Global Telecom API Market By Type (Web RTC API, Messaging API, Location API, Payment API, IVR API, Other Types), By End-User (Internal Telecom Developers, Enterprise Developers, Partner Developers, Long Tail Developers), By Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 29489

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Telecom API Market size is expected to be worth around USD 1,459.5 Billion by 2033, from USD 276.5 Billion in 2023, growing at a CAGR of 18.1% during the forecast period from 2024 to 2033.

Telecom APIs (Application Programming Interfaces) refer to a set of protocols and tools that allow developers to integrate telecom services into their applications, platforms, or systems. These APIs enable seamless communication and interaction between different software applications and telecommunications networks.

The market for Telecom APIs is driven by the increasing demand for advanced communication services that are capable of integrating with mobile applications, cloud services, and Internet-of-Things (IoT) devices. This integration facilitates enhanced operational efficiency, improved customer experiences, and the development of new revenue streams for telecom service providers.

In terms of opportunities, the telecom API market presents several prospects for both telecom service providers and developers. Telecom service providers can leverage APIs to monetize their existing network infrastructure by offering value-added services to developers and businesses. By exposing their network capabilities through APIs, telecom service providers can tap into new revenue streams and partnerships, enabling them to extend their reach beyond traditional telecommunication services.

In the dynamic landscape of the Telecom API market, recent financial activities underscore the sector’s significant growth potential and investor interest. The acquisition of Nexmo by Vonage Holdings for $6 billion in January 2023 is a testament to the burgeoning value of cloud communication APIs and the strategic importance of expanding international reach. This move not only enhances Vonage Holdings’ capabilities in delivering cutting-edge communication solutions but also solidifies its position in a competitive global market.

Infobip’s successful raise of €200 million in Series D funding in November 2023 further highlights the sector’s attractiveness to investors. This capital injection is poised to accelerate Infobip’s API platform development and its global expansion efforts, indicating strong future growth prospects and the company’s commitment to solidifying its market leadership.

Bandwidth Inc.’s securing of $4.5 billion in debt financing in July 2023 reflects the company’s strategic initiatives towards enhancing its API-driven communications solutions and expanding its fiber network infrastructure. This financial maneuver is indicative of Bandwidth’s aggressive growth strategy and its focus on sustaining innovation and infrastructure development to meet the growing demands of the digital economy.

Twilio’s share price experienced a significant range, peaking at $139.72 in January 2023 before declining to a low of $40.34 in October, and slightly recovering to $48.12 by February 9, 2024. This pattern suggests a challenging market environment, possibly affected by competitive pressures, regulatory changes, or shifts in investor expectations regarding growth potential.

Key Takeaways

- Market Size Projection: The Telecom API market is projected to reach a value of USD 1,459.5 billion by 2033, with a robust CAGR of 18.1% during the forecast period.

- Messaging API Dominance: In 2023, the Messaging API segment held a significant market share of over 37.6%. This dominance is fueled by the widespread adoption of SMS, MMS, and chat apps across various sectors, including retail, banking, and healthcare.

- Enterprise Developers’ Preference: Enterprise developers constituted the largest segment in 2023, holding more than a 39.1% share of the Telecom API market. This preference is due to the growing demand among enterprises for customized communication solutions that seamlessly integrate into their existing business processes.

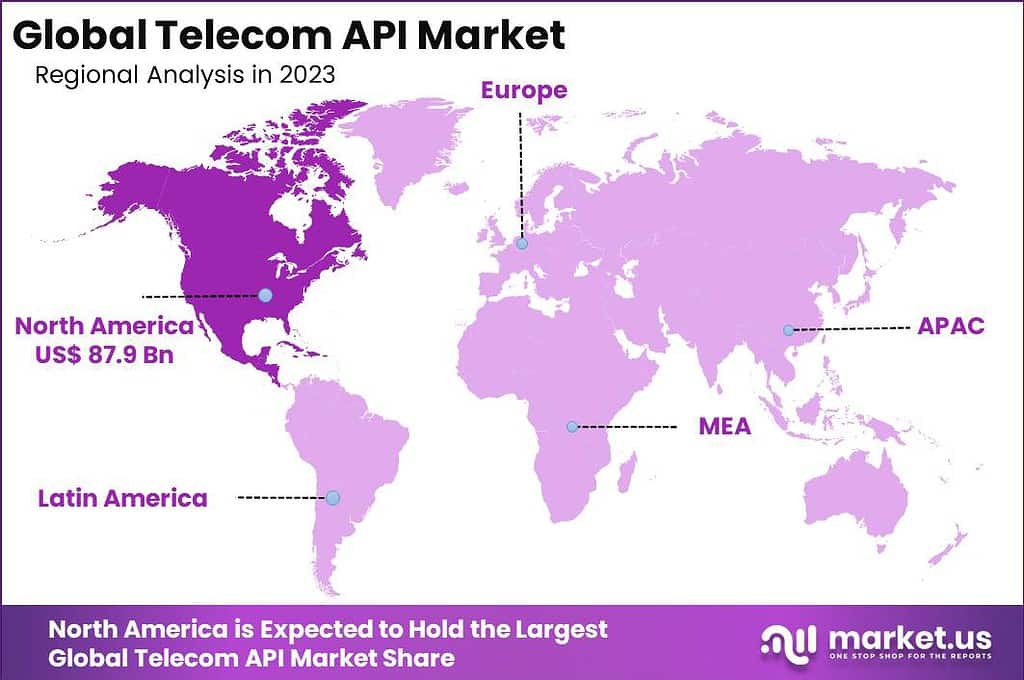

- North America dominated the Telecom API market in 2023, capturing a significant share of over 31.8%. This regional dominance can be attributed to factors such as a mature telecommunications industry, a vibrant developer ecosystem, and a strong regulatory environment.

Type Analysis

In 2023, the Messaging API segment held a dominant market position, capturing more than a 37.6% share of the Telecom API market. This position is attributed to the widespread adoption of SMS, MMS, and chat apps across various sectors, including retail, banking, and healthcare, for direct customer engagement. Messaging APIs facilitate seamless integration of messaging services with existing business applications, enabling companies to enhance customer experience through timely, personalized communication.

The utility of Messaging APIs extends beyond customer service to include transaction alerts, appointment reminders, and promotional campaigns, making it an indispensable tool for businesses aiming to maintain a direct line of communication with their customers. The ability to automate these communications not only improves operational efficiency but also significantly reduces the cost associated with traditional communication methods.

Moreover, the surge in mobile device usage and the global shift towards mobile-first strategies have further propelled the demand for Messaging APIs. Businesses leverage these APIs to reach customers on their most frequently used devices, ensuring higher engagement rates compared to other communication channels. The versatility and reliability of Messaging APIs, coupled with their ability to integrate with a wide range of platforms and devices, underscore their critical role in the digital communication ecosystem.

The continued innovation within the Messaging API segment, including the integration of advanced features like end-to-end encryption, rich media support, and conversational AI, indicates a trajectory of sustained growth and expansion. As companies across industries strive to personalize customer interactions and streamline communication processes, the Messaging API segment is poised for further advancements, reinforcing its significant share in the Telecom API market.

End-User Analysis

In 2023, the Enterprise Developers segment held a dominant market position within the Telecom API market, capturing more than a 39.1% share. This substantial market share can be attributed to the growing demand among enterprises for customized communication solutions that can seamlessly integrate into their existing business processes. Enterprise developers leverage Telecom APIs to build and implement these tailored solutions, facilitating enhanced operational efficiencies, improved customer engagement, and the creation of new revenue streams.

The appeal of Telecom APIs for enterprise developers lies in their ability to offer scalable, flexible, and cost-effective communication capabilities. Whether it’s automating customer service interactions through messaging APIs, enabling location-based services, or integrating secure payment processing capabilities, these APIs empower enterprises to innovate and refine their service offerings. The direct impact on customer experience and operational agility has made Telecom APIs an essential tool for enterprise developers looking to drive digital transformation initiatives.

Additionally, the trend towards digitalization, accelerated by the COVID-19 pandemic, has underscored the importance of robust and flexible communication tools in maintaining business continuity. Enterprise developers are at the forefront of this shift, implementing APIs to ensure that businesses can communicate effectively with their customers across multiple channels, regardless of the physical constraints imposed by global events.

Key Market Segments

Type

- Web RTC API

- Messaging API

- Location API

- Payment API

- IVR API

- Other Types

End-User

- Internal Telecom Developers

- Enterprise Developers

- Partner Developers

- Long Tail Developers

Driver

Increasing Demand for Enhanced Communication Services

The escalating demand for enhanced communication services across various sectors, driven by the digital transformation of businesses, serves as a significant driver for the Telecom API market. In an era where customer engagement and personalized communication are paramount, Telecom APIs enable businesses to integrate messaging, voice, and video functionalities into their applications, thereby facilitating more dynamic and interactive customer interactions.This demand is further amplified by the proliferation of mobile devices and the growing expectation for seamless, omnichannel communication experiences. As enterprises continue to seek innovative ways to connect with their customers and streamline operations, the adoption of Telecom APIs is poised to rise, driving market growth.

Restraint

Concerns Over Data Security and Privacy

One of the primary restraints facing the Telecom API market is the growing concern over data security and privacy. As Telecom APIs facilitate the exchange of sensitive information, including personal data and payment details, they become prime targets for cyberattacks.This vulnerability necessitates stringent security measures and compliance with data protection regulations, which can be both costly and complex to implement. The challenge is exacerbated by the evolving nature of cyber threats and the varying data protection laws across different jurisdictions. These concerns can deter businesses from adopting Telecom API solutions, thereby hindering market growth.

Opportunity

Expansion into Emerging Markets

The Telecom API market presents significant opportunities for expansion into emerging markets, where the penetration of mobile devices and internet connectivity is rapidly increasing. These regions offer untapped potential for the adoption of advanced communication technologies, driven by a growing number of tech-savvy consumers and small-to-medium-sized enterprises seeking cost-effective ways to enhance their communication capabilities. By tapping into these markets, Telecom API providers can diversify their customer base, mitigate risks associated with market saturation in developed regions, and fuel overall market growth.

Challenge

Integration and Interoperability Issues

A key challenge in the Telecom API market is the issue of integration and interoperability with existing systems and software. As businesses often use a multitude of communication platforms and IT infrastructures, ensuring that Telecom APIs can seamlessly integrate and function within these complex environments is crucial.However, achieving this interoperability can be challenging, especially in cases where legacy systems are involved. This challenge not only complicates the implementation process but also increases the costs and time required to deploy Telecom API solutions, potentially limiting their adoption among businesses with constrained IT resources.

Regional Analysis

In 2023, North America held a dominant market position in the Telecom API market, capturing a significant share of more than 31.8%. The demand for Telecom API in North America was valued at US$ 87.9 billion in 2023 and is anticipated to grow significantly in the forecast period.

This regional dominance can be attributed to several key factors. North America has a mature telecommunications industry, with advanced infrastructure and widespread adoption of mobile and internet services. The region is home to major telecom service providers and tech companies that have been at the forefront of developing and offering telecom APIs. The early adoption of APIs by these industry players has given North America an advantage in terms of market penetration and innovation.

Moreover, North America has a highly developed application developer ecosystem. The region boasts a large number of software developers, startups, and technology hubs that actively utilize telecom APIs to enhance their applications and services. This vibrant developer community drives the demand for telecom APIs and fosters innovation in the market.

Furthermore, North America has a high level of digitalization across various industries, including finance, healthcare, e-commerce, and entertainment. Businesses in these sectors are increasingly leveraging telecom APIs to enable communication and connectivity features in their applications. For example, telecom APIs are used for secure payment verification, two-factor authentication, and real-time customer support. The widespread adoption of these applications contributes to the growth of the telecom API market in North America.

In addition, North America has a strong regulatory environment that promotes competition and innovation in the telecom sector. This encourages telecom service providers to offer APIs and collaborate with developers to create value-added services. The presence of favorable regulatory policies and frameworks supports the growth of the telecom API market in the region.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Telecom API market is characterized by a dynamic competitive landscape, with several key players that drive innovation and market growth through strategic partnerships, technological advancements, and expanding service offerings. These companies play a pivotal role in shaping the direction of the market and influencing its evolution.

Twilio stands out as a leading provider in the Telecom API market, offering a comprehensive suite of communication APIs that include messaging, voice, video, and email services. The company’s success is largely due to its developer-friendly platform, extensive documentation, and robust support system. Twilio’s continuous innovation in cloud communications and its strategic acquisitions to enhance capabilities and expand its product portfolio underscore its commitment to maintaining a dominant market position.

Top Market Leaders

- Twilio Inc.

- AT&T Inc.

- Verizon Communications Inc.

- Telefónica, S.A.

- Apigee Corp.

- Alcatel–Lucent S.A.

- Vonage

- Orange S.A.

- Vodafone Group plc

- Ribbon Communications Inc.

- Plivo Inc.

- Cisco Systems, Inc.

- Other Key Players

Recent Developments

1. Twilio Inc.:

- January 2023: Announced a new partnership with Microsoft Azure to integrate Twilio’s API platform with Azure cloud services, targeting enterprise customers.

- March 2023: Launched several new products and features, including Programmable SMS Chat, Programmable Assistant, and Flex for WhatsApp, expanding communication capabilities for developers.

- June 2023: Partnered with Salesforce to launch “Verified SMS for Marketing Cloud,” enhancing SMS communication within Salesforce marketing campaigns.

2. AT&T Inc.:

- February 2023: Announced a collaboration with Ericsson to develop innovative 5G edge computing solutions, which could leverage APIs for future applications.

- April 2023: Partnered with IBM to offer hybrid cloud solutions for businesses, potentially including API integration capabilities.

- October 2023: Launched the “AT&T API Marketplace,” providing developers with access to various APIs for communication, network services, and data analytics.

3. Verizon Communications Inc.:

- March 2023: Launched “Verizon Developer Portal,” a revamped platform offering access to APIs for mobile network access, messaging, and IoT solutions.

- July 2023: Partnered with Amazon Web Services (AWS) to develop innovative solutions for edge computing and 5G networks, potentially utilizing APIs for future use cases.

- October 2023: Announced the expansion of its “BlueJeans Gateway API,” enabling developers to integrate video conferencing capabilities into their applications.

Report Scope

Report Features Description Market Value (2023) US$ 276.5 Bn Forecast Revenue (2033) US$ 1,459.5 Bn CAGR (2024-2033) 18.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Web RTC API, Messaging API, Location API, Payment API, IVR API, Other Types), By End-User (Internal Telecom Developers, Enterprise Developers, Partner Developers, Long Tail Developers) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Twilio Inc., AT&T Inc., Verizon Communications Inc., Telefónica S.A., Apigee Corp., Alcatel–Lucent S.A., Vonage, Orange S.A., Vodafone Group plc, Ribbon Communications Inc., Plivo Inc., Cisco Systems Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Telecom APIs?Telecom APIs (Application Programming Interfaces) are sets of protocols, tools, and definitions that enable software applications to communicate with telecommunications networks and access various services and functionalities provided by telecom operators.

What is the Telecom API Market?The Telecom API Market refers to the segment of the telecommunications industry focused on providing and monetizing APIs for developers, businesses, and organizations to integrate telecom capabilities into their applications, services, and systems.

How big is Telecom API Industry?The Global Telecom API Market size is expected to be worth around USD 1,459.5 Billion by 2033, from USD 276.5 Billion in 2023, growing at a CAGR of 18.1% during the forecast period from 2024 to 2033.

Which type segment accounted for the largest Telecom API market share?In 2023, the Messaging API segment held a dominant market position, capturing more than a 37.6% share of the Telecom API market.

Who are the key players in telecom API market?Some key players operating in the telecom API market include Twilio Inc., AT&T Inc., Verizon Communications Inc., Telefónica S.A., Apigee Corp., Alcatel–Lucent S.A., Vonage, Orange S.A., Vodafone Group plc, Ribbon Communications Inc., Plivo Inc., Cisco Systems Inc., Other Key Players

What are the Key Drivers of Growth in the Telecom API Market?Several factors drive the growth of the Telecom API Market, including the increasing demand for innovative communication services, the proliferation of mobile devices and IoT (Internet of Things) devices, the rise of cloud computing and digital transformation initiatives, and the need for telecom operators to diversify revenue streams and enhance customer experiences.

-

-

- Twilio Inc.

- AT&T Inc.

- Verizon Communications Inc.

- Telefónica, S.A.

- Apigee Corp.

- Alcatel–Lucent S.A.

- Vonage

- Orange S.A.

- Vodafone Group plc

- Ribbon Communications Inc.

- Plivo Inc.

- Cisco Systems, Inc.

- Other Key Players