Global Sweet Potato Fries Market Size, Share and Report Analysis By Product (Fries, Cubes/Puffs, Chips/Crisps), By Nature (Organic, Conventional), By End Use (Foodservice Industry, Household/Retail) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175680

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

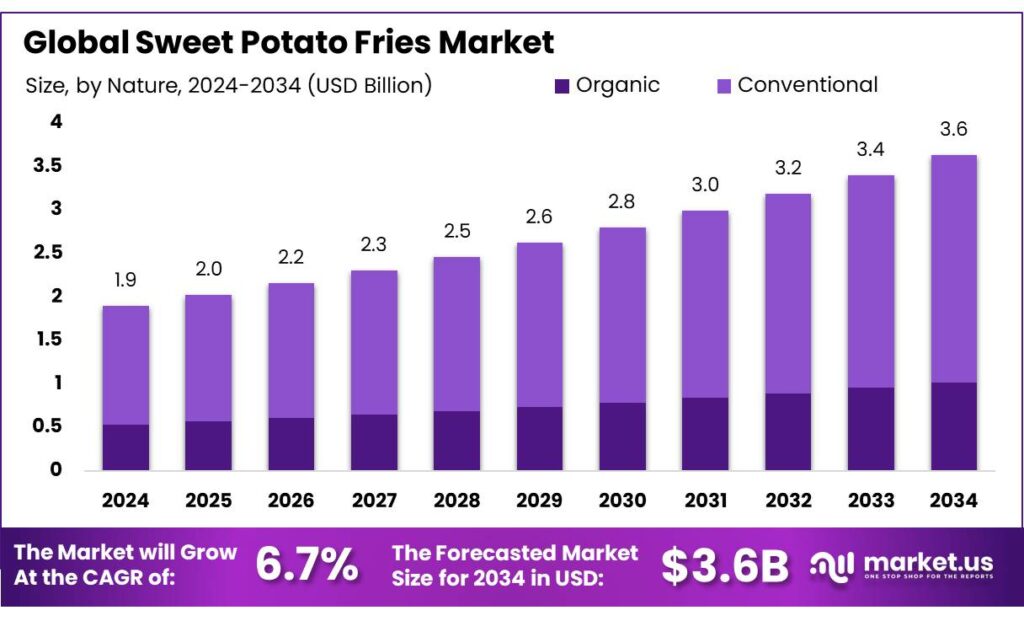

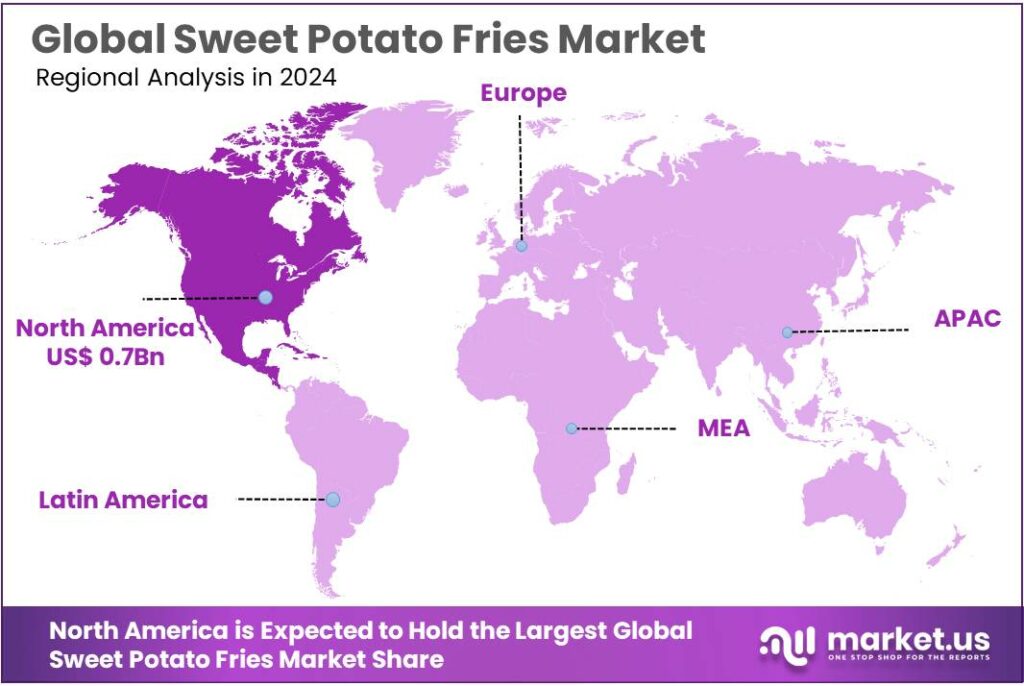

Global Sweet Potato Fries Market size is expected to be worth around USD 3.6 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 38.4% share, holding USD 0.7 Billion in revenue.

Sweet potato fries sit at the intersection of convenience foods and “better-for-you” menu innovation, using naturally sweet, nutrient-dense roots to differentiate from standard potato fries. Industrially, the category spans frozen, chilled, and fresh-cut formats, with processing focused on consistent strip sizing, blanching, par-frying or oven-ready coatings, rapid freezing, and moisture management to protect crispness. In raw-material terms, supply strength matters: in the U.S. alone, sweet potato production in 2024 totaled 24.7 million cwt with an estimated crop value of $615 million, giving processors a meaningful domestic sourcing base for fries, wedges, and other value-added cuts.

From an industrial scenario perspective, sweet potato fries benefit from the same downstream channels that drive broader fry consumption—quick-service restaurants, casual dining, and institutional foodservice—while also expanding through retail frozen aisles and air-fryer-led at-home cooking.

- The U.S. restaurant and foodservice industry is forecast to reach $1.5 trillion in sales in 2025, with total industry employment projected at 15.9 million by the end of 2025. That scale helps absorb premium side items and menu line extensions, where sweet potato fries often price above regular fries and improve mix without requiring a completely new kitchen workflow.

- In the U.S., USDA finalized school meal standards in 2024 that phase in added-sugars limits and update nutrition requirements aligned to the Dietary Guidelines for Americans. Separately, the school meal system’s scale—about 15 million breakfasts and nearly 30 million lunches served daily, supported by roughly $22.6 billion in annual spending—signals why institutional demand can materially influence processing formats, pack sizes, and compliance documentation for fry suppliers.

Raw-material concentration also shapes the competitive landscape. For example, North Carolina is a major U.S. production hub: in 2024 it harvested 86,500 acres, produced 12,975,000 cwt, and recorded $254.52 million in sweet potato production value. At the global level, sweetpotato production has been estimated in the range of 88.7–92.3 million metric tons across 2018–2021, highlighting both the crop’s scale and the opportunity to expand industrial processing beyond fresh consumption.

Key Takeaways

- Sweet Potato Fries Market size is expected to be worth around USD 3.6 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 6.7%.

- Fries held a dominant market position, capturing more than a 62.4% share.

- Conventional held a dominant market position, capturing more than a 72.3% share.

- Foodservice Industry held a dominant market position, capturing more than a 69.2% share.

- North America leads the Sweet Potato Fries Market with a 38.4% share, supported by strong frozen-food habits and a value of USD 0.7 Bn.

By Product Analysis

Fries lead the Sweet Potato Fries Market with a strong 62.4% share, reflecting their popularity and convenience-driven appeal.

In 2024, Fries held a dominant market position, capturing more than a 62.4% share, largely because consumers continue to prefer ready-to-cook formats that fit easily into both home kitchens and foodservice operations. The category benefits from its familiarity—most buyers already understand how fries should look, cook, and taste, which reduces hesitation when switching from regular potato fries to sweet potato variants. This strong acceptance has helped the segment maintain its lead through 2024 and into 2025, supported by growing demand for healthier alternatives that still provide a sense of comfort and indulgence.

By Nature Analysis

Conventional Sweet Potato Fries dominate with a strong 72.3% share, driven by affordability and wide consumer acceptance.

In 2024, Conventional held a dominant market position, capturing more than a 72.3% share, primarily because these products are more accessible in both retail and foodservice channels. Consumers often choose conventional sweet potato fries due to their familiar taste, consistent texture, and lower price point compared to organic variants. This combination makes them a practical choice for households, restaurants, and quick-service outlets that prioritize value without compromising on flavor or quality.

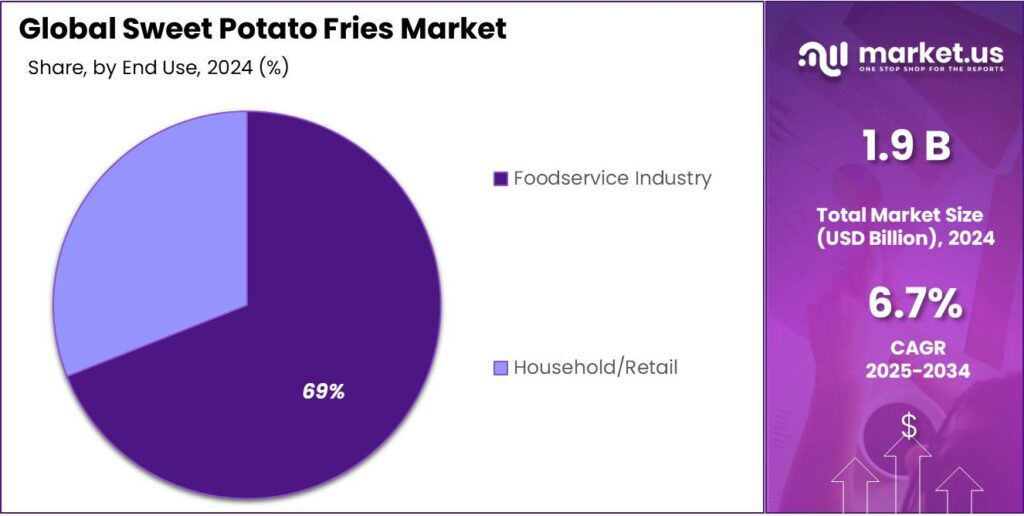

By End Use Analysis

Foodservice Industry leads the Sweet Potato Fries Market with a strong 69.2% share, supported by rising menu demand and consistent supply needs.

In 2024, Foodservice Industry held a dominant market position, capturing more than a 69.2% share, driven by the rapid adoption of sweet potato fries across quick-service restaurants, cafés, and casual dining chains. Operators increasingly use sweet potato fries as a premium side option that enhances menu variety without adding operational complexity. Since they cook like regular fries and require no additional training or equipment, kitchens find them an easy upgrade that helps lift average order value.

Key Market Segments

By Product

- Fries

- Cubes/Puffs

- Chips/Crisps

By Nature

- Organic

- Conventional

By End Use

- Foodservice Industry

- Household/Retail

Emerging Trends

Air-fryer optimization is the latest trend shaping how Sweet Potato Fries are made, labeled, and sold

A clear latest trend in sweet potato fries is how quickly the category is being redesigned around air-fryer cooking. The air fryer has moved from a “nice-to-have” appliance to a daily tool in many kitchens, and that shift is changing what consumers expect from frozen fries—crisp edges, even browning, and fast cook times without deep frying. In response, brands are updating cut sizes, surface coatings, and oil-management steps so sweet potato fries perform well in air fryers, not just in ovens or commercial fryers.

Industry evidence shows how strongly air-fryer use is influencing frozen food formats. Conagra Brands reported in January 2024 that U.S. air fryer ownership increased by 27 percentage points since 2020. In the same report, it noted the number of frozen foods carrying air-frying instructions rose by 90% in the past four years. For sweet potato fries, this translates into a practical growth lever: when packaging includes air-fry directions, the product becomes a quicker weekday option, which supports repeat purchases.

This air-fryer trend is also riding on a bigger reality: the frozen fry ecosystem is already deeply embedded in consumer demand and retail supply chains. In the U.S., frozen potato products—most of which are french fries—represent about 50% of potato per-capita availability at 58 pounds per person. That matters because sweet potato fries benefit from the same cold-chain distribution, freezer merchandising, and household buying habits that keep standard fries in steady rotation.

Health policy is shaping what “air-fryer-friendly” looks like in practice. Many consumers associate air frying with lighter cooking, so they also pay closer attention to nutrition labels—especially sodium. In August 2024, the U.S. FDA announced draft Phase II voluntary sodium targets intended to help reduce average sodium intake to about 2,750 mg/day, around 20% lower than intake levels prior to 2021 if the combined Phase I and Phase II efforts are achieved.

Drivers

Convenience-led frozen food habits are a major driver for Sweet Potato Fries demand

A major driving factor for sweet potato fries is the steady shift toward convenient, freezer-friendly foods that deliver “restaurant-style” results at home and in foodservice. Sweet potato fries fit this need well because they cook quickly, pair easily with popular meals, and feel like a premium upgrade without changing how people eat. This demand is reinforced by the wider frozen potato ecosystem: in the United States, frozen potato products—mostly french fries—now account for about 50% of potato per-capita availability at around 58 pounds per person.

A clear example is the air fryer effect. Conagra Brands reported that U.S. air fryer ownership jumped by 27 percentage points since 2020, and—importantly for products like sweet potato fries—the number of frozen foods carrying air-frying instructions increased by 90% over the past four years. This is a practical, shelf-level signal: when brands add air-fry directions, it typically means they expect repeat demand from shoppers who want crisp results with less effort and less mess.

Government and trusted public-health initiatives further reinforce the demand for improved “everyday foods,” pushing manufacturers to reformulate and label more clearly—often without taking away the comfort factor. The World Health Organization recommends adults consume less than 2,000 mg/day sodium , which keeps pressure on salty snack and side categories to offer better sodium management.

In the U.S., the FDA’s Phase II sodium reduction work references a population-level target of around 2,750 mg/day and notes that Phase I and Phase II targets together could support about a 20% reduction in average sodium intake from earlier levels. These efforts encourage manufacturers to improve seasoning strategies and product design, which can make items like sweet potato fries more broadly acceptable for institutions and families trying to moderate sodium without giving up convenient foods.

Restraints

Supply Chain and Raw Material Constraints Slow Growth of Sweet Potato Fries

One of the major restraining factors for the sweet potato fries market is the challenge of securing a stable and cost-effective supply of high-quality sweet potatoes, which directly affects production, pricing, and availability. Unlike regular white potatoes that have very large and geographically diverse production bases, sweet potatoes tend to be more concentrated in specific growing regions.

For example, in the United States, North Carolina harvested 86,500 acres and produced 12,975,000 hundredweight (cwt) of sweet potatoes in 2024, with a production value of $254.52 million. While that is a strong output, it highlights how production is concentrated in a relatively narrow set of growers and geographies, which can create risk when weather or crop disease affects yields. A bad season in a key area can ripple through supply chains, tightening availability and pushing costs up for processors who rely on steady input volumes.

Global data shows total sweet potato production around 88.7–92.3 million metric tons in recent measured years, but regional disparities and year-to-year weather impacts can leave processors scrambling for consistent quality inputs. When processors cannot lock in long-term, reliable supplies, they may face sharp cost increases or be forced to limit production runs, both of which restrain market growth.

Government and public health initiatives also have indirect effects on supply and product formulation. Efforts to reduce sodium consumption, such as the World Health Organization’s guidance of less than 5 g salt per day, encourage manufacturers to change seasoning practices. While this is positive for public health, it requires recipe reformulation, additional testing, and sometimes new supplier agreements for seasoning blends—all of which can strain smaller processors that lack large R&D budgets.

Opportunity

Nutritional Awareness and Health Trends Open New Growth Paths for Sweet Potato Fries

One of the most promising growth opportunities for the sweet potato fries market lies in rising global awareness about the nutritional benefits of sweet potatoes and the way consumers are increasingly choosing foods that offer both taste and health value. Sweet potatoes are not just a tasty root vegetable—they are packed with nutrients and are part of a broader shift toward wholesome foods that support better health outcomes.

Sweet potatoes themselves play a significant role in global food systems as a nutrient-rich staple. Worldwide, more than 105 million metric tons of sweet potatoes are produced annually, with about 95% of this crop cultivated in developing countries. This scale underscores the potential raw material base for processed products like fries, and it also highlights why sweet potatoes are valued for their rich content of vitamins, minerals, and dietary fiber.

Government guidelines and public health discussions further support these shifts. Many dietary authorities encourage increased consumption of vegetables and nutrient-dense foods, framing them as tools for long-term health. For example, global nutrition advice often highlights the importance of Vitamin A and fiber for overall well-being, which aligns with the nutrient profile of sweet potatoes. As public health messaging continues to emphasize balanced eating, food manufacturers are responding by reformulating products and highlighting inherent nutritional qualities.

Regional Insights

North America leads the Sweet Potato Fries Market with a 38.4% share, supported by strong frozen-food habits and a value of USD 0.7 Bn.

In North America, sweet potato fries benefit from a mature frozen-food ecosystem that already treats fries as a default side at home and in restaurants. The region’s dominance is anchored by established cold-chain infrastructure, high freezer penetration in retail, and menu dependence on fries across quick-service and casual dining. This is reflected in broader potato consumption patterns: in the U.S., frozen potato products—mostly french fries—represent about 50% of potato per-capita availability at 58 lb per person (average across 2022–2024), showing how deeply “frozen fries” are embedded in everyday buying behavior.

Another regional tailwind is the acceleration of fast, at-home cooking, especially through air fryers. A major North American packaged-food player reported that U.S. air fryer ownership increased by 27 percentage points since 2020, and the number of frozen foods featuring air-frying instructions rose by 90% over the past four years.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Aviko, established in 1962 in the Netherlands, is one of the world’s largest potato processors, producing chilled and frozen potato products including sweet potato fries. In earlier financial reporting, its revenue was around €757 million, with over 2,000 employees, reflecting strong European and global processing scale.

Blue Tribe Foods is an emerging plant-based food brand focusing on health-oriented snacks. In January 2025, it launched a 420 g sweet potato fries product designed for health-conscious consumers. The product highlights natural ingredients, rich fiber, and no preservatives—a positioning that supports growth in premium and wellness-focused segments.

McCain Foods Limited is a Canadian frozen food powerhouse founded in 1957, with about 20,000 employees and CAD 14 billion in revenue as of 2023. It is the world’s largest manufacturer of frozen potato products, with products sold in 160+ countries, including sweet potato fries alongside traditional fries and snacks.

Top Key Players Outlook

- McCain

- Aviko

- Simplot Global Food, LLC

- Blue Tribe

- Lamb Weston, Inc.

- Agristo

- Kraft Heinz

- Conagra Brands, Inc.

- Farm Frites

- Cavendish Farms Corporation

- IFCG

Recent Industry Developments

In 2024–2025, Simplot Global Food played a key role in the sweet potato fries space by building on its deep heritage in potato processing and strong foodservice relationships. Headquartered in Boise, Idaho, the privately held company has grown from a small agribusiness in 1929 to a global food and agriculture leader with around 18,000 employees and an estimated USD 11 billion in revenue in 2024, up from earlier years.

In January 2025, Blue Tribe Foods launched its 420 g Sweet Potato Fries pack priced around ₹250, targeting consumers who want a wholesome alternative to traditional fries made with real orange-fleshed sweet potatoes and no preservatives or palm oil.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Bn Forecast Revenue (2034) USD 3.6 Bn CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Fries, Cubes/Puffs, Chips/Crisps), By Nature (Organic, Conventional), By End Use (Foodservice Industry, Household/Retail) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape McCain, Aviko, Simplot Global Food, LLC, Blue Tribe, Lamb Weston, Inc., Agristo, Kraft Heinz, Conagra Brands, Inc., Farm Frites, Cavendish Farms Corporation, IFCG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- McCain

- Aviko

- Simplot Global Food, LLC

- Blue Tribe

- Lamb Weston, Inc.

- Agristo

- Kraft Heinz

- Conagra Brands, Inc.

- Farm Frites

- Cavendish Farms Corporation

- IFCG