Global Synbiotic Products Market Size, Share, Growth Analysis By Form (Powder, Liquid, Capsule, Others), By Application (Functional Food and Beverages, Dietary Supplements, Others), By End-User (Adults, Children), By Distribution Channel (Pharmacies/Health Stores, Supermarkets/Hypermarkets, Online Retail Stores, Others) – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157069

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

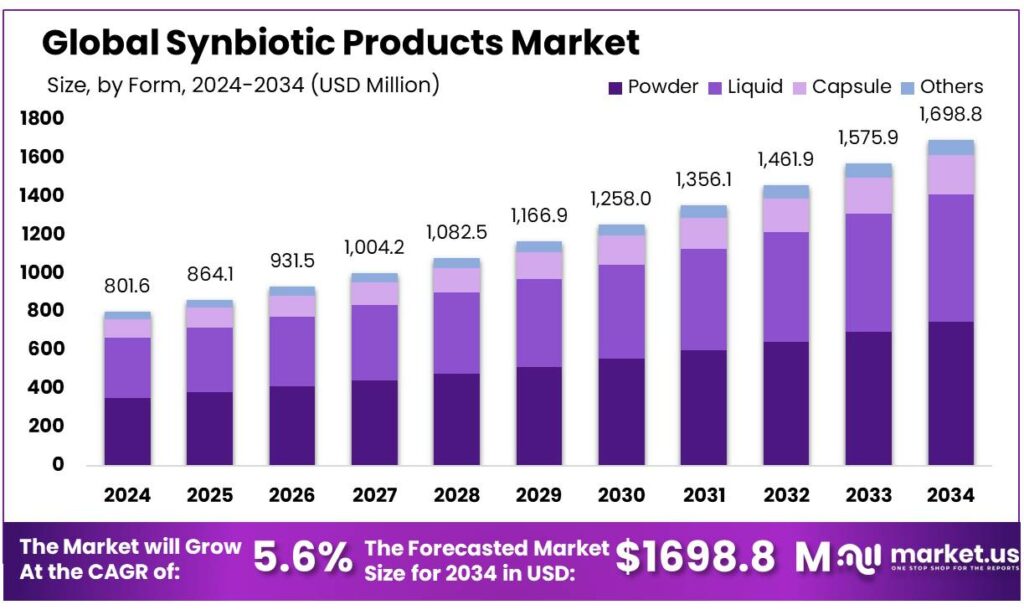

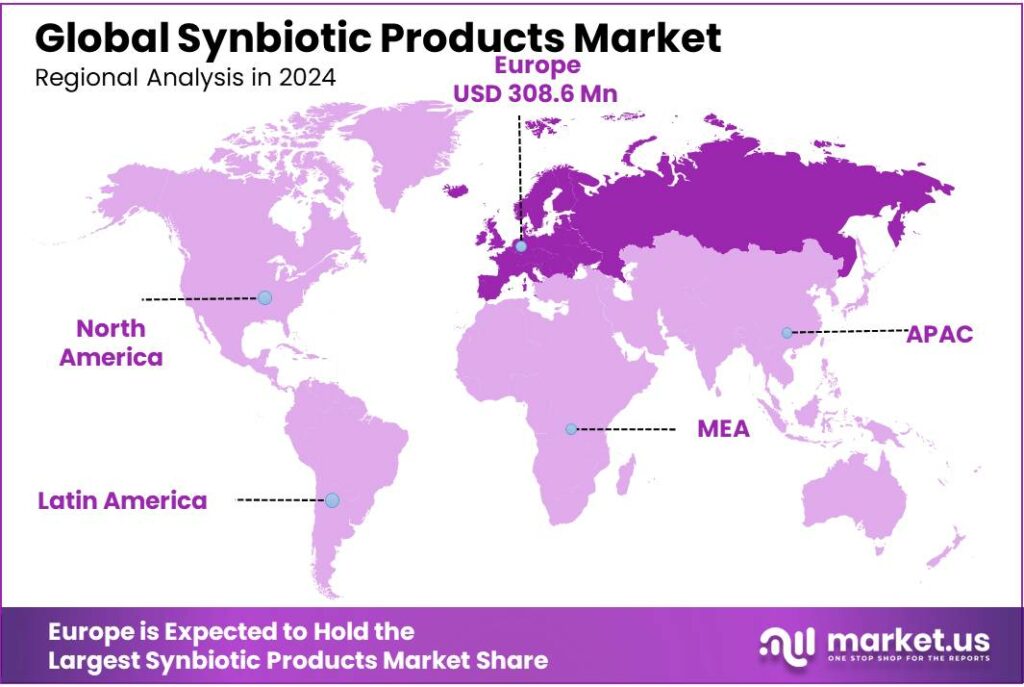

The Global Synbiotic Products Market size is expected to be worth around USD 1698.8 Million by 2034, from USD 801.6 Million in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 38.50% share, holding USD 308.6 Million in revenue.

Synbiotic products, which combine probiotics and prebiotics, are gaining prominence in the Indian market due to their potential health benefits, including improved gut health and enhanced immunity. The Indian bioeconomy, encompassing sectors like biotechnology, agriculture, and healthcare, has shown significant growth. As of 2021, the Indian biotechnology sector contributed approximately $70 billion to the GDP, with projections aiming for $150 billion by 2025, driven by advancements in biomanufacturing and bio-based products.

The industrial scenario for synbiotic products in India is evolving, with increasing consumer awareness and demand for functional foods and dietary supplements. This growth is supported by the government’s initiatives to foster innovation and strengthen the biotechnology sector.

For instance, the Department of Biotechnology (DBT) through the Biotechnology Industry Research Assistance Council (BIRAC) has been instrumental in promoting research and development in areas like industrial biotechnology, which includes the development of synbiotic products.

Government initiatives and supportive policies have further bolstered this trend. In India, for example, the probiotics market has doubled in size over five years, reaching INR 2,070 crore by 2025. This growth is attributed to increased consumer awareness and the government’s focus on promoting health and wellness.

Key Takeaways

- Synbiotic Products Market size is expected to be worth around USD 1698.8 Million by 2034, from USD 801.6 Million in 2024, growing at a CAGR of 5.6%.

- Powder held a dominant market position, capturing more than a 44.2% share in the global synbiotic products market.

- Functional Food & Beverage held a dominant market position, capturing more than a 55.7% share in the global synbiotic products market.

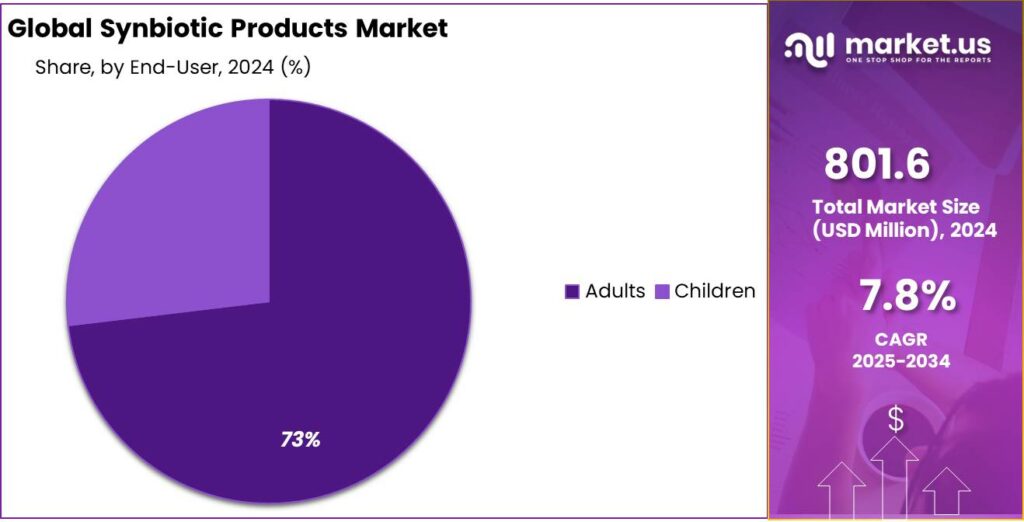

- Adults held a dominant market position, capturing more than a 73.4% share in the global synbiotic products market.

- Pharmacies/Health Stores held a dominant market position, capturing more than a 35.30% share in the global synbiotic products market.

- Europe accounted for 38.50% of the global synbiotic products market, representing approximately USD 308.6 million.

By Form Analysis

Powder Form Leads with 44.2% Due to Its Versatility and Easy Consumption

In 2024, Powder held a dominant market position, capturing more than a 44.2% share in the global synbiotic products market. This leadership is largely driven by its ease of integration into a wide variety of daily consumables such as smoothies, juices, yogurts, and dietary supplements. Powder forms offer better shelf life and higher concentration of active ingredients compared to capsules or liquid forms, which makes them attractive to both manufacturers and health-conscious consumers.

As awareness around gut health and immunity continues to rise, more consumers are turning to synbiotic powders for daily use, particularly those who prefer customizable intake over fixed capsule doses. In 2025, the segment is projected to retain its lead, supported by a steady demand in both developed and developing countries. Product innovation in flavored and fast-dissolving powders is also expected to further boost adoption.

By Application Analysis

Functional Food & Beverage dominates with 55.7% as daily diets embrace gut-health solutions

In 2024, Functional Food & Beverage held a dominant market position, capturing more than a 55.7% share in the global synbiotic products market. This large share reflects a strong shift in consumer behavior towards incorporating health-boosting ingredients into everyday foods rather than relying solely on supplements. People are now more interested in products like synbiotic yogurts, cereals, health bars, smoothies, and even dairy alternatives that support digestion and immunity without changing their meal routines.

Functional foods and beverages are increasingly viewed as a natural way to maintain well-being, especially in busy lifestyles where convenience and nutrition must go hand in hand. In 2025, the trend is expected to continue, with brands expanding their portfolios to include plant-based and clean-label synbiotic formulations. The growing demand for products that support gut health and immunity post-pandemic is also fueling consistent interest.

By End-User Analysis

Adults lead the way with 73.4% as gut health takes center stage in personal wellness

In 2024, Adults held a dominant market position, capturing more than a 73.4% share in the global synbiotic products market. This strong lead reflects the growing awareness among adults about the importance of gut health, immunity, and overall digestive balance. Adults, especially those between the ages of 25 to 55, are the most active consumers of synbiotic supplements, functional foods, and beverages. They are often dealing with stress, irregular diets, and lifestyle-induced digestive issues, making synbiotic products a regular part of their health routines.

The trend is supported by the rise of preventive healthcare—many adults now prefer incorporating daily wellness products rather than relying on curative treatments later. In 2025, this segment is expected to remain the largest, with continuous product launches targeting adult-specific health concerns like IBS, bloating, and energy levels.

By Distribution Channel Analysis

Pharmacies and Health Stores dominate with 35.3% thanks to trust and expert guidance

In 2024, Pharmacies/Health Stores held a dominant market position, capturing more than a 35.30% share in the global synbiotic products market. This strong position is largely due to consumer trust in pharmacists and health advisors when choosing gut health supplements. Pharmacies and specialized health stores offer professional advice, certified products, and better product curation, which appeals to individuals seeking safe and effective synbiotic options.

Many adults prefer buying synbiotic products through these channels because they can ask questions, compare formulations, and get guidance based on their specific health needs. In 2025, this distribution channel is expected to retain its lead, especially as more functional food brands partner with health retailers to widen reach and offer premium, clinically-backed products.

Key Market Segments

By Form

- Powder

- Liquid

- Capsule

- Others

By Application

- Functional Food & Beverages

- Dietary Supplements

- Others

By End-User

- Adults

- Children

By Distribution Channel

- Pharmacies/Health Stores

- Supermarkets/Hypermarkets

- Online Retail Stores

- Others

Emerging Trends

Personalized Nutrition and Functional Synbiotics

The synbiotic products market is experiencing a significant transformation, driven by the growing consumer demand for personalized nutrition and functional health solutions. Synbiotics, which combine probiotics and prebiotics, are increasingly being tailored to meet individual health needs, reflecting a broader shift towards customized dietary interventions.

Governments and health organizations are recognizing the importance of personalized nutrition in promoting public health. Initiatives such as the U.S. Department of Health and Human Services’ “Food Is Medicine” program aim to integrate nutrition into healthcare strategies, emphasizing the role of diet in disease prevention and management. These efforts support the development and adoption of personalized nutrition solutions, including synbiotic products tailored to individual needs.

The convergence of personalized nutrition and synbiotics represents a significant opportunity for innovation in the food and health industries. As research continues to uncover the complex interactions between diet, the microbiome, and health outcomes, synbiotic products are poised to play a pivotal role in individualized health strategies. This trend not only meets the growing consumer demand for personalized health solutions but also aligns with broader public health objectives aimed at improving overall well-being.

Drivers

Government Initiatives and Public Health Awareness

The growing awareness of gut health and its connection to overall well-being has led to significant government initiatives aimed at promoting healthier lifestyles and improving nutrition. In the United States, the Department of Health and Human Services (HHS) has developed the “Food Is Medicine” initiative. This program focuses on integrating consistent access to diet- and nutrition-related resources to reduce the prevalence of chronic diseases and improve health outcomes. The initiative includes diet-related research and programmatic efforts that increase access to nutrition interventions, such as medically tailored meals and produce prescriptions, to improve health in the United States.

In addition to federal efforts, state governments are also taking action to promote healthy eating. For example, the National Governors Association has highlighted the importance of “Food Is Medicine” approaches, which position healthy food as a reimbursable, clinically relevant intervention to address chronic disease. These interventions, including medically tailored meals and produce prescriptions, offer states a policy-relevant tool to reduce avoidable healthcare costs and improve outcomes for individuals with diet-related conditions.

These government initiatives reflect a broader recognition of the importance of nutrition in public health. By supporting access to healthy foods and promoting dietary interventions, these programs aim to address the root causes of chronic diseases and improve the overall health of populations. As awareness continues to grow, it is expected that such initiatives will play a crucial role in shaping public health strategies and fostering healthier communities.

Restraints

Limited Consumer Awareness and Knowledge Gaps

Despite the growing interest in synbiotic products, a significant barrier to their widespread adoption is the limited consumer awareness and understanding of these products. Synbiotics, which combine probiotics and prebiotics, are often misunderstood or confused with similar terms like probiotics alone. This lack of clarity can hinder consumers from making informed choices about their health and nutrition.

A study conducted in Poland found that only 35% of participants could correctly identify the difference between probiotics and synbiotics. More than half of the respondents admitted they did not know the distinction between the two, highlighting a significant knowledge gap. Additionally, when it came to selecting a synbiotic product, only 33% of consumers considered the number and type of probiotic strains included, while 47% were unaware that such variations existed.

This limited understanding is not confined to Poland. In Australia, a study revealed that while 76.6% of participants recognized the term “probiotics,” only 35.3% knew what “prebiotics” meant. Furthermore, over 58% were not familiar with the term “prebiotics” at all. The lack of awareness extends to the perceived efficacy of these products. In the same Polish study, only 12.9% of consumers believed that more expensive synbiotic products were more effective, while 50.2% were unsure, indicating a need for better education on the benefits and value of these products.

Opportunity

Government Support and Market Growth in India

India’s synbiotic products market is experiencing significant growth, driven by increasing consumer awareness of gut health and supportive government initiatives. The Food Safety and Standards Authority of India (FSSAI) has implemented regulations to ensure the safety and quality of synbiotic products, fostering consumer trust and market expansion.

The “Eat Right India” campaign, launched by FSSAI, promotes the consumption of safe and nutritious food, including functional foods like synbiotics. This initiative aims to educate the public about healthy eating habits and the benefits of functional foods in maintaining overall health.

Additionally, the “Make in India” initiative encourages domestic manufacturing of synbiotic products, reducing reliance on imports and supporting local businesses. This policy has led to increased investment in the food processing sector, including the production of synbiotic products.

These government efforts, combined with a growing consumer base seeking preventive healthcare solutions, position India as a promising market for synbiotic products. The market’s expansion is further supported by advancements in research and development, leading to innovative product offerings that cater to the evolving health needs of consumers.

Regional Insights

Europe leads with 38.50% share, generating USD 308.6 million in Synbiotic Products revenues

In 2024, Europe accounted for 38.50% of the global synbiotic products market, representing approximately USD 308.6 million in revenue. This regional dominance is driven by mature healthcare awareness, high disposable incomes, and a strong preference for functional foods and dietary supplements that support gut and immune health. Europeans are increasingly reaching for synbiotic yogurts, fortified beverages, and capsule supplements, especially as digestive wellness becomes a household priority.

Behind the numbers, Europe benefits from well-established supply chains and active R&D funded through public and private partnerships. That includes national and EU-level initiatives promoting microbiome science and innovation in functional nutrition. Countries like Germany, the UK, and France are particularly influential; Germany alone held about 19.5% of the European synbiotic product demand in 2024, reflecting both consumer trust and local production capacity.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Daflorn Ltd, a Bulgarian biotech innovator, crafts all‑natural probiotic and synbiotic supplements rooted in wild Lactobacillus bulgaricus strains found in spring water. Their lab-to-production process includes patented fermentation and lyophilization methods, plus over 40 product variants in powder and capsule forms. With an emphasis on purity, Daflorn avoids preservatives, GMOs, and artificial colors, and has earned multiple patents and FSSC 22000 food safety certification.

Sabinsa Corporation is a US‑based nutraceutical pioneer emphasizing clinically researched botanical and synbiotic ingredients. Their R&D‑driven portfolio includes synbiotic blends designed for skin and hair health (e.g., LactoSporin), aimed at delivering dual pre‑ and probiotics synergistically. Their strategy focuses on science‑backed innovation and expanding clean‑label offerings within the global synbiotic space.

Danone, a global leader in food and nutrition, lends its expertise to the synbiotic market through functional foods and infant formulas. Its patented synbiotic blend, scGOS/lcFOS (9:1), mimics human milk oligosaccharides and has shown benefits like reduced allergy and infection risk. With a nearly century‑long heritage in fermentation, Danone continues to blend traditional gut‑health wisdom with modern formulation innovation.

Top Key Players Outlook

- Daflorn Ltd

- Sabinsa

- Danone

- Yakult Honsha Co. Ltd

- Probiotical S.p.A

- NUtech Ventures

Recent Industry Developments

In 2024, Daflorn Ltd—operating out of Bulgaria with a compact team of 11–50 employees—made a name for itself by offering all‑natural synbiotic products uniquely developed from wild probiotic strains found in spring water—a patented innovation that earned them 15 patents and 7 trademarks for their formulations.

In 2024, Danone—a global food leader—reported €27,376 million in sales (a 4.3% like‑for‑like increase) and achieved a recurring operating margin of 13.0%.

Report Scope

Report Features Description Market Value (2024) USD 801.6 Mn Forecast Revenue (2034) USD 1698.8 Mn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Liquid, Capsule, Others), By Application (Functional Food and Beverages, Dietary Supplements, Others), By End-User (Adults, Children), By Distribution Channel (Pharmacies/Health Stores, Supermarkets/Hypermarkets, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Daflorn Ltd, Sabinsa, Danone, Yakult Honsha Co. Ltd, Probiotical S.p.A, NUtech Ventures Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Daflorn Ltd

- Sabinsa

- Danone

- Yakult Honsha Co. Ltd

- Probiotical S.p.A

- NUtech Ventures