives, making it an attractive option for both consumers and retailers. The demand for frozen tempeh has surged as more consumers embrace plant-based diets but seek products that are easy to store and prepare, especially for those with busy lifestyles.

Frozen tempeh also benefits from its wide availability across various retail channels, including supermarkets, hypermarkets, and online platforms. The ability to store frozen tempeh for extended periods without compromising on nutritional value adds to its appeal. Furthermore, the growth of plant-based food offerings in the frozen category has played a significant role in the segment’s expansion. As of 2025, the frozen tempeh market is expected to maintain a steady growth rate, driven by the increasing preference for plant-based, ready-to-cook products that can be conveniently prepared at home.

By Nature Analysis

Soya Beans Dominates with 72.4% Share in 2024 Due to its High Nutritional Value and Cost-Effectiveness

In 2024, Soya Beans held a dominant market position, capturing more than a 72.4% share of the global tempeh market. The high nutritional content of soybeans, including their rich protein, fiber, and essential amino acids, makes them the preferred source for tempeh production. This widespread preference for soybeans is further driven by their cost-effectiveness and accessibility, particularly in major tempeh-producing regions like Southeast Asia and North America. The ability of soybeans to provide a stable and reliable base for tempeh fermentation has helped solidify their position as the leading source.

The increasing popularity of plant-based proteins, combined with the ongoing shift towards healthier, more sustainable food choices, has contributed to the continued dominance of soya beans in the market. In 2025, soya beans are expected to maintain a stronghold, with steady demand due to their versatility and widespread cultivation. As plant-based diets continue to gain traction globally, the soya bean segment remains well-positioned for sustained growth. The ongoing research into improving soybean yields and the environmental benefits of growing soybeans over animal-based protein sources will also support the segment’s dominance in the coming years.

By Distribution Channel Analysis

Hypermarkets & Supermarkets Lead with 31.5% Share in 2024 Due to Widespread Consumer Access

In 2024, Hypermarkets & Supermarkets held a dominant market position, capturing more than a 31.5% share of the global tempeh market. This distribution channel continues to be the primary point of access for tempeh due to its broad consumer reach and established infrastructure. Hypermarkets and supermarkets offer convenience, making it easy for consumers to find tempeh alongside other plant-based food products, which is particularly appealing to shoppers who are increasingly turning to plant-based diets.

The increasing availability of tempeh in large retail chains has played a significant role in boosting its market share. As of 2025, the trend is expected to continue, with supermarkets and hypermarkets capitalizing on the growing demand for plant-based protein products by expanding their tempeh offerings. These retail formats also provide competitive pricing, larger product variety, and strategic locations, which make tempeh more accessible to a wider consumer base. As more consumers seek convenient, nutritious, and affordable plant-based food options, the dominance of hypermarkets and supermarkets is projected to grow, cementing their position as the leading distribution channel for tempeh.

Key Market Segments

By Type

- Frozen

- Fresh

- Ready-to-Eat

By Source

- Soya Beans

- Multi-grain

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Foodservice

- Retail

- Convenience Stores

- Online

- Others

Emerging Trends

Clean Label Movement and Consumer Demand for Natural Ingredients

A significant and emerging trend in the tempeh industry is the growing consumer preference for clean-label products—foods with minimal, recognizable ingredients and no artificial additives. This shift reflects a broader movement towards transparency and health-conscious eating habits.

The tempeh industry is aligning with this trend by focusing on product innovation that emphasizes natural ingredients and minimal processing. Companies are developing tempeh products with fewer ingredients, avoiding artificial preservatives and additives, and highlighting the use of whole, plant-based components. This approach caters to consumers seeking wholesome, minimally processed foods that support their health and wellness goals.

Government initiatives are also supporting this trend. For example, Denmark’s Plant-Based Action Plan, launched in October 2023, includes measures to promote the development of plant-based foods with clean labels. The plan provides funding for research and development, supports the transition to plant-based production methods, and encourages the use of natural ingredients in food products. This initiative demonstrates the government’s commitment to fostering a food system that aligns with consumer preferences for transparency and natural ingredients.

Drivers

Rising Health Consciousness and Demand for Plant-Based Proteins

The increasing global shift towards healthier lifestyles and sustainable food choices has significantly contributed to the growth of the tempeh market. Consumers are increasingly seeking plant-based protein sources that offer nutritional benefits, align with ethical considerations, and have a lower environmental impact compared to traditional animal-based proteins.

Tempeh, a traditional Indonesian food made from fermented soybeans, has gained popularity due to its high protein content, fiber, and probiotics, making it an attractive option for vegetarians, vegans, and health-conscious individuals.

- According to the U.S. Department of Agriculture (USDA), soybeans, the primary ingredient in tempeh, are among the top agricultural exports from the United States, with exports reaching $1.2 billion in 2024. This indicates a strong international demand for soy-based products, including tempeh.

In Indonesia, where tempeh originated, the government has recognized the importance of soybean production to meet domestic demand. However, recent reports indicate challenges in soybean production due to reduced government assistance, leading to a decrease in production to 360,000 metric tons in 2023/24. Despite these challenges, the demand for tempeh remains robust, highlighting its significance in the local diet and economy.

Restraints

Soybean Supply Chain Vulnerabilities

One significant challenge facing the tempeh industry is the vulnerability of its soybean supply chain. Tempeh production heavily relies on soybeans, and disruptions in their supply can have cascading effects on production and availability.

- Indonesia, the birthplace of tempeh, is one of the world’s largest importers of soybeans, with over 2.3 million metric tons imported in 2023. Approximately 86% of these imports come from the United States, primarily in genetically engineered (GE) varieties. These soybeans are predominantly used for human food production, including tempeh and tofu.

However, the soybean supply chain is susceptible to various disruptions. In 2023, Indonesia experienced challenges in soybean imports due to global supply chain issues and domestic policy changes. These disruptions led to fluctuations in soybean prices and availability, affecting the production of tempeh and other soy-based products.

To mitigate such risks, the Indonesian government has implemented policies to stabilize the domestic soybean market. For instance, the government has introduced price controls and subsidies to support local soybean farmers and ensure a steady supply of soybeans for food production. Additionally, efforts are being made to enhance domestic soybean production through research and development initiatives aimed at improving crop yields and resilience.

Opportunity

Government Support and Technological Advancements in Tempeh Production

A significant growth opportunity for the tempeh industry lies in leveraging government support and technological advancements to enhance production efficiency and sustainability. Governments worldwide are recognizing the importance of plant-based proteins, including tempeh, in promoting public health and environmental sustainability.

In Indonesia, where tempeh originated, the government has implemented various initiatives to support the tempeh industry. The Ministry of Agriculture has been promoting the use of alternative legumes, such as jack beans, to diversify the raw materials for tempeh production. This initiative aims to reduce dependence on soybeans and improve food security. In 2025, the Alternative Tempeh Project was launched in Aceh and West Java, focusing on promoting the production and consumption of jack bean and mixed bean tempeh. The project provides seed funding, business consulting, and marketing support to small enterprises, fostering a sustainable tempeh ecosystem

Technological advancements also play a crucial role in the growth of the tempeh industry. The SWITCH-Asia program, funded by the European Commission, has been instrumental in promoting sustainable production practices among small and medium-sized enterprises (SMEs) in Indonesia’s tofu and tempeh sector. The program focuses on transitioning from traditional firewood-based cooking methods to more efficient technologies, such as liquefied petroleum gas (LPG) and stainless steel equipment. This shift has led to improved hygiene, reduced production costs, and increased profitability for SMEs

Furthermore, international collaborations have bolstered the tempeh industry’s growth. The U.S. Department of Agriculture (USDA) has supported the export of U.S. soybeans to Indonesia, benefiting local tempeh producers. In 2010, U.S. soybean sales to Indonesia reached a record b marking a 40% increase over six years. This partnership has facilitated the availability of high-quality soybeans for tempeh production, contributing to the industry’s growth

Regional Insights

Asia Pacific Leads the Tempeh Market with 43.90% Share in 2024, Valued at USD 2 Billion

In 2024, Asia Pacific dominated the global tempeh market, holding a significant share of 43.90%, valued at approximately USD 2 billion. This dominance is largely driven by the region’s deep-rooted cultural familiarity with tempeh, particularly in countries like Indonesia, where the product originated. In Southeast Asia, tempeh is a staple of local diets, and its consumption is deeply embedded in traditional culinary practices. As a result, the production and consumption of tempeh are well-established, contributing to the market’s strong performance in the region.

Moreover, the Asia Pacific market benefits from the increasing adoption of plant-based diets, especially in urban areas, where there is a growing awareness of health and sustainability issues. The rising demand for plant-based protein alternatives, along with the expanding vegan and vegetarian populations in countries such as India, Japan, and South Korea, is further fueling market growth. The region’s favorable climate for soy cultivation also ensures a steady supply of soybeans, which are the primary ingredient in tempeh, thus supporting the affordability and availability of the product.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Horizon Foods is a prominent producer of tempeh, offering a variety of plant-based protein products. The company focuses on quality and innovation in the plant-based food sector, catering to health-conscious consumers seeking high-protein, nutritious options. Horizon Foods has made significant strides in the tempeh market by expanding its product range and distribution channels globally, contributing to the growing demand for plant-based protein alternatives.

Tootie’s Tempeh specializes in producing high-quality, organic tempeh products, offering a range of flavorful, plant-based protein options. The company emphasizes traditional production methods, ensuring the authenticity and nutritional value of its tempeh. With a strong commitment to sustainability, Tootie’s Tempeh sources organic soybeans and other ingredients to meet growing consumer demand for clean-label, sustainable products in the global tempeh market.

Nutrisoy Pty Ltd is a leading Australian manufacturer of soy-based products, including tempeh. The company is recognized for its focus on delivering nutritious, plant-based protein alternatives that cater to vegan and vegetarian diets. Nutrisoy’s tempeh products are known for their high protein content and clean ingredients. As the demand for plant-based foods continues to rise, Nutrisoy’s innovation in tempeh production has positioned the company as a key player in the regional market.

Top Key Players Outlook

- HORIZON FOODS

- Tootie’s Tempeh

- Nutrisoy Pty Ltd

- Maple Leaf Foods Inc.

- Primasoy

- Lightlife Foods

- Tofutti Brands

- Eden Foods

- Hain Celestial

- Vitasoy

- Wildwood

Recent Industry Developments

By 2024, Tootie’s Tempeh had saved over 90,000 single-use plastic bags from landfills through this innovative approach.

In 2024 Nutrisoy Pty Ltd, announced plans to invest $75 million in building a state-of-the-art food manufacturing facility in Banksmeadow, Sydney, to enhance production capacity and streamline operations.

Report Scope

Report Features Description Market Value (2024) USD 4.6 Bn Forecast Revenue (2034) USD 7.8 Bn CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Frozen, Fresh, Ready-to-Eat), By Source (Soya Beans, Multi-grain, Others), By Distribution Channel ( Hypermarkets and Supermarkets, Foodservice, Retail, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape HORIZON FOODS, Tootie’s Tempeh, Nutrisoy Pty Ltd, Maple Leaf Foods Inc., Primasoy, Lightlife Foods, Tofutti Brands, Eden Foods, Hain Celestial, Vitasoy, Wildwood Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- HORIZON FOODS

- Tootie’s Tempeh

- Nutrisoy Pty Ltd

- Maple Leaf Foods Inc.

- Primasoy

- Lightlife Foods

- Tofutti Brands

- Eden Foods

- Hain Celestial

- Vitasoy

- Wildwood