Global Synthetic Media Market Size, Share Analaysis Report By Component (Solution, Services), By Technology (Generative AI, Speech Synthesis, Computer Vision, NLP, Others), By Application (Media & Entertainment, Education & E-Learning, Healthcare, Retail & E-commerce, BFSI, Gaming, IT & Telecom, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154663

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Role of AI

- US Market Size

- Emerging Trends

- Growth Factors

- By Component: Solution (66.8%)

- By Technology: Generative AI (44.6%)

- By Application: Media & Entertainment (28.5%)

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Landscape

- Recent Developments

- Report Scope

Report Overview

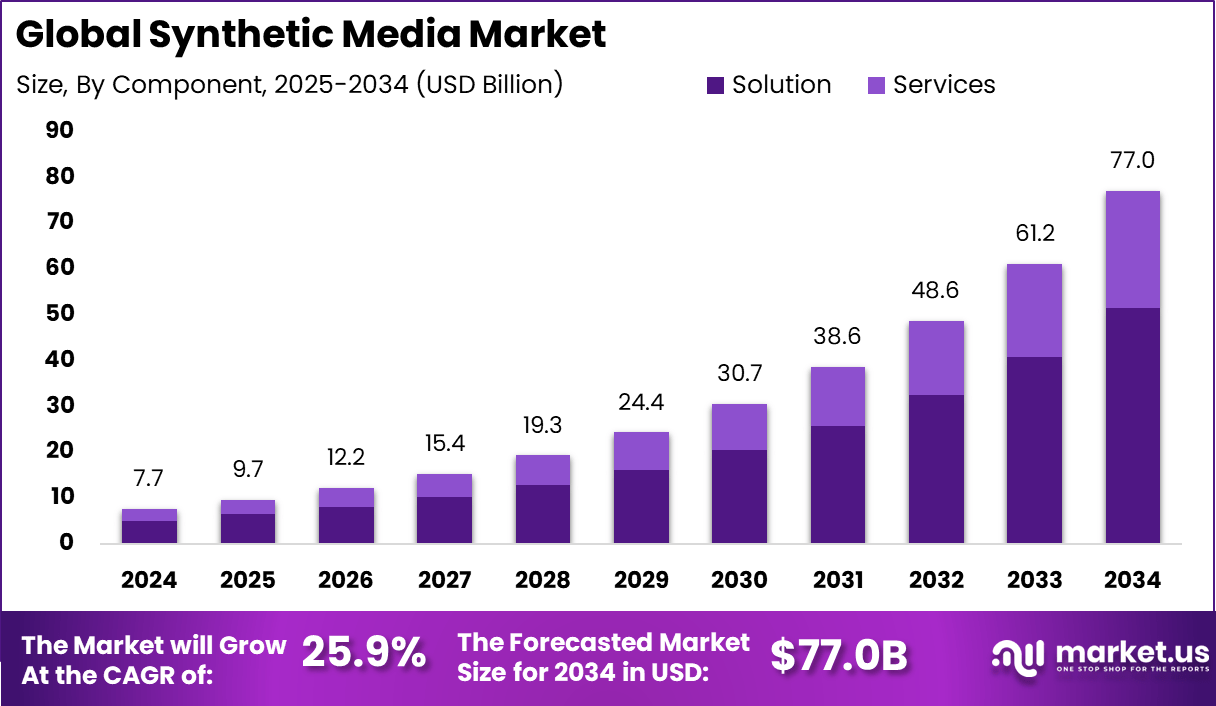

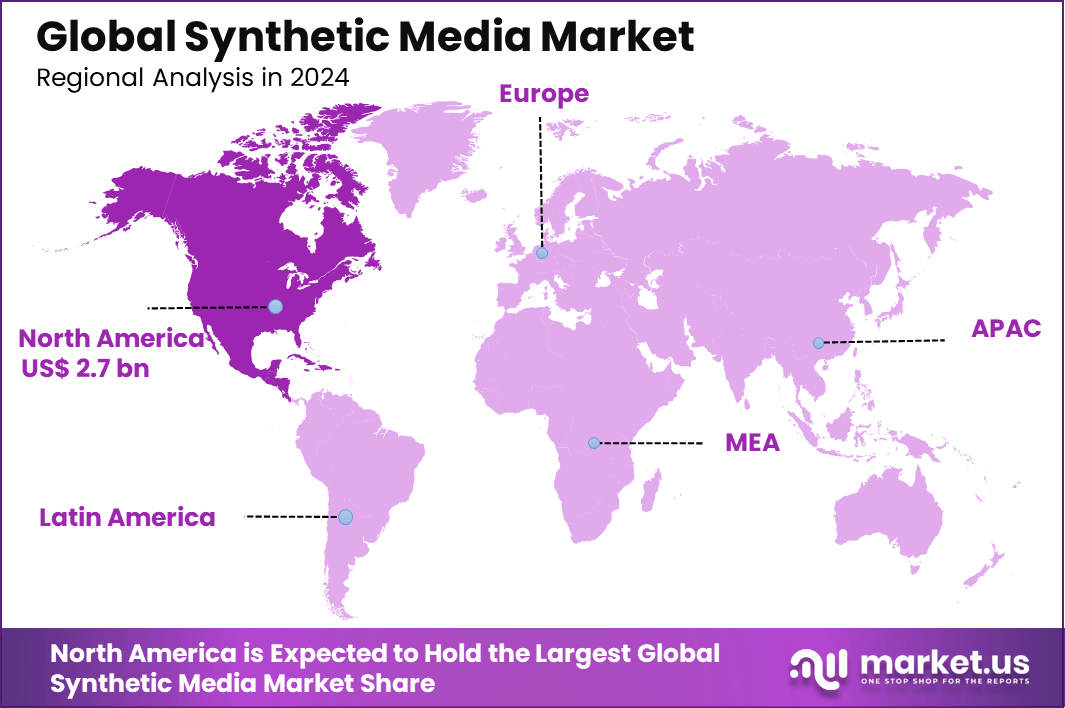

The Global Synthetic Media Market size is expected to be worth around USD 77 Billion By 2034, from USD 7.7 billion in 2024, growing at a CAGR of 25.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.6% share, holding USD 2.7 Billion revenue.

The Synthetic Media market refers to the creation, manipulation, or generation of audio, video, text, or visual content by artificial intelligence and machine learning algorithms rather than human effort. This includes deepfake videos, AI-generated art, voice synthesis, virtual avatars, and automated text. The term broadly covers all media produced with algorithmic guidance rather than manual production.

A key driving factor for this market is the demand for personalized content at scale. Synthetic media allows companies and creators to customize marketing campaigns, training videos, advertisements, and even entertainment experiences for highly targeted audiences – all with low costs and rapid turnaround times. The advancements in artificial intelligence, such as natural language processing and generative models, have dropped the cost and expertise barrier, democratizing content creation.

Market Size and Growth

Metric Statistic / Value Market Value (2024) USD 7.7 Bn Forecast Revenue (2034) USD 77 Bn CAGR(2025-2034) 25.9% Leading Segment Solution: 66.8% Region with Largest Share North America [35.6% Market Share] Largest Country U.S. [USD 2.33 Bn Market Revenue], CAGR: 23.2% Key Insight Summary

- The global market is projected to expand from USD 7.7 billion in 2024 to approximately USD 77 billion by 2034, registering a high CAGR of 25.9%, driven by rapid advancements in content generation technologies.

- North America led the market with a 35.6% share, generating USD 2.7 billion in revenue, reflecting strong adoption across digital media, advertising, and enterprise training.

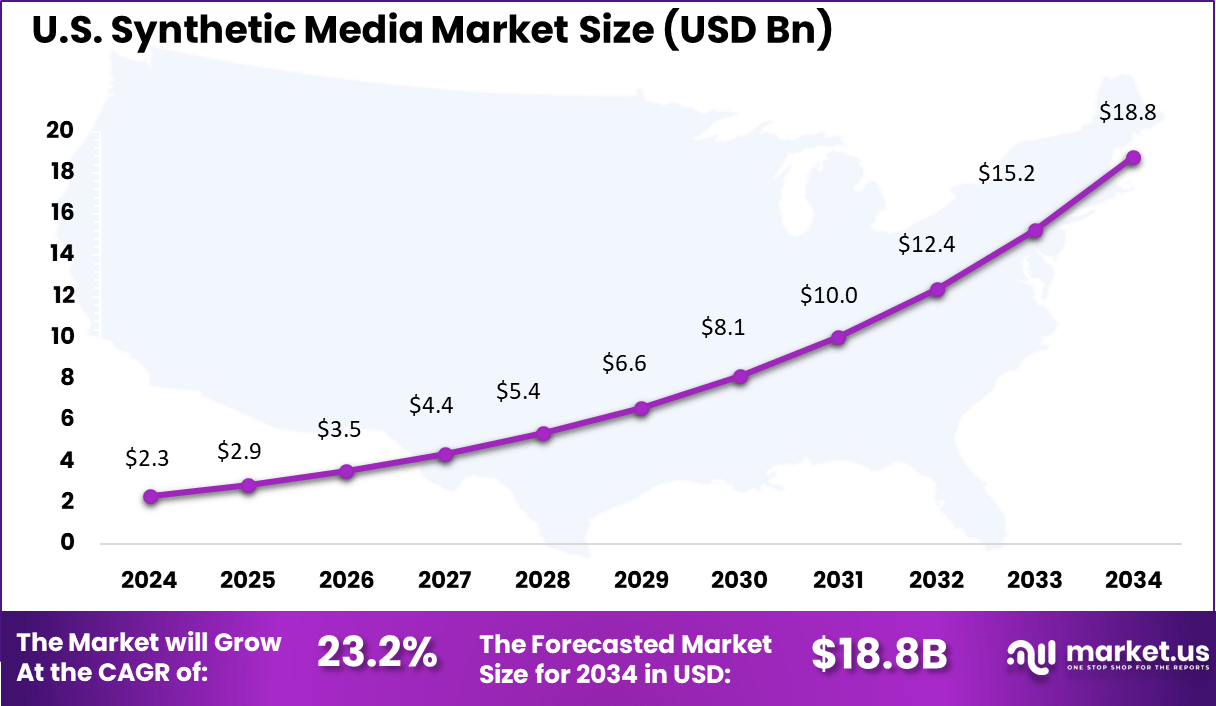

- The U.S. market alone contributed USD 2.33 billion and is projected to grow at a CAGR of 23.2%, supported by innovation hubs and significant investments in generative AI startups.

- The Solution segment held the largest share at 66.8%, indicating growing demand for end-to-end synthetic media platforms that support video, voice, and image generation.

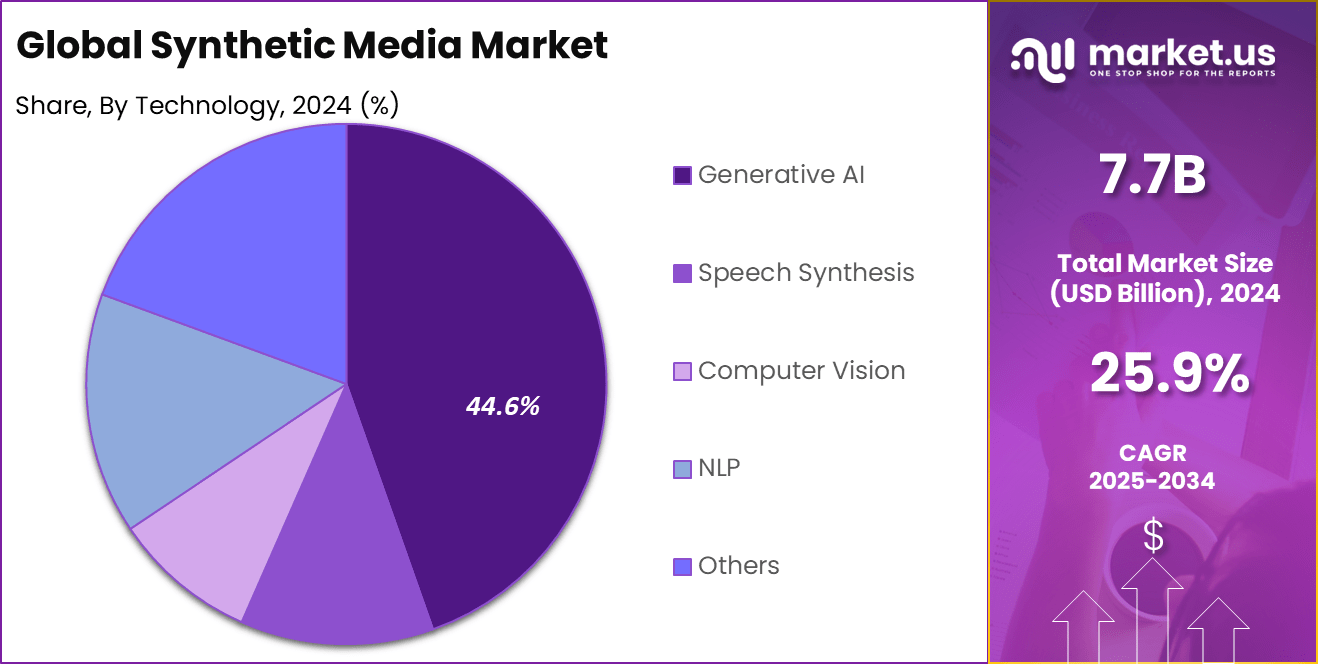

- Generative AI was the leading technology, capturing 44.6%, fueled by its use in creating hyper-realistic avatars, voiceovers, virtual influencers, and dynamic video content.

- The Media & Entertainment sector dominated the application segment with 28.5%, leveraging synthetic content for storytelling, personalization, and immersive audience experiences.

Role of AI

Role/Function Description Content Generation AI creates text, audio, video, images, virtual avatars, and synthetic humans for media and marketing Personalization Algorithms deliver customized, context-aware content at scale for different audiences and platforms Realistic Simulations Deep learning (GANs, NLP) enables ultra-realistic voice, face, and body animation Workflow Automation AI streamlines editing, localization, translation, scriptwriting, and asset generation Verification & Detection AI also helps identify deepfakes and authenticate media to combat misuse and ethical risks US Market Size

The U.S. Synthetic Media Market was valued at USD 2.3 Billion in 2024 and is anticipated to reach approximately USD 18.8 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 23.2% during the forecast period from 2025 to 2034.

The United States holds a leading position in the synthetic media market due to a combination of advanced technological infrastructure, early adoption of generative AI, and strong venture capital funding ecosystems. The country has been at the forefront of AI innovation, with a robust base of companies, research institutions, and developers focused on generative models for text, images, audio, and video.

Moreover, the U.S. benefits from a mature digital economy and high content consumption across entertainment, marketing, and social platforms. The widespread integration of synthetic media in advertising campaigns, virtual influencers, and content automation has driven strong domestic demand. The entertainment and media industries use synthetic voice and face tech to cut costs and deliver content faster, strengthening their market lead.

In 2024, North America held a dominant market position, capturing more than 35.6% share, generating approximately USD 2.7 billion in revenue. This regional leadership can be attributed to the early adoption of synthetic media technologies across entertainment, advertising, education, and enterprise sectors. The presence of advanced AI research ecosystems, paired with significant investment in generative content platforms, has accelerated the regional adoption rate.

The demand for hyper-personalized digital content, including AI-generated avatars, voices, and video, is particularly strong across the United States, where media companies and content creators are prioritizing scalability and cost-efficiency. The region’s dominance is further reinforced by favorable regulatory frameworks that support innovation while also addressing ethical standards around deepfakes, misinformation, and copyright concerns.

North American companies have shown a proactive approach in developing responsible synthetic media tools with built-in watermarking and content authentication. In addition, the region benefits from a mature digital infrastructure and high internet penetration, which contribute to broader accessibility and experimentation with synthetic content in marketing, gaming, e-learning, and corporate training environments.

Emerging Trends

Trend/Innovation Description Hyper-Realistic Avatars AI-generated avatars, digital humans, and influencers in ads, customer service, and social media Self-Service Creative Suites Cloud-based, drag-and-drop tools allowing non-experts to make videos, voices, images, and presentations Multilingual/Multimodal Output Instant translation and adaptation for global audiences Responsible & Ethical AI Use Adoption of verification technologies, regulation, and transparency to address deepfake risks Integration with Commerce Interactive shoppable videos, personalized ad creatives, and virtual try-ons in e-commerce Growth Factors

Key Factors Description AI & Deep Learning Advancements Breakthroughs in GANs, NLP, and voice synthesis drive realism and application variety Demand for Custom/Engaging Content Brands and creators require rapid, cost-effective, immersive content for advertising, education, and training Accessibility of Tools/Platforms Democratization of content creation with user-friendly, cloud-based AI platforms lowers barriers to entry Expanding Industry Adoption Uptake in entertainment, advertising, education, journalism, healthcare, social media, and VR/Gaming Scalability and Economic Benefits Synthetic media enables high-volume production at lower costs compared to conventional methods By Component: Solution (66.8%)

The solution segment leads the synthetic media market with a commanding 66.8% share. This dominance highlights the growing demand for comprehensive software platforms that enable the creation, editing, and management of synthetic media content. Solutions encompass a wide range of tools, including AI-powered video generators, deepfake creation software, and synthetic voice synthesis platforms.

These tools allow creators and enterprises to streamline production workflows, enhance content personalization, and reduce costs associated with traditional media creation. The increasing adoption across industries reflects the value synthetic media solutions bring in driving innovation and scalability.

By Technology: Generative AI (44.6%)

Generative AI stands out as the primary technology in synthetic media, accounting for 44.6% of the market share. This technology powers the creation of realistic, high-quality synthetic content by learning patterns from existing data and generating new, original media such as images, videos, and audio.

Its applications extend from entertainment and advertising to virtual assistants and personalized content delivery. The rapid advancements in generative models, including GANs and large language models, are accelerating the development and adoption of synthetic media, transforming how content is produced and consumed.

By Application: Media & Entertainment (28.5%)

The media and entertainment sector is the leading application segment with a 28.5% market share. Synthetic media technologies are revolutionizing this industry by enabling the creation of immersive visual effects, virtual actors, and personalized advertising.

Studios and content creators use these tools to produce high-quality content faster and at a lower cost, while offering audiences more engaging and interactive experiences. Additionally, synthetic media is enhancing post-production processes and enabling new forms of storytelling, solidifying its importance within the evolving media landscape.

Key Market Segments

By Component

- Solution

- Services

By Technology

- Generative AI

- Speech Synthesis

- Computer Vision

- NLP

- Others

By Application

- Media & Entertainment

- Education & E-Learning

- Healthcare

- Retail & E-commerce

- BFSI

- Gaming

- IT & Telecom

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Demand for Personalized and Immersive Digital Content

One of the key drivers behind the rise of synthetic media is the growing need for more personalized and immersive digital content. Digital audiences are demanding content tailored expressly for their interests, backgrounds, and current needs. Synthetic media, which includes AI-generated text, lifelike avatars, and dynamic video or voice, allows creators to deliver experiences that are not just engaging but specifically targeted.

In sectors such as entertainment, education, and marketing, this ability to adapt content to the individual has sparked widespread adoption of synthetic tools. Marketers, educators, and content creators now find they can build rich user experiences faster and at lower cost by using these technologies for dynamic personalization.

Another factor is the technical leap in artificial intelligence and machine learning, which makes it possible to generate realistic voices, animations, and even entire video productions from a small set of prompts. This creates new value without relying on traditional studios or high-budget setups. The pace of these advancements encourages innovation and competition, opening up synthetic media even to smaller creators and organizations who previously lacked such capabilities.

Restraint

Ethical and Data Privacy Concerns

While synthetic media offers enormous creative potential, concerns about data privacy and ethics act as significant constraints on adoption. Synthetic content, especially technologies like deepfakes, introduces uncertainty about whether what viewers see and hear is authentic. The fear of unauthorized use for malicious purposes – such as identity theft, misinformation, or impersonation – has prompted both consumers and businesses to take a cautious approach.

Regulatory frameworks, such as the European Union’s General Data Protection Regulation (GDPR) or California’s Consumer Privacy Act (CCPA), now require organizations working with synthetic media to implement strict compliance measures. This adds complexity and cost to synthetic media initiatives, with companies needing heightened transparency, consent measures, and robust data governance.

Opportunity

Transforming Learning and Training Experiences

Synthetic media carries huge promise for transforming educational and training environments. Traditional training programs can be time-consuming, costly, or too generalized for diverse learner needs. Synthetic media allows for the easy creation of interactive video lessons, simulations, and virtual role-plays designed for each learner’s pace and learning style.

This flexibility can lead to better knowledge retention and greater learner motivation across a range of disciplines – from corporate compliance to language learning and beyond. Additionally, education and training organizations can now scale their offerings to global audiences without extensive localized resources.

For example, synthetic media tools can produce content in dozens of languages or create avatars that reflect the cultural context of participants. These innovations enable both public institutions and private companies to reach more people, more effectively, at any time. As quality and accessibility of synthetic media keep improving, the educational sector is poised to see even wider adoption, helping bridge gaps that traditional media delivery could not address.

Challenge

Legal Ambiguities in Content Authenticity and Ownership

A major challenge in the synthetic media landscape is the lack of clear legal frameworks regarding content authenticity, identity rights, and ownership. The ability to generate hyper-realistic media blurs the boundaries between original and artificial, leading to disputes over rights to voices, likenesses, or creative materials.

This not only complicates content distribution – especially across jurisdictions – but can create risk for organizations around consent, attribution, and liability if a synthetic likeness is abused. The problem is amplified by differences in global regulations. Some countries have established initial standards, while others lag behind, resulting in a patchwork of requirements and ongoing legal grey areas.

Companies must navigate these hurdles carefully, often working alongside legal experts and industry bodies to build their own safeguards and avoid stalling innovation. Until universal best practices and laws are developed for synthetic media, businesses will need to balance creative ambitions with the need for regulatory compliance, clear disclosure, and respect for personal rights.

Competitive Landscape

In the Synthetic Media Market, IBM, Microsoft, and Google have emerged as foundational players. Their early investments in cloud infrastructure and AI frameworks have supported widespread adoption of generative media tools. These companies continue to focus on scalable solutions for enterprise-grade content generation, virtual assistants, and natural language processing.

NVIDIA Corporation, Adobe, OpenAI, and DataRobot, Inc. have played a crucial role in advancing creative and computational models. NVIDIA powers high-performance GPU hardware optimized for generative media. Adobe integrates AI into creative suites for automated content creation. OpenAI’s language models are widely used in text and voice synthesis.

Companies like Deepbrain AI, Synthesis AI, Inc., Baidu, Inc., Teads, and other emerging vendors are also shaping this market. Their focus is primarily on region-specific and vertical-based innovation. Deepbrain and Synthesis AI specialize in hyper-realistic digital humans. Baidu leverages its AI cloud for Chinese-language synthetic content. Teads drives performance through ad-based synthetic video technologies.

Top Key Players in the Market

- IBM

- Microsoft

- Synthesis AI, Inc.

- NVIDIA Corporation

- Deepbrain AI.

- Baidu, Inc.

- Adobe

- DataRobot, Inc.

- OpenAI

- Others

Recent Developments

- In July 2025, Baidu unveiled MuseStreamer, an AI-powered video generator that enables businesses to quickly convert images into short videos. This tool streamlines digital marketing and offers scalable, cost-efficient video content creation using generative AI.

- In June 2025, Adobe launched an AI-driven image generation app for smartphones, expanding its creative suite. The app allows users to easily create high-quality, customizable visuals, while Adobe also announced new AI integrations across its platforms to transform digital content workflows.

- In March 2025, NVIDIA introduced its Physical AI Data Tools and Cosmos World Foundation Models. These innovations support the generation of synthetic, photorealistic environments, accelerating training for robotics and autonomous systems through its Cosmos and Omniverse platforms.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution, Services), By Technology (Generative AI, Speech Synthesis, Computer Vision, NLP, Others), By Application (Media & Entertainment, Education & E-Learning, Healthcare, Retail & E-commerce, BFSI, Gaming, IT & Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM, Microsoft, Synthesis AI, Inc., NVIDIA Corporation, Deepbrain AI, Baidu, Inc., Adobe, DataRobot, Inc., OpenAI, Google, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IBM

- Microsoft

- Synthesis AI, Inc.

- NVIDIA Corporation

- Deepbrain AI.

- Baidu, Inc.

- Adobe

- DataRobot, Inc.

- OpenAI

- Others