Global Target Drone Market Size, Share, US Tariff Impact Analysis Report By Type (Aerial, Ground, Marine), By Application (Combat Training, Target & Decoy, Reconnaissance, Target Identification, Target Acquisition), By Operation (Autonomous, Piloted), By End-User (Military & Government, Commercial), By Payload (Less than 15 Kg, 15-30 kg, More than 30 Kg), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146322

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- US Tariff Impact Analysis

- Business Benefits

- Key Features of Target Drones

- U.S. Target Drone Market

- Type Analysis

- Application Analysis

- Operation Analysis

- End-User Analysis

- Payload Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Key Player Analysis

- Top Opportunities for Players

- Recent Developments

- Report Scope

Report Overview

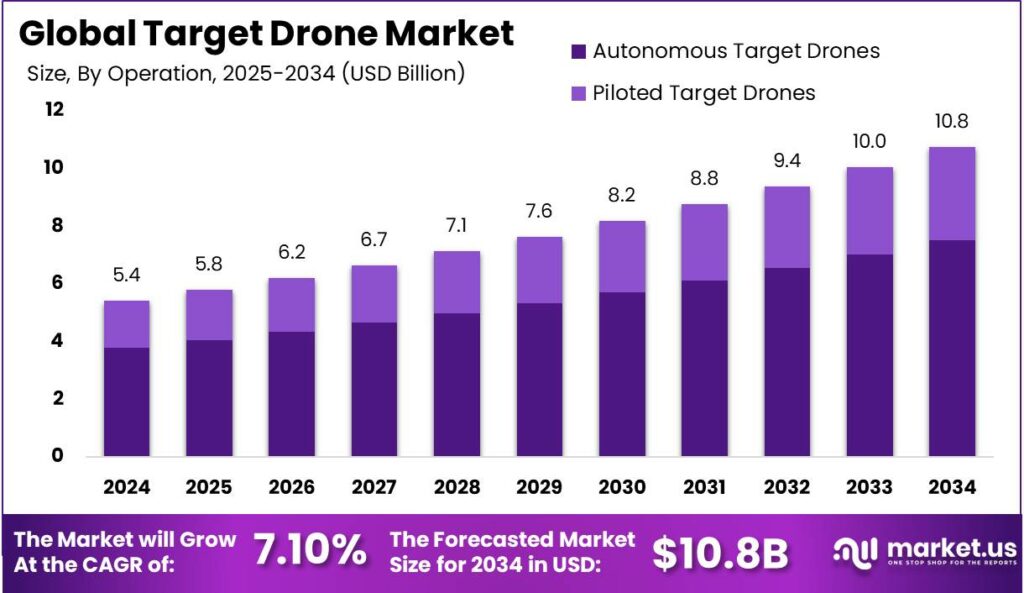

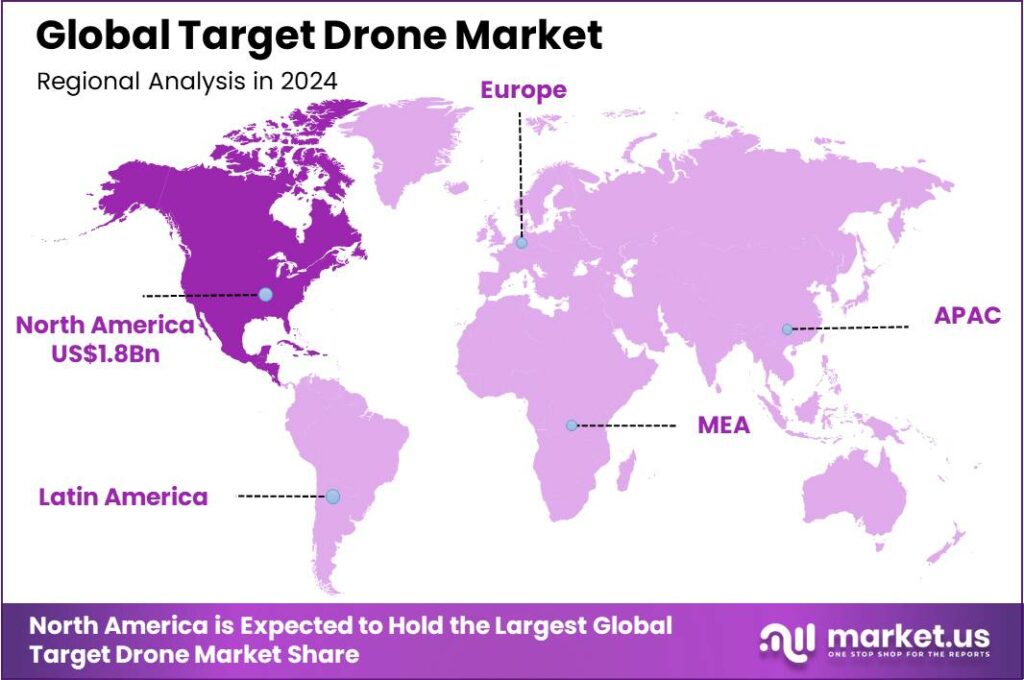

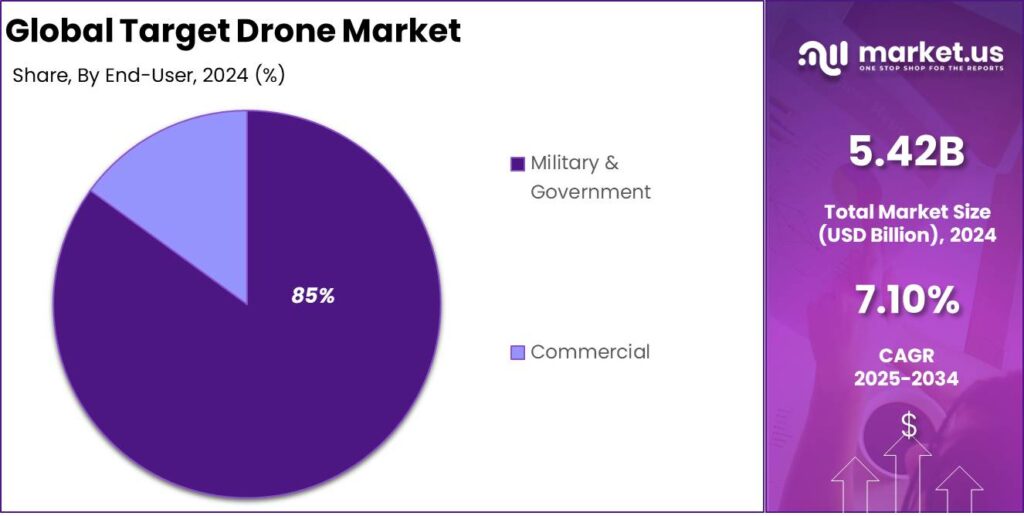

The Global Target Drone Market size is expected to be worth around USD 10.8 Bn By 2034, from USD 5.42 Bn in 2024, growing at a CAGR of 7.10% during the forecast period from 2025 to 2034. In 2024, North America dominated the target drone sector, holding over 35% market share with revenues of USD 1.8 bn. The U.S. target drone market, valued at USD 1.7 bn, is expected to grow at a CAGR of 5.8%.

A target drone is an unmanned aerial vehicle (UAV), often remote-controlled, used primarily for military training to simulate enemy aircraft and test anti-aircraft defenses. These drones mimic radio-controlled model airplanes and can replicate various military threats using technologies like radar and electronic defenses. Target drones serve crucial roles in training for threat detection, weapons system evaluation, and the testing of manned combat aircraft and anti-aircraft weaponry.

As geopolitical tensions intensify and global defense budgets expand, the demand for advanced target drones is projected to increase steadily. These drones play a critical role in enhancing combat readiness by offering realistic, high-performance training environments that simulate modern threat scenarios. Their ability to replicate fast-moving aerial threats, including cruise missiles and stealth aircraft, makes them essential tools for weapons testing, radar calibration, and live-fire exercises across naval, air, and ground forces.

This growing adoption is being driven by the need to prepare defense personnel for increasingly complex warfare dynamics, particularly in electronic warfare, hypersonic defense systems, and unmanned aerial combat environments. As a result, target drone systems are becoming integral to military modernization programs in key regions such as North America, Europe, and Asia-Pacific.

The target drone market has seen significant growth, fueled by rising defense budgets and a stronger focus on rigorous military training to address emerging security challenges. Technological advancements in drone technology have further enhanced their capabilities and reliability, making them a key component of modern military training programs.

According to estimates from the U.S. Department of Defense (DoD), more than 11,000 unmanned aerial systems (UAS) are currently operated by the Pentagon, assisting in both domestic training exercises and overseas contingency missions.

Innovation in target drones focuses on better endurance, range, and payload. Recent advancements include AI for simulating complex enemy behaviors, improved stealth, and reusable drones for multiple engagements. These innovations enhance training and expand applications in disaster management and environmental monitoring.

Key Takeaways

- The Global Target Drone Market size is expected to be worth around USD 10.8 Billion by 2034, from USD 5.42 Billion in 2024, growing at a CAGR of 7.10% during the forecast period from 2025 to 2034.

- In 2024, the Aerial Target Drones segment held a dominant market position, capturing more than 61% share.

- In 2024, the Combat Training segment held a dominant market position within the target drone industry, capturing more than 45% share.

- In 2024, the Autonomous Target Drones segment held a dominant market position, capturing more than 70% share.

- In 2024, the Military & Government segment held a dominant market position in the Target Drone market, capturing more than 85% share.

- In the Target Drone Market, the segment for drones with a payload of less than 15 Kg demonstrated a commanding lead in 2024, securing over 50% of the market share.

- In 2024, North America held a dominant market position in the target drone sector, capturing more than 35% share with revenues amounting to USD 1.8 billion.

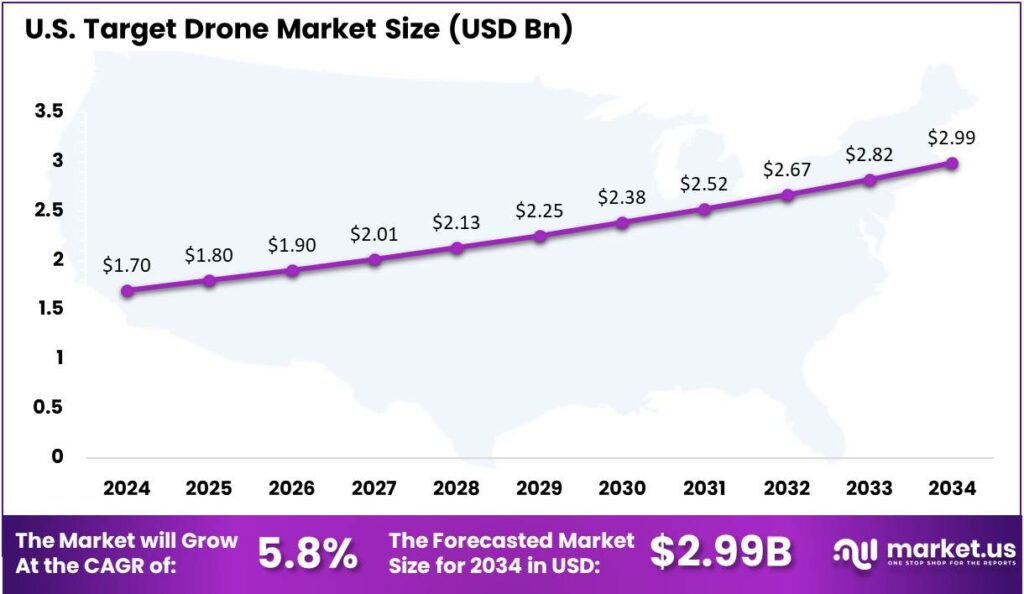

- In 2024, the U.S. Target Drone Market was estimated at a value of USD 1.7 billion. This market is projected to grow at a CAGR of 5.8%.

US Tariff Impact Analysis

Accoridng to LE Drones, The implementation of a 10% import tariff is expected to raise the cost of several high-performance drones, significantly impacting procurement decisions across defense and commercial sectors. For instance, the DJI Matrice 30T with Care Enterprise Basic, currently priced at $9,643, is projected to increase to approximately $10,600.

Similarly, the DJI Matrice 4T Drone with Care Enterprise Plus may see its price rise from $7,299 to around $8,028, while the Autel Robotics EVO Max 4T, currently available for $8,999, is estimated to cost $9,898 after the adjustment. The recent imposition of U.S. tariffs has had a significant impact on the target drone market, particularly affecting the costs and supply chain dynamics for drones.

Here’s an analysis of the implications:

- Cost Implications: Tariffs have led to increased prices for drones, especially those manufactured in China like DJI models. Retailers may adjust these prices upward to account for the higher import costs. For example, DJI, a major player, might absorb some costs, but historical trends suggest that importers generally pass most of these additional costs onto consumers.

- Supply Chain Disruptions: The tariffs have prompted U.S.-based manufacturers to consider diversifying their supply chains. Companies are exploring manufacturing options in countries like Vietnam, Taiwan, and Mexico to mitigate risks associated with reliance on Chinese components.

- Market Dynamics: There is a notable shift in consumer behavior, with potential increases in the demand for refurbished drones or domestically produced alternatives as new DJI drones become prohibitively expensive. This could slow the growth of hobbyist communities and impact professional usage such as aerial surveying, cinematography, or agriculture.

- Opportunities for Domestic Manufacturers: U.S. manufacturers like Skydio may see an increase in demand for their drones, which, while still containing some Chinese-made parts, might partially avoid the full brunt of tariffs. However, their ability to scale and match the features of leading brands like DJI could be a limiting factor.

- Regulatory and Security Landscape: The tariffs coincide with increased U.S. regulatory scrutiny over drones, particularly Chinese-made ones, due to national security concerns. This has shifted the market focus from merely price to security and trust as key selling points. The demand is growing for drones with secure communication and data storage capabilities, primarily from enterprises and governmental agencies.

Business Benefits

Investing in target drone technology offers significant advantages for defense and military training. Drones can also safely inspect hard-to-reach structures like bridges and tall buildings, capturing detailed images to spot issues early. This reduces the need for risky manual inspections and enhances worker safety.

Drones are being used to deliver packages, especially in areas where traditional delivery is challenging. They can transport items like medicines or small parcels quickly and directly to recipients. This method reduces delivery times and can be more environmentally friendly. According to DealAid report, Walmart, teaming up with DroneUp, Flytrex, Zipline, and Wing, has launched 36 drone delivery hubs across seven U.S. states marking a major leap in its aerial delivery expansion.

Drones collect data for mapping, surveying, and monitoring tasks more quickly and at a lower cost than traditional methods. They can cover large areas without the need for extensive manpower or equipment. This efficiency translates into significant cost savings for businesses. Coolest Gadgets’ 2023 report reveals that drones were primarily used for mapping and surveying, with Business-Internal-Service (BIS) companies holding 37% of the market and Drone Service Providers (DSPs) capturing 33%.

Key Features of Target Drones

- Realistic Threat Simulation: Target drones are designed to closely mimic the flight patterns, speed, and radar signatures of actual enemy drones or missiles. This helps teams train against realistic scenarios, whether it’s a single fast-moving drone or a swarm of small UAVs.

- Flexible Launch and Recovery: Many target drones use lightweight, man-portable catapult launchers, allowing them to take off from almost anywhere. They’re also built for safe and reusable landings, often using parachutes that can be quickly repacked for the next mission.

- Advanced Flight Control and Autonomy: These drones can follow pre-set GPS waypoints, switch to visual guidance for terminal approaches, and operate in both manual and fully autonomous modes. Some can execute evasive maneuvers or sea-skimming, testing air defense systems to their limits.

- Customizable Payloads and Modularity: Target drones can carry different payloads, such as radar reflectors, smoke pods, or flares, to better simulate various threats. Their modular designs allow easy component swaps or upgrades, and some drones can tow secondary targets for advanced exercises.

- Reliable Communication and Safety Systems: Operators control the drone through radio links or Wi-Fi apps, with sensors like GNSS navigation, barometric and laser altimeters, and onboard cameras. Safety features include automatic flight termination and parachute deployment for safe recovery and minimal risk.

U.S. Target Drone Market

In 2024, the U.S. Target Drone Market was estimated at a value of USD 1.7 billion. This market is projected to grow at a compound annual growth rate (CAGR) of 5.8%. The sustained growth trajectory is attributable to several pivotal factors, including advancements in drone technology and increasing defense expenditures by the U.S. government.

The rising demand for target drones is primarily driven by their critical role in military training and weapons testing. These drones are used extensively to simulate enemy aircraft or missiles for live fire exercises and missile testing, thereby providing realistic scenarios for military personnel. The integration of high-fidelity sensors and emulation technologies in target drones enhances their utility in complex training operations.

The expansion of the target drone market is driven by ongoing innovations in drone technology, including improved endurance, better payload capacities, and enhanced maneuverability. These advancements allow drones to more accurately replicate enemy tactics, crucial for effective military training. With a continued focus on national security and military modernization, the U.S. target drone market is expected to keep growing in the future.

In 2024, North America held a dominant market position in the target drone sector, capturing more than a 35% share with revenues amounting to USD 1.8 billion.

This region leads primarily due to the significant investment in defense and military training programs by countries such as the United States and Canada. The presence of major defense contractors and technology firms that specialize in aerospace and drone technologies further bolsters North America’s leading position.

The robust infrastructure for research and development in North America facilitates continuous innovation in drone technology, enhancing the capabilities of target drones in terms of endurance, agility, and sensor technology. This innovation is critical as it aligns with the increasing complexity of defense training needs, where realistic simulation of enemy aircraft and missile systems is crucial.

The regulatory environment in North America supports the testing and deployment of advanced military equipment, including target drones. Government policies and defense funding foster the adoption of new technologies, ensuring the military is equipped with cutting-edge training tools. These factors help North America maintain and expand its leadership in the global target drone market.

Type Analysis

In 2024, the Aerial Target Drones segment held a dominant market position, capturing more than a 61% share. This leadership can be primarily attributed to the extensive use of aerial target drones in high-fidelity military training exercises that simulate enemy aircraft or missile attacks.

Aerial target drones are favored for their versatility and ability to mimic various enemy tactics. With advanced flight control systems, they can perform complex maneuvers that closely replicate opposing aircraft, improving training realism for defense forces. These drones also carry payloads like radar, infrared, or optical systems, crucial for electronic warfare training.

The robust demand for aerial target drones is also supported by continuous technological advancements that improve their endurance, speed, and reliability. These improvements make aerial drones more capable of withstanding varied and harsh operational conditions, thus ensuring their effectiveness in diverse training environments.

The expansion of aerial target drones is fueled by the increasing global investment in military training programs that focus on aerial combat readiness. Countries are allocating substantial budgets to enhance their aerial defense capabilities, which in turn drives the growth of the aerial target drone market segment, ensuring its leading position within the industry.

Application Analysis

In 2024, the Combat Training segment held a dominant market position within the target drone industry, capturing more than a 45% share. This prominence is attributed to the escalating need for highly realistic aerial combat simulations in military training exercises.

Target drones are essential in combat training, offering realistic, mission-critical scenarios that enhance tactical skills and decision-making under pressure. By simulating enemy fighters and missiles, they create dynamic training environments, helping military personnel prepare for real combat and driving growth in this sector.

The technological advancements in drone systems, such as enhanced maneuverability, speed, and payload capacity, have made them even more vital for combat training. These improvements help in mimicking various threat scenarios with greater accuracy, thereby providing more value in training regimens.

Moreover, the increased defense budgets and investments in training technologies by several countries ensure the continuous demand for target drones in combat training. As these drones evolve with cutting-edge technologies, their integration into regular training programs becomes more profound, reinforcing the dominant position of the Combat Training segment in the target drone market.

Operation Analysis

In 2024, the Autonomous Target Drones segment held a dominant market position, capturing more than a 70% share. This significant market dominance can be attributed to several key factors that favor the adoption of autonomous systems in military and training applications.

The growing focus on reducing human risk in combat and training scenarios is driving the adoption of autonomous target drones. These drones perform complex tasks like aerial combat training, ground support, and reconnaissance, all without endangering pilot lives. This capability is highly valued in global defense sectors, which prioritize safety and efficiency.

Advancements in AI and machine learning have significantly enhanced autonomous drones, enabling them to perform complex maneuvers with minimal human intervention. This improves their reliability in simulating realistic battle scenarios and boosts their adoption, particularly for navigation, target acquisition, and data collection.

Cost-effectiveness is a key factor in the increasing preference for autonomous target drones. They incur lower operational costs than piloted drones, requiring less maintenance and no extensive pilot training. This reduction in costs, coupled with high efficiency, makes autonomous drones an appealing choice for defense organizations.

End-User Analysis

In 2024, the Military & Government segment held a dominant market position in the Target Drone market, capturing more than an 85% share. This substantial market share is underpinned by several pivotal factors that underscore the segment’s preeminence.

The demand for target drones in military and government sectors is driven by the need for improved defense training and testing. They are essential for aerial target practice, missile testing, and training radar and weapon systems, helping nations enhance military capabilities and preparedness, thus boosting demand in this segment.

The increased budget allocations towards defense spending in numerous countries significantly contribute to the dominance of the Military & Government segment. These financial investments facilitate the procurement of advanced training and testing equipment, including target drones, which are integral to modernizing military operations and strategies.

Technological advancements in drone technology, including improved endurance, better flight control systems, and increased payload capacity, have made target drones more attractive to military and government users. These improvements enable more realistic and effective training, crucial for simulating combat scenarios, driving growth in this segment.

Payload Analysis

In the Target Drone Market, the segment for drones with a payload of less than 15 Kg demonstrated a commanding lead in 2024, securing over 50% of the market share. This dominance can be attributed to several key factors.

The affordability and accessibility of lighter drones make them ideal for various applications. Their lower cost appeals to budget-conscious buyers and enables the acquisition of larger fleets at a reduced total cost of ownership. This economic advantage is important in sectors like education and small-scale commercial settings, where cost-effectiveness is key.

Drones with a payload under 15 kg generally face less stringent regulatory requirements, enabling quicker deployment and broader operational flexibility. This ease of compliance is especially beneficial in densely populated or tightly regulated areas, allowing for faster response times and more adaptable mission planning.

Technological advancements in miniaturization have boosted the capabilities of lightweight drones, equipping them with advanced sensors and imaging technologies. Despite their small size, they can now perform complex tasks in fields like environmental monitoring, agriculture, and tactical surveillance.

Key Market Segments

By Type

- Aerial

- Ground

- Marine

By Application

- Combat Training

- Target & Decoy

- Reconnaissance

- Target Identification

- Target Acquisition

By Operation

- Autonomous Target Drones

- Piloted Target Drones

By End-User

- Military & Government

- Commercial

By Payload

- Less than 15 Kg

- 15-30 kg

- More than 30 Kg

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand for Realistic Military Training

The increasing need for realistic military training scenarios is a primary driver for the target drone market. Modern warfare requires armed forces to prepare for complex combat situations without risking human lives during training.

Target drones serve as cost-effective and safe tools for simulating enemy threats, allowing military personnel to practice and refine their skills in a controlled environment. These drones can mimic various aerial threats, including enemy aircraft and missiles, providing a dynamic training platform.

The U.S. Department of Defense has been investing in advanced target drone systems to boost combat readiness and better prepare troops for real-world scenarios. This focus on realistic training is set to drive global demand for target drones.

Restraint

High Acquisition and Maintenance Costs

Despite their benefits, the high costs associated with acquiring and maintaining target drones pose a significant restraint to market growth. Advanced target drones equipped with sophisticated technologies, such as stealth capabilities and electronic warfare systems, require substantial investment.

Additionally, the operational costs, including regular maintenance, repairs and the need for skilled operators, add to the financial burden. These expenses can be particularly challenging for developing countries or smaller defense budgets, limiting their ability to adopt such systems extensively. The high costs may also deter commercial entities from integrating target drones into their operations, thereby restricting market expansion.

Opportunity

Technological Advancements in Drone Capabilities

The rapid advancements in drone technology present significant opportunities for the target drone market. Innovations such as artificial intelligence (AI), machine learning, and enhanced sensor systems are transforming target drones into more versatile and effective training tools.

AI integration allows drones to simulate complex enemy behaviors, providing more realistic training scenarios. Improved sensors enhance the accuracy and reliability of data collected during exercises, facilitating better performance analysis.

These technological enhancements not only improve training outcomes but also open new applications for target drones in areas like surveillance and reconnaissance. As technology continues to evolve, the capabilities of target drones are expected to expand, offering new growth avenues for manufacturers and service providers.

Challenge

Regulatory and Compliance Issues

Regulatory and compliance challenges represent a significant hurdle for the target drone market. The operation of drones, especially in military contexts, is subject to stringent regulations to ensure safety, security, and privacy. Navigating the complex regulatory landscape can be time-consuming and costly for manufacturers and operators.

Inconsistent regulations across different countries further complicate international operations and collaborations. Additionally, concerns over data security and the potential misuse of drones necessitate robust compliance measures, which can strain resources.

Addressing these regulatory challenges requires coordinated efforts between industry stakeholders and regulatory bodies to establish clear, standardized guidelines that facilitate the safe and effective use of target drones.

Emerging Trends

The integration of AI and machine learning is transforming target drone capabilities, allowing for autonomous navigation, adaptability, and complex maneuvers in training scenarios. For example, Ukraine has deployed AI-enhanced drones that operate effectively in signal-jammed areas, increasing strike accuracy without manual control.

Swarm technology is another emerging trend, where multiple drones operate in coordination to simulate realistic threat scenarios. This approach enhances the complexity and realism of training exercises, preparing military personnel for modern combat situations .

Miniaturization and cost reduction are making target drones more accessible. Smaller, cost-effective drones allow for frequent training exercises without significant financial burdens. Additionally, the development of “drone-in-a-box” systems, which autonomously deploy and return to a charging station, is streamlining operations and reducing the need for human intervention .

Key Player Analysis

As defense spending increases globally, several companies are taking a lead role in this growing industry.

Air Affairs Australia is a key player in the target drone market, especially in the Asia-Pacific region. Known for its Phoenix drone series, the company provides high-performance aerial targets used in naval and air force training. What sets Air Affairs apart is its ability to offer turnkey aerial target services, including operations, logistics, and maintenance.

Denel Dynamics, based in South Africa, is a prominent name in the drone and missile systems market. Their Skua high-speed target drone is widely recognized for simulating fast-moving threats such as missiles and enemy aircraft. The company’s strength lies in its engineering excellence and decades of experience in advanced defense technology.

Embention, headquartered in Spain, brings cutting-edge autonomy to the target drone space. Unlike traditional drone manufacturers, Embention focuses on high-end autopilots and control systems, like their Veronte autopilot, which is used to convert various aerial platforms into advanced UAVs.

Top Key Players in the Market

- Air Affairs Australia

- Denel Dynamics

- Embention

- Saab AB

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- The Boeing Company

- Airbus SE

- BAE Systems plc

- Kratos Defense & Security Solutions, Inc.

- QinetiQ Group plc

- Griffon Aerospace

- Leonardo S.p.A.

- Safran Electronics & Defense

- Other Key Players

Top Opportunities for Players

The target drone market presents several promising opportunities that market players can capitalize on to expand and enhance their market positioning.

- Hybrid Target Drones Development: The market is witnessing a surge in the popularity of hybrid target drones, which combine the best features of fixed-wing and rotary-wing drones. With high maneuverability and vertical takeoff and landing capabilities, these drones are ideal for diverse military and commercial uses. Advances in propulsion technology are expected to drive their widespread adoption.

- Expansion in Commercial Applications: There’s a growing trend towards using target drones for commercial purposes, such as infrastructure inspections and small package deliveries. This diversification is being driven by the increasing number of drones registered for commercial use, highlighting a robust market growth opportunity outside of traditional defense applications.

- Advancements in Autonomous Technologies: The integration of advanced autonomous and artificial intelligence technologies is reshaping the target drone market. The development of drones capable of complex, autonomous operations without human intervention is expanding their applications in military training, surveillance, and reconnaissance, thereby opening new avenues for growth.

- Strategic Partnerships for Innovation: Collaborations and strategic partnerships between companies are crucial for driving innovation and adapting to the evolving market demands. These partnerships help companies combine strengths in technology and market access, driving the development of advanced target drone solutions for both defense and commercial needs.

- Increasing Defense Expenditures Worldwide: With global defense budgets on the rise, there is an increasing demand for military training and testing equipment, including target drones. This surge in defense spending is directly contributing to the expansion of the target drone market, as countries invest in enhancing their military training capabilities to ensure preparedness and operational effectiveness.

Recent Developments

- In March 2024, Kratos Defense & Security Solutions, based in San Diego, has secured a $57.7 million contract modification from the U.S. Navy to produce 70 BQM-177A surface-launched aerial targets. These high-performance drones are designed to simulate anti-ship missiles, with the deal marking the full-rate production of Lot 5.

- In 2024, Northrop Grumman successfully launched three Medium-Range Ballistic Missile (MRBM) targets for the Aegis Weapon System test, demonstrating its capabilities in providing realistic threat simulations.

Report Scope

Report Features Description Market Value (2024) USD 5.42 Bn Forecast Revenue (2034) USD 10.8 Bn CAGR (2025-2034) 7.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Aerial, Ground, Marine), By Application (Combat Training, Target & Decoy, Reconnaissance, Target Identification, Target Acquisition), By Operation (Autonomous, Piloted), By End-User (Military & Government, Commercial), By Payload (Less than 15 Kg, 15-30 kg, More than 30 Kg) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Air Affairs Australia, Denel Dynamics, Embention, Saab AB, Lockheed Martin Corporation, Northrop Grumman Corporation, The Boeing Company, Airbus SE, BAE Systems plc, Kratos Defense & Security Solutions, Inc., QinetiQ Group plc, Griffon Aerospace, Leonardo S.p.A., Safran Electronics & Defense, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Air Affairs Australia

- Denel Dynamics

- Embention

- Saab AB

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- The Boeing Company

- Airbus SE

- BAE Systems plc

- Kratos Defense & Security Solutions, Inc.

- QinetiQ Group plc

- Griffon Aerospace

- Leonardo S.p.A.

- Safran Electronics & Defense

- Other Key Players