Global Telecommunication Services Market Size, Share Analysis Report By Service Type (Fixed Voice Services, Fixed Internet Access Services, Mobile Voice Services, Mobile Data Services, Pay TV Services, Machine-to-machine (Mobile IoT) Services, Others), By Transmission (Wireline, Wireless), By End User (Consumer/Residential, Business), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2025

- Report ID: 152388

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

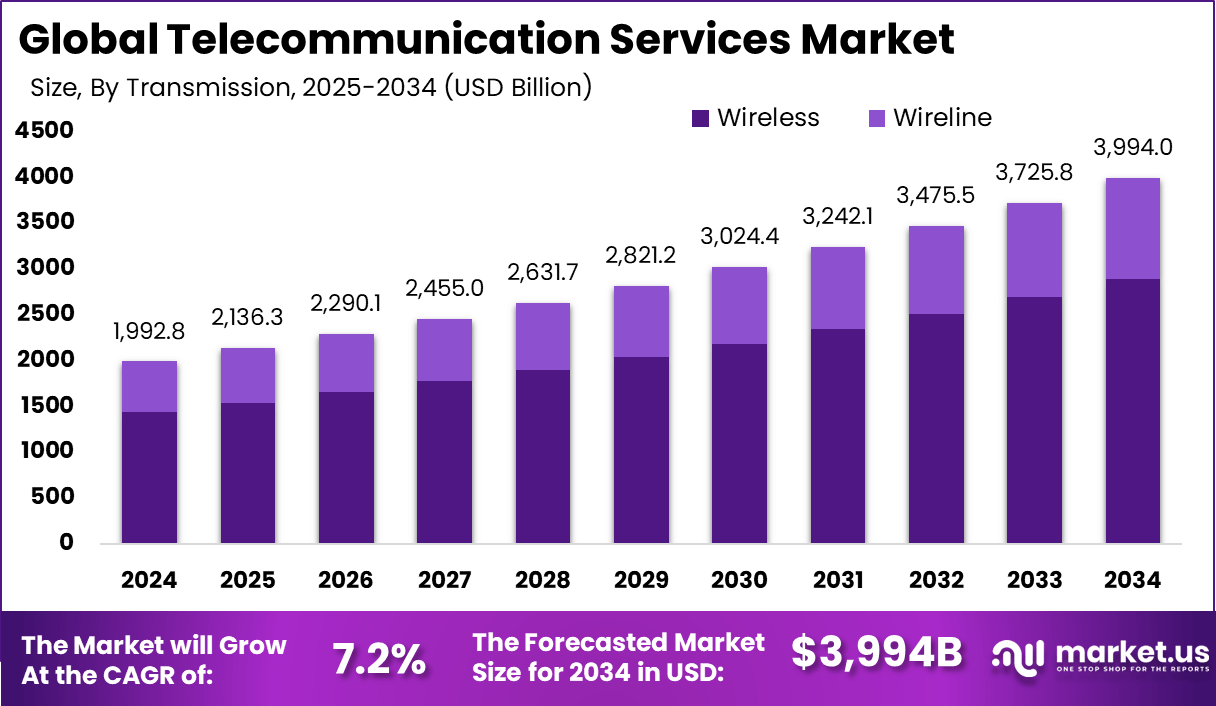

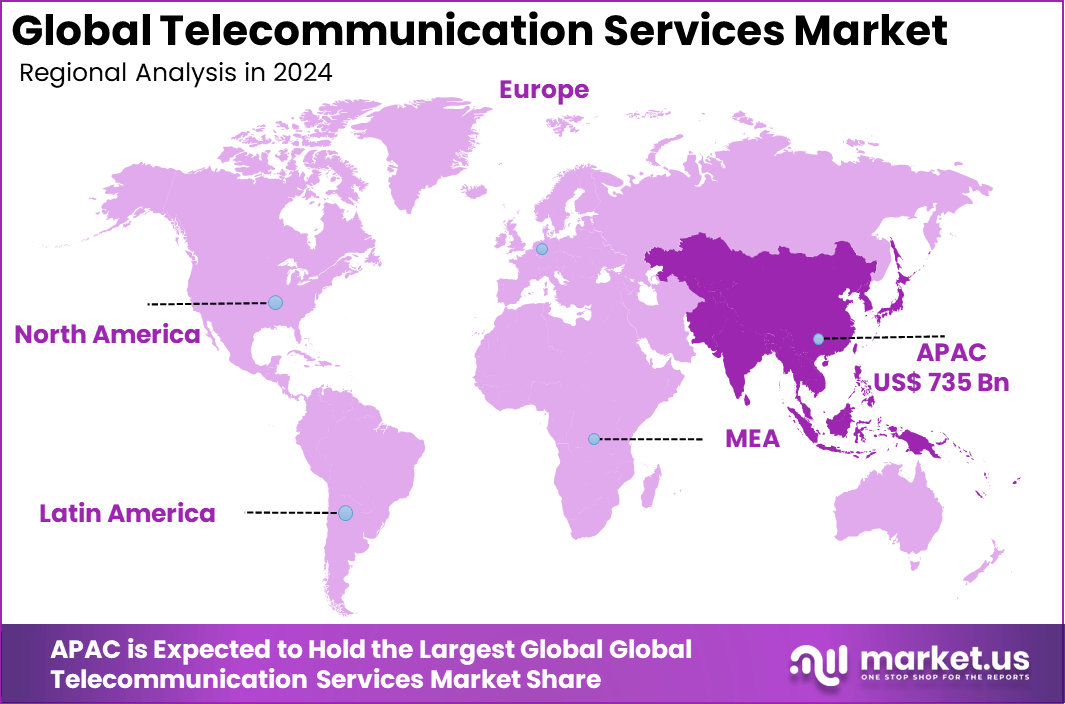

The Global Telecommunication Services Market size is expected to be worth around USD 3,994 Billion by 2034, from USD 1,992.8 Billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing around a 36.9% share, holding USD 735 Billion in revenue.

The telecommunication services market refers to the industry segment that provides voice, data, and video transmission services over wired and wireless networks. This market encompasses a range of services, including mobile and fixed-line telephony, broadband internet access, satellite communication, and managed network services. It serves as the backbone of global digital communication, enabling personal, commercial, and governmental connectivity.

Top Driving Factors shaping the market include the growing penetration of mobile devices and the rising need for high-speed internet access. The proliferation of smartphones, IoT-enabled devices, and cloud-based applications has significantly increased data traffic, which has prompted providers to expand network capacity and improve service quality. Additionally, the rollout of next-generation mobile networks has further stimulated demand by offering higher bandwidth and lower latency.

One example is the General Services Administration (GSA) of the United States, which is contributing cost-effective and modern telecommunication and network services to the various departments of the government, thus reflecting a wider movement of the public sector investing in telecom infrastructure. Manufacturers are taking the lead in innovating 5G base stations that are fundamental to the growth and expansion of network capacity and speed, such as Ericsson’s new 5G base stations.

Increasing Adoption Technologies such as 5G, fiber-to-the-home (FTTH), software-defined networking (SDN), and network function virtualization (NFV) are being deployed widely. These technologies improve efficiency, scalability, and flexibility of networks, enabling operators to deliver faster, more reliable services while optimizing operational costs. The integration of AI-driven network management and edge computing is also gaining traction, offering improved performance and real-time analytics capabilities.

Key Reasons for Adopting These Technologies include the necessity to handle exponentially rising data traffic, enhance customer experience, and remain competitive. Operators adopt these innovations to meet the growing expectations for seamless, high-speed connectivity while managing infrastructure costs effectively. Enhanced network automation and virtualization reduce downtime and support rapid deployment of new services.

Key Takeaway

- The global telecommunication services market is projected to reach USD 3,994 billion by 2034, up from USD 1,992.8 billion in 2024, growing at a CAGR of 7.2% during the forecast period.

- In 2024, Asia Pacific dominated with a 36.9% market share, generating approximately USD 735 billion in revenue, driven by high mobile and internet penetration.

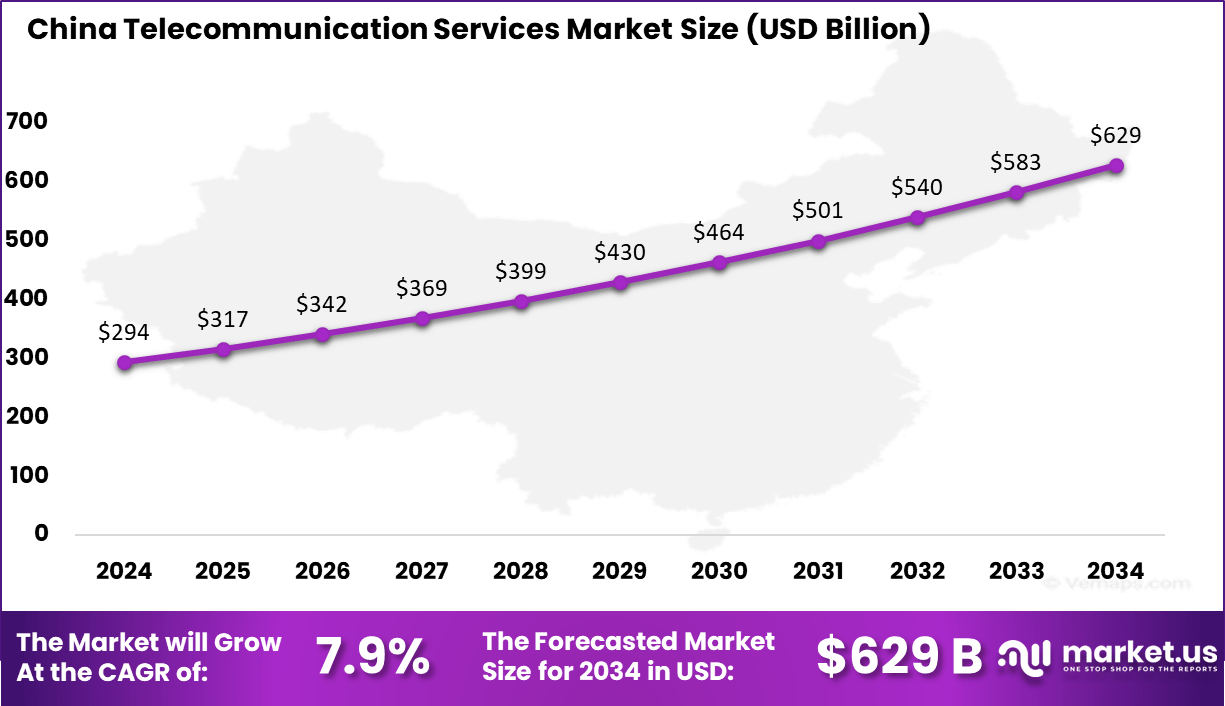

- China contributed USD 294.06 billion, growing at a CAGR of 7.9%, supported by strong investments in 5G and digital infrastructure.

- By service type, mobile data services accounted for 41.3% share, reflecting increased smartphone usage and digital consumption.

- Wireless transmission led the market with a 72.3% share, as demand for mobility and connectivity surged.

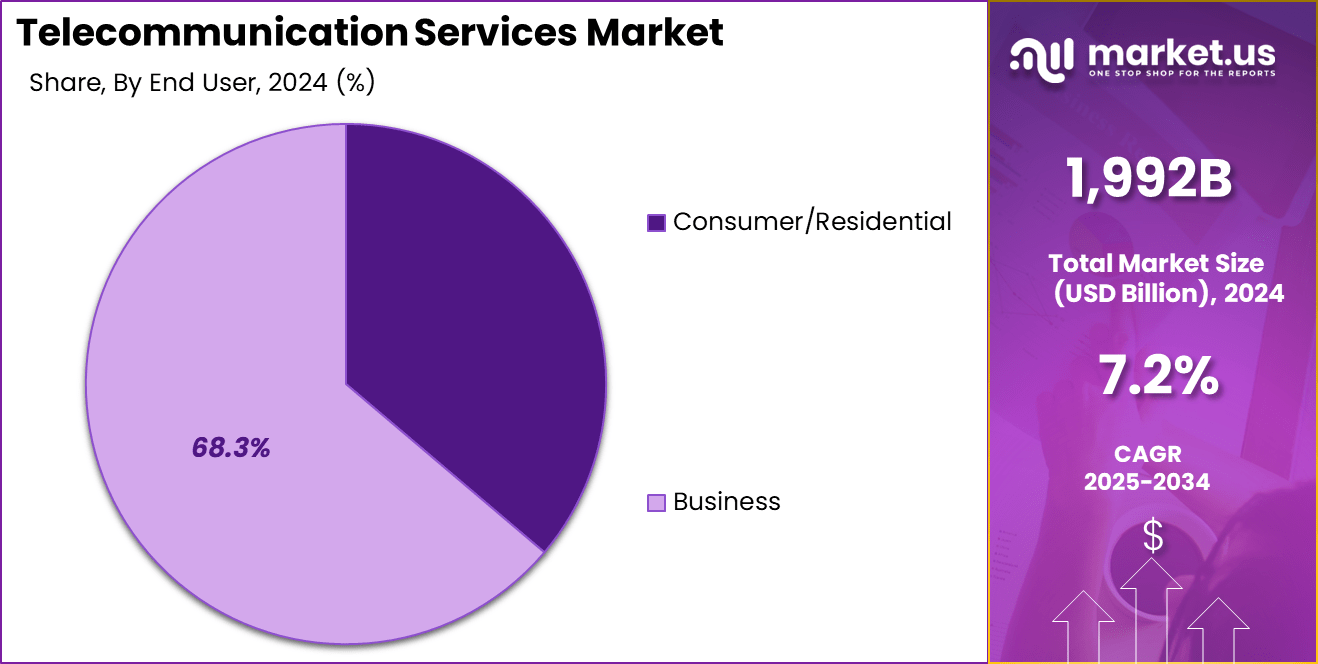

- The business end-user segment held 63.8% share, driven by enterprises adopting advanced communication solutions.

China Market Size

The China Telecommunication Services Market was valued at USD 294 Billion in 2024 and is anticipated to reach approximately USD 629 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 7.9% during the forecast period from 2025 to 2034.

The market for telecommunication services in China has greatly benefited from the large amount of funding that the government has put into the sector and from the ever-increasing demand for digital services among consumers. The ambitious 5G rollout implemented by the state is one of the most significant mobilizers.

By 2024, the number of 5G base stations in China had exceeded 4.25 million, thus surpassing the 5G infrastructure of all other countries. This is among the initial steps of the “Made in China 2025” plan, a broader strategy for the development of the digital and technological sectors, the end goal of which is innovation.

In addition, the growth of mobile internet has significantly contributed to the telecommunication services. In 2024, the amount of internet traffic in China registered an increase of 11.6%, reaching 337.6 billion gigabytes, thus showing digital consumption of the country’s users. On the other hand, the industry still has to struggle with some challenges, like reducing the digital divide and better coordinating infrastructure.

The government has, acknowledging these issues, been making efforts to provide telecommunications services under fair conditions to all the residents of the country. However, among the adversities, many of these are also opportunities, especially in the segments of IoT and AI appliances, the latter being firmly grounded in the ever-increasing share of China’s digital economy.

In 2024, Asia Pacific held a dominant market position in the global Telecommunication Services market, capturing more than a 36.9% share. The telecommunication services market in the Asia-Pacific region has experienced an upsurge, with substantial government investments playing a major role and the demand for advanced connectivity increasing. To enhance connectivity and support digital economies, countries in the region are making great investments in 5G infrastructure.

The Indonesian government, as an example, is heavily investing in 5G infrastructure to strengthen the nation and the ecosystem of 5G in Asia-Pacific. Similarly, the Malaysian government rolled out the JENDELA Program, which is aimed at increasing the local mobile broadband coverage of 4G from 91.8% to 96.9% and the broadband speed from 25Mbit/s to 35Mbit/s, thus laying the groundwork for 5G networks.

The rise in mobile internet usage is highlighted as the other cause of the boost, with data traffic estimated to rise four times between 2023 and 2030. This is driven by more data-intensive content and the widespread adoption of 5G. The reasons behind the growth are the increasing number of smartphone users and the increase in 5G adoption, and the subsequent demand for robust telecommunication services.

Service Type Analysis

In 2024, Mobile Data Services dominate the global telecommunication services market, holding the highest market share of 41.3%. The significant share of the market is mainly driven by the fact that the consumption of mobile internet is increasing, thus smartphones, mobile applications, and data-heavy content like video streaming, gaming, and social media are also becoming more prevalent.

One of the driving factors of this trend is the fast deployment of mobile broadband, a process in which both authorities and telcos invest ample amounts of funds for the construction of the infrastructure that could cope with the rising data usage. For instance, the Chinese government’s Digital China initiative has made it possible for the Internet to be accessible to the rural areas via mobile data services with the end goal of establishing a universal 4G network by 2025.

Meanwhile, the Indian Department of Telecommunications (DoT) is doing the same with the BharatNet on to the bridge program, and thus, their broadband cell R, making it the fastest growing in the world to connect the urban and rural areas. Indian mobile carriers such as Airtel and Vodafone, which cater to the electronic communication medium private service, are also launching 5G data plans to meet the demand.

Transmission Analysis

In 2024, Wireless transmission services account for the largest share in the global telecommunication services market, capturing 72.3% of the segment. Wireless services are dominating due to the rapid growth of mobile networks, especially with the widespread adoption of 4G and 5G technologies.

The adoption of the wireless infrastructure is steered by the most recent technologies and investments from the government and innovations of the industry. In the Asia Pacific region, the 5G rollout is being dominated by countries like China, India, and South Korea that have been receiving the push from the national policies and local governments.

For example, the Ministry of Industry and Information Technology (MIIT) of China has been the driving force behind the construction of the country’s 5G infrastructure and therefore has been marked out as a key factor for the nation’s digital economy development.

According to the data taken from the years 2024 to 2025, China has already established more than 1.5 million 5G base stations and aims to increase that number to over 2 million by 2025, thus putting into practice the commitment to wireless infrastructure development.

In addition to having India’s Department of Telecommunications allocate higher investment funding for the 5G network rollout, the government’s goal is to be able to provide the next generation network to more than 300 cities in the country by the end of 2024.

End User Analysis

In 2024, the business segment holds the largest share in the telecommunication services market, accounting for 63.8% of the total market. The primary reason for this is that the global industries are undergoing a massive digital change that is initiated by businesses that require telecommunication services for communication, data transfer, cloud computing, and the general course of business.

The use of cloud computing, e-commerce, and digital payments has triggered a high demand for telecommunication services in terms of speed and reliability. The numbers are similar to those in regions where authorities recognize the importance of providing businesses with digital tools, especially in emerging markets like the Retail Market in India.

Thus, startups, unicorns, and small to medium businesses around the world are making their mark in the Retail Sector in India with the help of Digital India. Similarly, in the South Korean Market, the focus is on ensuring that all businesses can be covered by 5G by the year 2025. This entails upgrading digital infrastructure to support various industries, including IT, medical, and manufacturing.

The global telecommunications services market is growing as new technologies are being used often by digital companies, technology startups, and data firms in the sharing economy. Through the means of infrastructure development and digital transformation plans that are invested in by most governments, the business segment’s dominance of the market will be maintained.

Key Market Segments

By Service Type

- Fixed Voice Services

- Fixed Internet Access Services

- Mobile Voice Services

- Mobile Data Services

- Pay TV Services

- Machine-to-machine (Mobile IoT) Services

- Others

By Transmission

- Wireline

- Wireless

By End User

- Consumer/Residential

- Business

- IT & Telecom

- Manufacturing

- Healthcare

- Retail

- Media & Entertainment

- Government & Defense

- Education

- BFSI

- Energy and utilities

- Transportation & Logistics

- Travel & Hospitality

- O&G and Mining

- Others

Drivers

Government Investment in Digital Infrastructure

Substantial government spending on digital infrastructure is a major factor driving the global telecommunication services market. For instance, in Canada, the federal government has pledged USD 45 million over the next five years to implement 5G wireless and other advanced network technologies across the country’s economy.

The funds will be deployed to increase network coverage, expand the economy, and promote equal digital services for the whole country. Similarly, the federal government of Australia has dedicated funds of USD 3.8 billion as part of the NBN upgrade from copper to fiber to bring NBN to the areas where the existing infrastructure is not sufficient. These investments are substantial as they will lead to an acceleration of internet speeds, investment, and access, particularly in unconnected areas.

Government actions in digital infrastructure essentially create a vehicle that fosters not only innovation and economic development but also social inclusion. These activities not only improve the telecommunications sector but also drive most of the private sector’s investments in digital communications, contributing to the rapid growth of digital communication.

Restraint

Network Congestion and Data Security Concerns

The global telecom services market faces a major hindrance from network overload problems and data security threats. The most obvious result of a massive increase in data traffic is the malfunction of the networks that support it. For example, congested networks will slow down internet connection, disconnect calls, or so degrade the other person’s voice quality as to make it impossible to understand.

Network users will be dissatisfied and won’t be able to keep their activities running smoothly as a result of the low level of network performance caused by the congestion. At the same time, the increase in online crimes like DDoS attacks, ransomware, and phishing scams has become quite common and creates substantial threats to the security and reliability of networks.

Among the biggest and worst problems in telecommunication companies are cyberattacks. The hackers who managed to arrange for the hacking of the network used in telecommunications form the target group of various cybercrimes. The primary severity of these attacks is the extent to which they result in system disruptions and data breaches, and ultimately, customer trust and legal regulations suffer.

Opportunities

Increasing Demand for 5G-Enabled Applications

The growing demand for 5G-enabled applications provides lucrative opportunities for the global telecommunication services market. The Global 5G Services Market size is expected to be worth around USD 3,299.8 Billion by 2033, from USD 88.5 Billion in 2023, growing at a CAGR of 43.6% during the forecast period from 2024 to 2033.

This upsurge is due to the rapid adoption of 5G technology in a wide spectrum of sectors such as healthcare, manufacturing, transportation, and entertainment. 5G’s low latency and reliability, as well as high bandwidth, facilitate the creation of innovative applications like autonomous vehicles, smart cities, augmented reality, and real-time remote monitoring.

The 5G industry is the main beneficiary of both government and private sector funds, which support its projects and unlock new revenue sources. It plays a key role in achieving national goals, such as India’s National Telecom Policy 2022, which aims for self-reliance in telecommunications and boosting the country’s digital infrastructure.

The National Telecom Policy of 2022 aims to make 5G technology interoperability a key driver of productivity and economic competitiveness. This goal is expected to create more jobs and increase the share of telecom export revenues in GDP from the current 8% to 16% by 2030.

Challenges

High Capital Investment in Network Expansion

Global telecommunication services are facing a major challenge of high capital investment in the network expansion area. In 2023, global telecom operators spent USD 315 billion on capital expenditures, which was about 17% of their total revenues.

This huge investment is essential for the replacement of existing infrastructure, the proliferation of new technologies like 5G, and the expansion of service coverage to the unreached parts of the world. However, the return on investment (ROI) that can be received from these capital expenditures is often slow, and the pressure is on the telecom companies to be cost-effective while being technologically advanced.

The high costs of the network expansion can restrain smaller operators from entering the market, and it can restrict the ability of the existing ones to innovate and compete effectively. Moreover, the fast pace of technological advancements means that the investments may get out of date sooner, thus complicating financial planning and strategy even further.

In order to counter the negative impact of technological changes and reduction in investments, telecommunication companies are trying new, unconventional financing methods such as public-private partnerships and infrastructure sharing. Despite such steps, the high capital intensity of network expansion still remains a crucial challenge that has to be approached through careful management and strategic planning.

Latest Trends

Adoption of Cloud-Native Telecom Solutions

The adoption of cloud-native telecom solutions is a prominent trend in the global telecommunication services market. Telecom companies are increasingly transitioning from traditional network architectures to cloud-native designs to enhance scalability, flexibility, and operational efficiency.

This shift enables providers to deploy services more rapidly, reduce infrastructure costs, and improve service reliability. Cloud-native architectures support the integration of emerging technologies such as 5G, Internet of Things (IoT), and edge computing, facilitating the development of innovative services and applications.

Furthermore, cloud-native solutions enable telecom providers to offer more personalized and responsive customer experiences, fostering greater customer satisfaction and loyalty. As the industry continues to evolve, the adoption of cloud-native telecom solutions is expected to accelerate, driving digital transformation and competitive advantage for telecom companies worldwide.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

AT&T Inc., Verizon Communications Inc., and Vodafone Group Plc have been actively strengthening their positions through network modernization and 5G deployment. These players focus on expanding fiber-optic infrastructure to support high-speed data services. Strategic mergers and innovative enterprise solutions have also been prioritized to enhance customer experience and maintain competitive advantage in global markets.

China Mobile Limited, China Telecom Corporation Limited, and Nippon Telegraph and Telephone Corporation continue to dominate Asian markets by leveraging strong domestic customer bases. Investments in cloud computing and IoT services have been observed to diversify revenue streams. Furthermore, these companies emphasize affordable mobile services and rural connectivity to sustain growth across emerging economies.

Deutsche Telekom AG, Orange S.A., Telefonica S.A., SoftBank Corp., and KDDI Corporation are focused on expanding digital service portfolios and enhancing operational efficiencies. Emphasis is placed on AI-driven customer support and private 5G networks for enterprises. Partnerships with technology firms have been pursued to accelerate innovation and improve network resilience, ensuring long-term market sustainability.

Top Key Players in the Market

- AT&T Inc.

- China Mobile Limited

- China Telecom Corporation Limited

- Deutsche Telekom AG

- Nippon Telegraph and Telephone Corporation

- SoftBank Corp.

- Orange S.A.

- Telefonica S.A.

- Verizon Communications Inc.

- Vodafone Group Plc

- KDDI Corporation

- Others

Recent Developments

- In June 2025, Ericsson and Google Cloud jointly launched a carrier-grade 5G Core-as-a-Service platform, which enables telecom operators to provision networks rapidly while leveraging AI-assisted troubleshooting to enhance reliability and reduce operational complexities.

- In May 2025, Ericsson collaborated with Zain Jordan to begin a Business Support Systems (BSS) transformation project, adopting a cloud-native architecture to improve digital services, customer experiences, and operational efficiency across Jordan’s telecommunications sector.

- Also in May 2025, Lumen Technologies entered into an agreement to sell its consumer fiber-to-the-home division to AT&T, reflecting its strategic shift to focus on serving enterprise customers with advanced networking solutions.

- In May 2025, Verizon secured FCC approval for its USD 20 billion acquisition of Frontier, significantly expanding its fiber network presence across 25 U.S. states and strengthening its position in high-speed broadband services.

- In January 2025, the Union Minister of Communications introduced the Sanchar Saathi mobile app, a government-led initiative designed to improve user security. The app allows individuals to report suspected fraud, identify unauthorized SIMs, and block lost or stolen devices to safeguard digital identities.

- In January 2025, Vodafone Idea, through its CEO Akshaya Moondra, announced plans to roll out 5G services, aiming to deliver high value and superior performance to customers in the evolving Indian telecom market.

- In December 2024, Verizon partnered with NVIDIA to deliver AI-powered workloads over private 5G networks, tailored for industrial clients seeking low-latency and high-performance computing capabilities at the edge.

Report Scope

Report Features Description Market Value (2024) USD 1,992.8 Bn Forecast Revenue (2034) USD 3,994 Bn CAGR (2024-2033) 7.2% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2033 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Fixed Voice Services, Fixed Internet Access Services, Mobile Voice Services, Mobile Data Services, Pay TV Services, Machine-to-machine (Mobile IoT) Services, Others), By Transmission (Wireline, Wireless),By End User(Consumer/Residential, Business) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape AT&T Inc., China Mobile Limited, China Telecom Corporation Limited, Deutsche Telekom AG, Nippon Telegraph and Telephone Corporation, SoftBank Corp., Orange S.A., Telefonica S.A., Verizon Communications Inc., Vodafone Group Plc, KDDI Corporation, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Telecommunication Services MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Telecommunication Services MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AT&T Inc.

- China Mobile Limited

- China Telecom Corporation Limited

- Deutsche Telekom AG

- Nippon Telegraph and Telephone Corporation

- SoftBank Corp.

- Orange S.A.

- Telefonica S.A.

- Verizon Communications Inc.

- Vodafone Group Plc

- KDDI Corporation

- Others