Global Sweetener Market By Product Type (Sucrose, Natural Sweetener, Artificial Sweetener, Sugar Alcohols), By Product Form (Solid and Liquid), By Application (Bakery and Confectionery, Foods and Beverages, Dairy Products, Frozen Food, Pharmaceuticals), By Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Departmental Stores, Online) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 105866

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

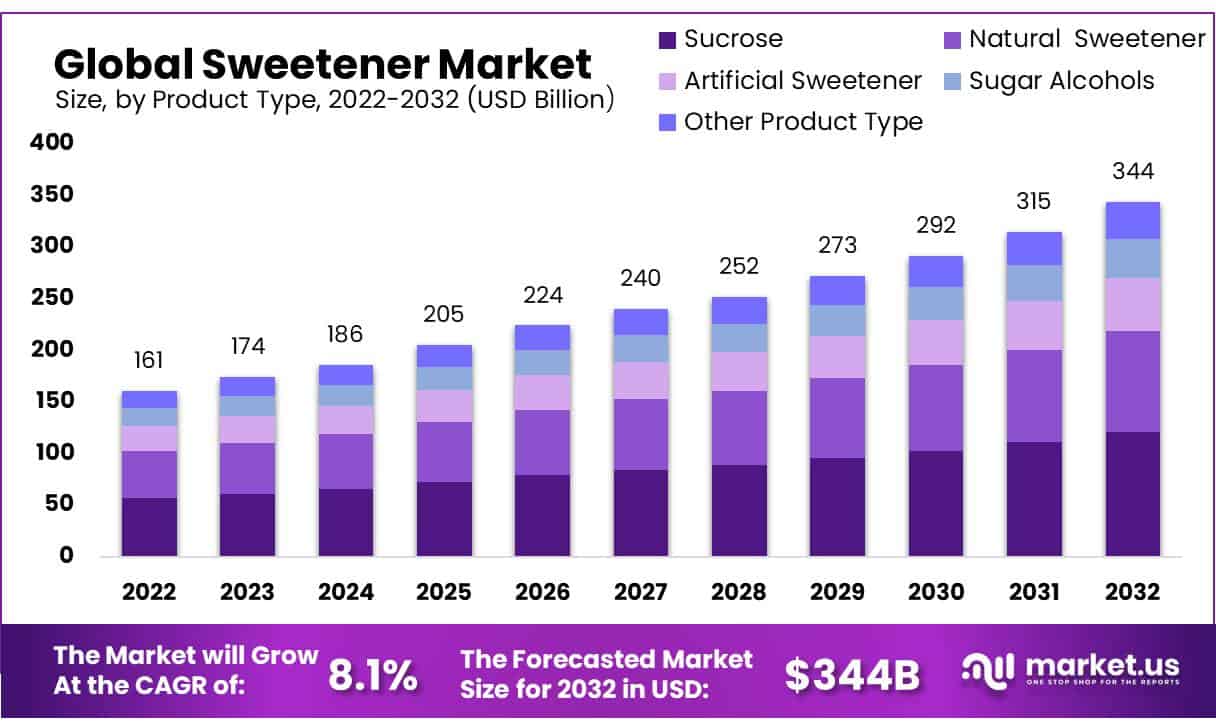

In 2022, the Global Sweetener Market was valued at USD 161.1 Billion, and is expected to reach USD 344 Billion in 2032 from 2023 to 2032, this market is estimated to register a CAGR of 8.13%.

Sweeteners are additives used to create a sweet taste in food. Over the last few decades, the popularity of sugar has decreased, leading researchers to develop alternative sweetening options. These sugar substitutes are known as sweeteners. Sweeteners come in various forms, available worldwide.

Some are naturally occurring, while others are made through synthetic means. Due to the rise in health problems such as obesity and diabetes, the demand for food products that are low in calories and sugar-free is increasing. Several consumers are becoming conscious of the potential health hazards of excessive sugar intake.

Hence, they are seeking healthier food choices to improve their health. As a result, there has been a trend towards low-sugar and sugar-free items, which is increasing the demand for sweeteners.

Actual Numbers Might Vary in the final report

Key Takeaways

- Market Growth and Valuation: The Sweetener Market was valued at USD 161.1 Billion in 2022 and is projected to reach USD 344 Billion by 2032, with a Compound Annual Growth Rate (CAGR) of 8.13% during the period from 2023 to 2032.

- Shift from Sugar to Sweeteners: The declining popularity of sugar has led to the development and increasing demand for sweeteners, which are used as sugar substitutes in various food products. This shift is driven by health concerns such as obesity and diabetes, with consumers seeking low-calorie and sugar-free alternatives.

- Product Type Analysis: Sucrose dominated the sweetener market in 2022, holding a 60% market share due to its extensive use in bakery and confectionery products. Sucrose is not only used in baked goods but also in pharmaceutical formulations to improve taste.

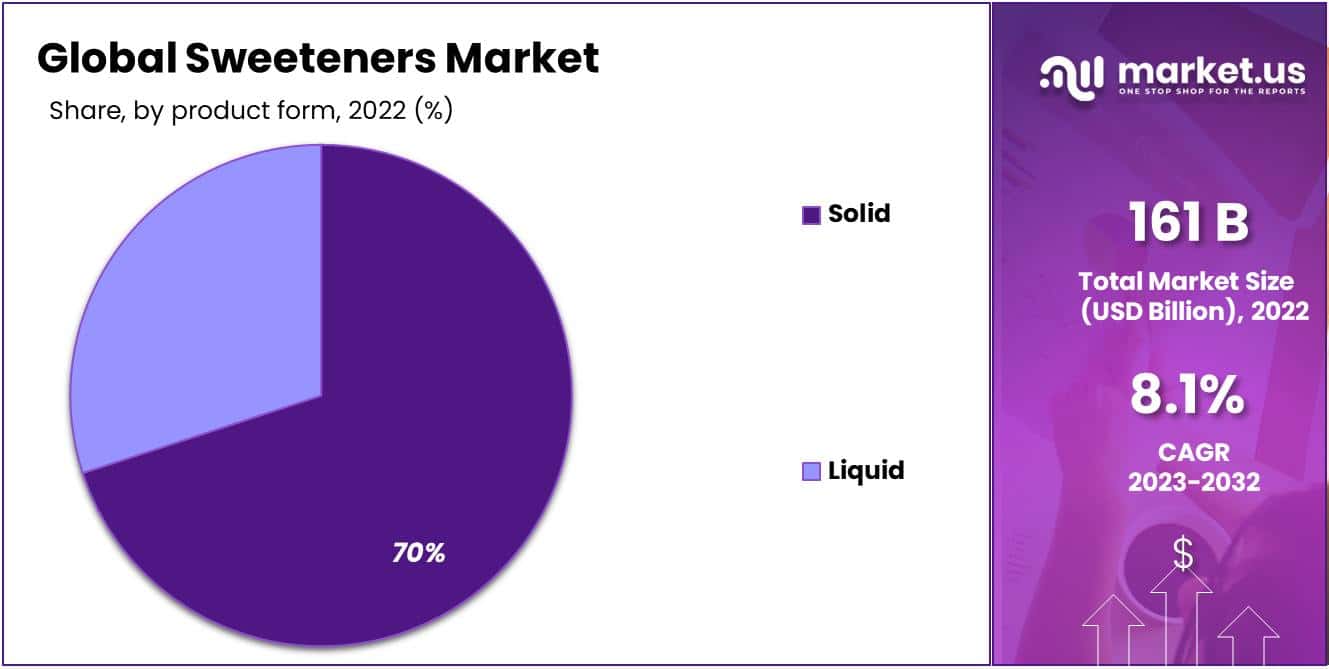

- Product Form Analysis: Solid sweeteners make up approximately 70% of the market share due to their practicality, stability, and versatility. They are widely used in the food and beverage industry because of their physical characteristics and ease of consumption.

- Application Analysis: The bakery and confectionery segment accounted for the largest revenue share in 2022. Sweeteners are essential in achieving the desired taste profiles in baked goods and enhancing shelf life.

- Distribution Channel Analysis: Online distribution channels are growing rapidly due to increased internet access and the convenience of choosing from a variety of products in one place.

- Market Drivers: Rising health consciousness among consumers is driving the demand for sugar substitutes, especially among those looking to control their weight and sugar intake. The growing preference for natural sweeteners aligns with health-conscious consumer trends.

- Market Restraints: The production of artificial sweeteners requires a significant initial investment, which can hinder market growth. Premium pricing of natural sweeteners due to higher production costs is a challenge.

- Market Opportunities: Research and development activities are increasing to develop new and advanced natural sweetener products that cater to health-conscious consumers’ needs.

- Market Trends: Consumers are increasingly favoring plant-based sweeteners and clean-label solutions, with a preference for natural options like stevia and monk fruit.

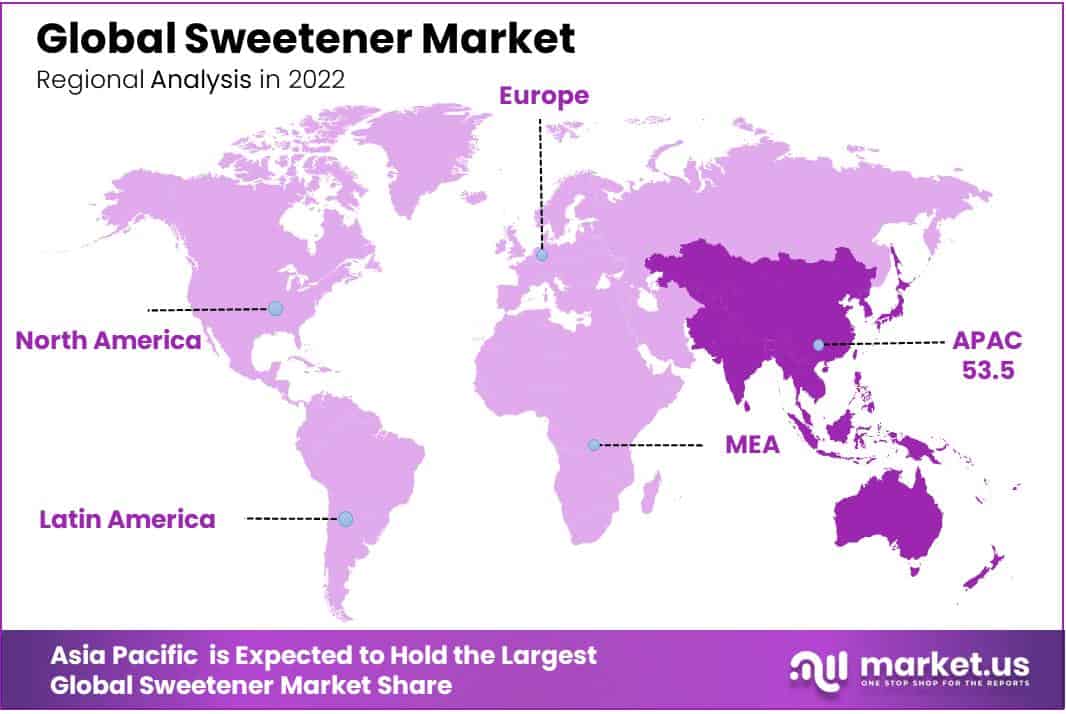

- Regional Analysis: The Asia-Pacific region accounted for the largest revenue share in 2022, with a high demand for artificial and natural sweeteners in countries like China, Indonesia, and India. Europe holds the second-largest market share, and Latin America is the fastest-growing region.

- Key Players: Major players in the sweeteners market include Tate & Lyle PLC, Ingredion Incorporated, Cargill, Incorporated, Ajinomoto Co., Inc., and others. These companies invest in research and development, launch new products, and engage in strategic initiatives to expand their global presence.

Market Scope

Product Type Analysis

Sucrose Dominated the Market Due To Its Affordability Compared To Other Sweeteners.

Based on product type, the global sweetener market is segmented into sucrose, natural sweetener, artificial sweetener, sugar alcohol, and other product types. Among these, sucrose held the largest market share, at 60% in 2022. This growth is estimated owing to its extensive applications in bakery and confectioneries.

Sucrose is a key ingredient in the baking industry as it helps to create the necessary structure and maintain consistency in baked goods. Additionally, it is used in medicine formulations to improve the taste of unpleasant chemicals. According to the Physicians Committee for Responsible Medicine (PCRM), it was found that sucrose is associated with relation to diabetes risk.

Individuals who consume higher amounts of sucrose have an 11% lower risk of developing type 2 diabetes compared to those who consume lower amounts.

Moreover, bakery products such as cookies and cakes contain high sucrose levels to help them maintain their shape and structure. Sucrose is also commonly used as a bulking agent in these types of food products.

Product Form Analysis

The Global Market is Dominated by Solid Sweeteners Due to Their Widespread Availability in Various Solid Forms.

Based on product form, the global sweetener market is segmented into solid and liquid forms, in which the solid form is the dominant and holds approx. 70% of the market share because they are available in crystalline, powdered, and solid forms.

This is due to their practicality and numerous functional advantages, such as ease of packaging and transportation, stability, and versatility in various applications. Furthermore, solid sweeteners are widely used in the food and beverage industry owing to their physical characteristics and ease of consumption.

Application Analysis

The Bakery and Confectionery Segment Has Emerged As The Largest Segment Because They Commonly Make Use Of Sucrose As A Sweetener

Based on applications, the global sweetener market is further divided into bakery and confectionery, foods and beverages, dairy products, frozen food, pharmaceuticals, and other applications. Among these applications, the bakery and confectionery segment accounted for the largest revenue share in 2022. The inherent nature of bakery and confectionery products necessitates the incorporation of sweeteners to achieve the desired taste profiles.

Sweeteners play a vital role in enhancing the flavors of various baked goods, such as cakes, pastries, cookies, and other sweet treats. The versatility of sweeteners enables confectioners to explore the broad spectrum of recipes and formulations. Whether it’s providing the sweetness in a cake batter, offering the right texture in a caramel sauce, or ensuring the ideal crystallization in a fudge, sweeteners are integral to the success of numerous recipes.

Moreover, sweeteners contribute to the overall shelf life and preservation of bakery and confectionery items. They serve as preservatives by inhibiting microbial growth, thereby extending the products’ freshness and quality.

Distribution Channel Analysis

Convenience to Choose Variety of Products at One Platform is Expected to Boost the Sales of Sweeteners Through Online Distribution Channels

Based on distribution channels, the global sweeteners market is segmented into supermarkets/hypermarkets, convenience stores, departmental stores, online, and other distribution channels. Among these, the online distribution channel is the dominant segment. This dominance is attributed to the rapid growth of online sales.

This is due to the increased availability of internet access across the world, leading to the expansion of the e-commerce industry. Several suppliers of sweetener products are selling their products through their websites as well as through various e-commerce platforms. As a result, the market is expected to continue growing during the forecast period.

Furthermore, Online retailers often have customer reviews that can help them in making decisions about which sweetener to buy. Therefore, the convenience of choosing a variety of products on one platform has led to the growth of online platforms.

Key Market Segments

By Product Type

- Sucrose

- Natural Sweetener

- Artificial Sweetener

- Sugar Alcohols

- Other Product Type

By Product Form

- Solid

- Liquid

By Application

- Bakery and Confectionery

- Foods and Beverages

- Dairy Products

- Frozen Food

- Pharmaceuticals

- Other Applications

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Departmental Stores

- Online

- Other Distribution Channels

Drivers

Growing Trend Towards Preventive Healthcare Measures Due to Rising Health Consciousness Among Consumers

Major factors driving the expansion of the global sweetener market are increasing awareness about the importance of healthy food choices and a growing trend towards preventive healthcare measures.

Due to the rising health concerns among consumers, the shift towards sugar substitutes is simultaneously increasing. These artificial sweeteners offer a sweet taste without providing extra calories. In addition, they are a great choice for individuals who want to control their weight or lower their sugar consumption.

Growing demand for Natural Sweeteners due to growing consumer preference towards natural sweeteners

According to 2017-2018 data from the National Health and Nutritional Examination Survey (NHANES), Nearly 1 in 3 adults are overweight, for which natural sweeteners are increasingly being used in various products.

Moreover, these are widely used in the food and beverage industries for their numerous benefits. Furthermore, the availability of low-calorie products and sugar-free sweeteners is expected to bolster the market’s growth.

Restraints

The Initial Cost for Manufacturing is Relatively High.

The declining demand for artificial sweeteners is a significant challenge in the market’s growth. Moreover, several products, such as sweeteners and sugar substitutes, need a high amount of initial investment to produce. In addition, prominent market players are making significant efforts in research and development activities to develop innovative products.

It is worth noting that the premium pricing of natural sweeteners due to higher production costs is a key challenge in the target market. Moreover, growing health concerns linked to the sugar levels found in sweeteners are attributed to hinder the market growth.

Opportunity

R&D Activities Are Rising to Develop Newer and Advanced Natural Sweetener Products.

The sweetener market has witnessed significant changes over the past few years, driven by shifts in consumer preferences, health concerns, technological advances, and regulatory factors. Scientists are developing a variety of natural sweeteners to cater to the increasing demand for health products among consumers.

Rising R&D investments in non-caloric and high-intensity natural sweeteners that are safe for consumption are also propelling the market. In recent years, major food and beverage industry players have introduced various key players to monk fruit sweeteners. These sweeteners are gaining popularity due to their significant health benefits and safety levels.

Therefore, the successful research and development in the global sweeteners market lead to better and safer products, meeting the growing demand for beneficial options. This presents a significant growth opportunity for the key players in the sweeteners market in the coming years.

Trends

Increase in Demand for Plant-Based Sweeteners and Clean-Label Solutions.

Consumers have different opinions regarding labels that claim reduced or zero sugar, especially artificial sweeteners such as sucralose, aspartame, and acesulfame potassium, compared to natural options such as stevia, monk fruit, and allulose.

Recently, there has been a growing preference for natural sweeteners, which has increased the popularity of plant-based alternatives such as stevia and monk fruit. This trend has become even more significant in the past few years, driven by the global pandemic and the resulting surge of interest in healthy nutrition.

According to Innova’s 2022 Global Trends report, nearly 80% of American consumers believe certain sweeteners should be avoided. Furthermore, 58% of consumers actively seek products with a “clean label,” the highest recorded figure. The report also highlights that plant-based options have become a significant factor in consumers’ decision-making processes.

COVID-19 Analysis

COVID-19 Has Significantly Impacted the Growth of the Global Sweeteners Market Owing to the Halt in Production and Supply Chain Activities.

The COVID-19 pandemic significantly impacted the demand for the global sweeteners market. In 2020, the pandemic caused a decline in sugar consumption as more individuals shifted to sugar substitutes and natural, plant-based products. In addition to this, there has been a growing trend of individuals seeking to reduce their sugar intake.

With the vaccination drive and a decline in COVID-19 cases globally, the situation is starting to feel more normal. Governments have lifted lockdowns, making it easier for supply chains to operate. The sweetener industry is experiencing growth and is projected to recoup its losses in the next 1-2 years.

Low-calorie products are becoming more popular due to consumer behavior and preferences changes. Consumers are interested in trying new sweetener options and maintaining a healthy lifestyle as a way to cope with the aftermath of the pandemic.

Regional Analysis

Asia-Pacific Holds Region Accounted Significant Share of the Global Sweeteners Market

In 2022, the APAC region accounted for the largest revenue share of 33.2%. This growth is attributed to the high demand for artificial and natural sweeteners in the APAC region. Countries such as China, Indonesia, and India contribute the majority of shares towards the sweetener market in the region.

In addition, the region is witnessing an increasing adoption of healthy sweeteners due to the rising prevalence of obesity, diabetes, and heart issues. Low-calorie sweeteners such as diet soda are becoming popular picks among consumers. Consequently, the sugar sweetener market will continue to grow in APAC in the coming years.

Overall, the Asia-Pacific region holds the strongest position in the global sweeteners market. This is due to the rising popularity of natural sweeteners and the growing consumption of processed foods and beverages in the region.

Europe has the second largest market share, and Latin America is the fastest-growing region. Artificial sweetener demand in Brazil is expected to increase in the next few years due to consumers’ preference for low-calorie products and profitable growth in the Brazilian drinks market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Several players are operating in the global sweeteners market, such as Tate & Lyle, Ajinomoto CO., Inc., Ingredion Incorporated, etc. They are investing heavily in research and development to expand their product range, contributing to the growth of the sweeteners market.

These market participants are also implementing various strategic initiatives to expand their global presence, including launching new products, signing contractual agreements, merging with or acquiring other companies, and collaborating with other organizations.

To survive and thrive in this highly competitive and rapidly expanding market, competitors in the sweeteners industry must offer cost-effective items.

Major Key Players

- Tate & Lyle PLC

- Ingredion Incorporated

- Cargill, Incorporated

- Swerve, L.L.C.

- Sweet Leaf Tea Company

- Ajinomoto Co., Inc.

- Dupont de Nemorus, Inc.

- Foodchem international corporation

- The Nutrasweet Company

- Archer Daniels Midland Company

- Celanese Corporation

- GLG Lifetech Corporation

- S&W Seed Company

- Dabur India Ltd

- Other Key Players

Recent Development

- In June 2023, SweetLeaf launched two New Natural Sugar Substitutes. A brand of sugar substitutes in the natural channel has announced an expansion of its SweetLeaf product line. The new additions include two zero-calorie sweeteners and three sugars with 50% fewer calories. These products have been designed to taste, bake, brown, and caramelize like regular sugar.

- In July 2023: Swerve, one of the leading plant-based and keto-friendly sweetener manufacturers. The company’s Monk Fruit and Allulose- Allulose-centered products are set to be key drivers of innovation. The company’s innovation and expansion into these products offer zero calories and zero sugar.

Report Scope

Report Features Description Market Value (2022) USD 161.1 Bn Forecast Revenue (2032) USD 344 Bn CAGR (2023-2032) 8.13% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sucrose, Natural Sweetener, Artificial Sweetener, sugar Alcohol, and other product type), By Product form (Solid and Liquid), By Application (Bakery and Confectionery, Foods and Beverages, Dairy Products, Frozen Food, Pharmaceuticals, and Other Applications) By Distribution Channels (Supermarket/Hypermarket, Convenient Stores, Departmental Stores, Online and Distribution Channels) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Tate & Lyle PLC, Ingredion Incorporated, Cargill, Incorporated, Ajinomoto Co., Inc., Dupont de Nemorus Inc., Foodchem International Corporation, The Nutrasweet Company, Archer Daniels Midland Company, Celanese Corporation, GLG Lifetech Corporation, S&W Seed Company, Dabur India Ltd, and other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the sweetener market?The sweetener market refers to the global industry that produces and supplies sweetening agents used to enhance the taste of food and beverages while providing an alternative to sugar.

Are natural sweeteners better than artificial ones?Natural sweeteners are often perceived as healthier because they are derived from natural sources. However, the choice between natural and artificial sweeteners depends on individual preferences and dietary restrictions.

What are the future trends in the sweetener market?Future trends in the sweetener market include the continued development of natural and low-calorie sweeteners, innovations in sugar reduction technologies, and a focus on sustainability and eco-friendly sweetening options.

What is the market size for Sweetener Market?Sweetener Market was valued at USD 161.1 Billion in 2022, and is expected to reach USD 344 Billion in 2032 from 2023 to 2032

What is the Sweetener Market CAGR During the Forecast Period 2023-2032?The Global Sweetener Market size is growing at a CAGR of 8.13% during the forecast period from 2023 to 2032.

-

-

- Tate & Lyle PLC

- Ingredion Incorporated

- Cargill, Incorporated

- Swerve, L.L.C.

- Sweet Leaf Tea Company

- Ajinomoto Co., Inc.

- Dupont de Nemorus, Inc.

- Foodchem international corporation

- The Nutrasweet Company

- Archer Daniels Midland Company

- Celanese Corporation

- GLG Lifetech Corporation

- S&W Seed Company

- Dabur India Ltd

- Other Key Players